🔬Deflation Nation: China's Prices Flatline

Plus: OPEC cuts global demand estimates (again); and much more!

"There is a time to make money and a time to not lose money."

- David Tepper

"He who lives by the crystal ball will eat shattered glass."

- Ray Dalio

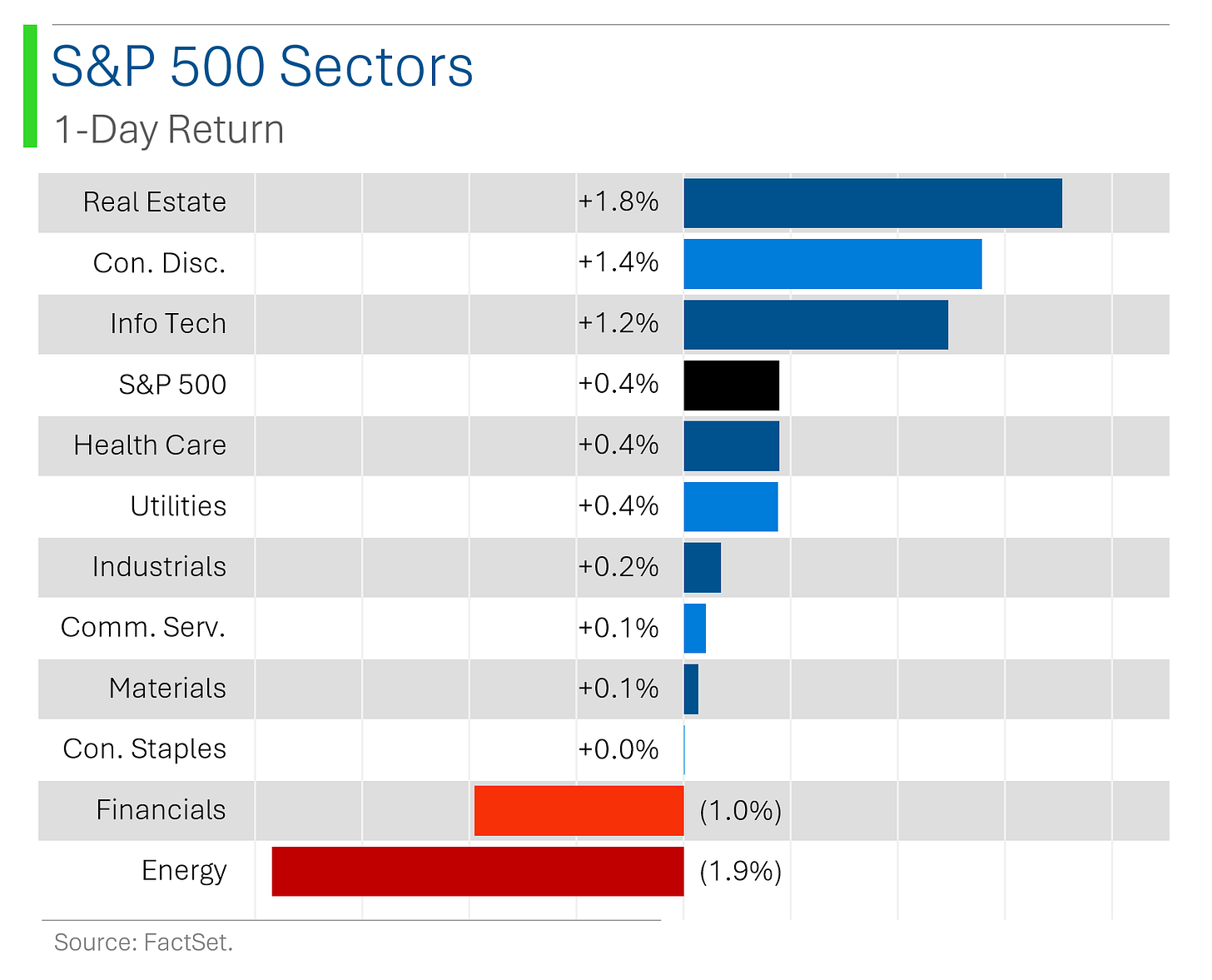

Tech and semis led the market rally, while banks, energy, autos, and commodities underperformed; 2Y Treasury yield hit its lowest since September 2022.

