🔬Explainer: Intel’s Lost Chip Crown (Part II)

"If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring."

- George Soros

“No one wants to get their ass beat to a soundtrack.”

- Dave Chappelle

Solid day for the big US markets on Friday with the S&P 500 +0.7% and Nasdaq +1.1%. For the week, the S&P 500 was flat and the Nasdaq +1.4%.

Only 2 of 11 sectors closed higher for the week: Tech (+3.4%) and Comm. Services (+0.3%) were the positives, while Energy (-3.8%) and Real Estate (-3.7%) did the worst.

Nvidia’s strong Q1 earnings release was the big story for the week, with shares closing up 15.1% since the previous Friday.

Oil finished the week down 2.3% as recent strength abates.

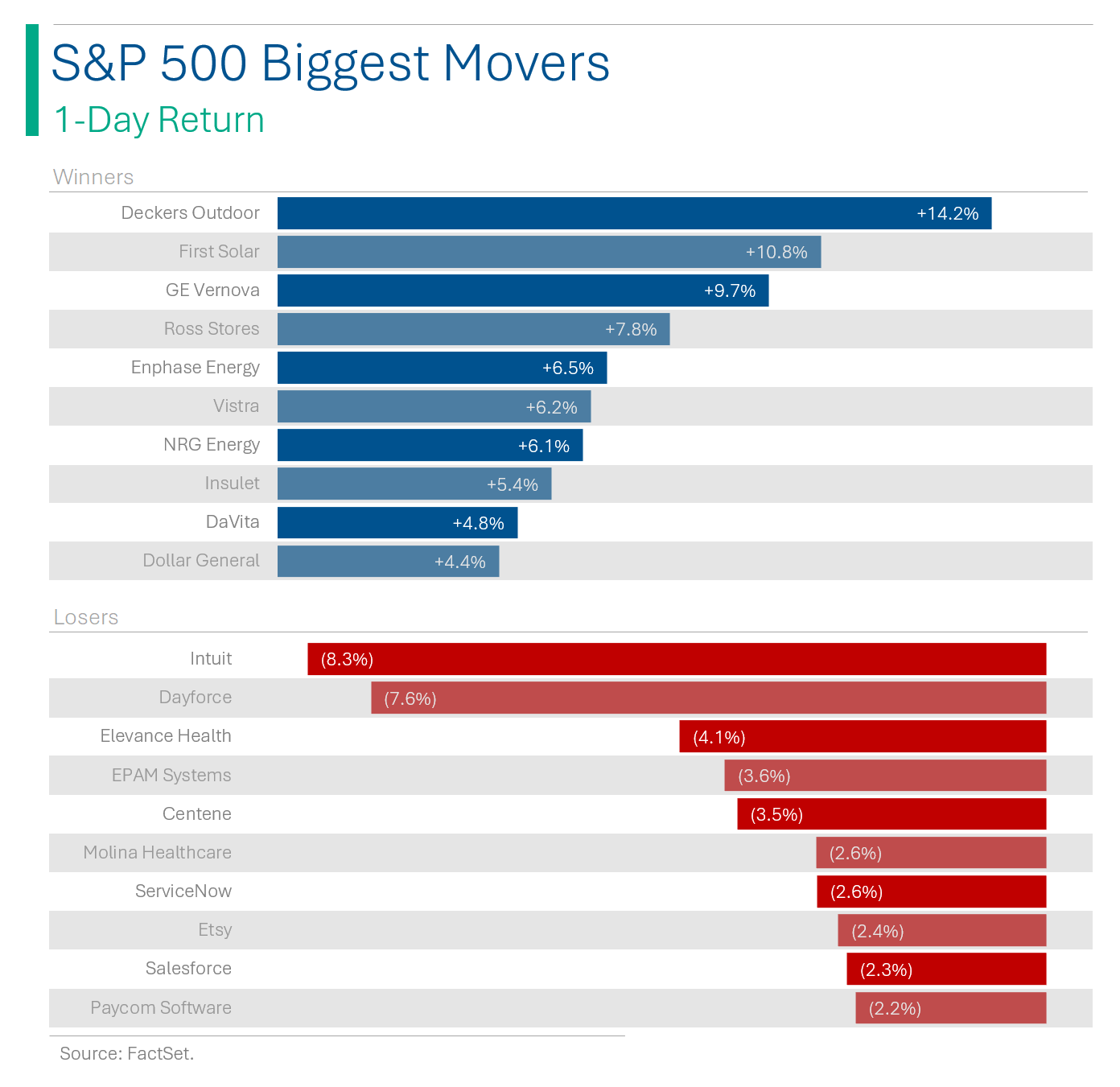

Notable Friday stocks:

Deckers Outdoor (DECK) [+14.2%] FQ4 EPS and revenue beat with strong margins; FY25 guidance largely in line.

