Gold, FX Risk & Tesla's Worst Quarter (ever)

"The four most expensive words in the English language are, 'This time it’s different'"

- Sir John Templeton

“Money and women are the most sought after and the least known about of any two things we have”

- Will Rogers

Street Stories

FX Hurts

The US market has been a rocket ship for the last decade.

For context, over the last seven years, the S&P 500 has outperformed China’s CSI 300 - the index that tracks the largest 300 stocks traded on the Shanghai and Shenzhen Stock Exchanges - by 106%.

Which is a lot.

In 2025, however, the picture has been a lot more icky, with the S&P 500 really only coming out ahead of the Japanese Nikkei amongst it’s global peers.

Japan makes a lot of cars, and cars really don’t like tariffs.

What makes this even worst for US investors is that the U.S. Dollar has also had a rocky time out there. In the world of ‘safe haven’ assets, the greenback hasn’t proved as resilient as gold (see below) - almost like foreign investors are a wee bit peeved by the global hegemon at the moment.

All the other major global currencies *cough* plus Canada *cough* have seen strengthening versus the USD this year.

The net effect is that since the US election, most major stock indices have picked up the relative boost of being denominated in non-USD currencies. When we take into consideration the foreign exchange impact, the outperformance of these indices only adds insult to the S&P’s injury.

For example, inclusive of the FX impact, Britain’s FTSE 100 picks up another +2.4% versus the S&P.

Europe has arguably been the biggest beneficiary.

The Eurozone’s 50 biggest companies - tallied in the EuroStoxx 50 - have outperformed the S&P by an FX adjusted ~15% since President Trump’s election.

China’s CSI 300 is underperforming the S&P 500 on a constant currency basis but sprinkle in a +2.6% FX gain, and even the country with Trump’s biggest bullseye on it is outperforming the US.

Heck, even whipping boy Canada is hanging in there!

Tesla’s Opposite Day

Small growth stocks often get a pass for bad quarters. Growth can be lumpy and as long as the vision is intact then, sure, take the quarter off.