Weak banking updates, European auto guidance cuts, and declining commodities created headwinds, while focus shifted to the upcoming CPI data and political uncertainty with the presidential debate.

Corporate updates included Oracle’s earnings beat, Apple's $14B tax loss in Ireland, Google’s €2B fine in the EU, and Fed’s Barr reducing proposed capital requirements for big banks in Basel III updates.

Notable companies:

Oracle (ORCL) [+11.4%]: Oracle smashed fiscal Q1 expectations, with the Street loving their cloud growth and new MultiCloud agreement with AWS.

Under Armour (UA) [-9.6%]: They upped their expected restructuring charges after deciding to exit a key distribution facility.

Goldman Sachs (GS) [-4.4%]: CEO David Solomon said trading revenues are down close to 10% this quarter, and they’re running a bigger capital buffer than usual.

More below in ‘Market Movers’.

Street Stories

Deflation Nation: China's Prices Flatline

The Chinese economy has been on the rocks since 2022, and the sluggishness of recovery is having ripple effects across the global. Today I break down some of the big problems facing the Middle Kingdom. Here we go!

What kicked off the latest round of Chinese macro worry was the release of inflation data Monday, which saw the CPI inflation barely budged in August, up a measly +0.6% - the 18th straight month below +1%. That’s what happens when consumers tighten their belts.

And it's all a cycle, as wages are down so the consumer is holding out for lower prices instead of splurging on big-ticket items. And it’s awfully familiar to Japan in the 1990s.

Retail sales helps illustrate this: A barometer of economic health and prosperity, it’s now in stagnation territory.

Discretionary categories like jewelry, cosmetics and automobiles are seeing significant declines as unnecessary spending grinds slower.

Moreover, the categories showing growth are mostly staples like food and medicine; stretching the consumer further.

