🔬Explainer: Why Disney Shares Have Been Terrible (Part I: The Phantom Profits)

Plus: the Fed meeting was par for the course; IPO's are hot again; Neuralink is witchcraft; and much more.

"If you are going to panic, panic early"

- Barry Sternlicht

“Buy low, sell high. Fear? That’s the other guy’s problem”

- Louis Winthorpe III, Trading Places

Solid day for the big US markets with the S&P 500 +0.9%, Nasdaq +1.3%.

9 of 11 sectors closed higher with Consumer Discretionary (+1.5%) and Communication Services (+1.3%) in the lead. Healthcare (-0.2%) and Energy (-0.1%) were the only two losers.

Big news of the day was the Federal Reserve meeting, which thankfully was pretty uneventful despite some market worries headed into it. Shares were lifted by the (lack of) news. (more below)

Paramount Global jumped 12% on more take-over news. Today’s update was that private equity giant Apollo is trying to snag its film and TV studio business for $11 billion. Company is still in merger talks with Skydance.

Topgolf Callaway popped 15% on take-over news. They denied it. But still closed +8.8%.

Street Stories

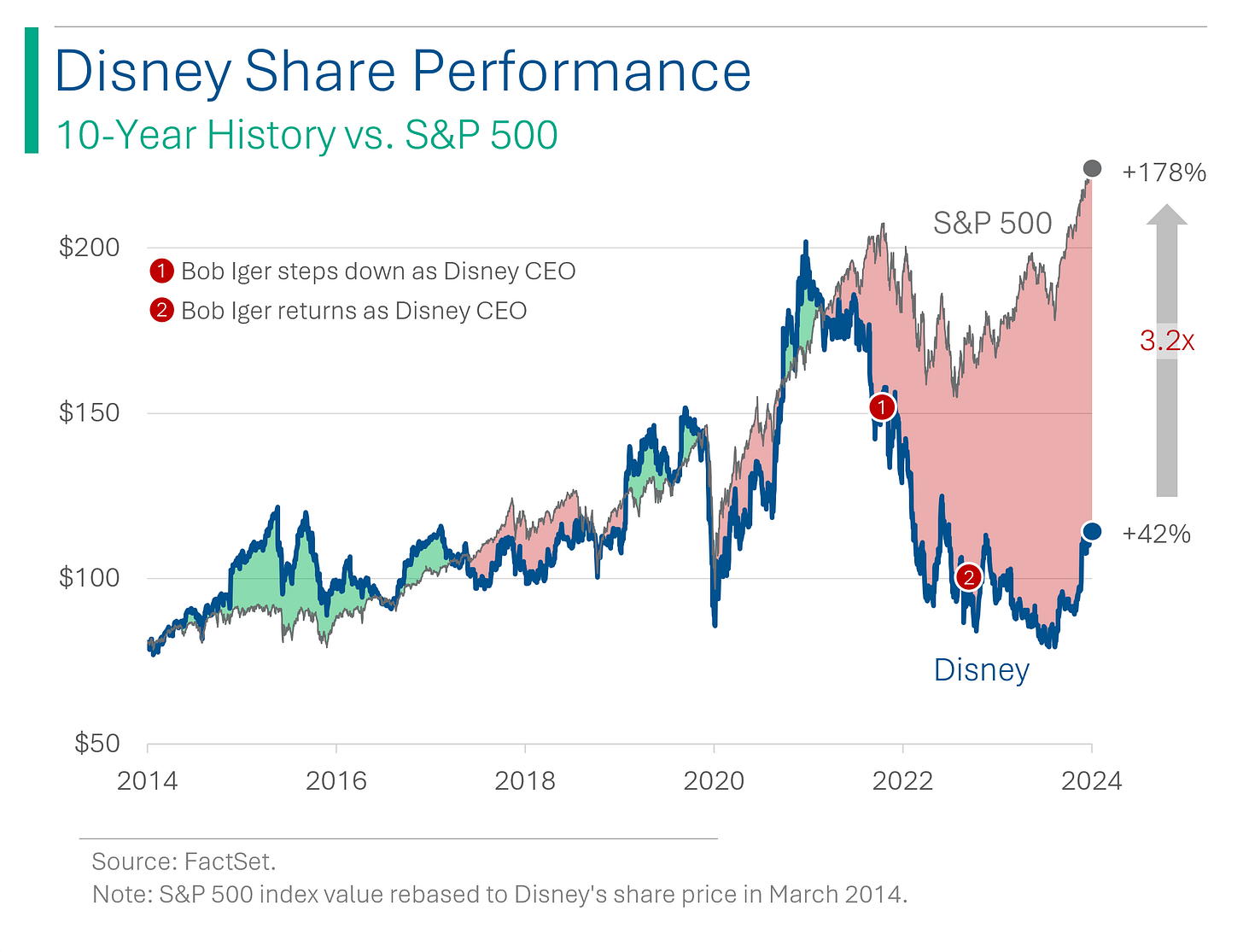

Disney’s Terribleness… In Numbers!

In the past few months I’ve written a decent amount about the proxy battle between Disney and billionaire Nelson Peltz’s activist hedgefund, Trian, but I haven’t really got into the specifics as to why they stepped in to try and shake things up at the House of Mouse. To start, I like Bob Iger. His autobiography ‘Ride of a Lifetime’ should be on everyone’s reading list. Moreover, I don’t like Peltz. At all. But he does have some good reasons to take a run at Disney. Here’s why.

To start, Iger had some great early years running Disney when he took over the CEO role in 2005. It bought Pixar in 2006 for $7.6 billion (they’ve probably made that much money on Frozen merch alone). Marvel in 2009 for $4 billion (the MCU reportedly made ~$23 billion on the films and ~$41 billion in merch by 2020). And Lucasfilm (Star Wars) for $4 billion in 2012. Not too shabby.

In fact, during this period Disney made 16 of the 30 highest grossing films of all-time. Collecting billion dollar films like they were friggin Infinity Stones. (But notice that there has only been one since 2020.)

