Green October for Reporting Continues, The Great Wall of Sanctions, and Much More

StreetSmarts Morning Note

***Friendly reminder to hit the ‘Like’ button above, it really helps to get Substack to share my newsletter***

“Wide diversification is only required when investors do not understand what they are doing.”

-Warren Buffett

“Business is the art of extracting money from another man’s pocket without resorting to violence.”

-Max Amsterdam

Table of Contents

A.M. Allocations: Summaries of important news and investing events

Green October: Earnings Season Scorecard

Prime-Time Showdown: Will TikTok’s Views Steal Amazon’s E-Commerce Crown?

The Great Wall of Sanctions: U.S. Blueprint to Halt China’s Chip Charge

Oil’s Well That Ends... in Recession? The $140 Barrel Debacle

Hot Headlines: Links to some of the top financial stories of the day

A.M. Allocations

Green October: Earnings Season Scorecard

You can expect an S&P 500 earnings update from me every Monday.

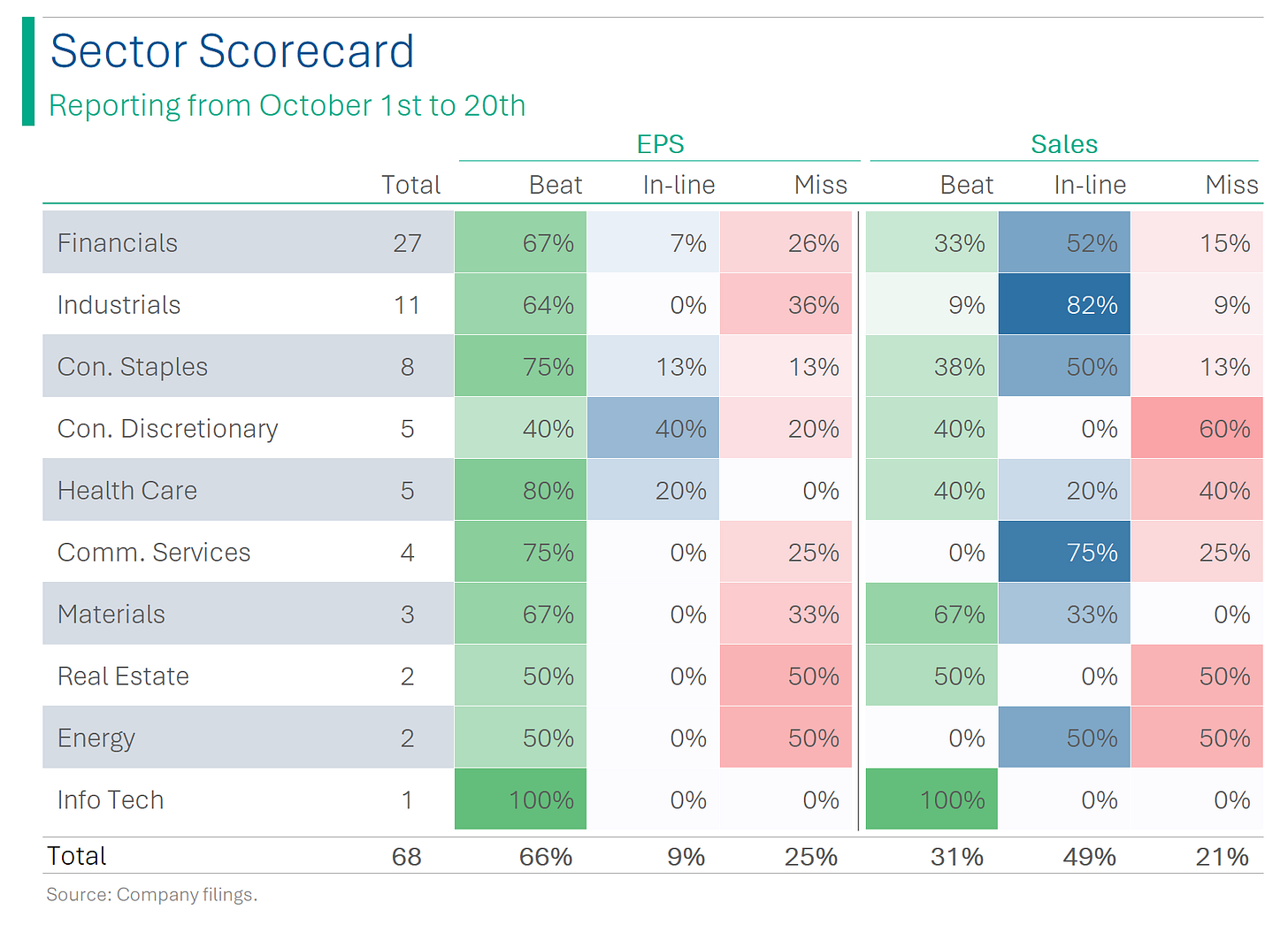

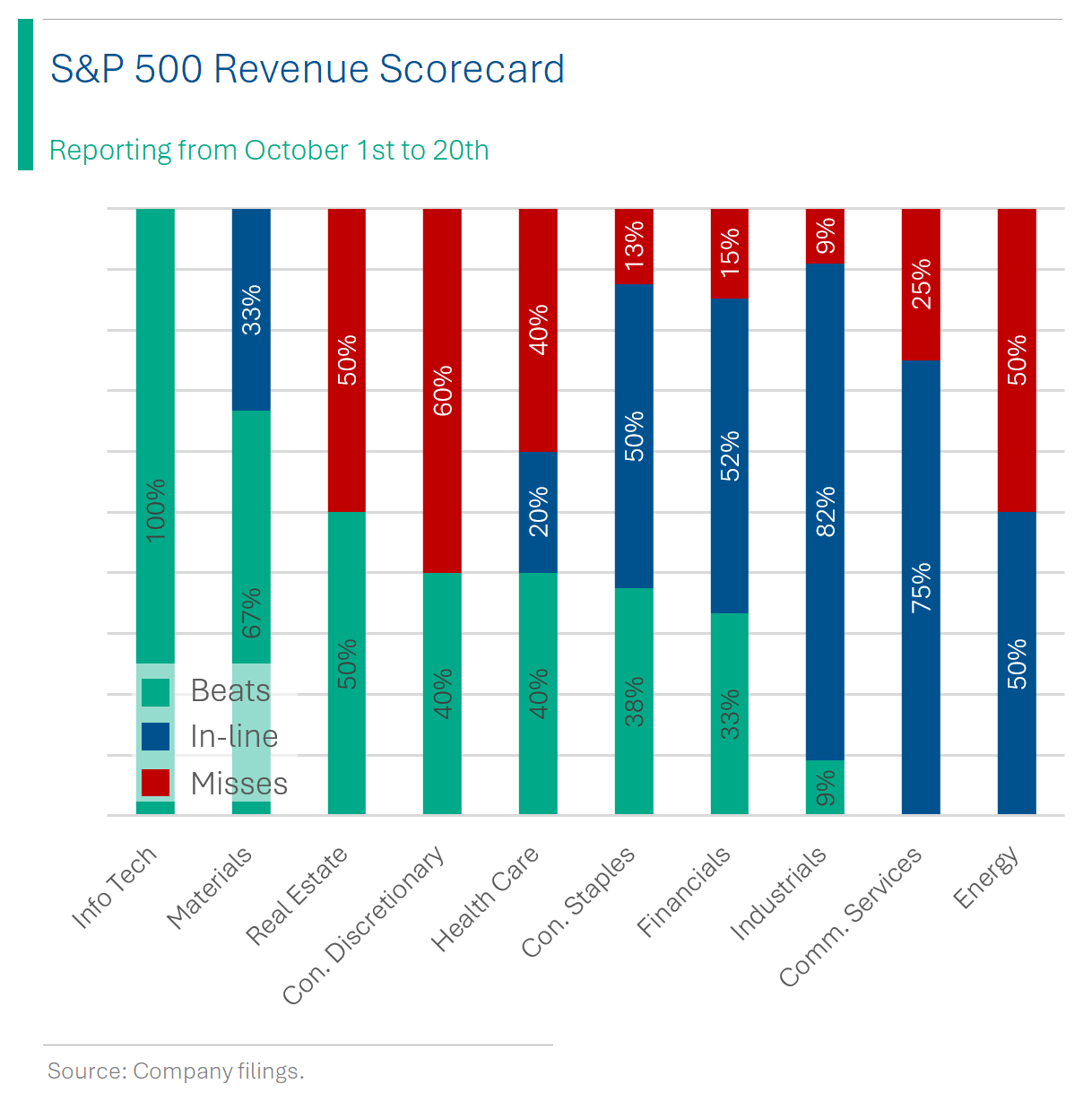

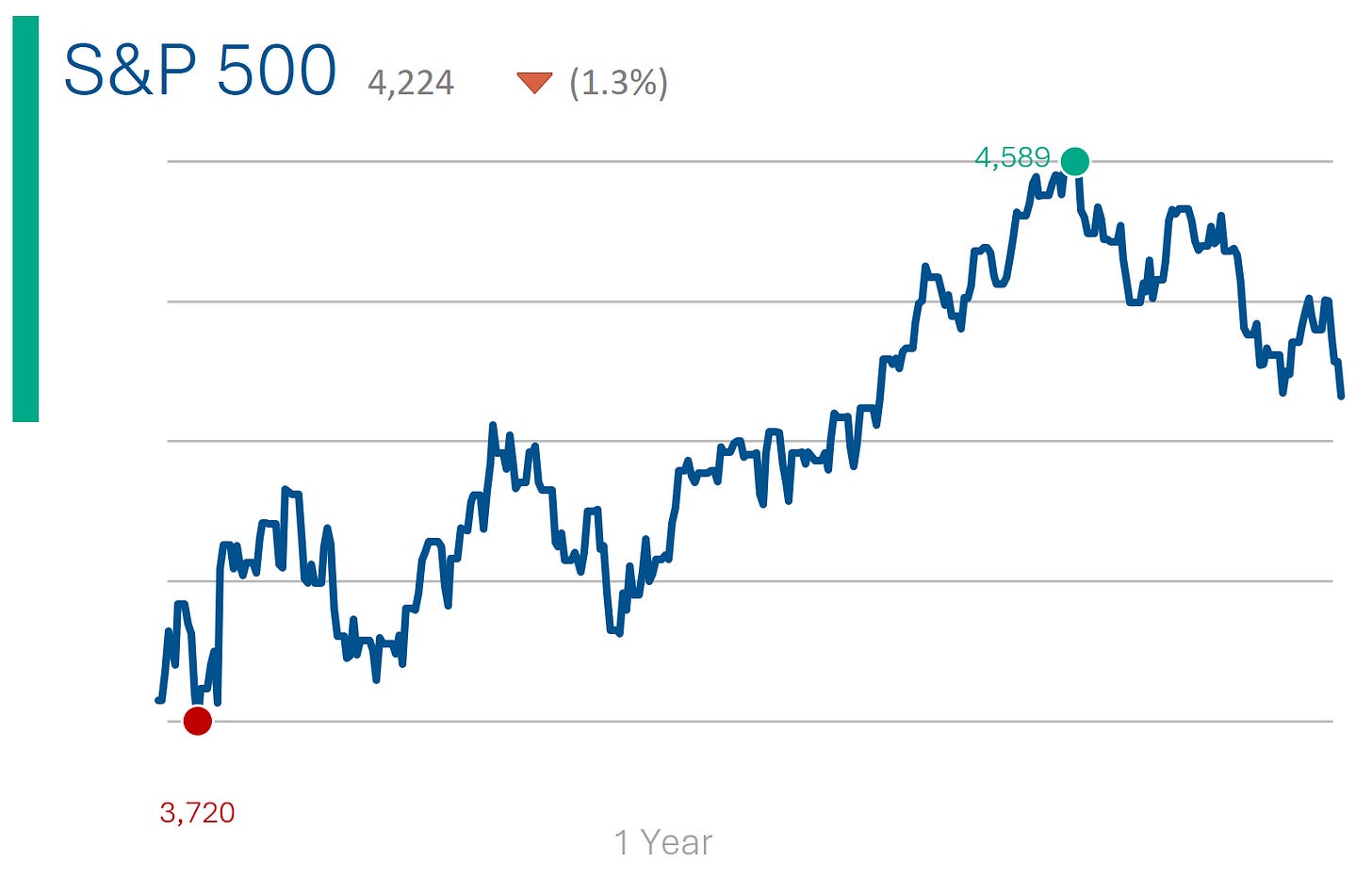

Thus far, things are looking rosy for the S&P 500, with 75% of companies reporting Earnings Per Share figures that either Beat or were In-line with Wall Street estimates. The numbers are similar for Revenue performance (80%) - although more were ‘In-line’ instead of outright beats. We’ll take it.

Since my unofficial start-date of October 1st, 68 of the companies in the S&P 500 have reported (14%) so there is still quite a bit of reporting left to hit the tape. However, the distribution isn’t exactly even: 38% of listed Financials have reported, including most of the big banks. While only a handful of Real Estate (6.5%) and Tech companies (1.5%) have reported. And no Utilities (although, who cares? They’re boring anyway).

