🔬Explainer: Why Disney Shares Have Been Terrible (Part II: Bonfire of the Vanities/Cashflow)

Plus: The IPO frenzy continues; Apple's having a terrible March; and much more.

"The flower that blooms in adversity is the most rare and beautiful of all"

- The Emperor, Mulan

“For the strength of the Pack is the Wolf, and the strength of the Wolf is the Pack”

- Mowgli, The Jungle Book

Modest up day for the big US markets with the S&P 500 +0.3% and Nasdaq +0.2%, following the tailwinds from yesterday’s Fed meeting.

9 of 11 sector closed higher with Industrials (+1.0%) and Financials (+0.9%) at the top of the pile. Utilities and Communication Services (both -0.2%) were lowest.

U.S. Home Sales came in +9.5% for February, with median prices for existing homes rising to 5.7% year-over-year.

Reddit IPO’d and went up a lot, while Apple got sued by the DOJ and went down. (more on both below)

Street Stories

Disney’s Terribleness… In Numbers!

(If you missed Part I yesterday, here’s the link)

Continuing from yesterday, Revenue at Disney has shown positive growth, except for the Covid blip that crushed the resort and parks business, which is tucked into the ‘Experiences’ division. The other division, Entertainment, has seen steady growth but under the surface its not as a pretty a story. Let me give you a ‘for instance’:

The impact of Covid on the Experiences division’s operating profit was pretty dramatic as you can see below. However, the business was quick to recover and has grown profitability nicely. Whereas, the Entertainment division is a shadow of what it was during the height of Disney’s cinematic dominance prior to the 2020s. The cash bonfire that its Disney+ hasn’t helped either.

To fully illustrate how dramatic this shift has been, note that in 2017 Experiences contributed to around 37% of total operating profit but by 2023 this had grown to a whopping 86%.

To save time, Experiences (parks, resorts, etc.) is pretty solid (if overpriced) and I’ll skip over them for the rest of this.

So what the hell went wrong with Entertainment AKA ‘The Cash BBQ’? Well, lots of things, actually. As you can see below Entertainment consists of three divisions: Direct-to-Consumer (DTC), Linear Networks, and Content Sales/Licensing & Other. Each with their own headaches which we’ll dive into.

1) Linear Networks (aka ‘The Melting Ice Cube Division’)

What is it?

A bunch of television assets, including ABC, Disney, Freeform, FX, 73% of National Geographic and a few others, including a 50% investment in A+E TV Networks, which operates A&E, HISTORY and Lifetime.

Why has it sucked?