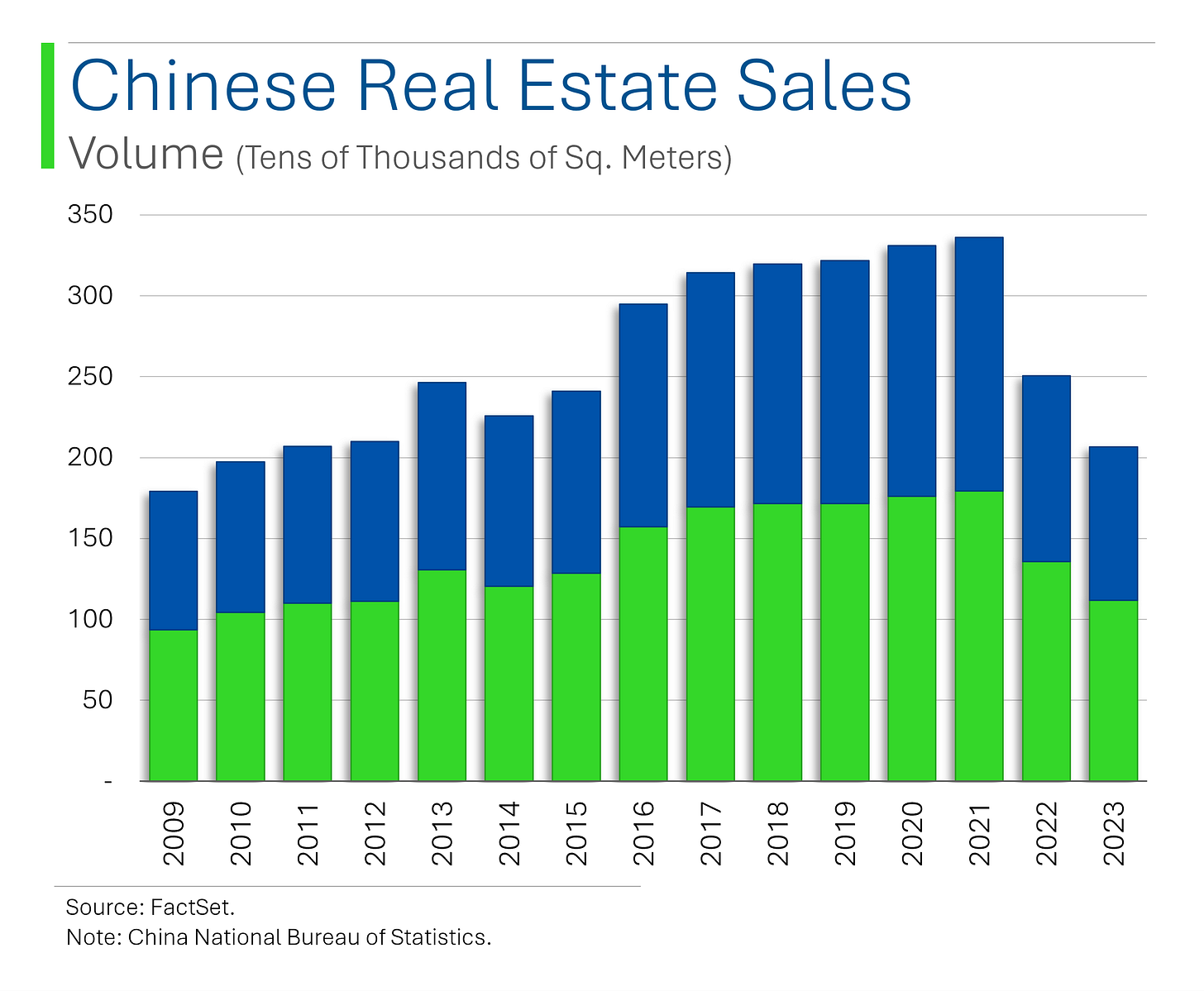

The Housing market in China also has shown little signs of turning around after the crisis in 2022, precipitated by aggressive lending, over optimistic demand expectations - and more than a little corruptions.

Beyond all those cool YouTube videos of massive Chinese real estate developments being dynamited, this has left the banking and financial system extremely stretched. Moreover, prior to the collapse, the Housing sector was typically 25-30% of GDP. Kinda important…

All of this boils down to economic growth, where once China was the undisputed king of growing GDP. However, this has been progressively cooling over the years and Q2 GDP came in at just +4.6% - way below the government’s 5.5% target.

And importantly, the gap to their biggest rival has also closed. The days of double-digit growth seem far behind.

All this adds to the global investor community’s reticence about putting their money to work in China.

And their stock market has been a disaster as a result.

So clearly the situation isn’t too pretty right now. But more concerning is the fact that Chinese demographics will make a return to strong future growth very difficult. A rapidly aging population and miniscule birth rates means that millions are now leaving the work force on net every year.

Bottom line: China’s deflation spiral and weakened economic outlook isn’t just a domestic issue…it’s a global one. With retail sales in the gutter, wages stagnant, and GDP growth lagging, the ripple effects are already being felt worldwide.

OPEC’s Crystal Ball Needs Glasses: Another Oil Forecast Cut

OPEC has once again slashed its 2024 oil demand forecast, blaming China’s sluggish economy (see above) and its inconvenient love affair with cleaner fuels. Now, they predict a modest 2.03 million barrels per day growth to 104.2 million daily, down from the overly optimistic 2.11 million.

Meanwhile, OPEC+ has hit the snooze button on increasing output after oil prices dropped even while its production in August declined due to disruptions in Libya.

The western (ie: non-cartel) International Energy Agency also released it’s production estimates, which clearly didn’t get the memo on being “optimistic”, coming in well below OPEC’s 2024 number at only +970k barrels per day in 2024. Likely the true figure will be somewhere in the middle.

Joke Of The Day

What's the difference between inlaws and outlaws?

Outlaws are wanted.

Hot Headlines

CNBC / Economic misery index leans toward Harris in tight race. The index is a combination of unemployment and inflation rates, and it is currently at 7.02…below the critical 7.35 threshold that would suggest an incumbent party loss. Sounds dumb but it’s worth noting that this index has accurately predicted 15 of the last 16 presidential elections since 1980.

