🔬Fed's Rate-Cut Party Gets an Uninvited Guest: Inflation & Jobless Data

“Successful investing requires the management of your own ego and temperament and usually that of your clients as well.”

- Tom Gayner

“Have you ever noticed that anybody driving slower than you is an idiot, and anyone going faster than you is a maniac?”

- George Carlin

Markets struggled on Thursday amid choppy trading: Sectors like airlines, building products, housing-related retail, and semiconductors lagged, while outperformers included P&C insurance, energy, copper, and cybersecurity. Treasuries were mixed, with the 10Y yield notably rising, while the dollar dipped slightly and gold was up.

Economic data drove some of the downside: A hotter-than-expected September CPI report and a sizeable jump in initial jobless claims weighed on sentiment, though analysts and Fed officials downplayed these results. Fed members spoke about potential pauses and future rate cuts, with the narrative shifting toward a soft landing and modest optimism for Q3 earnings.

Earnings updates and company news were mixed: Amazon noted its biggest October shipping event, while Delta Air Lines missed revenue expectations, and Domino’s Pizza beat EPS estimates but issued caution on the macro environment. Meanwhile, GXO is exploring a sale, and 10X Genomics lowered its revenue outlook due to consumer headwinds.

Notable Companies:

Toronto-Dominion Bank (TD) [-5.3%]: They're paying a $3B fine and facing US growth restrictions due to a settlement over a spoofing scheme.

PayPal (PYPL) [-3.3%]: They were downgraded by Bernstein due to competitive pressures and uncertainty around their long-term strategy.

Pfizer (PFE) [-2.8%]: Former CEO and CFO announced they won’t be involved in Starboard Value’s activist push, expressing confidence in the current management team.

More below in ‘Market Movers’.

