🔬 Ferrari Explained (Part II): Inner Workings of a Champion

Plus: Nvidia closes in on Apple for number two on spot on the biggest company list; North Korea's garbage bombs; and much more:

"The stock market is designed to transfer money from the Active to the Patient."

- Warren Buffett

“I can't take his money. I can't print my own money. I have to work for my money. Why don't I just lie down and die!”

- Homer

Weak day for the big US markets with the S&P 500 -0.7% and Nasdaq -0.6%, as rising bond yields gave investors pause.

All 11 sectors closed lower led by Tech (-0.4%) while Energy was worst, down -1.8% as oil closed down 0.8% following a big +2.7% yesterday.

Notable companies:

Marathon Oil (MRO) [+8.5%] Acquired by COP in an all-stock transaction with an enterprise value of $22.5B, inclusive of $5.4B of net debt, representing a 14.7% premium to yesterday's closing share price.

AST Spacemobile (ASTS) [+69.2%] Announced a strategic partnership with Verizon, including a $100M commitment. VZ noted the partnership will enable 100% coverage in the continental US.

American Airlines Group (AAL) [-13.5%] Slashed Q2 EPS $1.00-1.15 ex-items vs prior guidance $1.15-1.45; adjusted operating margin and TRASM guidance also lowered. Downgraded to Hold from Buy at Jefferies; cited lack of strategy execution.

Street Stories

Ferrari Explained Part II: Inner Workings of a Champion

This is Part II of my look into the financial side of Ferrari. If you haven’t checked out Part I yet, you can find it here. Andiamo!

I left off yesterday highlighting that, while Ferrari may be a small player on a revenue and profit basis, investor love for the company has meant that it trades at a massive premium to it’s automotive peers.

In fact, Ferrari has now officially become the third most valuable automobile manufacturer in the world! If Enzo Ferrari were alive, I’m sure he’d be overjoyed - just kidding, all he cared about was racing and he’d be pissed they haven’t won the F1 championship since 2007.

To add some emphasis to how incredible this feat is, last year Ferrari only sold 13,663 cars. Or, 0.1% and 0.2% of what Toyota (11.2 million) and GM (6.2 million) sold respectively.

However small that number may be, though, it has grown at an incredible pace - up +222% over the last 20 years.

That sales growth has only been outpaced by Porsche, and much of that having to do with them transitioning to a majority SUV company (+63% of units in US in 2022), with the ole 911 only representing 10% of sales US sales.

