🔬 Do Dividends Mean You Are Old?

I Look At Dividend Payers To See If They Still Grow, The Jobs Report Doesn't Suck, But Regional Banks Do (Again), and Much More.

"Do not save what is left after spending, but spend what is left after saving"

- Warren Buffett

“Money is the best deodorant”

- Elizabeth Taylor

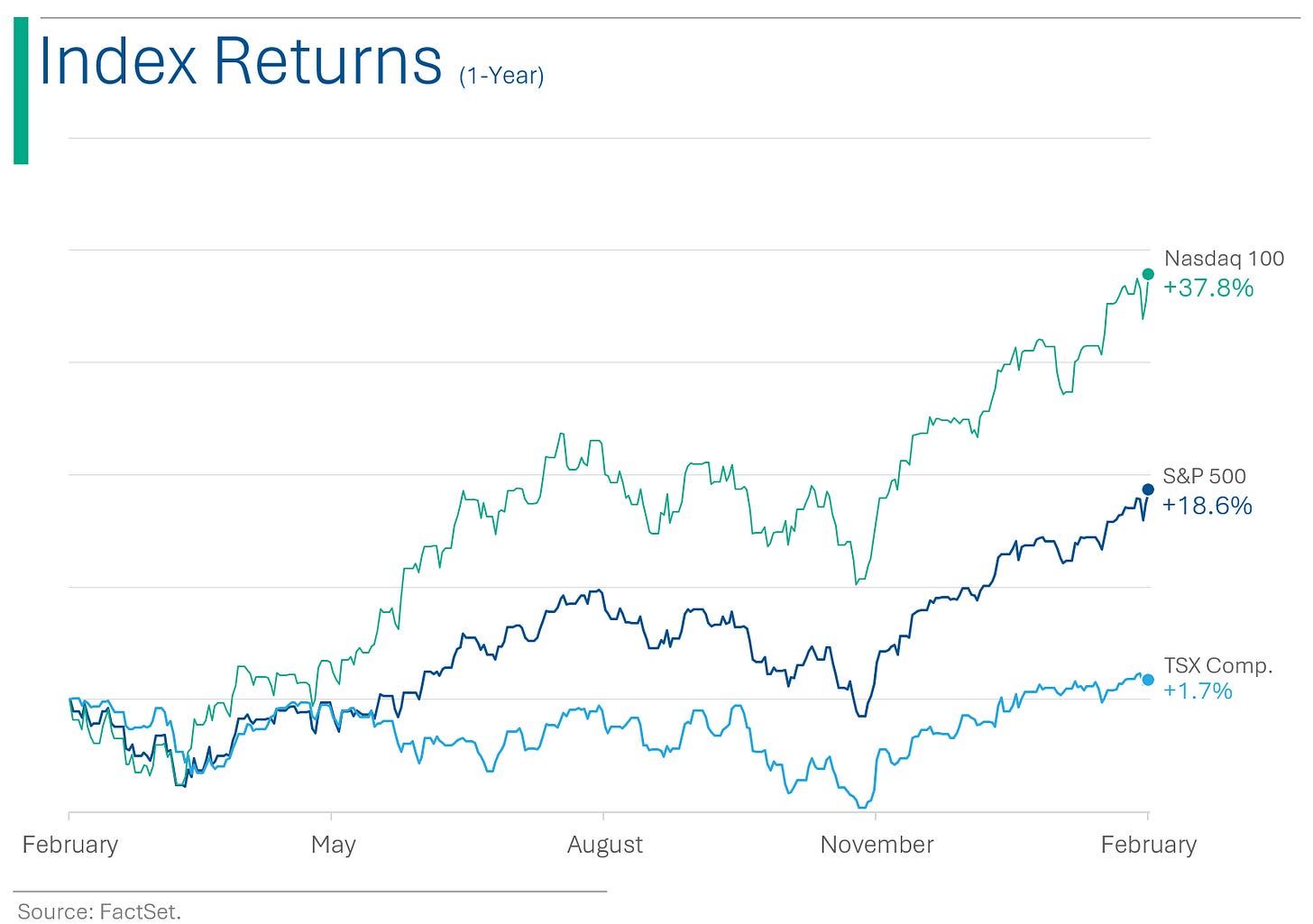

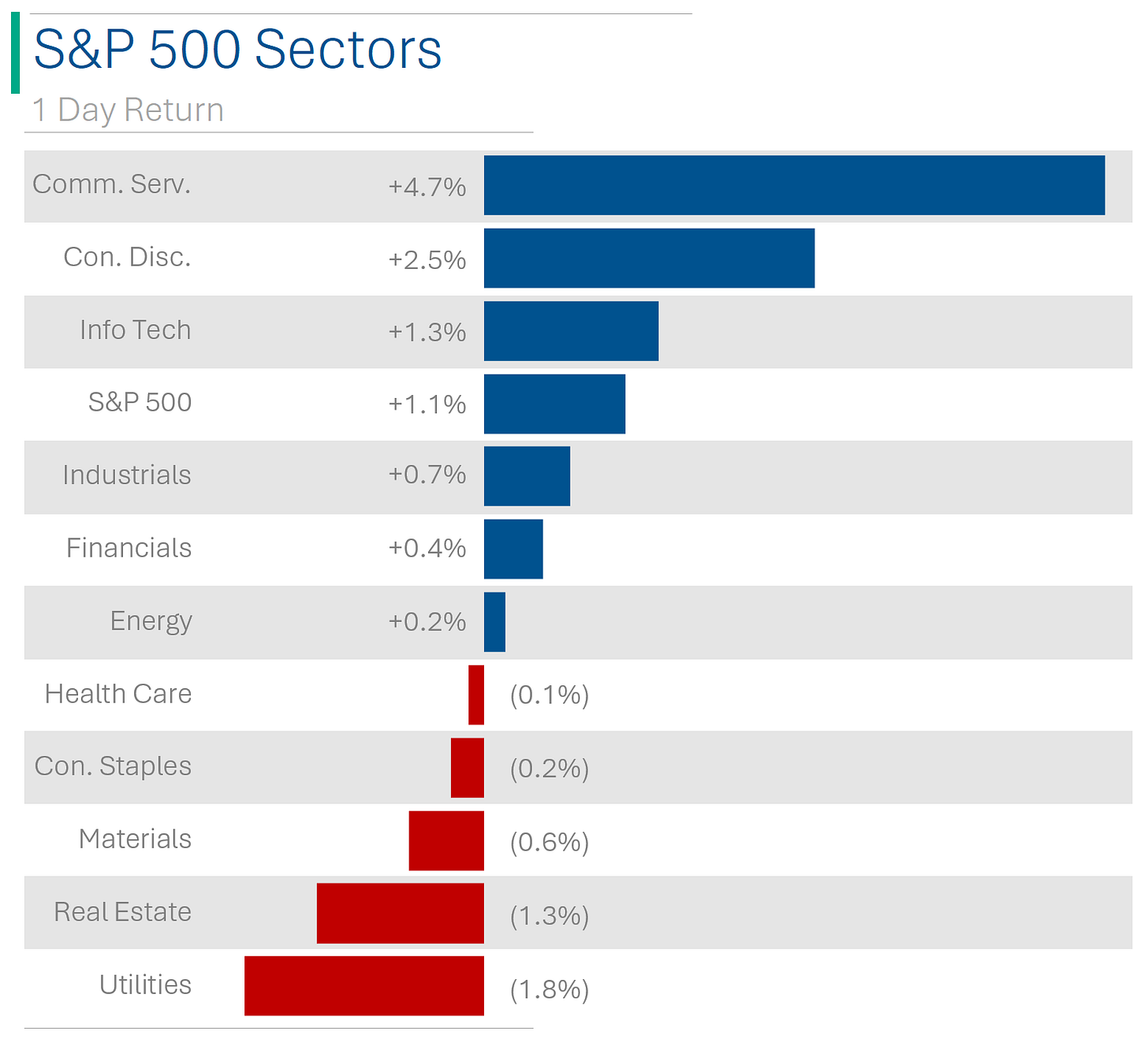

The big US markets had a big Friday to close out the week (S&P 500 +1.07%, Nasdaq +1.74%).

6 of 11 sectors closed up with techy Communication Services (+4.7%) leading the way, pulled up after Meta (frmly. Facebook) posted a banner quarter and ended the day +20.3%. Utilities (-1.8%) and Real Estate (-1.3%) led on the way down.

The US jobs report came in hot with Non-Farm Payrolls hitting at 353k,well ahead of consensus of 177k.

