🔬Explainer: Why Do Small-Caps Suck?

Plus: The Meme Stock rally comes to an end; Weight Loss ETF launches; and much more.

"Being too far ahead of your time is indistinguishable from being wrong"

- Howard Marks

“You win some, you lose some, but you keep on fighting . . . and if you need a friend, get a dog”

- Gordon Gekko

US markets were closed due to Memorial Day so to here’s an update on the Polish markets.

The Warsaw Composite slumped 0.4% on light Monday trading. While the Warsaw WIG 20 had modest gains of +0.1%.

The Złoty picked up +0.05% against the US dollar.

Street Stories

Why Do Small-Caps Suck?

Over the past five years, the S&P 600 Small-Cap Index has returned 44% - half of what its big brother the S&P 500 has returned.

So, I guess that means it sucks?

What’s interesting is that that hasn’t always been the case. From a valuation perspective, the Large-Cap, Mid-Cap and Small-Cap indices actually traded at roughly similar P/E multiples in the past. This trend only really severed around 2019. Since then, the S&P 500 (Large-Cap) has gone on to trade at record multiples, whereas Small-Cap has been relegated to trading below it’s historical average.

So what gives?

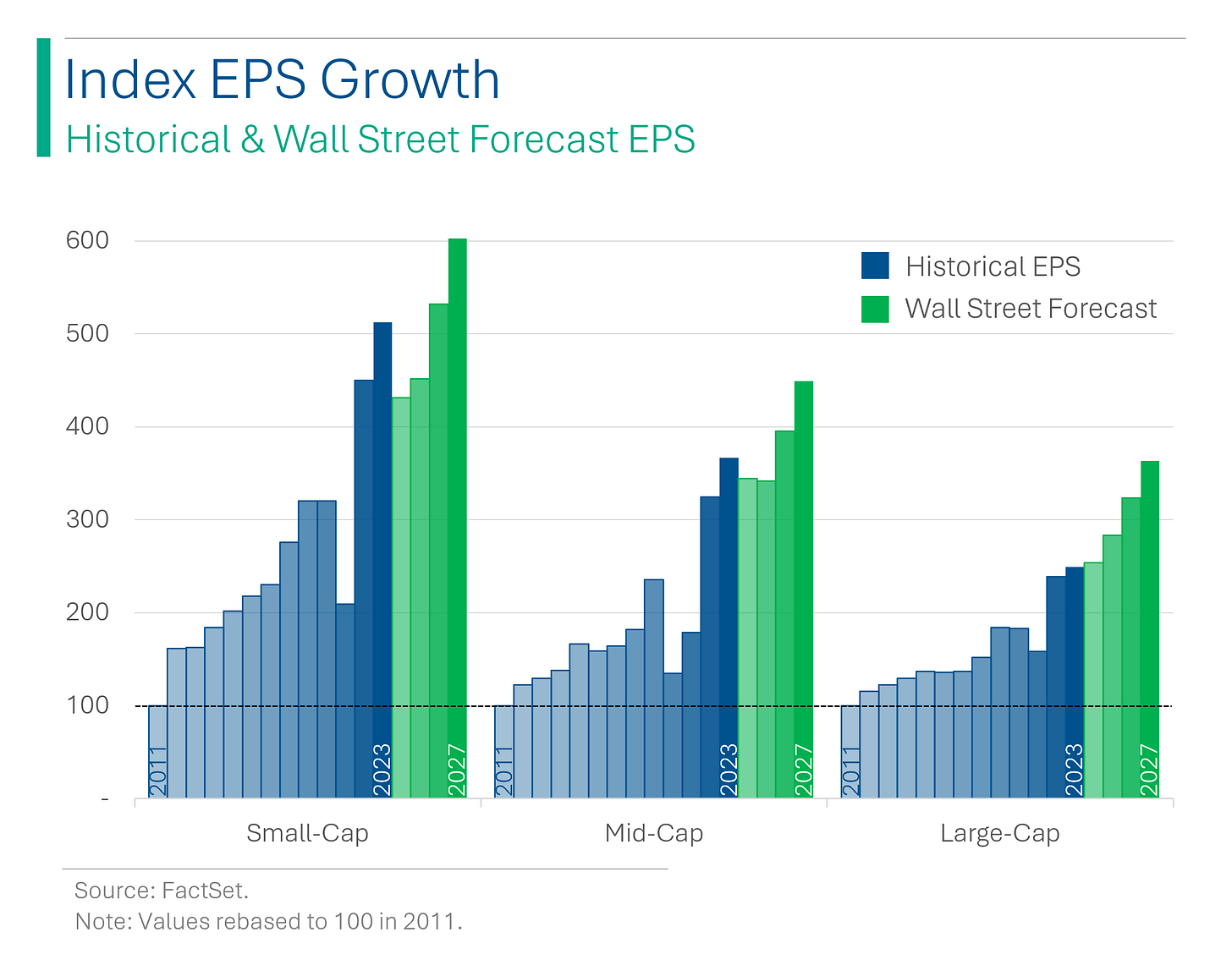

Well, part of this may be growth. Between the calendar years of 2011 and 2023, the Small-Cap index actually grew revenues +412%. This compares to +267% for the Mid-Cap and +149% for the Large-Cap. Great!

Ya, but. According to Wall Street analysts this outperformance is coming to an end. From 2023 to 2027, Wall Street sees the Small-Cap index only growing Sales by 18% vs. 23% for Mid-Cap and a whopping +46% for Large-Cap.

Now it’s starting to make sense.

Moreover, this is consistent for earnings per share growth. Small-Cap owned Large-Cap between 2011 and 2023 (+209% vs. +90%), but going forward the Street has them about even (+21% between 2023 to 2027).

