Government Shutdown, China Property Market, the US Consumer, and more...

StreetSmarts Morning Note

“The stock market is a device to transfer money from the impatient to the patient.”

-Warren Buffett

Table of Contents:

Trivia

Joke Of The Day

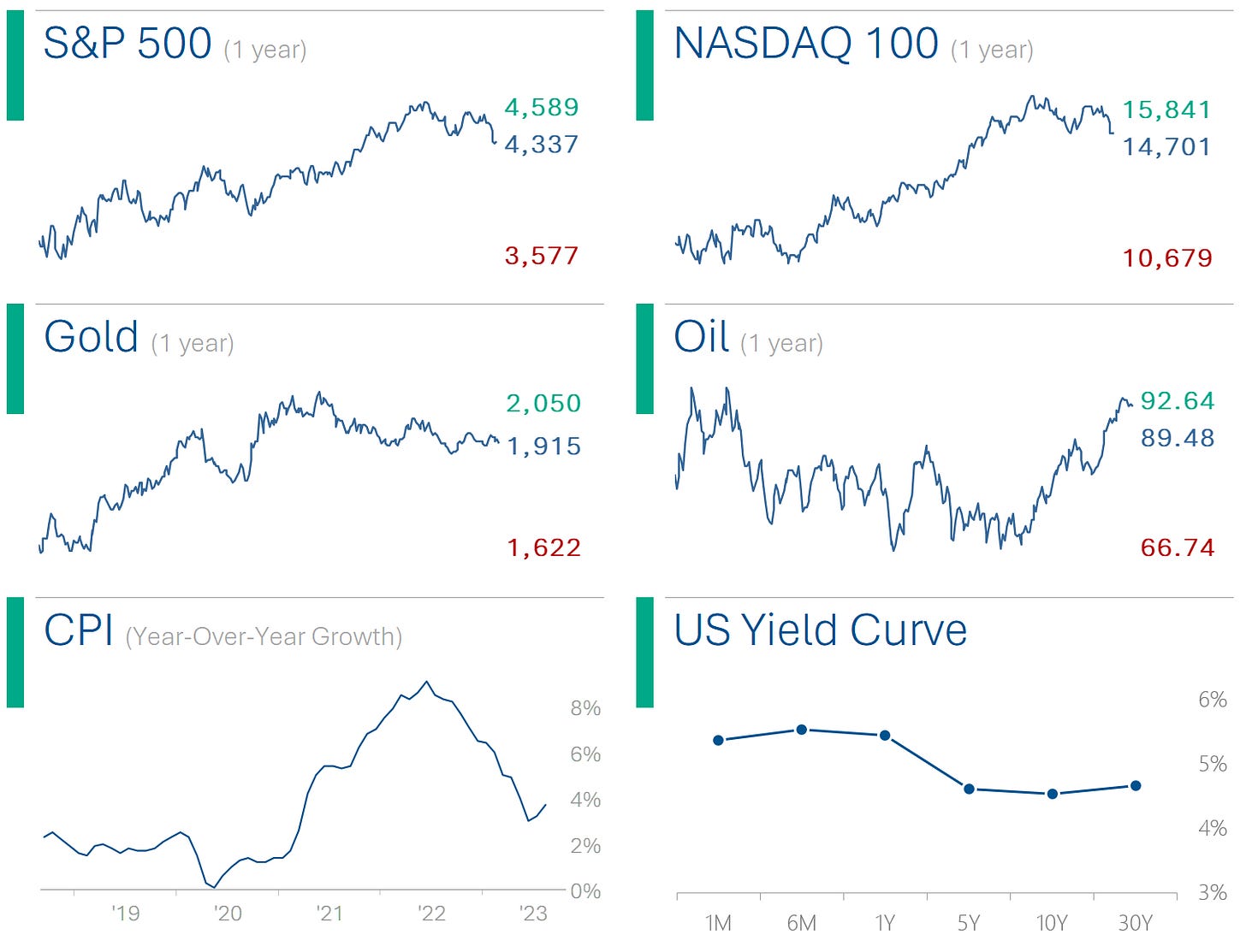

Main Indices

Global Market Indices

Global Commodity Prices

Global Exchange Rates

Interest Rates

(Shut)downgrade

Potential Moody’s Downgrade for US Credit Rating

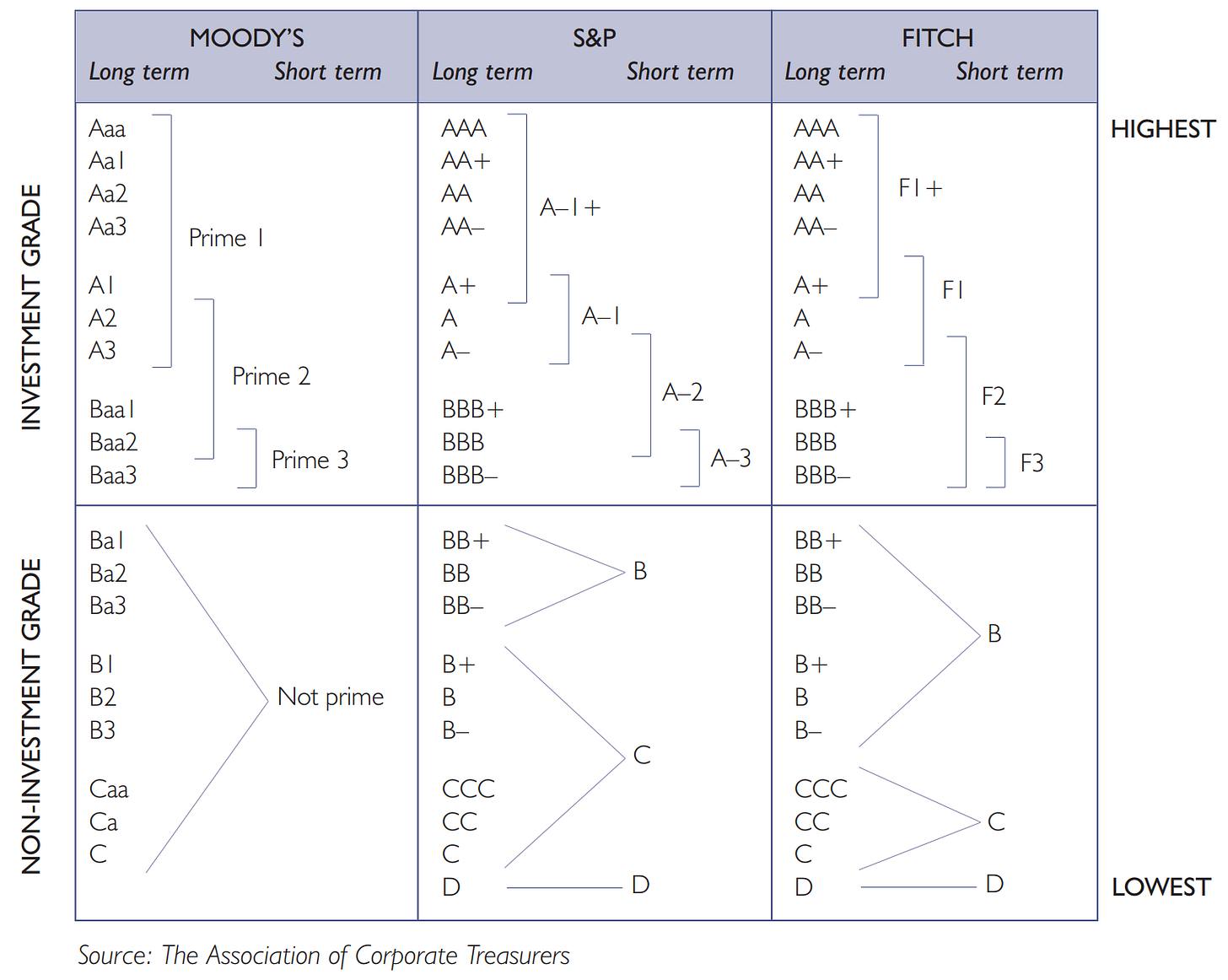

There are three big credit rating agencies in the world: Moody’s, S&P Global and Fitch. These agencies effectively provide the risk ranking for various bonds and loans, be they public companies, private ones, or governments. US debt in the form of T-Bills, T-Notes and T-Bonds have been the gold standard of investing since way before I was born, and as a result have almost always carried a AAA rating (Aaa if from Moody’s, which I still think is weird). Also, US Treasuries are known as “safe haven assets” - products investors flock to in times of uncertainty. Prior to 2023, the only time the US was downgraded by a major rating agency was in 2011 by S&P. 18 days later its CEO was forced to resign. Two years later they woke up to a $5 billion lawsuit by the US Government. Needless to say, the ratings agencies tread lightly with respect to the market for US ‘govies’. Or they did.

