🔬Europe... kinda sucks

Plus: Boeing continues to bump into every sharp object; and much more!

"Buy on the cannons, sell on the trumpets"

- Old Wall Street saying

“The broker said the stock was "poised to move." Silly me, I thought he meant up”

- Randy Thurman

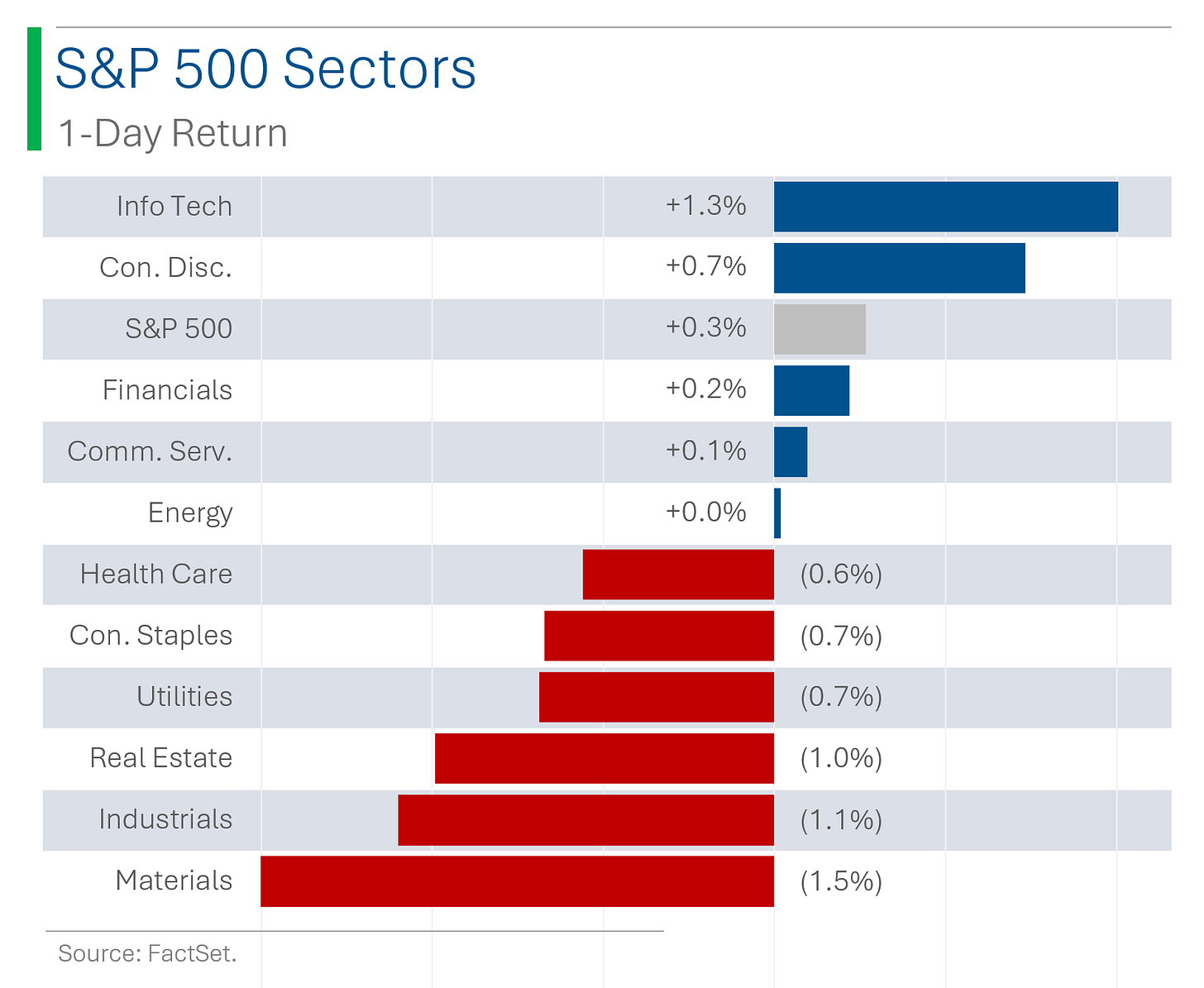

Decent day in the green for the big US markets with the S&P 500 +0.3% and Nasdaq +0.8%, on a heavy news but low volume kinda day.

