🔬Disney vs. Netflix: Binge-Watching the Throne

Plus: The S&P 500 Equal Weight Index starts to close the gap to big brother; and much more!

"If you are going to panic, panic early"

- Barry Sternlich

“For the strength of the Pack is the Wolf, and the strength of the Wolf is the Pack”

- Mowgli, The Jungle Book

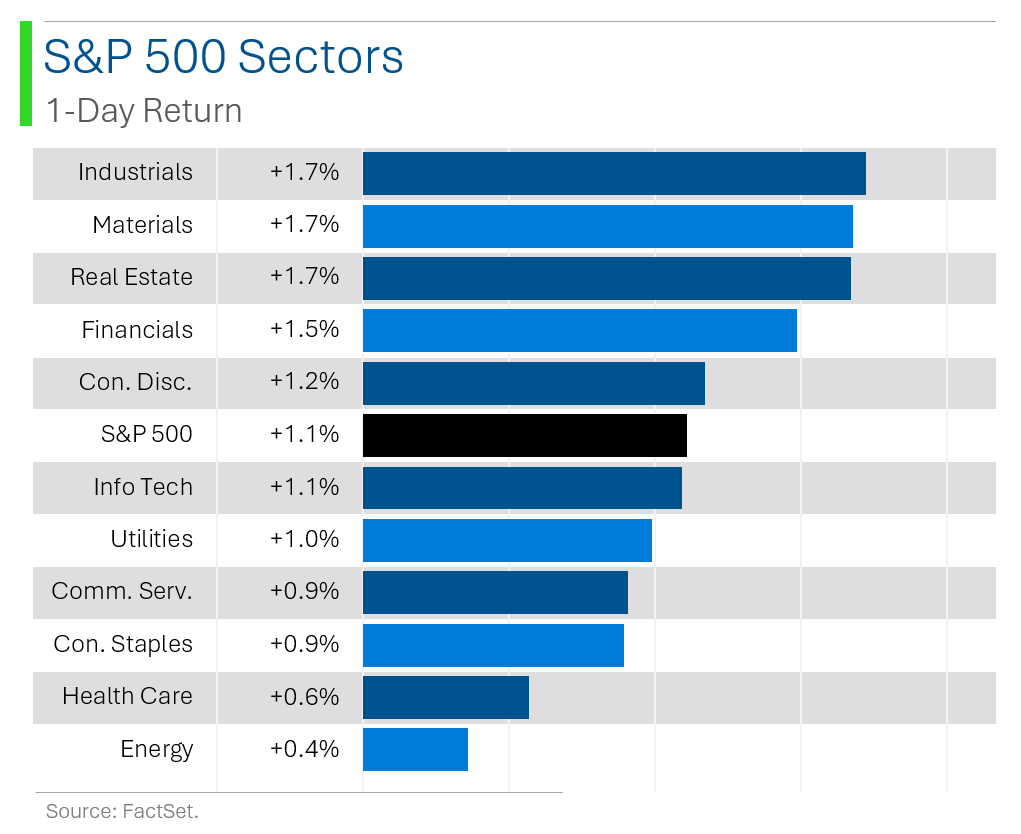

Relief day for the big US markets with the S&P 500 +1.1% and Nasdaq +1.0% after another painful week that ended with the S&P down -0.8% and Nasdaq -2.1%. The Russell 2000 was +1.7% as the Small-Cap rally continues.

7 of 11 sectors closed higher for the week, led by Utilities (+1.5%) and Materials (+1.4%). Tech (-2.4%) and techy Communication Services (-3.8%) had it the worst.

June Core PCE Inflation was in-line with Street expectations at +2.6% and sitting at it’s lowest level since March 2021.

Notable companies:

3M (MMM) [+23.0%]: Big Q2 EPS beat on better margins, sales nearly 3% ahead; raised FY EPS guidance, though sales guidance unchanged and below consensus at midpoint.

Biogen (BIIB) [-7.2%]: Europe's CHMP adopted a negative opinion on approving Alzheimer's drug Leqembi in Europe.

Dexcom (DXCM) [-40.7%]: Q2 EPS beat, revenue slightly below consensus; Q3 revenue guidance below consensus, FY24 revenue guidance lowered.

More below in ‘Market Movers’.

