🔬Defense Stocks: Ready, Aim, Profit?

Plus: July fund flows see investors throw out the 2024 playbook; and much more!

"The market is a pendulum that forever swings between unsustainable optimism and unjustified pessimism."

- Benjamin Graham

"It’s not the years in your life that count. It’s the life in your years."

- Abraham Lincoln

Bla end to a crazy week with the S&P 500 and Nasdaq both +0.2% on Friday. The S&P 500 was +3.9% for the week, it’s largest gain since the first week of November last year (+5.9% during the last bout of rate cut fever).

8 of 11 sectors finished higher but none were standouts (Best: Financials +0.6% ; Worst: Industrials -0.2%). Over the week, though, Tech had a monster finishing +7.5%!

July Housing Starts were a bit disappointing on Friday. Coming in at +1.24m vs. Wall Street estimates for +1.35m - notching it’s lowest level since May 2020! That said, much of the weakness is being blamed on Hurricane Berly so 🤷♂️.

Notable companies:

Rocket Lab USA (RKLB) [+12.5%]: Stock rose 12.5% after successfully shipping two Mars-bound spacecraft to Cape Canaveral for NASA’s ESCAPADE mission.

Sphere Entertainment (SPHR) [+6.4%]: Shares rose 6.4% after JPMorgan upgraded the stock to overweight, citing the Las Vegas Sphere’s growing status as a key tourism venue.

B. Riley Financial (RILY) [+16.1%]: Share price surged 16.1% after Bryant Riley proposed to acquire all remaining shares for $7 each.

More below in ‘Market Movers’.

Street Stories

Defense Stocks: Ready, Aim, Profit?

A pretty standard joke in the world of investing is that when the geopolitical world is looking bleak, you should buy defense companies. It’s a pretty linear narrative: America invades the sandbox, buy the stuff the invaders are firing. Shooting war in Europe? Ditto that.

Today I wanted to check out how well that’s actually panned out and, with geopolitical risk seemingly growing by the day, is that a worthwhile strategy going forward?

To set the table, most of the biggest weapons producers are American or Chinese. Of the top 15 largest companies, 7 are from the US, 5 from China and a single player each from the UK, France and Italy.

Pretty much what you’d expect.

