COVID Vax Estimates Get Shot in the Arm, Home Sales Approach Crisis Levels...and Much More

StreetSmarts Morning Note

“In investing, what is comfortable is rarely profitable.”

-Robert Arnott

“I’d be a bum on the street with a tin cup if the markets were always efficient.”

-Warren Buffett

Bank of America, Bank of New York Mellon, Goldman Sachs Group, J.B. Hunt Transport Services, Johnson & Johnson, Lockheed Martin, Omnicom Group, Prologis, and United Airlines report earnings today.

Table of Contents

A.M. Allocations: Summaries of important news and investing events

Needles and Numbers: Pfizer’s Punctured COVID Profits

Home Alone: Sales Drop as Mortgages Skyrocket

Pills, Bills, and Bankruptcy: Rite Aid’s Slippery Slope to Chapter 11

Job Offers in Jeopardy: MBAs’ Unexpected Curriculum

Hot Headlines: Links to some of the top financial stories of the day

A.M. Allocations

Needles and Numbers: Pfizer’s Punctured COVID Profits

COVID drug kingpin Pfizer took its 2023 guidance to the woodshed after seeing reduced demand for its vaccine, Comirnaty, and its COVID treatment, Paxlovid, drop-off.

The company said the decline in guidance is 100% attributable to its COVID franchise, with Paxlovid reduced by $7 billion and Comirnaty by $2 billion.

Pfizer is also writing-off $5.5 billion in inventory due to reduced demand.

Take-Aways: Looks like the boon to big pharma from COVID is waning which has broader implications for this slice of the healthcare industry. I know I’ve been keen to forget about the dark days of the pandemic, and we’ve gotten inklings that even with potential future flare-ups (like in August), people are open to turning a blind-eye to the prospect of lock-downs - or really doing anything - to reduce transmission.

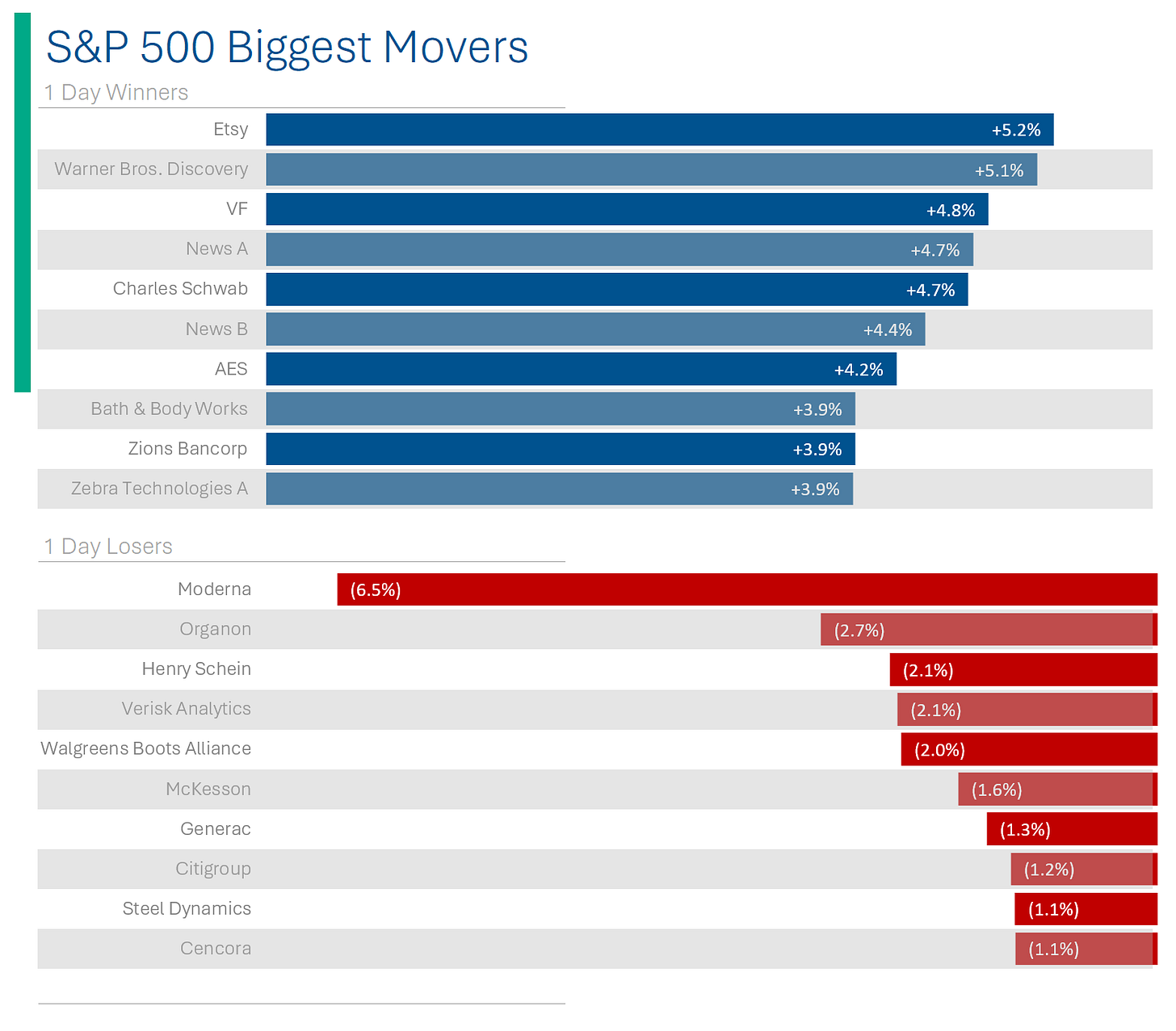

Moderna - the other big COVID vax player - announced yesterday that it is sticking to its guidance of $6 - $8 billion in vaccine sales… which the market didn’t enjoy, dropping them the most in the S&P 500 (investors like it when management knows things, and isn’t building up inventory just to chuck it). The company held strong to the belief that 50 - 100 million Americans will get the (new and improved) jab this autumn/winter. Time will tell if COVID shots end up just being a casual, oft forgotten seasonal thing like flu shots…but I’m willing to bet I won’t be waiting in another mile long line standing 6ft apart for a shot to ‘flatten the curve’.

