🔬Explainer: Uber vs. Lyft ...in charts!

Plus: The funds that incinerate the most investor money; and much more!

"Wide diversification is only required when investors do not understand what they are doing."

- Warren Buffett

"Experience is what you got when you didn’t get what you wanted."

- Howard Marks

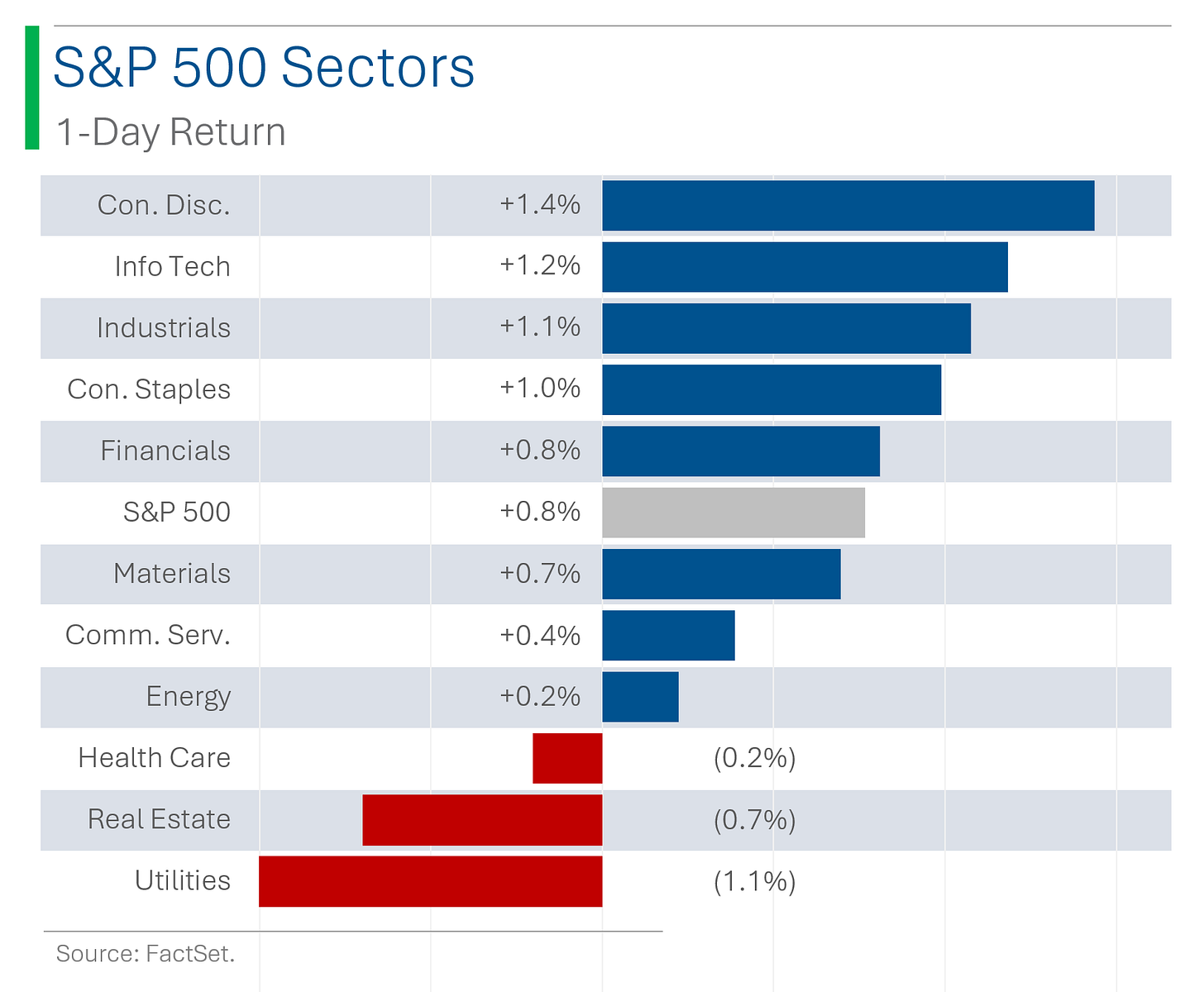

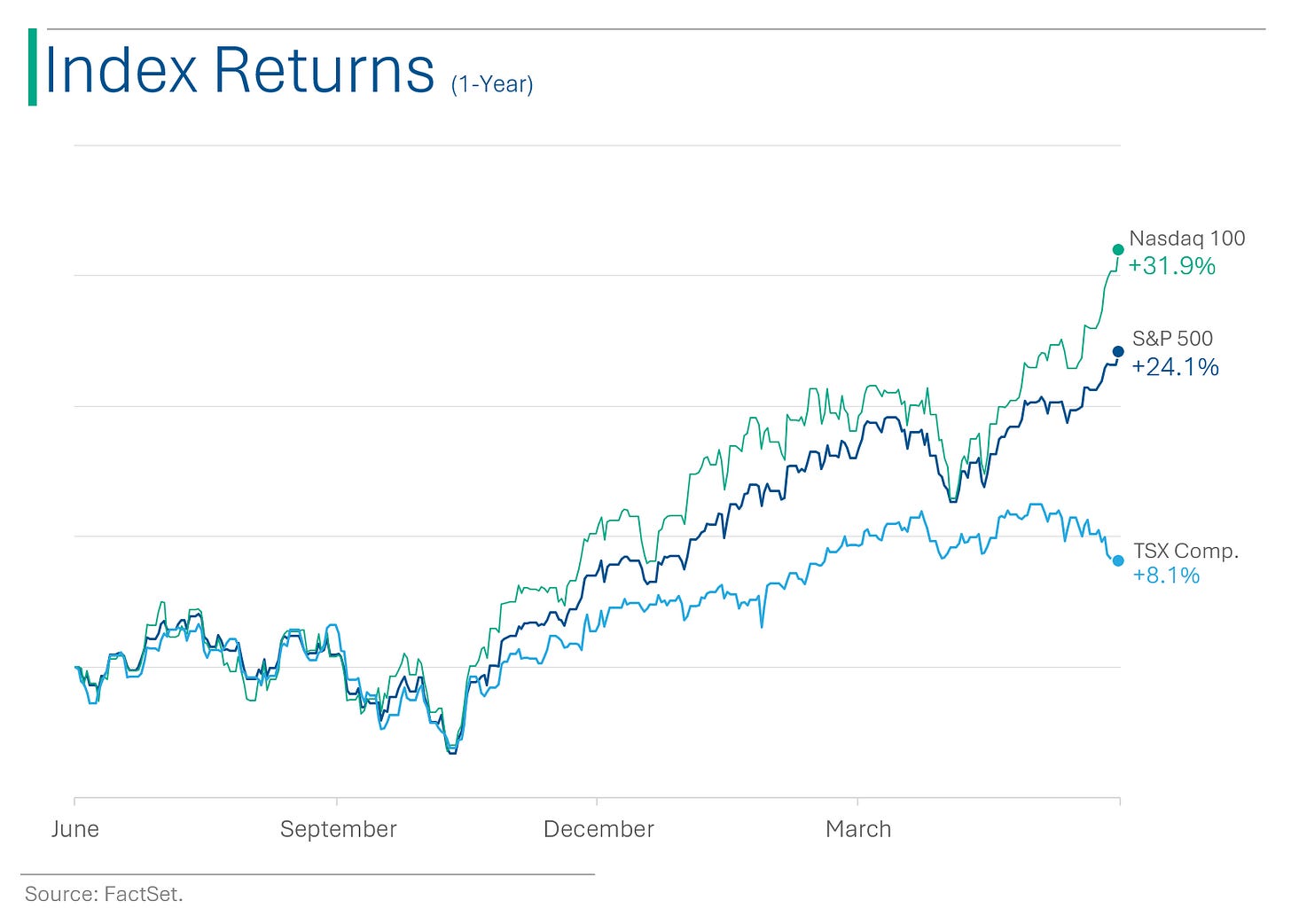

Another strong day for the big US markets with the S&P 500 +0.8% and the Nasdaq +1.0%. Amazingly, the S&P is up 9 of the last 12 days and those three down days were all <0.15% declines.

