"People want a simple narrative, but the world doesn't give you that"

- Jeffrey Gundlach

“It's not a question of enough, pal. It's a zero sum game, somebody wins, somebody loses”

- Gordon Gekko

Strong end to the week for the big US markets, with the S&P 500 and Nasdaq both closing Friday up +0.6%. For the week, the S&P was +0.9% making it 10 of the last 12 weeks. For the Nasdaq, it’s 11 for 12. #freemoney

10 of 11 sectors finished higher on the week, led by Real Estate (+4.4%) with Communication Services (-3.6%) the only loser for the week.

Earnings season kicks off with the banks, to mixed result. And chatter for a rotation away from the big name winners towards laggards and small-cap persists.

Notable companies:

Carvana (CVNA) [+4.9%]: Initiated buy at BTIG; noted industry-leading margins, business model, large TAM, and reduced competition.

Bank of New York Mellon (BK) [+5.2%]: Q2 earnings beat; fee revenue ahead of consensus; net interest income (NII) slightly better but net interest margin (NIM) light; analysts upbeat on stable expenses, and lower compensation ratio.

Wells Fargo (WFC) [-6.0%]: Q2 revenue and EPS slightly better due to strong fee income (capital markets standout); credit in line (released $65M reserves); guided 2024 NII to low end of prior outlook; raised expense guidance. So, bad.

More in ‘Market Movers’ below.

Street Stories

GameStop Deep-Dive Pt. I: The History and the Potential

This is part one of my two parter on GameStop. Today covers the history and the operations, while tomorrow goes through the stock and the valuation.

The GameStop saga and the meme-stock euphoria it set in motion is one of the most entertaining and interesting stories in the history of the stock market. It has it all: David (retail) vs. Goliath (Wall Street), and heroes (Keith Gill aka Roaring Kitty aka DeepF*****Value) and villains (hedge funds like Gabe Plotkin’s Melvin and Citadel CEO Ken Griffin).

But it seems like there are really only two camps: the financial media and Wall Street that think the company is a bust. And the retail investing folks - notably the beautiful optimists on Reddit’s r/Superstonk (talk of GME is banned on r/Wallstreetbets now) - that still believe the company is going to the moon. 💎✋🤚🚀

Likely, the truth lies somewhere in between and I’m going to take a crack at figuring that out. Pitter patter. Let’s get at ‘er!