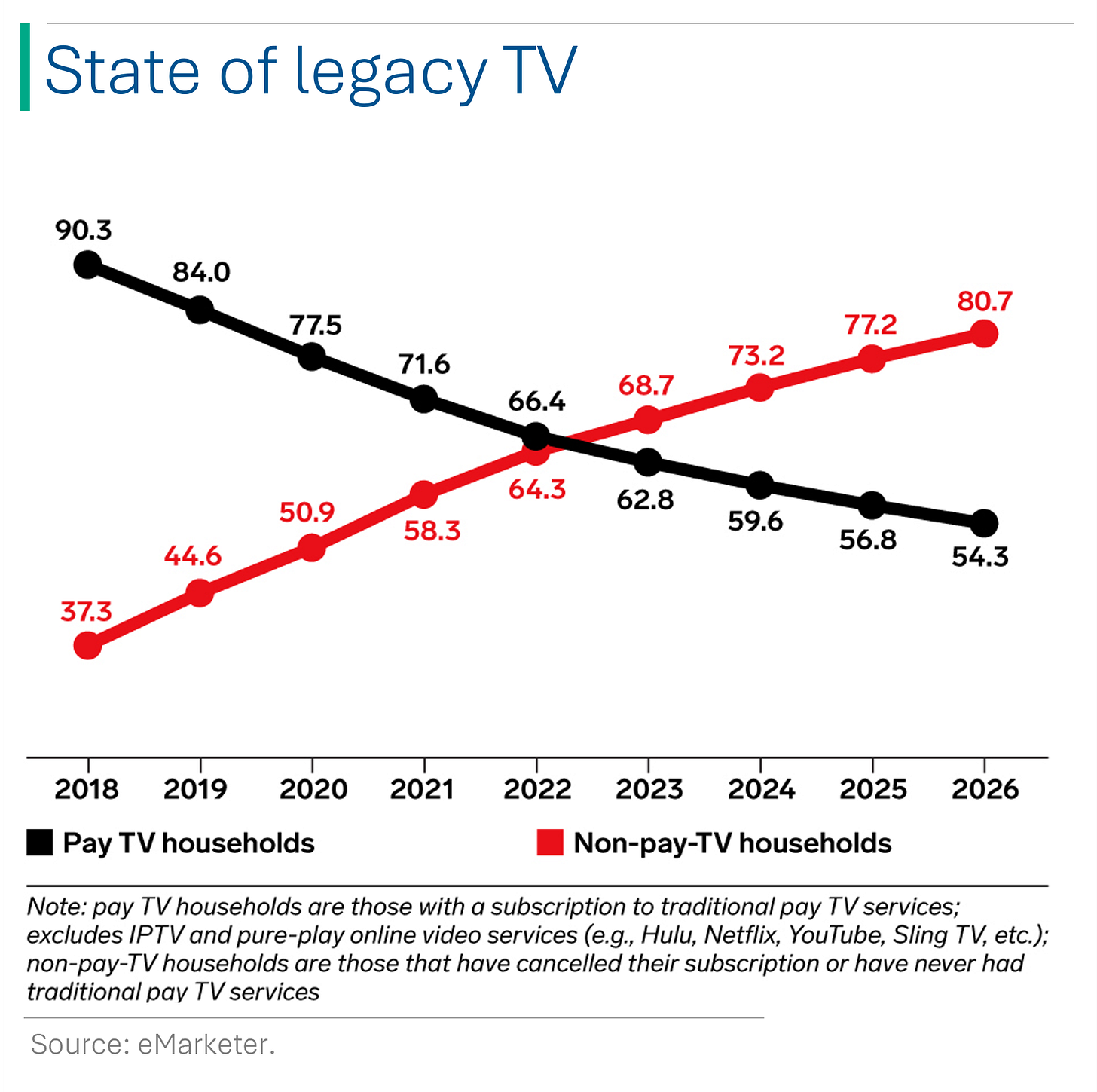

The collection of brands is of a good quality, but like most of legacy TV they are getting hammered by the cord cutting trend.

2) Direct-to-Consumer (aka ‘The Black Hole’)

What is it?

Basically Disney+ and Hulu.

For those unfamiliar with Hulu (67% owned by Disney) it’s a digital over-the-top (OTT) service which includes live streams of cable networks as well as additional on-demand programing.

Why has it sucked?

Well, there is a lot to unpack here, but essentially the streaming business is a knife fight. We have been in a ‘content glut’ for a few years now as streamers like Netflix, Disney, Amazon and Apple have operated at massive losses to vie for market share. #newmedia

Disney has tried to alleviate some of the pain with material price hikes and massive cuts to its SG&A expenses in 2023, with more planned in 2024. However, operating expenses - which are higher than subscription revenue - have grown faster than total revenue so it’s been an uphill battle.

Within those expenses, below you can see that programming and production costs at Disney+ keep increasing massively (+27% in 2023). Not a heck of a lot of progress made on reigning in content chimera, eh?*

*Bizniss lesins: 1) Costs > Revenue = Bad; 2) Costs Growth 50% > Revenue Growth = Also bad.

3) Content Sales/Licensing (aka ‘Hubristic Apathy Becomes Manifest’)

What is it?

Bit of a mishmash including theatrical releases, DVD sales (actually still a thing), as well as licensing content (such as to Disney films to third party TV networks) and rights for things like the ‘Disney on Ice’ I went to last weekend with my kiddos.

Why has it sucked?

Most of the businesses here haven’t been terrible but the biggest mover is theatrical releases… which have been terrible. Recall from yesterday that Disney hasn’t had a big hit in a few years. It’s last ‘billion dollar film’ was the 2021 Spiderman sequel - and, oh yeah, due to a weird IP situation, Sony gets to keep 95% of of Spiderman profits. 🤷♂️

The graph below shows you the poor state of Disney’s releases but it is important to note that the profit margin isn’t fixed for films. Disney is still spending big to make these movies - it’s just now that they often find themselves losing money on them. For example, big flops in 2023 included The Marvels (~$205m box office vs. ~$275m budget), Indiana Jones ($383m box office), Ant-Man ($476m box) and Wish ($176m boxy woxy).

