📈🔬Earnings Are Great, but the Market Hates Them, Cloud Computing is Cool Again, and Much More

StreetSmarts Morning Note

***Friendly reminder to hit the ‘Like’ button above, it really helps to get Substack to share my newsletter***

“The way to make money is to buy when blood is running in the streets.”

-John D. Rockefeller

“When you gave me that money, you said I wouldn’t have to repay it ’til the future. This isn’t the future. It’s the lousy, stinking now!”

-Homer Simpson

Table of Contents

A.M. Allocations: Summaries of important news and investing events

Green October: Earnings Season Scorecard

Head in the Clouds: Competition Heats Up with AI Market at Stake

Home Sweet (Fixed Rate) Home: Owners Won't Budge at 8% Mortgage Rates

Hot Headlines: Links to some of the top financial stories of the day

A.M. Allocations

Green October: Earnings Season Scorecard

You can expect an S&P 500 earnings update from me every Monday.

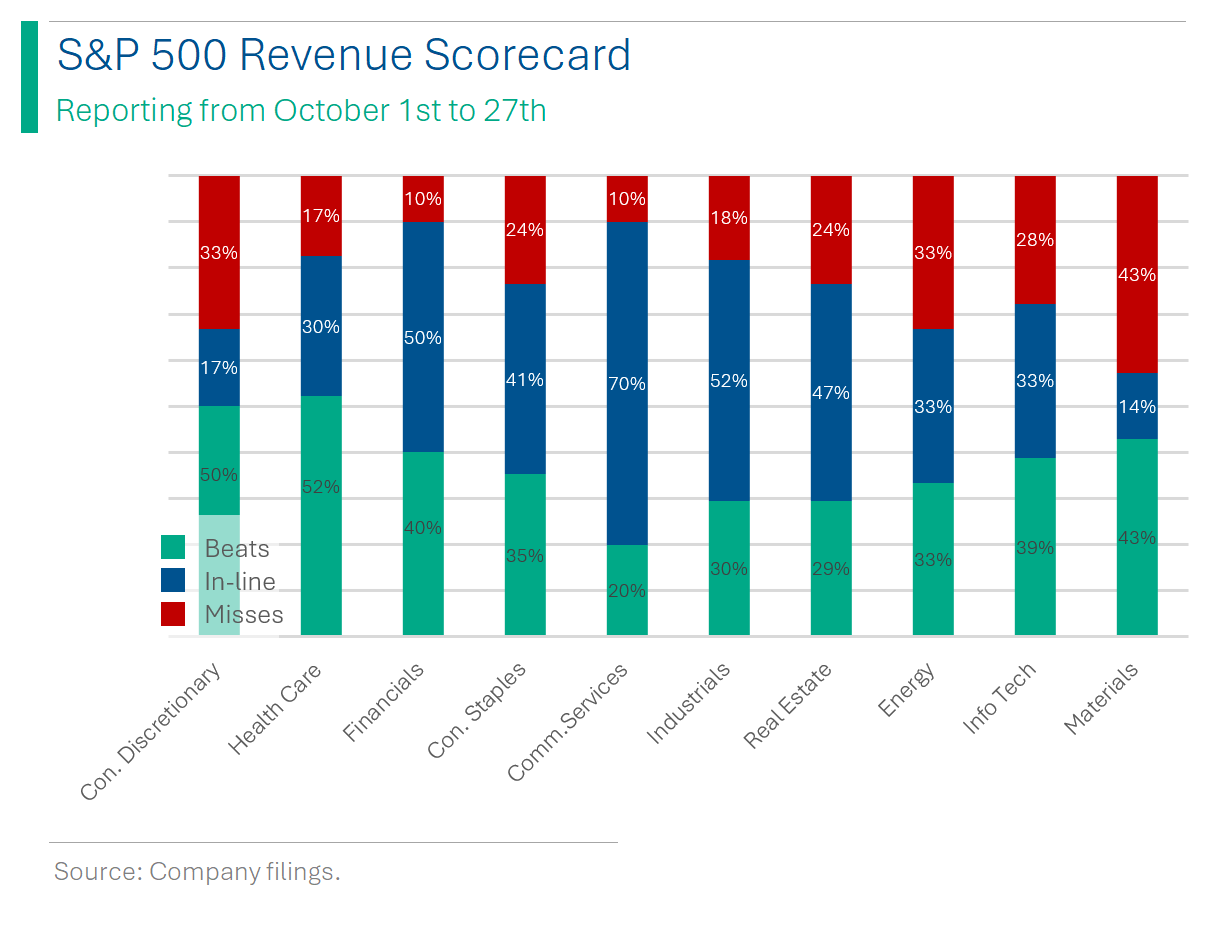

With 226 companies having reported since things unofficially kicked-off October 1st, we are now about 45% the way through earnings season - and what a season it been. So far 90% of companies have posted Beats or In-line quarters for Earnings Per Share, and 78% of them the same for Revenue.

Nearly all of the big banks have reported but we’ve still got a long way to go for the rest of the index. As I wrote on Friday, we’ve seen 5 of the 7 companies that make up the ‘Magnificent 7’ - but oddly, we’ve only seen around 28% of tech companies post earnings. Utilities have had the fewest companies report…although, who cares? They’re boring anyway.

