🔬GDP Growth Doesn't Suck, the Nasdaq Does, and Much More

StreetSmarts Morning Note

***Friendly reminder to hit the ‘Like’ button above, it really helps to get Substack to share my newsletter***

"The four most dangerous words in investing are: 'This time it's different'

-Sir John Templeton

"The less prudence with which others conduct their affairs, the greater the prudence with which we must conduct our own."

-Howard Marks

Table of Contents

A.M. Allocations: Summaries of important news and investing events

GDP Goes From Flat to Phat (as the kids say)

Cloudy with a Chance of Profit-Taking: the Nasdaq's New Forecast

Hot Headlines: Links to some of the top financial stories of the day

Market Movers

Winners

IBM (IBM) [+4.9%]: Reported a Q3 EPS and revenue beat, with stronger-than-expected gross margins (GM). Reaffirmed FY23 revenue and free cash flow (FCF) guidance but anticipates revenue at the low end due to FX headwinds. Analysts emphasized AI bookings strength and Consulting momentum, but noted concerns about Red Hat consumption.

Keurig Dr Pepper (KDP) [+1.4%]: Delivered Q3 organic sales growth of +4.1%, surpassing consensus, led by 5.5% net price realization. However, this was partially counterbalanced by a volume/mix decrease of 1.4%. EPS matched expectations, and the company upheld its fiscal year guidance.

O'Reilly Automotive (ORLY) [+5.3%]: Presented better-than-anticipated Q3 comp growth, revenue, and EPS. Enhanced FY23 EPS guidance based on improved sales, robust DIY, and share gains.

Losers

Align Technology (ALGN) [-24.9%]: The fancy braces company’s Q3 results showed earnings, revenue, and GM misses. The company highlighted challenges in the macro environment, including reduced patient visits and fewer case starts, especially among adults, and anticipates a sequential revenue decline in Q4.

Whirlpool Corp. (WHR) [-15.8%]: Q3 EPS and revenue beat; however, the company reduced its FY23 EPS and FCF outlook. Concerns arise from an expected 350 bp impact on Q4 margins due to price/mix changes.

Hasbro (HAS) [-11.7%]: Q3 saw earnings and revenue misses. While Wizards/Digital Gaming performed well, Consumer Products lagged. The Hollywood strike impacted the Entertainment segment, leading to reduced FY23 guidance.

Meta Platforms (META) [-3.7%]: Q3 revenue surpassed consensus by 2%, and operating income exceeded expectations by 20%. Key takeaways were mainly positive, emphasizing progress in operational efficiency and AI-driven product initiatives. Despite better-than-expected expense and capex guidance, the company noted potential early Q4 challenges linked to Middle East incidents.