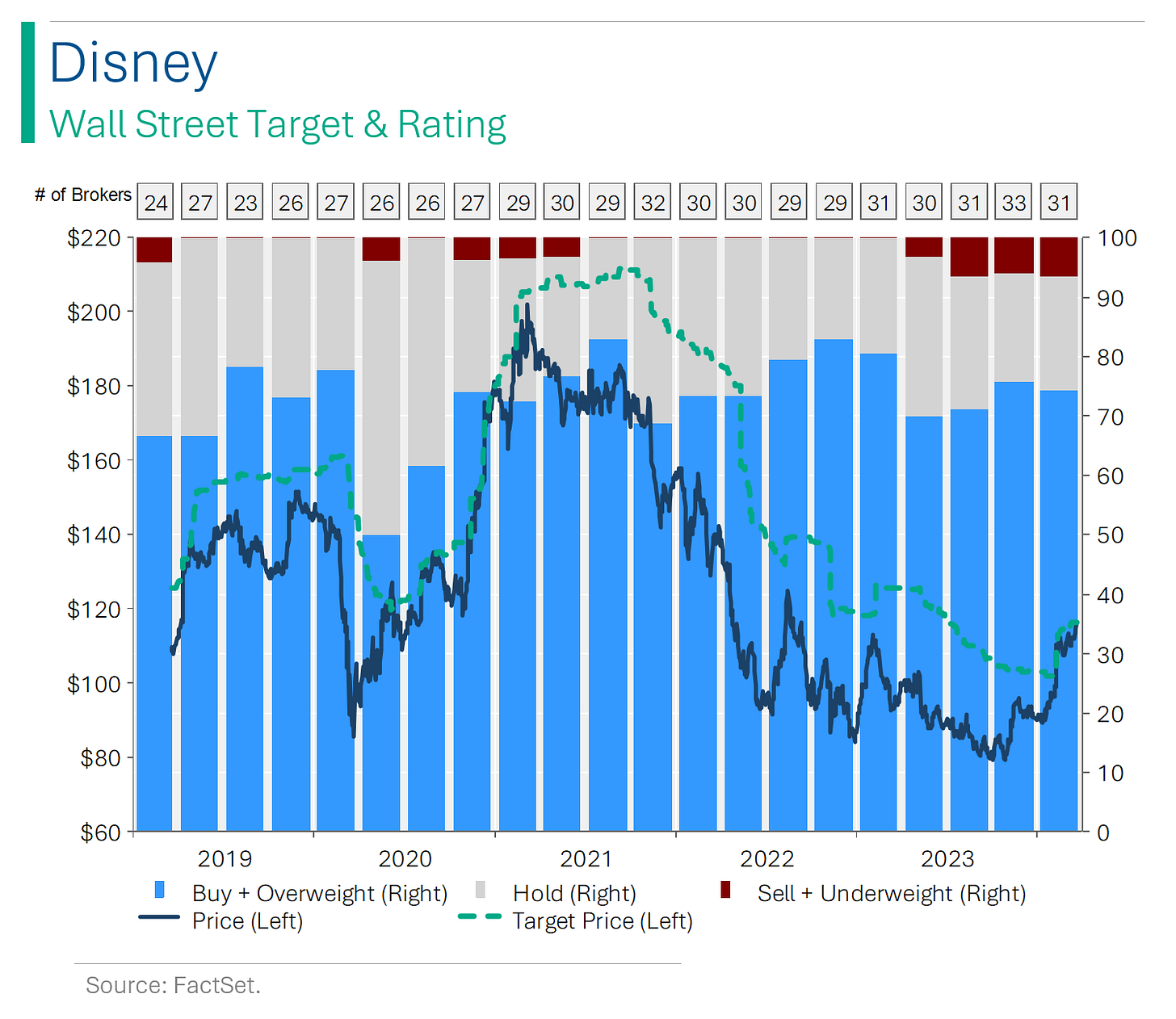

So that’s my brief on what the hell happened to make them stop being a half decent company. What’s interesting, though, is that Wall Street has been positive on the stock… the whole way down. If you needed a final straw as to the usefulness of Wall Street analysts, consider that before plunging 57% in 2021, 84% of analysts had ‘buy’ ratings on Disney. Compare that with 64% of analyst holding a ‘buy’ rating on Nvidia in February 2024 before it went up +350%.

Finally, throughout this whole process Disney hasn’t exactly gotten cheap either (from a valuation perspective), as the company still trades at a multiple well above it’s historical average. Market has essentially been pricing in a turnaround which keeps refusing to occur.

Another day, another +$10 billion IPO

After Astera Labs popped nearly 80% after listing yesterday, Reddit followed suit today. However, the biggest social media IPO since 2021 only closed up a modest 48%. The move puts Reddit’s market cap at a cushy $9.8 billion.