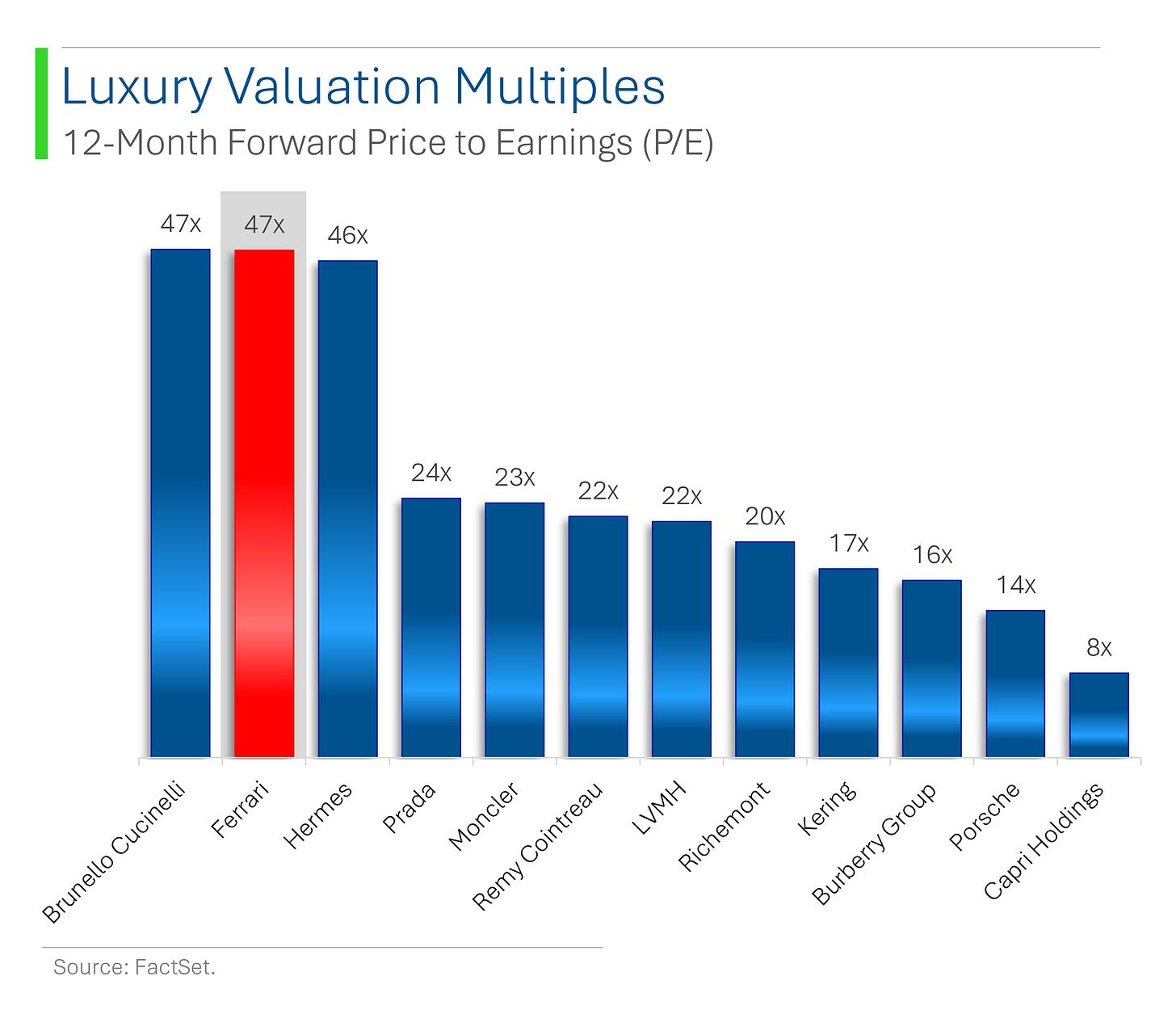

However, a different and probably more reflective way to look at Ferrari is to instead compare it to its peers in the luxury sphere. And even there it’s a behemoth!

Only LVMH (Louis Vuitton, Dior, Dom Pérignon), Hermès and Richemont (Cartier, Montblanc, IWC Schaffhausen) are bigger by market cap, with the closest automaker being Porsche at half the size - and half the ultra luxury appeal.

Here (finally) Ferrari has some competition on the valuation front, as both Hermès and LVMH trade at similar forward P/E’s in the high-40s. Beyond them, however, there isn’t really anyone else that trades at such a ridiculous premium.

Recall that Ferrari’s automaker peers trade around 5-9x earnings. Très gauche.

And unlike the auto peers that average gross margins in the teens and 20s percent range, compared to its luxury peers, Ferrari’s margins look quite sluggish. Time for a price hike!

Looking at what makes the company tick, they report four different divisions but only one of them really matters: Cars and Spare Parts.

This division is primarily the sale of new vehicles (duh), which has grown from only a few types available per year to 11 currently. Granted, that includes stuff like SF90 Stradale and the SF90 Spider separately.

This also doesn’t include its Special Series and ICONA: super rare Ferraris with starting prices typically in the millions.

I should also say that it’s a pretty fun Annual Report and Presentation to work your way through.

Beyond the cars, Ferrari does make a decent chunk of change selling engines (the ‘Engines’ division), primarily to Maserati ($138 million in 2023).

Sponsorship, Commercial & Brand is mostly the revenues generated from Formula 1 but increasingly consists of licensing and other products, like merch.

‘Other’ includes a pile of stuff, ranging from financial services to renting out their Mugello race track, which even got to host a Formula 1 race (granted it was the pandemic and there were a total of 1,500 fans).

Lastly, Ferrari’s mass appeal has started gaining traction in Asia - the largest growth market for luxury goods. China and Other Asia Pacific has been their fastest growing segments, but still only represent 28% of sales (vs. 37% at LVHM) meaning they likely have lots of room left to grow.

That concludes my overview of Ferrari. It’s a truly exceptional company with one of the world’s strongest brands…albeit with a valuation as premium as its supercar range.

Thanks to my buddy Charlie I. for his help with this write-up.

Nvidia Closes In On Apple

Nvidia is up 7.0% over the last two weeks, with the biggest movements triggered by its strong earnings and renewed (err, less insane) hype around chip demand after Elon Musk’s xAI raised $6 billion in funding and is rumored to be buying ‘100,000’ Nvidia chips.

The movement means Nvidia has crept even closer to overtaking Apple to become the world’s second biggest company. Currently there is only a measly 4.0% difference. The $111 billion gap between the two, was a slightly larger $1.95 trillion just two years ago.

Joke Of The Day

I’m not saying my financial advisor is bad at her job... but when I went into her office and asked her to check my balance, she tried to push me over.

Hot Headlines

Axios / Restaurant menus lean hard on "limited time offers" in the age of inflation and fast changing TikTok food trends. The number of limited-time offers at restaurants - or "LTOs" in industry parlance - has grown 53% in the last four years, according to Technomic.

NY Post / Wall Street’s longest serving CEO could be on the way out as Jamie Dimon says he could step down as CEO in as little as 2.5 years.

Who will be left to slander cryptos?!

CNBC / North Korea sends balloons filled with waste into South Korea. Move considered retaliation after South Korean activists sent anti-Pyongyang leaflets over the border recently. New definition of a dirty war. 🚮

CNN Business / ConocoPhillips is buying Marathon Oil in $22.5 billion deal. Consolidation in the oil and gas space is intensifying, following Exxon’s $60 deal for Pioneer, Chevron’s $53 billion deal for Hess and others.