Street Stories

Fed's Rate-Cut Party Gets an Uninvited Guest: Inflation & Jobless Data

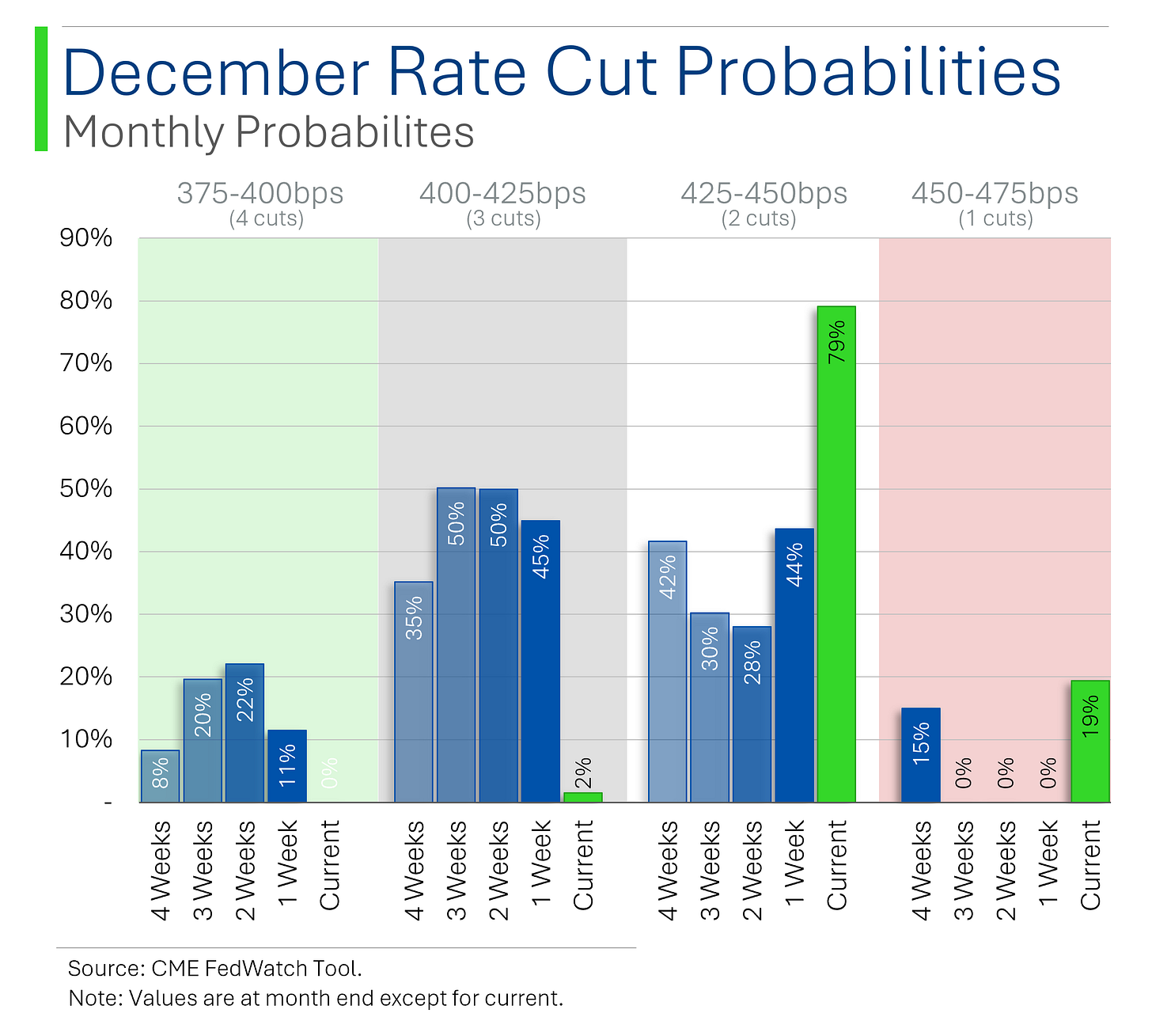

In recent interviews, Fed Chair Jerome Powell all but declared victory against inflation. With the economy seemingly on a solid footing, it seemed that there was no rush for the Fed to keep it’s foot on the accelerator with more 50 basis points cuts (like in September) and that we should expect modest 25 basis point cuts at the remaining two Fed meeting (Nov and Dec).

As a result, Wall Street expectations have plummeted over the last few weeks, with the base case moving from 100-75 basis points in cuts, down to 50-25. Party poopers.

However, with Thursday’s CPI Inflation print coming in hotter that expected (+2.4% annual rate vs. Wall Street consensus for +2.3%) I’m wondering if that’ still set in stone.

If inflation keeps disappointing, this will change the narrative - and make the Fed earn those paychecks.

Jobless claims also had a heavy miss Thursday, as the cooling in layoffs we witnessed over the last few months appears to have ended. The +33k increase over the previous week was also the largest week-over-week gain since July 2021. Oof.

If the Fed’s lax attitude towards rate cuts was premised on the idea that inflation was in the rearview and that the economy was steady, it might be premature to just go ahead and call it a year…