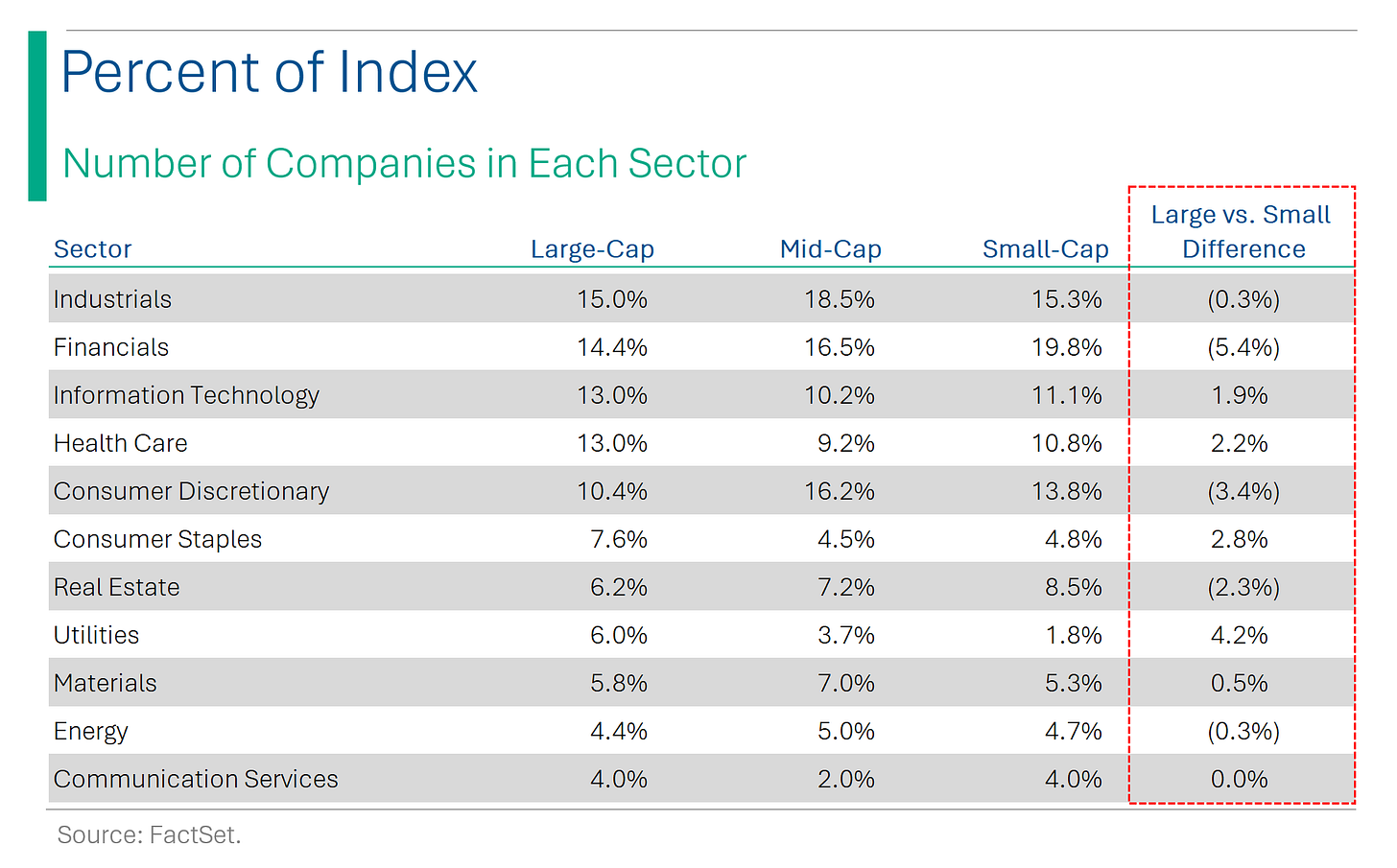

Something else worth digging into is the composition of the indices. As you can see below, there is actually surprisingly little variation in the percent of companies in each sector across the difference indices. For example, Tech companies make up 13.0% of the Large-Cap index vs. 11.1% in the Small-Cap index.

However, as I’ve talked a lot about in the past, the S&P 500 (Large-Cap) has some distorting effects of size which is also likely playing a role.

For example, even though Large-Cap and Small-Cap have a similar percent of companies in Tech, the market cap weighting is much lower. Tech currently makes up 30.5% of Large-Cap’s market cap but this figure is only 17% in the Small-Cap index. And Tech has done pretty well lately in case you haven’t noticed.

Communication Services has been another outperformer (Meta, Alphabet, etc.) and the Small-Cap index is underweight there as well (9.5% vs. 6.4%), but noticeably overweight underperforming sectors like Industrials (8.0% vs. 8.8%), Materials (+2.3% vs. 3.7%) and Real Estate (2.1% vs. 5.1%).

To tie it all together, Small-Cap had much stronger growth historically but that seems to be cooling off at the moment. Also Small-Cap has a higher weighting in sectors that aren’t particularly loved at the moment, and a lower weighting in ones that are.

These are contributing factors as to why right now… Small-Caps kinda suck.