However, the end of Bob’s (first) tenure wasn’t so pretty: Revenue growth cooled off massively but, ex-Covid Pandemic, the company still grew sales. Earnings, however, were like a bad sequel. Costs increased drastically, driven in a large part by the addition of Disney+, and big revenue drivers like the five Pirates of the Caribbean movies, Star Wars and Marvel Phases 3-4 had run their course. Since then Disney has had a string of flops, and earnings never recovered.

The result has been five plus years of steady declines in Wall Street’s earnings estimates. Draconian cost cutting measures were announced at the end of 2023 ($5.5 billion) and were upped this February ($7.5 billion), and it looks (fingers crossed) that Disney estimates may have just bottomed out.

Tune in tomorrow for Part II, where I’ll dig more into the causes of Disney’s pain.

Mind Over Mouse: Neuralink's Brain Implant Turns Thought into Digital Action

On Wednesday, Elon Musk-owned Neuralink introduced Noland Arbaugh, a 29-year-old paralyzed man, as the first human to receive its brain implant, enabling him to play online chess and video games by controlling a cursor with his thoughts.

The device, aimed at allowing paralyzed individuals to operate digital interfaces through brain signals, marks a significant advancement in brain-computer interface technology. Following FDA approval for human trials, Arbaugh's successful use of the technology underscores Neuralink's progress towards enhancing autonomy for individuals with paralysis. It’s also pretty friggin rad.

Check out the video (Link)

No Surprises At Fed Meeting

As expected, the Fed kept its benchmark interest rate unchanged (5.25% to 5.50%), in what was a unanimous decision by the Federal Open Market Committee (FOMC) (the folks that get to vote on interest rate stuff). Few changes to the policy statement beyond stating that job gains have ‘remained strong’ versus January’s ‘job gains have moderate since early last year’. That’s big for econ nerds.

Concerns that the Fed’s ‘Dot Plot’ forecast would show expectations for 2 rate cuts versus the three previously targeted ended up proving unfounded. Probably most interesting was in the Fed’s Summary of Economic Projections (SEP), where they increased their expectations for GDP growth, but scaled back their forecast for interest rates.

