🔬Gold Is Hot, USD Is Cold, Leftover Turkey Is Delicious, and Much More

"Only when the tide goes out do you discover who's been swimming naked"

- Warren Buffett

"All I want to know is where I’m going to die, so I’ll never go there"

- Charlie Munger

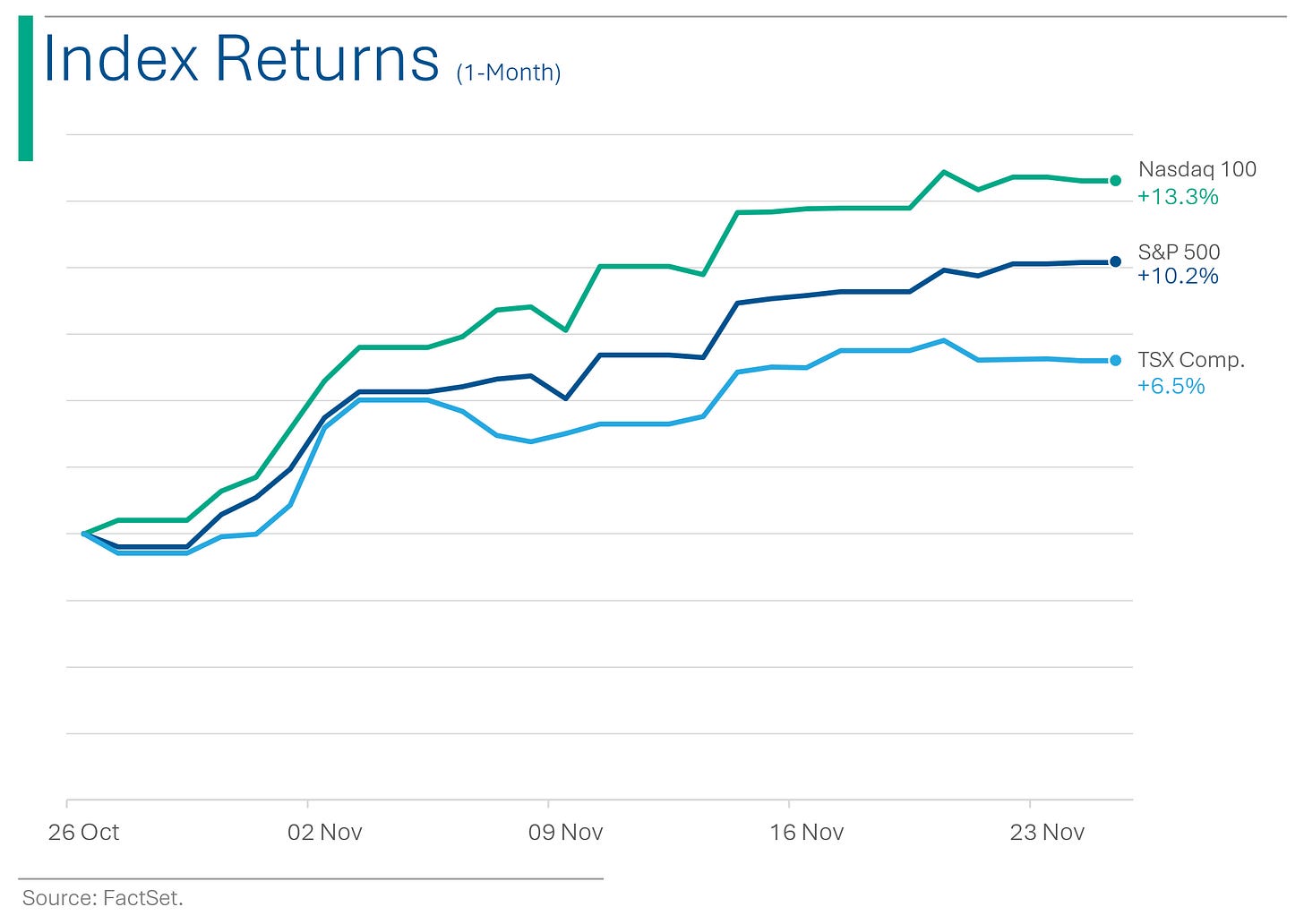

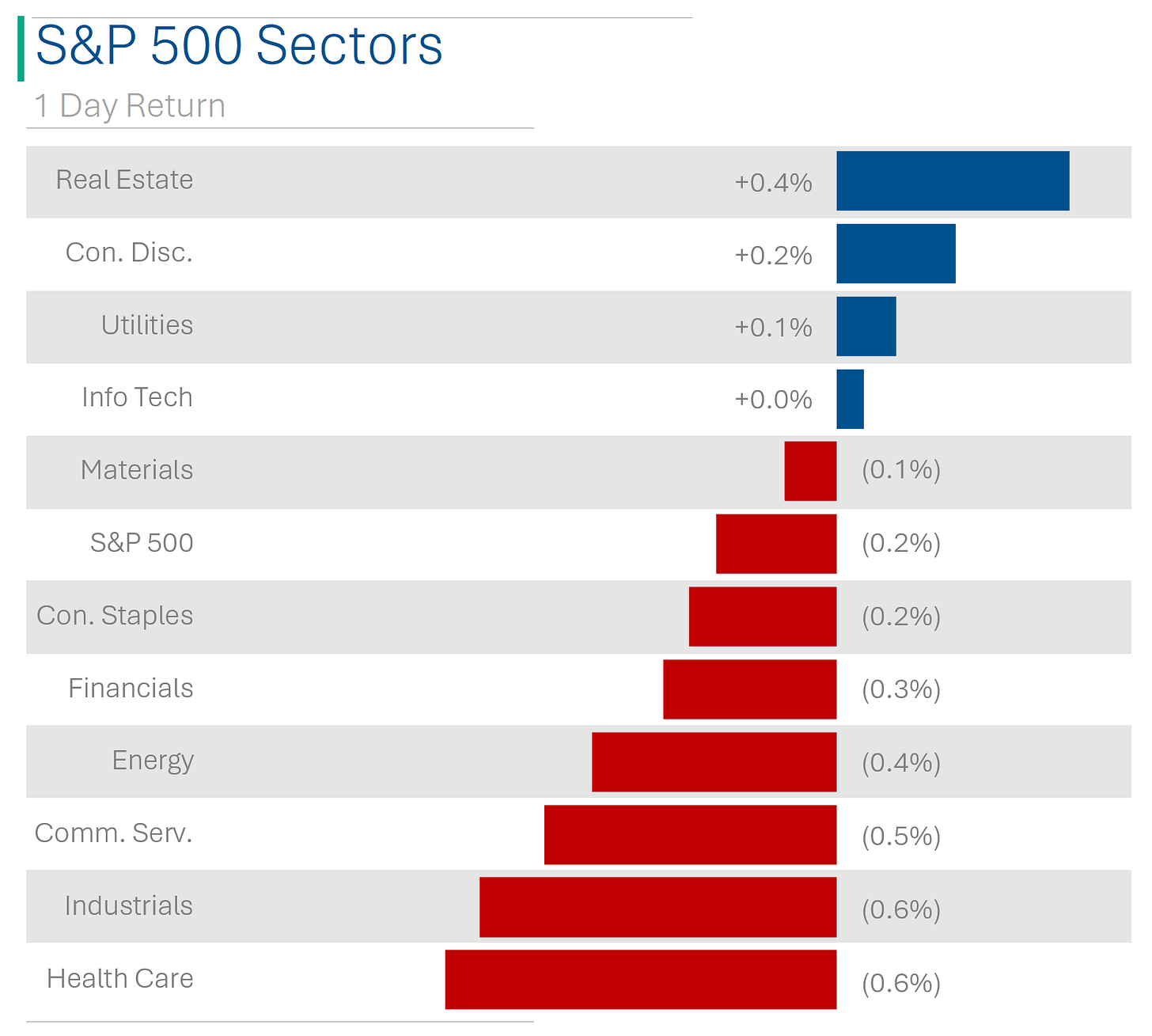

US equities finished down smalls (S&P 500 -0.20%, Nasdaq -0.07) and near lows of the day in a sleepy start to the week.

4 of 11 sectors finished in the green led by Real Estate (+0.4%) and Consumer Discretionary (+0.2%). Health Care and Industrials weakest (both -0.6%)

Gold was up +0.5% as it closes in on all-time highs (more below)

Shopify was up +4.9% following strong Black Friday eCommerce. Amazon (+0.7%) wasn’t as lucky.

Oil down 0.9% on continued slide and renewed volatility after OPEC members push back on Saudi demands to lower quotes (more below)

Some mixed takeaways around Black Friday and consumer trends, notably increasing retailer discounting.

Hot Headlines

GOLD CLOSES IN ON AT ALL-TIME HIGH - Gold broke the $2k price and is now only ~3.7% off of its all-time high price, which came about after the money printing party stimulus efforts in the early-Pandemic. Buoyed by increased optimism for a soft-landing for the economy and an end to additional Fed rate hikes, the most recent move forward came after the November 14th inflation report came in much lower than expected. I’ve been talking about gold for a while now, here’s a bit of deep-dive I did on why it outperforms when markets are shaky.