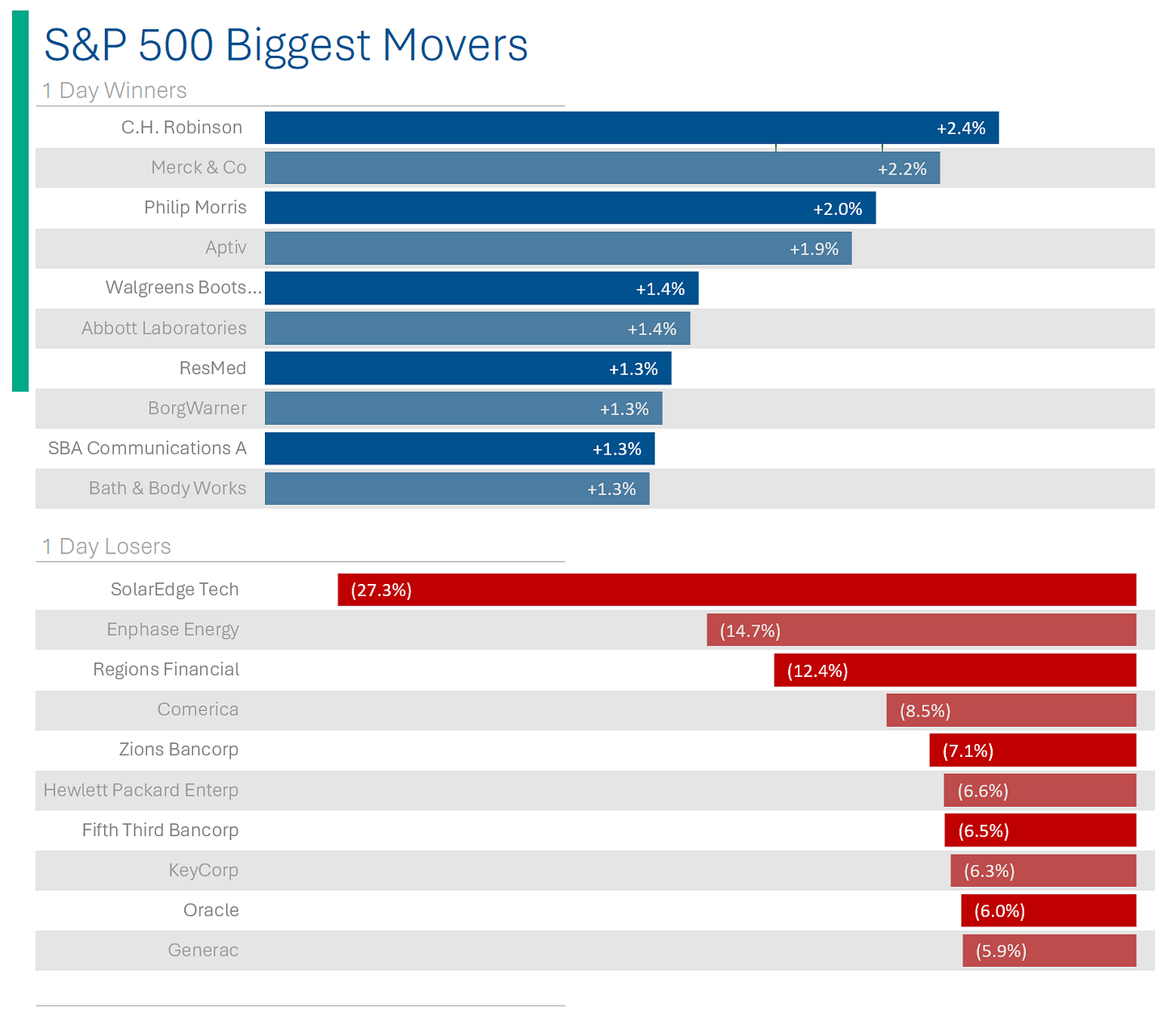

Focusing just on the biggest names to report, Tesla was the only miss - and what a miss it was, with the stock pulling back around 10% on the day (including after hours trading). The Sales blip for J&J likely had to do with stale estimates out of brokers that haven’t accounted for their spin-off of Kenvue, their consumer products division (Tylenol, Motrin, Band-Aid, etc.).

Explainer: If you don’t own any of the companies that have reported, why should you care? Well, there are a few reasons. The first is what are sometimes called ‘read-throughs’ or ‘read-across’. You might not care how Pepsi did when they reported last Tuesday, but you might if you owned Coke shares. Do to operational and competitive factors, their earnings will look different but some of the macro economic factors that influenced Pepsi’s performance can be used as a hint for Coke. For example, if ‘Small Regional US Bank #1’ reported record profits and massive loan growth, you might infer that ‘Small Regional US Bank #2’ is probably going to have a decent quarter as well.

Another consideration is market sentiment. It’s complex, opaque and hardly worth building an investment strategy around, but if a broad mix of companies is having a good quarter, that helps to set a positive tone for the market. Conversely, if every company is out there reporting disastrous earnings, you might want to have a look into your market exposure.

Notes on calculations:

1. Determining what constitutes a ‘Beat’ or a ‘Miss’ is subjective. For myself, I consider a figure that exceeds the estimate by greater than 1% as a ‘Beat’ and a figure that falls short by greater than 1% as a miss.