8 of 11 sectors closed higher, with Consumer Discretionary (+1.4%) outpacing Tech (+1.2%) for the top spot. Utilities (-1.1%) and Real Estate (-0.7%) were worst. As usual.

WTI Crude Oil was +1.9% taking the total to +7.2% in just two weeks.

Notable companies:

GameStop (GME) [-12.1%] Lower after company's annual meeting; press noted no detailed strategy remarks; CEO suggested reducing store count and focusing on higher-profit products.

Best Buy Co. (BBY) [+4.6%] Upgraded to buy from neutral at UBS; cited improving housing trends, pending electronics replacement, product innovation, and new categories.

Taiwan Semiconductor (TSM) [+2.7%] Planning to raise 3nm prices by over 5%, with orders filled through 2026; packaging prices expected to increase 10-20% next year.

More below in ‘Market Movers’.

Street Stories

Uber vs. Lyft

Ride sharing and delivery companies - or as Lyft prefers to use in their 10K, ‘Transportation-As-A-Service’ companies - used to be a hot start-up area with dozens of well-funded competitors. However, after more than a decade of burning through billions in venture capital, the ride sharing game has consolidated (and foreclosed) into the system we know today: Uber, the 800lb Gorilla, and Lyft, the plucky underdog that nobody bothered to write a book/TV series about.

In this write-up I’m going to break down some of the key similarities and differences between the two transport rivals. Pitter patter, let’s get at ‘er.

