🔬Explainer: How Bad Is The Housing Market?

Plus: Inflation picks up because (spoiler) housing is bad; India's equity options outpace the world; Boeing continues to be terrible; and much more.

"I am a great believer in luck, and I find the harder I work the more I have of it"

- Thomas Jefferson

"If you can count your money, you're not a billionaire"

- J. Paul Getty

The big US markets had a strong day with the S&P 500 +1.1% and Nasdaq +1.54%.

7 of 11 sectors closed in the green, led by a huge day in Tech (+2.5%). Utilities (-1.0%) finished worst (for like the hundredth time this year).

Today gave us more reminders of why Boeing sucks, as the FAA announced a scathing audit of its 737 Max production facilities (more below). Moreover, Southwest tanked -14.9% after announcing capacity cuts linked to delayed Boeing deliveries.

Oracle popped 11.8% on solid Q3 results and Cloud momentum.

Street Stories

Putting The House In Order

The US housing market hasn’t been talked about much now that the worry of a collapse driven by economic woes and high interest rates has tapered off due to rate cut expectations and a surprisingly resilient US consumer. That said, I thought it would be helpful review some of the moving parts in the US housing market to see where we stand.

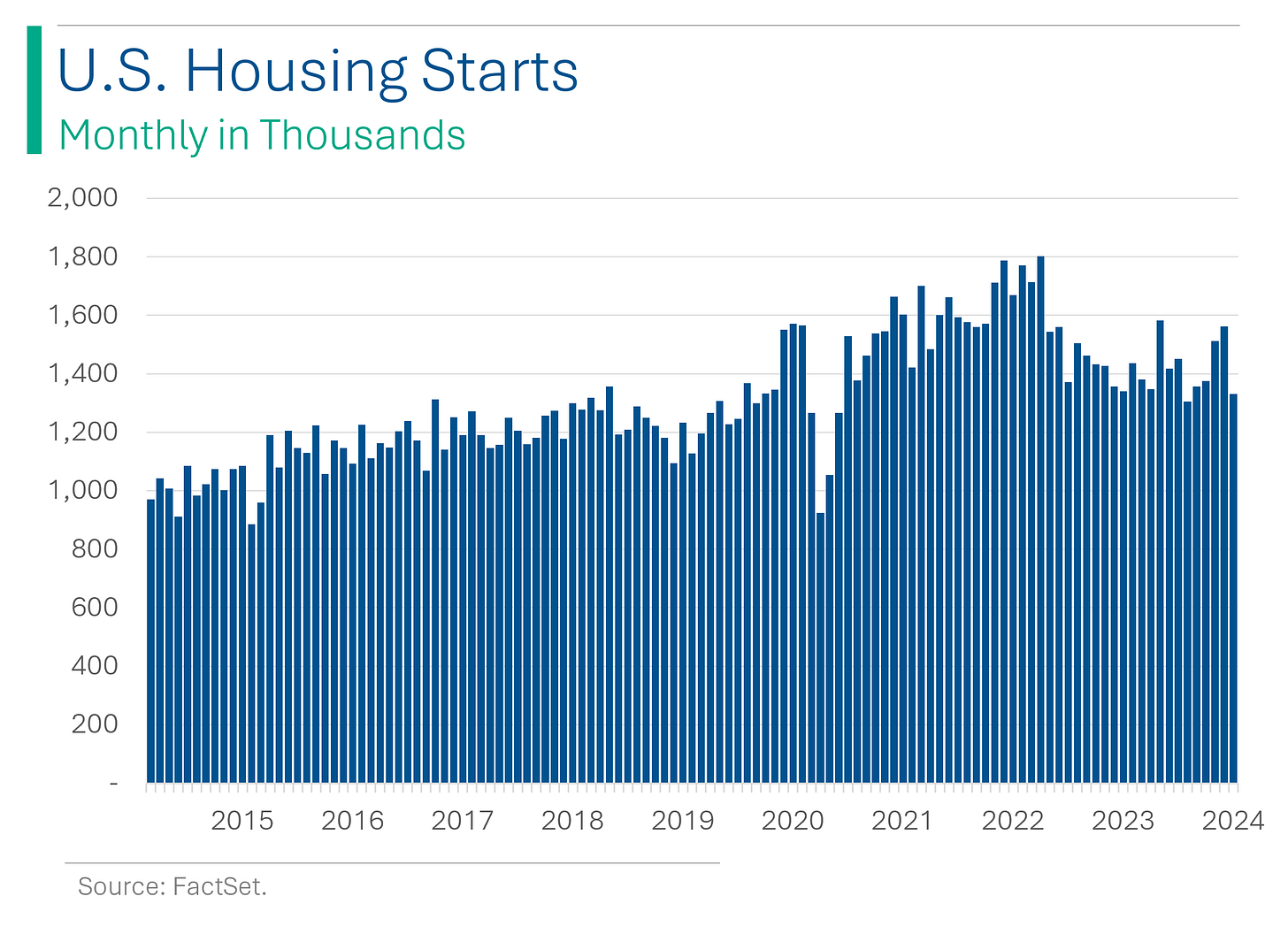

To start, houses under construction remain near the all-time highs reached in 2022. However, supply has remained depressed so current levels haven’t been enough to satisfy demand. High interest rates have also helped to slow builder development but not anywhere near as bad as some feared. Builders gunna build.

On a more granular level, you can see that housing starts were quite elevated in the later stages of the pandemic but that, while still elevated, current starts are noticeably below 2021 and 2022 levels before interest rates started rising.

Mortgage rates are down about 1% since peaking in October at around 8%. However, further declines have stalled as the Fed pushed its ‘the economy is fine so we are in no rush to ease’ narrative, and hopes of early-2024 rates cuts evaporated.

The impact of high interest rates can probably be seen most in the home sales data. Existing home sales are well below their 10-year average, whereas new homes are slightly above it. Basically there is a bit of a seller strike at the moment*.

*By ‘seller strike’ I’m implying that some current home owners are more inclined to wait for lower interest rates in order to sell their home since, even though prices are high, many would require a mortgage on their new property at a higher expected interest rate.