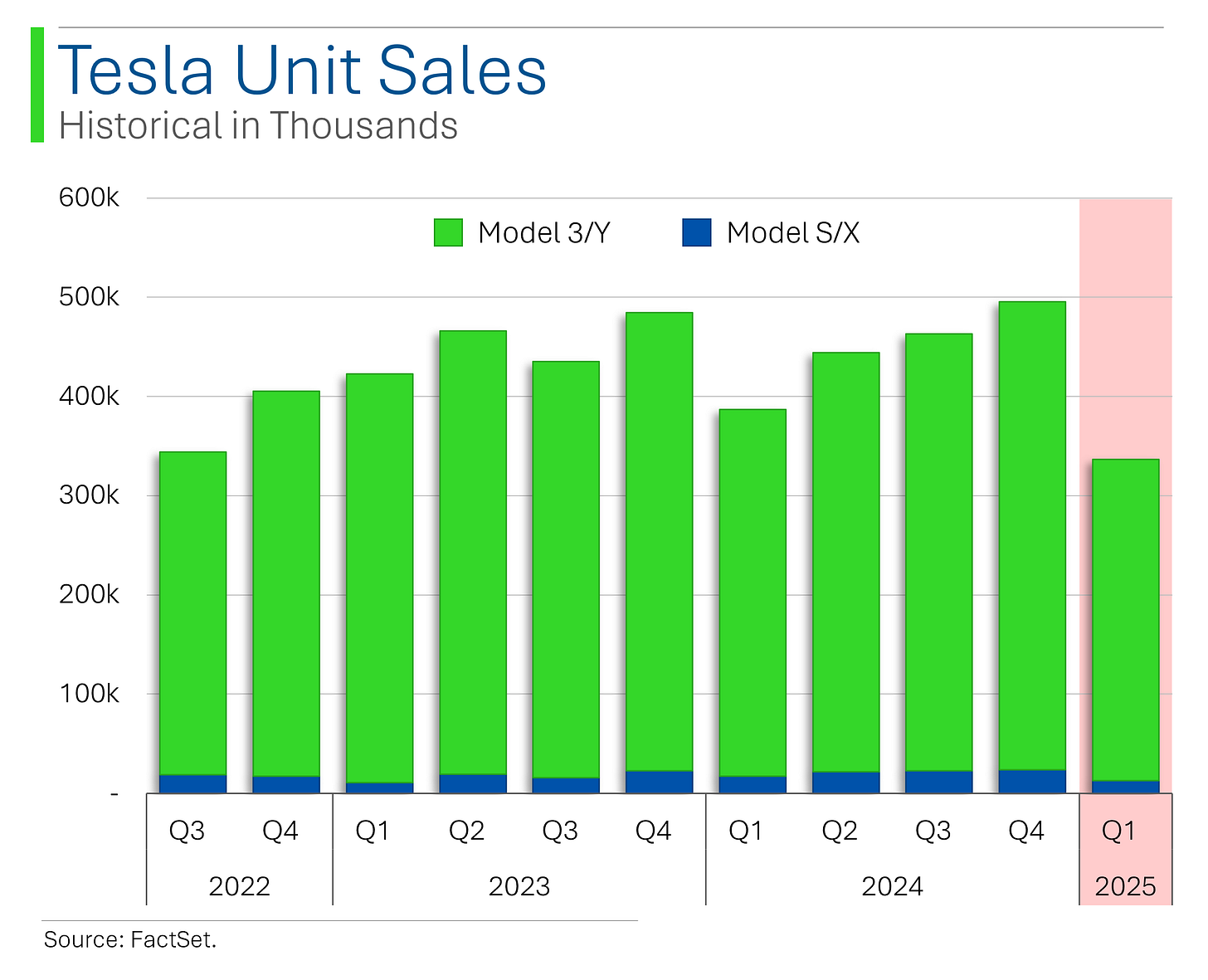

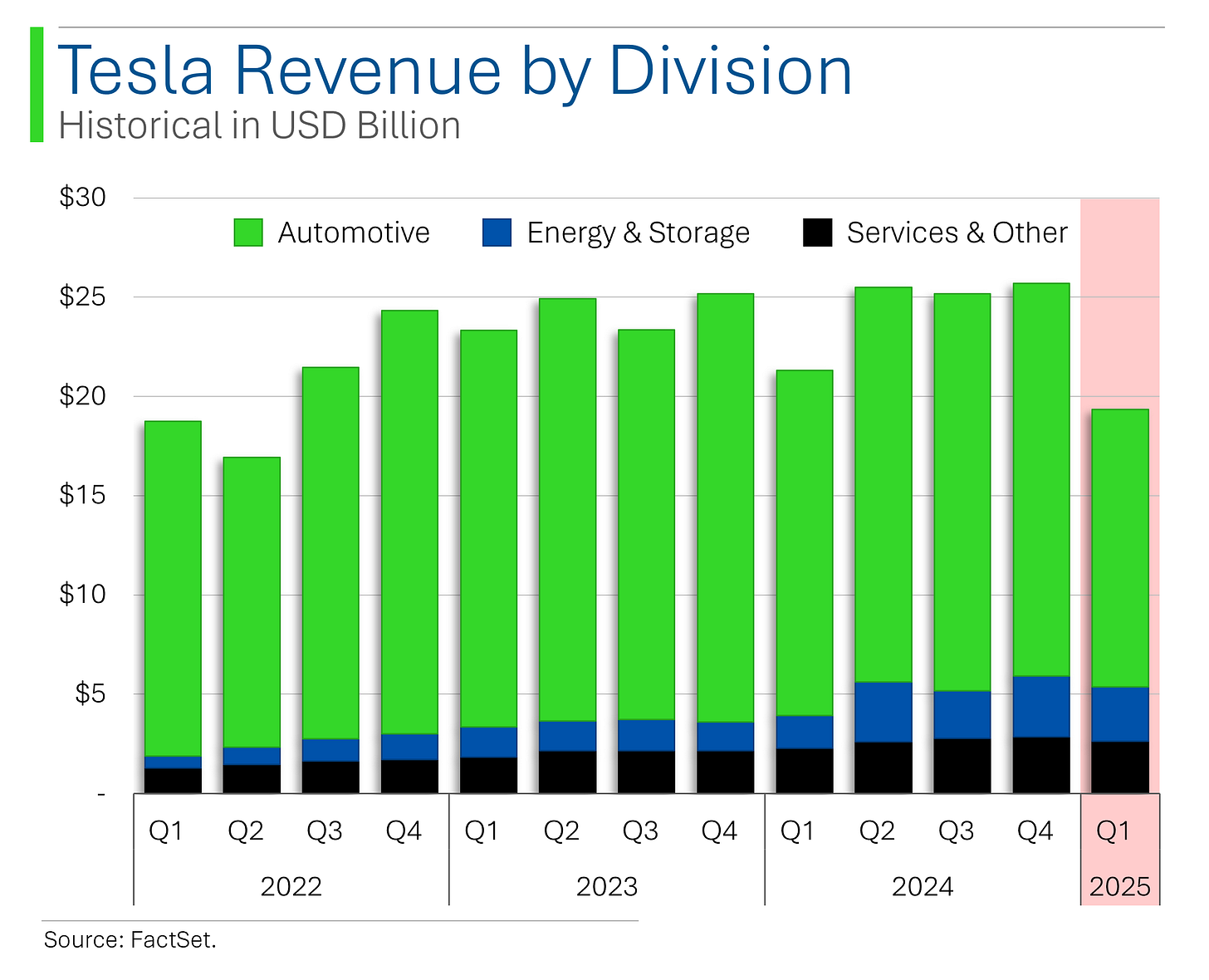

But for former trillion dollar companies, missing EPS estimates by 34% ($0.27 vs. Wall Street estimate for $0.41) and Revs by 9% ($19.3B vs. est. $21.2B) the result is usually ugly. Really ugly.

Unless you’re Tesla. In which case your stock goes up by 5.4%.

Yes, Trump did a 180 on tariffs shortly after they reported post-market on Tuesday. Yep, the stock was down 40% this year. And sure, maybe expectations were for the quarter to be even worse (if that’s even possible).

But since Tuesday, Tesla’s stock is up 25% after what was unequivocally their worst quarter EVER.

Anyone else find that odd?

