🔬GameOver For Meme-Stocks

Plus: Super update on the state of markets, and much more!

“It's not a question of enough, pal. It's a zero sum game, somebody wins, somebody loses.”

- Gordon Gekko

"It is impossible to produce superior performance unless you do something different from the majority."

- John Templeton

Soft day for the big US markets with the S&P 500 -0.2% and Nasdaq -0.3%, on a quiet day for the markets following yesterday’s fresh new all-time high for the S&P.

10 of 11 sectors closed lower with Consumer Staples (+1.5%) the sole winner. Consumer Discretionary (-0.8%) and Materials (-0.7%) were the worst.

April Housing Starts came in a bit weak at 1.36M vs. Wall Street hopes for 1.44M.

Notable companies:

AST Spacemobile (ASTS) [+68.2%]: Announced a commercial agreement with AT&T to provide space-based broadband directly to everyday cell phones.

Walmart (WMT) [+7.0%]: Q1 revenue just over 1% better, EPS more than 13% ahead; comps increased 3.8% vs. 3.5% consensus; guided FY sales and EPS to high end or above prior outlook; positive broad-based share gains.

Chubb Ltd. (CB) [+4.7%]: Berkshire Hathaway disclosed a new 25.9M share position in the company.

More in ‘Market Movers’ at bottom

Street Stories

Well that was fun…

In ‘Meme Stocks & Why It’s Different This Time’ on Tuesday, I expressed my nostalgia for the 2021 GameStop short squeeze but also my concerns that most of the driving factors for the original rally weren’t present this time around. Most notably, the short-interest in GME shares was a fraction of what it was last time (2.8 billion shares vs. 644 million this time) and that the turnaround story has had +3 years to show itself, with mediocre results.

Sadly, that ended up being the case. Not that I believed this would ignite some structural changes to the business, but that it’s upsetting knowing that a lot of hopeful retail investors jumped on the hype train, and were left holding the bag when the train left the station.