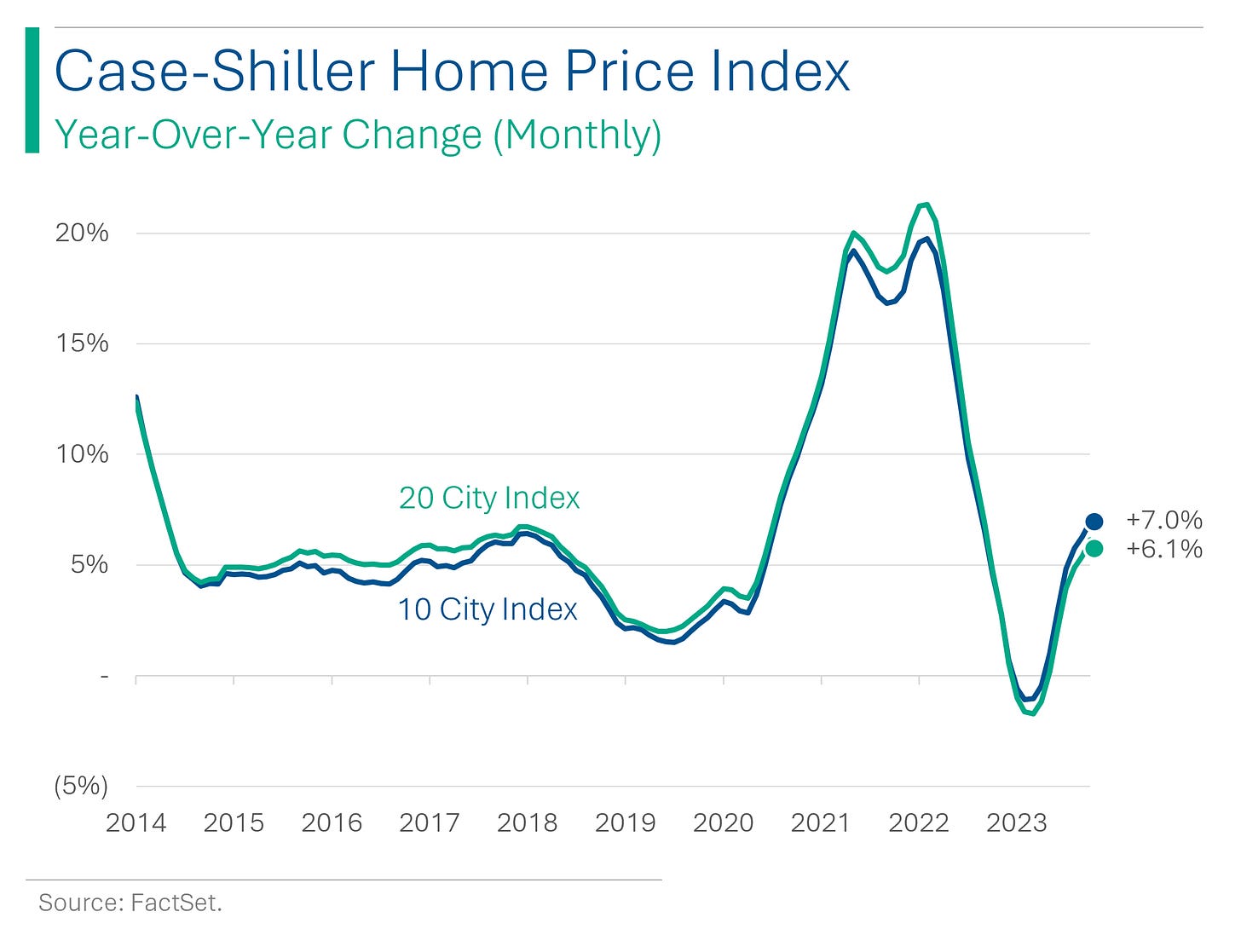

Lastly, prices for homes have continued to pick up after turning negative briefly last year. It goes to show how desperate US cities are for additional housing that even at multi-decade high mortgage rates, prices are still rising so quickly.

While far from ideal, the US housing market does generally appear to be on sound footing (or at least the doomsday scenarios appear off the table now). With some luck, we will see a soft landing here too. They just gotta build faster.

Inflation's Sticky Situation: Gas and Rent Refuse to Chill

The U.S. Consumer Price Index (CPI) rose by +0.4% in February, driven largely by increased costs in gasoline and shelter. This sparked worries of persistent inflation that might postpone a predicted Federal Reserve rate cut in June. Over the past 12 months, the consumer price index (CPI) saw a 3.2% rise, a slowdown from a peak of 9.1% in June 2022, though recent months have shown stalled progress towards the Fed’s target 2% rate.

