🔬Cuatro Comma Club

Plus: Beyond Meat is beyond funny; the rise of the mega-caps; the curtain closes on the Warner/Paramount deal; and much more.

"The markets are like a large movie theater with a small door"

- Jeffrey Gundlach

"The best time to buy a stock is when the company is as unpopular as a dentist at a lollipop convention"

- Peter Lynch

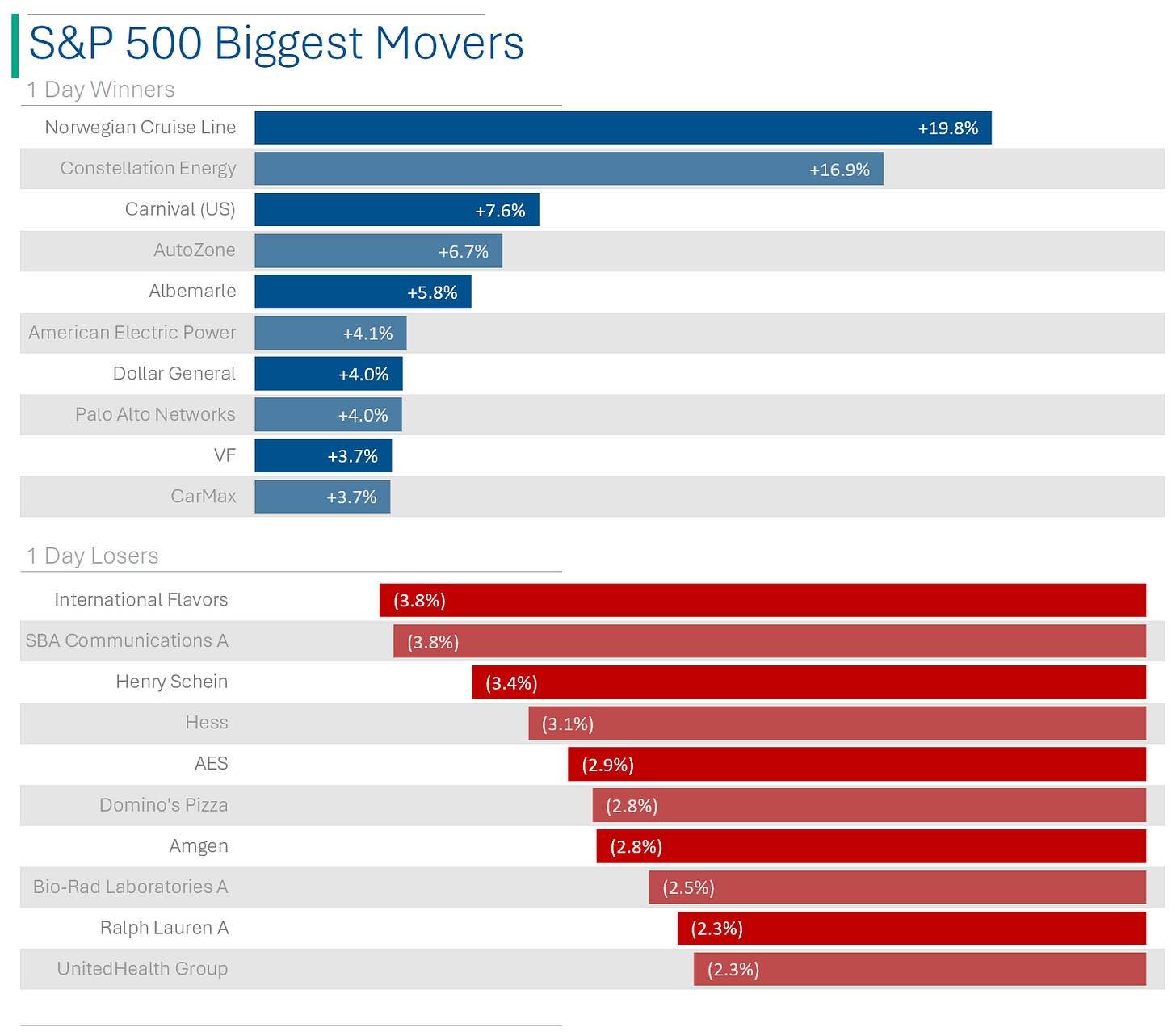

Decent day for the big US markets with the S&P 500 +0.17% and Nasdaq +0.37%.

