🔬CrowdStrike...in charts!

Plus: Netflix's Q2 was good but no blockbuster; and much more!

"If you have trouble imagining a 20% loss in the stock market, you shouldn’t be in stocks."

- John Bogle

"There is no such thing as a free lunch."

- Milton Friedman

Bad end to a bad week for the big US markets, with the S&P 500 and Nasdaq closing Friday -0.7% and -0.8% respectively. For the week, the S&P lost 2% while the Nasdaq had it even worse, finishing down 3.6%.

5 of 11 sectors closed higher on the week, led by Energy (+2.0%), Real Estate (+1.3%) and Financials (+1.2%) - the latter mostly due to Q2 reporting starting out positively for most of the banks. Tech (-5.1%) was the worst performer of the week by a mile.

WTI Crude Oil finished down 3.3% Friday, taking the weekly total to 4.3%.

Notable companies:

Starbucks (SBUX) [+6.8%]: Activist Elliott Global has taken a sizable stake; size and board seat intentions unclear.

American Express (AXP) [-2.7%]: Q2 EPS beat but revenue light; raised FY24 EPS guidance.

Scholastic (SCHL) [-19.9%]: Big Q4 earnings and revenue miss; weaker school-fair participation; lower transactions offset higher sizes.

More below in ‘Market Movers’

Street Stories

CrowdStrike…in charts!

CrowdStrike: destroyer of worlds; causer of flight delays.

Friday saw the most extensive cyber disruption in history as a reported 8.5 million Microsoft devices crashed and were unable to properly restart. For context, the second greatest disruption was the 2017 WannaCry cyber-attack which only took down a paltry 300k computers.

The company behind it all, CrowdStrike, was relatively unknown to most people before the shutdown, with pretty much just tech investors and fans of the Mercedes Formula 1 team (they’re a lead sponsor) ever hearing their name.

Today I’m going to give a brief overview of one of the most important companies you’ve never heard of!

To kick things off, as you’ve heard by now, CrowdStrike is a cybersecurity technology company that provides threat intelligence and endpoint security - basically the idea that a company’s devices are interconnected and thus create opportunities for cyberthreats to spread and take out a network.

Founded in 2011, the company’s main product is its subscription platform, Falcon, which uses AI to help detect threats and respond to cyber attacks. A vital facet of Falcon’s success is that it is wholly run from the cloud which allows it to spread protection across all connected devices and - as was responsible for Friday’s meltdown - be updated automatically with the latest software to detect, assess and remedy any threats.

And as you can see above, the company has been growing like gangbusters!

Note: CrowdStrike has a January fiscal year end so it is technically in its fiscal 2025.

The shares have done pretty darn well also, up +265% over the last 5-years, leaving the broader market in its dust.

Saying ‘AI’ 200x on each earnings call has had that effect lately…

Additionally, those earnings calls have been pretty easy for management to make since the company has grown revenues consistently and HAS NEVER missed a quarter on Revenue…

…or Earnings Per Share. Like, not once, EVER, since they went public in 2019.

That’s insane!

And expectations are that the company will continue to crush it, as Wall Street sees revenue growth over the next 4 fiscal years averaging +26%.

EPS is also expected to keep pace at +25%.