Despite the 5 ‘Magnificent 7’ names all posting Beats on EPS and Revenue (except an In-line of Revs by Alphabet), the headline was about softer guidance and operational outlook which weighed on shares this week.

It’s worth noting that the two Misses last week on EPS came from Big Oil names Chevron and Exxon.

Explainer: If you don’t own any of the companies that have reported, why should you care? Well, there are a few reasons. The first is what are sometimes called ‘read-throughs’ or ‘read-across’. You might not care how Pepsi did when they reported last Tuesday, but you might if you owned Coke shares. Do to operational and competitive factors, their earnings will look different but some of the macro economic factors that influenced Pepsi’s performance can be used as a hint for Coke. For example, if ‘Small Regional US Bank #1’ reported record profits and massive loan growth, you might infer that ‘Small Regional US Bank #2’ is probably going to have a decent quarter as well.

Another consideration is market sentiment. It’s complex, opaque and hardly worth building an investment strategy around, but if a broad mix of companies is having a good quarter, that helps to set a positive tone for the market. Conversely, if every company is out there reporting disastrous earnings, you might want to have a look into your market exposure.

Notes on calculations:

1. Determining what constitutes a ‘Beat’ or a ‘Miss’ is subjective. For myself, I consider a figure that exceeds the estimate by greater than 1% as a ‘Beat’ and a figure that falls short by greater than 1% as a miss.

2. I am only using companies that have reported since October 1st to align with my subjective view of what constitutes ‘earnings season’. For example, Nike reported its Q1 earnings on September 29th because it has a May fiscal year end. Weirdos.

