🔬Disney is Turning into a Knife Fight, Cybertruck Launches (2 years Late), and Much More

"People want a simple narrative, but the world doesn't give you that"

- Jeffrey Gundlach

“It's not a question of enough, pal. It's a zero sum game, somebody wins, somebody loses”

- Gordon Gekko

Mixed day for the big markets (S&P 500 +0.38%, Nasdaq -0.23%) but some outsized moves for popular names (see ‘Market Movers’ below).

Sectorally speaking, 6 of 11 ended the day up, with Real Estate leading (+0.8%) and Consumer Staples lagging (-0.8%).

Gold was down 0.5% (someone must have told it I called for all-time high yesterday)

PCE - the Fed’s favorite gauge shows inflation - rose 0.2% in October and 3.5% from a year ago, which was in-line with Street estimates.

Chicago PMI surprised to the upside and pending home sales declined a bit less than expected (but index still at record lows).

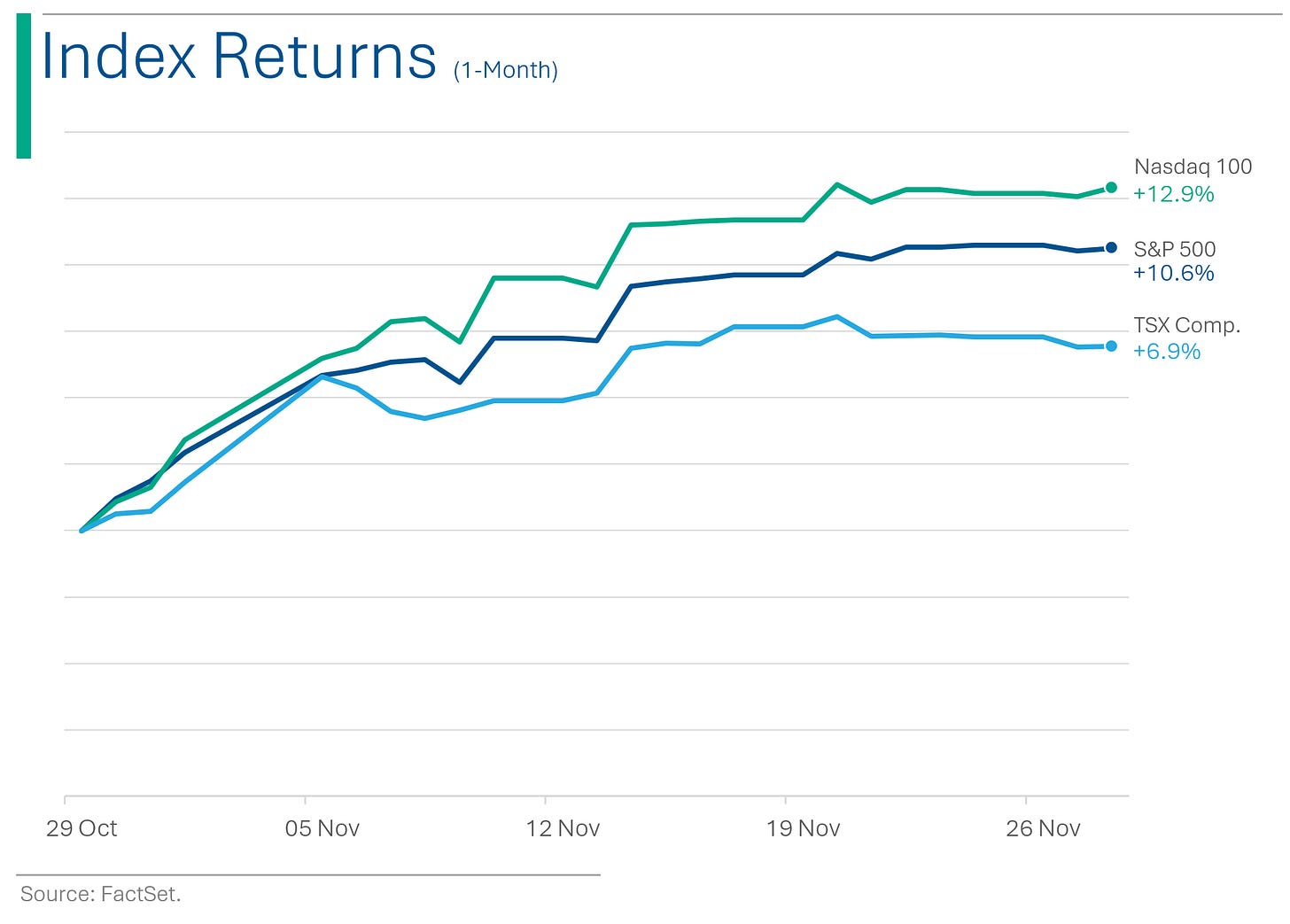

The Nasdaq and S&P 500 closed November with one of the all-time best months for stocks, up 10.7% and 8.9% respectively.

Oil closed down 2.4% as the market laughed off OPEC+’s 2 million barrel cut for 2024.