Having said that, 2023 has been a weird year for government debt. Beyond the interest rate hikes, the US’ credit rating came into question this summer in the run-up to raising the debt ceiling. Brinksmanship and a sprinkle of idiocy meant things (as usual) came down to the eleventh hour. Fitch was getting sick of these games, and citing fiscal deterioration over the next three years (sure, ok) and repeated down-to-the-wire debt ceiling negotiations that threaten the government’s ability to pay its bills (← the real reason) and they downgraded the US from AAA to AA+.

Maybe Fitch had just had enough - or maybe the CEO was hoping the expected fireworks would get him a golden parachute like the S&P guy (coining the phrase ‘Loud Quitting’). Regardless, it was a sign that financial markets are getting sick of the government playing games for political ends. A sign that Congress took to heart…for about a month.

Without a new funding plan in place, the US ‘Government Shutdown’ will take place on 12:01 a.m. on Sunday, Oct. 1, 2023. Potentially hundreds of thousands of government employees are at risk of being furloughed but the impact (if any) would likely be limited and short-lived (obviously it could get really bad but congresspeople want to get re-elected).

Moody’s - the last holdout still giving the US a shiny AAA rating - is looking like the next one of the trio to get sick of this political brinksmanship. Moody’s bond nerd Senior Credit Officer, William Foster, listed his displeasure in a statement to the press. Foremost of this concerns is that the maneuvering regarding the Shutdown ‘underscore[s] the weakness of US institutional and governance strength relative to other Aaa-rated sovereigns’. For unsmiling bond credit rating people, that’s a big diss.

Opinion: I don’t know what’s going to happen. Probably another last minute deal. Even so, Moody’s might just bite the bullet and drop the rating like all the other cool kids. What stands out to me is how little this stuff seems to really matter to markets anymore. When Fitch cut its rating back in August the Street shook it off in a few hours. Ratings, printing trillions, fiscal indifference - these things use to be big events. Maybe its our Millennial attention spans. Or maybe everyone sorta figured out this stuff is all made up any way.

TLDR: If Moody’s cuts, it will be a big deal. For 6 hours.