Seven & I's Shedding Weight to Fend Off Couche-Tard

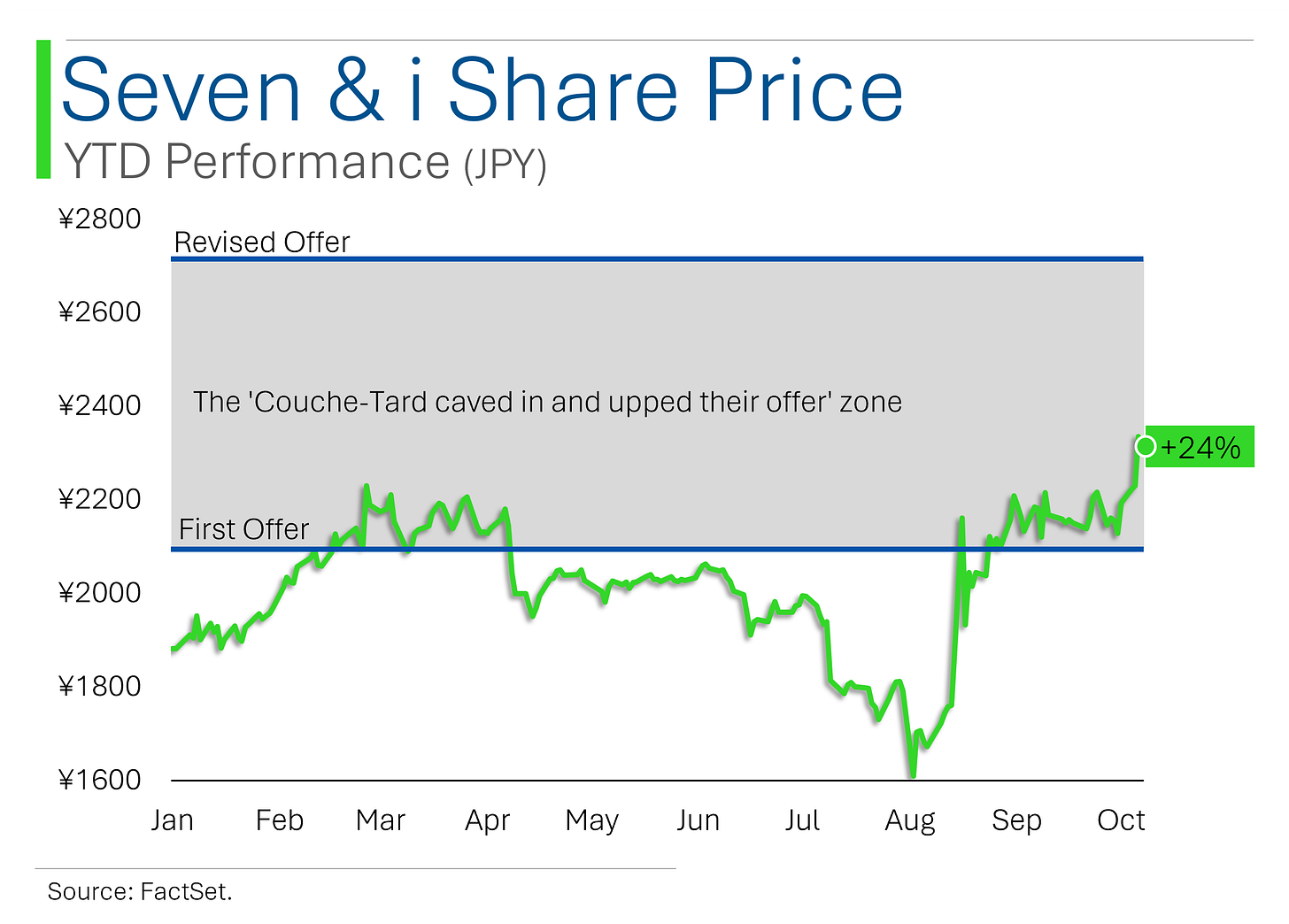

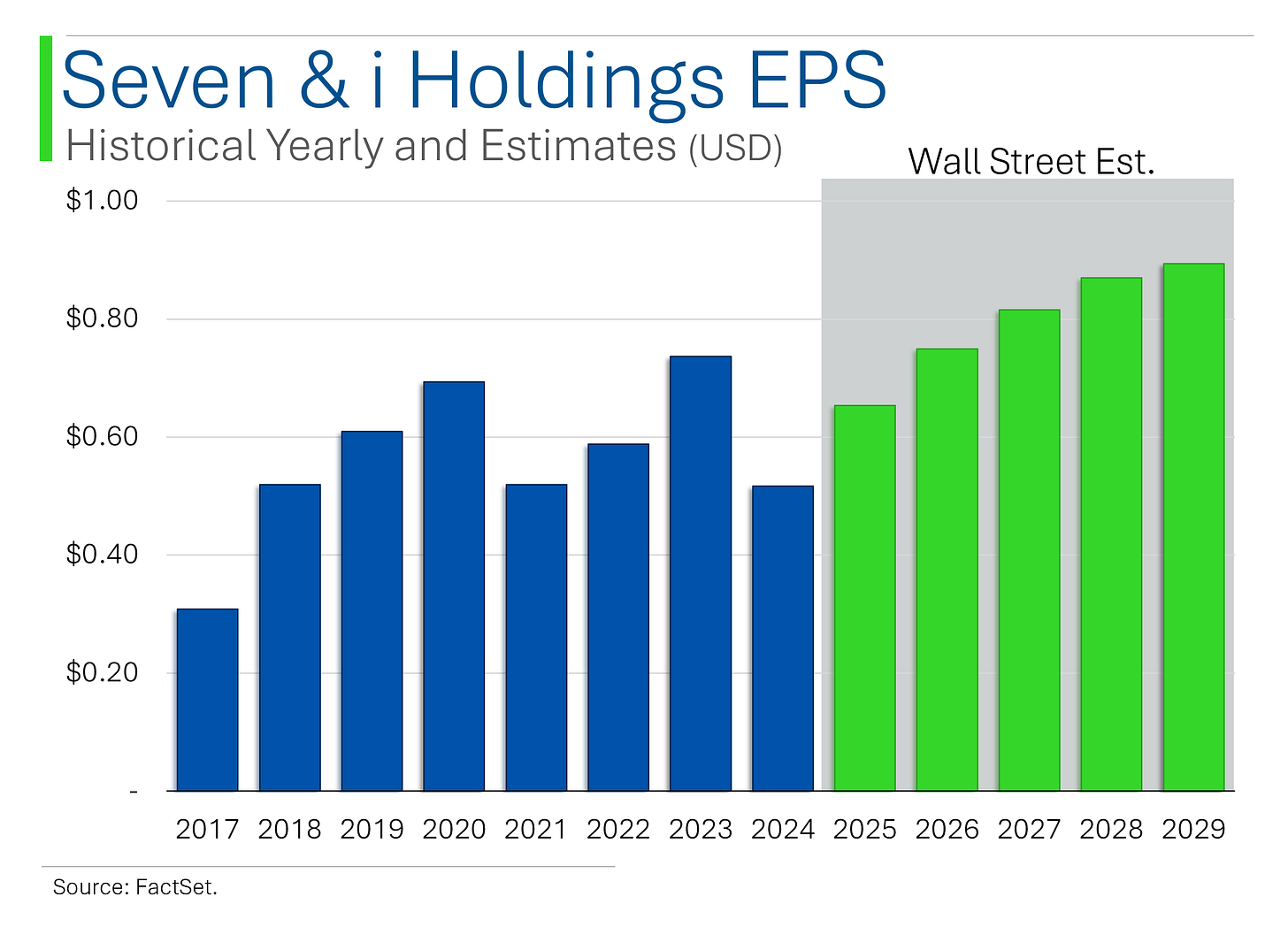

The biggest autumnal M&A news has been 7-Eleven’s Japanese parent, Seven & i, ramping up efforts to fend off a revised $47 billion takeover bid from Canadian convenience store operator, Alimentation Couche-Tard.

The company is planning a major restructuring, which includes selling off non-core assets to focus on its core 7-Eleven business.

However, the market has been voting the only way it knows how and Seven & i has traded materially closer to the revised offer price since its Wednesday announcement.

As part of its strategy, the company plans to shift 31 non-core businesses into a separate holding company, with potential plans to list the entity publicly.

However, Seven & i also announced a downgrade in its operating profit forecast for the fiscal year, reducing it over 35% to just $2.7 billion as a result of weaker top-line revenue figures.

The stakes are high as the company faces growing competition in the global convenience store sector, and its stock has surged over 30% since news of Couche-Tard’s interest and is up 24% on the year. All eyes are on Seven & i’s investor relations day on October 24, where management will announce a plan.

Joke Of The Day

My friend got me an elephant for my room. I said thanks and she said, don’t mention it.

Hot Headlines

CNBC / TD Bank pleads guilty in money laundering case, will pay $3 billion in penalties. TD Bank admitted to criminal charges…period. Share fell. 5%.