Meme Rally Comes To An End

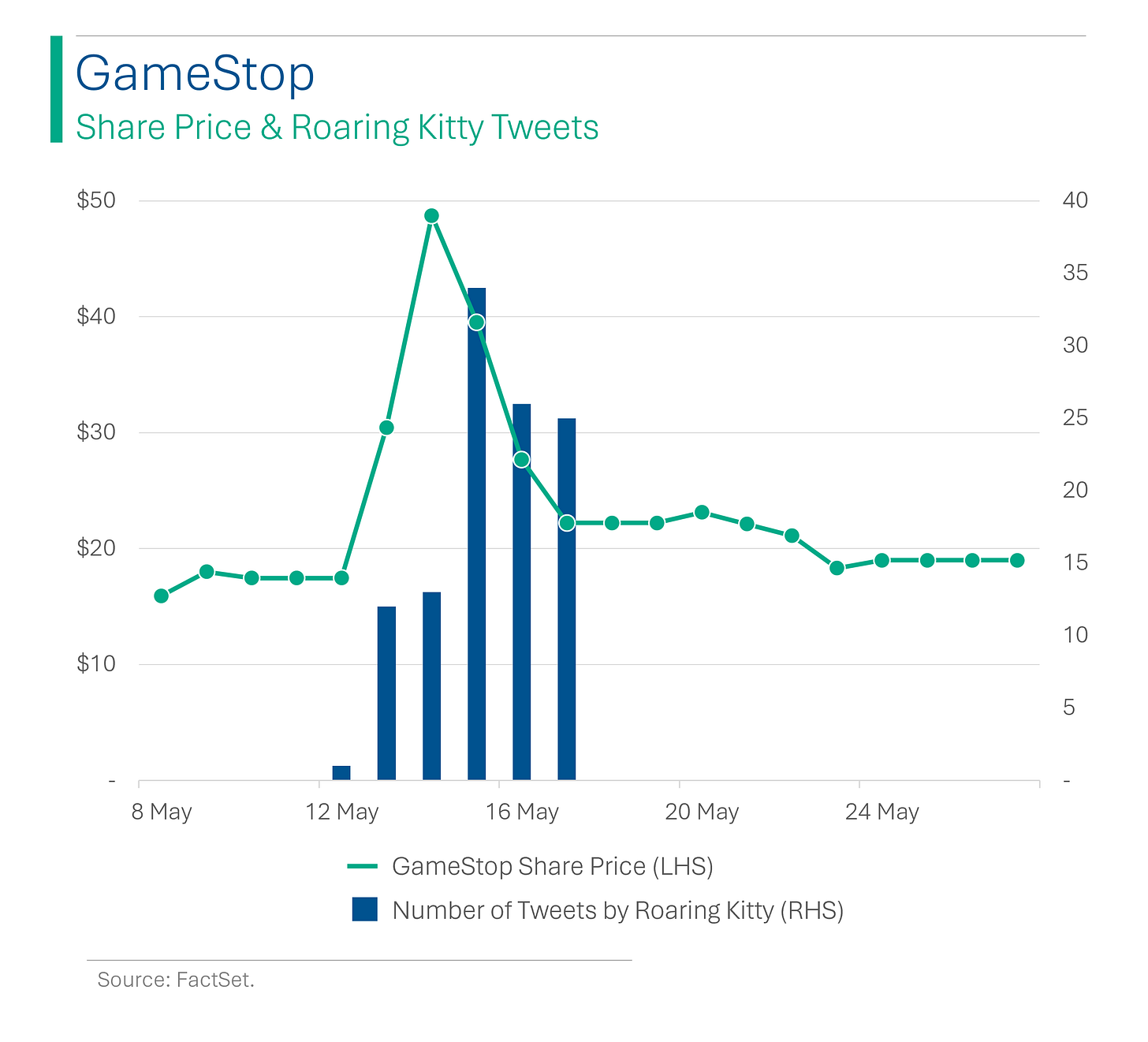

Well, that was fun - unless you were one of the thousands of retail investors that FOMO’d and got caught holding the bag.

Although I must say that some of the stocks caught up in the meme rally actually seem to be holding at higher levels, with the average company in my little meme index below up +16% since things kicked off.

Albeit, that the average company is also down 35% from their peak.

It’s also worth noting that famed GameStonk hype man, Keith Gill aka Roaring Kitty aka DeepF***ingValue, has now gone radio silent after pumping out a grand total of 111 tweets over the course of six days.

Joke Of The Day

❄️It was so cold today I saw a stockbroker with his hands in his own pockets.

Hot Headlines

Axios / Elon Musk raises $6 billion to challenge OpenAI. Musk’s start-up xAI raised one of the largest venture capital funding rounds of all time, with the list including legendary VCs Andreessen Horowitz and Sequoia Capital. Musk was a co-founder of OpenAI before leaving after a dispute over the company’s pivot from being a not-for-profit.

CNBC / ETF maker Roundhill launches weight loss drug ETF. The ‘GLP-1 & Weight Loss ETF’ holds the ticker $OZEM (get it?!) with about 20% weights in Eli Lilly and Novo Nordisk, as well as other such as Zealand Pharma, Amgen and Chugai Pharmaceutical.

CNN Business / China is pumping another $47.5 billion into its chip industry. Its largest-ever semiconductor state investment fund is aimed at continuing to develop their domestic chip industry in the face of new US trade restrictions.