Street Stories

Disney vs. Netflix: Binge-Watch the Throne

Once upon a time, Disney was the content king and Netflix merely a jumped up vassal. But things for the magic kingdom have soured, and a second stint as CEO for Bob Iger hasn’t yet put the House of Mouse in order. Spending so much of your time batting away activist investors tends to have that effect…

And while it hasn’t always been smooth sailing for Netflix (2022 got pretty ugly when subscriber growth evaporated) it’s clear there they’ve hit the big time when it comes to streaming content. What follows is a brief comparison between Disney and Netflix for your hearts - and eyeballs.

To start, size-wise, Netflix has officially left Disney in its dust. That comes courtesy of Disney trading at 46% of its $356 billion 2021 peak. Netflix, however, has recovered from its 2022 weakness to hammer out a +250% rally, and put over $100 billion of space between the two.

The above helps illustrate just how shoddy Disney shares have been: only 2019 and 2020 have returned double-digits in the last decade (you can thank Avengers: Infinity War and End Game for that).

The 2010s were an incredible time for Disney - producing 16 of the 30 highest grossing films in history - but the 2020s, well, they haven’t been so kind.

Both companies have had pretty consistent growth over the years save for a few hiccups (Covid didn’t do any favors to Disney’s Parks business).

However, Netflix has incredibly been able to bang out high-single/low-double digit revenue growth like it’s just another season of Drive to Survive. Save for perpetual price increases at Disneyland, the Magic Kingdom hasn’t been able to come close to that level of growth.

And Wall Street doesn’t have particularly high hopes either. Any post-Covid pop has subsided for Disney, while expectations are that Netflix can keep hammering through international growth and passing on price increases.

On the earnings front, it’s not any prettier. In fact, Disney has yet to fully recover from the pandemic while Netflix has more than doubled EPS.

And Wall Street hasn’t started to turn around in their opinion of Disney, as estimates for 2025 revenue continue to get ratcheted down. Netflix took a step back in 2022 on the back of the Covid pop waning, but still has relatively stable targets from the Street.