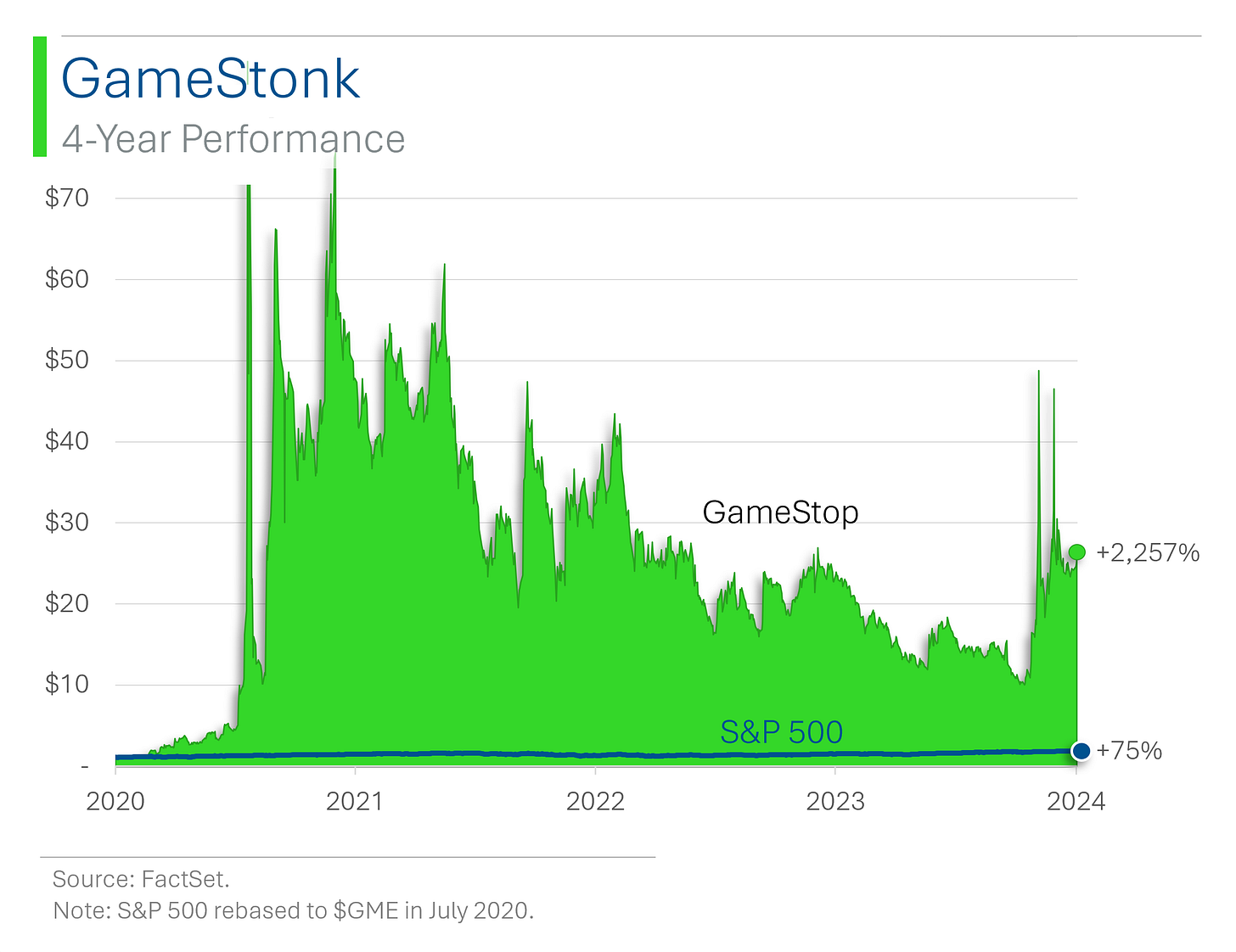

To kick things off, shares in GameStop are well off the highs set during the 2021 rally but, being up more than +2k% in a few years, I think they get a pass.

And just like last time, most of the price action is again driven by DeepF******Value; with his obscure X posts kicking things back off in May. Anytime he has turned on his laptop the stock has gone higher, although shares did take a nose dive on July 1st when he revealed a $240 million position in online pet retailer Chewy.

The fact that the math is a little squishy for how he could have afforded both positions is beyond the scope of this course. Barron’s did an interesting report on this, and basically the dude either punted more options than he revealed or is levered up with outside financing. Either way: Awesome!

An important aspect to most of the folks on r/Superstonk’s investment thesis is the MOASS (‘Mother of All Short Squeezes’) where once again retail will hammer the hedge funds and Wall Streeters shorting GME.

However, this is very unlikely to happen imho. Last time around, short sellers held a comical amount of the company short - roughly 145% of the free float. At only 11% this time around there really isn’t a hell of a lot to squeeze.

Switching to the actual operations of the company, things have continued to deteriorate on the revenue front. Management promised a million things, including an aggressive pivot to online, but little progress in that regard seems to have been made.

For context, at the time of the 2021 rally the company banked $1.3 billion in Q1 revenue. In 2024, this figure has fallen to only $0.9 billion - a decline of 31%!

The decline is also pretty broad-based but software has been hit the hardest at a 40% haircut.

The big caveat to that, however, is the fact that the company has closed about 13% of locations since then as the company tries to right-size the number of physical locations.

Revenue will drop but (hopefully) costs will drop by even more leading to profitability.

