🔬Economic Data Is Great (and the Markets Don't Like That) and Much More

"The markets are like a large movie theater with a small door"

- Jeffrey Gundlach

“If at first you don’t succeed, try, try again. Then quit. There’s no point in being a damn fool about it”

- WC Fields

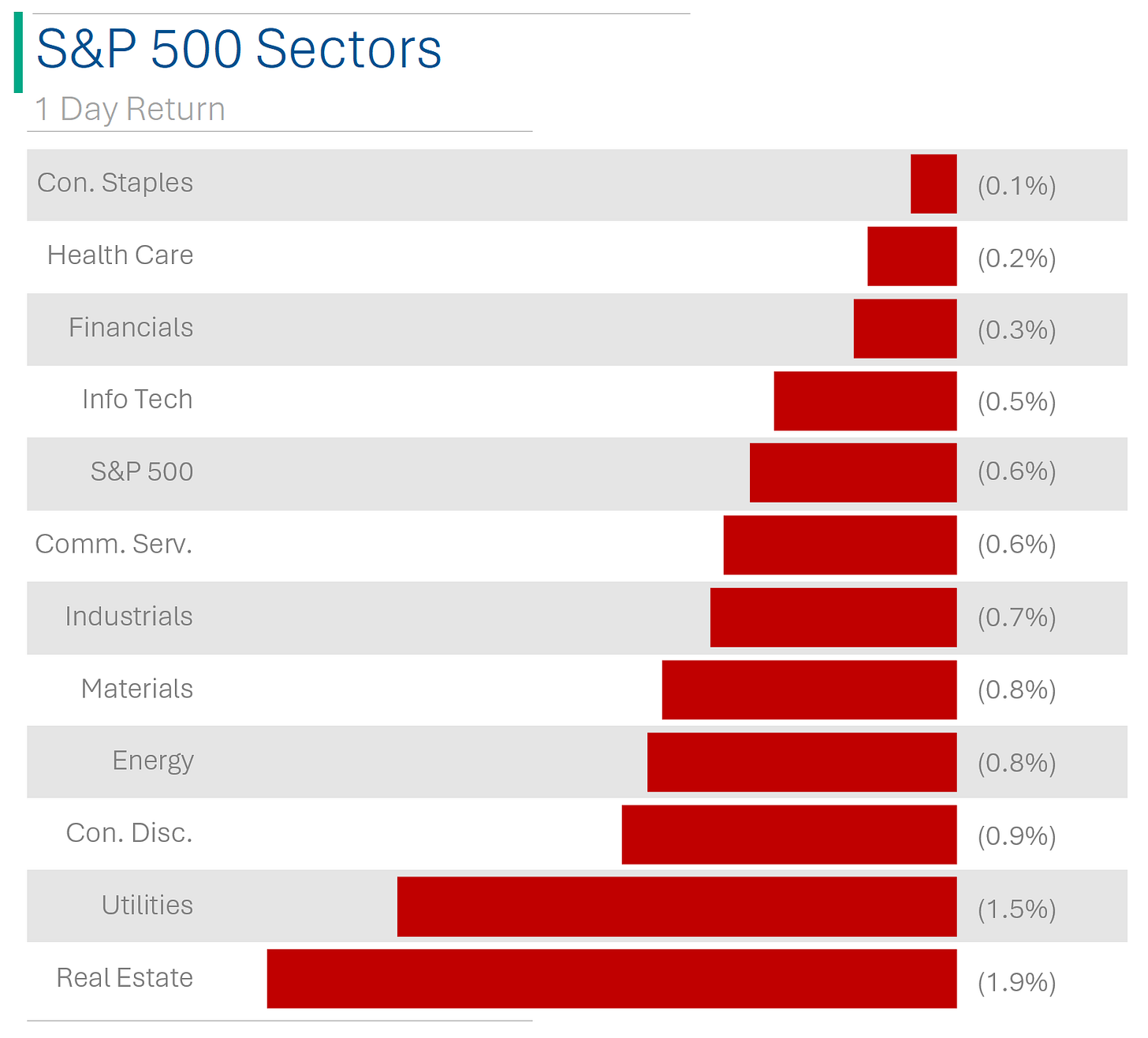

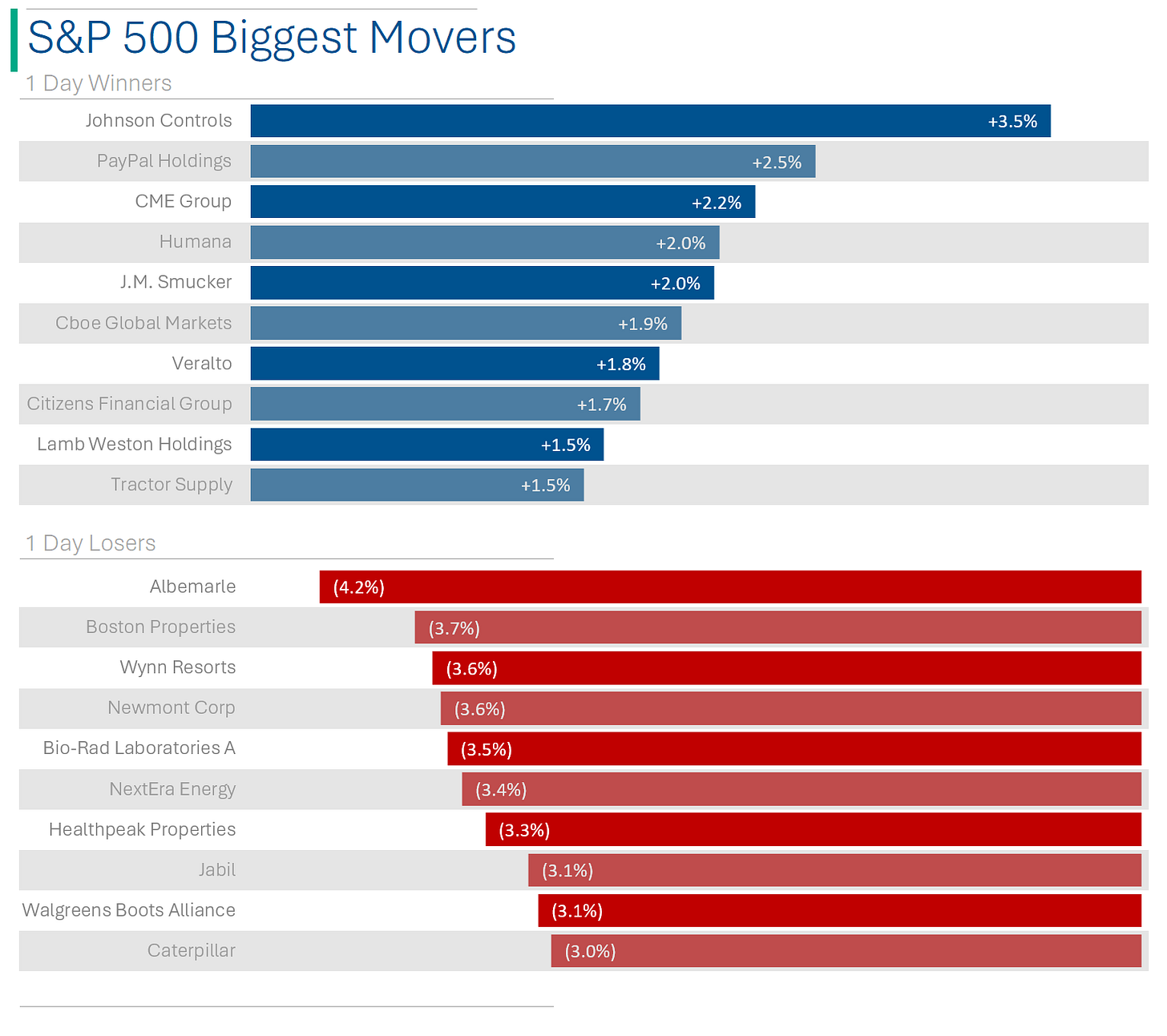

Another day to forget in the markets, with the S&P 500 down -0.6% and the Nasdaq down -0.59%.

All 11 sectors went red today. Defensive sectors Consumer Staples (-0.1%) and Healthcare (-0.2%) were the best, while Real Estate got smoked on the US treasury rally.

Positive economic: December Retail Sales came in hot (+0.6% vs. Wall Street estimate of 0.4%), while the Housing Market Index surprised with another strong month (44 vs. WS estimate of 38, and 37 last month).

Street Stories

Mickey Mouse Clubhouse: No Room for Peltz and Pals

Disney officially rejected the Board Member candidates proposed by activist hedgefunds Trian and Blackwells. Recall that Disney is in a proxy fight with Trian’s CEO Nelson Peltz, who’s nominated himself and ex-Disney CFO Jay Rasulo for Board seats. Earlier Disney implied that they would reject the proposal, unloading a few zingers Nelson and Jay’s way. Including that in Peltz’s two year hunt for a Board seat that he “had not actually presented a single strategic idea for Disney,” and that he lacked experience in the media or technology sector. Thems fightin’ words.

