🔬Explainer: Apple's Fall From Grace – In Pictures!

Plus: TSMC gets massive subsidy for US chip plants; The market can't catch its 'breadth'; Spirit Airlines is probably going bankrupt; and much more.

"It's not your salary that makes you rich, it's your spending habits"

- Charles A. Jaffe

"I just want to lie on the beach and eat hot dogs. That's all I've ever wanted"

- Kevin Malone (The Office)

Little action on the big US markets (S&P 500 -0.04%, Nasdaq +0.03%) as it seems like investors are sitting on their hands until the Fed meeting and CPI print (both Wednesday).

5 of 11 sectors closed higher, led by Real Estate (+0.8%). Energy (-0.6%) was worst, giving some back from its big rally as of late.

Oil was down 0.6% after a popping +4.5% last week.

Not a whole heck of a lot going on…

Street Stories

Rotten Apple

On January 12th, 2024, Microsoft passed Apple to be the largest company in the world. Apple had held the title for years and so most of us assumed they’d be scrapping it out with Microsoft for the title again soon. That very much didn’t happen.

Apple has had a real fall from grace in 2024 and, along with Tesla, ruined that catchy ‘Mag7’ title we all liked throwing around last year. Shucks.

Apple’s supposed to be a perpetual share price growth machine. So what the hell happened? Well honestly, it’s not too complicated - they just stopped growing. As you can see below, the biggest contributor to Apple’s sales is the iPhone and revenue there has been pretty much flat for the past few years. The iPad, you say? That’s shrunk over the last two years. In fact, the whole of Apple’s ‘Product’ division has had zero percent revenue growth over the past two years. And that’s not accounting for inflation.

Watch sales have been the only bright spot, but that’s just 6% of revenue and after 10 years on the market we can’t expect that to all of a sudden become the backbone of a missing growth story.

What has been working is the Services division (App Store, Apple Music, Apple TV, etc.) but that’s not all sunshine either. The biggest chunk of that business is the App Store, which has basically been a lawsuit magnet for the past two years and there is real risk that profitability here takes a material hit over the anti-steering and payment restrictions. From Epic Games to Spotify to that little club called the European Union, Apple has been under attack by some serious foes - but the newly announced Department of Justice lawsuit last week could be a game changer.

The punchline is that the fabulous trend of earnings growth has petered out. Wall Street analysts see this picking back up but that’s definitely not a guarantee, given the lack of new products and risks to App Store profitability.

Moreover, Apple is about two years into a terrible trend of downgrades. Essentially every time they report they say or do something that makes Wall Street chop their sales estimates by 5%. I’m no ‘momentum trader’ but that trends doesn’t look like your friend.

And just in case that contrarian part of your brain clicked on with thoughts about a nice 'Value’ turn-around play: It’s not exactly a particularly cheap story either.

Anyway you slice it, Apple’s got some serious problems at its core.