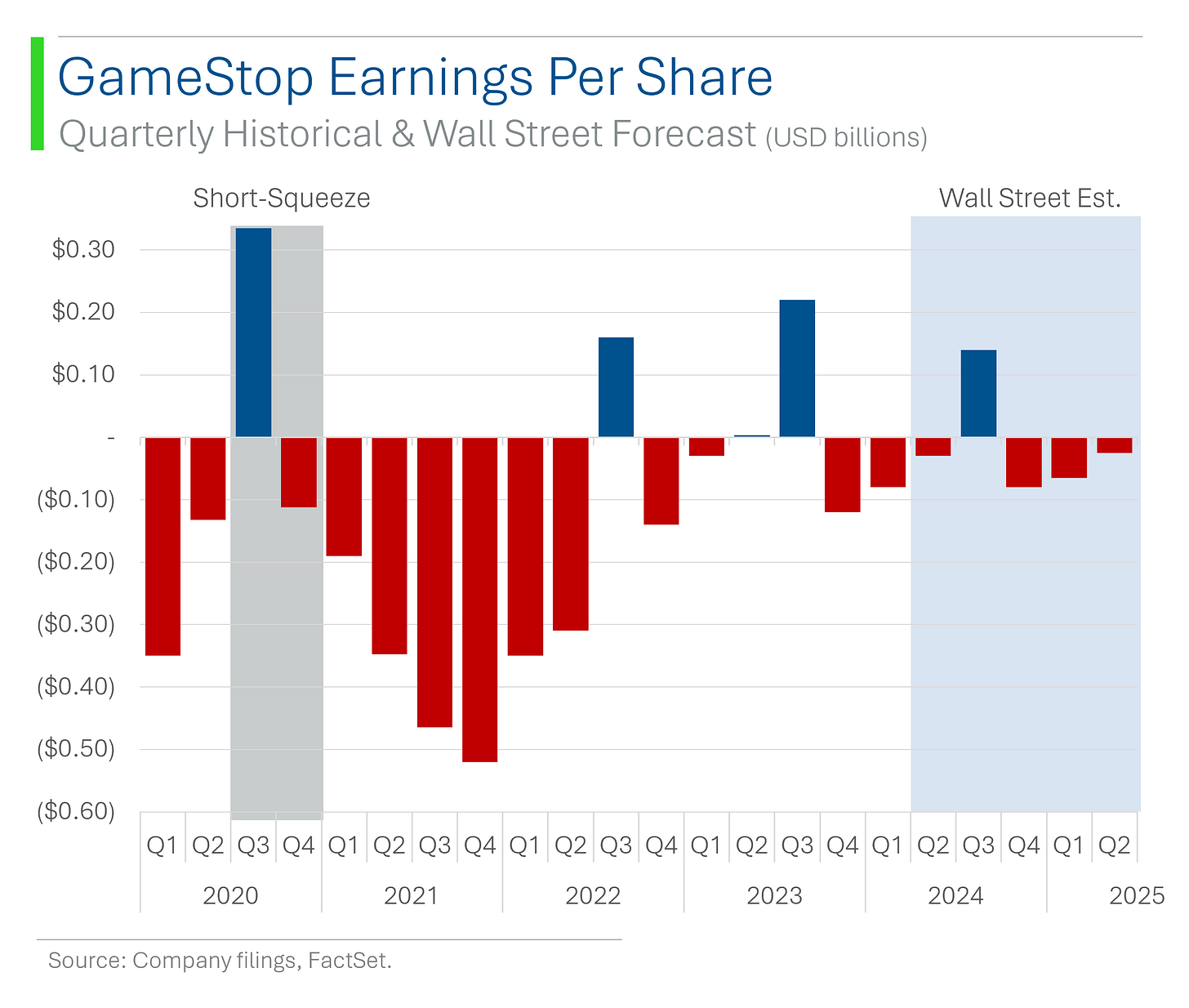

And that’s something we are actually starting to see. Profitability-wise, GME bottomed out toward the end of 2021 and has had positive earnings per share in 3 of the last 6 quarters.

Not exactly Nvidia but still some strong progress operationally!

The natural follow-up question to profitability is ‘sure, fine, but are they still burning cash? Are they gunna go bankrupt?’

The answers are: Not really. And hell no.

GameStop has been flirting with positive operating cash flow for a while now. It’s yet to make the transition to being a steady cash machine but with the billions raised by management, there is zero chance the company will go bankrupt anytime soon.

The clowns and ‘pundits’ saying GameStop will be bankrupt soon have no idea how to read a balance sheet or cashflow statement.

That said, the company still has a long way to go with bringing down costs for the core retail business. The decline in gross profit since 2015 hasn’t been met with commensurate declines in operating costs.

For the business to properly turn the page towards profitability, it still has a ways to go to fix its house operationally.

And looking outwards towards the future, the company will need to spend significantly to shore up the retail business and make the needed investments to build on the new opportunities that management has been prophesizing.

Right now, it seems like that investment isn’t currently a priority.

This is probably a good place to leave things for today. Look out for tomorrow’s note when I dig into the stock and the valuation to see what shareholders might expect in the coming years.

Lastly, I came up with the idea for today’s note after chatting with the brilliant Aaron Pek of the famed Value Investing Substack. His look at GameStop is certainly an inciteful read and he tackles it from a more nuanced value perspective. Check it out!

