🔬Explainer: Why Tesla Has Been Terrible

Plus: OPEC is less and less important; Bitcoin volatility; the job market is solid; and much more.

"Behind every stock is a company. Find out what it’s doing"

- Peter Lynch

"A stockbroker is someone who invests your money until it's all gone"

- Woody Allen

Solid day for the big US markets with the S&P 500 +0.5% and the Nasdaq +0.6%.

9 of 11 sectors closed higher, with only Consumer Discretionary (-0.4%) and Comm. Services (-0.2%) in the negative column. Odd couple Utilities (+1.0%) and Tech (+0.9%) were in the lead.

January’s jobs report (JOLTS) came in roughly in-line with estimates, and little changed from December.

Foot Locker closed down 29% after a terrible Q4 earnings report. Victoria’s Secret (-26% in after-market) reported a similar quarter (not sure how correlated these businesses are).

Street Stories

Tough Luck Tesla

Tuesday’s arson attack at the Berlin Gigafactory has reportedly cost close to $1 billion in damage. That’s big. The slump in Tesla shares this year has cost the company/investors about $228 billion in market capitalization. That’s Giga very big.

While some of Elon’s social media antics and bad press about getting his $56 billion pay package revoked haven’t helped things, the real driver has been growing negativity about the EV space. Demand has cooled off, particularly in China where Tesla has found itself forced to make some material price cuts to remain competitive with Warren Buffett endorsed BYD. We saw some of this pricing impact come into play last year in the form of reduced profit margins, which were down 35% in 2023 and expected to decline further.

Wall Street analysts have also taken their forecasts for deliveries to the woodshed. For example, six months ago the Street was forecasting unit deliveries to grow by 1.1 million between 2023 and 2025. That growth have been cut 40% to only 655k units.

The end result is that forecasts for Revenue and EPS have been coming down pretty drastically over the last six months. The Street’s target for 2025 revenue plummeted from $163 billion to $134 billion (18%) over that period, while 2025 EPS has been dropped by 33%.

Time will tell if this bearish outlook for EVs turns around (it has done so many times previously) but historically it hasn’t been a particularly wise move to bet against Elon Musk.

OPEC+'s Slimming Diet: Losing Market Share to Fatten Up Prices

OPEC+ has deliberately been cutting oil production over the past year in an effort to jack-up the price of oil. While they’ve had modest success in that capacity, they have also been donating market share to hungry drillers across the globe to the point that by summer time they are expected to hold the lowest market share in their history (according to Rystad Energy).

This reduction has opened up opportunities for oil producers outside the alliance, such as those in the U.S., to increase their output and capitalize on higher prices due to the controlled supply from OPEC+. Despite the decrease in market share, led by substantial cuts from Saudi Arabia, OPEC+ aims to maintain cohesion among its members and continue its approach to prop up oil prices, even though it has prompted some members, like Angola, to exit the alliance due to frustrations over production constraints.

Bitcoin Is Whippy

Ok, yeah. Rain is wet, snow is cold, Bitcoin is volatile. But you gotta admit the scale of the daily moves is insane.

January JOLTS

The Bureau of Labor Statistics latest JOLTS (‘Job Openings and Labor Turnover Survey’, if you’re lame) came roughly in-line with Wall Street expectations (8.86 million vs. consensus for 8.9 million), as job openings fell marginally in January. The number of workers that quit their jobs dropped to a three-year low, as the labor market shows signs of gradual easing. This also bodes well (ie: bad) for wage inflation, which is a material source of overall price pressures in the economy.

Quits rate 2.1% vs 2.2% prior

Layoffs and discharges unchanged at 1.6 million

Hires unchanged at 5.7m

Separations 5.3m vs 5.4m prior

Joke Of The Day

I felt a rush of culture shock wash over me as I walked through a middle eastern market. It was bazaar.

My buddy just got a job in marketing with Kellogg's cereals... I guess you could say his job is raisin bran awareness.

