🔬Explainer: Crypto Companies Pt. II - Are These Real Businesses?

Plus: Reddit tanks on short report; GameStop tanks on earnings; and much more.

“The illusion that we understand the past fosters overconfidence in our ability to predict the future”

- Daniel Kahneman, Thinking, Fast and Slow

“Weaseling out of things is important to learn; it’s what separates us from the animals… except the weasel”

- Homer J. Simpson

Strong day for the big US markets (S&P 500 +0.9%; Nasdaq +0.5%) as we cruise towards Easter with another slow news day.

All 11 sectors closed higher (rarity) led by Utilities (+2.8%) and Real Estate (+2.4%). Techy Communication Services and actual Tech were at the bottom (both +0.1%).

Reddit tanked 11% on a short report by Hedgeye and GameStop went into freefall (-15%) after a weak earnings report. More below.

Famed psychologist and behavioral economist Daniel Kahneman passed away at 90 yesterday. If you haven’t read his book Thinking, Fast and Slow or the Michael Lewis book The Undoing Project, about Kahneman’s work and collaboration with Amos Tversky, you should check them out. Some of my favorites. RIP.

Street Stories

Crypto Companies Part II: Are They Actual Companies?

This is a follow-up to yesterday’s write-up, where I looked at the market caps and share performance of the biggest crypto companies out there. Today I dig into the financials to see if they are actually half decent businesses, or just milking the crypto euphoria. Spoiler: Some of them. Kinda…

To start off, Coinbase is a real company. Unless they go ahead and pull an FTX or Binance, they seem in good shape to continue on as the leading crypto exchange around. The Street has a positive outlook on revenue growth and they have had positive earnings in 3 of the last 4 years.

That said, they may not be the greatest investment opportunity unless you have some bullish views on the future volume of crypto trading and their ability to maintain significant market share. At nearly 3x the P/E multiple of Nvidia, the valuation is definitely punchy.