Head in the Clouds: Competition Heats Up with AI Market at Stake

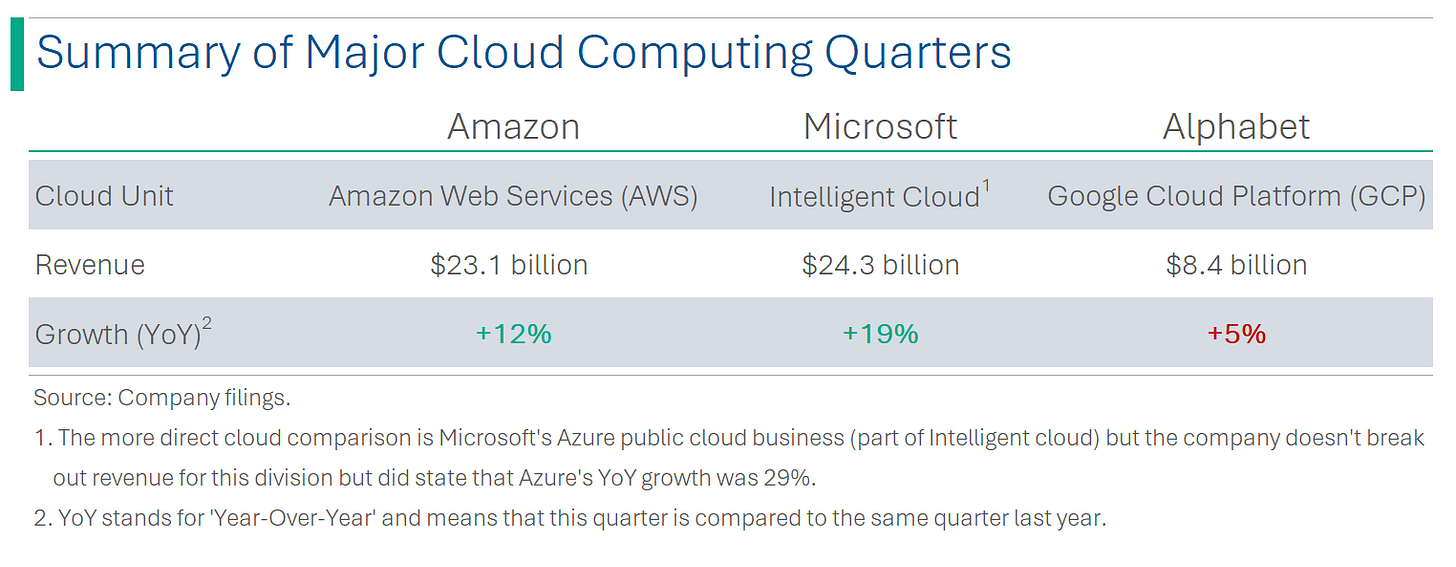

Alphabet got smacked hard last week by the market (-10.5%) despite a modest beat on EPS and an in-line revenue figure. The cause of the hate came predominantly from a lackluster quarter for their key growth engine Google Cloud Platform, which posted $8.41 billion in revenue vs. Wall Street estimates of $8.64 billion. Additionally, their outlook for cloud seemed much less optimistic than for their peers at Amazon and Microsoft.

Take-Aways: Cloud is particularly in focus lately as it is expected to continue to show massive growth driven by AI. The market seems to fear that Alphabet isn’t in a strong position to capture much share in this emerging cloud segment.

Home Sweet (Fixed Rate) Home: Owners Won't Budge at 8% Mortgage Rates

Mortgage Rate Spike: U.S. mortgage rates have hit their highest level in 23 years, with the average rate reaching 8.04%. Despite this, the median mortgage holder's rate remains below 4%, according to the National Association of Realtors.

Market Dynamics Altered: High rates have deterred buyers and sellers, reducing the number of homes for sale to less than half of the pre-pandemic average. Consequently, home sales in September dropped to their lowest since 2010, but home prices have still risen due to low supply.

Lock-in Effect: Many homeowners are opting to stay put due to the financial advantage of their current low mortgage rates, leading to fewer homes on the market. This "mortgage rate lock-in effect" is keeping supply low amidst steady demand.

Homeowner Sentiment: Despite financial incentives to stay, a significant portion of homeowners still plan to sell within three years, primarily driven by the desire for upgraded or more desirable homes, rather than purely financial reasons. However, the financial aspect does influence decisions, especially for those with loans requiring private mortgage insurance.

Joke Of The Day

Why is Google Chrome like a submarine? They tend to get a little slow if you open too many windows.

I got an e-mail saying “At Google Earth, we can even read maps backwards”, and I thought...“That’s just spam”

Hot Headlines

(WSJ) Does Strong Growth Fuel Inflation? Fed Debates Whether Old Model Still Applies - The Federal Reserve is currently engaged in an internal debate about whether to adhere to traditional economic models, as the U.S. economy is exhibiting a unique combination of heightened activity and a slowdown in inflation, a scenario that defies typical economic predictions. This ongoing discussion within the central bank is pivotal, as it will significantly influence upcoming decisions regarding interest rates. While some Fed officials are advocating for a cautious approach, arguing for the need to consider recent positive supply developments, others are emphasizing the importance of remaining vigilant and prepared to take action should inflation stop its downward trend. The outcome of this debate will shape the Fed's monetary policy and its response to the evolving economic landscape.