2. I am only using companies that have reported since October 1st to align with my subjective view of what constitutes ‘earnings season’. For example, Nike reported its Q1 earnings on September 29th because it has a May fiscal year end. Weirdos.

Prime-Time Showdown: Will TikTok’s Views Steal Amazon’s E-Commerce Crown?

The Wall Street Journal did an interesting deep-dive into the unlikely battle taking place between Amazon…and TikTok as the future value of ‘Social Shopping’ becomes apparent. Here’s the gist of it:

E-Commerce Clash: Social media giant TikTok is entering the e-commerce space, challenging Amazon's dominance by transforming its massive user base into a shopping audience.

Amazon's Social Stretch: In response, Amazon is enhancing social elements on its platform, focusing on user engagement to maintain its appeal among younger consumers and compete with TikTok’s interactive user experience. One of these, “Inspire,” is essentially a TikTok style feed.

Trust and Logistics: Amazon holds an advantage with its well-established consumer trust and advanced logistics network, while TikTok - still building its credibility and delivery systems - excels in user engagement. Links to the Chinese government and surveyance on the app have raised the hurdle for them in the US.

Market Projections: Both are vying for a piece of the booming social e-commerce market, expected to reach $100 billion by 2025, and adapting strategies to amalgamate social interaction and online shopping for a wider audience reach.

In the emerging business of ‘social shopping,’ TikTok dominates the social and is spending big to improve the selling. Amazon dominates selling, and is working on the social.