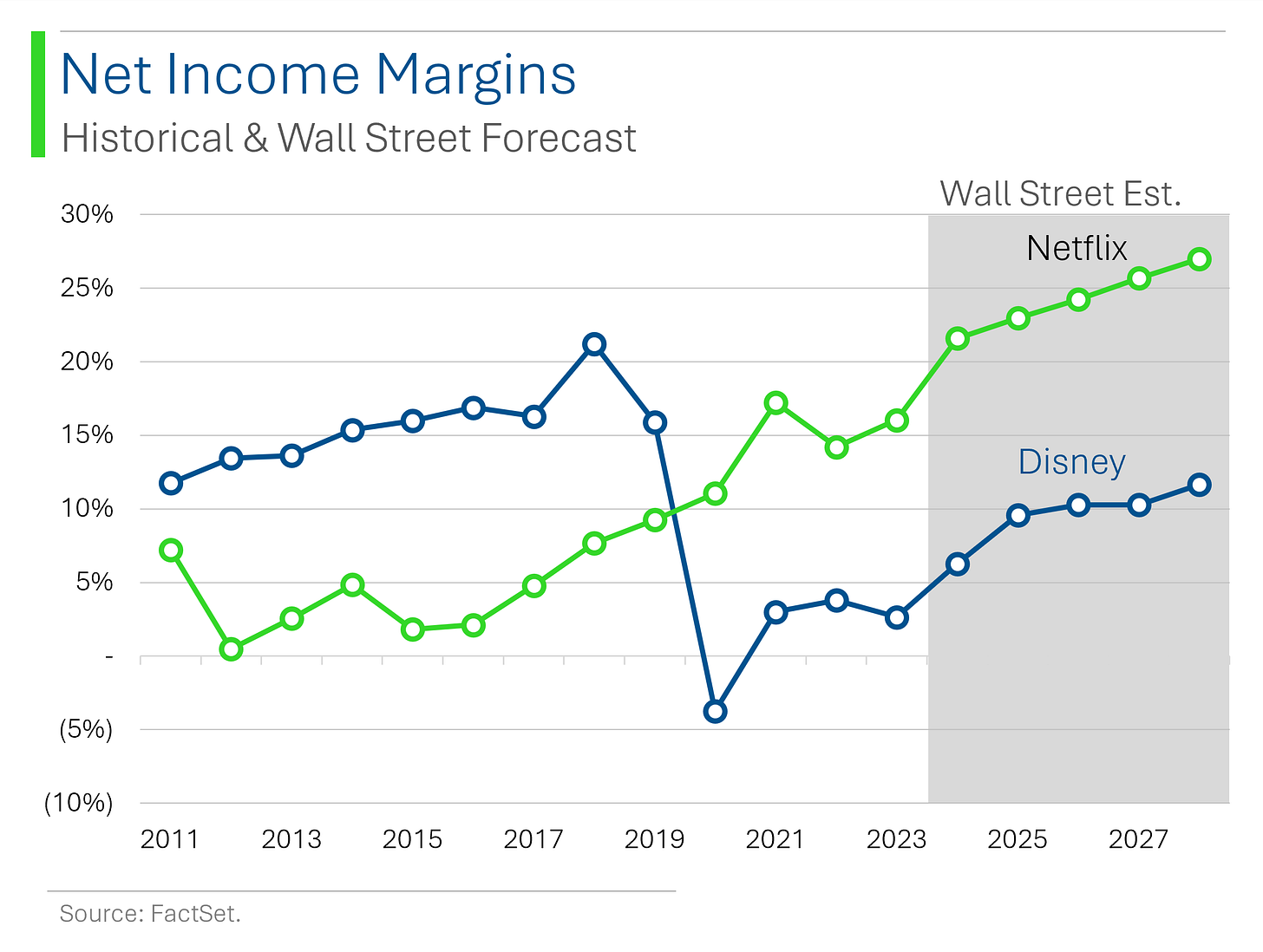

Profitability-wise is where Disney’s descent from greatness really rears its ugly head: 2023’s net income margin sat at 2.6% vs. a 2018 peak at around 21%.

All this while Netflix casually glides into the 20s...

Streaming subscribers have also hit something of a snag for Disney, any new additions have declined on net versus Q4 2022.

At Netflix, however, growth has been much easier to come by. Two quarters of slip-ups back in 2022 (which helped cause the shares to lose 2/3rds of their value) are in the rearview and even domestic subscribers - which had seemingly plateaued at ~68 million - have reignited growth with the recent password sharing crackdowns.

Thus far, pretty much everything has supported the case for Netflix being the better investment but at nearly 2x the P/E multiple it’s a little less cut and dry.

Disney is within spitting distance of its cheapest valuation this millennium, while Netflix is trading at a 50% premium to the broader market.

To wrap this up, Netflix is clearly the better company, but that’s not necessarily the same thing as being the better investment. Disney has shown signs that it is turning itself around and is cheap enough to possibly make that interesting. Meanwhile, Netflix is at the top of their game - with a valuation that reflects that.