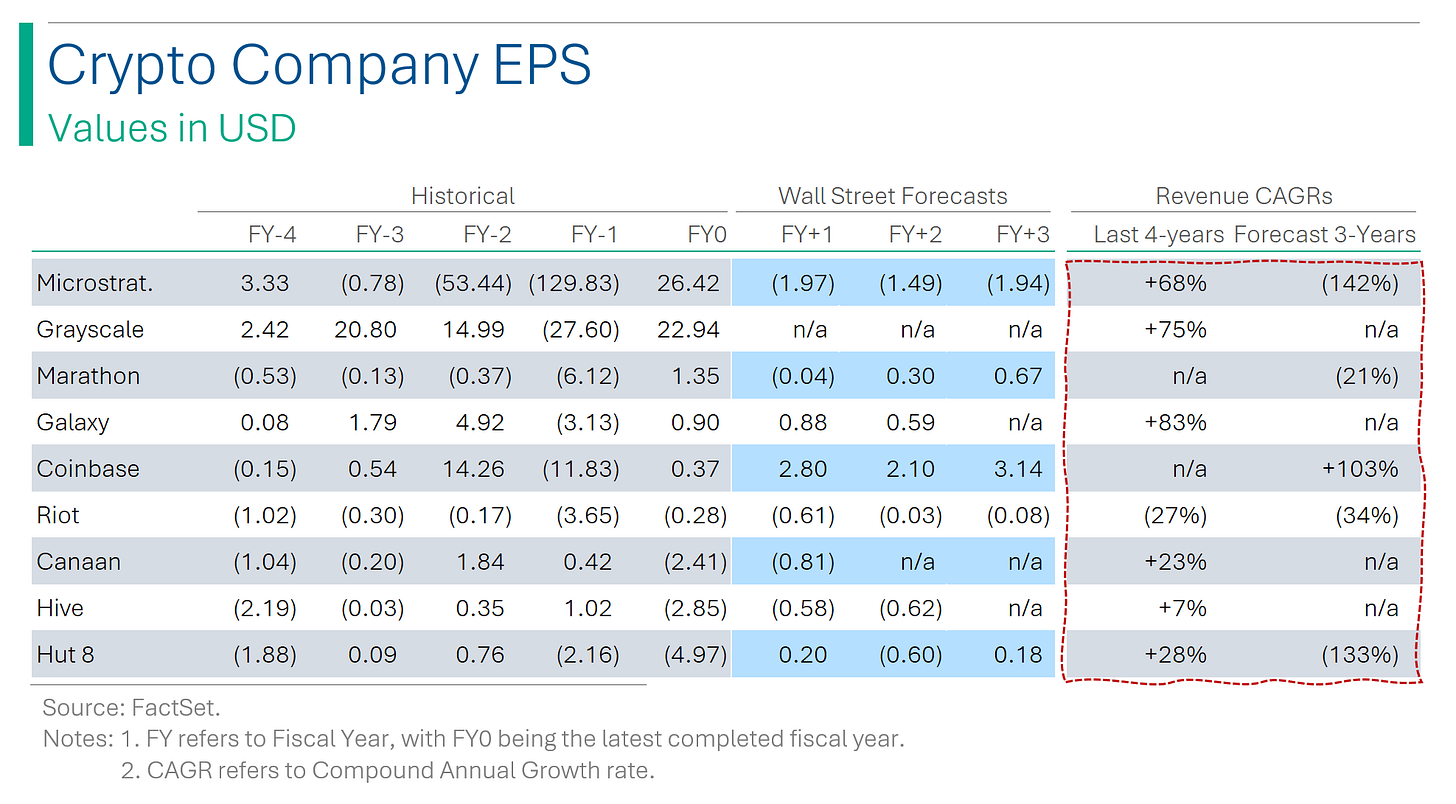

Since you probably don’t want me to make 8 more charts like the above, this table summarizes the historical and forecasts revenue growth for the big crypto players. As you can see, with the exception of Canaan (Chinese crypto hardware maker) and Microstrategy (random software company that buys crypto), generally the revenue growth been pretty strong over the last 4 years. Albeit, often quite bumpy.

On the earnings front, it’s a bit more of a dog’s dinner: Out of the big 4 crypto mining companies (Marathon, Riot, Hive, and Hut 8), only one of them had positive earnings per share in their latest fiscal year. For Hut 8 and Hive, who haven’t yet reported their FY2023, part of that is that the latest figure is from 2022 which saw declining crypto prices, and since they hold an inventory of coins, this may be marked-to-market downward. But even considering that, they are still not particularly profitable in the actual ‘mining’ of crypto. For example, in their latest 9 months (Q3), Hut 8 reported revenue of $55.2m vs. a cost of revenue of $70.5m. Ie: they don’t mine particularly well.

Microstrategy - the mediocre software company moonlighting as a Bitcoin bank - has the most entertaining earnings, with EPS going from +$3.33 in 2019, to -$129.83 in 2022, to +$26.42 last year. It’s a mess.

Anyway, I won’t get into the weeds here but there is some ‘fun’ accounting going on. Essentially, their operating loss over the past two years almost perfectly matches up with what they’ve claimed to be the impairment associated with their Bitcoin purchases. How they listed a Bitcoin impairment in 2023 when the crypto was up +100% is beyond the scope of this course.

Finally we get to valuation. Now since most of the companies have negative (or sketchy) earnings forecast for next year, comparing them on P/E doesn’t really make sense. The best proxy might be to look at Price to Sales (Market Cap to Sales in this case), in which case you can see that there are some hefty premiums built into these crypto companies. The loss making miners trade at multiple well ahead of the S&P 500, but they have crypto inventories which add to their value so it’s a but unfair.

Microstrategy again stands out here as having a ridiculous multiple (64x) but again doesn’t account for the fact that the company has a big pile of Bitcoin. Specifically, they have 214,246 as of this writing, which is valued at $14.9 billion.

It’s actually brilliant in a way, since the software side looks to be essentially little more than a break-even business at the best of times. If you’re business might end up going bankrupt, why not take advantage of the huge premium your company trades at by issuing more shares (or in their case, convertible debt) and cramming it into Bitcoin? Basically this business - which would probably be worth less than one or two billion on its own - now has a crypto pile worth more than Fox and MGM. Definitely one of the crazier things I’ve seen in the stock market.