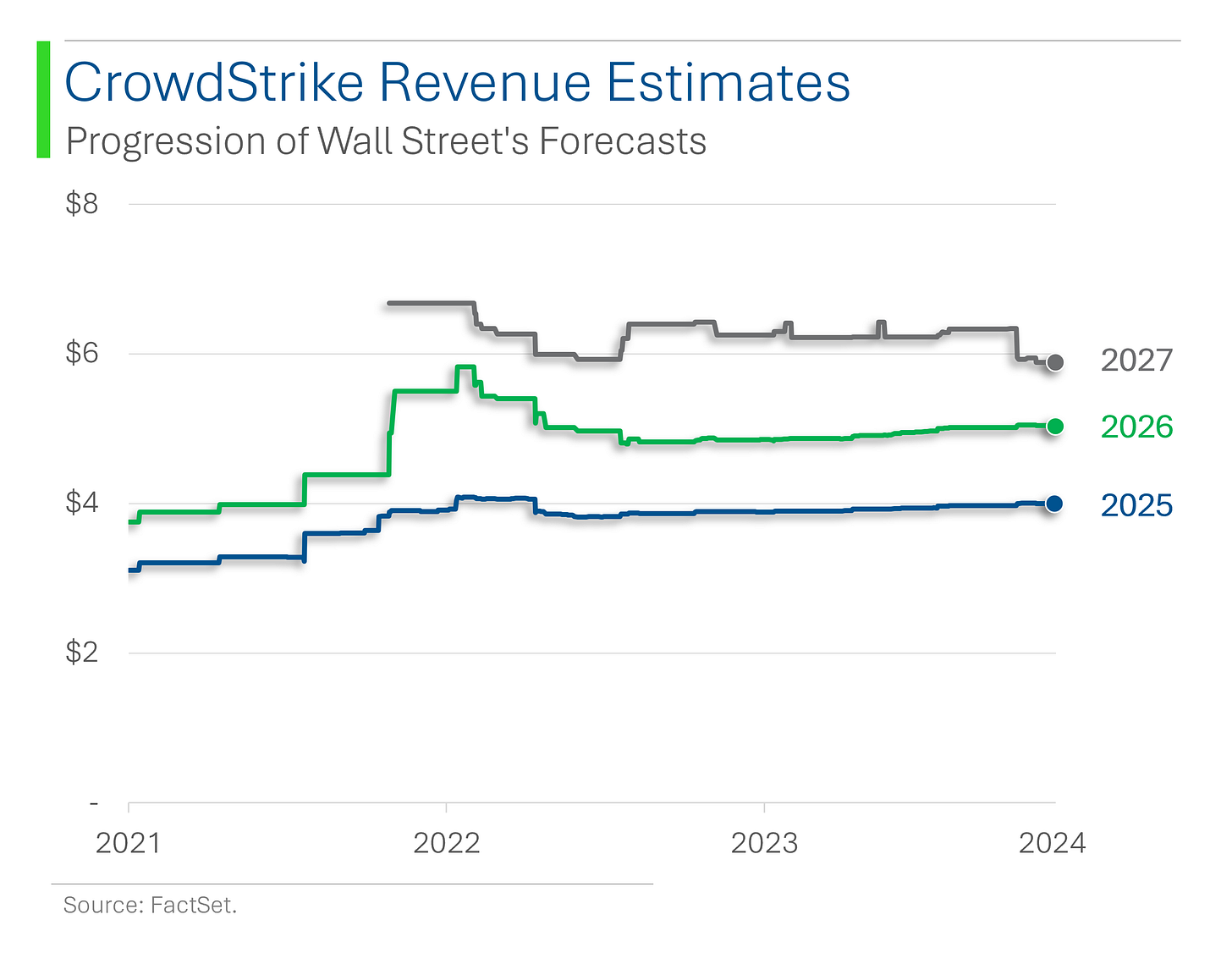

However, it is worth noting that Wall Street forecasts haven’t really been moving up lately - and I’m sure Friday wouldn’t have helped as analysts update their numbers.

Forecasts for fiscal 2025 (current year), 2026 and 2027 are actually below where they were back in 2022.

That said, the Street’s average target price has continued to keep pace with the shares, and prior to Friday’s meltdown, sat at +16% higher than the share price.

Currently that gap is 30%, but there’s a good chance that we see analysts bring the target price down a titch after Friday’s debacle.

Valuation-wise, the company definitely isn’t cheap - trading at a 12-month forward Price to Earnings multiple of ~69x (versus the broader market at 21x).

Owning a company that bangs out double-digit revenue growth like clockwork doesn’t come cheap - especially if you can name drop AI and actually mean it.

Having said that, the valuation actually holds up pretty well in comparison to their cybersecurity peers: SentinelOne is only forecast to grow revenue a bit stronger than CrowdStrike (+27% vs. +24% for CrowdStrike) but trades at a massive premium (179x P/E vs. 69x).

All of the other main peers are expected to exhibit much lower growth.

To wrap this up, CrowdStrike is an amazing company despite getting its name dragged through the mud recently. They’ve obviously never had a foul up of this scale before, so for the sake of civilization - and more importantl,y the shareholders - let’s hope it doesn’t happen again.

Oh, as an aside, isn’t it weird that Formula 1 is full of cybersecurity sponsors?

It use to be cigarettes and liquor, now they’re major backers of McLaren (Darktrace), Mercedes (CrowdStrike), Red Bull (Artic Wolf), etc. Ferrari has Bitdefender now - only because they dumped Russian-based Kaspersky following the Ukraine invasion. Even Williams has Keeper Security - and no one wants to sponsor Williams…

Netflix’s Latest Hit

Netflix reported decent second-quarter earnings, surpassing Wall Street expectations with earnings per share of $4.88 (+2.9% beat) and revenue of $9.56 billion (+0.3% beat). The company saw a 16.5% year-over-year increase in global paid memberships, reaching 278 million, driven by its ad-supported memberships and crackdown on password sharing. Despite the beat, shares traded down 1.5%, since with the shares being up +30% this year investors had pretty lofty hopes for the quarter.

