🔬 Europe Sucks (its stock markets, that is)

Plus: Apple is bleeding market share in China; Bitcoin price action is getting hilarious; and much more.

"Buy on the cannons, sell on the trumpets"

- Old Wall Street saying

“The broker said the stock was "poised to move." Silly me, I thought he meant up”

- Randy Thurman

Bad day for the big US markets with the S&P 500 -1.0% and the Nasdaq -1.7%.

Only 3 of 11 sectors closed in the green Tuesday, with Energy (+0.7%) riding the recent oil strength, finishing tops. Info Tech (-2.2%) and Consumer Discretionary (-1.3%) had particularly bad days.

Bitcoin broke 2yr old all-time high…then dropped 10%.

Tesla (-3.9%) suspends German gigafactory after reported arson. While Stitch Fix (-21%) reported an objectively terrible quarter. CrowdStrike crushed it’s Q4 after market close Tuesday and is up ~21% pre-market.

ISM Services PMI came in a touch light (52.6 vs. Wall Street at 53.0) but still positive for 14th straight month.

Street Stories

Europe Kinda Sucks

Over the last 15 years, Europe has underperformed the US to a near comic degree. Zee Germans have been the most respectable, clocking in with a DAX return 59% that of the S&P 500, but for the rest it’s… kinda embarrassing. For example, the UK’s FTSE 100 is up 14% since I moved back to Toronto from London - THAT WAS 10 YEARS AGO.

The first thing that stands out is that Europe doesn’t really have companies anywhere near the same scale as in the US. There are a handful of mega-caps, such as Novo Nordisk ($580 billion) and LVMH ($460 billion), but generally they are much smaller. Like their cars. For example, Microsoft is bigger than the CAC 40 (40 largest French companies), the FTSE 100 (100 largest UK companies) and the DAX (40 largest German companies). Now it’s not a prerequisite that in order to have strong stock market performance, you need jumbo companies. But if you look below at the handful of US mega-caps, it’s pretty clear that those companies aren’t just big but have effective oligopolies in their respective industries. Very big industries, I should add.

