🔬Explainer: Should You Buy A Pro Sports Team?

Plus: Tesla shares go down because deliveries data should be going up (or at least less down); Crude oil rally continues (super...); bonds are weak; and much more

"There are two classes of forecasters: those who don’t know, and those who don’t know they don’t know"

- John Kenneth Galbraith

"All this from a slice of gabagool?"

- Tony Soprano

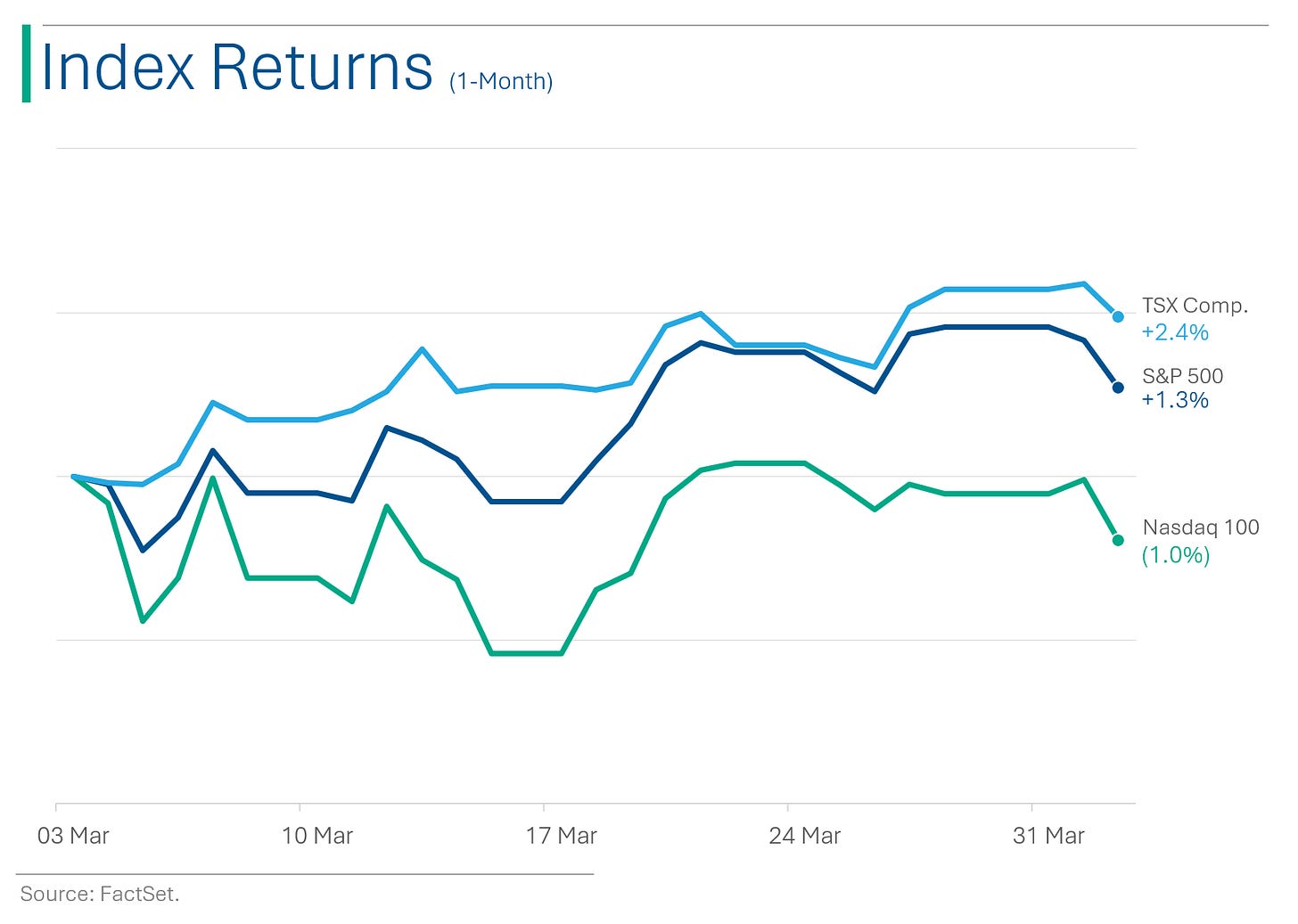

Weak day for the big US markets (S&P 500 -0.7% and Nasdaq -1.0%), with rates backing up as the main story of the day.