A.M. Allocations

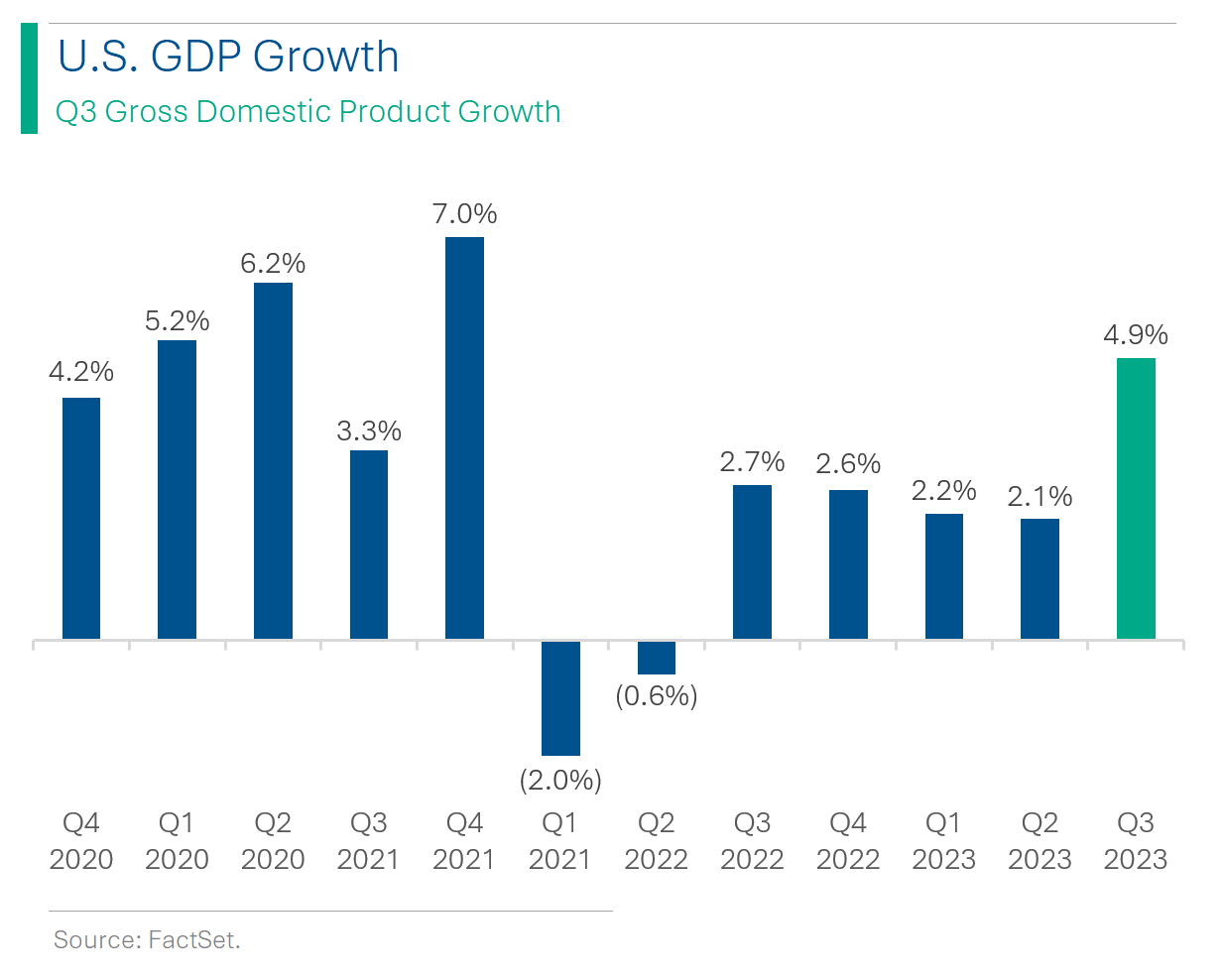

GDP Goes From Flat to Phat (as the kids say)

The U.S. Gross Domestic Product (GDP) experienced a notable increase, growing by 4.9% in the third quarter. This growth surpassed economist expectations of 4.7%, driven primarily by robust consumer spending, as well as boosts in inventories, exports, residential investment, and government spending.

In the face of challenges like ongoing inflation and the Federal Reserve's decision to raise interest rates, the resilience of the U.S. consumer became evident. Consumer spending, especially during the third quarter, played a significant role, constituting approximately 68% of the GDP.

While the U.S. economy demonstrated strength in recent quarters, many financial experts and economists are projecting a potential slowdown in growth in the upcoming periods. However, the prevailing sentiment remains optimistic, with most believing that the U.S. will likely steer clear of a recession, barring any unexpected economic shocks.

On top of domestic financial concerns, external factors are also exerting pressure on the U.S. economy. The imminent restart of student loan payments is anticipated to impact household budgets significantly. Additionally, the economy faces headwinds from high gas prices, stock market volatility, and international geopolitical tensions, such as the ongoing conflicts in Israel and the situation in Ukraine, all of which add layers of uncertainty about future economic performance.