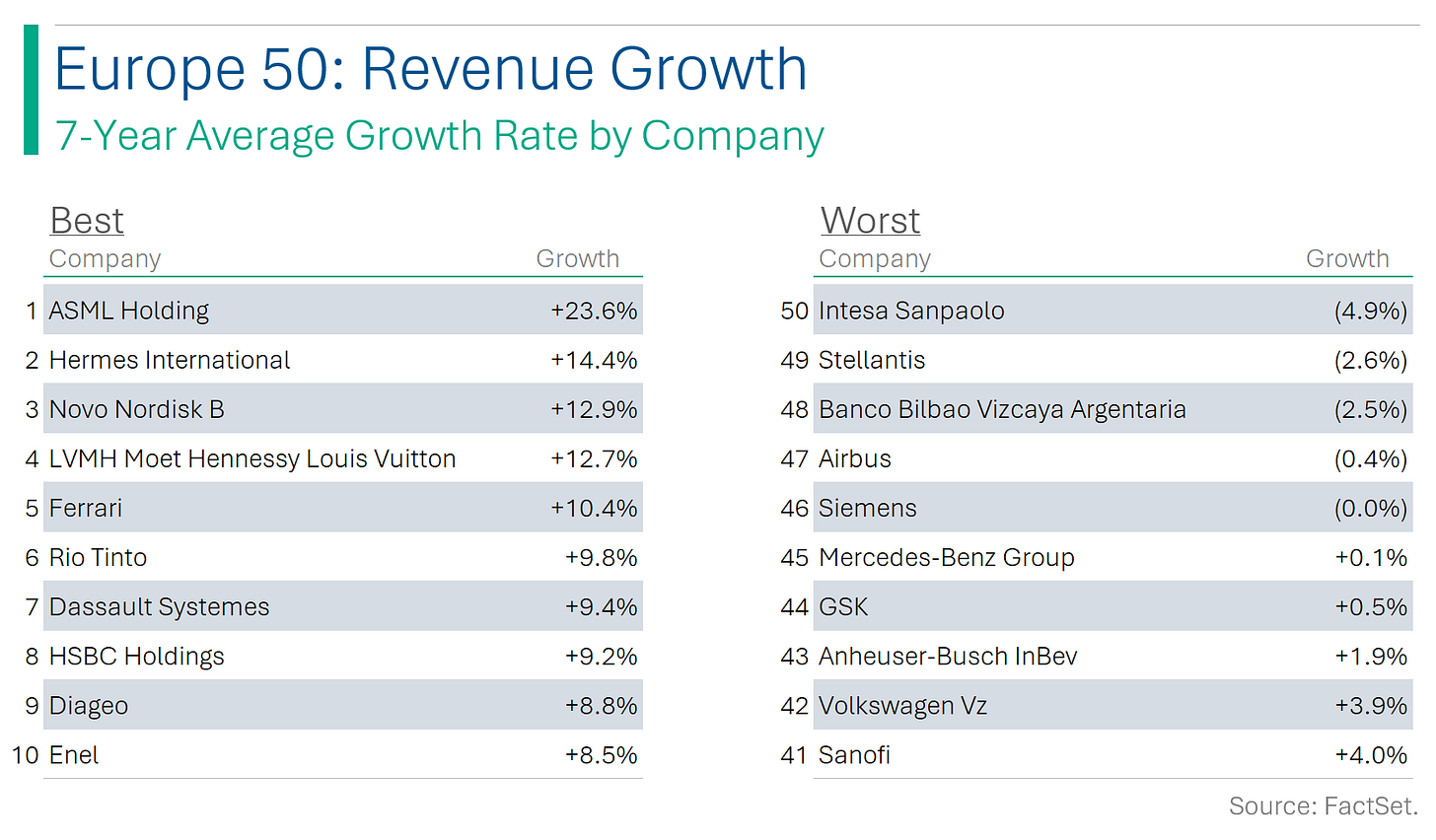

Beyond missing some important scale, European companies don’t seem to be growing anywhere near as fast as their American cousins. For example, I compiled a list of the largest 50 European companies to see how fast they have been growing revenue*. The result is that over the last seven years, these companies averaged revenue growth of ~6.5%.

*Technically I used Revenue Per Share to limit some of the distortionary effects of mergers and acquisitions.

While 6.5% revenue growth isn’t exactly paltry, if you do the same exercise for the US then you get an average revenue growth figure of ~11.5% - almost 80% higher.