After posting earnings, Amazon finished up +7.9% and Apple -0.5%. Internet and media giant, Charter Communications, tanked 16.5% after weak earnings and surprising loss of broadband subscribers.

Street Stories

The Dividend Conundrum

One of the alleged truisms of the stock market is that dividends are for mature, low growth companies. If you’re paying a divy, you probably aren’t one of the cool kids anymore. That’s why it was pretty wild when Meta (formerly Facebook (formerly The Facebook)) announced on its earnings call after hours Thursday that it was going to be initiating a dividend - in the same breath that it revealed revenue growth was +17.5% for the year.

Spoiler: I’m pretty sure Zuckerberg is only doing this so he doesn’t have to dilute his voting majority by selling shares to fund his wild lifestyle. More on this tomorrow.

So, as an outside-the-box, contrarian thinker (lol jk) I thought I would dive into the world of dividends and see if it’s true that divy payers are the old, slow growth fogies of the capital markets. To start, 401 of the 500 companies in the S&P pay a dividend (80.2%) with the average sitting at around a 2.0% dividend yield. In case curious, this number is 20.6% of companies in the techy Nasdaq. The highest dividend payer is cigarette maker Altria, as the ESG movement hasn’t been kind to its share price.

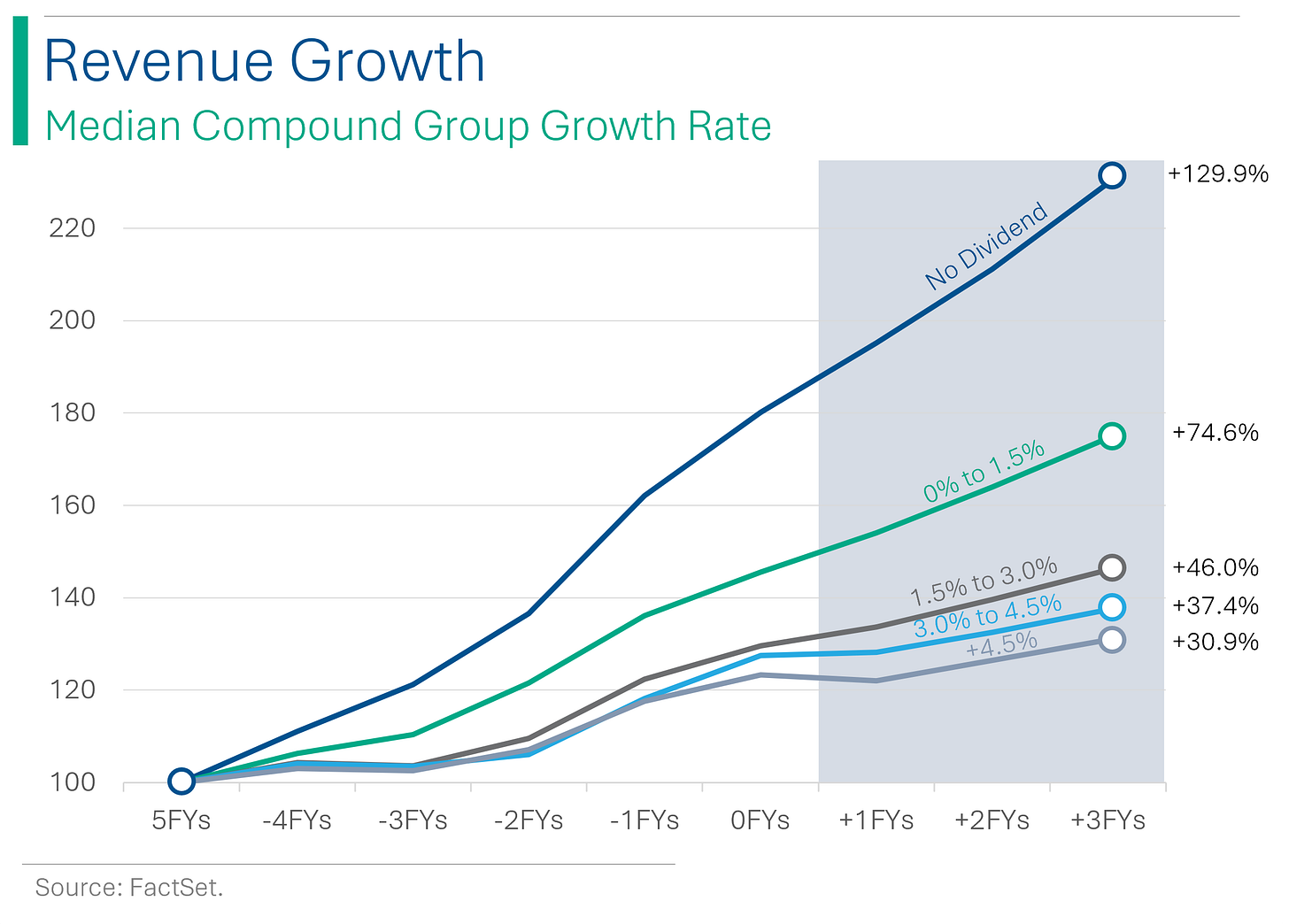

What does the data show? Well, some market aphorisms are indeed true. If you put the companies in the S&P 500 into buckets based on their dividend yield, it’s immediately clear that, not only do dividend payers have slower growth than non-payers, in fact the bigger the dividend, the slower the growth.

Over the preceding 5 fiscal years, the no dividend bucket has grown revenue at a median of 12.5% per year. For the highest bucket (+4.5% dividend yield) this figure drops down to 4.3%. Looking out, Wall Street forecasts the median no-divy to grow Revs at 8.5%, while also seeing the +4.5% yield group to grow at a measly 2.0%. That’s not chump change.

Ryan’s Take Aways: I’ve always been more of a growth investor than a ‘value guy’, so I prefer to hold companies that are on the way up, as opposed to just hanging in there. But, it does seem that if you are going to allocate a portion of your portfolio to income generating stocks, then it’s better to go all-in on the ones with the biggest dividends.

If you use Wall Street’s median revenue growth estimate over the next three years as a proxy for share price return, and add it to the dividend yield to guess at ‘Total Return’, then it looks better to bet on the high dividend stocks. The modest reduction in share appreciation looks to be more than offset by higher dividend return.