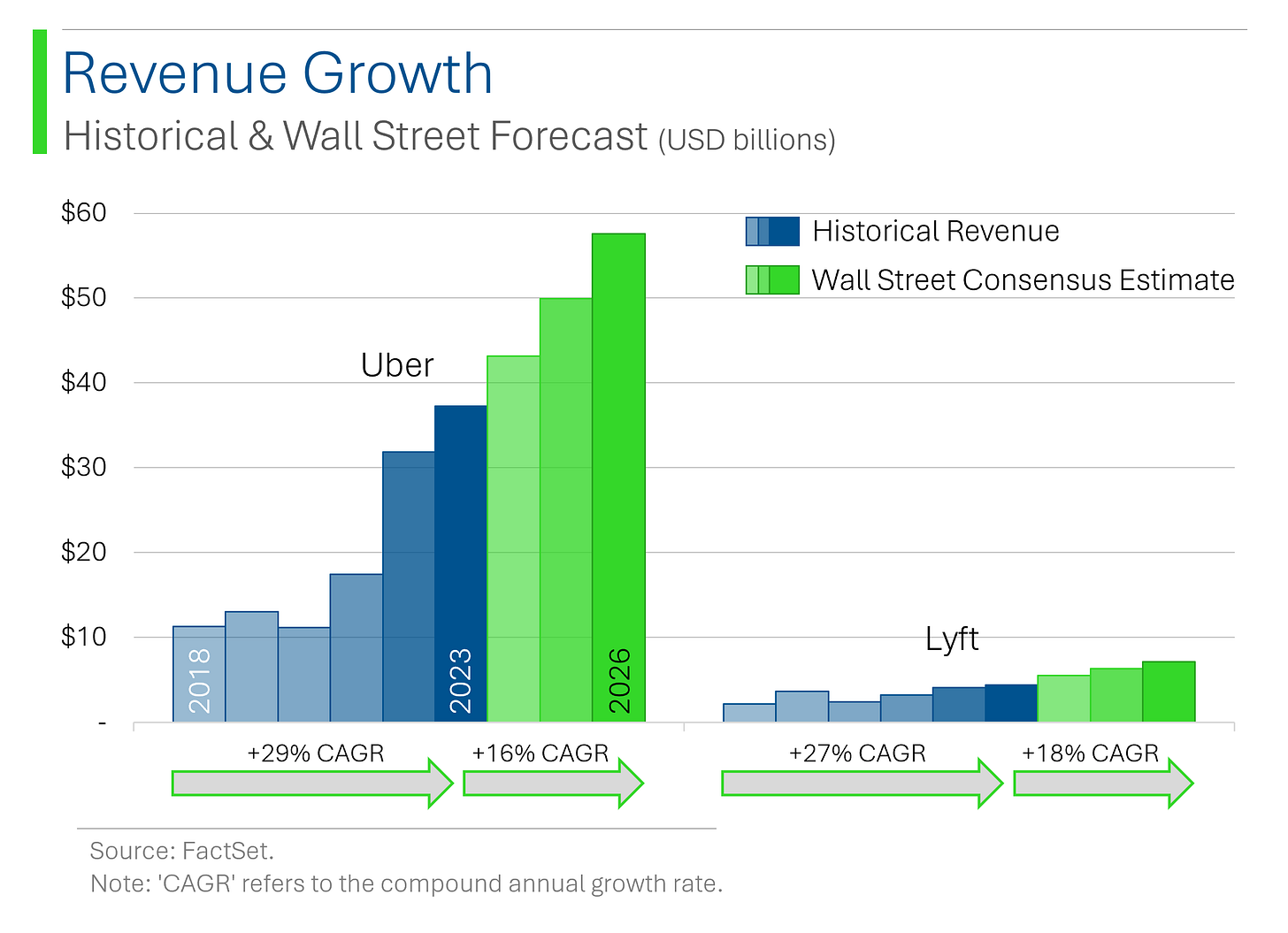

To start, everyone knows Uber is bigger than Lyft but I think the scope of this is more significant than most people realize. For example, in 2023 Uber brought in around $37.3 billion in revenue - 7.8x the $4.1 billion that Lyft made. Peanuts, really.

But that doesn’t tell the whole story as far as market share, as Lyft is pretty much just a US/Canada company, while Uber makes only around 55% of its revenue from those two nations.

On a strictly US basis, the market share split is a much more equitable 76%/24% between Uber and Lyft respectively.

Additionally, Lyft is pretty much just a ride sharing company. In 2023, 6.5% of their revenue came from Flexdrive, their car rental program for Lyft drivers (and occasionally Uber drivers) but other than that the company makes effectively all of their money from ride sharing.

Uber on the other hand, makes only 53% of its revenue from ride sharing, with 33% coming from Uber Eats and the rest from it’s Freight division1, which handles shipping.

1. In the past Uber had other divisions but none survived as separate reporting units.

That said, ride sharing (‘Mobility’) is by far the biggest contributor to EBITDA due to its much higher margins. Freight… just kinda sucks.

Next, Uber isn’t just bigger than Lyft, it’s actually been growing faster by most metrics. Looking at total rides, Lyft got hit hard by the pandemic and has struggled to regain its footing. Since 2018, Lyft has only managed to grow annual rides by 14.5%, while Uber has managed to grow this figure by 81.0%.

Looking further out, Wall Street doesn’t see Lyft catching back up to its bigger rival, expecting total rides to grow at less than half the pace of Uber (+121% vs. +281%) between 2018 and 2029.

And looking deeper at that growth, there are even more troubling signs for Lyft: in the last quarter before the pandemic (Q4 2019), Lyft was sitting at a monthly active user base of around 22.9 million. Fast forward to Q4 2023 and that number has yet to catch back up - sitting at only 22.4 million monthly active users.

Uber has had much greater success here, growing its monthly active users by +35.1% over that time (111m to 150m).

This all combines to lead to some underwhelming expectations for Lyft’s gross booking values in its fight for market share in ‘Transportation-As-A-Service’.

The result of Lyft’s inability to compete effectively against Uber has shown itself in the change in relative size between the two companies. When Lyft hit its peak market cap in March 2021, it was 19.3% the size of Uber ($21.6 billion vs. $112 billion).

Today that ratio is only 3.8%.

Damn.

Looked at differently, Lyft trades at a steep discount to Uber on a forward EV/EBITDA basis. Investors require growth and will take a chance on a fast growing number two player if they have the growth to back it up. But being a subscale second fiddle and getting outperformed by your much larger rival by a around a factor of 2:1? That’s a first class ticket to disountville.

Or put another way…

Worst of The Worst

Over the past 10 years, mutual funds and ETFs have generated a reported $11.1 trillion in market value. But that definitely doesn’t imply that everyone was a winner.