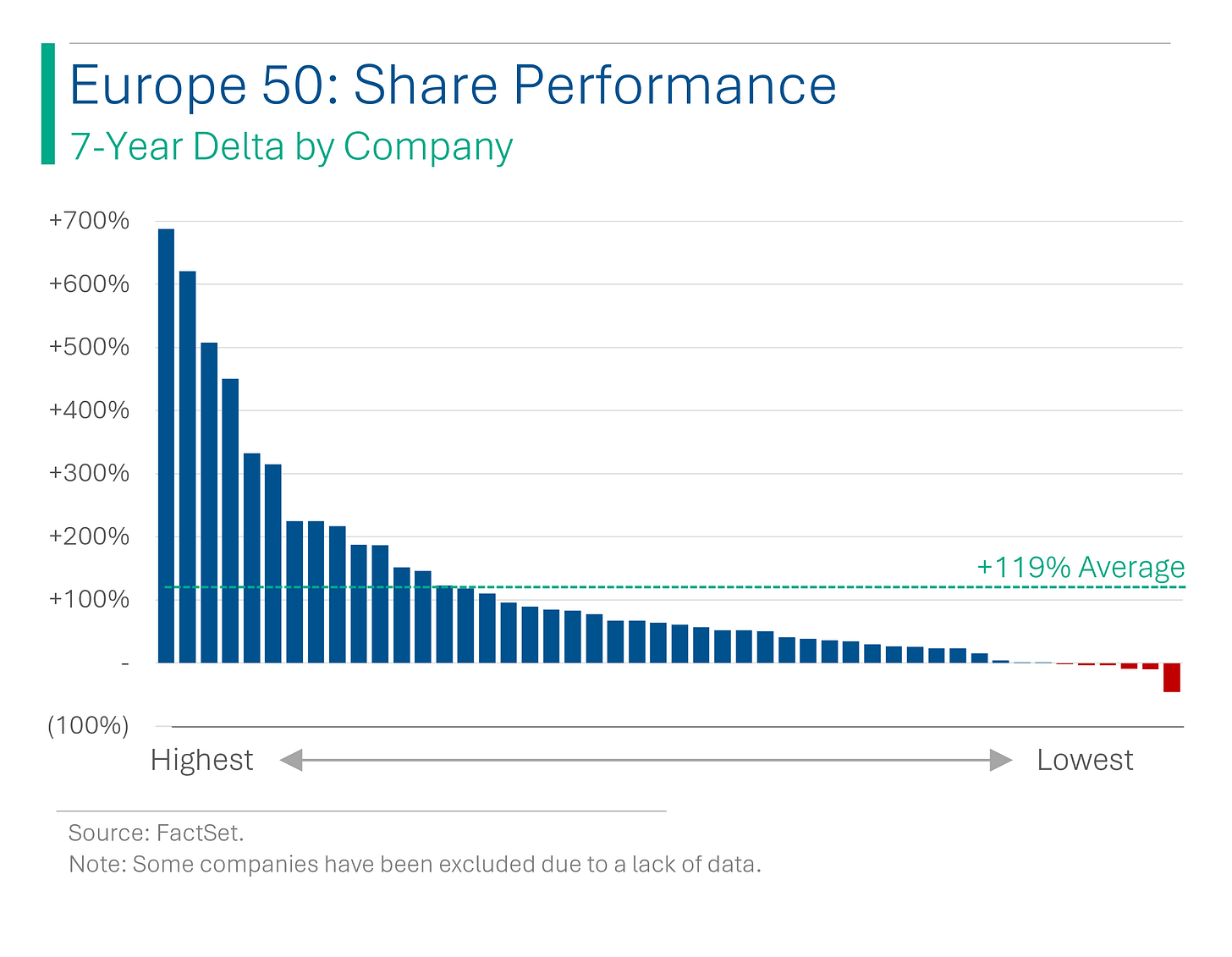

Taken all together, the biggest US companies (on average) tend to grow faster than their European peers, and more often enjoy the benefits of scale. To tie things back to the beginning, that list of the 50 biggest European companies has averaged about 119% growth in their share prices over the last seven years. A little more than a third of what their American peers have pulled out. ‘Merica!

iPlummet: Apple's Chinese Market Share Drops as Huawei Plays Catch Up

Apple's iPhone sales in China dropped 24% year-on-year in the first six weeks of 2024, with the company's market share falling to 15.7% amid intense competition from domestic brands like Huawei, which saw a 64% increase in sales. This downturn has contributed to Apple’s shares getting smacked 12% this year and comes amid concerns over slowing demand, especially as Apple's revenue forecast fell $6 billion short of Wall Street expectations. Ooof.

In response, Apple has initiated price subsidies on certain iPhone models through Alibaba’s Tmall and its official sites, offering discounts of up to 1,300 yuan ($180.68). There’s no hiding how important China has been to Apple’s growth story, and the company appears willing to fight for that market share.