Chinese Property

Headaches Continue

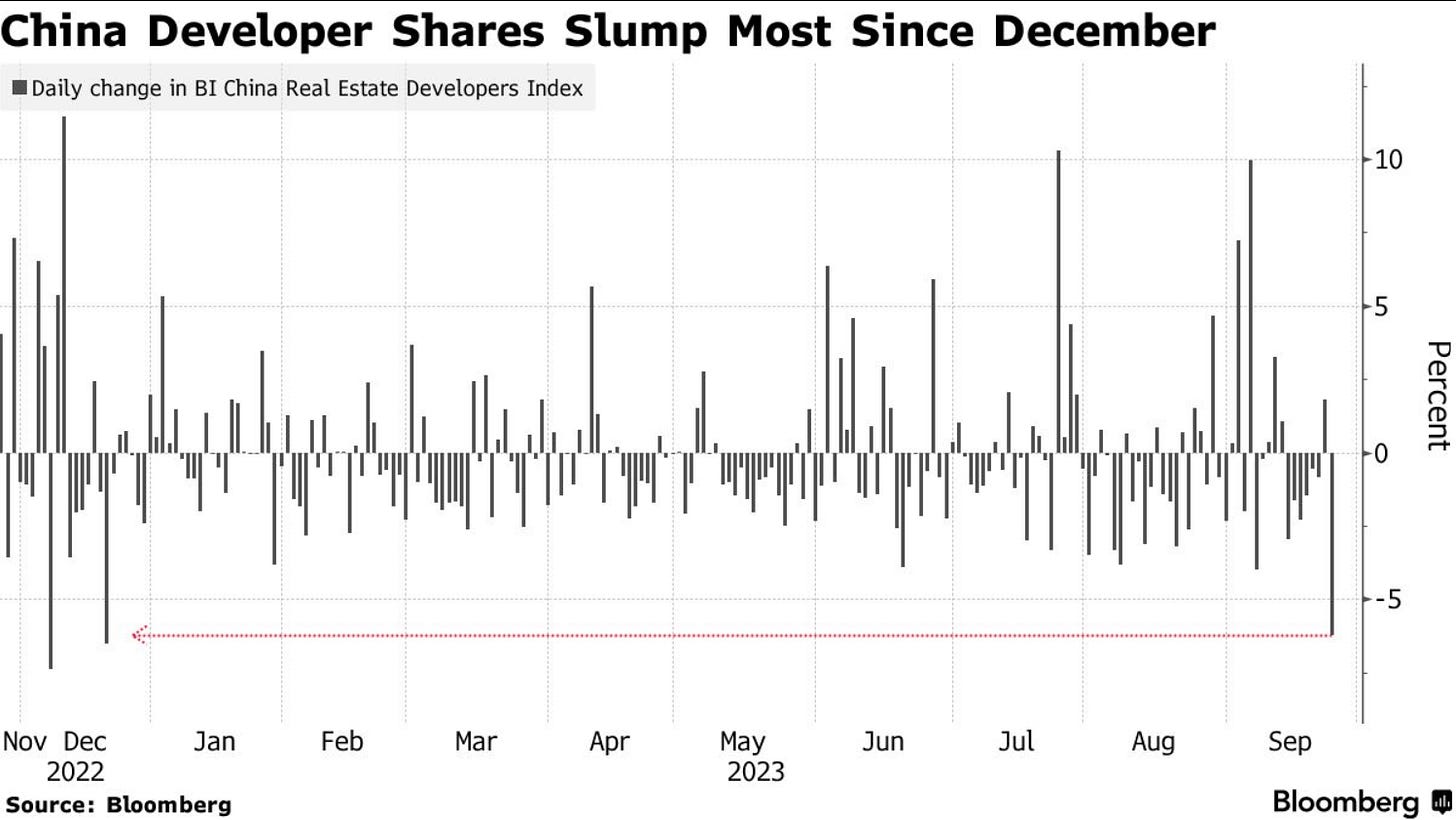

Property stocks in China tanked on Monday with Bloomberg’s developer tracker dropping 7.1% - the most since last December. Why does this matter? Well, China contributes to ~18% of global output; and China property alone makes up over a quarter of Chinese GDP. So, a China property slowdown, like we saw kick off in 2020 on the back of increased regulation, will ultimately be a drag on global growth. The main catalyst for Monday’s plummet was the rumored pending liquidation of China Evergrande following a restructuring that has apparently gone less then well. But its not just Evergrande:

China Aoyuan Group dropped a record 72% following its less than glorious return to trading after an 18 month halt.

Last week the Chinese securities regulator launched in investigation into Ping An Real Estate over an overdue loan payment.

Country Garden, China’s largest developer until last year, staved off default in July with a domestic debt restructuring but apparently missed another payment on a USD denominated bond on September 17th and still has a 109 billion yuan ($14.9bn) in loan and bonds coming due in the next 12 month.

“Overall, the risk of real estate investment in China is controllable”

-Benjamin Deng, Ping An CIO (March 2023)

…he forgot to say ‘psyche!’

