🔬G7 Rate Cuts Are Starting (ex-US)

Plus: Nvidia is now the 2nd biggest company in the world; and much more!

“The economy depends about as much on economists as the weather does on weather forecasters”

- Jean-Paul Kauffmann

“Money is better than poverty, if only for financial reasons.”

- Woody Allen

Huge day for the big US markets with the S&P 500 +1.2% and Nasdaq +2.0%, as a chip-fueled Tech rally rips market higher.

7 of 11 sectors closed higher led by a massive +2.7% day for Tech, with its techy little brother Communication Services +1.5%. Defensive Consumer Staples (-0.6%) and Utilities (-0.2%) were weakest. Obviously.

Mixed US economic data with ISM Services coming in at 53.8, well above consensus 50.8 and April's 49.4. Offset by ADP Private Payrolls data which increased by 152k vs. the 175k expected by the Street and the lowest gain since January.

Notable companies:

Hewlett Packard Enterprise (HPE) [+10.7%] Fiscal Q2 results beat; focused on server outperformance due to AI strength; AI-server sales more than doubled, flagged momentum in enterprise AI customer base; storage margins scrutinized. AI, AI, AI.

ASML Holding (ASML) [+9.5%] Jefferies noted CFO upbeat on commercial discussions with TSMC nearing conclusion; sees 2nm-related orders from Q2 or Q3.

Dollar Tree (DLTR) [-4.9%] Q1 earnings, revenue, and margins in line; comps below consensus (though Family Dollar outperformed); noted increase in traffic but lower average ticket; Q2 guidance midpoints below the Street; cut FY EPS guide (damaged Marietta distribution center); considering potential sale of Family Dollar segment.

More in ‘Market Movers’ below.

Off-topic but I’m looking for a junior analyst to help with my newsletter and run some of the social media (because I suck at it). If you know someone that likes talking stocks all day, please have them shoot me an email at ryan@mktlab.io. 😘

(job posting)

Street Stories

Cutting Edge: Bank of Canada Snips Rates, ECB Poised to Follow

The Bank of Canada cut its benchmark interest rate by 25 basis points to 4.75%, marking the first reduction in over four years and the first among G7 nations since 2020. This move, expected by economists, signals a potential series of cuts if inflation continues to ease, with further decisions being made on a meeting-by-meeting basis. Following the central bank's decision, Canada's major banks lowered their prime mortgage rates by 25 basis points to 6.95%.