Equal Opportunity Rotation

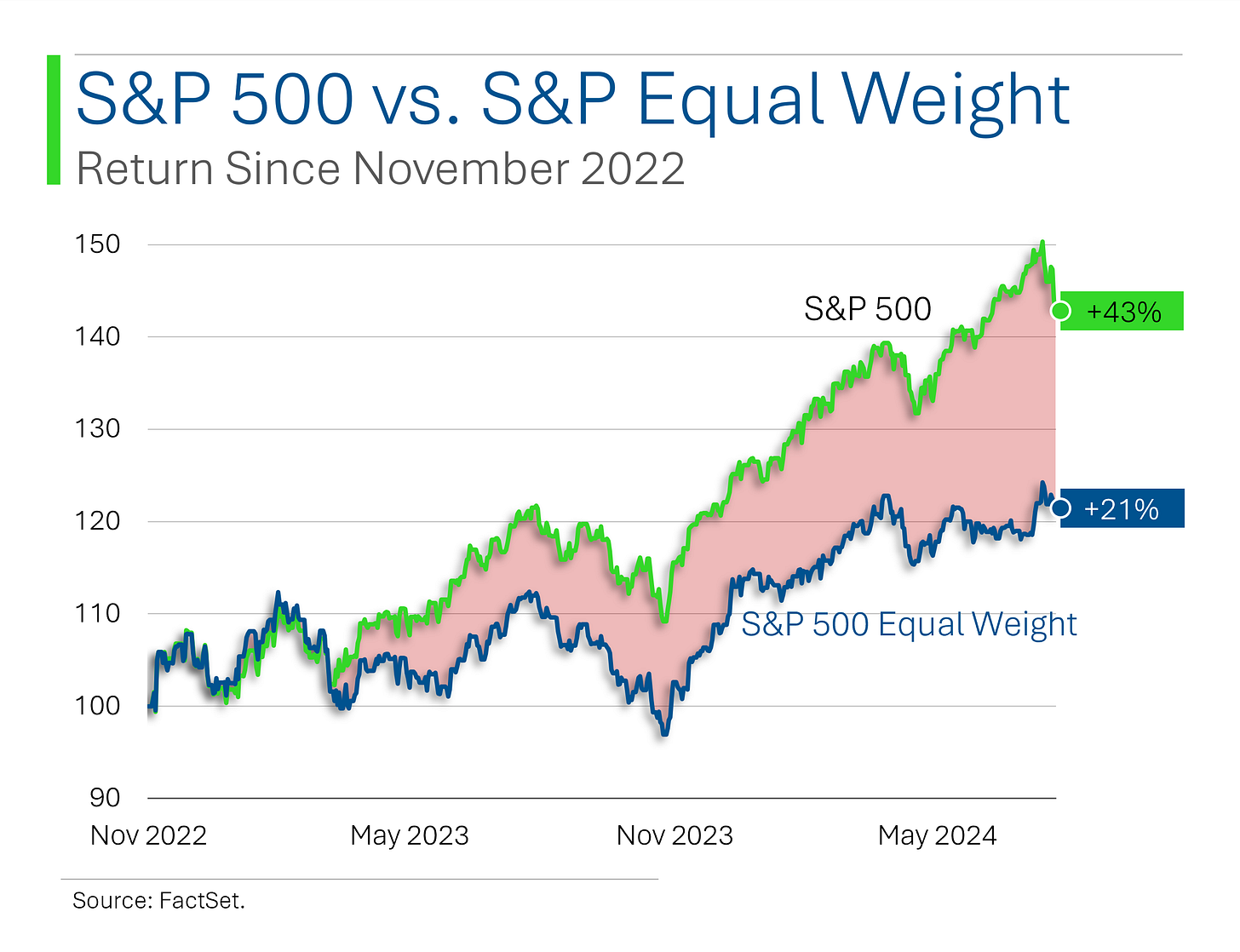

So far in July, the S&P 500 Equal Weight Index has outperformed the S&P 500 (ugh, ‘Regular Weight’) index by 2.9%. That’s the most it has beat its more famous big brother since November 2020 - basically the equivalent of Stephen Baldwin winning an Oscar.

As I’ve talked about incessantly, the market’s lack of breadth this year has been astonishing (Stock Market Identity Crisis, The Golden Age of Momentum, etc.) . Since the November 2022 market bottom, the top-heavy S&P 500 was up +50% vs. the Equal Weight +20% when the top blew off two weeks ago.

An while the Equal Weight is only a smidge above its historical average, the S&P 500 has a lot of air under that valuation. Oooof.

Hello to all the new readers that subscribed following my appearance on the Market Huddle. And special thanks to Kevin and Patrick for inviting me on the show.

Kev also writes The Macro Tourist which is one of my favorite things to read!

Joke Of The Day

My boss says I have a preoccupation with vengeance. We’ll see about that.

Hot Headlines

CNBC / Trump proposes strategic national crypto stockpile: ‘Never sell your bitcoin’. I can’t make fun of this since I’m Canadian and we have a strategic national maple syrup reserve:

WSJ / A multibillion-dollar cyberfraud industry operating out of Southeast Asia relies on forced labor and torture. The disgusting world where Chinese gangsters traffic people, often to remote and lawless parts of Southeast Asia, and force them to sit at computers all day scamming strangers online.

CNBC / U.S. union and Apple reach tentative labor agreement. Employees will get to vote on the proposed plan August 6th, which would mark the first unionized Apple employees.

WSJ / Google has reversed its decision to eliminate cookies but the $600 billion digital ad industry is preparing for battle over the phrasing of a prompt to let users opt out. The snippets of code that have fueled the lucrative digital-advertising economy for decades might disappear anyway despite cookies staying put.

Quartz / It turns out a lot of return-to-office mandates were meant to make workers quit. Executives surveyed by Bamboo HR said they hoped return-to-office mandates would encourage ‘voluntary turnover’. Making people jump through hoops to avoid paying severance?

Trivia

Today’s trivia is on interesting feats in the world of stocks.

Which company had the largest initial public offering (IPO) in history as of 2023?

A) Saudi Aramco

B) Alibaba

C) Facebook

D) SoftBank Group

The term "Blue Chip" comes from which game?

