🔬Fedspeak is Good (for once), Oil Sucks Again, and Much More

"I'm not so much concerned about the return on my money, as the return of my money"

- Will Rogers"A stockbroker is someone who invests your money until it's all gone"

- Woody Allen

Table of Contents

Hot Headlines

Joke Of The Day

A.M. Allocations:

- Busy With Fedspeak

- Oil's Well That Ends... Lower? Crude Prices Hit a Slick Slope

Trivia

Market Movers

Market Update

Hot Headlines

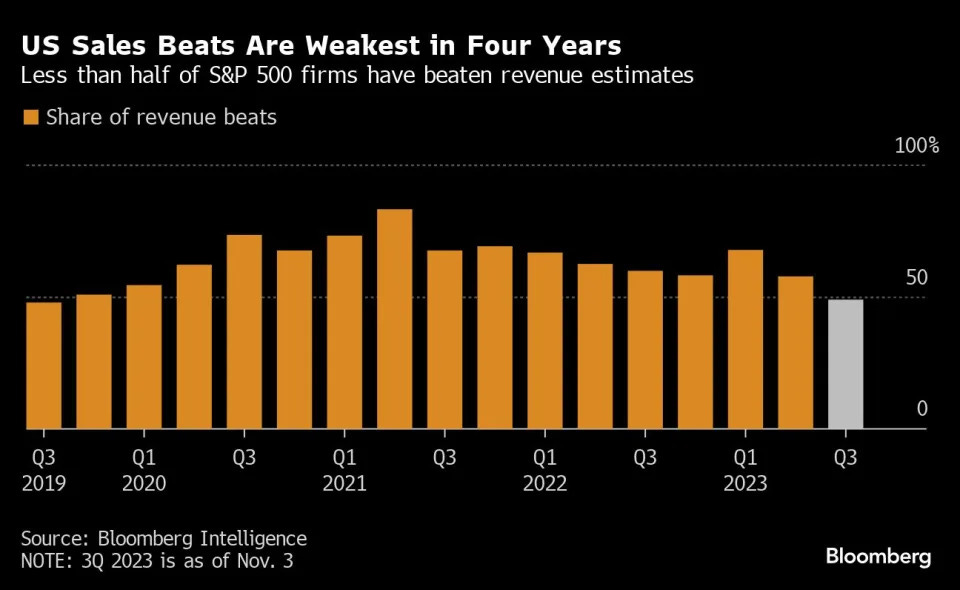

EARNINGS SEASON - Corporate America is experiencing its worst sales reports in four years, with less than half of S&P 500 companies surpassing revenue estimates, pointing to a drop in consumer demand and companies' reduced ability to hike prices. High-profile revenue warnings from major companies like Apple and Remy Cointreau have underscored this trend, despite a slight increase in quarterly earnings, signaling a cautious outlook for future sales and profit margins. (Yahoo)

APPLE PRODUCTS - Apple Inc. has temporarily halted the development of new features for its upcoming software updates across all devices to address and fix existing bugs. ABOUT. DAMN. TIME. Maybe they’ll even get my iPhone to stop playing U2 when it connects to Bluetooth? (Bloomberg)

HOUSING MARKET SENTIMENT - A Fannie Mae survey reveals that 85% of Americans feel it's a bad time to buy a house due to high prices and mortgage rates. Mortgage rates, which have been over 7% since mid-August, are discouraging both buying and selling, with many homeowners unwilling to trade their low rates for current higher ones, exacerbating inventory shortages and keeping home prices high. Despite positive feelings about job security and personal finances, the persistent rise in living costs has led to widespread frustration, with 78% of Americans thinking the economy is heading in the wrong direction, the highest dissatisfaction since June 2022. Shocking! (Fannie Mae)

CHINESE GDP GROWTH - The International Monetary Fund has raised China's economic growth forecast to 5.4% for this year, citing a strong post-COVID recovery and new policy support, but expects growth to slow to 4.6% in 2024 due to ongoing issues in the property sector and subdued external demand. The IMF warns that China's long-term growth is threatened by local government debt and real estate downturn, advising comprehensive measures to manage debt levels and improve fiscal transparency. (Yahoo)

CONSUMER LEVERAGE - U.S. household debt rose by $228 billion in the third quarter to $17.3 trillion, with credit card balances increasing by $48 billion and reaching a record annual rise since 1999, as reported by the Federal Reserve Bank of New York. Delinquency rates are climbing, especially among Millennials and those with student and auto loans, even as overall delinquency levels remain near or below pre-pandemic figures. (New York Fed)

HOUSING MARKET - Commercial and multifamily mortgage origination in the U.S. dropped by 49% year-over-year in the third quarter, with all property types experiencing declines, particularly in health care properties which saw a 76% decrease. This downturn, attributed to market uncertainties, higher interest rates, and concerns over property fundamentals, may signal upcoming distress in the sector, with $1.5 trillion of debt maturing soon and potential office price drops forecasted. (Business Insider)

(Bloomberg) Rockstar Plans to Announce Much Anticipated ‘Grand Theft Auto VI’ - first game since Red Dead Redemption in 2018? Hope it’s in time for Christmas.