5 of 11 sectors closed higher led by Tech (+1.3%) and Consumer Discretionary (+0.7%). Materials (-1.5%) and Industrials (-1.1%) were at the bottom of the pile.

Some of the weakness in Mats and Industrials may have been the result of a soft June ISM Manufacturing print that came in at 48.5 (lowest since February) vs. consensus 49.1.

Notable companies:

GameStop (GME) [-5.5%]: Keith Gill (Roaring Kitty) discloses 6.6% stake in Chewy, sparking speculation he sold GameStop shares to finance the purchase.

Spirit AeroSystems (SPR) [+3.4%]: Boeing confirmed $8.3B stock acquisition, offering $37.25/share, a 13% premium to Friday’s close.

Tesla (TSLA) [+6.1%]: Chinese EV rivals announce strong Q2 demand potentially implying a return to growth for Tesla.

I had a great Canadian long weekend, spent mostly at my wife’s +700 person family reunion, ‘The Keogh 500’. Who would have thought Irish Catholic farmers procreated so effectively?

It was great to see so many people who’ve been supporters of my writing, with a special shout out to J. Weber, K. Mullins, The Drs, and Kev & Marie.

Street Stories

Europe... kinda sucks

The S&P 500 is up +14.5% in the first six months of the year.

The UK’s FTSE 100 index is up +22.0%. Not this year. And not last year. It’s up +22.0% since I moved back to Canada from London… in November 2013.

The Old World has so many wonderful and beautiful things about it.

Its stock markets aren’t one of them.

This persistent lack of shareholder return is probably best seen in the size of it’s national champion stock indices. Yup, Europe’s three biggest stock indices - consisting of 180 of their largest companies - are still smaller than Microsoft and Apple, with $907 billion to spare.

Part of this discrepancy has to do with the relative growth rates between U.S. and European companies. For example, looking at the 50 largest European companies compared to the 50 largest U.S. ones, their growth rates over the last 6 fiscal years is little more than half that of their American peers.

That’s not to say that all European companies are duds; some are truly amazing businesses and if you found the rights ones to invest in you would have done rather nicely.

But it is worth pointing out that Europe’s notable lack of Tech is a big factor in it’s equity market underperformance. High-end luxury has been very profitable for European companies, but save for ASML (equipment maker for semiconductor manufacturers) they are sorely missing what has been the world’s great growth engine his century.

All jokes aside - and Europe’s stock markets have been rather comical - this is actually a pretty important stuff to think about. Diversifying your portfolio into international stocks can be helpful and history is certainly no guarantee of future performance, but investors should be careful they aren’t mindlessly picking up currency risk and Russian meddling just to end up with a weaker basket of stocks.

TLDR: No one ever went broke betting on America.

Boeing's Big Buyback

Some stuff about Boeing isn’t appropriate to make fun of, like Sunday’s announcement that the company is waiting to be charged by the US Justice Department for criminal fraud following findings that it violated it 2021 deferred-prosecution agreement tied to the Lion Air and Ethiopian Air crashes.