Bitcoin’s Shakey All-Time High

After a run up of over 50% in the last month, Bitcoin finally broke its former all-time high it set back in November 2021 before the ‘Crypto Winter’ (I feel a little douchey every time I write that). Bitcoin started the day about 2.3% shy of its $68,991 target but rose to a high of ~$69,200 a little after breakfast time here in EST. Did it hold the high? Of course not. Bitcoin pulled a Bitcoin and proceeded to flop down 10% to wrap up civilized trading hours at ~$62,200. Cowabunga.🙏🕊️🧐

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

I made a FORTUNE in the stock market. I walked in and stole some guy's Rolex.

Why was Dr. Dre kicked out of the farmer's market? He kept dropping beets.

Hot Headlines

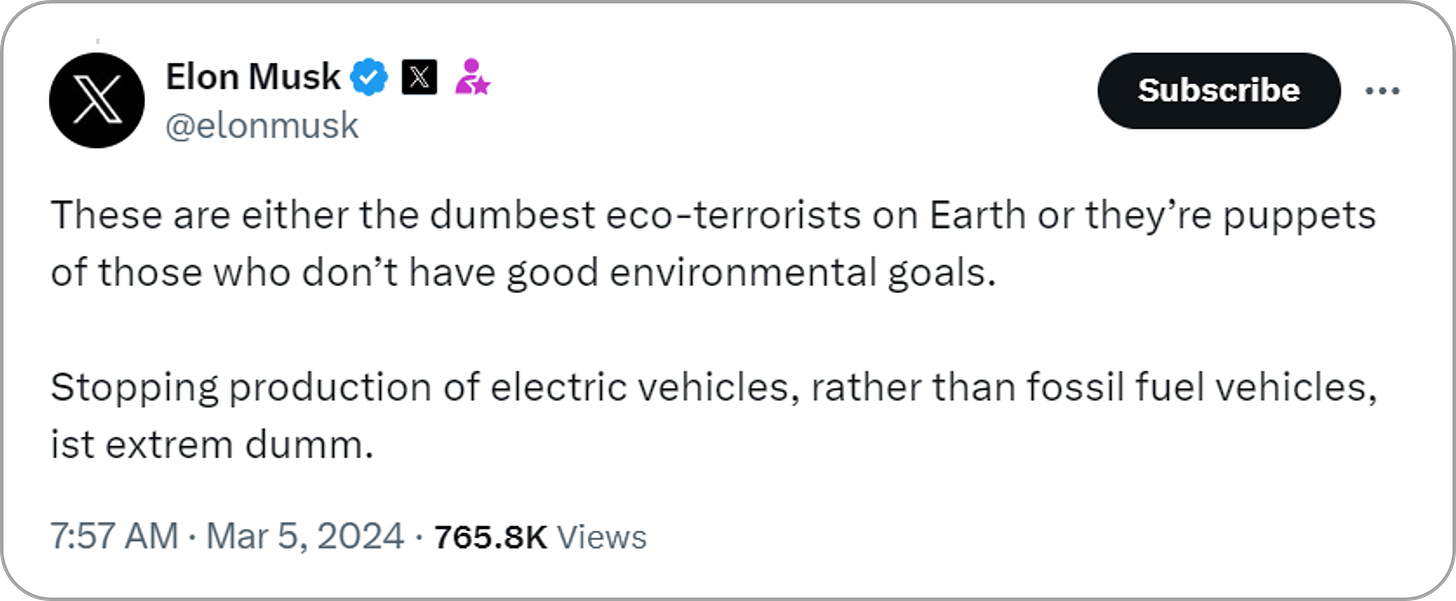

CNBC / Tesla shares slip 3.9% after suspected arson attack halts production at Berlin Gigafactory. Left-wing extremists Vulkangruppe, or Volcano Group, claimed responsibility for the attack in a letter posted to alternative news site Kontrapolis.

