Gold Is Safe (and Shiny!), House Hunters Become Couch Potatoes, and Much More

StreetSmarts Morning Note

***Friendly reminder to hit the ‘Like’ button above, it really helps get Substack to share my newsletter***

“The economy depends about as much on economists as the weather does on weather forecasters”

-Jean-Paul Kauffmann

“Money is better than poverty, if only for financial reasons.”

-Woody Allen

American Airlines Group, AT&T, Blackstone, CSX, Fifth Third Bancorp, Freeport-McMoRan, Genuine Parts, Intuitive Surgical, KeyCorp, Marsh & McLennan, Philip Morris International, Taiwan Semiconductor Manufacturing, Truist Financial, and Union Pacific report earnings today.

Table of Contents

A.M. Allocations: Summaries of important news and investing events

Glittering Safeguard: Why Gold Gleams Brightest in the Gloom

Ohm My God: Tesla’s Jolts and Jitters in a Un-Plugged Economy

Home Alone: Mortgage Hikes Turn House Hunters into Couch Potatoes

Hot Headlines: Links to some of the top financial stories of the day

A.M. Allocations

Glittering Safeguard: Why Gold Gleams Brightest in the Gloom

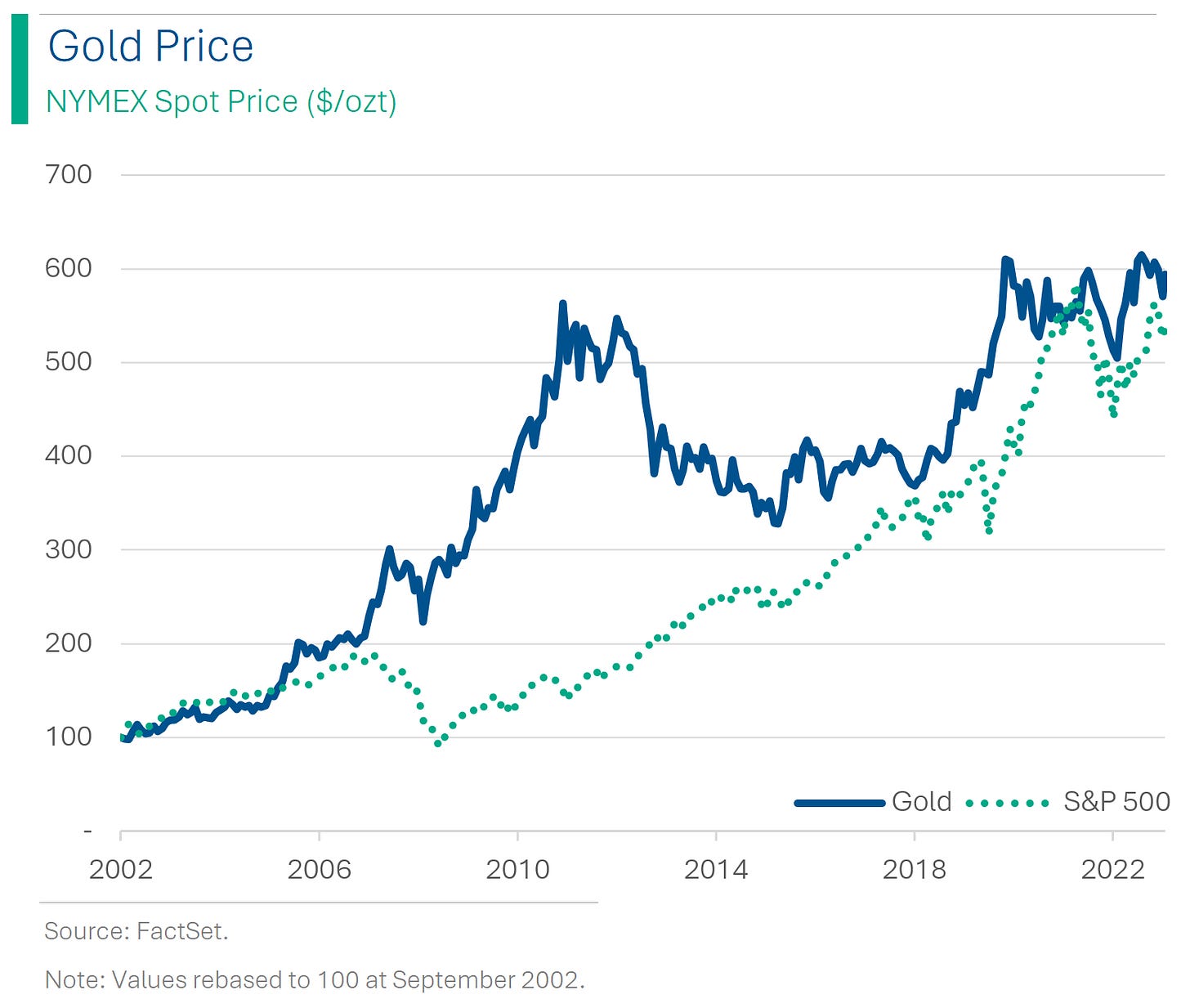

Last Tuesday, I touched on the gold price (‘Is Gold Poised For a Rally?’), the idea being that – along with the USD – Gold is considered one of the world’s ‘safe haven assets’: a role it’s held since pre-history. Gold is up 3.3% and the S&P is up less than 1% in the 9 days since that post.

While the USD has strengthened against other global currencies (the Dollar Index (DXY) is up over 13% in the last 3 years), gold is still hovering below its all-time high it touched back in July 2020.

Explainer: “Safe Haven” assets are key portfolio additives when the global macroeconomic outlook is murky – or super scary, as we saw a flight to quality assets during the Great Financial Crisis. The utility of gold as an investment can be seen its stability (and often appreciation) in the run-up and during economic crisis or recessions.

Now I don’t want to tell anyone how to invest - that’s not the point of this newsletter, and I don’t have a boilerplate disclaimer below - but rather, I wanted to present ideas and explain options for people that might be considering Gold as an investment. So, if you hold the view that the economic outlook for the world is deteriorating (as many do) then consider the below:

1. A high proportion of precious metals are mined in Africa and there is often significant labor disruption. For example, in my investment banking days, we had to call off an M&A pitch because one of the company’s main competitors had a strike that turned into a literal massacre.

Take-Aways: Considering the double-digit inflation we’ve seen since gold’s last peak, plus rising recession fears for 2024, and now a war in the middle-east, it seems increasingly likely to me that we will see ‘safe haven’ assets attract new investors looking to hedge amidst the murkier global economic outlook.