Hot Headlines

Axios / Ex-Google engineer charged with stealing AI trade secrets. The DOJ indicted Linwei Ding on charges of stealing AI secrets from the company to pass on to two Chinese companies.

Tech Crunch / Apple terminates Epic Games developer account calling it a ‘threat’ to the iOS ecosystem. Just the latest chapter in Apple’s fight against the Fortnite maker over App Store payments. Move is likely a violation of Europe’s Digital Markets Act which could mean another EU lawsuit for Apple (that is a rounding error to them).

Yahoo Finance / Bank of Canada holds rate at 5%, says too early to talk cuts. They also apologized for not cutting.

Punchbowl / The White House is backing a bipartisan bill that could potentially lead to a ban on TikTok in the US.

Had to use this one since I couldn’t find ‘TikTok dance at my grampa’s funeral’. 😔

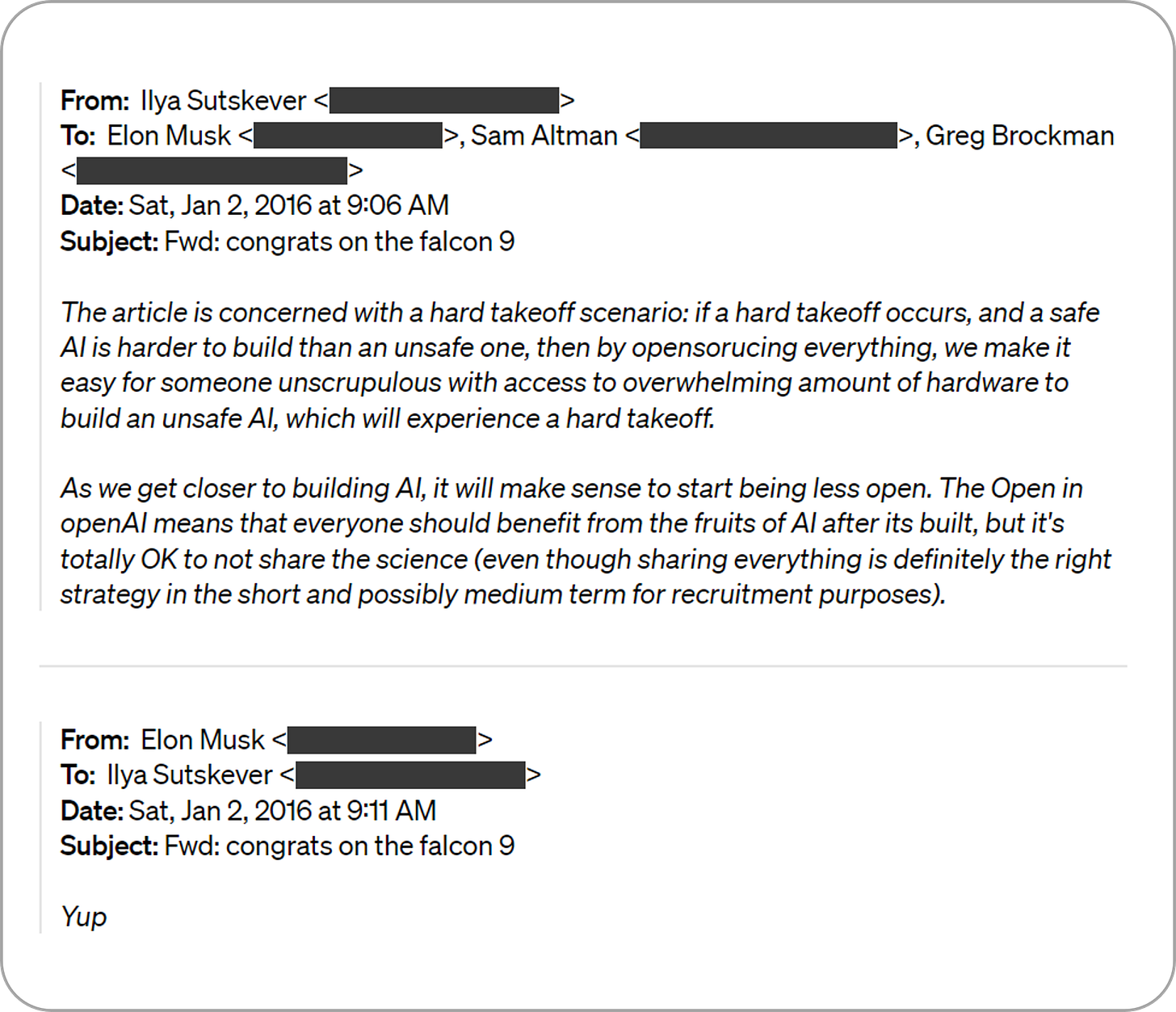

OpenAI / OpenAI responded to Elon’s lawsuit by sharing emails he made regarding his backing for a for-profit business model and even that he wanted to merge OpenAI with Tesla. Some ‘gotchas’ and few zingers in there.

Trivia

This week’s trivia is on famous companies, and today’s is on IBM.

In what year was IBM founded?

A) 1890

B) 1929

C) 1911

D) 1935IBM stands for:

A) Ibbotson, Buell and Mackenzie

B) International Business Machines

C) Innovative Business Models

D) Intercontinental Business ModalitiesIBM employees and alumni have won how many Nobel Prizes:

A) 1

B) 2

C) 4

D) 6IBM introduced the first hard disk drive in:

A) 1937

B) 1956

C) 1968

D) 1982

(answers at bottom)

Market Movers

Winners!

JD.com (JD) [+16.2%]: Q4 revenue, EBITDA, and EPS surpassed expectations. The company highlighted outperformance in home appliance and electronics, a return to growth in general merchandise, improvements in user experience, and market share gains. Announced a new $3B share repurchase program.