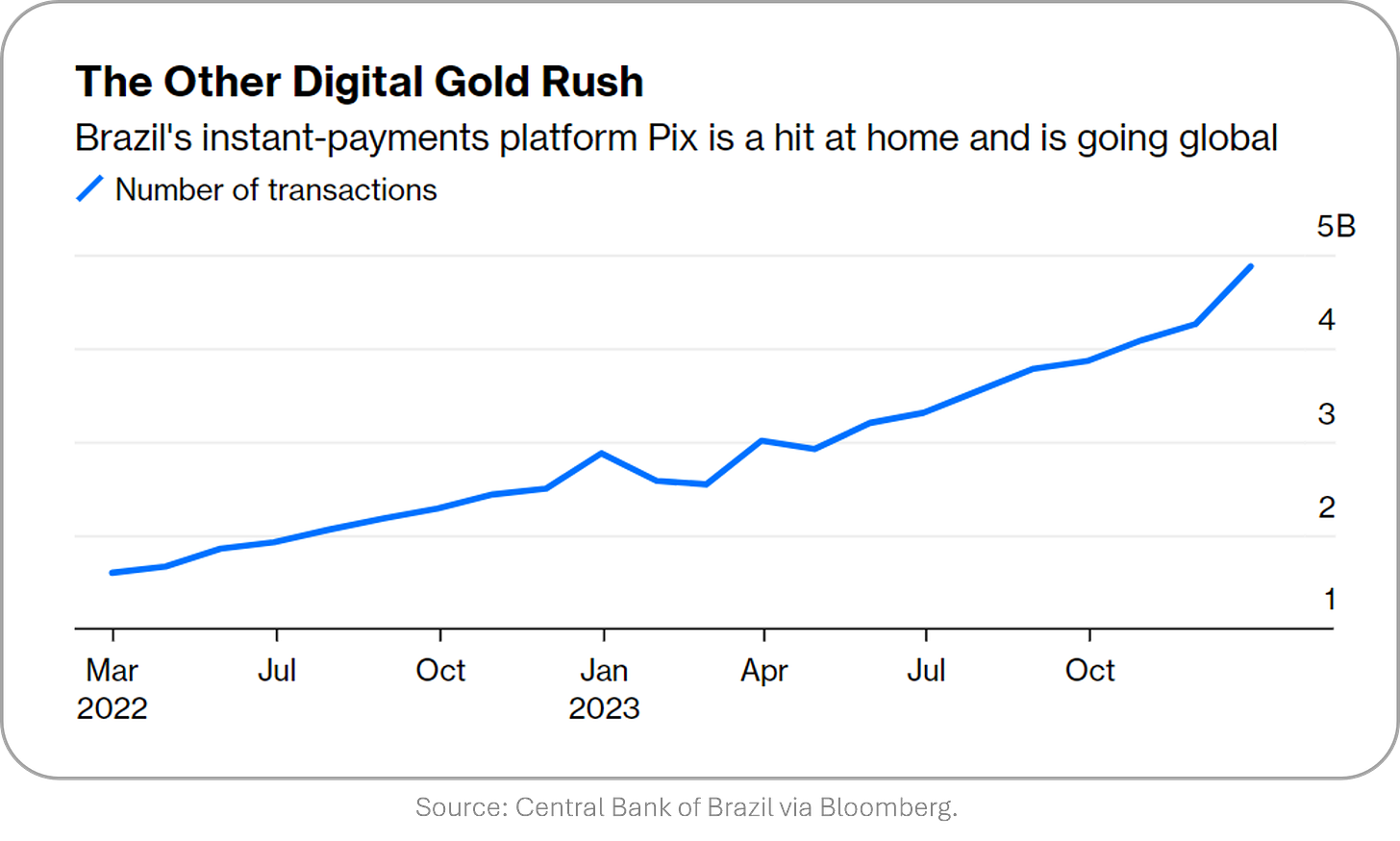

Bloomberg / Bitcoin is up but the future of money lies elsewhere. An interesting look at how Pix has taken Brazil by storm with +80% of adults having used the new payment system.