GameStonk Misses Again

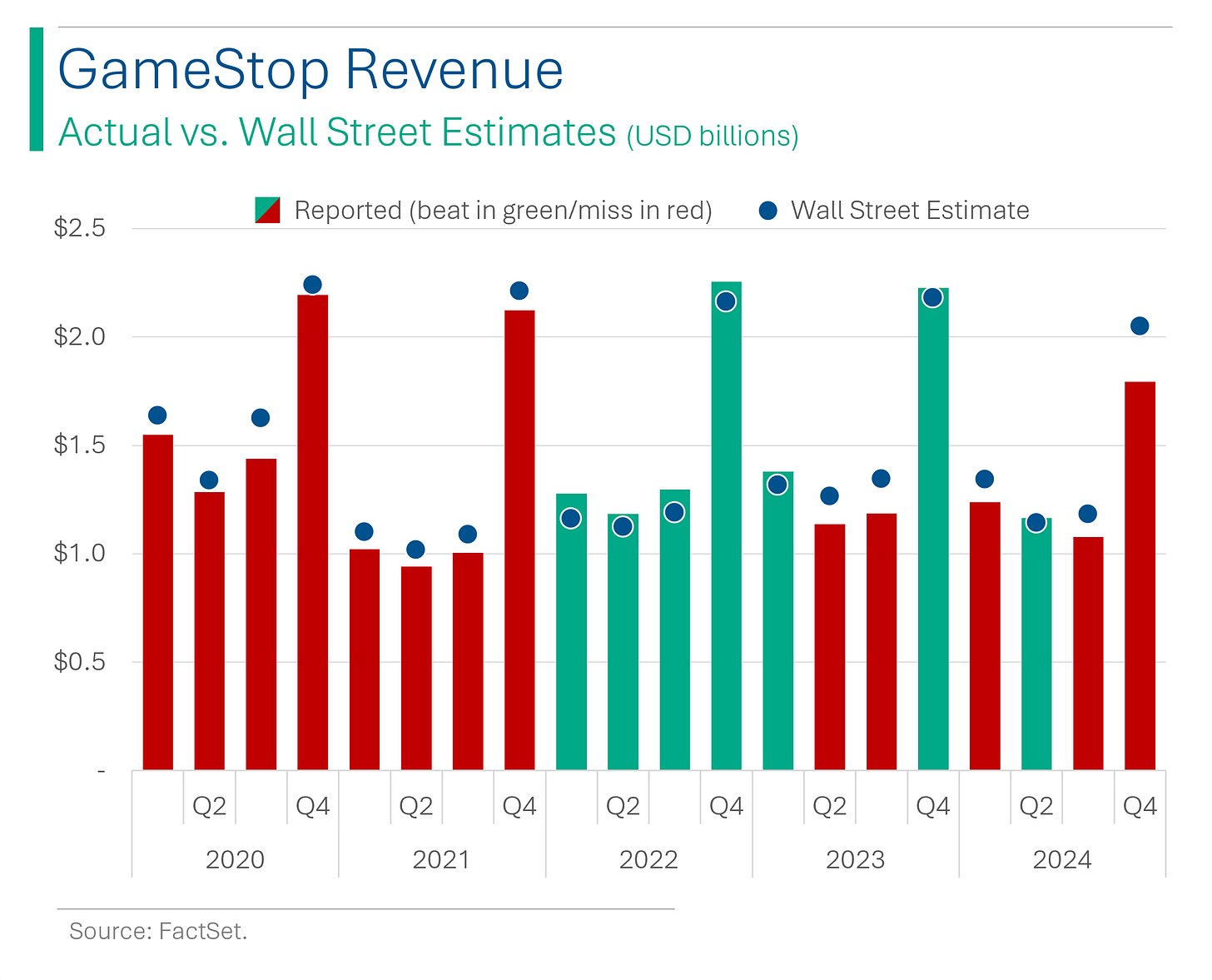

Everyone’s favorite meme stock had another rough day after (another) miss on earnings:

- Revenue: $1.79 billion vs. Wall Street consensus estimate for $2.05 [13% miss]

- EPS: $0.22 vs. Street’s $0.30 [27% miss]

The company hasn’t exactly reported well…

They’ve missed on revs 65% of the time over the last 5 years by an average of 3.2%.

And EPS hasn’t been any better, missing 60% of the time by a whopping 62.6% average*.

*Excludes Q1 2020 and Q3 2024 where estimates where distortive by being close to zero.

This isn’t meant to be a ‘stock picking’ newsletter but a good tip might be not to own GME on reporting days, because the company has averaged declines of 6.1%.

Shorts Targeting Reddit

Reddit plunged 11.3% yesterday plus another 6.6% in after hours trading following a Hedgeye short report that sees the shares potentially dropping more than 50%. Short interest in Reddit is already at least 7.1% of the company’s free float, which is apparently pretty huge for a newly listed company.

However, shares are still up pretty big since IPO but the valuation is quite rich. For example, I posted the below - to Reddit of all places - on Friday, highlighting that Wall Street’s sales growth estimates for Reddit are much lower than Nvidia’s but the company trades at a material premium. Since I wrote that, Reddit’s shares are +16.9% higher. 😕

Joke Of The Day

If you can’t convince them, confuse them.

Efficiency is a highly developed form of laziness.

Hot Headlines

CNBC / Amazon spends $2.75 billion on AI startup Anthropic in its largest venture investment yet. This adds to its initial $1.25 billion check in the company.

Bloomberg / Study finds that Novo Nordisk’s blockbuster diabetes drug Ozempic can be made for less than $5 a month vs. $1k sticker price. The active ingredient in Ozempic was reported to cost only 7 cents a dose. Good time to point out that 28% of Novo Nordisk shares (and 77% of voting rights) is controlled by the Novo Nordisk Foundation - a charity.

