🔬 Gold At An All-Time High & Bitcoin Looking To Follow Suit

Plus: Another market valuation update; the JetBlue/Spirit odyssey is officially over; Apple gets shaken by $2 billion EU fine; and much more.

"After all, the chief business of the American people is business."

- Calvin Coolidge

"If the only tool you have is a hammer, you tend to see every problem as a nail"

- Abraham Maslow

The big US markets had a modest weak day with S&P 500 -0.1% and the Nasdaq -0.4%.

7 of 11 sectors closed in the green, with Utilities (+1.6%) and Real Estate (+1.1%) in the lead, while Comm. Services (-1.5%) and Consumer Discretionary (-1.3%) were worst.

Super Micro Computer (+18.6%) rose on news it’s joining the S&P 500, while Macy’s popped (+13.5%) on acquisition news. NY Community Bancorp (-23.7%) tumbled on another credit rating downgrade from Fitch and Moody’s.

Gold set a new all-time high, while Bitcoin looks poised to break it’s record from November 2021 (more below).

Street Stories

Market Valuation Update

Umm, yep, still expensive.

JetBlue Merger: Breaking-Up Is Hard To Do Overdue

After a painful 1.5 years in limbo, JetBlue Airways and Spirit Airlines have officially decided to terminate their merger agreement following a federal antitrust lawsuit that resulted in a judge blocking the deal, citing potential harm to cost-conscious travelers. The news was expected as it was seen as unlikely that JetBlue would appeal. Spirit Airlines will get the $69 million break-fee and now faces the challenge of addressing its financial issues independently (it’s shares are down ~11% in after-hours trading since the announcement), while JetBlue looks to refocus on improving operations and reducing costs.

Shiny New All-Time High For Gold

Gold closed off Monday in new all-time high territory, up +1.5% on the day to settle at $2,118. The shiny metal is up in the last three sessions where it’s gained +4.2% or $84.70 a troy ounce. Some theories for the recent performance of gold include:

The recent fall in real and nominal rates after last week’s in-line inflation report (lower rates make gold a more attractive investment).

Fresh concerns about the banking sector. Notably the regional banks, as new concerns at NYCB sent it’s shares down 26% on Friday.

Commodities more broadly are getting investor attention, partly motivated by the recent rises in oil prices.