U.S. Jobs Report Doesn’t Suck

The US economy exceeded expectations by creating 353,000 nonfarm payroll jobs in January 2024, surpassing the anticipated 185,000. The unemployment rate remained stable at 3.7%, while wages saw a notable increase of 0.6% monthly and 4.5% yearly, higher than expected. However, the labor force participation rate slightly declined to 62.5%, and average weekly hours worked decreased to 34.1, with significant job growth in professional and business services, healthcare, and retail trade. Basically with the economy in such good shape, that March Fed rate cut feels like it’s off the table.

Regional Banks Suck Again

U.S. regional bank stocks, including New York Community Bancorp (NYCB), saw a slight recovery on Friday after a significant plunge due to concerns over a surprise loss on commercial real estate loans. NYCB's shares increased by 5% following a 45% drop over two sessions, prompted by a dividend cut and loan loss provisions, leading Fitch to downgrade its ratings (BBB to -BBB) to just a notch above junk bond status.

Concerns over commercial real estate loans remain, especially for NYCB, given its significant exposure and the broader implications for the banking sector amidst high interest rates and office vacancies. Didn’t we just do this last year with Silicon Valley Bank and Signature bank? Hope this isn’t a new Q1 tradition...

News Sites Are Old News

The steady decline of online editorial journalism continued its drop in 2023, with only People Magazine (not really journalism) and USA Today (sorta journalism) seeing an increase in site visits. Most of the Top 10 experienced double digit declines. Maybe everyone just started reading StreetSmarts instead? Jk - no one reads StreetSmarts. (PressGazette has more on this)

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

A trader and an engineer meet in the Caribbean. The trader said, “I’m here because my house burned down, and everything I owned was destroyed by the fire. The insurance company paid for everything.”

“That’s quite a coincidence,” said the engineer. “I’m here because my house and all my belongings were destroyed by a flood, and my insurance company also paid for everything.”

The trader looked somewhat confused and asked “How do you start a flood?”

Hot Headlines

WSJ | Mark Cuban enters Elon Musk’s Echoverse of Madness. The two are having a standoff over Musk’s dismissal of corporate diversity, equity and inclusion (DEI) initiatives. Since then Cuban has gotten trolled hard on the internet.