Workday (WDAY) [-15.3%] Q1 revenue and EPS beat, but billings growth and 12-month subscription backlog missed; focus on lowered FY25 subscription guidance.

Lions Gate Entertainment (LGF.A) [-9.8%] FQ4 earnings better with revenue largely in line; Television segment strong on library sales and post-strike content deliveries, with some analyst disappointment in STARZ.

Street Stories

Explainer: Intel’s Lost Chip Crown (Part II)

In Friday’s Part I, I dug into what caused Intel’s meltdown and its poor financial performance. Today I’ll get into their Foundry business, and try to highlight some of the opportunities and risks facing the company going forward. Pitter patter. Let’s get at 'er!

Part of Intel’s fall from grace should be attributed to doing too many things and, as a result, doing many of them poorly. The company is still the leader in chips for personal computing, but missed out heavily by offering inferior products for mobile (see: Qualcomm).

(Fun fact: Intel turned down Apple’s offer to make iPhone chips, believing it to be too small of a market.)

And whereas most of its peers moved to a Fab-less model of designing chips and leaving the manufacturing to others, they lost share in commercial and data centers by failing to innovate their chips designs (see: Nvidia) and also fell far behind the curve in manufacturing capabilities (see: TSMC). A pattern has emerged!

Intel is now doubling down on manufacturing as a way to leverage its - albeit no longer first rate - expertise in chip manufacturing. In helping others to develop their own chips, Intel expects to not just make a tidy profit but also help it stay on the cutting edge of manufacturing trends.

Wall Street and investors were generally pleased by this move, but recently sentiment has cooled considerably. For example, on April 2nd of this year the company officially began reporting its Foundry business as a separate division, and restated its historical financials. Investors were none too pleased when Intel revealed that it’s Foundry division lost $7.0 billion in 2023 - and a combined $17.2 billion over the last three years.

Intel has been up front that this is a multi-year pivot but their ambitions of becoming the world’s second-largest foundry by 2020 and the Foundry unit being profitably by 2027 have begun to look suspect.

Moreover, if you look above you might also see that the company’s ‘Intersegment Eliminations’ are roughly the same as the Foundry’s revenue. Ie: Virtually all of Foundry’s sales are still only to Intel and not to third parties.

Intel has taken other efforts to become more competitive with their chips, and some of this has come in the form of refocusing towards better technological development. However, the impact on overall R&D spending hasn’t been too significant.

As we discussed on Friday, their shrinking profitability has reduced their capabilities in this department, as less money is floating around to be allocated to R&D.

One area where Intel has made great strides is allocating money towards Capital Expenditures. This includes updating their facilities, as well as the production of new manufacturing facilities (‘Fabs’). For example, their biggest projects at the moment are a massive expansion to their Arizona facility, and two new fabs located in New Mexico and Ohio.

In 2023, Intel reportedly poured more than 2 million cubic yards of concrete across all of their projects - enough concrete to build New York’s Empire State Building 32 times over.

The costs of these massive projects, however, has taken a massive amount of cash. Intel had $12.3 billion in negative free cash flow in 2023, and negative $19.9 billion in 2022.

This money had to come from somewhere. In particular, Intel has funded this cash gap through the issuance of debt.

Historically, Intel ran with nearly zero credit but current has about $52.5 billion in bonds and credit lines.

As a result of the increased financial burden, Intel chopped their dividend in 2023. And since the next few years are forecast to be equally rocky, it’s likely that they will have to trim this even further.

That could pose increased risks for Intel, as a lot of their investor base includes staid, sleepy investment funds that looked at Intel as the safe bet in the chip space. These investors are also ones that tend to like dividends.

To conclude, Intel has started making some smart moves to become more competitive but the success of these bets and their financial needs in order to bridge to that future mean that things could likely be rocky for some time.