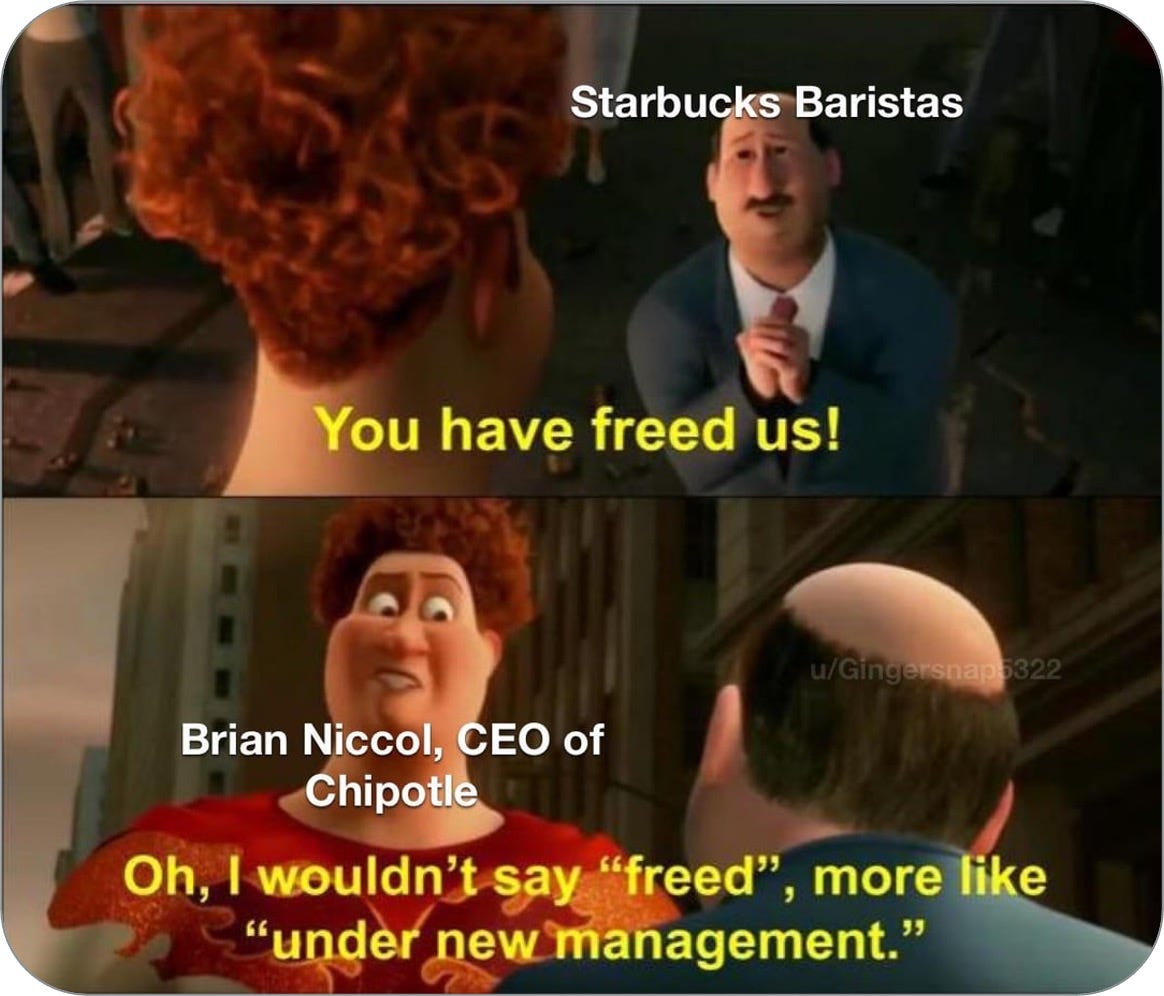

CNBC / New Starbucks CEO Brian Niccol targets U.S. turnaround. He’s starting by enhancing the barista experience, streamlining morning service, upgrading in-store environments, and reinforcing Starbucks' brand identity. With slumping sales in both the U.S. and China, he plans to emulate any success internationally. Pumpkin spice lattes are going to hit hard next month.