The Great Wall of Sanctions: U.S. Blueprint to Halt China’s Chip Charge

During the Mt. Fuji Dialogue in Tokyo, Under Secretary of Commerce for Industry and Security Alan Estevez emphasized that US-led restrictions on advanced chipmaking equipment would hinder China's progress in developing its indigenous semiconductor industry. Estevez's comments came amidst debates on the effectiveness of US export controls following Huawei's launch of a 5G phone equipped with a 7-nanometer chip made by SMIC.

The US, in collaboration with Japan and the Netherlands, is imposing measures to limit China’s access to advanced chipmaking gear, including restrictions on securing spare parts for existing equipment. The sanctions aim to curb potential military applications of advanced semiconductor technology by China and stem the country’s technological advancement.

Although the US has tightened export control measures to restrict China's access to AI-capable semiconductors and chipmaking equipment, it has yet to address Chinese firms' use of overseas cloud computing services for AI model training. Estevez acknowledged the need for further action in this area and mentioned alternative tools available for responding to potential dumping of lower-end chips by Chinese companies on the global market.

Oil’s Well That Ends... in Recession? The $140 Barrel Debacle

Ana Boata of Allianz Trade warns that a Middle East war - particularly one involving Israel and Hamas - could spike oil prices to $140 a barrel, potentially triggering a global recession with a 20% probability of occurring.

The surge in oil prices could lead to faster inflation and weaker economic growth, causing central banks to adopt a wait-and-see approach before cutting interest rates. Global growth could slow to 2%, nearing the contraction threshold.

Boata raised concerns about increased sovereign risks due to higher real interest rates than growth, highlighting the lack of clear plans by governments to adjust their public finances, and drawing parallels to the 2012 sovereign crisis in Europe.

Take-Aways: At the start of the conflict the focus was obviously localized and humanitarian in nature. Now as the permutations involving Hezbollah, Iran and long-term occupation get delved into, the deeper potential for global contagion is becoming apparent. The global economy is already starting to look fragile, and an open-ended conflict is unlikely to improve that picture.

Joke Of The Day

My first real estate investment will involve campers and dolphins. For all intents and porpoises...

What's the biggest difference between men and bonds? Bonds mature.

What do you call an alligator with an investment account? An investigator.

Hot Headlines

(CNBC) The 10-year Treasury yield just crossed 5% for the first time since 2007

(CNN) China restricts exports of graphite as it escalates a global tech war

(CNBC) Javier Milei: The Argentine presidential candidate wants to abolish the country’s central bank and move to the U.S. dollar - sounds dumb. Unless you’ve had +130% inflation this year. Then it just becomes something they will mess up because that’s their thing.

(Daily Mail) Inside Amazon's 'dystopian' new robot warehouses - no word on productivity improvements, but abandoned water bottles filled with pee is down 57%.

(Gallup) US Confidence in Media Matches 2016 Record Low - New high of 39% have no confidence at all, compared with 27% in 2016.

(Politico) Israeli official slams Greta Thunberg after she backs Palestinians in Gaza

Trivia

What year was Amazon founded?

1989

1991

1994

1998

Amazon has over 100 subsidiaries. Which of the below isn’t one of them?

ComiXology - a cloud-based digital comics platform

Beijing Century Joyo Courier Services - a freight forwarder

Whole Foods Market - an American supermarket chain

Twitch - a live-streaming video platform

HoloLens - an augmented reality (AR)/mixed reality (MR) headset

Where did Jeff Bezos work before founding Amazon?

Hedge fund D.E. Shaw & Co.

NASA

Database software and technology Oracle

Consulting company McKinsey & Co.

(answers at bottom)

Market Update

Trivia Answers

1994.

HoloLens - that’s owned by Microsoft.

D.E. Shaw & Co. Its one thing to leave a dead-end job to start a business, but bailing on one of the top hedge funds in the world - where he was one of their youngest ever VPs - to open a book store on the as-yet-unknown internet was a leap.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and give us a ‘Like’ below.