CNBC / The gold, silver and copper rally has just taken a breather but new highs are not that far off according to commodity experts. ‘Safe haven’ buying has remained strong but so has Chinese consumer demand after the country overtook India as the world’s largest jewelry buyer in 2023.

I mean, it’s been a better investment than Chinese stocks lately…

Axios / Gen Z drives a teen-job comeback. Labor force participation rate for the 16-19 year old bracket recently hit a 14-year high of 38%.

No word on how many list ‘TikTok influencer’ as a job title tho.

Trivia

Today’s trivia is on the US Federal Reserve aka The Fed.

Founding Year: When was the Federal Reserve System established?

a) 1913

b) 1933

c) 1895

d) 1920FOMC: The group within the Fed that makes the big monetary decision is the FOMC. What does that stand for?

a) Federal Office of Monetary Control

b) Financial Operations and Management Committee

c) Federal Operations Management Corporation

d) Federal Open Market CommitteeNumber of Federal Reserve Banks: How many region Fed Banks are there?

a) 12

b) 50

c) 20

d) 7Dual Mandate: The Fed has two main jobs to do, often referred to as its ‘Dual Mandate’. What are they?

a) Inflation and Economic Growth

b) Interest Rates and Inflation

c) Economic Growth and Price Stability

d) Price Stability and Full Employment

(answers at bottom)

Trivia Answers

a) The Fed was founded in 1913.

d) FOMC stands for Federal Open Market Committee.

a) 12 regional banks make-up the Federal Reserve system.

d) Price Stability and Full Employment make up the ‘Dual Mandate’

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.