Bloomberg / JP Morgan leads banks in dimming outlooks based on new capital requirement rules. Given the new Basel III financial constraints, JPMorgan warned of lower net interest income and tightening loan margins, in fact, the KBW Bank Index dropped 1.9%, with JPMorgan falling 5% on these concerns about future performance. Most importantly, are bonuses going down though?

Bloomberg / Private equity fights insurance for $15 trillion retirement prize. Insurers argue that private equity-backed investments are riskier, while PE firms claim they provide better returns. Tensions are high as regulators decide how to handle this growing clash, with significant implications for millions of savers at risk within one of America’s largest industries.

Bloomberg / BOJ’s bond buying cuts carve out opening for Japanese investors. Trust banks, driven by pension funds, have led the charge and with bond yields rising gradually, domestic demand is expected to stay strong. This will continued to support the BOJ’s plan to cut purchases by half through March 2026.

Trivia

Today's Trivia Is On the Rothschilds!

Which 19th-century event significantly boosted the Rothschild family’s wealth and influence by providing early information on a historic battle?

A) The Battle of Trafalgar

B) The Battle of Waterloo

C) The Crimean War

D) The Franco-Prussian WarThe Rothschilds were pivotal in funding the construction of which major European infrastructure project in the 19th century?

A) The Suez Canal

B) The Panama Canal

C) The Trans-Siberian Railway

D) The Eiffel TowerWhich Rothschild family member is credited with establishing the London branch of the banking empire, which became one of the most powerful in the world?

A) Mayer Amschel Rothschild

B) Nathan Mayer Rothschild

C) James Mayer Rothschild

D) Salomon Mayer RothschildWhat symbol, still associated with the Rothschild family today, was originally used as the logo for their banking business?

A) A lion

B) A red shield

C) A crown

D) An eagle

(answers at bottom)

Market Movers

Winners!

Mission Produce (AVO) [+21.5%]: Q3 results beat estimates, but management expects flat to lower volumes in Q4 with avocado prices still up from last year.

Oracle (ORCL) [+11.4%]: Oracle smashed fiscal Q1 expectations, with the Street loving their cloud growth and new MultiCloud agreement with AWS.

Boot Barn Holdings (BOOT) [+9.9%]: Their Q2 comps came in better than expected, with strong store transaction growth driving improvement in recent months.

Vista Outdoor (VSTO) [+3.3%]: Vista's board is still in talks with MNC Capital about a takeover at $43 per share.

Johnson Controls International (JCI) [+2.5%]: Bank of America upgraded JCI, pointing out their strong data center exposure compared to peers.

Equity Residential (EQR) [+2.4%]: Deutsche Bank upgraded them thanks to their coastal focus and tight supply.

DraftKings (DKNG) [+1.4%]: DraftKings got a bump after BNP Paribas Exane lifted their rating to neutral from underperform.

Losers!

Ally Financial (ALLY) [-17.6%]: Credit challenges worsened in Q3 with borrowers struggling due to inflation, high living costs, and a softening labor market.

Under Armour (UA) [-9.6%]: They upped their expected restructuring charges after deciding to exit a key distribution facility.

Hewlett Packard Enterprise (HPE) [-8.5%]: They're raising $1.35B through a preferred stock offering to help fund their Juniper Networks acquisition.

JPMorgan Chase (JPM) [-5.2%]: They warned that 2025 NII expectations are too high and that Q3 fees and trading revenues are below expectations.

Goldman Sachs (GS) [-4.4%]: CEO David Solomon said trading revenues are down close to 10% this quarter, and they’re running a bigger capital buffer than usual.

Nutrien (NTR) [-1.8%]: Goldman Sachs downgraded them, citing potential bad debt and loss reserves issues in their retail segment.

Rubrik (RBRK) [-1.5%]: Despite raising full-year guidance, their shares are under pressure due to an upcoming IPO lockup expiry.

Market Update

Trivia Answers

B) The Rothschilds gained significant wealth and influence by receiving early information on the outcome of the Battle of Waterloo.

A) The Rothschilds helped finance the construction of the Suez Canal, a crucial infrastructure project in the 19th century.

B) Nathan Mayer Rothschild is credited with establishing the London branch of the Rothschild banking empire.

B) The red shield, or "Rothschild" in German, was originally used as the logo for their banking business.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.