A) Bridge

B) Poker

C) Checkers

D) Monopoly

What year did the NASDAQ stock market first begin operations?

A) 1951

B) 1961

C) 1971

D) 1981

(answers at bottom)

Market Movers

Winners!

Coursera (COUR) [+44.7%]: Q2 revenue and EPS beat with strong demand for entry-level certificates and AI-related content; Enterprise ahead, growth initiatives gaining traction; no change to 2024 guide, though some firms see outlook as conservative.

Newell Brands (NWL) [+40.5%]: Q2 earnings beat, revenue slightly light; core sales declined, offset by international pricing; noted fourth sequential quarterly GM improvement; raised FY EPS guidance midpoint.

3M (MMM) [+23.0%]: Big Q2 EPS beat on better margins, sales nearly 3% ahead; raised FY EPS guidance, though sales guidance unchanged and below consensus at midpoint; strength in electronics, mixed industrial markets, soft consumer retail spending.

Mohawk Industries (MHK) [+19.5%]: Q2 revenue light, earnings beat; management highlighted sales initiatives and cost-containment; continued consumer pressure from trading down and competitive pricing; Q3 EPS guidance ahead; announced further cost-savings.

Charter Communications (CHTR) [+16.6%]: Q2 earnings and revenue beat; FCF well ahead; customer relationships topped consensus; expects FY24 capex below prior guidance amid lower internet and video net adds.

Bristol Myers Squibb (BMY) [+11.4%]: Q2 earnings and revenue beat; strong performance from Growth (Opdivo, Orencia, Yervoy) and Legacy (Eliquis, Revlimid); raised FY EPS and GM guidance; FY revenue near high end of prior guide.

Norfolk Southern (NSC) [+10.9%]: Q2 EPS beat with solid cost controls; revenue mostly in line; lowered FY24 revenue growth guidance to ~1% from ~3%; analysts positive on maintaining OR guidance despite soft volume backdrop.

Deckers Outdoor (DECK) [+6.3%]: Big fiscal Q1 EPS beat on better sales and GM; strength in HOKA and UGG; focus on DTC growth via new product launches; raised FY EPS guide, sales guidance unchanged; more normalized promotional environment expected.

Baker Hughes (BKR) [+5.8%]: Q2 EBITDA beat by 8%; raised midpoint of FY EBITDA guide by 5%; better revenue and margins, IET orders, record backlog, new energy momentum, favorable capital return dynamics.

Boyd Gaming (BYD) [+4.3%]: Q2 earnings and revenue beat; outperformance in each segment; Midwest & South segment expected to stabilize with potential growth in 2025; consumer improvements in May and June offset slow start; no buyout of PENN indicated.

Colgate-Palmolive (CL) [+3.0%]: Q2 EPS and revenue beat; organic growth ahead; raised FY24 EPS and organic sales guidance; analysts positive on GM expansion due to cost savings; US pricing pressure likely to ease.

Texas Roadhouse (TXRH) [+2.0%]: Q2 comps, RLMs, and EPS ahead; resilient traffic trends vs. casual dining peers, margin expansion, productivity gains; revised FY24 commodity inflation guidance down; improved menu-mix.