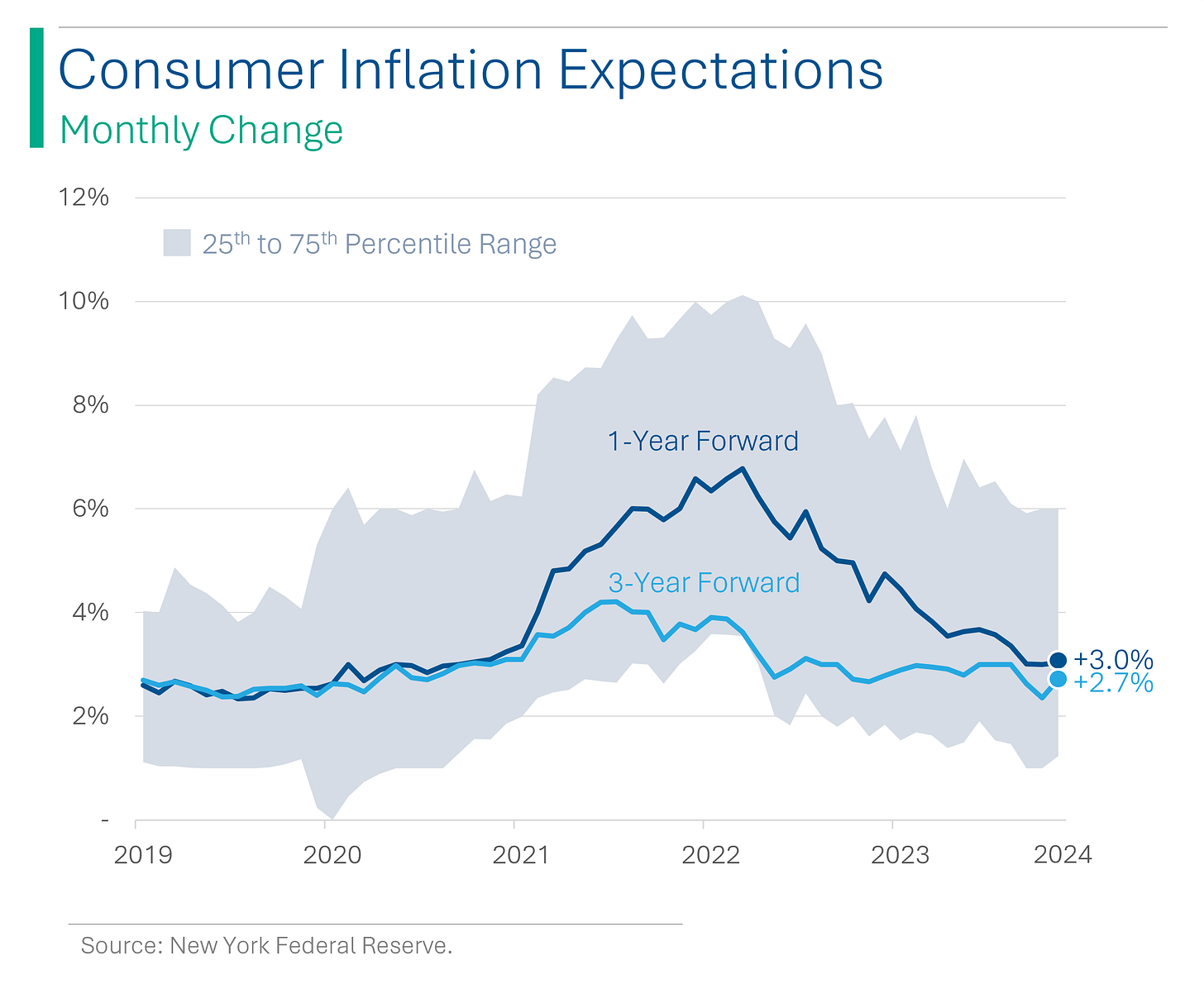

Adding to the issue of sticky inflation is the idea that consumer inflation expectations don’t see inflation dropping into the ~2% target range anytime soon.