Was still better received than the Cobra Kai Season 6 premiere…😤

Joke Of The Day

My mum always used to say "50 is the new 30". Lovely woman... banned from driving.

Hot Headlines

The Verge / China’s Xiaomi unveils new foldable phone line. So impressive I’d happily send all my data to the CCP for one.

Tech Crunch / North Korea linked hackers steal $230 million from Indian crypto exchange WazirX. The company, one of India’s largest crypto exchanges, has ‘temporarily’ suspended all trading activities and blocked user withdrawals.

OilPrice.com / Western efforts to disrupt Russian oil flows appear to be failing. The West has drastically cut Russian imports but countries like China and India has stepped in to fill the gap at massive discounts. You’re welcome, I guess?

BBC / Russia convicts US reporter Evan Gershkovich of espionage. The brief trial has been called a sham by his employer, the Wall Street Journal, and the US. The journalist has been sentenced to 16 years in a high-security penal colony.

Trivia

Today’s trivia is on cybersecurity and famous hacks.

The first computer virus is believed to be the ‘Creeper Worm’ developed by Bob Thomas. When was it developed?

A) 1961

B) 1971

C) 1981

D) 1991Which virus caused an estimated $10 billion in damages in 2000?

A) Melissa

B) Nimda

C) BlasterD) ILOVEYOU

Which major financial institution was breached in 2019, compromising the personal data of over 100 million customers?

A) JPMorgan Chase

B) Bank of America

C) Wells Fargo

D) Capital One

The first major ransomware attack, known as the AIDS Trojan, happened after biologist Joseph Popp handed out 20k infected floppy disks at a World Health Organization conference on AIDS. What year was this dick move?

A) 1989

B) 1995

C) 1999

D) 2004

(answers at bottom)

Market Movers

Winners!

Intuitive Surgical (ISRG) [+9.3%]: Q2 EPS and revenue beat; da Vinci procedures grew 17% y/y; raised FY24 procedure growth target; improved margins due to better cost performance.

Western Alliance Bancorp (WAL) [+7.9%]: Q2 revenue and EPS beat; strong NII, NIM; higher than expected expenses and NCOs; improved capital position, deposit and loan growth.

Starbucks (SBUX) [+6.8%]: Activist Elliott Global has taken a sizable stake; size and board seat intentions unclear.

Arm Holdings (ARM) [+3.2%]: Upgraded to overweight by Morgan Stanley; opportunities in AI, custom silicon, new designs, and extensions.

Losers!

Scholastic (SCHL) [-19.9%]: Big Q4 earnings and revenue miss; weaker school-fair participation; lower transactions offset higher sizes; FY25 revenue growth ahead due to 9 Story acquisition, but consumer pressures remain.

Selective Insurance Group (SIGI) [-18.2%]: Q2 results ahead of schedule; EPS well below consensus due to casualty reserve build; combined ratio above forecasts with adverse prior year development; increased FY24 combined ratio guide.

CrowdStrike (CRWD) [-11.1%]: Cybersecurity update impacting MSFT applications, causing global outages; issue not related to security incident or cyberattack.

Comerica (CMA) [-10.5%]: Q2 EPS beat; NII and NIM in line; FY24 outlook for loans and deposits lowered; muted loan demand and deposits pressured by high rates; improved fee income and expenses.

Autoliv (ALV) [-10.1%]: Q2 revenue and EPS light; lowered FY organic sales growth and margin guidance; underperformance in Americas and China due to lower vehicle production and inventory reductions.

Travelers Cos. (TRV) [-7.8%]: Q2 core EPS beat; revenue light with net premiums below consensus; positive on lower combined ratio with favorable prior-year development despite higher cats.

Halliburton (HAL) [-5.6%]: Q2 EPS in line, revenue missed; strong international demand but equipment tightness; C&P and D&E segments missed on revenues; North America also missed estimates; FCF ahead of consensus.

PPG Industries (PPG) [-2.8%]: Q2 earnings better but revenue missed; weakness in Performance and Industrial Coatings; strength offset by weaker automotive builds; Q3 EPS guidance below, cut FY EPS guide; flagged uneven global industrial production.

American Express (AXP) [-2.7%]: Q2 EPS beat but revenue light; raised FY24 EPS guidance; smaller than expected provision and service fees; analysts positive on provisions and NCOs, cautious on consumer business due to billings slowdown.

Market Update

Trivia Answers

B) The first computer virus was developed in 1971.

D) ILOVEYOU came out in 2000 and wrecked many a computer.

D) Capital One was hacked in 2019 resulting in +100 million customers data being compromised.

A) The AIDS Trojan happened in 1989. Total dick move…

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Amazing work!