Bloomberg / China’s bullish 5% growth goal seen as ‘Target Without a Plan’. Economists have concerns that things like deficit spending for stimulus or a strategy to boost flagging consumer behavior are missing from the ambitious growth target.

Reuters / UnitedHealth, the USA’s largest health insurer, reportedly paid $22 million ransom in bid to recover data from hacker group, Black Cat. *shrug*

FX Street / US ISM Services PMI declines to 52.6 in February vs. 53 expected.

AP / Target launches new paid membership program in a bid to drive sales at a time of cautious spending. Innovation…

Trivia

This week’s trivia is on famous companies, with today’s on Alphabet.

Google changed it’s name to Alphabet in 2015 but Google itself was founded in what year?

A) 1989

B) 1992

C) 1998

D) 2000Google takes it’s name from googol (1 followed by 100 zeros), which was a big improvement over it’s initial name:

A) WebZoomB) Searchy

C) BackRub

D) Ask ZeevesDeepMind, acquired by Alphabet, is best known for developing AI that:

A) Predicts weather

B) Defeated a world champion at Go

C) Manages traffic signals

D) Creates artWhich Alphabet initiative aimed to provide internet access via high-altitude balloons?

A) Wing

B) Project Loon

C) Fiber

D) Google Station

(answers at bottom)

Market Movers

Winners!

Apogee Therapeutics (APGE) [+42.1%]: Positive Phase 1 data for APG777 boosts stock; cash up 160% y/y, with runway until 4Q 2026.

AeroVironment (AVAV) [+27.9%]: Beats FQ3 EPS and revenue; gross margins rise 48% y/y. Ups FY23 guidance, expects FY25 double-digit growth without relying on Ukraine.

Paymentus Holdings (PAY) [+20.6%]: Surpasses Q4 EPS, EBITDA, and revenue forecasts. FY24 EBITDA guidance beats expectations; client growth at ~16% y/y.

Viavi Solutions (VIAV) [+12.5%]: Acquiring UK's Spirent for $1.28B, deal to close in 2H 2024.

Target (TGT) [+12%]: Q4 EPS exceeds by 23%, with positive comp and revenue. Benefits from lower costs and improved inventory; provides strong FY guidance. Also announced details of its membership program.

Losers!

Stitch Fix (SFIX) [-21%]: Missed Fiscal Q2 across revenue, GM, EBITDA, EPS (basically everything you can miss); cut FY24 outlook amid active customer decline, aiming to enhance customer engagement.

Gitlab (GTLB) [-21%]: Beat Q4 EPS, revenue but FY24 forecasts below expectations; positives in cRPO, NRR, strong margins despite high pre-report expectations.

Albemarle (ALB) [-17.9%]: $1.75B depository share offering raises funding project concerns; includes $262.5M option for additional shares.

SEMrush Holdings (SEMR) [-16.3%]: Topped Q4 revenue, net income; FY24 revenue guidance below expectations, GM and deferred revenue weak.

Vivid Seats (SEAT) [-10.4%]: Q4 revenue, EBITDA above expectations; cut FY24 EBITDA outlook but maintains revenue; starts $100M repurchase program.

Ferguson (FERG) [-6.8%]: Fiscal Q2 misses in growth, revenue, profit, EPS; unchanged FY24 guide; price deflation noted in commodity categories.

Zillow Group (ZG) [-5.4%]: Faces increased scrutiny after Spruce Point's short-sell report, highlighting litigation, regulatory risks, and competitive threats.

Tesla (TSLA) [-3.9%]: Suspends German gigafactory operations due to suspected arson; uncertain production resumption timeline.

Market Update

Trivia Answers

C) Google was founded in 1998.

C) The original nickname for the search engine was BackRub, due to the algorithms use of backlinks to page rank.

B) DeepMind got famous for defeating a world champion at Go (Lee Sedol).

B) Project Loon attempted to provide internet via hot air balloons but the project was cancelled after initial test flights. Neat tho.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.