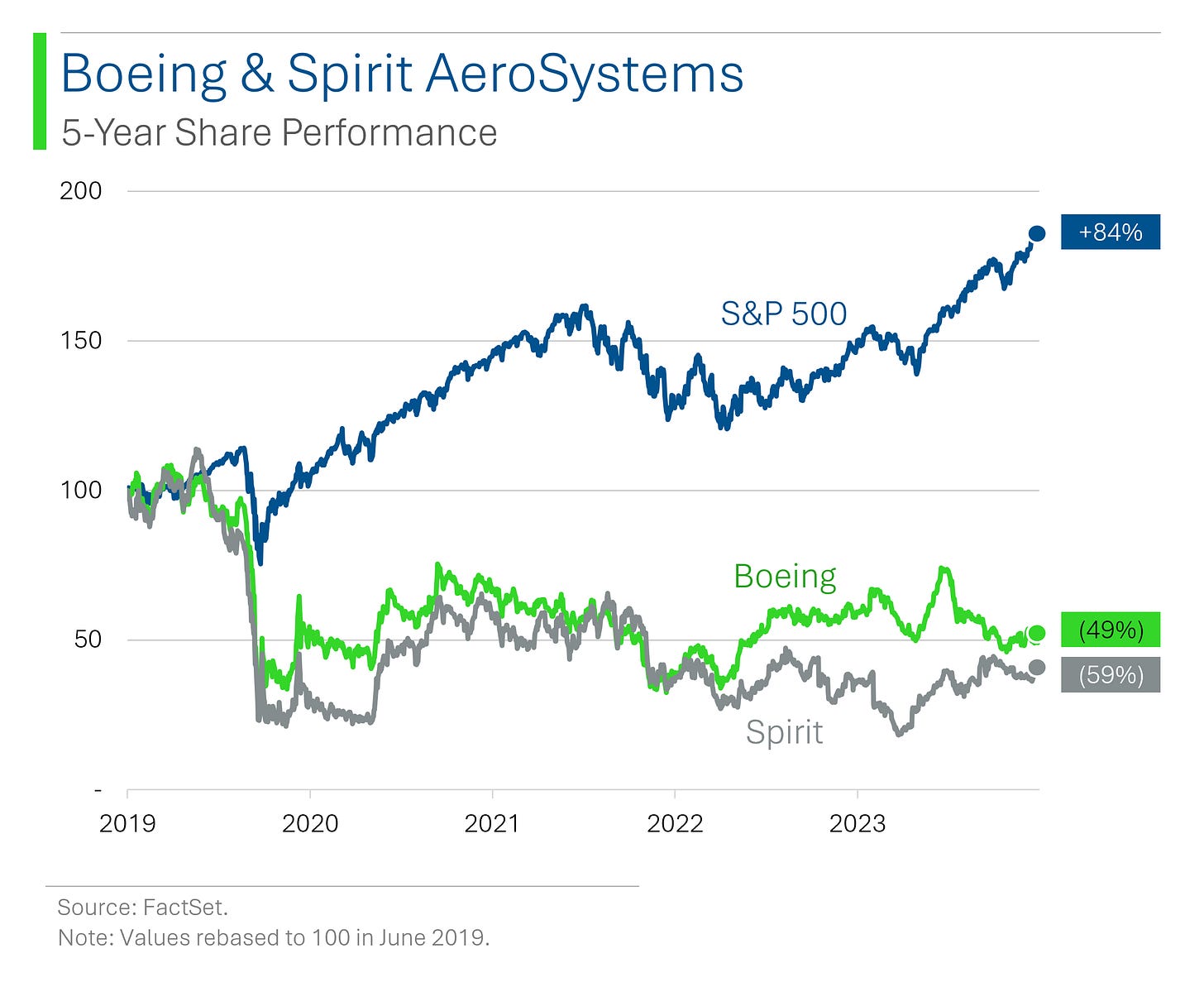

Some stuff, however, is pretty funny. Like how Boeing announced it will be buying Spirit AeroSystem’s for $4.7 billion. You may recall that Boeing used to own Spirit years ago but sold them off as part of a push to run an asset-light, high shareholder return company (and also so that they could squeeze them more as a supplier than they could as a subsidiary).

So how did that work out? Quality tanked. Employees got alienated. Boeing’s corporate culture got shredded. But, hey, at least it made money right?

Psyche! The same Spirit AeroSystems they are buying for $4.7 billion they originally sold off for $375 million.

Joke Of The Day

I made a fortune in the stock market. I walked in and stole some guy's Rolex.

Why was Dr. Dre kicked out of the farmer's market? He kept dropping beets.