Morningstar did an interesting review of some of the worst investments over the past decade. The results… probably won’t shock you.

To start, the market has had one of its strongest decades ever. Meaning that betting against it hasn’t gone too well. That’s why the vast majority of money lost in ETFs and mutual funds has come in the form of short positions in equity markets.

China and commodities also stand out as notable losers. The latter in a small way caused by the former, as a weak China means weaker demand for commodities.

At the fund family level, my favourite investor to pick on - Cathie Wood and her ARK Management - sit in first place as the greatest single entity out there lighting people’s money on fire1.

Next up is KraneShares which invests in various Chinese sectors and strategies, and if you looked at Chart 1 you can guess how they got here.

1. If you want to learn more about how she has managed to destroy so much of people’s hard earned saving, check out my post ‘Cathie Wood's ARK Has (Losing) Money Problems’.

Joke Of The Day

A bipartisan bill legalizing medical marijuana for use in alleviating symptoms of arthritis would be joint support for joint support for joint support.

Hot Headlines

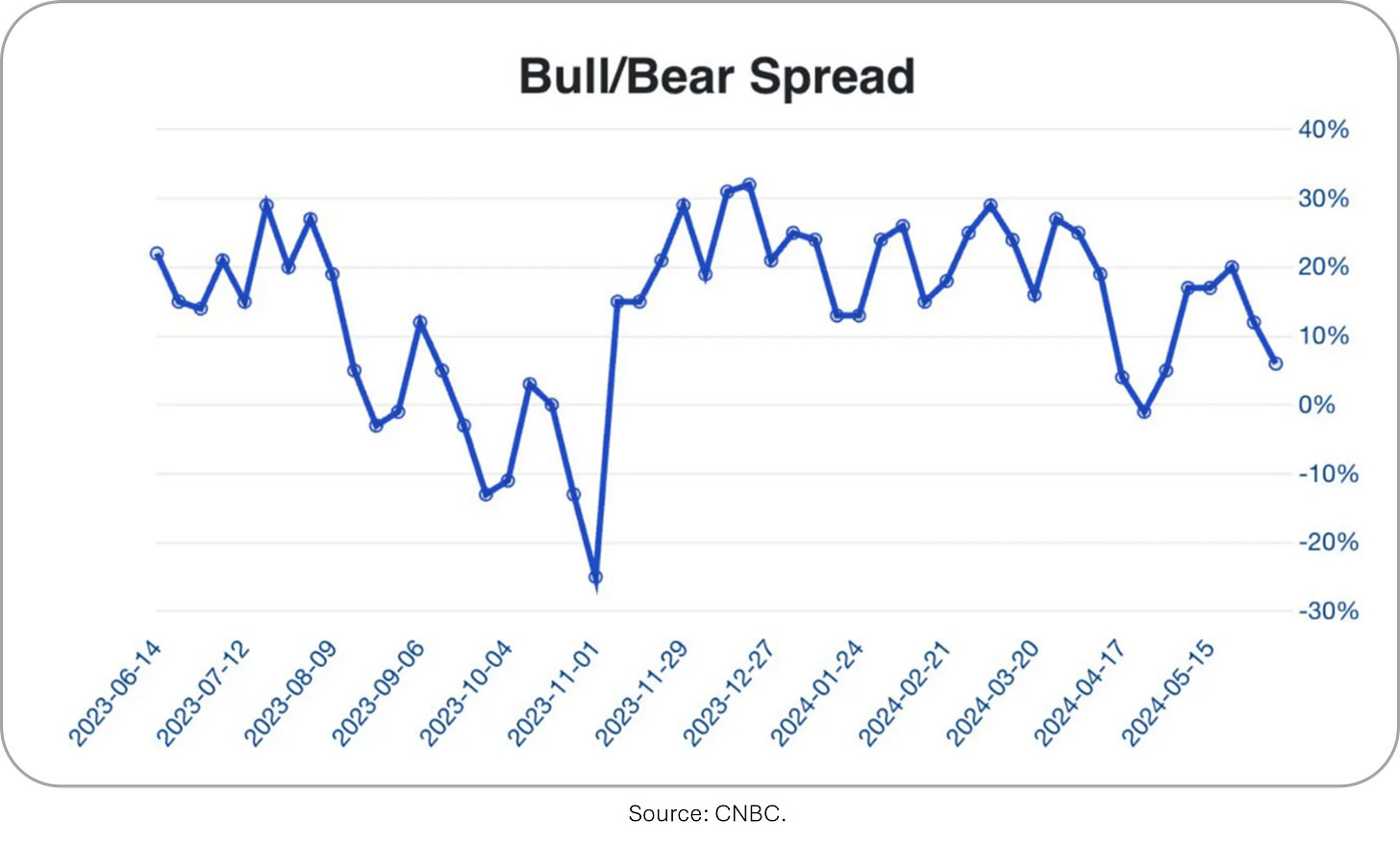

CNBC / Why so many investors find it hard to embrace this run of market records. With the market being held together by a select few megacap Tech companies, investors are finding it harder to buy into the belief that the market is on sound footing. Positive market bets in the options market are showing investors bullish-ness to be subsiding.

Noahpinion / How not to be fooled by viral charts. A nice look at how financial and economic charts can often be misleading. Cool examples!