Out of Breadth

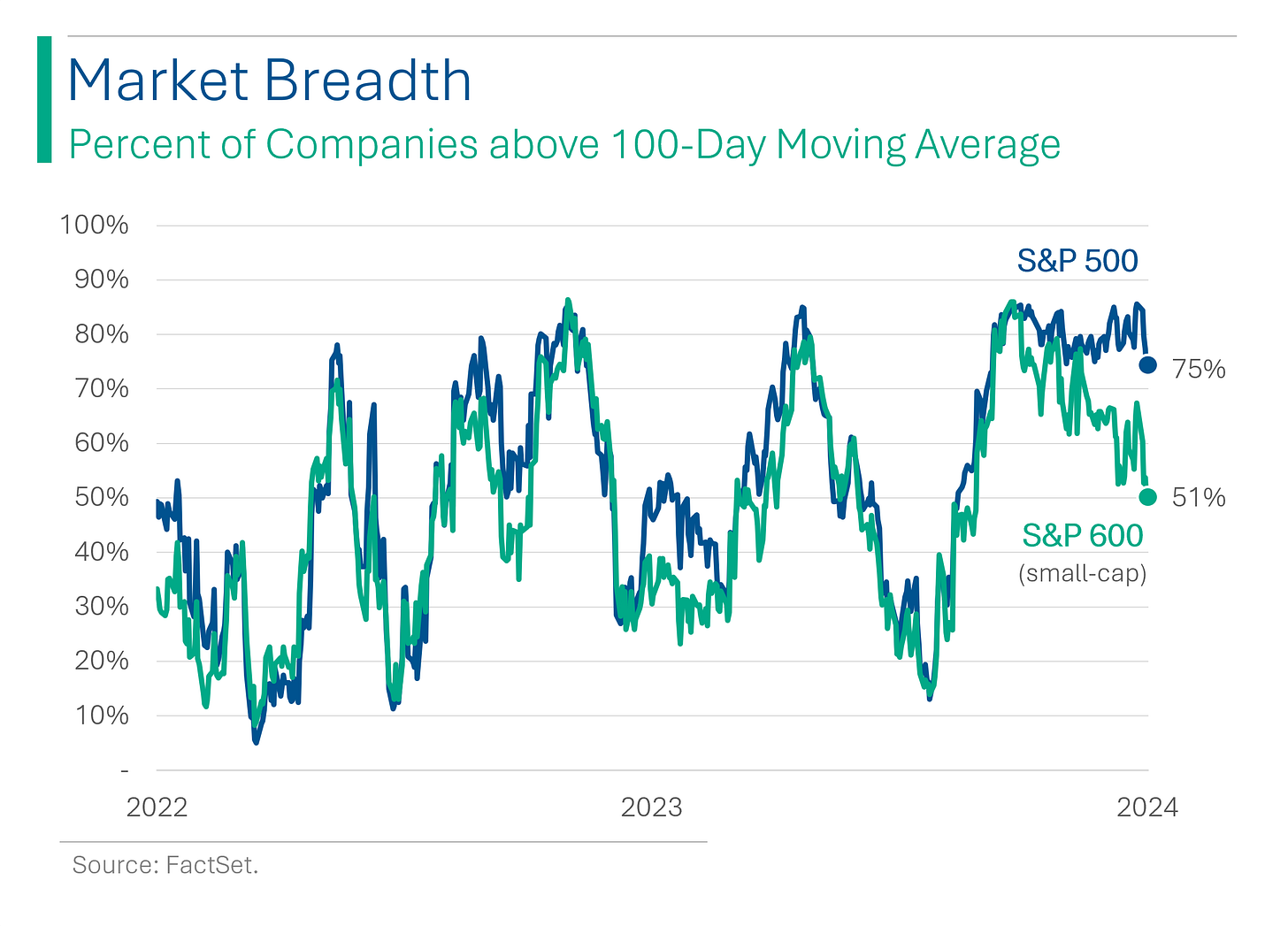

While the S&P 500 has continued to plow along nicely, there are some cracks apparent. One of which is that the breadth of the rally has started to come off of multi year highs. To me, this hints that there are fewer and fewer companies (in this case ‘quality growth’ ones) that are doing the heavy lifting.

To the extent you can look at the S&P Small-Cap Index as a canary in the coal mine - given their lower ‘quality’ status - things have started to turn quite dramatically.

I’m not nervous, you’re nervous. 😅

Silicon Desert: TSMC’s Billion-Dollar Bet on Arizona

Taiwan Semiconductor Manufacturing Co. (TSMC) is set to receive up to $6.6 billion in U.S. government funding under the 2022 Chips Act for a new semiconductor factory complex in Phoenix, Arizona, expanding the project to include a third factory and advanced 2-nanometer chip production (aka the top of the line).

The initiative represents the largest foreign direct investment in U.S. history, aimed at bolstering domestic chip manufacturing and addressing national security concerns tied to the global semiconductor supply chain. This expansion raises TSMC's total investment to over $65 billion, promising to create thousands of jobs and significantly enhance the U.S.'s capacity to produce cutting-edge semiconductor chips by 2030.

Spirit Scrambles to Stay Aloft

Spirit Airlines announced plans to defer deliveries of new Airbus planes in effort to bolster its liquidity by approximately $340 million over the next two years. The move, coupled with a decision to furlough about 260 pilots, comes as the airline navigates financial challenges exacerbated by the collapse of its acquisition by JetBlue Airways due to antitrust concerns.

Another case of regulators scuttling a deal that leads to bankruptcy? #RIPRiteAid

Joke Of The Day

You can’t believe everything you hear—but you can repeat it.

A man went into a seafood restaurant and asked for a lobster tail. The waitress smiled sweetly and said, “Once upon a time there was this handsome lobster…”

Hot Headlines

Reuters / Google's contemplated HubSpot megadeal would prompt new fight with regulators. The rumored +$34 billion deal for the marketing software firm would potentially shrink competition in the Ad space.

Visual Capitalist / Visualizing America’s shortage of affordable homes.

Reuters / Wells Fargo boosts end-2024 target on S&P 500 to Street-high of 5,535. The target represents around a +6.5% return from current levels.

CBS News / JPMorgan's Jamie Dimon sounds alarm about possible worst risks to U.S. since WWII. Article is based on his words in this annual predictions letter to shareholders, which was a pretty good read.

Yahoo Finance / The gold market hunts for answers behind bullion's sudden surge. Sticky inflation and geopolitics are top contenders but don’t tell the whole story, as they’ve been present for a while now.

Trivia

Today’s trivia is on Steve Jobs.

What year was Apple founded?

A) 1970

B) 1976

C) 1980

D) 1984After the departure of 3rd founder Ronald Wayne, what was the ownership split of Apple between Steve Jobs and Steve Wozniak?

A) 90/10

B) 65/35

C) 50/50

D) 20/80After a famous power struggle with CEO John Sculley, what year was Steve Jobs famously fired from Apple?

A) 1979

B) 1985

C) 1989

D) 1991What year did Steve return to Apple as CEO?

A) 1992

B) 1994

C) 1996

D) 1997

(answers at bottom)

Market Movers

Winners!

Apartment Income REIT (AIRC) [+22.4%] Blackstone confirms acquisition at $39.12/share cash, closing expected in Q3 2024.

Model N (MODN) [+10.0%] Going private via Vista Equity Partners at $30/share, ~11% premium to last Friday.

GE Vernova (GEV) [+5.9%] JP Morgan upgrades to overweight, citing valuation and potential in electrification markets.

Tesla (TSLA) [+4.9%] Elon Musk announces Robotaxi reveal on 8-Aug, countering reports of scrapping a low-cost model.

Losers!

Paramount Global (PARA) [-7.6%] Report on Skydance Media deal talks; Shari Redstone could get $2B+ cash, nonvoting shares to receive stock in merged entity.

Kroger (KR) [-3.4%] BNP Paribas downgrades to underperform, pointing to increased competition and margin pressures in the grocery sector.

Market Update

Trivia Answers

B) Apple was founded in 1976.

B) The split was 65% for Jobs and 35% for Woz. If you said 50/50 you don’t know anything about Steve Jobs as a person…

B) Jobs was fired in 1985.

D) Jobs returned in 1997.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.