3 of 11 sectors closed in the green, led by Energy (+1.4%) as the oil rally picks up steam. Healthcare was worst (1.6%) primarily due health insurers following announced Medicare reimbursement rates below expectations.

U.S. 10-Year bond touched 4.4% yield for the first time since November, while Gold finished +1.1% for another all-time high.

February JOLTs report (job openings) was a non-event (8.756M vs consensus for 8.770M).

Street Stories

Sports Valuations

‘Invest in scarcity’ is one of my investment maxims. Basically, things that are rare and valuable become even more rare and valuable over time. Art has been a good example of this, as in recent decades coveted pieces now change hands for hundreds of millions where just a few decades earlier the prices were merely millions.

Now as far as trophy assets go, nothing is as highly valued as professional sports franchises. And indeed, my scarcity rule holds here also. For example, my beloved Toronto Maple Leafs, currently valued at around $2.8 billion, could have been bought for the bargain price of CAD84 million back in 1996 (that’s like $65 million in Freedom Dollars). The most valuable franchise in the world, the $9.0 billion Dallas Cowboys, was scooped up by Jerry Jones in 1989 for $140 million.

Anyway, I got my hands on some Forbes data that values teams in the big four North American professional leagues (sorry MLS) and I thought it would be fun to look into the investment performance of these assets. Just in case any of you are currently on the market for a team.

Looking at the NFL, estimated team prices have risen from an average of $1.2 billion in 2013 to $3.9 billion as of last year. This works out to an annual growth rate of 12.8%, and would probably be a lot more fun than T-Bills too. The ‘cheapest’ team on the list, the Bengals, is still worth more than the dearest NHL team (just in case a rich uncle gives you a choice).

Shocker, the Yankees are the most valuable baseball franchise. Interestingly though, they are worth 48% more than the next highest valued team, the Dodgers, at $4.8 billion. Perhaps indicative of the slowing popularity of baseball, the average team has ‘only’ seen their value go up by 312% over the last decade, compared to 435% in the NFL and 606% in the NBA. The NHL hasn’t been much better at 320%. If you follow hockey, you’ll know that this is somehow Gary Bettman’s fault.

As the popularity of basketball continues to grow rapidly, some of the best investments have been for basketball franchises. For example, Golden State was picked up by a consortium in 2010 for $450 million. At a 24% unlevered IRR, any private equity shop would be so lucky.

For those of you reading that only have single digit billions, mayhaps an NHL team is more within your budget. Long considered the distant forth in North American professional sports, the NHL has seen a big uptick in recent years, with average values doubling over the last four years. Whether or not that will be enough to stay ahead of the fast growing MLS is an open question. Forbes only recently started estimating MLS values, with the Los Angeles FC holding the highest value at $1.2 billion and a league average of $658 million.

So how do the big pro leagues stand up as investments? Well, I think it’s fair to say that a lot of the mispricings and bargains have gone away as professional sports have… well, professionalized. That said, franchise returns have held up well over the last decade, with all the big leagues outpacing the S&P 500.

Basically, if you can get your hands on a pro sports team, you should probably do it. 🧐

Electric Slide: Tesla's Delivery Dilemma

Tesla reported its first quarterly decline YoY in deliveries in nearly four years, missing Wall Street's expectations with an 8.5% drop to 386,810 vehicles, resulting in a $30 billion loss in market value as shares fell by 5.2%. The decline is attributed to the company's aging model lineup, high interest rates affecting consumer spending on big-ticket items, and increasing competition from cheaper models, especially in China.

Tesla cited production adjustments at its Fremont factory and shutdowns at its Berlin plant (that whole ‘arson’ thing) as partial reasons for the delivery shortfall, which doesn’t seem too truthful given they produced 46,000 more vehicles than they sold in the quarter.