Apple in the Hot Seat: When the Orchard Becomes a Monopoly Board

Apple is having a month to forget as the U.S. Justice Department, alongside 15 states and the District of Columbia, have filed an antitrust lawsuit against Apple, accusing them of monopolizing the smartphone market by making it difficult for competitors to integrate with the iPhone, which they allege harms consumers by raising prices. The news comes after the EU fined Apple ~$2 billion earlier in the month.

Attorney General Merrick Garland criticized Apple for maintaining its market power through "unlawful exclusionary behavior" rather than through superiority, with the company controlling over 65% of the U.S. smartphone market. Apple vowed to vigorously defend against the lawsuit, asserting that the legal action threatens its core business model and innovation.

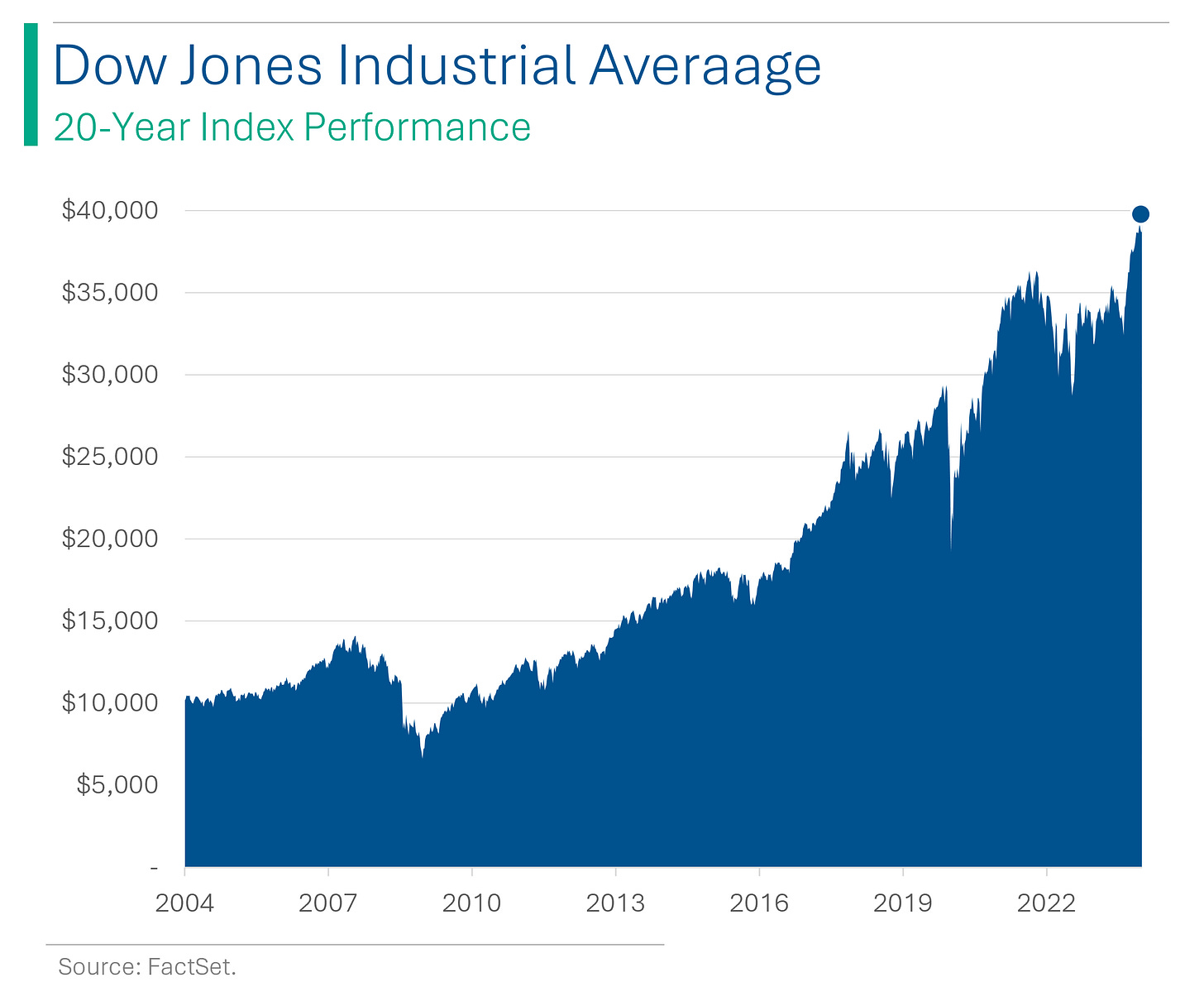

Dow 40k

Your grandpappy’s favorite index crossed another big milestone today (and no it’s not its 100th birthday, it did that 27 years ago), as it squeezed past an index value of 40,000. However, it couldn’t hold that level into the close - such a Dow thing thing to do.