Take-Aways: My recent pessimism seems unfounded - for now. I still believe the lack of savings and increasing debt and delinquency rates which I’ve written about before are indicative of an overstretched consumer. And while I’m not 100% certain of a recession in 2024, I definitely think ~5% GDP growth isn’t something we should all get accustomed to.

Cloudy with a Chance of Profit-Taking: the Nasdaq's New Forecast

With Apple and Nvidia left to report, the rest of the Magnificent 7 have posted fairly strong numbers but have been dragged down by weak outlook and guidance, such as the apparent weakening of Google’s cloud business. The tech-focused Nasdaq 100 has seen a downturn, entering a correction phase with a decline of 10.5% since its peak in July. It seems the big names that pulled the index up, are now the ones pulling it down.

Broader negative sentiment in the tech sector may be attributed to profit-taking by investors, as well as a market correction in response to the AI hype earlier in the year. Despite optimism about AI's long-term influence, its tangible impact on company revenues is still nascent.

Microsoft emerged as a notable performer this week, attributing some of its Azure cloud business growth to AI rollouts. However, AI's contribution to their cloud growth was just three percentage points of the total 28%. The broader implication is that AI's substantial economic impact is still in its early stages.

Joke Of The Day

After years of trading, a husband tells his wife the good news: “Honey, we’ve finally got enough money to buy what we started saving for 20 years ago!” His wife blushes with giddy excitement. “You mean a brand-new Cadillac?” she asks. “No,” says the husband, “a 2003 Cadillac.”

Hot Headlines

(Bloomberg) Serbia, Kosovo Get Blunt Message From EU to End Tension - During a European Union summit in Brussels, leaders of Germany, France, and Italy met with Serbia and Kosovo to address escalating tensions but failed to finalize a plan granting autonomy to Kosovo's ethnic Serbs, crucial for normalizing relations. While Kosovo's Prime Minister Albin Kurti was ready to sign, Serbian President Aleksandar Vucic expressed reservations about Kosovo's UN membership and independence, amidst heightened tensions after recent violent clashes in northern Kosovo. No more wars please.

(BNN) Yellen Says GDP Data Show US Economy Is ‘Doing Very Well’ - Treasury Secretary Janet Yellen commented that the US economy's 4.9% annualized growth in the third quarter indicates its robust health and suggested a "soft landing" scenario where inflation eases without causing a recession. This growth, driven primarily by consumer spending, is backed by a strong labor market, with unemployment consistently below 4% and an inflation measure at its lowest since 2020. Good ole Janet ‘Glass Half Full’ Yellen.

(Axios) X usage plummets in Musk's first year

(Politico) 19 U.S. troops diagnosed with traumatic brain injury following attacks in Iraq and Syria - Nineteen American service members in Iraq and Syria were diagnosed with traumatic brain injuries following attacks from Iran-backed militants last week, as confirmed by the Pentagon. This highlights an ongoing threat to U.S. troops in the Middle East, especially with increasing tensions and previous incidents where U.S. personnel sustained similar injuries from Iranian proxies.

(Yahoo) Nasdaq falls into correction territory as markets slip on disappointing tech earnings

(Reuters) GM, Stellantis work to reach UAW contract deals

(Reuters) Israeli troops raid Gaza as Arab nations condemn bombardment - Israel hints that there could be ‘several’ invasions along the strip.

(Barron’s) Ford Earnings Miss Estimates. EV Market-Share Losses Are Driving Spending Decisions.

Trivia

Nasdaq was the first electronic stock market (no goofballs yelling at each other waving papers and gang signs). What year was it founded?

1971

1979

1982

1984

What is the market value of all stocks traded on the Nasdaq (as of May 2023)?

$13.8 trillion

$17.7 trillion

$19.0 trillion

$24.3 trillion

How many companies make up the Nasdaq Composite Index?

831

1,500

2,350

3,479

(answers at bottom)

Market Update

Trivia Answers

1971.

$24.3 trillion

3,479

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and give us a ‘Like’ below.