The IPO Window Is Open

Astera Labs Inc., a semiconductor digital infrastructure firm focused on AI and machine learning in the cloud, saw its stock soar 72% in its trading debut, raising $713 million and closing with a market value of $9.46 billion.

More than $7.9 billion has been raised via IPOs on US exchanges this year, including Astera’s share sale, according to Bloomberg. That’s a 129% increase on the same period in 2023. Along with Reddit’s $6.5 billion IPO later today, the signs are clear that the IPO window is finally back open.

Joke Of The Day

I have a joke about trickle-down economics, but most people won’t get it.

Hot Headlines

WSJ / Apollo offers $11 billion for Paramount’s Hollywood and TV studio business. The bid comes as an independent committee of the company’s directors is reviewing another offer from Skydance Media to merge with all of Paramount, which also owns CBS, Nickelodeon and a number of other cable networks.

E+T / Intel to receive $8.5bn in government support to keep US at the ‘forefront of the AI era’. The proposed funding will expand semiconductor manufacturing and R&D projects at its sites in Arizona, New Mexico, Ohio and Oregon, creating nearly 30,000 jobs.

CNBC / Reddit prices IPO at $34 per share in first major social media offering since 2019. The price was top of the expected range of between $31-$34, and values the company at ~$6.5 billion.

Reuters / Hindenburg Research shorts data center firm Equinix alleging inflated profit metric and other accounting misconduct. Here’s the link to the short report.

Yahoo Finance / Biden Administration issues new auto rules aimed at cutting carbon emissions, and provides a boost to expected electric vehicles and hybrids. The news is seen as a positive to an EV industry that’s been languishing this year, with Tesla +2.5% and Rivian +0.9% on the news.

Trivia

Today’s trivia is on interesting stock market facts.

The term "Bear Market" refers to a market condition where prices fall 20% or more from recent highs. What is believed to be the origin of the term "bear" in this context?

A) It comes from the way a bear attacks its prey, swiping down.

B) It’s a mix up from ‘bare market’, referring to a lack of buyers of stock.

C) It's named after a famous statue of a bear in the Wall Street area.

D) It was named after "Bearson", the trader who first sold stocks short.Which company was the first to reach a $1 trillion market cap?

A) Amazon

B) Apple

C) Microsoft

D) Apple

Who is known as the "Father of Value Investing"?

A) Warren Buffett

B) Benjamin Graham

C) Philip Fisher

D) Peter Lynch

(answers at bottom)

Market Movers

Winners!

Riot Platforms (RIOT) [+11.8%] Upgraded to outperform by JP Morgan due to Corsicana facility's expected improvements in fleet efficiency and mining economics, offering clearer growth path than peers.

Paramount Global (PARA) [+11.8%] Apollo reportedly offers $11B for studios, per media.

Triumph Group (TGI) [+9.7%] Reinstated as buy by Goldman Sachs, with anticipation of benefits from increased new aircraft deliveries and strong aerospace aftermarket.

Topgolf Callaway Brands (MODG) [+8.8%] Reports suggest an unknown investor aims to buy the company, with plans to separate Topgolf and sell Callaway Golf, although Callaway has denied being in discussions.

Mobileye Global (MBLY) [+7.5%] Announces partnership with Volkswagen for advanced driver assistance systems, supplying software and hardware.

Losers!

Signet Jewelers (SIG) [-12.1%] Met Q4 EPS with a tax benefit but reported lower sales and EBIT. Guidance for Q1 and FY is weaker, citing a soft Q1 start with improvement since mid-Feb, digital integration issues, and a new cost-savings plan and increased capital return.

Equinix (EQIX) [-2.3%] Hindenburg Research accused the company of accounting manipulation and business decay in a negative report.

Market Update

Trivia Answers

A) Bear Market is believed to come from the way a bear attacks its prey, swiping down. Whereas, a bull thrusts upward with its horns to attack; thus, a ‘Bull Market’.

D) Apple was first to reach a trillion dollar market cap.

B) Sorry Buffett fans, but Benjamin Graham is the OG value investor.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Great writeup as always. Super engaging.