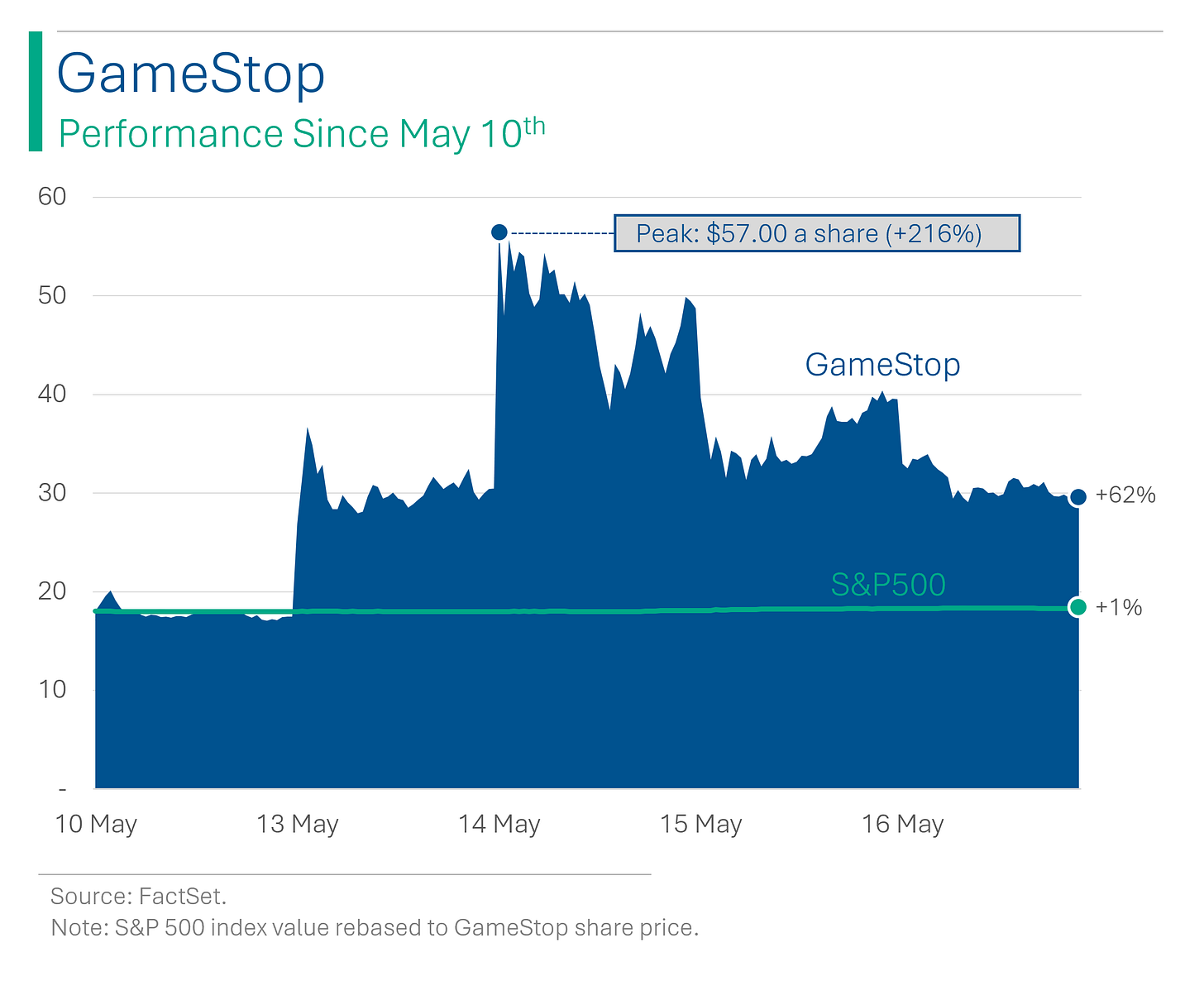

GameStop shares are still up 62% since Roaring Kitty first posting on May 11th, but the trend isn’t looking to promising. I won’t speculate where things will be when the dust settles but I’m certainly not holding my breath for some sort of squeeze that gives Wall Street it’s comeuppance.