Bloomberg / Pot companies are fleeing the first nation to legalize marijuana. Uruguay's cannabis industry, once expected to be a powerhouse, has fallen short with just $30 million in exports since 2018, as red tape and slow regulatory processes have led major companies to exit the market.

Bloomberg / Hedgefund are avoid election bets as ‘too close to call’ but still remain more invested on net than previous election years.

BNN Bloomberg / Second Trump presidency would put ‘meaningful drag’ on Canada’s economy. This is mainly as a result of potential tariffs on Canadian imports and downward pressure on energy prices. Canadian GDP pictured below.

Bloomberg / Mortgage rates jump most since April, sending 30-Year to 6.32%. This is simply following the move up in treasury yields imo. Investing is an opportunity set people.

Reuters / Delta warns of revenue hit from US presidential election. Delta Air Lines expects a 1% drop in fourth-quarter revenue as the U.S. election causes travelers to delay bookings…I’m sure it’s not for other reasons.

Yahoo Finance / What back-to-school sales signal about the state of the consumer. Back-to-school sales in 2024 are up 2% year-over-year…but this marks the weakest performance in 15 years.

Reuters / Ethel Kennedy, widow of Robert Kennedy, dies at 96. Ethel passed away after a stroke, leaving behind a legacy of public service and a family marked by both triumphs and tragedies.

Reuters / Zelenskiy sees 'opportunity' to end war in Ukraine by 2025. An invitation to join NATO is his ‘victory plan’...it’s also why Putin invaded.