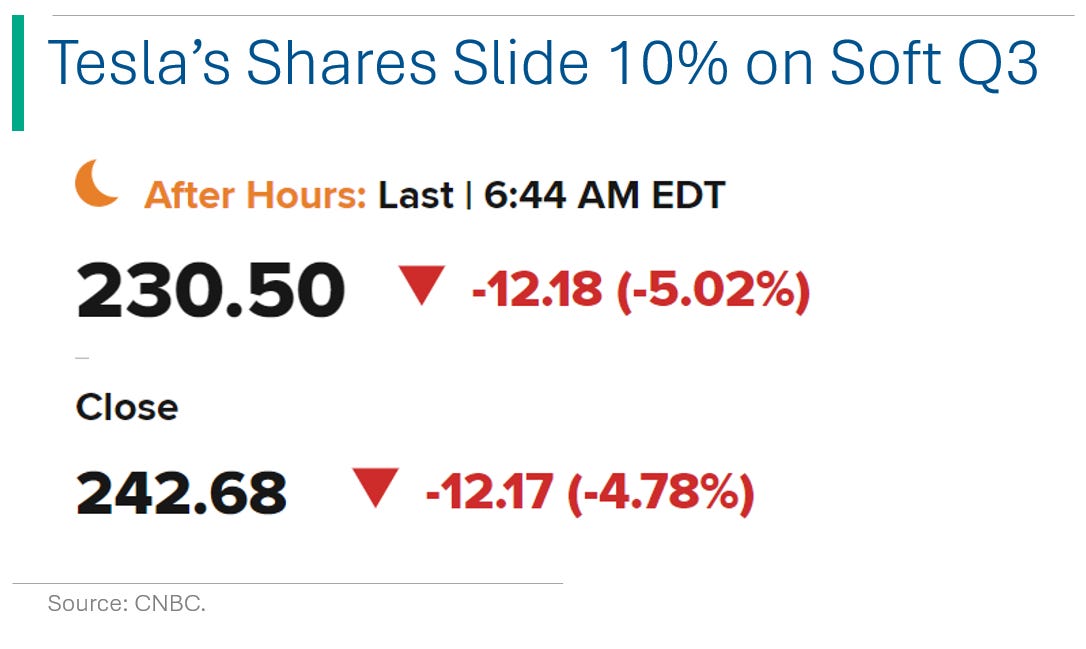

Ohm My God: Tesla’s Jolts and Jitters in a Un-Plugged Economy

Tesla's shares fell after reporting lower than expected earnings and profit margins, attributed to significant price cuts to boost sales volume amidst rising interest rates and increased EV competition. The price cuts resulted in a reduction of automotive gross profit margins and a nearly 10 percentage points drop in operating profit margins year over year.

“Tesla is an incredibly capable ship,” Elon Musk said on the earnings call, “even a great ship in a storm has challenges.”

Elon expressed concerns about the high-interest-rate environment impacting car sales and acknowledged that Tesla’s rapid volume growth can’t continue indefinitely. Construction of Tesla’s Mexico plant and the goal of shipping 1.8 million units in 2023 could face challenges in the current economic climate.

Take-Aways: The broader auto industry, including General Motors and Ford, is also feeling the economic pinch, leading to delayed projects and reduced production. Rising interest rates and a slowing economy are prompting a more conservative approach in the face of evolving EV demand and profitability concerns.

Home Alone: Mortgage Hikes Turn House Hunters into Couch Potatoes

The U.S. has experienced a drastic decline in mortgage applications, reaching the lowest level since 1995, due to the continuous rise in interest rates on 30-year fixed-rate mortgages, currently at 7.90%—the highest since 2000. This increase has been influenced by rate hikes initiated by the Federal Reserve and recent bond market activity.

Sales of previously owned houses are anticipated to have fallen for the fourth consecutive month, largely attributed to elevated borrowing costs and a low inventory of available homes. Many current homeowners are reluctant to sell and re-enter the market at the present high borrowing costs.

Take-Aways: The escalating mortgage interest rates and a reduction in housing inventory are exacerbating the downturn in the U.S. housing market. Despite potential buyers showing increased interest in adjustable-rate mortgages to counter the high rates, the overall homebuying activity continues to retract, indicating ongoing challenges and a potential further slowdown in the housing market.

Joke Of The Day

Why is money called dough? Because we all knead it.

Got an email asking me to invest in Egyptian architecture. Sounds like a pyramid scheme to me.

A boy asked his bitcoin-investing dad for 1 bitcoin for his birthday Dad: What? $56k??? $31k is a lot of money! What do you need $18k for anyway?

Hot Headlines

(Reuters) US single-family starts rise; soaring mortgage rates a challenge - Data is actually a bit misleading here, due to the lag between application approvals and construction. Rates looked to be moderating a few months ago, when approvals went through before mortgage rates starting increasing to current record highs.

(Reuters) OPEC plans no immediate action after Iran urges Israel oil embargo - OPEC’s dumb but not stupid.

(USA Today) As Americans collected government aid and saved, household wealth surged during pandemic - U.S. households’ real median net worth grew to $192,900 by the end of 2022, up from $141,100 recorded three years prior.

(Yahoo) Netflix reports Q3 as subscribers surge and the company announces price hikes in some regions - Basic and Premium plans will now cost $11.99 (from $9.99) and $22.99 (from $19.99), respectively, in the US. Is now a good time to try Paramount+?

(CNBC) Amazon begins delivering medications by drone in Texas - Not sure if controlled substances are a good first step. Probably better than bricks, but still.

(Reuters) Canada's Scotiabank to cut 3% of its global workforce; takes Q4 charge

(Reuters) US analysis shows Israel not responsible for hospital explosion -White House

Trivia

Which country is the largest consumer of gold?

A. United States

B. China

C. India

D. Australia

Which war led to the establishment of the Gold Standard in the United Kingdom?