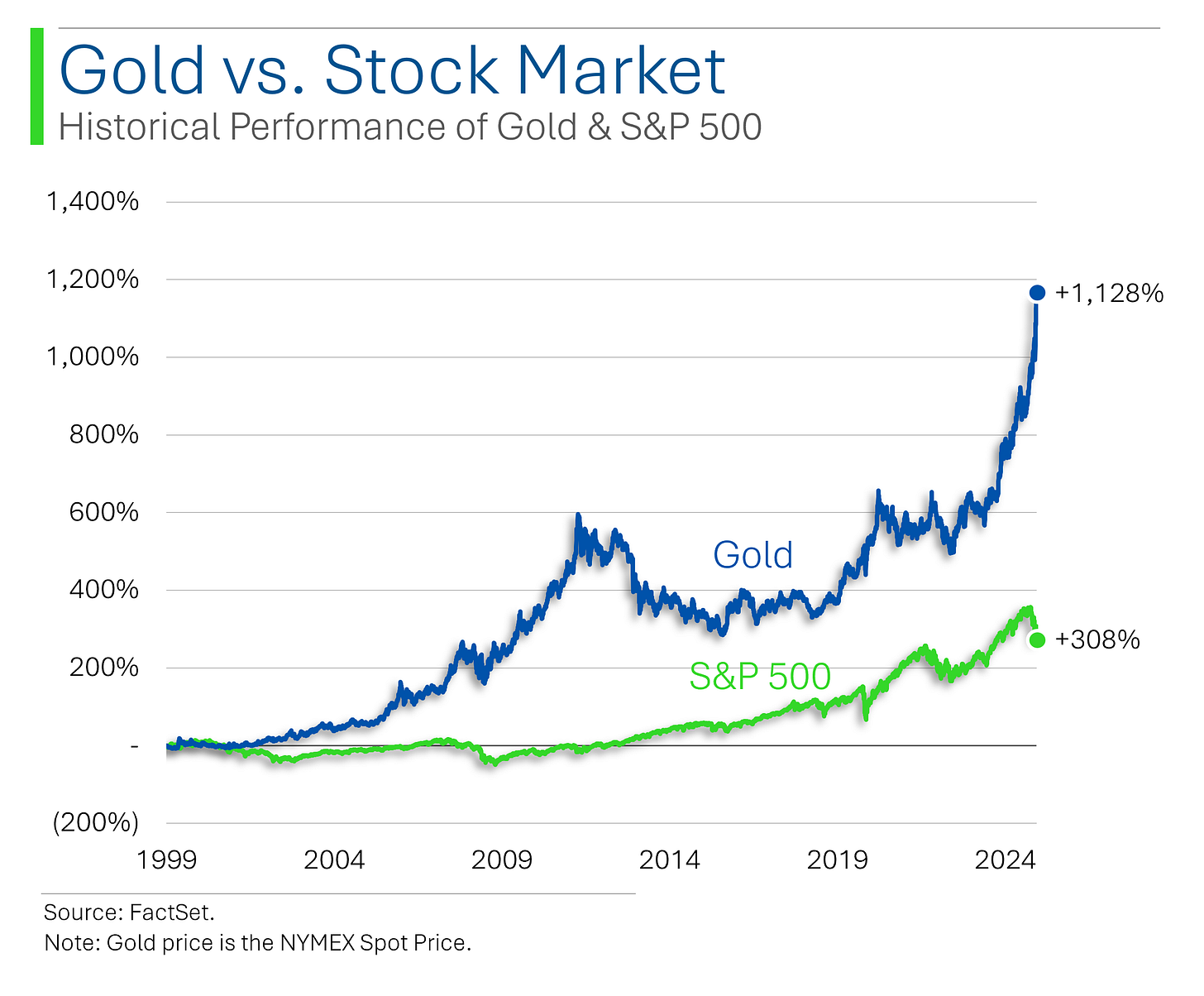

Gold at All-Time Highs

The shiny yellow metal has been going interplanetary since this time last year, giving Gold Bugs their first taste of success since the Covid Pandemic.

While I don’t begrudge anyone their successes, a skyrocketing gold price is usually associated with a ‘flight to safety’, meaning most times this happens things aren’t particularly fun elsewhere.

Moreover, if gold does find itself in something of a bubble, how likely is it that the roof falls in once disaster is averted?

To look into this, I compared how volatile were future gold returns were after periods of sharp increase. Basically, if gold was up X% over the last 12-months (Y-Axis), how did it do over the subsequent 12-months (X-Axis).

Turns out Gold doesn’t really ‘implode’ - especially after a big performance. Looking at monthly data since 2000, any time Gold was up >20% over the next 12-months the worst it’s ever drop was <9% (November 2007).

Joke Of The Day

Stockbroker: What is a million years like to you?

God: Like one second.

Stockbroker: What is a million dollars like to you?

God: Like one penny.

Stockbroker: Can I have a penny?

God: Just a second…

Trivia

This week’s trivia is on Investing 101.

In finance, liquidity refers to:

A) The ease of converting assets to cash

B) The amount of liquid in a company's water cooler

C) The duration of investment assets

D) The change in net operating cash flow of a businessThe Capital Asset Pricing Model (CAPM) is used to:

A) Determine yield on a bond or annuity

B) Calculate expected return on an investment based on its risk

C) Price capital goods

D) Model the capital of a city'Systemic Risk' refers to:

A) The risk that computer and technology failures pose to financial markets

B) The risk of collapse of an company, market or financial system

C) The risk associated with a particular operating system

D) The undiversifiable investment risk associated with the market2. The term "Black Monday" refers to:

A) The Monday after the end of the fiscal year

B) The launch of the Euro currency

C) The October 19, 1987 stock market crash

D) The day oil prices hit $100 per barrel

8. The "Volcker Shock" in the late 1970s/early 1980s refers to:

A) Deregulation of financial markets

B) Massive interest rate hikes to combat inflation

C) Collapse of the gold standard

D) Beginning of free trade agreements

(answers at bottom)

Market Update

Please consider giving this post a Like, it really helps get Substack to share my work with others.

Trivia Answers

A) Liquidity is the ease of converting assets to cash.

B) CAPM calculates expected return on an investment based on its risk (using Beta as the risk input).

B) Systemic Risk is the risk of collapse of a company, market or financial system. If you picked D, that’s ‘systematic risk’. Muahaha.

C) Black Monday refers to the October 19, 1987 stock market crash.

B) The Volker Shock refers to massive interest rate hikes to combat inflation.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.