Yahoo Finance / Billionaire Mark Cuban once ran a Ponzi scheme to pay for his college tuition. During his junior year at Indiana University, he ran a chain-letter Ponzi scheme to cover tuition costs, calling it a "scam" that ultimately helped him pay for school…Calling it right now, he’s getting dropped from Shark Tank.

CNBC / AMD launches AI chip to rival Nvidia’s Blackwell. More news to keep the market like a good cappuccino - frothy.

Trivia

In celebration of Pumpkin Spice Latte Season, today’s trivia will be all about Starbucks!

In which year did Starbucks introduce its famous Frappuccino, giving the world its first taste of blended coffee magic?

A) 1991

B) 1995

C) 1999

D) 2003Starbucks is known for sourcing its beans from around the world. From which region does Starbucks purchase the majority of its coffee?

A) South America

B) Africa

C) Southeast Asia

D) Central AmericaBefore Howard Schultz acquired Starbucks, what was the company primarily focused on selling?

A) Freshly brewed coffee

B) Roasted coffee beans and equipment

C) Baked goods

D) Tea and spicesWhich Starbucks innovation is credited with helping popularize the modern coffeehouse culture in the United States?

A) Drive-thru coffee service

B) Coffee loyalty programs

C) The introduction of espresso beverages

D) Free Wi-FiIn which country did Starbucks open its first international store, marking the beginning of its global expansion?

A) Canada

B) Japan

C) United Kingdom

D) Australia

(answers at bottom)

Market Movers

Winners!

Celsius Holdings (CELH) [+14.4%]: Rising after positive comments from Goldman Sachs, highlighting the company's focus on innovation, new flavors, and clean energy products to boost c-store demand into 2025.

GXO Logistics (GXO) [+14.1%]: Jumped on reports from Bloomberg that the company is exploring a potential sale.

Tronox Holdings (TROX) [+5.1%]: Upgraded to buy by UBS, citing improved operating rates, benefits from expected interest rate cuts, and China’s stimulus efforts potentially leading to restocking.

TeraWulf (WULF) [+2.9%]: Announced a new long-term lease at its Lake Mariner facility to support expansion into high-performance computing and AI data centers.

Birkenstock (BIRK) [+2.1%]: Initiated at buy by BTIG, pointing to solid customer loyalty, a strong distribution network, and investments in production capacity.

CVS Health (CVS) [+1.3%]: Upgraded by Barclays after the company hit key Medicare milestones, boosting confidence in their margin improvement plans for 2025.

Losers!

10X Genomics (TXG) [-24.7%]: They guided Q3 revenue below expectations, with the CEO pointing to disruptions from sales process changes and cautious customer spending, especially in the Americas.

E2open (ETWO) [-21.6%]: FQ2 earnings were good, but revenue fell short, with extended timelines for big deals and a cut to full-year guidance, though they’re training up their sales team.

Neogen (NEOG) [-7.1%]: FQ1 revenue slightly exceeded expectations, but year-over-year declines in key segments like Food and Animal Safety weighed on results, though they reaffirmed their full-year guidance.

Toronto-Dominion Bank (TD) [-5.3%]: They're paying a $3B fine and facing limits on US growth due to a settlement over a spoofing scheme.

PayPal (PYPL) [-3.3%]: They were downgraded by Bernstein due to competitive pressures and uncertainty around their long-term strategy.

Pfizer (PFE) [-2.8%]: Former CEO and CFO announced they won’t be involved in Starboard Value’s activist push, expressing confidence in the current management team.

Skyworks Solutions (SWKS) [-1.4%]: Barclays downgraded them, citing more modest assumptions for next year’s product content and growth.

Cirrus Logic (CRUS) [-1.3%]: Barclays downgraded them as well, saying valuations are high and there may not be clear catalysts until the iPhone 18 cycle.

Market Update

Trivia Answers

B) 1995 – Starbucks introduced the Frappuccino in 1995, revolutionizing cold coffee drinks.

A) South America – The majority of Starbucks' coffee beans come from South America, particularly Colombia and Brazil.

B) Roasted coffee beans and equipment – Before Schultz's acquisition, Starbucks was primarily a roastery, focusing on selling beans and equipment.

C) The introduction of espresso beverages – Schultz brought the idea of serving espresso drinks to Starbucks after visiting Italian cafés, launching the coffeehouse culture in the U.S.

A) Canada – Starbucks opened its first international store in Vancouver, Canada, in 1987.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.