Hot Headlines

Reuters / Tesla shares pop +6.05% ahead of Q2 deliveries report after Chinese competitors data indicates strong growth for EVs. Tesla shares are still down 15.5% this year while the S&P 500 is up 14.5%.

Yahoo Finance / Chewy shares jump +20% pre-market after Roaring Kitty of GameStop fame discloses 6.6% stake - just for shares to close down -6.6%. Note that online pet product retailer Chewy was founded by Ryan Cohen who is currently CEO of GameStop. It’s all kinda weird at this point.

Bloomberg / Bobby Jain raised $5.3 billion in largest hedgefund start since 2018. The ex-Millennium co-CIO’s new firm set to start trading Monday, and was the largest since ExodusPoint’s $8 billion thanks to big backing from the Abu Dhabi Investment Authority.

Bloomberg / BlackRock enters booming market for stock ETFs with a 100% hedge. Using options, it will provide investors with upside exposure to the S&P 500 to a cap of around 10.6% and hedge all of the downside over a 12-month period. WITCHCRAFT!

WSJ / Interactive Brokers is launching a binary (yes or no) prediction market on future economic and climate events. The contracts let users take yes-or-no positions on questions such as whether the consumer-price index will rise above a certain number or if the global temperature will reach a specific level. The lines between investing and gambling continue to blur.

BOND Capital / VC Queen Mary Meeker publishes her first special report since 2020 and it’s all about how AI and higher education will be partners. Worth checking out just for the cool charts.

Trivia

This week’s trivia is on famous companies, with today’s on Alphabet.

Google changed it’s name to Alphabet in 2015 but Google itself was founded in what year?

A) 1989

B) 1992

C) 1998

D) 2000Google takes it’s name from googol (1 followed by 100 zeros), which was a big improvement over it’s initial name:

A) WebZoomB) Searchy

C) BackRub

D) Ask ZeevesDeepMind, acquired by Alphabet, is best known for developing AI that:

A) Predicts weather

B) Defeated a world champion at Go

C) Manages traffic signals

D) Creates art

(answers at bottom)

Market Movers

Winners!

Warrior Met Coal (HCC) [+16.9%]: Anglo American halts production at Grosvenor mine after underground gas ignition on June 29.

Tesla (TSLA) [+6.1%]: Chinese EV rivals announce strong Q2 demand potentially implying a return to growth for Tesla.

Amedisys (AMED) [+5.3%]: Announced sale of care centers to VitalCaring; move may ease antitrust issues before planned H2 acquisition by UNH.

Spirit AeroSystems (SPR) [+3.4%]: Boeing confirmed $8.3B stock acquisition, offering $37.25/share, a 13% premium to Friday’s close.

Boeing (BA) [+2.6%]: Confirmed $8.3B stock acquisition of SPR, offering $37.25/share, a 13% premium to Friday’s close.

Constellation Energy (CEG) [+2.4%]: Reports suggest AMZN may secure nuclear power deal with CEG for data centers and AI projects.

Birkenstock (BIRK) [+1.8%]: Upgraded to buy from neutral at UBS; noted DTC expansion, strong Asia-Pacific growth, and premium product launch.

Losers!

NextEra Energy Partners (NEP) [-8.8%]: Downgraded to sector perform from outperform at RBC Capital Markets; potential dividend cut cited.

Masimo (MASI) [-7.6%]: COO Bilal Muhsin vows to resign if Chair/CEO Kiani is ousted; disputes accusations by Politan and threatens to leave if they take control.

GameStop (GME) [-5.5%]: Keith Gill (Roaring Kitty) discloses 6.6% stake in Chewy, sparking speculation he sold GameStop shares to finance the purchase.

Floor & Decor (FND) [-4.2%]: Spruce Point short report alleges misforecasted capex, expansion in lower-income markets, and changes in financial reporting obscuring issues.

Market Update

Trivia Answers

C) Google was founded in 1998.

C) The original nickname for the search engine was BackRub, due to the algorithms use of backlinks to page rank.

B) DeepMind got famous for defeating a world champion at Go (Lee Sedol).

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.