Stocks on Steroids: India's Equity Options Outpace the World

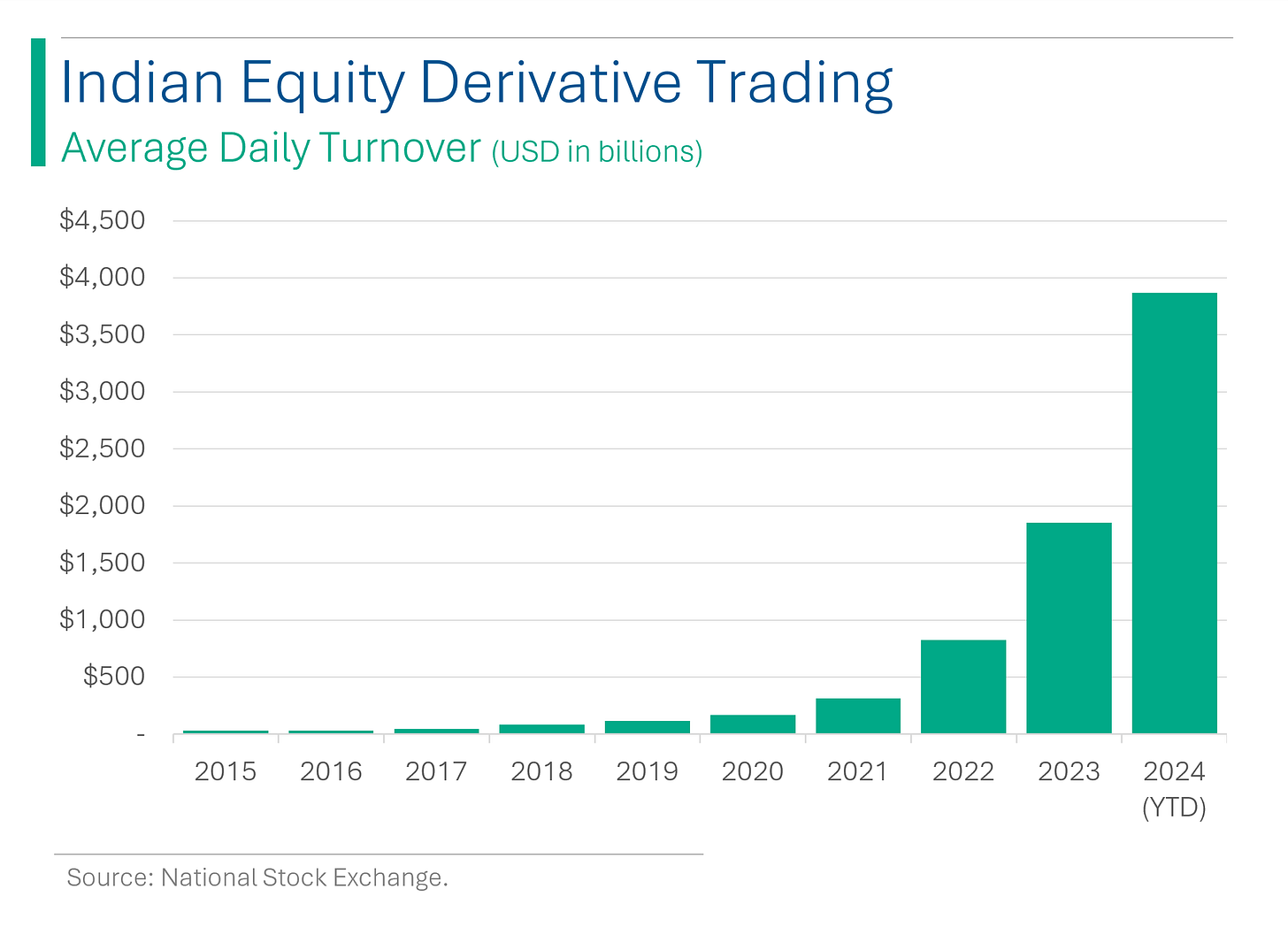

In India, stock index options trading has exploded to make the GameStop and bitcoin frenzies look like a quiet night in, claiming 78% of the global equity options market in 2023 with volumes that could make a casino blush. The trading craze, powered by mobile tech and FOMO, has turned brokerages and exchanges into the real winners, while nine out of 10 retail traders are basically donating their money, with the average loss matching the country's per capita income. (The WSJ did a nice deep-dive on this)

When Planes and Hotel Amenities Collide: Boeing's Unconventional Assembly Line

An FAA audit of Boeing's 737 Max production revealed numerous quality-control issues at Boeing and its key supplier, Spirit AeroSystems. The company failed 33 of 89 audits, as well as showing 97 instances of noncompliance - which sounds like a lot. The investigation, prompted by an incident where a door panel detached from a 737 Max during flight, exposed unconventional practices like using a hotel key card and Dawn soap in assembly processes.

Joke Of The Day

I told my female colleague that she drew her eyebrows too high. She seemed surprised.

Hot Headlines

ABC / Iran, Russia and China will show off their marine capabilities in a joint naval drill. More than 20 ships, support vessels and combat boats from the three countries, as well as naval helicopters, are involved in the exercise in the Gulf of Oman. Sounds like a fun club to be apart of…

CNBC / Gold’s recent run is one for the history books and has gotten out of hand, Barclays says. Shiny little all-time high machine.

Reuters / Icahn drops threat to challenge Illumina’s board to oust more members. He got a board seat last year after a proxy fight but wants more after the company’s lost three quarters of its market value and went through with the controversial $7.1 billion deal for blood test maker Grail.

Reuters / US to send new weapons package worth $300 million for Ukraine. President Biden announced the move on Tuesday, the first such move in months as additional funds for Kyiv remain blocked by Republican leaders in Congress.

CBS News / Boeing whistleblower John Barnett found dead in South Carolina. Family said he took his own life following PTSD and anxiety that came as a result of his experience with Boeing. Absolutely tragic.