(Reuters) This year 'virtually certain' to be warmest in 125,000 years, EU scientists say

(Reuters) Why WeWork failed, and what is next - I read the book and watched the documentary; pretty sure it’s the tall dumb guy’s fault.

(Reuters) Amazon.com previews FTC defense at companywide meeting - gotta love the ‘it’s actually good for competition’ rhetoric. Microsoft 1998 vibes.

(CNBC) Microsoft closes at all-time high on fresh OpenAI-related optimism - you know you’re getting old when you remember Microsoft being hated (see above) and terrible at everything (remember the Zune???) and now they are the intermediary of every major trend.

(Reuters) Russia says Israeli nuclear remark raises 'huge number of questions' - a ‘we’re not gunna nuke Gaza’ statement should be assumed but it’s 2023 and we’re all just all just living in a pit.

(WSJ) Goldman Moves to Unload GM Credit Card

Joke Of The Day

Two traders are walking uptown from Wall Street en route to the subway. A mugger approaches them with a gun and demands all of their money. The one trader turns to the other and says, “Oh, by the way, here’s that $100 I owe you…”

A.M. Allocations

Busy With Fedspeak

Tuesday was a busy day of ‘Fedspeak’ - the hints that Federal Reserve folks sprinkle into our lives relating to the path forward for the world’s biggest economy. Some policy clues include:

Fed Governor Christopher Waller noted the strong Q3 economic growth but also acknowledged signs of slowing job growth and the negative impacts of high long-term bond yields.

Dallas Fed President Lorie Logan emphasized the unexpected strength of the economy but pointed out that inflation is still above the Fed's target and that tight financial conditions (ie, higher rates) are necessary to bring it down to 2%.

Fed Governor Lisa Cook remarked on the emerging signs of debt stress among households with lower credit scores, which could reduce consumer spending and increase banks' reluctance to lend.

Chicago Fed President Austan Goolsbee observed that inflation is decelerating and that high market-based interest rates are effectively tightening credit, which could slow the economy with a lag.

Take-Aways: The market seems to have interpreted these as, net-net, being generally ‘dovish’ and further reinforcing the idea that economic cracks emerging are likely sufficient to quell inflation, negating the idea that further rate hikes are necessary. And yes, it is weird that the market sees positives in top economists, with their fingers on the ‘no fun’ interest rate button no less, saying they don’t need to do anything because things are looking bad enough without them mucking it up any further.

Oil's Well That Ends... Lower? Crude Prices Hit a Slick Slope

U.S. crude oil prices dropped to their lowest since July, with West Texas Intermediate and Brent crude settling at $77.37 and $81.61 a barrel, respectively, influenced by weak global economic data, particularly a significant drop in China's exports.

The decrease in oil prices occurred despite ongoing concerns about the Israel-Hamas conflict and persisted even though Saudi Arabia and Russia confirmed they would maintain output cuts through the end of the year.

Trivia

Commodities day!

In commodity trading, what does the term "Contango" refer to?

A) A fancy dance you do when your trade goes well.

B) The market condition where prices are higher in the coming months than now.

C) A type of futures contract that settles in cash instead of the physical commodity.

D) Two commodities that have highly correlated trading patterns .

What is the contract size for Gold Futures (GC) on the COMEX?

A) 100 troy ounces, also known as 'a small fortune'.

B) 1 kilogram, for when you've gone metric.

C) 10 troy ounces.

D) 5000 troy ounces.Approximately how many bushels are in one metric ton of wheat?

A) 36.7437 bushels, because why make it a round number?

B) 0.5 bushels, if you believe in diet portions.

C) 14.5159 bushels, just to ensure calculators stay in business.

D) 100 bushels.

