🔬Explainer: Intel’s Lost Chip Crown (Part I)

Plus: Nvidia stands tall as the market dives; business data shows surprising strength; and much more!

"I know you think you understand what you thought I said but I'm not sure you realize that what you heard is not what I meant."

- Alan Greenspan, Former Fed Chairman

"I made a fortune getting out too soon."

- J.P. Morgan

Another crummy day for the big US markets with the S&P 500 -0.7% and Nasdaq -0.4%.

1 of 11 sectors close higher, with Nvidia basically pulling Tech (+0.6%) into positive territory. Real Estate (-2.2%) and Utilities (-1.7%) continue to suck.

Weekly Initial Jobless Claims came in a bit light at 215K vs consensus 220K.

Copper sunk 1.2% following Wednesday drop of 5.0% as the hype takes a breather.

Notable companies:

NVDA (NVIDIA) [ +9.3% ] Big Q1 beat and guided Q2 higher; Data Center standout on strong AI demand; and announced 10-for-1 stock split.

LYV (Live Nation Entertainment) [ -7.8% ] DoJ and group states to sue for antitrust violations; will seek remedies including a breakup.

BA (Boeing) [ -7.6% ] CFO gave negative near-term update at conference, though some optimism expressed; company confirmed earlier report of delivery delays to China due to regulatory review of batteries.

Street Stories

Intel’s Lost Chip Crown (Part I)

Today is the first part in a two-part piece on Intel’s fall from being the undisputed king of the semiconductor world into an outdated player, scrambling to play catch-up.

Today I’ll dive into the state of Intel’s decline, and tomorrow I’ll get into the Foundry business that it hopes will compete with TSMC; potential signs of hope; and also the increased financial risks associated with its evaporating cash flow. Let’s get at ‘er!

To start, despite being the leader in semiconductors for decades, Intel investors haven’t really been rewarded for their support. Over the last 26 years, Intel shares have only returned +51%. And if you had the misfortune of investing at the peak of the Tech Bubble, you’d actually be down 57%!

Yes, Intel does pay a dividend but their historical average yield of between 2-3% doesn’t really move the needle here.

On the Revenue front, sales hit a peak of $78 billion in 2020, a decline of 30% in just three years.

And it’s not exactly like it’s been a bad time to be a chip maker: TSMC, Nvidia and AMD have seen their revenue increase by 43%, 265% and 132%, respectively over the same period. So yeah, that’s more of a ‘you’ problem…

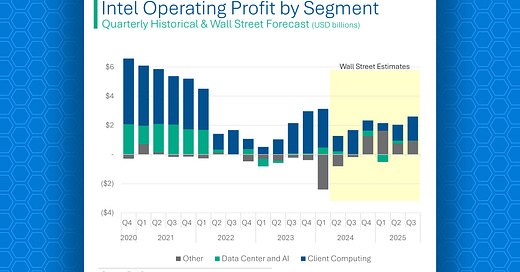

Even worse has been the decline in Operating Profit: In 2020 it was $25.2 billion. By 2023 it was only $4.7 billion. Miss the boat? I’m not sure Intel is at the right body of water.

The causes of this decline are broad-based:

Client Computing: This is the traditional CPU business for personal computers, which has suffered in the face of increased competition. That said, it hasn’t completely imploded so it’s the hero of this story.

Data Center and AI: Intel used to own the data center market, with it’s CPUs powering nearly all the world’s servers. However, a lack of vision and an inability to pivot towards the parallel processing has meant the GPU-dominated data center of the future has left Intel a virtual non-start in its former monopoly. Truly disgusting.

‘The Other’: Lot of junk in here, and little of it has worked out well. This mostly includes Mobileye - the autonomous driving company they bought in 2017 - as well as the sub-scale Network and Edge Computing, and most recently its Intel Foundry business which I’ll get into tomorrow.

Anywhoo, while Client Computing has taken a bath lately it’s still the only thing in the last year that’s made more money than a Burger King franchise.

All of this rolls down into Earnings Per Share, which (again) has been quite gross. Compared with Q1 four years ago, Intel has seen it’s EPS implode by 79% while nearly all of it’s peers have seen theirs more than double.

And the bleeding hasn’t fully stopped it seems, as the Street has continued to progressively lower their estimates for the future.

This is probably a good place to leave things. Tomorrow I’ll get into the Foundry business and look at the opportunities and risks facing Intel going forward.

Nvidia Stands Out In Weak Market

Stocks sucked yesterday with the only real standout being Nvidia (+9.3%) following its solid earnings after close on Wednesday.

PMI Party: US Economy Throws a Surprise Growth Bash in May!

The US economy's private sector decided to surprise everyone by growing faster in May, with the Composite PMI jumping to 54.4 vs. a 51.5 estimate from Wall Street and a 51.3 readout in April, as both Manufacturing and Services showed stronger growth. The increase moves the index to its highest value in 25 months.

Chris Williamson from S&P Global practically danced with joy, as he hinted that that GDP might actually look good this quarter, defying the previous months' slower pace.

Joke Of The Day

And God said to John, "Come forth, and you shall receive eternal life!" But John came fifth and won a toaster.