The US Consumer

Ending (not Spending) Spree

The situation for the US consumer (and also the stock market) isn’t all sunshine and rainbows (or, like, lattes and athleisure). While we’ve started to see signs that the wrenching inflation of the last year is starting to subside, there’s plenty more to deal with for the average Joe in the States.

Oil: Energy prices are a major overhang, with gasoline price up 10.6% in August and still increasing across the US in September. The oil price also creeps its way into nearly everything that we buy, and with oil closing in on $100 a barrel this could potentially fuel further sustained inflation. Translation: If things are more expensive, people buy less things.

Student Loans: The end of the student loan freeze means ~44 million Americans will likely have to reallocate a good portion of their consumption spending towards loan interest and principal (est. average monthly payment of around $503).

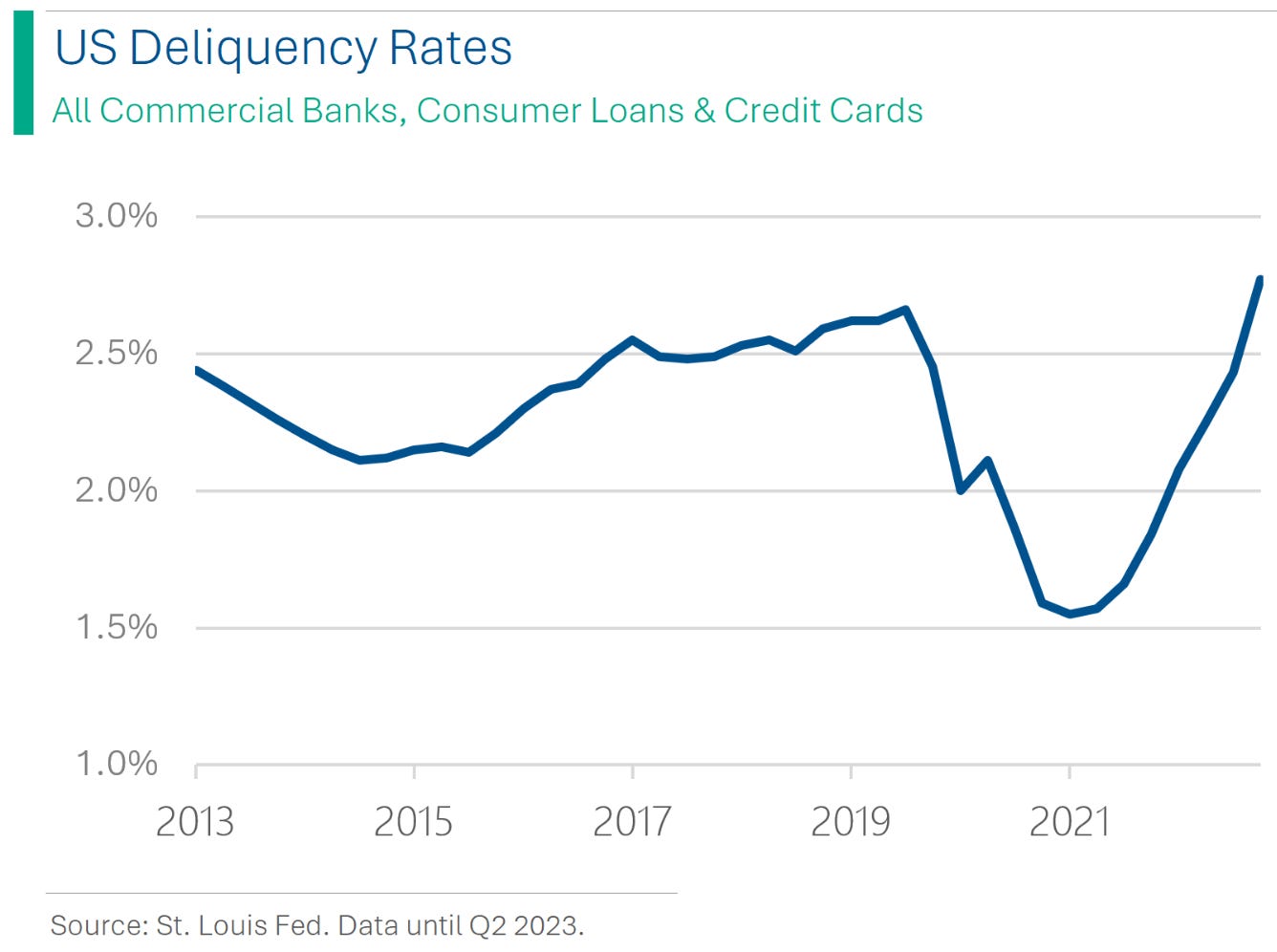

Consumer Credit: The high savings rates of the pandemic are gone (see Speed Round for more on this) and consumers are juicing their AMEX’s again, with total US credit card debt surpassing $1 trillion in the summer for the first time ever. Delinquencies are growing and now stand at 3.63% (up 1.5% from their recent bottom) with Goldman estimating this figure to grow to 4.93% by Q4 2024/Q1 2025. Auto loan delinquencies also reportedly hit 7.3% in Q2 and the growth rate across all of consumer credit doesn’t look to be slowing down any time soon.

Opinion: While talk of a ‘soft landing’ - ie: the idea that the economy can cool down inflation without triggering a recession - seems to be most people’s base case, the idea that the US consumer is healthy and that consumption is strong could require some rethinking.