(answers at bottom)

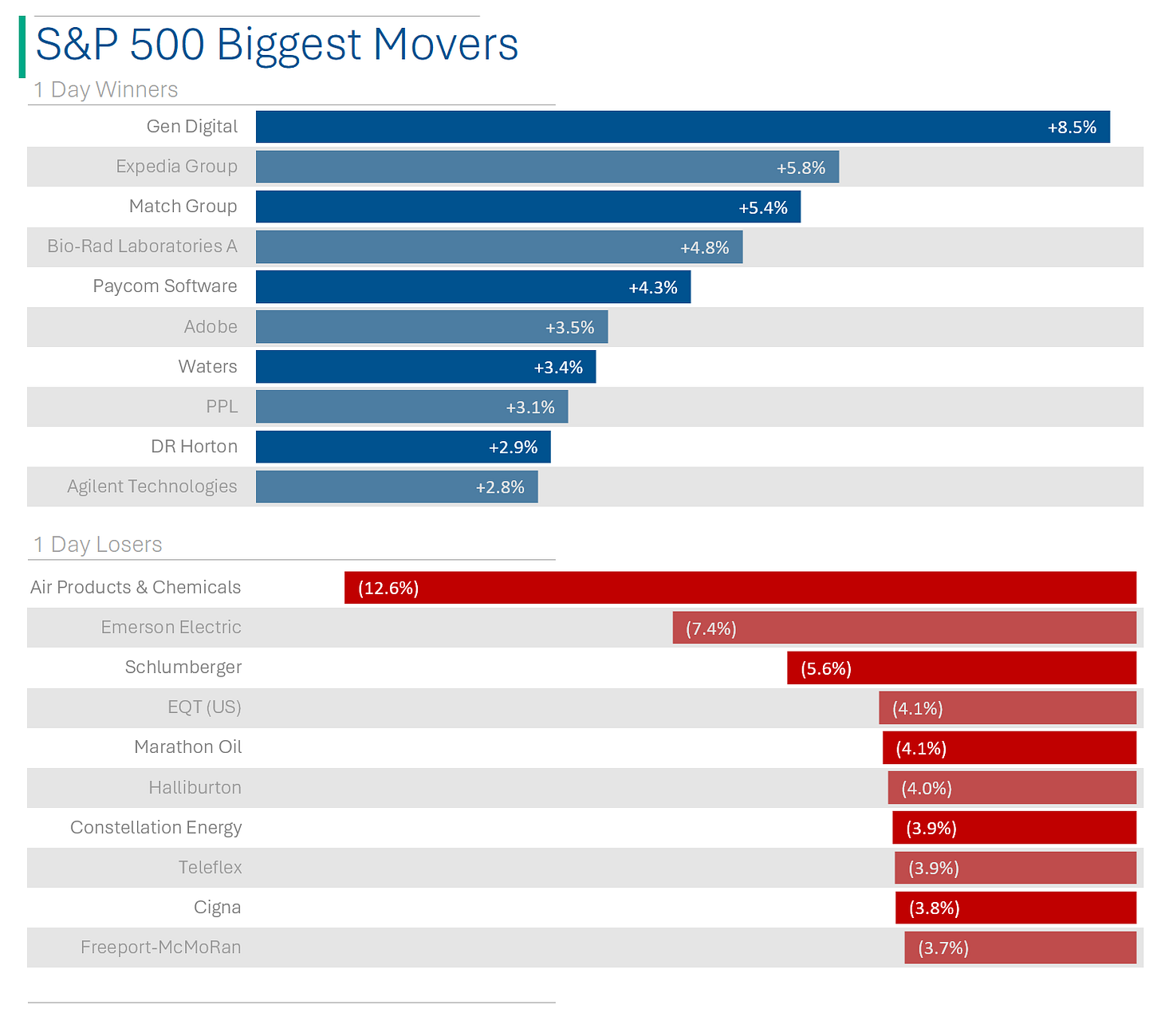

Market Movers

Winners!

Datadog (DDOG): [+28.5%] Surpassed Q3 expectations with 25% year-over-year growth. Raised Q4 guidance amid favorable short positions.

Elanco Animal Health (ELAN): [+14.3%] Q3 EBITDA beat with growth in key sectors; FY guidance improved with notable pipeline developments expected.

Planet Fitness (PLNT): [+13.4%] Q3 beat and positive outlook.

Biomarin Pharmaceutical (BMRN): [+12.2%] Elliott Management has taken a significant stake, initiating strategic discussions per Reuters.

TripAdvisor (TRIP): [+11%] Q3 earnings exceeded projections with strong segment growth; positive revisions to core revenue and cost savings.

Hims & Hers Health (HIMS): [+11%] Q3 beat and cite significant expansion potential.

GlobalFoundries (GFS): [+5.1%] Beat Q3 EPS estimates with steady revenue; anticipates stronger Q4 EPS but with cautious revenue expectations amid economic uncertainty.

Losers!

Shockwave Medical (SWAV): [-17.1%] Q3 beat but cited concerns on slowing growth.

Sanmina (SANM): [-14.3%] Fiscal Q4 and Q1 forecasts fell short.

Air Products (APD): [-12.7%] Beat Q4 EPS but missed Revs and EBITDA.