STOCK SELLING BAN IN CHINA - The Beijing Stock Exchange has informally barred major shareholders from selling their stocks to protect a recent surge in its market, which had previously struggled due to low investor interest. The exchange, which predominantly lists innovative small companies, saw a 46% rise in its benchmark index this month, following various supportive measures by authorities. This undeclared policy aims to prevent a market downturn by stopping institutional investors from offloading their holdings and I am sure in no way hurts the credibility or future listing prospects for the exchange. Psyche! (Reuters talks more about this)

SMUG COINBASE - At the U.K.'s Global Investment Summit, Coinbase CEO Brian Armstrong optimistically declared the $4 billion slap on Binance's wrist by the U.S. Department of Justice as a "turn-the-page" moment for the crypto industry's scandal saga, while casually downplaying Coinbase's own tiff with the SEC as just a minor legal hiccup. Apparently being the only crypto company legit enough to get invited to the summit is like getting a gold star, but in the crypto world, where the threshold for prudence and legality isn’t exactly that high at the moment, I’m not sure that’s really saying much. (CNBC has more)

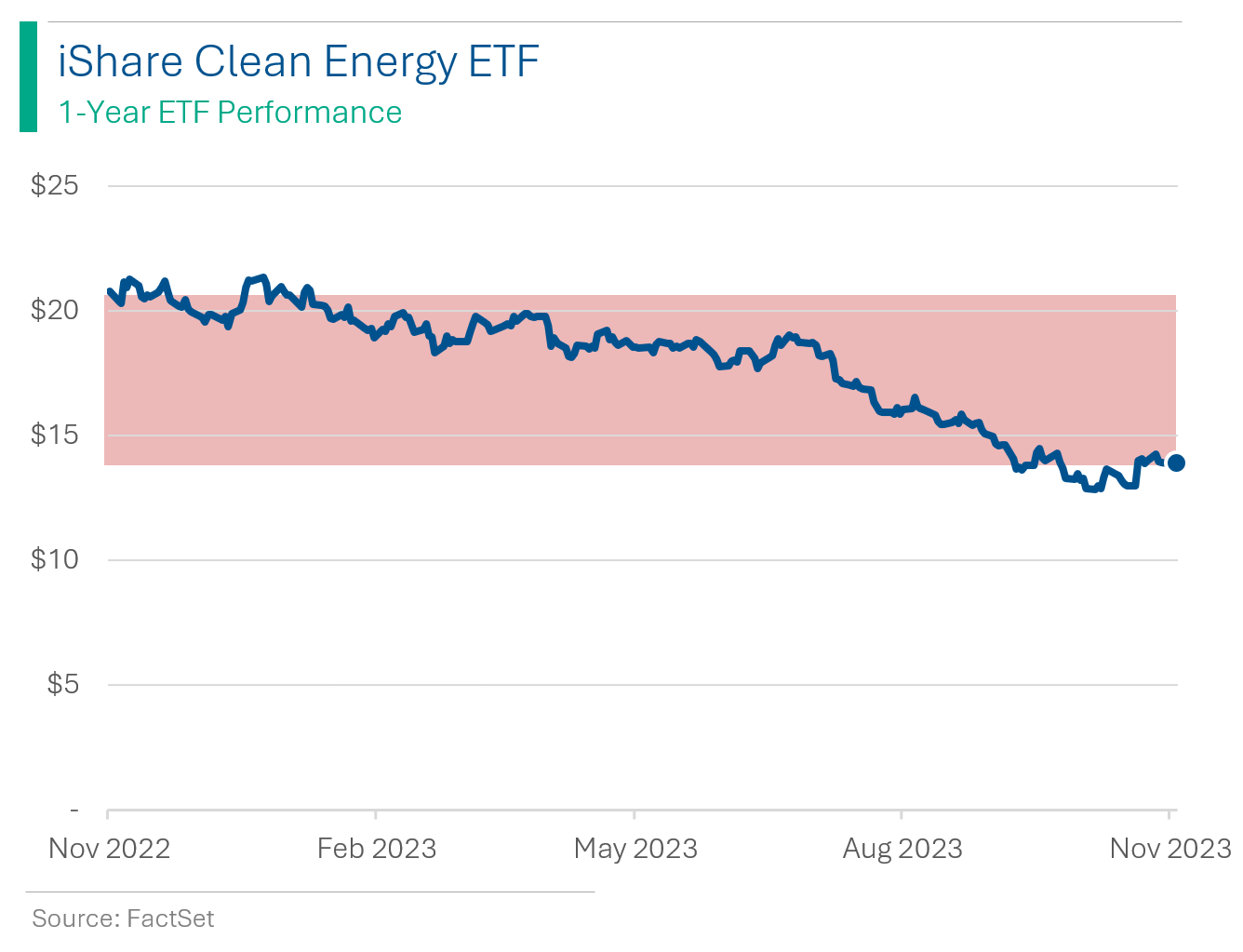

GREEN INVESTORS ARE FICKLE - The Bloomberg Live Pulse survey forecasts a continued downturn for green stocks into 2024, with nearly two-thirds of respondents planning to avoid the electric vehicle sector, including Tesla, which is at risk of falling out of the top 10 in the S&P 500. Tesla's market value has significantly declined from its peak, dropping below $800 billion amid concerns over high costs and CEO Elon Musk's controversial social media presence. Additionally, 57% of respondents expect the iShares Global Clean Energy exchange-traded fund - which is down about 30% this year - to extend its slide in 2024. Green ideals seem to capsize when the market is in rough waters.