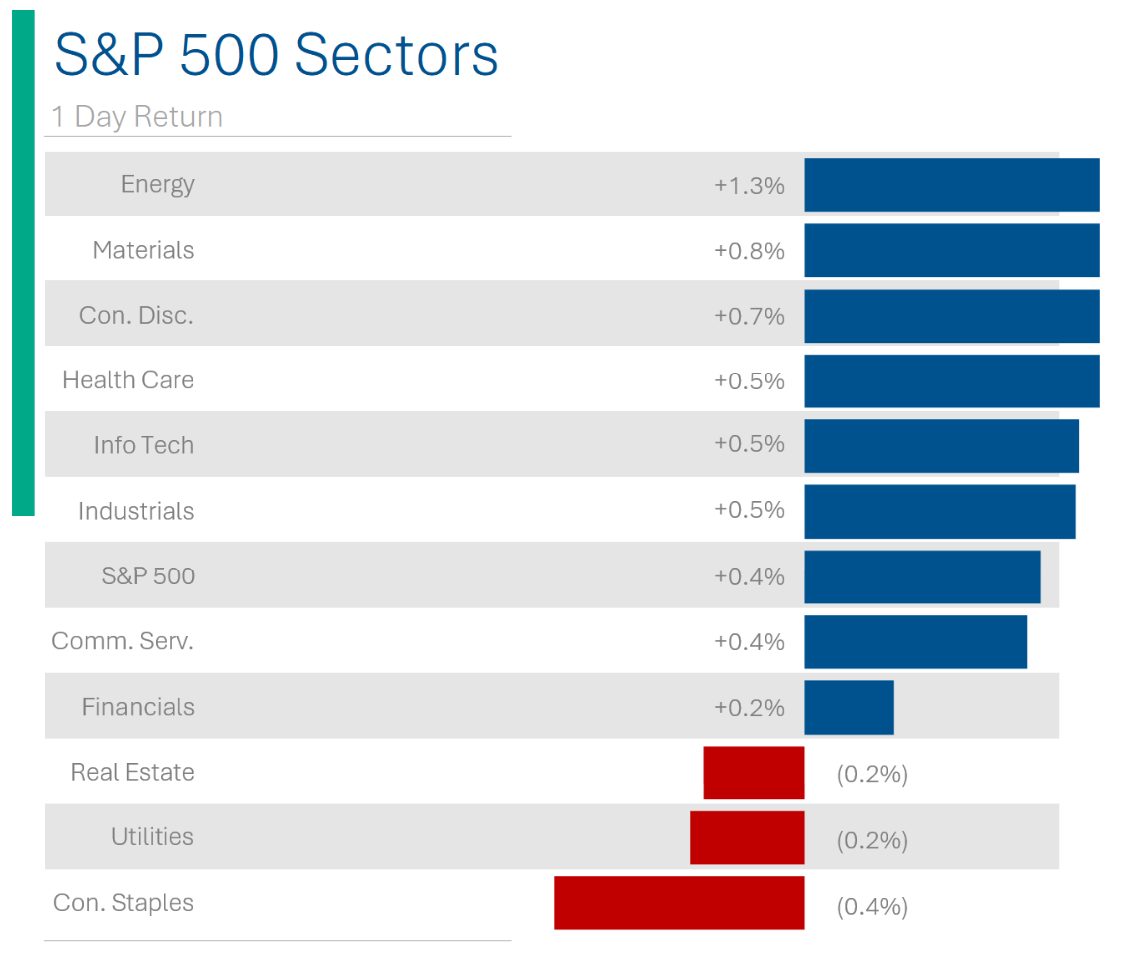

The core of the US economy is domestic consumer spending and you don’t need to have a doomsday prophecy to see there are potential weak points in financial markets. In particular, the US Consumer Discretionary sector has been on a tear this year and is currently trading at near record high valuations. Perhaps its time to take a little money of the table there if you have some.

TLDR: I’m probably not adding to my Horizon’s Consumer Discretionary ETF any time soon.

Speed Round

Canadian Parliament Accidentally Applauds Nazi - President Zelensky visited Canadian Parliament to an audience of not just politicians but also Ukrainian refugees and ex-pats. Nice touch. The Speaker of the House even called out 98 year old Yaroslav Hunka and led an ovation for the former WWII soldier. The moment wasn’t touching for long as it was soon revealed that Yary was actually former member of the Waffen SS. My 5 year old could vet people better than that.

Manhattan Rental Market - Your friendly, neighborhood investment banker didn’t move to Brooklynn just because it was trendy. In fact, I’m convinced that the only people who live in Manhattan are the bad guys in Dumb Money.