8 of 11 sectors closed in the green, led by Utilities (+1.9%) and Comm. Services (+1.0%), while Energy was lowest (again), down -0.4%.

Viking Therapeutics popped +121% following positive data for its Ozempic competitor drug in Phase 2 trials.

Macy’s (+3.4%) reported decent earnings but got props from the Street for announcing it’s closing ~150 stores and expanding upscale chains.

Apple is cancelling its decade-long plans to build an electric car, and moving the team into its AI division.

Headline January durable-goods orders dropped 6.1% m/m, below consensus for a 4.5% decline (blame Boeing. But actually). Ex-transport, orders were down 0.3% m/m against expectations for a 0.4% monthly rise. Ooof.

Street Stories

$2 Trillion Race

In December 2019, Saudi Arabia’s mostly state-owned oil giant, Saudi Aramco, became the first company to reach a market capitalization of USD$2 trillion. Given that it had just IPO’d four days earlier at a valuation of $1.88 trillion, it wasn’t really much of a run-up. The next ones to do it, however, took a lot longer. Both Apple and Microsoft took 2+ years to get to the next bracket of the Four Comma Club. That’s why when Nvidia breached this level during intraday trading on Friday (though it didn’t close above $2 trillion) it was extra impressive, as this feat only took a total of 176 trading days.

During the time it took Nvidia to secure its place as the fourth company to ever hit $2 trilly, three other companies have been trying to make it to the next threshold: Amazon, Alphabet and Tesla. The first two are nearly there, while Tesla has been on a pretty steady march backwards. Meta - the eighth company to cross $1T - just did it last month.