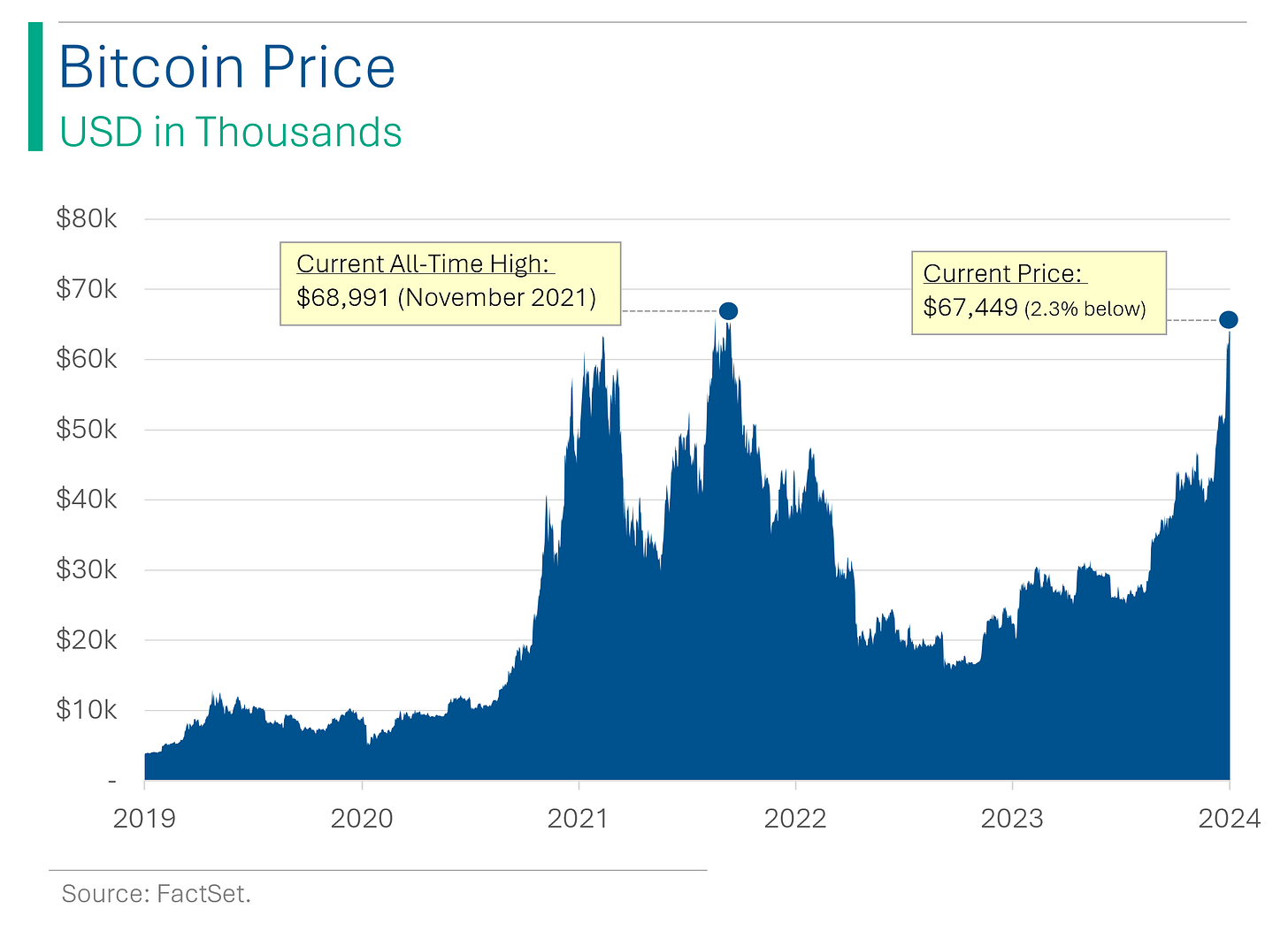

Bitcoin Closes In On All-Time High

The world’s oldest store of value hit a new high yesterday (above), just as one of the newest ones closes in on its +2 year high. Bitcoin is up 59.6% this year and just a few points below the record it set just before the ‘Crypto Winter’ kicked off at the end of 2021. Unlike previous rallies, this one seems to be driven by fundamentals - jk, there are no fundamentals. 🚀🚀✌️😅

Biting the Apple: EU Serves a $2 Billion Fine Over Discordant App Store Practices

In the latest fallout from Apple’s closed-door App Store, the European Commission fined the company €1.84 billion ($2 billion) for anti-competitive practices, marking its first penalty for violating EU rules, primarily affecting music streaming services like Spotify. The fine includes a €40 million base penalty plus a massive €1.8 billion fine because they can as a deterrent, totaling 0.5% of Apple's global turnover. Apple plans to appeal the decision, criticizing the Commission for not finding credible evidence of consumer harm and highlighting the market's competitive nature.

Apple lost $68 billion in market cap following the announcement, which could imply that the market sees potentially greater fines in their future or reduced profitability coming from the App Store if they are forced to open things up.

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

“If you lend someone $20, and never see that person again, it was probably worth it.”

The German government is calling for everybody to stock up on sausage and cheese in case of another lockdown. It's the Wurst-käse-scenario.

Hot Headlines

Bloomberg / ‘Don’t invest in China’, Goldman Sachs Wealth Management CIO warns. Don’t they usually sugar coat this stuff? In unrelated news, Goldman is banned from China.

NY Times / Supreme Court rules Trump can remain on Colorado ballot. The justices ruled that the 14th Amendment did not allow Colorado to bar the former president from the state’s primary ballot for engaging in insurrection.

Bloomberg / American Airlines orders 260 jets in big win for Boeing, Airbus, and Embraer. The order includes 85 Boeing 737 MAX 10 which goes a long way to alleviate some of the confidence crisis going on at Boeing. Deal also includes 85 Airbus A321neo and 90 Embraer E175.

Yahoo / Bank of America is the latest firm to see bullish outcome for stocks in 2024. The bank increased it’s 2024 target for the S&P 500 from 5,000 to 5,400 - a 5.4% premium to the current index value.

Yahoo / Arkhouse increases offer to buy Macy’s to $6.6 billion. Increase is almost $1 billion more than their December 1st offer. Shares popped up but still remain well below the offer price, implying the Street has suspicions that the deal won’t close.

Trivia

This week’s trivia is on some of the most famous companies. Today’s is on Warren Buffett’s Berkshire Hathaway.

Before Warren bought in, Berkshire Hathaway was initially a company in which industry?

A) Insurance

B) Textile manufacturing

C) Railroad transportation

D) Food and beverageBuffett has remained steadfast about not doing a stock split for Berkshire’s Class A shares. Currently one share costs:

A) $2,962

B) ~$109k

C) ~$297k

D) ~$611kWhat major financial move did Berkshire Hathaway make during the 2008 financial crisis?

A) Sold all stock investments

B) Invested $5 billion in Goldman Sachs

C) Filed for bankruptcy protection

D) Bought distressed real estateBerkshire Hathaway holds a significant stake in which beverage company?

A) PepsiCo

B) Coca-Cola

C) Dr. Pepper

D) Monster Beverage

(answers at bottom)

Market Movers

Winners!

Super Micro Computer (SMCI) [+18.6%]: Joining S&P 500, shares soared nearly 220% YTD before announcement.

Macy's (M) [+13.5%]: Arkhouse and Brigade propose $24/share cash acquisition, hinting at possible higher bid post-due diligence.

Akero Therapeutics (AKRO) [+11.7%]: Phase 2B HARMONY study shows significant histological improvements at week 96.

Coinbase (COIN) [+11.4%]: Crypto surge lifts stock; Bitcoin futures breach $65k and approach all-time high set in November 2021.

Lyft (LYFT) [+4.5%]: RBC Capital upgrades to outperform, cites competitive gains and potential DoorDash partnership.

JetBlue Airways (JBLU) [+4.3%]: Ends merger with Spirit Airlines; announces revenue initiatives.

Losers!

New York Community Bancorp (NYCB) [-23.7%]: Fitch and Moody's downgrades push credit rating further into junk.

Spirit Airlines (SAVE) [-10.9%]: Terminates merger with JetBlue.

G-III Apparel Group (GIII) [-10.6%]: Barclays downgrade to underweight, cuts target to $23 from $30 amid various headwinds.

Tesla (TSLA) [-7.2%]: Increased China incentives fuel EV price war concerns.

Market Update

Trivia Answers

B) Berkshire Hathaway was originally in textile manufacturing.

D) One Class A shares costs ~$611k.

B) During the GFC invested $5 billion in Goldman Sachs.

B) BH is a big investor in Coca-Cola.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.