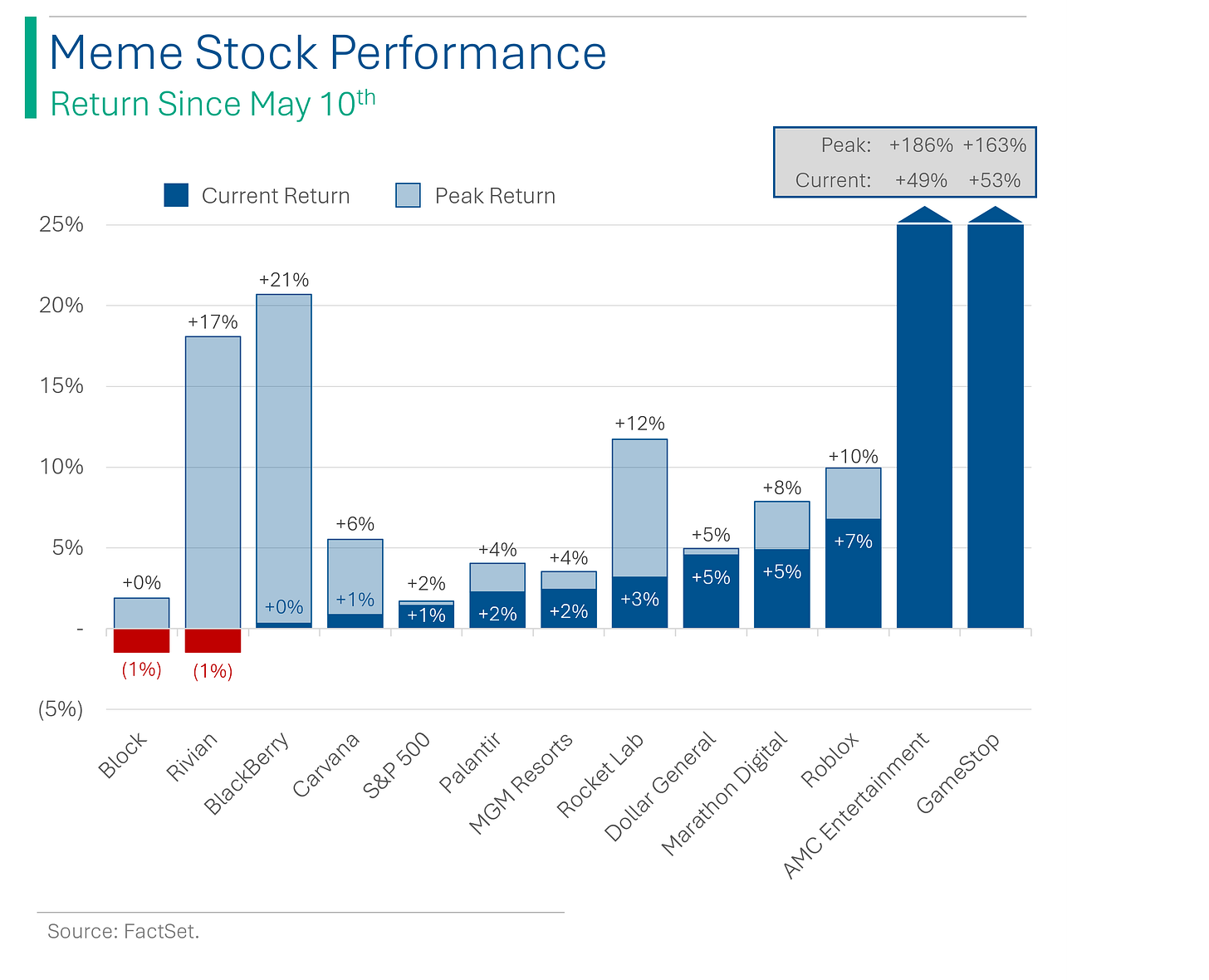

GME’s little brother, AMC, ended up peaking at an even higher level than GameStop (+235% vs. GME +216%) but that fizzled away quite quickly.

CEO Adam Arun has taken some flak for issuing shares during the hubbub but honestly, anyone reading the tea leaves knew this was an unsustainable pop so good for him for at least raising some much needed capital along the way. (Don’t get me wrong, I’m not suggesting he’s a good CEO).

Lastly, this meme-stock bubble hasn’t just impacted GameStop and AMC. Plenty of the the other meme-able companies have seen their shares shoot up this week, but, as you can see above, all of them have begun their descent back to earth.

An old stock market adage says that ‘markets can remain irrational longer than you can remain solvent’. But an old fighter pilot one says ‘Flying isn’t dangerous. Crashing is what’s dangerous.’ And gravity is a b*****.

Performance Update

I’ve been meaning to post a bit of a ‘lay of the land’ for a while since we are now solidly into 2024 and a lot has happened.

To start, despite all the wonkiness of markets and the devolution of ‘Peak Fed’ hype into ‘higher for longer’, the S&P 500 is still up nicely for the year.

Communication Services is doing exceptionally well, with it’s techy names (Alphabet, Meta) having strong years and standouts from the entertainment pieces, such as Netflix and Disney.

Tech is doing well on the backs of the semiconductor and chip euphoria, and Utilities has popped after terrible returns in 2022 and 2023.

Real Estate is the lone loser. It shot up on the ‘Peak Fed’ news in Q4 but has still mostly been terrible since 2021 - where it’s still down 27% from it’s peak.