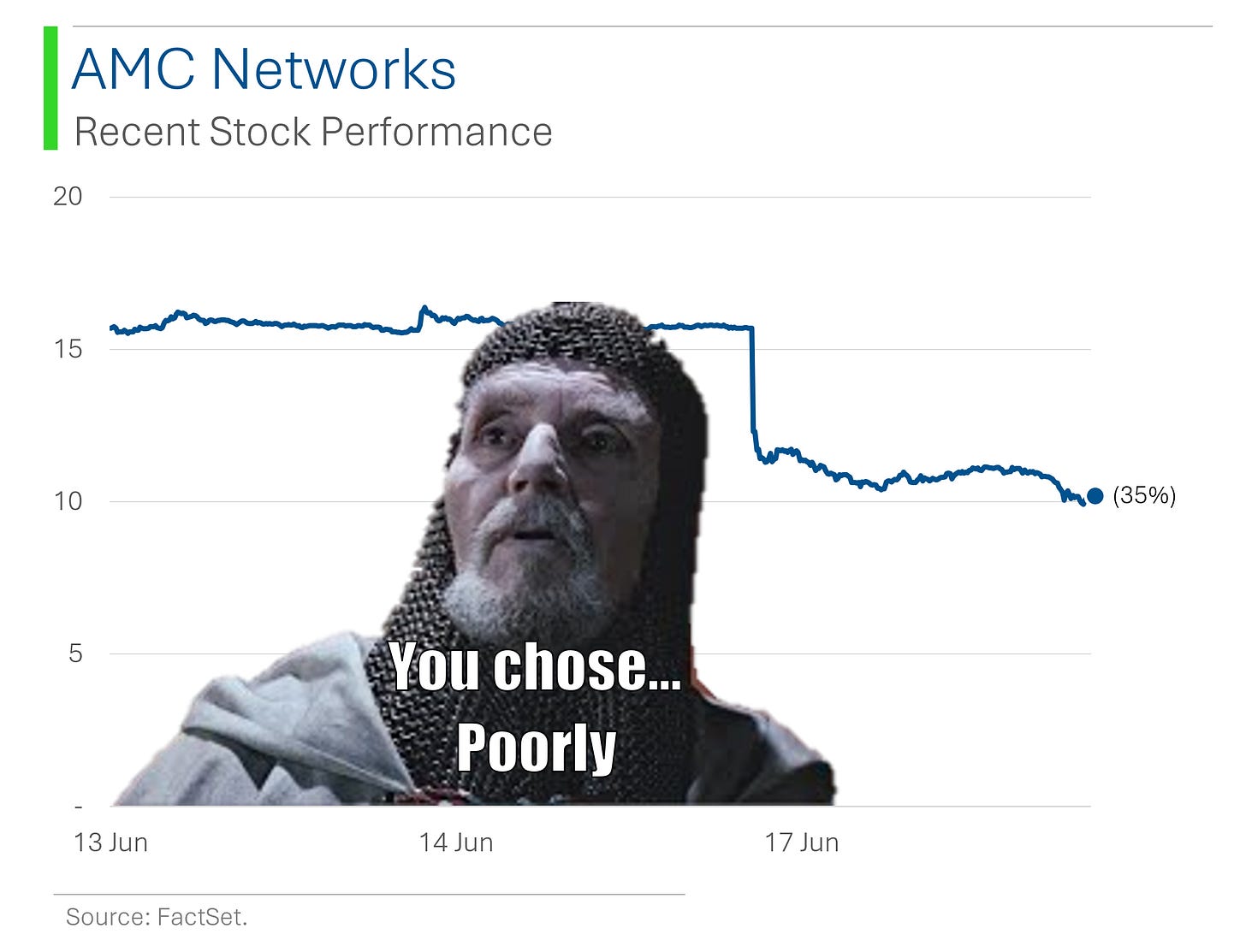

Investing.com / AMC Networks, owner of the eponymous cable network and others, thought it would be a good idea to follow the meme-stock trend and issue a $125m convertible debt offering. The market didn’t think it was such a good idea.

NY Times / US surgeon general calls for social media warning label. Amidst the growing mental health crisis among young people, social media has emerged as an important contributor.

The Verge / US sues Adobe for ‘deceiving’ subscriptions that are too hard to cancel. The Department of Justice has filed the claim that the company hides expensive fees and intentionally makes the cancellation process unnecessarily complicated.

Trivia

Today’s trivia is on Lyft.

What year was Lyft founded?

A) 2010

B) 2012

C) 2012

D) 2015Who are the co-founders of Lyft?

A) Travis Kalanick and Garrett Camp

B) Logan Green and John Zimmer

C) Elon Musk and Jeff Bezos

D) Reed Hastings and Marc Randolph

How does Lyft’s current share price of $14.08 compare to their IPO price?

A) Down ~80% (IPO price of $72)

B) Nearly Flat ($15 IPO)

C) Up 31% ($10.50 IPO)

D) Up 121% ($6.40 IPO)

(answers at bottom)

Market Movers

Winners!

Aaron's Co. (AAN) [+33.4%] Agreed to be acquired by IQVentures for $10.10 per share in cash, or ~$504M enterprise value; represents a ~34% premium to prior close.

Ollie's Bargain Outlet Holdings (OLLI) [+9.4%] Upgraded to overweight from neutral at JP Morgan; noted potential for disruption at BIG allowing opportunistic acceleration in SSS and unit growth.