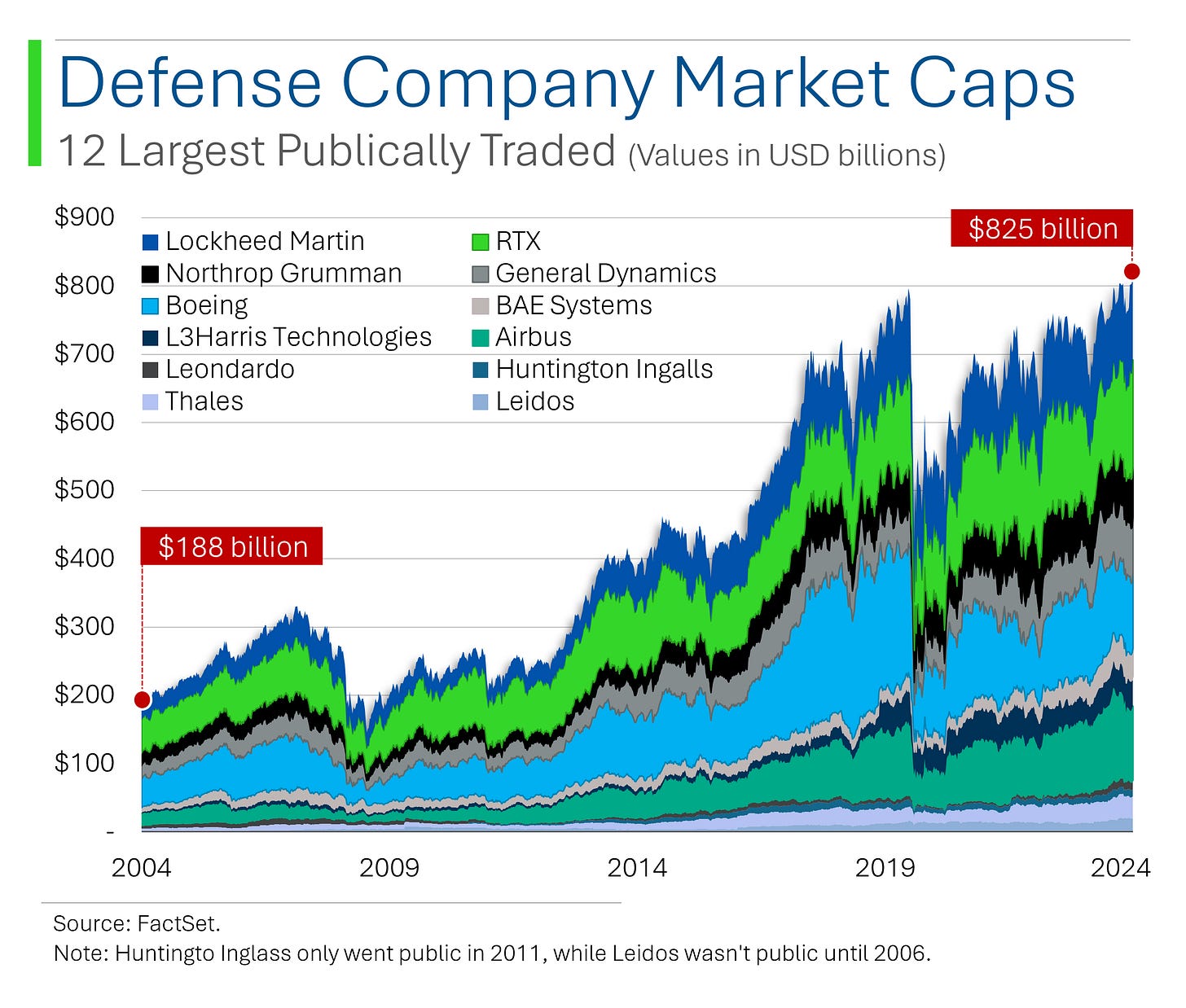

And as you’d also expect, they have grown considerably over the last two decades given the tumult in the Middle East as well as Western nations gearing up for a potential new cold war with Russia and China.

The 12 largest publicly traded defense companies now represent nearly a trillion dollars in market cap.

Not exactly the sunshine and rainbows we’d expected from a more civilized, post-Cold War world.

Looking at the recent past, the biggest players have actually seen pretty decent revenue growth, but it’s not exactly straight forward. For example, RTX - the merged Pratt & Whitney/Collins/Raytheon - has seen most of it’s recent growth not from the ‘high tech’ Raytheon side but from the more mundane categories, like engines (Pratt) and aircraft landing gear and breaks (Collins).

Not exactly preparing for the wars of the future…

EPS-wise, it’s still a mixed bag, like more cutting edge Lockheed Martin (missiles; jets; space stuff) forecast to under perform sleepy ole General Dynamics.

And don’t get me started on the bag of hammers that is Boeing…

Also interesting is that despite several prominent wars kicking off and increased East-West tensions, Wall Street estimates haven’t exactly been creeping up either.

For example, the consensus Street 2024 revenue estimates for RTX, Lockheed, and Northrop are down over the past three years. The only real winner has been General Dynamics, notably it’s Combat Systems division (tanks, APCs, logistics and training) - sadly the ‘picks and shovels’ of a European land war.

On the whole, defense hasn’t been a particularly sexy place to be over the past 5 years - with only 2 of the 12 biggest public companies actually outperforming the S&P 500.

That said, since the Russian invasion of the Ukraine, the S&P 500 is up 26%, while the average defense company is up +60%. If you have a dark outlook on the world, this might not be a bad place to put your money (but I do hope you’re wrong).

Where’s the money going?

According to Morningstar’s latest fund flows report, July was a pretty wild shuffle to the 2024 investor playbook.

Confusing economic times and a sinking yield curve have been good inducement to get people to move money into bonds - with taxable and municipal bonds pulling in a total of $57 billion in fresh assets in July.

US Equity flows were another big winner but the split between Passive Funds (+$46 billion) and Active Funds (-$26 billion) was pretty wild. Basically, people were flocking to more balanced, market based funds (including small-cap) and away from active managers - likely where all that Mag7 concentration has worked against it (finally).

Interestingly, while big caps took a beating last month, small caps saw a rush of love last month, with the iShares Russell 2000 ETF snagging $6.9 billion - it’s second highest month in recent memory! So, while some investors are running for cover, others are betting on the little guys to (finally) start working again.

Joke Of The Day

How do you find a good small-cap fund manager?

Find a good large-cap fund manager, and wait.

Hot Headlines

The Washington Post / Harris holds slight national lead over Trump, Post-ABC-Ipsos poll finds. With 77 days until the election, Biden’s dropping out of the race is starting to bear fruit for the democrats.