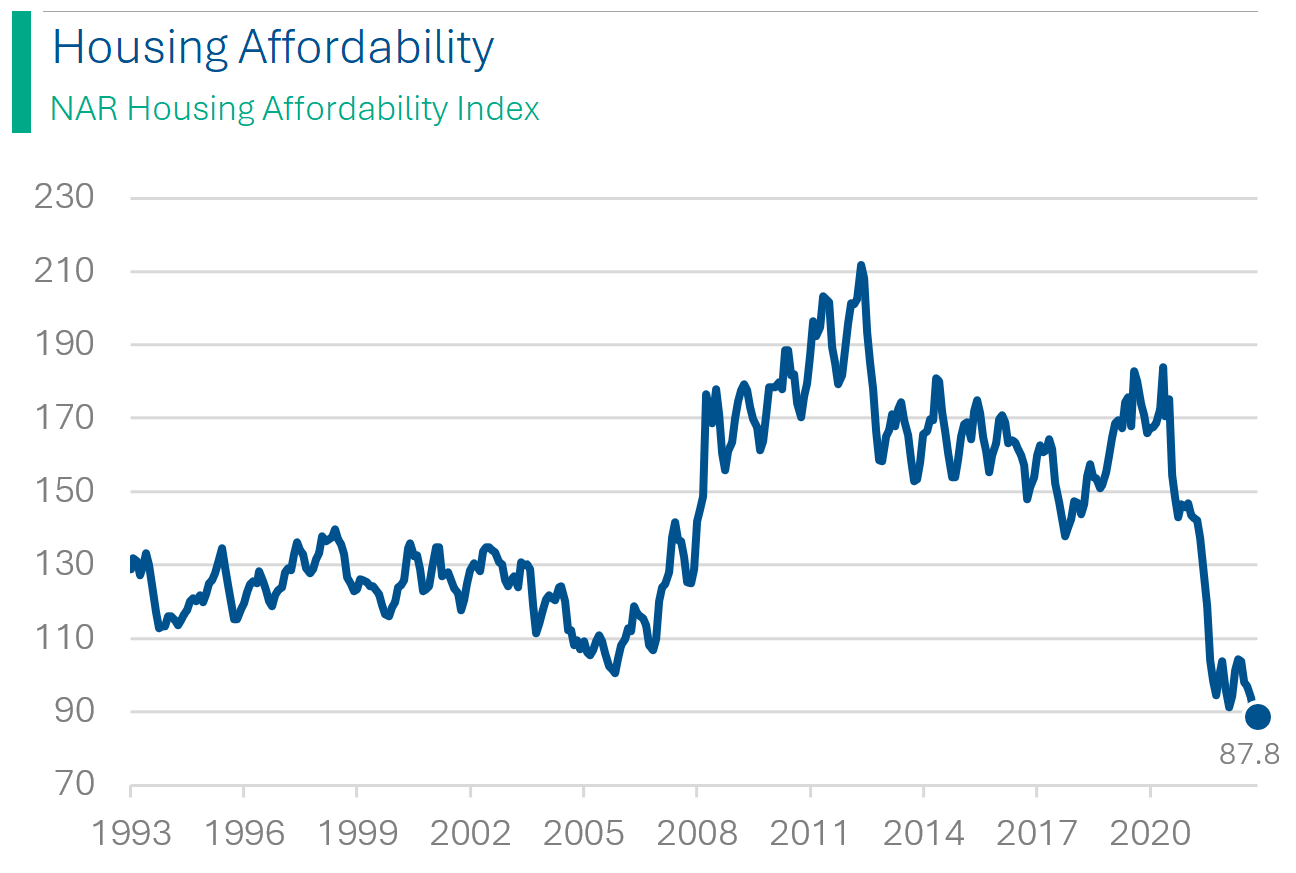

The 30-Year US Mortgage rate - is closing in on 8% for the first time since the year 2000. August saw applications for new mortgages reach a 28 year low, ie: worse than the Great Financial Crisis.

The above, coupled with stubbornly high housing prices, mean that housing affordability is at its lowest levels in over 30 years.

Household Savings - A new study from the Fed shows bottom that the 80% of earners have exhausted cash savings, now have less cash than before pandemic.

This week caps off a traditionally bearish time for markets, but fear not as Q4 tends to be surprisingly positive for US markets. Over the last 20 years, the DJIA has seen average monthly gains of 1% or more in each of October, November and December, with positive returns 65%, 70% and 65% of the time, respectively. In addition, the last three times SPX lost at least 1% in August and September, it bounced in October, rallying 8% in 2022, 8.3% in 2015 and 11% in 2011. Fingers crossed!

Grab Bag

Trivia:

Where's the oldest stock exchange in the world?

Lyon, France

Barcelona, Spain

Hamburg, Germany

Toulouse, France

Antwerp, Belgium

Geneva, Switzerland

Where was the first stock exchange in the United States?

Boston, Mass.

New York, N.Y.

Philadelphia, Pa.

Washington, D.C.

What was the first listed company on the NYSE?

Nationwide Insurance

Prudential

Bank of New York

Merrill Lynch

(answers at bottom)

Joke Of The Day:

Why are nudists bad for the stock market?

They are associated with bare markets.

I purchased $1,000 in Bose stock today.

My accountant said it would be a sound investment.

Market Update

Main Indices

Global Market Indices

Global Commodity Prices

Global Exchange Rates

Interest Rates

Trivia Answers:

Where's the oldest stock exchange in the world? The Belgian ‘Antwerp Bourse’ opened its doors in 1460 and kept going until 1997.

Where was the first stock exchange in the United States? New York is where all the action is today, of course, but the Philadelphia Stock Exchange, founded in 1790, predated it by two years

What was the first listed company on the NYSE? Shares of the Bank of New York were traded under the fabled buttonwood tree on Wall Street in 1792.

Great read