OIL PRODUCTION CUTS LOOK LESS LIKELY - Ahead of the 30-Nov OPEC+ meeting, Saudi Arabia’s efforts urging members to cut oil output to stabilize markets is facing resistance from countries like Iraq, Russia, and Kazakhstan, who are already exceeding their quotas. The UAE might be pressured to hold off on its planned 200K bpd quota increase from January. The meeting, previously postponed due to opposition from Angola and Nigeria against quota reductions, now shows only an 8% chance of a cut, as per CME's OPEC Watch tool, contrasting with last week's +50% prediction. This comes amidst a fifth consecutive week of falling oil prices and increasing supply from non-OPEC+ sources into 2024.

(WSJ) Investors are sitting on record cash in (boring) money-market funds. Some expect this $5.7 trillion sitting on the side-lines could flow into stocks and bonds, building on the bull market.

(Bloomberg) US gasoline prices fall for 60 straight days. Helpful for Christmas shopping season.

(Yahoo) Newly elected Argentine President to meet President Biden, IMF and Bill Clinton in DC this week. Oh to be a fly on the wall when this guy meets Biden.

(CNBC) iRobot shares plunge 17% after EU warns Amazon acquisition deal ‘may restrict competition’. Cuz we need to do all we can to stimulate competition in the strategically important robotic vacuum industry.

Joke Of The Day

Why did the PowerPoint Presentation cross the road? To get to the other slide.

If a tree falls in the forest and no-one hears it…then my illegal logging business is a success.

A.M. Allocations

Greenback's Gray November

Since Federal Reserve Chairman, Jerome Powell, spoke following the October 31st Fed Meeting, the S&P 500 has risen by +8% in November, while the US Dollar is poised for its worst month of the year. The Dollar Index - a basket of global exchange rates relative to the USD - has fallen 3.3% this month. That’s pretty huge in sleepy FX land.

Market expectations of the Federal Reserve ending its near-two-year streak of interest rate hikes have contributed to the dollar's decline, as the so-called “Peak Fed” narrative has taken hold.

Ryan’s Take: The market speculation is that the we will start to see the US begin cutting rates in the first half of 2024. While some other Western nations are expected to follow suit around the same time - for example, Street forecasts are the UK to begin in Q3 2024 - the general theme playing out is that investors will move money out of US Dollars in order to seek out better returns abroad.

The driving force behind the USD’s strength over the last six months has been the relative headstart they had on increasing rates. And now that could be reversing, as they take the lead on trimming rates.

(I did a pretty solid deep-dive on the Fed a few months back which adds some more color to the story)

Trivia

This week’s trivia questions are on the Roman Empire.

What was the primary currency in the Roman Empire?

a) Denarius

b) Sestertius

c) Drachma

d) TalentWhat practice did Roman merchants invent that is still used in modern economies?

a) Credit

b) Stock exchange

c) Auctions

d) InsuranceRoman soldiers were sometimes paid with salt, a practice that led to the creation of which word?

a) Salary

b) Bonus

c) Commission

d) Stipend

( answers at bottom)

Market Movers

Winners!

Xenon Pharmaceuticals (XENE) [+17.8%]: Positive Phase II data for major depression pill.

Affirm Holdings (AFRM) [+12.0%]: Surge in buy-now-pay-later usage, with a projected ~$782M online spend on Cyber Monday, marking ~19% growth y/y.

Shopify (SHOP) [+4.9%]: Merchants record a ~22% y/y increase in Black Friday GMV, larger average cart size, and growth in POS system.

Teva Pharmaceutical Industries (TEVA) [3.5%]: UBS upgrades to buy.

Crown Castle (CCI) [+3.5%]: Elliott Management acquires a ~$2B stake.

Losers!

IRobot (IRBT) [-17.2%]: European Commission's concerns over Amazon acquisition potentially limiting competition. No.

Southern Copper (SCCO) [-4.3%]: Morgan Stanley downgrades to underweight, pointing to lower production forecasts through 2027 and rising cash costs.

GE Healthcare Technologies (GEHC) [-3.5%]: UBS downgrades to sell, citing pressures on 2024 consensus from weak Q4 order growth, diminishing pricing benefits, and challenging margin targets in Imaging.

Market Update

Trivia Answers

a) Denarius

c) Auctions

a) Salary

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.