Beyond Funny

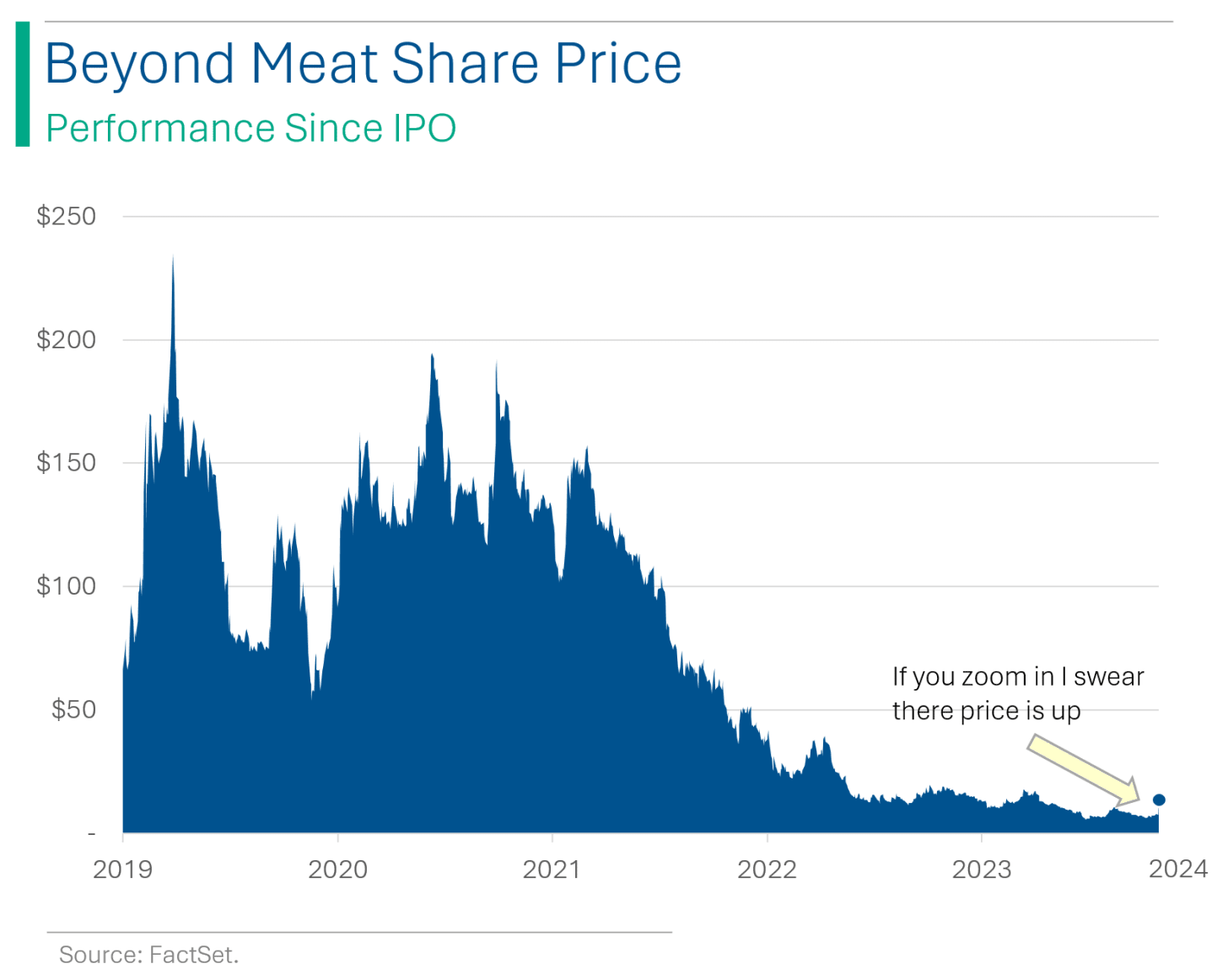

What happens when your company reports annual revenues down 18% YoY, soft 2024 guidance and an EPS figure that I’m not sure is comparable to estimates because of all the accounting ‘one-time’ charges they’ve accrued? Well, if you’re Beyond Meat, then your share price goes up 74%. Qu’est-ce que le f***?

The former retail favourite, now hedgefund punching bag is getting a massive pop in after-market trading, despite the weak quarter, after the company announced a massive cost-cutting program (ie: firing humans). I mean. Good for them, I guess. But, maybe they shoulda leaned into this before the shares were down 90% from their IPO?

Some charts that illustrate the situation:

Q4 Highlights:

Revenue: $73.7 million vs Wall Street estimate of $66.7 million

Adjusted EBITDA: ($125.1M) vs Street’s ($48.8M)

EPS: Was impacted by certain non-cash charges totaling $95.6 million and unclear if comparable to Street’s ($0.89)

FY 2024 Revenue Guidance: $315-to-$345 million vs Street’s $344.4 million

Management Commentary:

“Our 2024 plan includes taking steps to steeply reduce operating expense and cash use; pricing actions and the right-sizing of our production footprint, both in support of margin expansion; a years-in-the-making core platform renovation in Beyond IV that delivers superior health benefits and taste; and, following the announcement and initiation of our Global Operations Review, taking certain non-cash charges pertaining to inventory and assets that are no longer consistent with our path to profitability.”

“We believe these sweeping changes, together with measures we plan to pursue this year to bolster our balance sheet, will strengthen our near-term operations as we pursue our vision of being the global protein company of the future”

Rise of the Mega-Caps

The last 20 years has seen the rise of jumbo corporations in the US. In 2004 there were only 18 companies with market capitalizations greater than $100 billion. Now that number is 93. Even companies on the ‘lower-end’ of large-cap ($25-50 billion) has seen 425% growth over this period.

From Courtship to Curtains: The Warner/Paramount Merger

After months of negotiation, Warner Bros. Discovery has ceased discussions regarding the acquisition of Paramount Global, while Paramount explores other potential bids and financial strategies. The company has set up a special committee and hired financial advisors to sift through the offers, as the company seems to see its only way forward as a sale or being sold for pieces. Media mogul Byron Allen has reportedly offered $14 billion for the company, but has a history of flaking out. While Skydance Media is apparently still conducting due diligence.

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

Why is Google Chrome like a submarine? They tend to get a little slow if you open too many windows.

I got an e-mail saying “At Google Earth, we can even read maps backwards”, and I thought...“That’s just spam”

Hot Headlines

WSJ | U.S. opens antitrust probe against mega health insurer, UnitedHealth. Apparently the focus of the probe is their acquisitions and control in the care provider space, including their Optum health-services arm. As someone who covered US health insurers for the better part of a decade, yes, it’s a racket.

In other news, UnitedHealth announces it’s new logo…

Tech Crunch | Microsoft makes a $16M investment in Mistral AI, a French competitor to OpenAI (another of their investments).