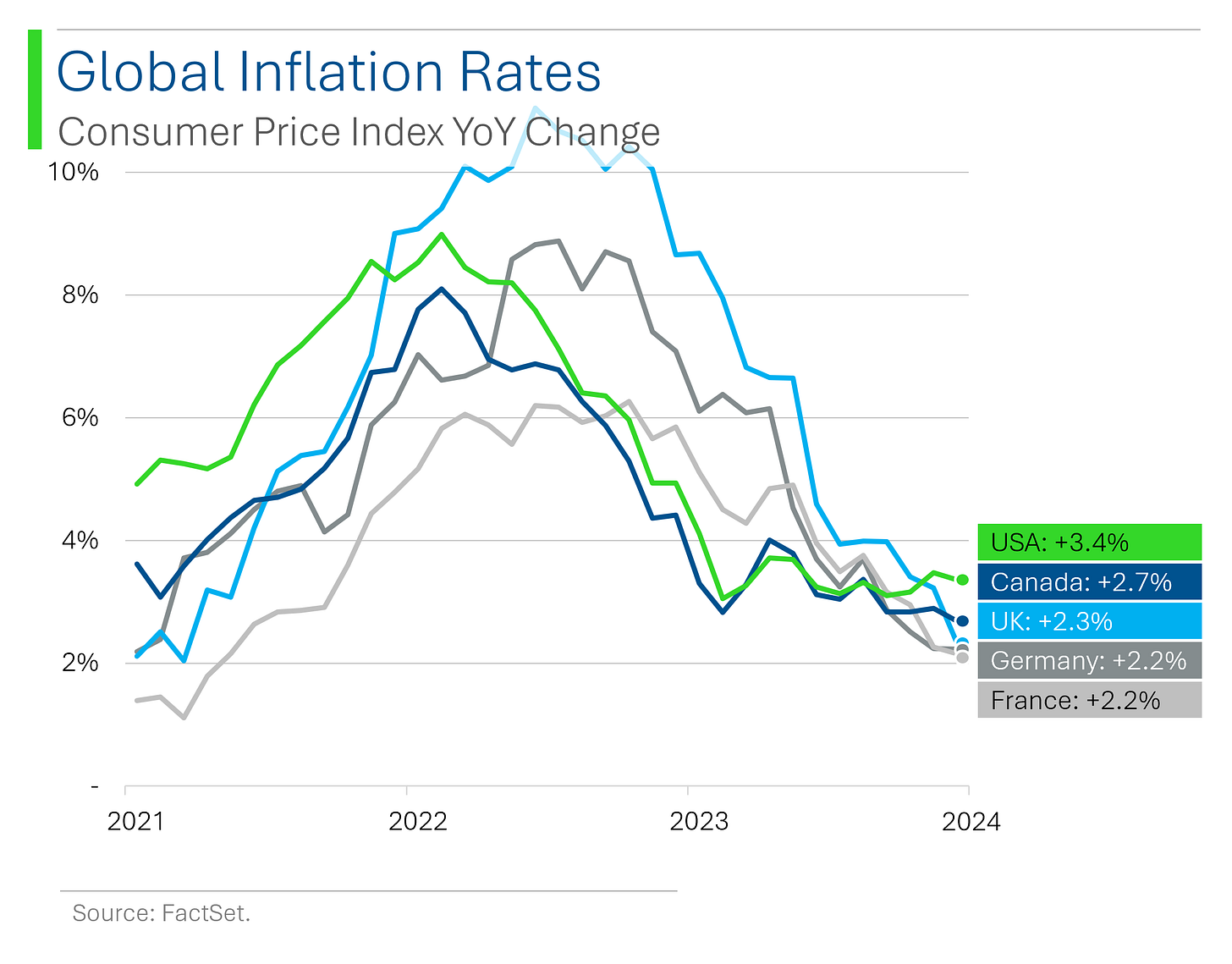

Currently the US has the highest inflation rate amongst its developed market peers, despite being one of the first to see inflation initially start to subside.

The European Central Bank (ECB) is expected to set it’s policy rate later today, with Wall Street forecasting a 93% chance that it follows Canada’s lead with their own 0.25% cut, which would take their main refinancing rate from 4.50% to 4.25%.

As for the US, little is expected over the next two Fed meetings (1% chance of a cut at the June; 19% chance in July). It isn’t until the Fed’s September meeting that probabilities skew in the favour of a cut, with a 69% chance of one or more cuts by then - a material improvement over the last week.

Nvidia Is Now World’s 2nd Biggest Company

Nvidia hit a double milestone on Wednesday by both passing Apple to be the second largest company in the world, and also becoming only the third public company to hit a market cap of $3 trillion.

The move came as Nvidia popped 5.2%, taking shares in the chip up +146% for the year, while Apple is only a up palty +1.7%.

This incredibly brings the total market cap gained in the last two years to a staggering $2.6 trillion dollars - a world record!

And while I’m happy for the company and the investors that stuck with them, I can’t say that passing Apple was a milestone I’d been hoping for.

When will I learn to keep my big mouth shut…

Joke Of The Day

A boy asked his bitcoin-investing dad for 1 bitcoin for his birthday Dad: What? $56k??? $31k is a lot of money! What do you need $42k for anyway?

Hot Headlines

WSJ / NBA nears reported 11 year $76 billion TV deal which has the potential to shake the foundations of sports media. The league is in advanced talks with NBC, Amazon and ESPN, with the deal representing a 2.5x the current structure. Last year the NFL inked their new deal for ~$10 billion a season, double their previous contract.