Treasury Weakness

The U.S. 10-Year bond yield ticked higher yesterday to reach a high not seen since last November. A strong ISM Manufacturing print on Monday is being partially blamed as adding to the ‘higher for longer’ narrative, as a robust economy is seen to potentially contribute to ongoing inflation, lifting expectations of the Fed’s easing of interest rates back even further.

Rates across the curve are still well below the cycle peak in October, but materially up since the start of the year.

Crude Rally Continues

West Texas Intermediate is now firmly entrenched in the $80s, as it approaches the 2023 high triggered by the Israel/Hamas conflict.

Joke Of The Day

Nothing is foolproof to a sufficiently talented fool.

Hot Headlines

Reuters / GE completes three-way split as energy business commences trading as GE Vernova ($GEV). GE HealthCare ($GEHC) was spun out at the end of 2022, and now only GE Aerospace is left to trade under the famed $GE ticker that once was the largest company in the world.

WIRED / Jeffrey Epstein’s island visitors exposed by data broker, Near Intelligence.

Bloomberg / Americans now say they need $1.5 million to retire. Increased prices and longer lifespans are driving a surge in how much US adults think a comfortable retirement will cost, according to Northwestern Mutual.

CNBC / Health insurer stocks slide as final Biden Administration sets new Medicare Advantage rates below where industry was expecting. The Centers for Medicare and Medicaid Services (CMS) said that government payments to Medicare Advantage plans are expected to rise 3.7% year over year.

Variety / Sports and entertainment giant Endeavor agrees to go private in $13 billion acquisition by private equity giant Silver Lake. The conglomerate that includes talent agency William Morris Agency and a 51% stake in UFC/WWE parent company TKO, will represent the largest ever deal in the entertainment/media sector.

Trivia

Today’s trivia is on Nike.

When was Nike, Inc. originally founded?

A) 1971

B) 1954

C) 1964

D) 1980What was Nike's original name?

A) Mountain Footwear

B) Blue Ribbon Sports

C) Victory Sports

D) Athlete's FootWhat was the initial payment for the creation of the Nike Swoosh logo?

A) $35,000

B) $35

C) $350

D) $3,500What were Nike’s sales in fiscal 2023?

A) $7.1 billion

B) $51.2 billion

C) $104.8 billion

D) $87.4 billion

(answers at bottom)

Market Movers

Winners!

ChampionX (CHX) [+10.4%]: SLB will acquire it in an all-stock deal.

EXACT Sciences (EXAS) [+4.7%]: Rose after Freenome's positive blood test results for colorectal cancer.

Roivant Sciences (ROIV) [+4.7%]: Shared positive Brepocitinib data from the NEPTUNE study and announced a $1.5B buyback.

Grindr Inc. (GRND) [+2.4%]: Started at outperform by Citizens JMP due to its strong brand and market leadership.

Losers!

PVH Corp (PVH) [-22.2%]: Q4 showed Calvin Klein and Tommy Hilfiger growth but noted wholesale weakness and a $2B buyback despite expecting revenue drops due to Europe's economy.

Humana (HUM) [-13.4%]: Unchanged CY25 Medicare Advantage rates at -0.16% led to a downgrade to neutral by BofA.

NEXTracker (NXT) [-6.9%]: Barclays downgraded it to equal weight over valuation concerns and potential FY25 guidance below expectations.

Petco (WOOF) [-6.7%]: Downgraded by BofA to underperform, citing P&L decline and lost market share.

Veeva Systems (VEEV) [-6.1%]: Brent Bowman steps down as CFO; E Nitsa Zuppas becomes President; reaffirmed guidance.

Rivian (RIVN) [-5.2%]: Q1 production missed expectations with 13,980 vehicles; 2024 outlook remains unchanged.

Tesla (TSLA) [-4.9%]: Missed Q1 delivery target with 386,810 vehicles amid logistical and Berlin factory issues.

Market Update

Trivia Answers

C) Nike was founded in 1964.

B) Nike’s original name was Blue Ribbon Sports.

B) Nike paid $35 for the famous ‘Swoosh’ design.

B) 2023 revenues were $51.2 billion.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.