Joke Of The Day

A man goes into a job interview, and presents himself well, including giving a brilliant presentation on why he is the ideal man for the job. The employer is shocked at how professional he is: “Wow, you have an incredible resume, and present yourself fantastically, but you seem to be missing 5 years on this part of your resume. What happened there?” The man replied “Oh that’s when I went to Yale.” The employer is even more impressed. “That’s great, you’re hired!” The man is super happy and says “Yay! I got a yob!

Hot Headlines

WSJ / Alphabet is near a $23 billion deal to acquire cybersecurity startup Wiz. At their last round, Wiz raised $1 billion at a $12 billion valuation in May 2024.

Politico / Feds tackle dialysis giants with antitrust probe. The two largest players, DaVita and Fresenius Medical, control ~70% of the market for this vital outpatient service, with the probe investigating allegations that they illegally thwart smaller competitors from competing.

Reuters / Meta to roll back some restrictions on Trump's Facebook, Instagram accounts. The social media company indefinitely suspended Trump's accounts following his praise of people who stormed the U.S. Capitol on Jan. 6, 2021 but said that his now restored accounts will no longer be subject to active monitoring.

Tech Crunch / AT&T a data breach sees cybercriminals steal phone records of “nearly all” of its cellular and landline customers. Such an AT&T thing to do.

NY Times / Democratic donors said to freeze roughly $90 million while Biden stays in race.

Trivia

Today’s trivia is (obviously) on GameStop.

GameStop traces it’s roots to software retailer Babbage’s which was founded in 1980. What year did ‘GameStop’ officially come into being?

A) 1984

B) 1999

C) 1995

D) 2005

GameStop was originally a subsidiary of what prominent retailer?

A) EB Games

B) Barnes & Noble

C) Target

D) Best BuyIn what year did GameStop acquire it’s collectibles business, ThinkGeek?

A) 2001

B) 2021

C) 2008

D) 2015

(answers at bottom)

Market Movers

Winners!

Array Technologies (ARRY) [+8.7%]: Upgraded to buy from neutral at Citi; valuation attractive after 40% YTD decline, long-term narrative intact, share gain opportunity this year.

Inter Parfums (IPAR) [+6.2%]: Upgraded to buy from hold at Jefferies; valuation attractive after 17% YTD decline, accelerating demand in Q2, guidance seen as beatable with new licenses.

Bank of New York Mellon (BK) [+5.2%]: Q2 earnings beat; fee revenue ahead of consensus; NII slightly better but NIM light; analysts upbeat on stable expenses, FX revenue surprise, no loan-loss provision, and lower compensation ratio.

Carvana (CVNA) [+4.9%]: Initiated buy at BTIG; noted industry-leading margins, business model, large TAM, and reduced competition.

Teck Resources (TECK) [+2.6%]: Rio Tinto reportedly considering a buyout offer of over $30B.

Fastenal (FAST) [+2.0%]: Q2 earnings, revenue, and OM in line; management highlighted growth with larger customers, new Onsite locations, June sales accelerated m/m, lower fastener pricing due to lower transportation costs.

Six Flags Entertainment (FUN) [+1.7%]: Assumed buy at Stifel; optimistic about significant growth potential at legacy parks after the merger.

Deckers Outdoor (DECK) [+1.1%]: Board approved 6:1 stock split proposal; shareholder vote on 9-Sep; post-split trading could begin on 17-Sep.

Losers!

The Vita Coco (COCO) [-9.1%]: Downgraded to neutral from overweight at Piper Sandler; rising ocean freight rates, with 2024 rates up 225% from 2023 levels, and holding fewer contracted rates than historically.

Wells Fargo (WFC) [-6.0%]: Q2 revenue and EPS slightly better due to strong fee income (capital markets standout); credit in line (released $65M reserves); NII light due to lower NIM and EOP loans; guided 2024 NII to low end of prior outlook; raised expense guidance.

Crocs (CROX) [-2.6%]: Downgraded to mixed from positive at OTR Global.

Snowflake (SNOW) [-1.8%]: T said customer information in recent cybersecurity incident obtained from Snowflake; in June, SNOW reported hackers targeted its customers, including TREE, AAP, and PSTG.

Market Update

Trivia Answers

B) GameStop came into being in 1999. The brand began its rise to prominence the following year following the acquisition of video game retailer Funco, and the rebranding of 400 FuncoLand locations.

B) Barnes & Noble owned to company from 1999 until it spun the company out in 2004.

D) GameStop acquire ThinkGeek in 2015.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

😮💨🔥