(Reuters) Israeli poll finds 49% support for holding off on Gaza invasion - Almost half of Israelis now prefer to delay a large-scale ground invasion of Gaza, a significant shift from previous support, according to a Maariv newspaper poll. This change in public opinion follows recent developments, including Hamas' release of four hostages and the reported killing of around 50 hostages in Israeli strikes.

(Axios) Why Microsoft owes the IRS $29 billion in taxes - The U.S. government is attempting to extract a record $29 billion in tax arrears from Microsoft, dating back to 2004, in what is the largest IRS audit ever attempted, focusing on alleged underpricing in a tax arrangement involving Microsoft's Puerto Rico subsidiary. Microsoft remains confident, expecting to owe less than $20 billion after appeals, but the complex case, involving significant tax avoidance accusations, is expected to take many years to resolve. Also, how the hell has it taken 19 years to figure this out?

(Axios) Fidelity has marked down the value of Twitter/X by 65% - There are Girls Scouts troops that are more profitable than X.

(Reuters) China Evergrande faces winding-up challenge in Hong Kong court - I’ve heard that finding yourself enmeshed in a $300 billion bankruptcy can be quite inconvenient.

(Reuters) Sam Bankman-Fried admits 'mistakes' but testifies he did not defraud anyone - Mistakes? MISTAKES? NO $#*&.

Trivia

Keeping with the Google theme….

Google’s original name was what?

BackRub

High-Five

Intersearch

Larry & Sergey’s Search Engine

The name Google is based on the mathematical expression googol, which is a 1 followed by how many zeros?

100

1,000

12

42

Which of the below countries is Google not banned in?

China (ex. Hong Kong and Macau)

North Korea

Iran

Saudi Arabia

(answers at bottom)