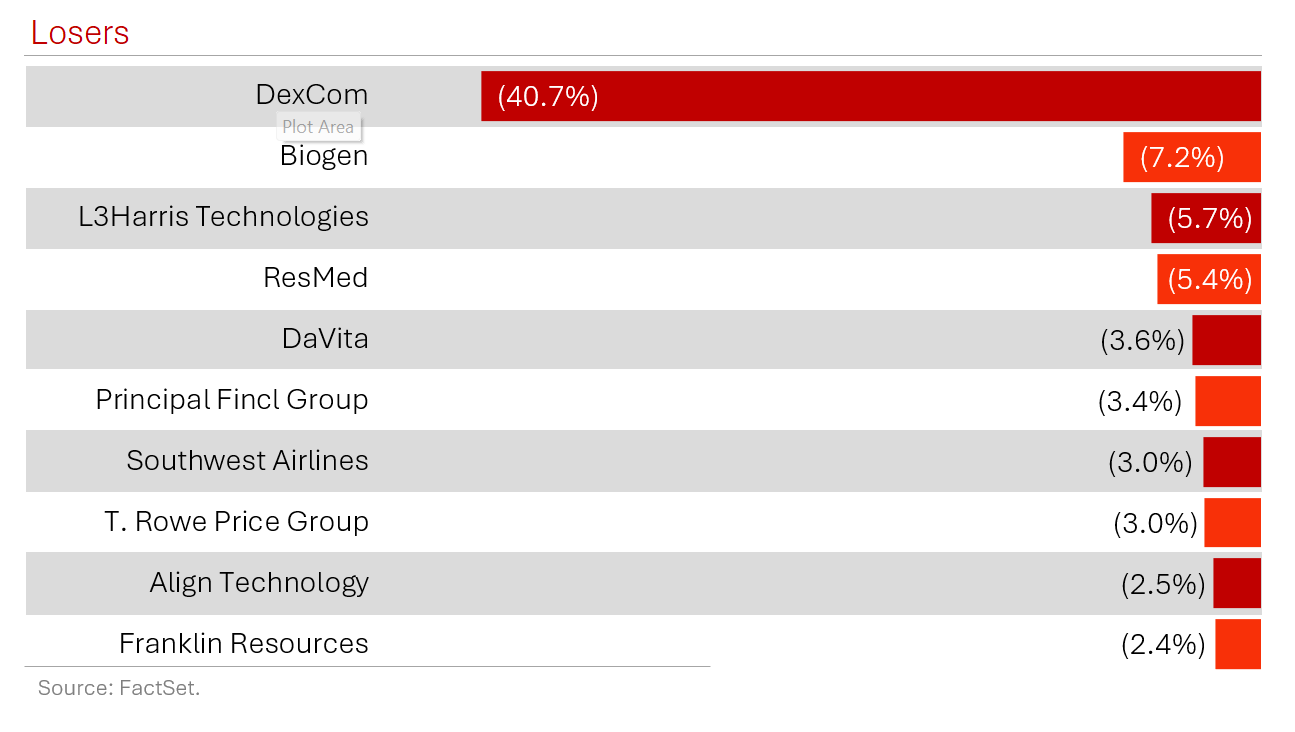

Losers!

Dexcom (DXCM) [-40.7%]: Q2 EPS beat, revenue slightly below consensus; Q3 revenue guidance below consensus, FY24 revenue guidance lowered; miss due to US execution issues with salesforce expansion, lower rep productivity, and lower new patient adds; lower share in DME also cited.

Saia Inc (SAIA) [-19.0%]: Q2 earnings and revenue missed; impacted by new-terminal openings; skew in business mix toward retail dragged on revenue per bill and OR; FY capex guidance slightly below the Street.

Booz Allen Hamilton Holding (BAH) [-9.0%]: FQ1 EPS and EBITDA missed, revenue in line; reaffirmed FY25 EPS, revenue growth, and EBITDA guidance; analysts noted weaker FCF and sales growth, but positive on book-to-bill trends; high expectations going into print.

Biogen (BIIB) [-7.2%]: Europe's CHMP adopted a negative opinion on approving Alzheimer's drug Leqembi in Europe; BIIB and partner Eisai (4521.JP) disappointed and prepared to petition for CHMP to reexamine their opinion.

Olin Corp (OLN) [-7.2%]: Q2 EBITDA missed by ~4%, company reduced FY EBITDA guide; larger-than-expected hurricane impact on Q3, continued volume weakness in 2H, no improvement in chlorine flagged.

Carter's (CRI) [-4.3%]: Q2 EPS beat, revenue missed; Q3 guidance weaker than expected; FY24 guidance lowered due to OshKosh pension plan settlement charge; slow start to the quarter and late arrival of warmer weather noted.

Gentex (GNTX) [-4.2%]: Q2 earnings, revenue, and GM missed; weaker light-vehicle production, biggest sales impact in June; lower sales and unfavorable mix offset purchasing-cost reductions; cut FY24 and FY25 revenue guidance, possible delay in hitting long-term GM targets noted.

T. Rowe Price Group (TROW) [-3.0%]: Q2 revenue and EPS slightly below consensus; lower expenses highlighted, but revenue miss driven by lower average AUM offsetting improving fee rates.

Market Update

Trivia Answers

A) Saudi Aramco was the biggest IPO in history, raising $29 billion at a $1.7 trillion valuation.

B) The term ‘Blue Chip’ comes from Poker, where traditionally blue chips were of highest value (apparently).

C) Nasdaq started operations in 1971.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.