Hot Headlines

Reuters / US new home sales fall in April but prices rise from year ago. New home sales dropped 4.7% to a seasonally adjusted annual rate of 634k units with sales down 7.7% YoY. Builders have been constructing smaller homes and giving incentives to buyers to offer some cushion from higher mortgage rates.

Yahoo Finance / Boeing sees free cash burn in 2024 as deliveries remain sluggish. CFO Brian West told Wolfe Research that he expects Boeing's full-year free cash flow to be negative, due partly to the delays in deliveries, compared with March's outlook for positive cash generation in the low single-digit billions.

Shares didn’t like that, and plunged 7.6%.

Bloomberg / SEC opens door for US spot Ethereum ETFs in landmark for crypto. Bitcoin’s quirky little brother could soon be getting the green light from regulators to join the big kid public markets.

No word on Doge Coin’s ETF status.

Tech Crunch / Robocaller who used AI to clone Biden’s voice gets $6M fine. The FCC has proposed the fine for the scammer who used voice-cloning tech to impersonate President Biden in a series of illegal robocalls during a New Hampshire primary election. It’s more about robocalls than AI, but the agency is clearly positioning this as a warning to other would-be high-tech scammers.

Reuters / Tesla drops delivery goal of 20 million vehicles a year from latest report. The move is another sign the company was moving away from electric cars as it shifts focus to robotaxis. The 2020 goal is roughly 2x what Toyota sold.

Trivia

Today’s trivia is on Nvidia.

When was Nvidia founded?

A) 1990B) 1993

C) 1996

D) 1999

In what year did Nvidia launch the GeForce 256, the world's first GPU?

A) 1995B) 1997

C) 1999

D) 2001

What is the name of Nvidia's software development platform for parallel computing (ie: the backbone of AI)?

A) RTX

B) CUDA

C) Vulkan

D) OpenGLIn what year did Nvidia surpass Intel in market capitalization for the first time?

A) 2001

B) 2020

C) 2018

D) 2022

(answers at bottom)

Market Movers

Winners!

NVDA (NVIDIA) [ +9.3% ] Big Q1 beat and guided Q2 above; Data Center standout on strong AI demand; positive takeaways on easing demand concerns; raised dividend by 150% and announced 10-for-1 stock split.

IP (International Paper) [ +6.0% ] Upgraded to buy from hold at Jefferies; see opportunities in value commercial approach, cyclical pricing tailwinds, and portfolio improvements.

RAMP (LiveRamp Holdings) [ +5.9% ] FQ4 earnings, revenue, and margins beat; management highlighted strong ARR from Habu acquisition, upselling, and new-customer growth; noted healthy digital-ad market; next-Q and FY25 guidance ahead of the Street.

Losers!

TITN (Titan Machinery) [ -14.7% ] Q1 sales, EBITDA, and EPS all below; slashed FY EPS guidance by over 20%; flagged industry-wide transition to a more challenging market; noted softening demand and excess inventory in many product categories.

MNRO (Monro Muffler) [ -11.8% ] FQ4 earnings, revenue, and comps missed; flagged trade-down behavior for tires among low- and middle-income consumers and industry oversupply of lower-margin tires; cautioned FQ1 preliminary comps down ~12% QTD; highlighted actions to reduce nonproductive labor costs.

TGI (Triumph Group) [ -11.6% ] FQ4 earnings and revenue better; noted aftermarket volume grew in remaining OEM businesses though Interiors weak; management said profit/cash flow lag cost drivers; FY25 guidance below the Street.

LECO (Lincoln Electric Holdings) [ -9.5% ] Updated FY24 financial assumptions; organic sales mid-single digit % decline vs prior assumption low- to mid-single digit % growth; adjusted operating income margin ~17.5% vs prior assumption low-to-mid 20%.

LYV (Live Nation Entertainment) [ -7.8% ] DoJ and group states to sue for antitrust violations; will seek remedies including a breakup.

BA (Boeing) [ -7.6% ] CFO gave negative near-term update at conference, though some optimism expressed; company confirmed earlier report of delivery delays to China due to regulatory review of batteries.

MDT (Medtronic) [ -5.1% ] FQ4 revenue better with earnings largely in line; organic growth ahead of consensus; some relative weakness in Structural Heart; FY25 guidance brackets the Street; raised dividend; noted larger-than-expected OM decline amid higher sales incentives and increased investments ahead of product launches.

UAA (Under Armour) [ -3.5% ] Downgraded to Hold from Buy at Oppenheimer; positive on longer-term potential but argued restructuring effort will take time.

VFC (VF Corp) [ -2.9% ] FQ4 EPS and revenue missed; GM missed, OM surprised negative as positive mix headwinds offset by turnaround plan and promo activity headwinds; multiple downgrades citing pressure in Vans, North Face segments, and limited visibility into Reinvent turnaround plan progress.

Market Update

Trivia Answers

B) Nvidia was founded in 1993.

C) The GeForce was launched in 1999.

B) The platform is CUDA, which (imo) is the real competitive advantage for the company as most AI developers are on this software.

B) Nvidia passed Intel in 2020 - albeit that had more to do with GPUs used for crypto mining than AI stuff.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.