CNH Industrial (CNHI): [-10.6%] Q3 industrial sales and EBIT below expectations with an unexpected negative free cash flow. Downgraded FY net sales growth outlook by 5 percentage points.

Emerson Electric (EMR): [-7.4%] Missed FQ4 EPS and revenue targets but saw an EBITDA rise due to Intelligent Devices and Software segments. Set FY24 EPS above analysts' predictions, but concerns were raised over the free cash flow forecast and less operating leverage than anticipated.

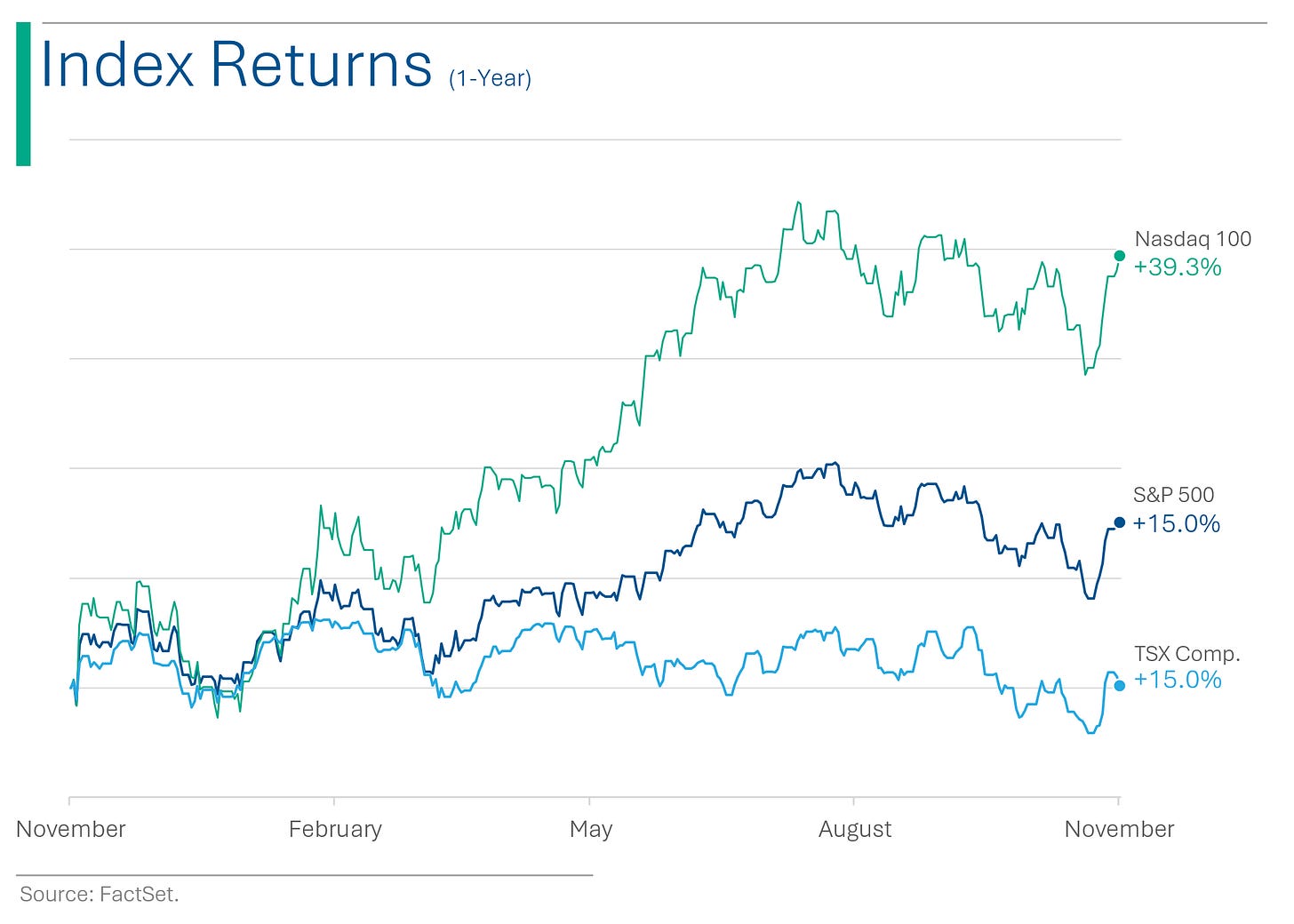

Market Update

Trivia Answers

B) The market condition where prices are higher in the coming months than now. The opposite is backwardation.

A) 100 troy ounces, also known as 'a small fortune'

C) 14.5159 bushels. WHY?

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and give us a ‘Like’ below.