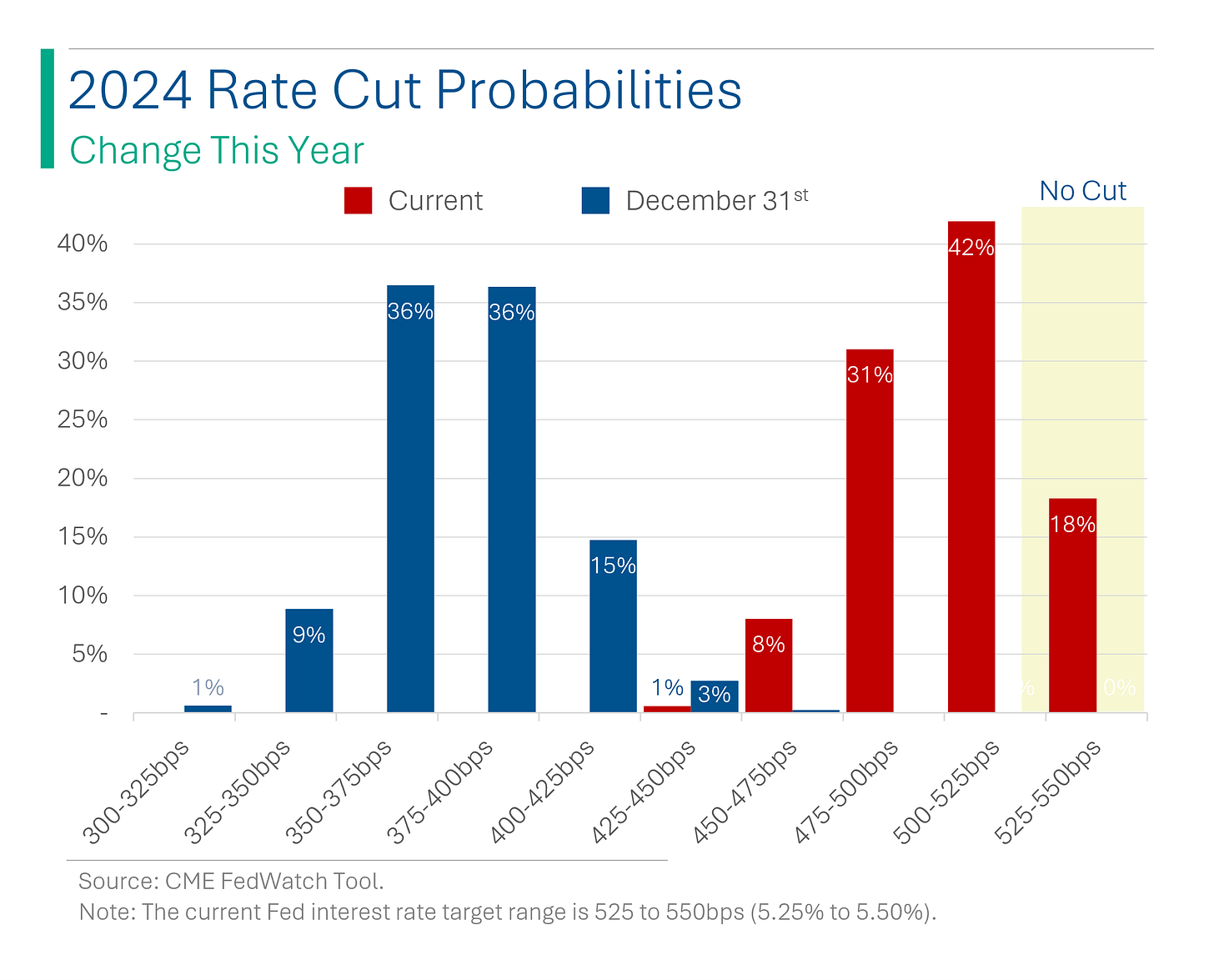

Fed Rate Cut Probabilities Sink Again

After cooling off in April, the market’s odds of interest rates cuts for 2024 have picked back up recently (as priced by interest rate the futures market).

Currently the odds of no rates cuts this year reached 18%, while the odds of only one cuts reached a new high at 42%.

This continues the trend this year of lowered expectations for Fed action. As recently as December, the market was pricing in around 7 to 8 interest rate cuts. Currently, it’s looking like only 1 to 2.

Joke Of The Day

Why does Snoop Dogg use an umbrella? Fo drizzle.

What kind of pants do Mario and Luigi wear? Denim-denim-denim

Hot Headlines

Washington Post / Uvalde parents sue gunmaker Daniel Defense, Call of Duty manufacturer Activision and Meta. The lawsuits may be the first of their kind to connect aggressive firearms marketing tactics on social media and gaming platforms to the actions of a mass shooter.