To cap off why they don’t need Peltz’s help in the press release, CEO Bob Iger highlighted their aggressive cost reduction initiatives which they expect to total $7.5 billion - around $2 billion more than previously targeted. The market wasn’t sold on this, and the shares closed 2.9% down.

If Trian rings a bell, check out the deep, investigative journalism I did on the Disney activist situation a few weeks backs (Link).

From Iowa to Wall Street: Trump's Victory Sparks Stock Spectacle

Digital World Acquisition Corp ($DWAC), the SPAC linked to Donald Trump's social media platform, saw a 15% stock pop after Trump won the first Republican contest in Iowa for the 2024 presidential race. This surge in stock value comes despite DWAC losing over 93% of its value in the past year due to delays in its merger with Trump Media & Technology Group. Other Trump related stocks like Phunware ($PHUN), the software developer hired to build Trump’s campaign app, and Rumble ($RUM), the video sharing app popular with conservatives, also saw significant trading activity and gains following Trump's Iowa victory.

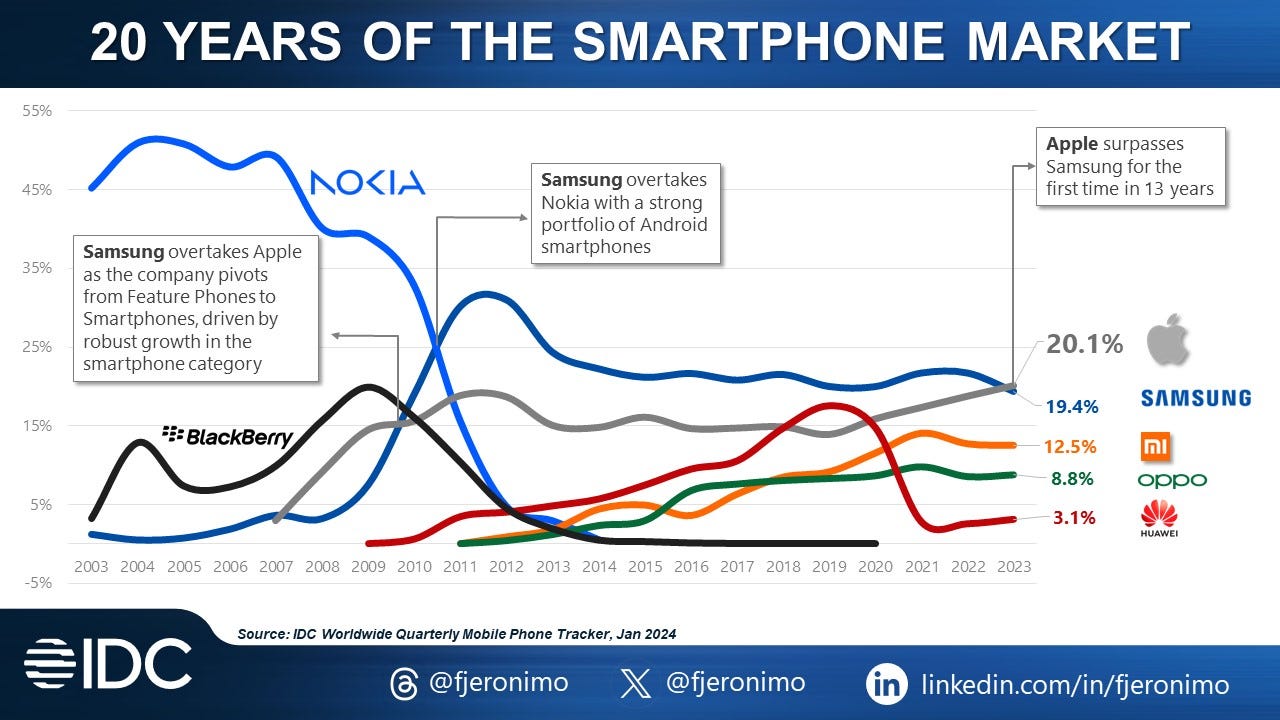

Apple Dethrones Samsung: A Decade-Long Reign Ends with a Bite

Apple surpassed Samsung as the world's largest smartphone seller in 2023 with a 20% market share, ending Samsung's 12-year reign. Amidst a global smartphone market decline of 3.2%, Apple and Chinese company Transsion were the only top vendors to see sales growth. Samsung's shipments fell by 13.6% due to a focus on higher-end phones, while Apple faced competitive pressure in China but managed to increase iPhone shipments by 3.7%. (Reuters has more on this)