Reuters | US intends further strikes on Iran-backed groups, national security adviser says.

Bloomberg | Elon Musk pressures some Tesla Board members to do illicit drugs with him. WSJ has previously reported that Musk did LSD, cocaine, ecstasy and psychedelic mushrooms, often at private parties. I swear Elon is part genius, moving society forward, and part that old friend from your hometown posting conspiracy theories on Facebook.

WSJ | Nikki Haley tries to keep home state of South Carolina from ending her campaign. Says she’s targeting 43% in the February 24th primary - the level she achieved in New Hampshire last month, but polling shows she trails Trump 63% to 32%.

Bloomberg | Reddit Picks New York Stock Exchange for IPO in Win Over Nasdaq. ~$5 billion IPO coming soon.

Trivia

This week’s trivia is on Investing 101.

In finance, 'hedging' refers to:

A) Gardening activities by bankers

B) Making investments to reduce the risk of adverse price movements

C) Predicting future trends in the stock market

D) Fencing in financial risksWhich index is known as the "Fear Index"?

A) Dow Jones Industrial Average

B) S&P 500

C) Volatility Index (VIX)

D) MSCI World Bond IndexWhat is a 'junk bond'?

A) A bond made from recycled paper

B) A bond of a company that has defaulted

C) A bond for waste management companies

D) A high-risk, high-yield bond

(answers at bottom)

Market Movers

Winners!

Meta Platforms (META) [+20.5%]: Q4 results exceeded expectations, with positive Q1 revenue guidance. Highlights include AI driving automation, targeting, and engagement, success with Reels, Advantage+, and Shops ads, disciplined expenses, and significant capital return, including a $50B repurchase increase and first dividend.

Amazon.com (AMZN) [+7.9%]: Q4 revenue and EBIT exceeded forecasts, with AWS growth, improved AWS and retail margins, record delivery speeds, first reduction in per-unit costs since 2018, and advertising growth as key positives.

Post Holdings (POST) [+7.7%]: FQ1 revenue, EBITDA, and EPS surpassed expectations, prompting an increase in FY24 EBITDA guidance above consensus. Strength noted across all segments and CEO's return from medical leave were positive.

Clorox (CLX) [+5.6%]: FQ2 EPS and revenue outperformed, with 20% y/y organic growth. FY24 EPS guidance beats consensus, strong margins reported, recovery from an August cyberattack, and exceptional performance in International and Health & Wellness sectors.

Losers!

Charter Communications (CHTR) [-16.5%]: Q4 earnings fell short with revenue meeting expectations. Weak performance in both Residential and Commercial segments, with an unexpected decline in total net adds across internet, video, and voice. FY24 capital expenditure guidance exceeds Street expectations, with FY25 likely similar.

Atlassian (TEAM) [-14.7%]: FQ2 earnings and revenue exceeded forecasts, with a slight uplift in FY guidance due to Datacenter. However, the focus was on slowing Cloud growth at the low end of expectations and a longer-than-anticipated Cloud transition, amidst high expectations.

Exponent (EXPO) [-12.8%]: Missed Q4 EPS and revenue, with Q1 revenue guidance flat to down single digits versus a consensus of +4.1%. Annual revenue growth guidance also falls short compared to the consensus of +7.1%, amid consumer electronics headwinds, budget constraints, and project delays.

Gen Digital (GEN) [-11.2%]: FQ3 EPS met expectations, but revenue fell short. Q4 EPS guidance aligns, but revenue guidance is softer than consensus, with lowered FY24 EPS and revenue forecasts. Cyber Safety revenue grew by 3%, with noted acceleration in customer acquisition and strength in identity and privacy products.

Skechers USA (SKX) [-10.3%]: Q4 EPS aligned with forecasts, but revenue underperformed due to Wholesale weakness. FY24 revenue guidance is solid, but EPS guidance misses consensus. Despite a 10% decline in domestic wholesale, direct-to-consumer growth and operating margins were highlights, presenting a buying opportunity.

Market Update

Trivia Answers

B) Hedging refers to making investments to reduce the risk of adverse price movements.

C) The Volatility Index (VIX) is generally referred to as the ‘Fear Index’ as higher trading activity in options can be indicative of increased concern over the markets direction.

D) A Junk Bond is a high-risk, high-yield bond, typically from a company with significant leverage and thus poses a higher risk of default.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.