Market Movers

Winners

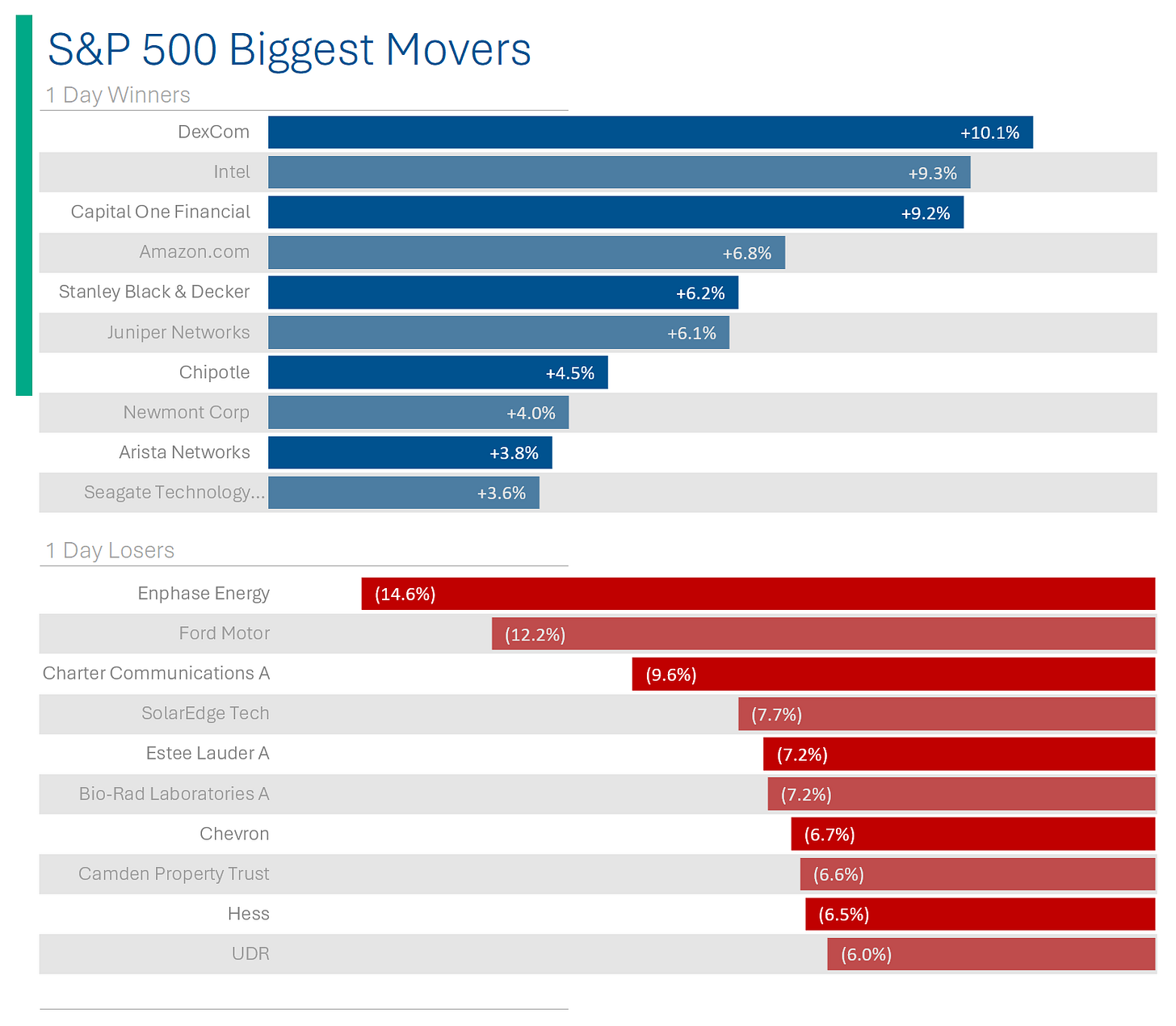

Dexcom (DXCM) [+10.1%]: Outperformed Q3 expectations with robust U.S. sales driving EPS and revenue above forecasts; raised FY23 outlook, with international sales up 30% organically; strong margins and free cash flow; U.S. market gaining with G7 launch and Type 2 diabetes expansion.

Intel (INTC) [+9.3%]: Surpassed Q3 earnings and revenue, fueled by client computing, particularly commercial and consumer gaming; Data Center results missed expectations, but positive segment outlook; management optimistic about long-term PC market and AI tech adoption; Q4 guidance exceeds expectations.

Amazon.com (AMZN) [+6.8%]: Q3 revenue exceeded predictions by 1%, operating income 30% above top guidance and 46% beyond consensus; positive margin trends, stable AWS growth, comments on optimization trends, Gen AI potential, and Q4 operating income guidance.

Losers

Sanofi (SNY) [-19.1%]: Q3 EPS and revenue fell short; maintains FY23 guidance for mid-single-digit EPS growth; foresees 2024 earnings drop due to higher R&D investments and tax-rate change.

Boston Beer (SAM) [-12.4%]: Q3 EPS surpassed expectations on an adjusted basis, with slightly improved gross margin; trimmed FY23 shipment/depletion outlook by ~1pt; highlighted Twisted Tea's success but noted Truly's weakness and uncertain recovery timeline.

Ford Motor (F) [-12.3%]: Missed Q3 earnings and revenue targets; cited strike and warranty costs; withdrew FY23 guidance due to UAW deal awaiting ratification (on track for EBIT guidance pre-strike); estimated agreement may increase vehicle costs by $850-900 by 2027.

Chevron (CVX) [-6.7%]: Q3 earnings and revenue underperformed despite better-than-expected production and Upstream earnings; Downstream results affected by international challenges (lower refinery margins, FX impacts); mentioned Q4 share repurchases might be limited due to HES deal.

Market Update

Trivia Answers

BackRub. The idea was based on how Google used a website’s backlinks as an estimator for a sites important.

100.

Saudi Arabia.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and give us a ‘Like’ below.