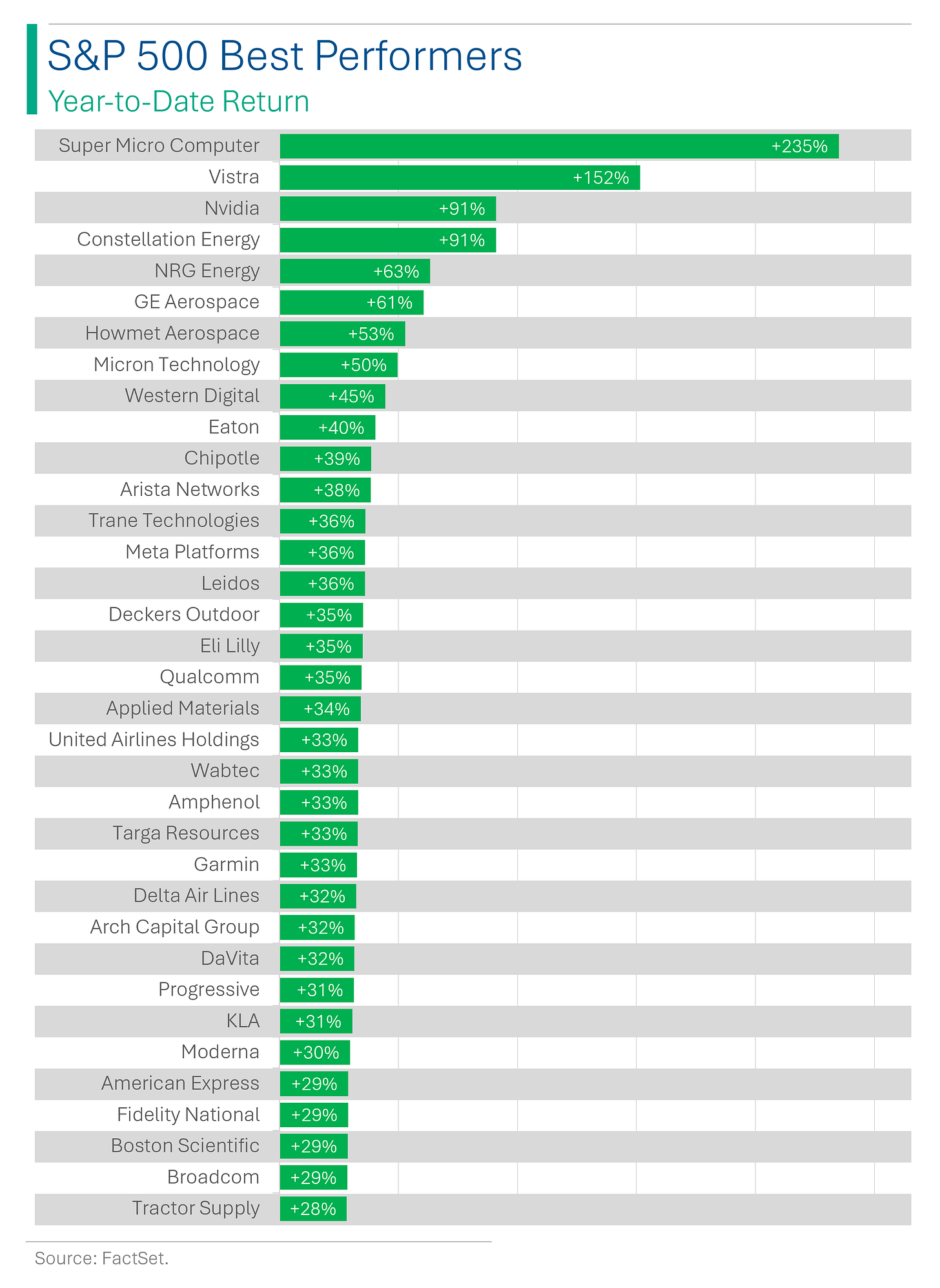

As expected, a lot of the best performers have come from Tech (Super Micro, Nvidia, Micron, Applied Materials) but there is a surprising amount of variety out there, including a lot of Energy and Consumer Discretionary.

Interestingly, some of the worst performers of the year have mostly come from two of those sectors - namely Tech and Consumer Discretionary.

The fact that Nvidia (+91%) and Micron (+50%) have worked while Intel sits at the bottom tells you that even a rising tide of hype doesn’t always lift all boats.

Around the world, returns have generally been positive for the bigger exchanges, with only Brazil showing a negative return. Turkey has been flying, while the rest of Europe is having one of their best years in a long time.

Even struggling China - which has gotten smoked the last few years - is doing well enough (Hang Seng +11.9%, Shanghai’s SSE +4.9%).

Commodity markets have also seen significant price rises. Cocoa, Orange Juice and others have seen massive price run-ups due to diseased crops and weather impacts.

While precious metals have ridden inflation concerns, and oil has appreciated on the back of Middle East conflict and OPEC+ cuts.

Joke Of The Day

A man goes to the zoo. There's only ONE exhibit in the entire zoo. It was a Shih Tzu.

Hot Headlines

CNBC / Wayfair to open its first large store, as physical locations make a comeback. CEO Niraj Shah says the experience can be better for customers than shopping online. The move follows other digitally native retailers, like Warby Parker, Figs, Glossier and Everlane.