Interest Rates Fall, Builder Hopes Soar

In January, U.S. home builder confidence, as measured by the NAHB-Wells Fargo housing-market index, increased to 44 from 37 in December, exceeding economist expectations for a 38 level due to falling mortgage rates and improving affordability. Mortgage rates dropped more than 110 basis points since late October, leading to more buyers and reduced home price cuts by builders. The index showed improvements in all areas, including current sales, future sales expectations, and buyer traffic, indicating a positive trend in the housing market.

Strong Retail Sales

In December 2023, U.S. retail sales rose +0.6%, surpassing economist expectations of +0.4%, with significant growth in clothing, accessory stores, and online retail, indicating robust consumer spending. Despite inflation, sales outpaced the annual inflation rate, suggesting strong consumer resilience and a dynamic economic landscape as the Fed contemplates future policy adjustments*.

*Basically, it’s good the U.S. economy isn’t barfing, but since it seems to be hanging in very well, there is effectively no rush to cut rates to help bolster the economy. As recession expectations evaporate, the market has some pretty aggressive rate cut expectations baked in that may start to dissipate as well. And if it does, will it take the market down with it?

Joke Of The Day

We need to start investing more in solar energy. But it's not just going to happen overnight.

Hot Headlines

AP | China’s population falls for a 2nd straight year, decreasing by 2 million people. The nation’s birth rate declined for the seventh straight year, while deaths picked up following the end of their extensive lockdown. In 2023 China was passed by India to be the largest country in the world by population.

Yahoo | Suez Canal traffic drops to lowest since 2021 blockage due to Houthi rebel attacks.

Bloomberg | Apple to face US antitrust lawsuit as soon as March. The Department of Justice alleges Apple has included limitations on its software and hardware on iPhones and iPads that stop rivals from being able to compete.

CNN | Costco is testing out a new system for entering stores after seeing uptick in non-members sneaking in. Plan includes ID scanning machines at the entrances, in lieu of indifferent teenagers.

Barstool | Buffalo Bills fans are throwing people into the pit where their new stadium is being built for good luck. Apparently someone accidentally fell into the pit 5 games ago and they haven’t lost since.

Trivia

This week’s trivia is on corporate firsts.

Which company was the first to develop a graphical user interface for its operating system?

A) Microsoft

B) Apple

C) Xerox

D) IBMWhich company introduced the first smartphone with a touchscreen?

A) Apple

B) IBM

C) Nokia

D) HTCWho was the first to create a practical light bulb?

A) Nikola Tesla

B) Thomas Edison

C) George Westinghouse

D) Humphry Davy

(answers at bottom)

Market Movers

Winners!

Natera (NTRA) [+7.3%]: Jury verdict in patent infringement lawsuit by Ravgen awarded damages much less than $410M sought. Jury found no willful infringement by Natera.

Masonite International (DOOR) [+6.7%]: PGT Innovations ended merger agreement with Masonite, opting for a $3.1B deal with MITER Brands at $42 per share. Masonite had agreed to acquire PGTI for $41 a share but waived right to counter MITER's offer.

Boeing (BA) [+1.3%]: FAA completed inspections of the first 40 737 9-MAX planes. Further review and potential additional inspections needed before service resumption. Boeing's stock is down nearly 20% since the January 5 incident.

Losers!

Rivian (RIVN) [-5.9%]: Deutsche Bank downgraded Rivian to hold from buy due to volume and margin risks, R2 capital needs, and production ramp challenges.

Mattel (MAT) [-2.6%]: Morgan Stanley downgraded Mattel to equal-weight from overweight, citing a tougher category outlook and limited restocking opportunities.

Tesla (TSLA) [-2.0%]: Tesla announced a 4.2%-9.1% price cut for the Model Y in Germany, following recent price reductions in China.

Market Update

Trivia Answers

C) Xerox invented the first GUI - which was promptly stolen by Steve Jobs.

D) HTC invented the first cell phone with a touch screen. They were also the largest cell phone vendor in the US in 2011 but basically disappeared in less than a decade.

B) Thomas Edison created the first practical light bulb.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.