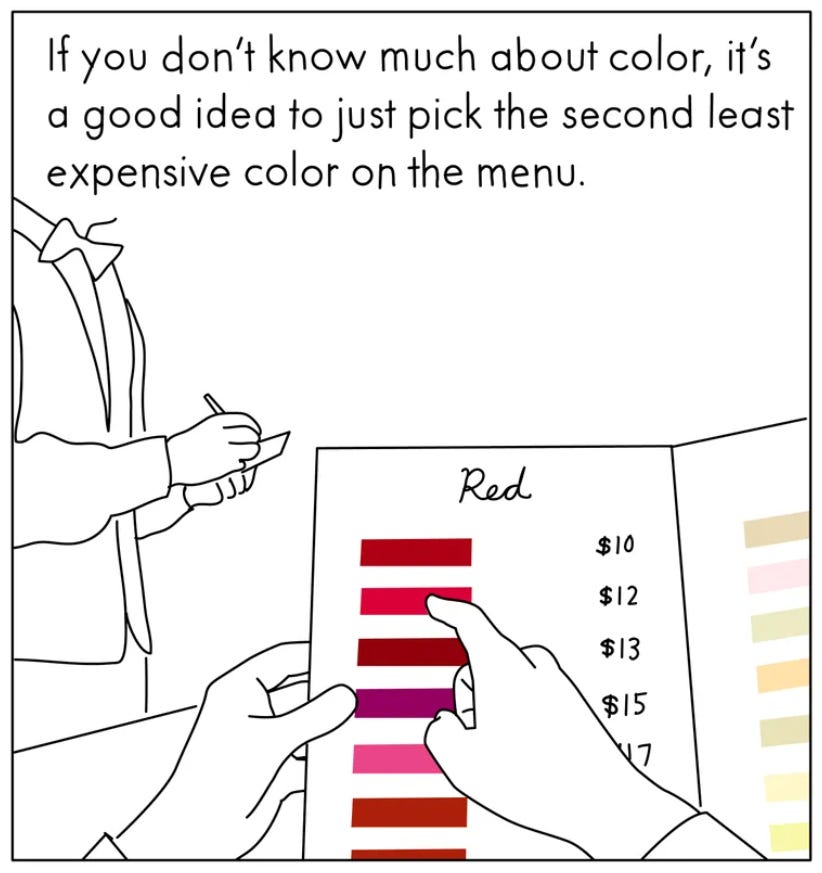

The New Yorker / The New Yorker’s humor team explain color theory.

Trivia

This week’s trivia is on Goldman Sachs, the ‘Vampire Squid’ of Wall Street.

Fun Fact: Vampire Squid only eat sea detritus. The name comes from the black color some exhibit as well as the webbing in between their tentacles which looks like a cloak. Also, they aren’t squid.

Which U.S. Secretary of the Treasury was a former CEO of Goldman Sachs?

A) Steven Mnuchin

B) Timothy Geithner

C) Henry Paulson

D) Robert Rubin

When was Goldman Sachs founded?

A) 1859

B) 1869

C) 1929

D) 1959

In 2023 Goldman had net revenue (including net interest revenue) of how much?

A) $109 billion

B) $27 billion

C) $61 billion

D) $46 billionGoldman agreed to pay $3.9 billion to settle a major scandal related to which country's sovereign wealth fund?

A) Qatar (QIA)

B) Norway (Norges)

C) Malaysia (1MDB)

D) Saudi Arabia (PIF)

(answers at bottom)

Market Movers

Winners!

Oracle (ORCL) [+11.8%] Fiscal Q3 revenue met expectations with EPS slightly above. Highlights include a record $80B total RPO, up 29% year-over-year, driven by significant new OCI deals. Oracle anticipates more large deals ahead.

New York Community Bancorp (NYCB) [+5.9%] Completed a $1.05B investment from multiple investors, resulting in a 39.6% ownership. Plans for a 1-3 reverse stock split are underway.

3M (MMM) [+5%] Appoints former LHX Chairman and CEO as its new CEO effective May 1, 2024, taking over from Michael Roman.

Archer-Daniels-Midland (ADM) [+3.9%] Finished its intersegment transactions investigation, confirming no impact on financial statements. Announced a $2B buyback increase; Q4 EPS was light, with FY EPS guidance just below the midpoint but in line with consensus.

Losers!

Southwest Airlines (LUV) [-14.9%] Announces 2024 capacity cut, especially in 2H, due to fewer Boeing 737 MAX deliveries. Anticipates Q1 net loss but expects profitability in March after efficiency drives.

Asana, Inc. (ASAN) [-12.7%] Q4 EPS and revenue exceeded expectations, but Q1 and FY24 forecasts slightly miss. Facing tech sector headwinds, yet customer upgrades increase due to AI demand. Aims for FCF positive by end of 2024, despite disappointing margins.

On Holding (ONON) [-8.9%] Q4 revenue falls short with significant FX challenges. Q1 and FY24 revenue forecasts below expectations, yet positive notes on EBITDA, full-price sales, and margin improvement.

American Airlines Group (AAL) [-4.7%] Sets Q1 EPS at lower end of the range, with reaffirmed FY24 outlook.

Boeing (BA) [-4.3%] The New York Times reports failure in 33 out of 89 FAA product audits, with 97 noncompliance instances for Boeing 737 Max production.

Market Update

Trivia Answers

C) Henry Paulson was CEO of Goldman Sachs.

B) Goldman was founded in 1869.

D) 2023 revs were $46 billion.

C) Malaysia (1MDB). Read ‘Billion Dollar Whale’ or watch the Netflix doc, it’s pretty wild.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.