Autodesk (ADSK) [+6.5%] Activist Starboard Value built a $500M stake, pushing for margin improvements and board changes; considering legal action over delayed probe disclosure.

Best Buy Co. (BBY) [+4.6%] Upgraded to buy from neutral at UBS; cited improving housing trends, pending electronics replacement, product innovation, and new categories.

Taiwan Semiconductor (TSM) [+2.7%] Planning to raise 3nm prices by over 5%, with orders filled through 2026; packaging prices expected to increase 10-20% next year.

Greif (GEF) [+2.3%] Upgraded to buy from neutral at Bank of America; cited broader containerboard recovery and pricing momentum with recent price hikes.

Walt Disney (DIS) [+1.6%] "Inside Out 2" earned an estimated $155M in weekend NA ticket sales; second-highest animated opening; $140M from international showings.

Losers!

AMC Networks (AMCX) [-35.1%] Announced private offering of $125M of convertible senior notes due 2029.

GameStop (GME) [-12.1%] Lower after company's annual meeting; press noted no detailed strategy remarks; CEO suggested reducing store count and focusing on higher-profit products.

Louisiana-Pacific (LPX) [-3.5%] Downgraded to sell from neutral at Goldman Sachs; cited expectations of lower R&R spend, competitive dynamics, and valuation concerns.

Dycom Industries (DY) [-3.3%] Announced CEO Nielsen will retire on 30-Nov after 25 years; to be succeeded by current COO Payovich; analysts noted the transition appears to be a standard succession plan.

Market Update

Trivia Answers

C) Lyft was founded in 2012.

B) Logan Green and John Zimmer are the cofounders of Lyft.

A) Lyft is down ~80% from its IPO price of $72.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.