Yahoo Finance / Sports streaming service from Disney, Fox, and Warner Bros. Discovery blocked by judge citing antirust concerns. It seems as though Uncle Sam is starting to rear his ugly head towards the streaming space with this one. That said, the consortium isn’t going to be taking this lying down and has already announced plans to appeal the ruling.

CNBC / Disney’s ‘Deadpool & Wolverine’ becomes the highest-grossing R-rated film of all time. With $516.8 million in domestic ticket sales and $568.8 million from international audiences, “Deadpool & Wolverine” has exceeded $1.085 billion globally – Marvel’s first really dark franchise seems to have staying power…

CNBC / Harris calls for expanded child tax credit of up to $6,000 for families with newborns. The plan comes less than one week after Sen. JD Vance of Ohio, former President Donald Trump’s GOP running mate, floated a $5,000 child tax credit. Talk about 1-up eh?

MSN / The Starbucks fixer. Incoming CEO Brian Niccol officially has his priorities lined up to whip the coffee chain back into shape: the app, long wait times and rising prices will be some of his main focuses as the top boss.

Trivia

Today’s trivia is on small cap stocks:

Small-cap stocks are often seen as the underdogs of the stock market. What market capitalization range typically puts a company in this “underdog” category?

A) $50 million - $300 million

B) $300 million - $2 billion

C) $2 billion - $10 billion

D) $10 billion - $50 billionOver the long haul, how have small-cap stocks performed compared to their larger, more established counterparts?

A) They’ve consistently underperformed

B) They’ve matched the performance of large-cap stocks

C) They’ve outperformed large-cap stocks with higher long-term returns

D) They’ve been more stable but with lower returnsWhich of the following best explains why small-cap stocks might be more vulnerable during periods of rising interest rates?

A) Small-cap companies are typically more reliant on debt financing

B) Small-caps usually have higher dividend payouts, making them less attractive

C) Small-cap stocks are more likely to have international exposure, which can be negatively impacted

D) They tend to operate in industries that are less sensitive to interest rate changes

The Russell 2000 (largest 1,0001 to 2,000 stocks in the US) is widely regarded as a benchmark for small-cap stocks in the U.S. What percentage of the total market capitalization of the Russell 3000 (largest 3k stocks) does the Russell 2000 represent?

A) About 8%

B) About 15%

C) About 25%

D) About 40%

(answers at bottom)

Market Movers

Winners!

B. Riley Financial (RILY) [+16.1%]: Share price surged 16.1% after Bryant Riley proposed to acquire all remaining shares for $7 each.

Rocket Lab USA (RKLB) [+12.5%]: Stock rose 12.5% after successfully shipping two Mars-bound spacecraft to Cape Canaveral for NASA’s ESCAPADE mission.

H&R Block (HRB) [+12.1%]: Shares gained 12.1% following strong Q4 results and a positive FY25 outlook. Despite concerns over share loss in assisted tax prep, the company announced a $1.5B buyback and a 17% dividend increase.

Coherent (COHR) [+7.5%]: The stock climbed 7.5% on strong FQ4 earnings, revenue, and margins, driven by AI datacenter transceivers and the resolution of SiC production issues.

Sphere Entertainment (SPHR) [+6.4%]: Shares rose 6.4% after JPMorgan upgraded the stock to overweight, citing the Las Vegas Sphere’s growing status as a key tourism venue.

Cisco Systems (CSCO) [+1.9%]: Stock rose 1.9% following an upgrade to buy at HSBC, which predicted better-than-expected results due to cost-cutting and demand recovery.

Fox Corp. (FOXA) [+1.4%]: Shares increased 1.4% after Wells Fargo upgraded the stock to overweight, highlighting potential growth in sports streaming through the Venu platform.

Losers!

Silicon Motion Technology (SIMO) [-4.2%]: Shares dropped 4.2% after being downgraded to underperform from buy at Bank of America, citing minimal growth in 2H and low exposure to AI and enterprise SSDs.

Applied Materials (AMAT) [-1.9%]: Stock fell 1.9% despite a FQ3 EPS and revenue beat, as FQ4 guidance was only slightly ahead of consensus. Positive analyst takeaways highlighted strong margins and offsetting moderating China revenues with growth in Leading-edge, Foundry/Logic, ICAPS, and HBM.

Market Update

Trivia Answers

B) $300 million - $2 billion typically defines a small-cap stock.

C) Historically, small-cap stocks have outperformed large-cap stocks with higher long-term returns.

A) Small-cap companies are typically more reliant on debt financing, making them vulnerable during periods of rising interest rates.

B) About 15% of the total market capitalization of the Russell 3000 is represented by the Russell 2000.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.