*** Thanks to Paul S. for noticing an error with one of my charts…that had been there for a month ***

Street Stories

DISNEY’S ACTIVIST FIGHT HEATS UP - Nelson Peltz, and his firm Trian, are fighting to get ‘more than’ two seats on the Disney board. Trian controls about $3 billion in Disney stock with much of it belonging to fired Marvel Boss, Ike Perlmutter. Disney hasn’t been keen to open the doors to Trian, in part due to the ‘bone to pick’ that Perlmutter has with CEO Bob Iger, so the proxy fight could end up messy. Poor Bob! He came out of retirement to return to a struggling Disney, that’s getting attacked from a series of activist investors, including ValueAct and Trian. Nm, I googled his net worth. No sympathy. (CNBC has more on the Trian squabble)

AUTOMAKERS FORECAST DEEP CUT FROM UNION DEAL - Ford Motor has estimated the cost of its new labor agreement with the United Auto Workers (UAW) at $8.8 billion, leading to a cut in its 2023 profit forecast from $11-12 billion to $10-10.5 billion. The deal, resulting from weeks of strikes, is expected to increase labor costs by around $900 per vehicle by 2028, with Ford planning to counterbalance this by reducing costs elsewhere. This adjustment follows General Motors' similar announcement of increased labor costs ($9.3 billion) but also measures like a ginormous $10 billion share buybacks and a dividend increase - which, as you can see, the Street liked more. (Reuters has more stuff)

TESLA CYBERTRUCKS GO ON SALE - Two years late and 50% more expensive than originally promised, Musk played the futuristic Santa by delivering the first batch to owners, including Reddit's co-founder Alexis Ohanian, at an event hosted in Texas. After navigating a production odyssey worthy of a sci-fi novel, Elon said it will take 12-18 months for the vehicle to provide positive cashflow to Tesla. Still not sure I like it, though. (Bloomberg has more)

OPEC+ TO CUT OIL PRODUCTION - Member countries, including the likes of Saudi Arabia and Russia, have agreed to voluntary output cuts totaling 2.2 million barrels per day for early 2024 to support the market (AKA jack up the price). However, the cut only amounts to real decline of around a one million barrel decline as the Saudis’ voluntary cut for 2023 is just being rolled into next year.

Despite these cuts, WTI Crude actually closed the day down 2.4%, amid speculation that the proposed cuts would be deeper and the fact that recent cuts have been quickly offset by increases from non-OPEC+ producers. To that I say…

MORTGAGE RATES KEEP FALLING - Mortgage rates have fallen for five consecutive weeks. The average 30-year fixed rate dropped to 7.22%, sparking some buyer interest, but overall purchase activity remains 20% lower than last year due to high rates and financial uncertainty. The low supply of homes, persistent high home prices, and buyer apprehension about high monthly payments continue to dampen market activity, despite hopes of future refinancing benefits. (BNN has more)

Joke Of The Day

A man goes into a job interview, and presents himself well, including giving a brilliant presentation on why he is the ideal man for the job. The employer is shocked at how professional he is: “Wow, you have an incredible resume, and present yourself fantastically, but you seem to be missing 5 years on this part of your resume. What happened there?” The man replied “Oh that’s when I went to Yale.” The employer is even more impressed. “That’s great, you’re hired!” The man is super happy and says “Yay! I got a yob!

Hot Headlines

WSJ | ‘No more dry burgers’ says McDonald’s following its biggest menu overhaul in decades. The company cites more than 50 tweaks on its burgers.

CNBC | Fed’s favorite inflation gauge shows +0.2% increase in October and +3.5% from a year ago, in line with Wall Street expectations.

Reuters | Brazil set to join the influential OPEC+ oil producers’ alliance. However, they apparently aren’t going to be forced to cap output as part of the deal. So basically, they’re just hanging out? Sounds pointless.

Bloomberg | Yellen says soft landing looks good, and unemployment may level-off. I’m worried now because I remember her always being wrong.

CBC | Canada’s Big Banks announce layoffs and more bad loans as TD, Royal and CIBC post quarterly results. Canada will not be left out of global banking decimation.

WSJ | Biden may limit Chinese role in U.S. EV market. Administration is expected to decide Friday what will disqualify EVs from eligibility for $7,500 consumer subsidy.

Trivia

This week’s trivia is on the Roman Empire.

What was a 'Triumvirate' in Roman times?

a) A three-man military alliance

b) A type of currency

c) A religious ceremony

d) A legal document

What was a primary source of wealth in the Roman province of Hispania?

a) Spices

b) Silver mines

c) Wine production

d) Silk tradingThe 'Pax Romana' was a period of?

a) Economic recession

b) Civil war

c) Peace and financial prosperity

d) Financial stagflation

(answers at bottom)

Market Movers

Winners!

ImmunoGen (IMGN) [+82.8%]: Agreed to be acquired by AbbVie for for about $10.1 billion, a ~95% premium to Wednesday's close. That’s old school premium.

Salesforce (CRM) [+9.4%]: Beat FQ3 EPS and revenue forecasts; raised FQ4 and FY guidance due to strength in key cloud services. Talked up AI benefits which was noted by analysts (so trendy).

Snowflake (SNOW) [+7%]: Beat Q3 earnings and revenue with strong FQ4 guidance. Notable increases in operating income and FCF.

Snap (SNAP) [+6.5%]: Upgraded to buy from hold by Jefferies, citing turnaround in Direct Response ads and a promising deal with Amazon for on-platform checkout, expected to drive North American growth.

Losers!

Pure Storage (PSTG) [-12.1%]: Beat Q3 results but guided to massive 15% cut in revenue for next quarter and reduced FY24 sales growth forecast by 450 bp. Should have mentioned AI. I’m just saying…

Cracker Barrel (CBRL) [-10.6%]: FQ1 EPS fell short with revenue meeting expectations; saw a 1.9% y/y revenue drop. Restaurant comps decreased slightly.

Titan Machinery (TITN) [-10.3%]: Missed Q3 revenue, EBITDA, and EPS expectations, lowered FY revenue outlook. So basically not good.

Market Update

Trivia Answers

a) A Triumvirate is a three-man military alliance, notably the one between Caeser, Pompey and Crassus, and Augustus, Mark Anthony, and Lepidus. None ended well…

b) Silver mines were the main source of wealth in Roman Hispania.

c) Peace and prosperity came from the Pax Romana.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.