Reuters / Dell hits record high amid rally in AI stocks. Shares popped. Dell shares rose 6% to $162.82 after paring some gains in the afternoon and were on track to add $6.6 billion to its market value. The stock, which has more than doubled year to date, ended in the green in the previous three sessions.

Barron’s / SpaceX is soaring while Boeing’s Starliner struggles. As SpaceX’s private market valuation approaches $200b ($50 more than Boeing’s), Boeing has continued to delay or cancel manned space flights. Boeing and its partner Lockheed were given the Nasa contracts in 2014 at the same time as SpaceX, which has been sending astronauts into space since May 2020.

Boeing gunna Boeing.

CNBC / Palm Beach housekeepers are making $150,000 a year due to massive demand from the wealthy. In other news, I’m moving to Palm Beach.

Reuters / Saudi sovereign wealth fund to reorganize management amidst budget crunch, sources say. ‘Reorganize’ is arabic for ‘we set money on fire for the last decade and now should probably stop’.

ESPN / NCAA, Power 5 agree to deal that will let schools pay players. The NCAA will pay more than $2.7 billion in damages over 10 years to past and current athletes, sources told ESPN. The parties also have agreed to a revenue-sharing plan allowing each school to share up to roughly $20 million per year with its athletes.

In other news, tuition is going up by 10% next year.

WSJ / Apple says these are the 100 Best Albums of all-time. For the past year, a team inside Apple worked on the project.

No Radiohead, Clash or Wu-Tang until the 30s? I call bs.

Trivia

Today’s trivia is on the Roman Empire.

What good was so heavily valued by the Romans that Diocletian's Edict on Maximum Prices of 301 AD fixed the price of one kilo of it at 4,000 gold coins?

a) Silk

b) Wine

c) Amber

d) DiamondThe collapse of the Roman currency is often attributed to?

a) Decrease in military conquests

b) Over-reliance on slave labor

c) Debasement of coins

d) Increased trade with the EastAround what year did the Roman Empire reach its maximum territorial extent, influencing its economic power?

a) 117 AD

b) 306 AD

c) 44 BC

d) 476 ADWhat was a primary source of wealth in the Roman province of Hispania?

a) Spices

b) Silver mines

c) Wine production

d) Silk trading

(answers at bottom)

Market Movers

Winners!

Deckers Outdoor (DECK) [+14.2%] FQ4 EPS and revenue beat with strong margins; FY25 guidance largely in line; analysts positive on cash position, balance sheet, and accelerating growth with Hoka performance up 34% y/y.

Magnite (MGNI) [+13.6%] Upgraded to buy from neutral at Bank of America; increasing confidence around industry shift to CTV advertising; Netflix programmatic partnership suggests it leads in CTV programmatic platforms.

Guardant Health (GH) [+13.4%] FDA's Advisory Committee voted that benefits of Shield blood test for colorectal cancer outweighed risks; analysts see a high chance of approval despite some risks.

Ross Stores (ROST) [+7.8%] Q1 EPS and revenue beat, but comps light; raised FY25 EPS guidance, reaffirmed comps; management noted inflation pressures, but analysts highlighted value offering and margin tailwinds from lower freight and buying costs.

Losers!

Workday (WDAY) [-15.3%] Q1 revenue and EPS beat, but billings growth and 12-month subscription backlog missed; focus on lowered FY25 subscription guidance; noted heightened deal scrutiny, fewer large deals, and lower customer headcount.

Lions Gate Entertainment (LGF.A) [-9.8%] FQ4 earnings better with revenue largely in line; Television segment strong on library sales and post-strike content deliveries; Motion Picture and Media Networks results below consensus, with some analyst disappointment in STARZ.

Intuit (INTU) [-8.3%] FQ3 earnings, revenue, and OM better; slight raise to FY guidance ranges, but next-Q EPS guide below the Street; analysts noted in-line TurboTax results underwhelmed vs elevated expectations; commentary on expected decline in TurboTax share of IRS returns.

Market Update

Trivia Answers

a) Silk was so valuable to the Roman elite that Diocletian fixed the price at $4,000 gold coins to guarantee price stability and supply.

c) Debasement of coins is considered the leading cause of the devaluing of Roman coinage.

a) The Empire reached its territorial zenith in 117 AD under Trajan.

b) Hispania had Silver mines.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.