Yahoo Finance / Megafund Calpers say it opposed Tesla’s $56 billion pay package for Elon Musk. The US’s largest state public pension fund joins the club in opposition, adding its 9.5 million share votes to the pile.

I don’t think he gettin’ that money.

Reuters / IMF upgrades China's GDP growth forecasts but warns of risks ahead. The International Monetary Fund is now targeting +5.0% growth vs. former estimate for +4.6% after “strong” first quarter. Also believes economic risks from the property crisis and its spill over impacts on consumers.

Bloomberg / Unemployment rates up from last year in 78% of US metro areas. The jobless rate climbed in 305 of the 389 metropolitan areas in April, according to data released by the Bureau of Labor Statistics.

Trivia

Today’s trivia is on Ferrari’s old foe, Porsche.

When was Porsche founded?

A. 1928

B. 1931

C. 1931

D. 1940Porsche IPO’d in 2022 but is still majority owned (76%) by which automaker?

A. Daimler-Benz

B. Volkswagen

C. BMW

D. StellantisWhat was Porsche’s total revenue in 2023?

A. €41 billion

B. €89 billion

C. €27 billion

D. €78 billionHow many vehicles did Porsche produce in 2023? (Note: Ferrari made 13.6k).

A. 45k

B. 72k

C. 221k

D. 320k

(answers at bottom)

Market Movers

Winners!

AST Spacemobile (ASTS) [+69.2%] Announced a strategic partnership with Verizon, including a $100M commitment ($65M in commercial prepayments). VZ noted the partnership will enable 100% coverage in the continental US.

Chewy, Inc. (CHWY) [+27.1%] Q1 revenue slightly better; EBITDA and EPS well ahead of consensus; EBITDA margin beat by 170 bp. Raised FY EBITDA margin guide on unchanged revenue outlook. Noted FY24 off to a solid start; cautious takeaways include difficult industry backdrop and fewer customers. Announced $500M share repurchase program.

Abercrombie & Fitch (ANF) [+24.3%] Q1 earnings, revenue, and margins beat; comps well above consensus with double-digit growth at both Abercrombie and Hollister. Highlighted digital strength; noted margin benefits from better freight costs and lower discount/clearance selling. Q2 guidance ahead of Street; raised FY guide.

SurModics (SRDX) [+19.9%] To be taken private by GTCR for a total equity valuation of ~$627M; $43/sh cash consideration represents a ~23% premium to Tuesday's close. Deal expected to close in H2'24.

Dick's Sporting Goods (DKS) [+15.9%] Q1 earnings, revenue, and GM beat; comp growth ahead of consensus with increase in both transactions and average ticket. Highlighted strength in footwear and athletic apparel. Shrink higher y/y but below forecasts; raised FY25 EPS and comp guidance.

Box, Inc. (BOX) [+8.6%] Q1 earnings, revenue, and margins beat. Highlighted large-customer strength, Suites attach rate, and strong Box AI demand. Billings a weak spot amid dollar strength. Q2 and FY EPS guidance better despite expected continuation of FX headwinds.

Marathon Oil (MRO) [+8.5%] Acquired by COP in an all-stock transaction with an enterprise value of $22.5B, inclusive of $5.4B of net debt, representing a 14.7% premium to yesterday's closing share price. Transaction expected to close in Q4 2024.

Losers!

American Airlines Group (AAL) [-13.5%] Guided Q2 EPS $1.00-1.15 ex-items vs prior guidance $1.15-1.45; adjusted operating margin and TRASM guidance also lowered. Group CCO Vasu Raja to depart in June 2024; downgraded to hold from buy at Jefferies; cited lack of strategy execution.

Biohaven (BHVN) [-12.2%] Announced broad portfolio and pipeline updates, but analysts focused on underwhelming results from ascending-dose study of BHV-1300 for immunological and inflammatory disorders.

Advance Auto Parts (AAP) [-10.9%] Q1 comps and sales missed; some takeaways noted comps likely better than feared; EPS beat on better margin performance. Reiterated FY guidance; noted margin pressure in Q2 with focus on pricing actions; consumer at an inflection point; disappointment with lack of meaningful progress on Worldpac sale.

Toast, Inc. (TOST) [-7.1%] Investor Day presentation sees FY EBITDA midpoint somewhat below the Street (though also increased long-term margin targets); note stock up more than 30% YTD.

UnitedHealth Group (UNH) [-3.8%] Management at Bernstein conference expects ongoing disturbance from prolonged Medicaid redetermination cycle; utilization trends have not seen much improvement since last update.

ConocoPhillips (COP) [-3.1%] Announced acquisition of MRO in all-stock transaction with enterprise value of $22.5B, inclusive of $5.4B of net debt, representing a 14.7% premium to yesterday's closing share price; transaction expected to close in Q4 2024.

Market Update

Trivia Answers

C. 1931 by Ferdinand Porsche.

B. Volkswagen owns the majority of Porsche.

A. 2023 revenue came in at €41 billion.

D. Porsche produced 320k vehicles in 2023.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.