Axios / After years of delays and cancelled flights, Boeing's Starliner reaches orbit in first crewed mission to ISS. The mission is critical for Starliner to be declared an operational crew system by NASA and for Boeing to begin competing with SpaceX for additional missions to the space station. And yes, I still hate Boeing.

WSJ / Citron Capital’s Andrew Left called out a new short position in GameStop only to see shares rise 19%. The short seller bet big against the company during the 2021 frenzy and… I think the nice way to put it is that he got his face ripped off.

Bloomberg / Chip equipment maker ASML surpasses LVMH as second-biggest stock in Europe. Shares popped +8.1% amid a broad tech-driven rally, while Novo Nordisk retains title as Europe’s largest company by market cap.

Reuters / The new Texas Stock Exchange, based by BlackRock and Citadel Securities, is hoping to submit registration docs to SEC later this year. The company has raised $120 million and plans to begin trading in 2025.

CNBC / Electric air taxi maker Archer Aviation gets key FAA sign-off. The company plans to make electric vertical takeoff and landing aircraft, or eVTOLs, and won orders and backing in 2021 from United Airlines, which says the new technology could reduce carbon emissions.

Cool. Where do I sign up?

Trivia

Today’s trivia is on ‘first year economics’.

The 'Efficient Market Hypothesis' suggests that:

A) All markets are inherently efficient

B) Stock prices fully reflect all available information

C) Only financial markets can reach efficiency

D) Market efficiency is impossibleThe 'Big Mac Index' is an informal measure of:

A) The profitability of fast food chains

B) Purchasing power parity between currencies

C) Global obesity rates

D) Consumer preference for fast foodWhat is the primary aim of 'Supply-Side Economics'?

A) To increase government revenue

B) To reduce inflation

C) To boost production and lower the cost of goods and services

D) To increase consumer spending

(answers at bottom)

Market Movers

Winners!

Stitch Fix (SFIX) [+29.4%] Big fiscal Q3 EBITDA beat on better sales, GM, and cost control; raised FY24 guidance; positive turnaround execution but flagged continued decline in customer count; stock down ~25% YTD into the print.

CrowdStrike (CRWD) [+12.0%] Q1 results ahead and raised FY25 guide; positive takeaways on 22% NNARR growth in a tough macro environment, larger platform deals, competitive displacements, and momentum in emerging areas.

Hewlett Packard Enterprise (HPE) [+10.7%] Fiscal Q2 results beat; focused on server outperformance due to AI strength; AI-server sales more than doubled, flagged momentum in enterprise AI customer base; signs of recovery in traditional and cloud markets; storage margins scrutinized.

ASML Holding (ASML) [+9.5%] Jefferies noted CFO upbeat on commercial discussions with TSMC (TSM) nearing conclusion; sees 2nm-related orders from Q2 or Q3.

Applied Materials (AMAT) [+5.3%] Upgraded to equal weight from underweight at Barclays; cited positive trends in semi cap including growth in China spend Y/Y in CY24, 2nm, HBM, and capacity buildouts.

Hanesbrands (HBI) [+5%] Signed agreement to sell global Champion business to Authentic Brands Group for $1.2B, plus earnout up to $300M.

Losers!

Brown-Forman (BF.B) [-5.9%] FQ4 earnings better but revenue light and organic growth below consensus; GM weaker but OM well ahead of expectations; forecasts return to growth in FY25 driven by international gains and normalizing inventory trends.

Dollar Tree (DLTR) [-4.9%] Q1 earnings, revenue, and margins in line; comps below consensus (though Family Dollar outperformed); noted increase in traffic but lower average ticket; Q2 guidance midpoints below the Street; cut FY EPS guide (damaged Marietta distribution center); considering potential sale of Family Dollar segment.

Market Update

Trivia Answers

B) The Efficient Market Hypothesis states that stock prices fully reflect all available information.

B) The Big Mac Index measures the purchasing power parity between currencies.

C) Supply-Side Economics aims to boost production and lower the cost of goods and services in the effort of increasing GDP growth and maximizing employment.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.