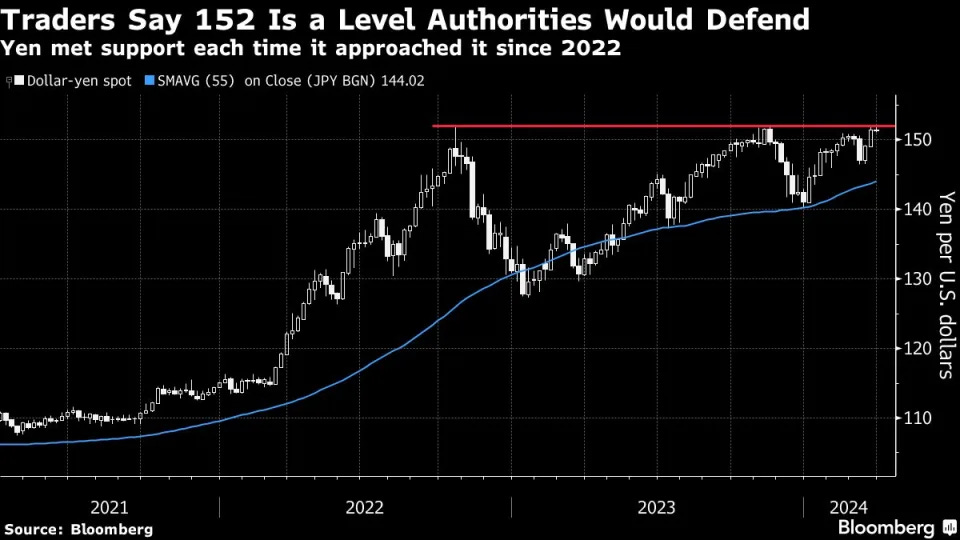

Yahoo Finance / Japanese Yen slides to 34-year low. Japanese officials issued their latest round of warnings that they will intervene in the currency market if this weakness persists.

Reuters / Fast-food companies seeing low-income diners cut spending due to increased prices. Roughly a quarter of low-income consumers, defined as those making less than $50,000 a year, said they were eating less fast food and about half said they were making fewer trips to fast-casual and full-service dining establishments, according to polling.

Reuters / Oil prices fall on weak US gasoline demand causing growing stockpiles. U.S. crude oil stocks rose by 3.2 million barrels while gasoline stocks rose by 1.3 million barrels in the week ended March 22, according to data from the Energy Information Administration (EIA).

Trivia

Today’s trivia is on Apple.

What year was Apple founded?

A) 1971

B) 1976

C) 1981

D) 1986In what year did Apple become the first public company to be valued at over $1 trillion?

A) 2016

B) 2018

C) 2019

D) 2020Apple's "1984" commercial was directed by which famous director?

A) Steven Spielberg

B) James Cameron

C) Martin Scorsese

D) Ridley ScottHow many iPhones were sold in the first weekend after its launch in 2007?

A) 50k

B) 270k

C) 510k

D) 1.1 million

(answers at bottom)

Market Movers

Winners!

nCino (NCNO) [+19.0%]: Q4 earnings and operating margin beat, with subscription revenue showing strong growth. Q1 and FY EPS guidance above expectations; analysts highlight solid RPO, positive management outlook, and lower expected churn.

Cintas (CTAS) [+8.3%]: FQ3 EPS and revenue outperformed, with a notable gross margin improvement and reduced energy costs. FY24 EPS and revenue forecasts raised, benefiting from lower interest expenses.

Merck (MRK) [+5.0%]: Received FDA approval for Winrevair (sotatercept) for pulmonary arterial hypertension (PAH); the clean label and pricing strategy are expected to facilitate quick adoption.

Losers!

GameStop (GME) [-15.0%]: Missed Q4 EPS and revenue targets, announced job cuts due to e-commerce competition and lower consumer spending; hardware and software sales fell, with software down 31%.

Reddit (RDDT) [-11.3%]: Hedgeye called it a short idea, predicting a 50% downside.

Celsius Holdings (CELH) [-8.5%]: Amended its distribution deal with PepsiCo on 23-Mar, introducing an incentive program for their support of CELH products.

Coinbase (COIN) [-3.8%]: Must face an SEC lawsuit as per court ruling, accused of operating as an unregistered exchange.

Market Update

Trivia Answers

B) Apple was founded in 1976.

B) Apple became the first ‘trillion dollar company’ in 2018.

D) Ridley Scott directed the famous ‘1984’ commercial.

B) 270,000 iPhone’s were sold in its first weekend launch.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.