I mean, sure but like, isn’t that your schtick?

Forex Live / Copper prices hit a record, breaking $5 per pound for the first time. Supply short fall expected to gain steam in coming years.

Bloomberg / JP Morgan CEO Jamie Dimon warns of sticky inflation and places higher odds on hard landing than market is forecasting. Sees significant price pressures to continue to influence the US economy. He cited costs linked to the green economy, re-militarization, infrastructure spending, trade disputes and large fiscal deficits.

CoinDesk / U.S. Senate votes to kill SEC's crypto accounting policy, testing Biden's veto threat. Issued by the agency in 2022, SAB 121 held that a company keeping a customer's cryptocurrencies should record them on its own balance sheet - which could have major capital implications for banks working with crypto clients.

BBC / London Stock Exchange CEO denies they have a problem - meanwhile companies continue to swap London for New York. Firms worth hundreds of billions have quit the UK or are considering it. Even recent IPO’s have shown the majority of domestic companies prefer to list outside the UK.

I’d say I feel bad for my old investment banking team, but they don’t exist any more. #RIPCreditSuisse.

Trivia

Today’s trivia is on Disney.

What year was the Walt Disney Company founded?

A) 1910

B) 1965

C) 1923

D) 1934Disney's acquisition of which company in 2006 expanded its ownership of famous animated characters?

A) Pixar Animation Studios

B) DreamWorks AnimationC) Illumination Entertainment

D) Blue Sky Studios

In which year did Disney enter the streaming market with the launch of Disney+?

A) 2015

B) 2017

C) 2019

D) 2020

How much revenue did Disney’s Parks division make in 2023?

A) $11 billion

B) $7 billion

C) $40 billion

D) $28 billion

(answers at bottom)

Market Movers

Winners!

AST Spacemobile (ASTS) [+68.2%]: Announced a commercial agreement with AT&T to provide space-based broadband directly to everyday cell phones.

Trupanion (TRUP) [+15.8%]: Upgraded to buy from neutral at BofA Securities; recent weakness in underwriting margins expected to improve, potentially exceeding FY24 margin guidance.

GoodRx Holdings (GDRX) [+10.9%]: Upgraded to outperform from market perform at Raymond James; highlighted stabilization from new management and opportunities in GLP-1 and specialty drugs.

Extreme Networks (EXTR) [+10.3%]: Upgraded to buy from neutral at Craig-Hallum; positive earnings report from competitor CSCO, particularly regarding customer inventories and product order growth.

Corebridge Financial (CRBG) [+7.8%]: AIG to sell 20% stake in Corebridge to Nippon Life for $31.47/share, or $3.8B.

Walmart (WMT) [+7.0%]: Q1 revenue just over 1% better, EPS more than 13% ahead; comps increased 3.8% vs. 3.5% consensus; guided FY sales and EPS to high end or above prior outlook; positive broad-based share gains.

Chubb Ltd. (CB) [+4.7%]: Berkshire Hathaway disclosed a new 25.9M share position in the company.

Losers!

Deere & Co. (DE) [-4.7%]: FQ2 EPS and equipment revenue better; all equipment segments saw lower volumes (some offset by better pricing); cut FY net income and cash-flow guidance for the second straight quarter; weaker Ag/Turf results across US/Canada, Europe, and SA.

Dillard's (DDS) [-4.7%]: Q1 EPS down year-over-year though revenue beat consensus; comps -2% vs. consensus -4%; ending inventory fell 2% year-over-year; total retail sales down 1% year-over-year.

Cisco Systems (CSCO) [-2.7%]: Q3 EPS and revenue beat; Q4 EPS guidance in line, revenue guidance stronger than consensus; FY24 revenue guidance raised; positive sentiment on normalizing inventory and improving order trends with Enterprise not as bad as feared, Splunk results also a positive, but increased opex seen as weighing on margins and near-term EPS.

Market Update

Trivia Answers

C) Disney was founded in 1923.

A) Disney acquired Pixar Animation Studios in 2006.

C) Disney+ launched in 2019.

D) The Parks division made $28 billion in 2023 revenue.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.