If you’re a new reader, you’ve missed my Dow rants, the culmination of which was my magnum opus: ‘The Dow Explained (and why I hate it)’.

Reading is Lame

JP Morgan has a nice series called ‘Unpacked’ which does short explainer videos on interesting financial topics in a beginner friendly way.

Click the image above to check out the latest one on CPI or here to see the list of other video topics.

***No I’m not getting paid for that, I just think it’s neat***

Joke Of The Day

My boss says I have a preoccupation with vengeance. We’ll see about that.

Some people say the glass is half full. Some people say the glass is half empty. Engineers say the glass is twice as big as necessary.

Hot Headlines

Yahoo Finance / Proxy-advisory firm ISS recommends Disney shareholders elect Nelson Peltz to the Board in upcoming at April annual meeting. How topical.

BNN / New FDIC rules add additional hurdles to suppress bank mega-mergers. The Federal Deposit Insurance Corp. announced plans to add consideration of community impact when reviewing deals involving at least $50 billion in assets, while +$100 billion deals would need stricter review of things compliance processes, such as anti-money laundering. ‘Too big to fail’ rules… 20 years too late.

Yahoo / Gold tops $2,200 an ounce for the first time. The price is on a +10% tear since mid-February.

Axios / With crypto prices at all-time highs, FTX customers don't want a refund, they want their crypto back.

Guardian / Donald Trump to make $3.4bn if shareholders back plan to float Trump Media. Truth Social’s planned SPAC merger to be voted on today, however there may be a possible delay due to the SPAC (Digital World) suing sponsor ARC Global, which wants to obstruct the vote.

Trivia

This week’s trivia is on interesting feats in the world of stocks.

Which company had the largest initial public offering (IPO) in history as of 2023?

A) Saudi Aramco

B) Alibaba

C) Facebook

D) SoftBank GroupThe term "Blue Chip" comes from which game?

A) Bridge

B) Poker

C) Checkers

D) MonopolyWhat year did the NASDAQ stock market first begin operations?

A) 1951

B) 1961

C) 1971

D) 1981

(answers at bottom)

Market Movers

Winners!

Reddit (RDDT) [+48.4%] IPO surges, opening at $47/sh; IPO priced at $34/s, near the top of $31-34/sh range.

Guess? (GES) [+20.7%] Beats Q4 EPS and revenue; strong Q1 and FY guidance from rag & bone acquisition, though EPS guidance lighter; rag & bone to drive major FY24 sales growth.

Micron Technology (MU) [+14.1%] Posts strong Q2 and Q3 guidance above expectations; DRAM and NAND pricing improves; high demand for HBM, sold out through 2025; AI exposure boosts outlook.

Broadcom (AVGO) [+5.6%] Gains from "Enabling AI Infrastructure" event, securing new ASIC customer for XPU accelerator; upgraded by TD Cowen.

Commercial Metals (CMC) [+5.3%] FQ2 earnings and revenue top forecasts; despite seasonal slumps and weather issues, sees steel margin improvement and rebound in new contracts; European market outlook improves.

DraftKings (DKNG) [+3.6%] RSI eyes sale, contacts DraftKings, reports Bloomberg.

Losers!

Chewy, Inc. (CHWY) [-10.3%] Beats Q4 earnings and revenue, with improved margins but weaker net adds; misses Q1 revenue guidance, FY guidance around consensus. Management notes declining pet household trends but analysts positive on FCF and Autoship.

Accenture (ACN) [-9.3%] FQ2 earnings exceed expectations, revenue falls short; FQ3 revenue and trimmed FY24 guidance below Street; highlights record client retention and $600M+ generative AI bookings, despite flat performance in most verticals.

FactSet Research Systems (FDS) [-7.6%] FQ2 earnings surpass forecasts, revenue slightly misses; sees q/q deceleration in organic ASV growth, client and user count below consensus; sets FY24 revenue and ASV at low end of guidance.

Darden Restaurants (DRI) [-6.5%] FQ3 revenue misses with EPS on target; consolidated comps and restaurant margins better than expected, though Olive Garden lags; trims FY24 guidance, announces $1B buyback.

Market Update

Trivia Answers

A) Saudi Aramco was the biggest IPO in history, raising $29 billion at a $1.7 trillion valuation.

B) The term ‘Blue Chip’ comes from Poker, where traditionally blue chips were of highest value (apparently).

C) Nasdaq started operations in 1971.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.