CrowdStrike (CRWD) [+10.8%]: Exceeded Q4 expectations with a notable acceleration in Net New ARR. The FY25 revenue outlook is better than anticipated, with no signs of spending fatigue, contrasting Palo Alto Networks' observations.

Palantir Technologies (PLTR) [+9.9%]: Secured a $178.4M US Army contract for TITAN next-gen deep-sensing capability.

Box, Inc. (BOX) [+8.6%]: Q4 EPS surpassed forecasts, with revenue matching expectations. Q1 and FY24 guidance on EPS and revenue are aligned with forecasts, but FY24 guidance is slightly conservative. Announced a $100M boost in stock repurchase program. Noted improvements in margins and billings.

New York Community Bank (NYCB) [+7.5%]: Received a $1B equity investment from a consortium including Steve Mnuchin's Liberty Strategic Capital. The stock initially dropped following the announcement of seeking equity investment.

Losers!

Foot Locker (FL) [-29.4%]: Q4 comps and EPS exceeded forecasts, with notable sales acceleration from Q3 and improvements in key metrics. The FY comp guide is optimistic, but EPS expectations are lower due to the investment cycle. The company announced a two-year delay in achieving the 8.5-9% EBIT margin target for its Lace Up Plan.

Nordstrom (JWN) [-16.1%]: Q4 EPS surpassed expectations, though revenue fell short. Gross margins were below forecasts, and FY24 EPS and revenue growth guidance missed consensus amid cautious consumer spending. Noted strength in Rack but weakness in the Nordstrom banner this quarter.

Thor Industries (THO) [-15.4%]: FQ2 EPS and revenue underperformed, leading to a reduction in FY24 EPS and revenue guidance. The management pointed to a challenging macro environment, including high interest rates and a consumer reluctance towards large discretionary purchases. Analysts highlighted inventory challenges and a shift towards lower-priced units.

Market Update

Trivia Answers

C) IBM was founded in 1911.

B) IBM stands for International Business Machines.

D) IBM employees have won 6 Nobel Prizes.

B) The first hard disk drive was introduced in 1956.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.