A. The War of the Roses

B. The Napoleonic Wars

C. World War I

D. The Crimean War

The discovery of gold in which country in the 1880s led to the Witwatersrand Gold Rush and the founding of Johannesburg?

A. Australia

B. Canada

C. South Africa

D. United States

(answers at bottom)

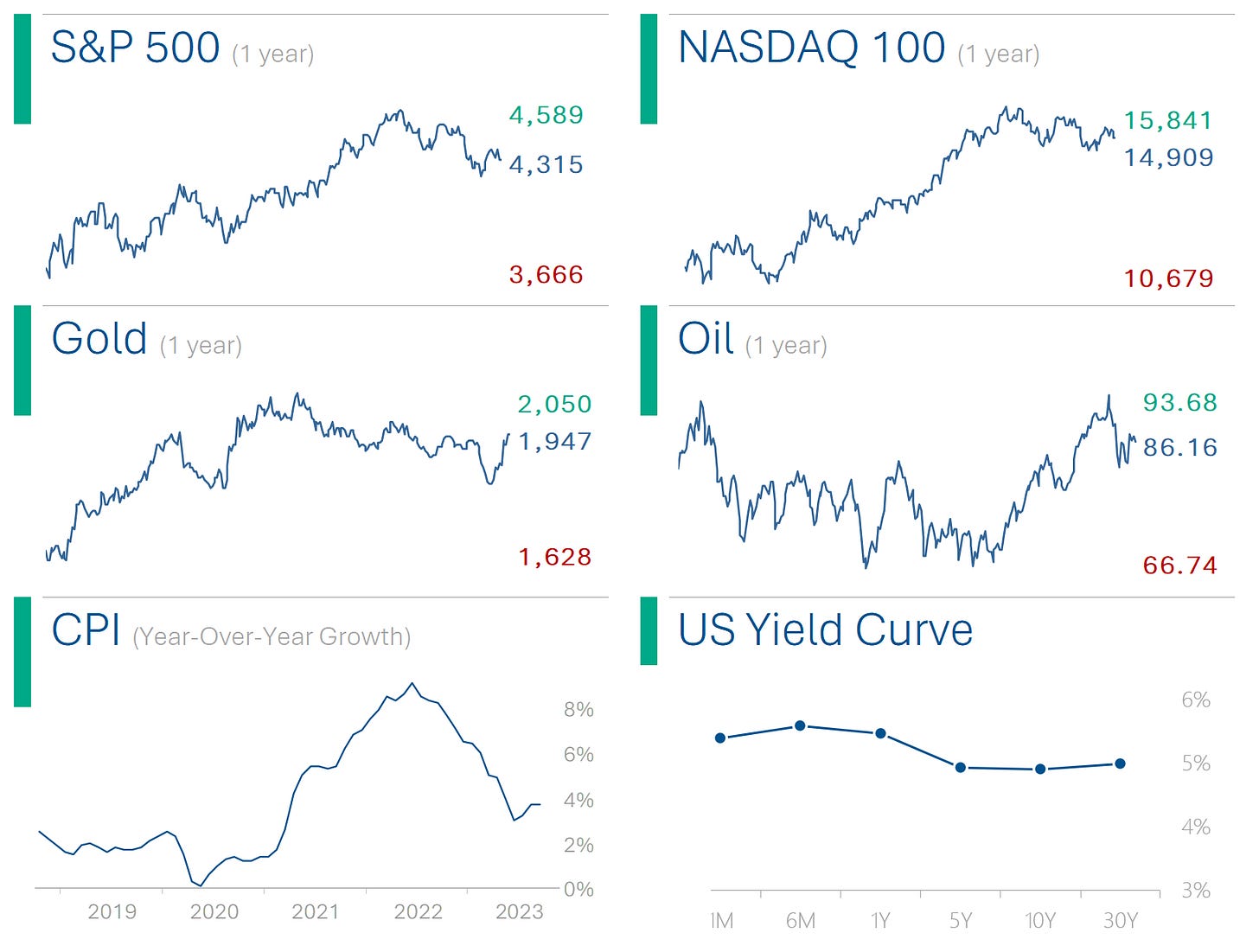

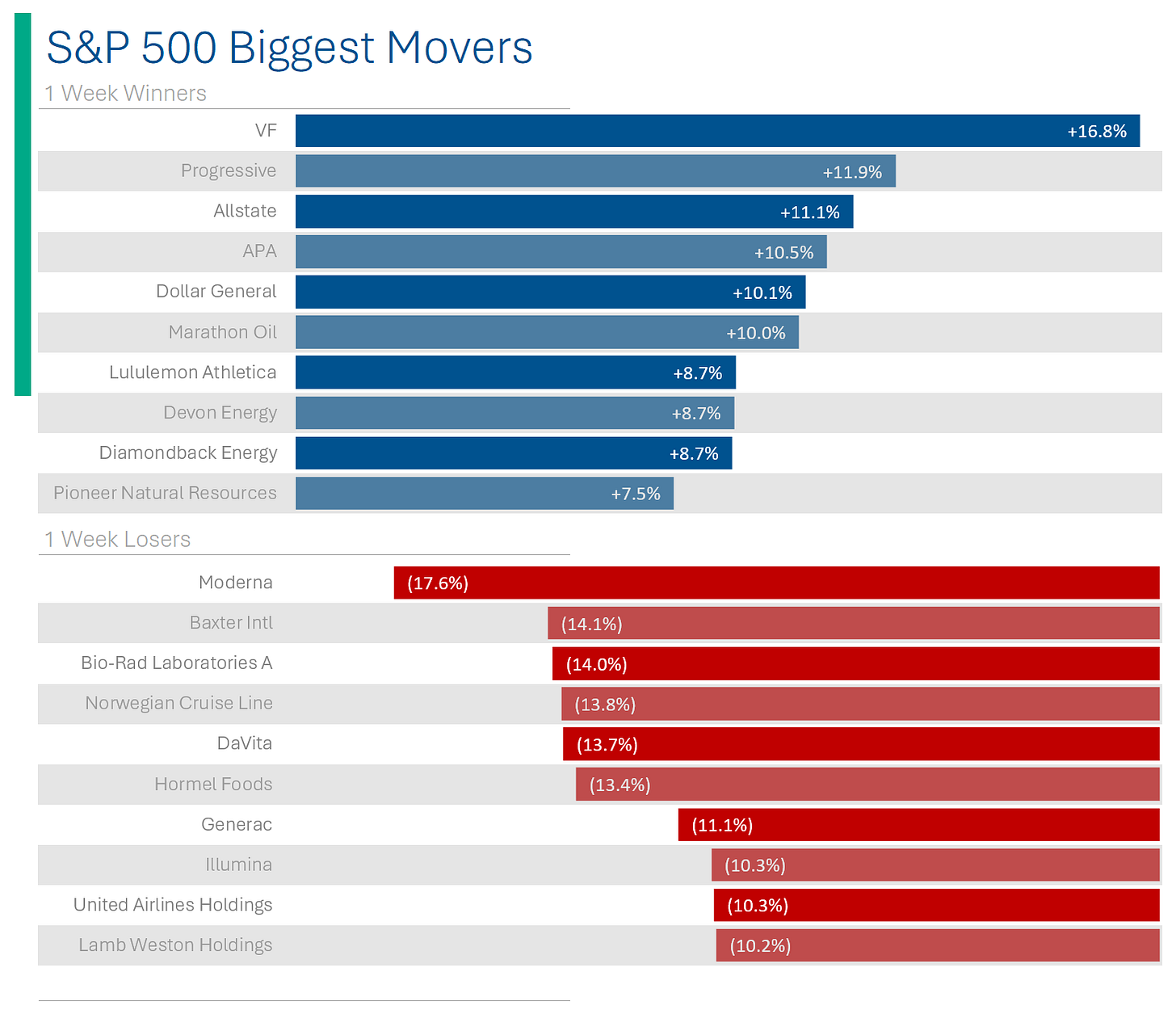

Market Update

Trivia Answers

C. India. Gifting gold is a deeply ingrained part of marriage rituals in Indian society—weddings generate approximately 50 percent of annual gold demand in India.

B. Napoleonic Wars. After the Napoleonic Wars - which induced financial unease - the British parliament passed a law in 1819, forcing the Bank of England to make all its currency notes changeable to gold.

C. South Africa.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and give us a ‘Like’ below.