ARS Technica | Wendy’s will experiment with dynamic surge pricing for food in 2025. This is the dumbest s*** I’ve ever heard.

Bloomberg | Apple to wind down electric car effort after decadelong odyssey, and fold those employees in its growing AI division. Over the years Apple has pumped billions into the program, called Project Titan, which initially had investors hyped about them conquering a new category.

Reuters | Bitcoin scorches past $57,000 as big buyers flock in. ETF access has reportedly fueled investment demand, while big institutions have moved hard into the crypto, including MicroStrategy which reportedly acquired another 3k bitcoins for an outlay of $155 million.

Too bad it’s gunna go down now cuz of this guy…

Bloomberg | Klarna in talks with banks for US IPO at $20 Billion value. Sounds impressive until you recall that the Swedish ‘buy now, pay later’ company was valued at $45.6 back in 2021.

Trivia

This week’s trivia is on this week’s trivia is on early corporations. Today’s on the Hudson’s Bay Company.

When was the Hudson's Bay Company (HBC) founded?

A) 1492

B) 1598

C) 1670

D) 1759

What was the original purpose of the Hudson's Bay Company?

A) To explore the Canadian wilderness

B) To trade furs, especially beaver pelts

C) To establish colonies in Canada

D) To map the Arctic region

How many acres did the original HBC charter grant access to for trade?

A) Over 1 million acres

B) Over 100 million acres

C) Over 1.5 billion acres

D) Over 500 million acres

Which company did the HBC acquire in 2008, marking a significant expansion?

A) Macy's

B) Saks Fifth Avenue

C) Nordstrom

D) Bloomingdale's

(answers at bottom)

Market Movers

Winners!

Viking Therapeutics (VKTX) [+121%]: Achieved significant weight loss in a phase 2 study of its GLP-1/GIP receptor agonist (competitor to Ozempic), with plans for FDA discussions on next steps.

Hims & Hers Health (HIMS) [+30.9%]: Surpassed Q4 EPS and revenue forecasts, reporting unexpected profit and projecting strong future revenue and earnings, particularly from dermatology and weight loss.

Norwegian Cruise Line Holdings (NCLH) [+19.9%]: Despite Q4 EPS miss, revenue exceeded expectations with robust Q1 EPS guidance and high demand for 2024 voyages; FY24 EPS guidance aligns with expectations.

TransMedics Group (TMDX) [+14.1%]: Q4 earnings and revenue significantly exceeded expectations, with plans to expand logistics fleet to 15-20 aircraft by late 2024 or early 2025.

Cava Group (CAVA) [+12.1%]: Outperformed Q4 EPS, EBITDA, and revenue expectations, with strong comp sales and plans for 48-52 new openings in FY24, buoyed by lower food costs and expansion.

Zoom Video (ZM) [+8%]: Beat Q4 earnings and revenue, with strong performance across customer segments and a $1.5B buyback announced; positive outlook tempered by slower revenue growth caution.

AutoZone (AZO) [+6.6%]: FQ2 earnings outpaced expectations with steady revenue; faced lighter domestic comps but strong international performance; margins beat consensus despite commercial slowdown concerns.

Macy's (M) [+3.4%]: Q4 results surpassed expectations with better sales and margins, despite a softer Q1 outlook and light FY24 sales guidance; plans include closing ~150 stores and expanding upscale chains.

Losers!

Perrigo Co. (PRGO) [-15.1%] saw Q4 revenue slightly miss, despite better EPS, with organic net sales affected by SKU prioritization. FY24 guidance underwhelmed, citing headwinds in its infant formula business, expecting improvement in 2H24.

Unity Software (U) [-6.1%] reported underwhelming Q4 organic results and guidance, facing strategic challenges. Piper Sandler upgraded it to neutral, acknowledging restructuring progress despite ongoing strategy headwinds.

Workday (WDAY) [-4%] beat Q4 EPS and operating income expectations, with revenue meeting forecasts. Subscription forecasts slightly positive but faced disappointment in subscription revenue and cRPO deceleration, amidst high expectations.

Market Update

Trivia Answers

C) The HBC was founded in 1670.

B) The HBC was established to trade furs, especially beaver pelts.

C) The initial land grant included over 1.5 billion acres.

B) Saks Fifth Avenue

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

So much great information! I was especially intrigued by the Beyond Meat story. So sad it has gotten down to where it is right now