Home Alone: Sales Drop as Mortgages Skyrocket!

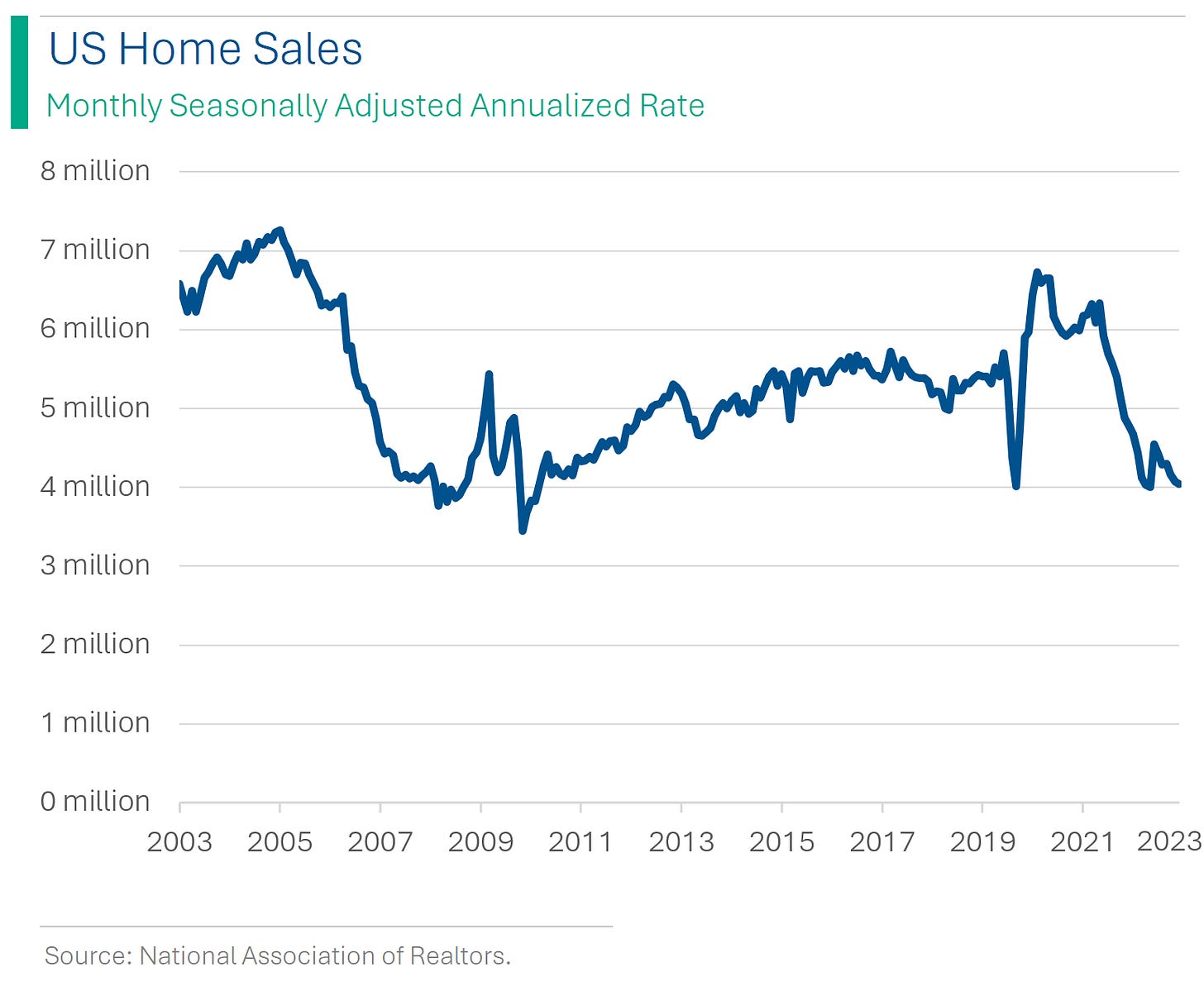

Mortgage rates have surged to their highest levels in 23 years, causing a significant decline in home sales, reminiscent of the levels observed during the subprime crisis. Economists predict that sales of previously owned homes will continue to plummet, reaching a low not seen since 2011 or even 2008. High borrowing costs, soaring home prices, and a limited inventory of available homes are exacerbating the issue.

The rapid increase in mortgage rates, which recently hit an average of 7.57% for a 30-year fixed mortgage, is discouraging potential homebuyers. This rise in rates is coinciding with a seasonal slowdown in the housing market during the fall and winter when sales and prices typically drop due to the school year and holiday season. The confluence of these factors is expected to suppress home sales in the upcoming months.

Take-Away: The downturn in the housing market could have broader economic consequences, including forcing potential homeowners to continue renting. This sustained demand for rentals could drive rents higher, contributing to increased consumer prices. This, in turn, could pose challenges for the Federal Reserve in moderating interest-rate increases, further complicating the economic landscape.

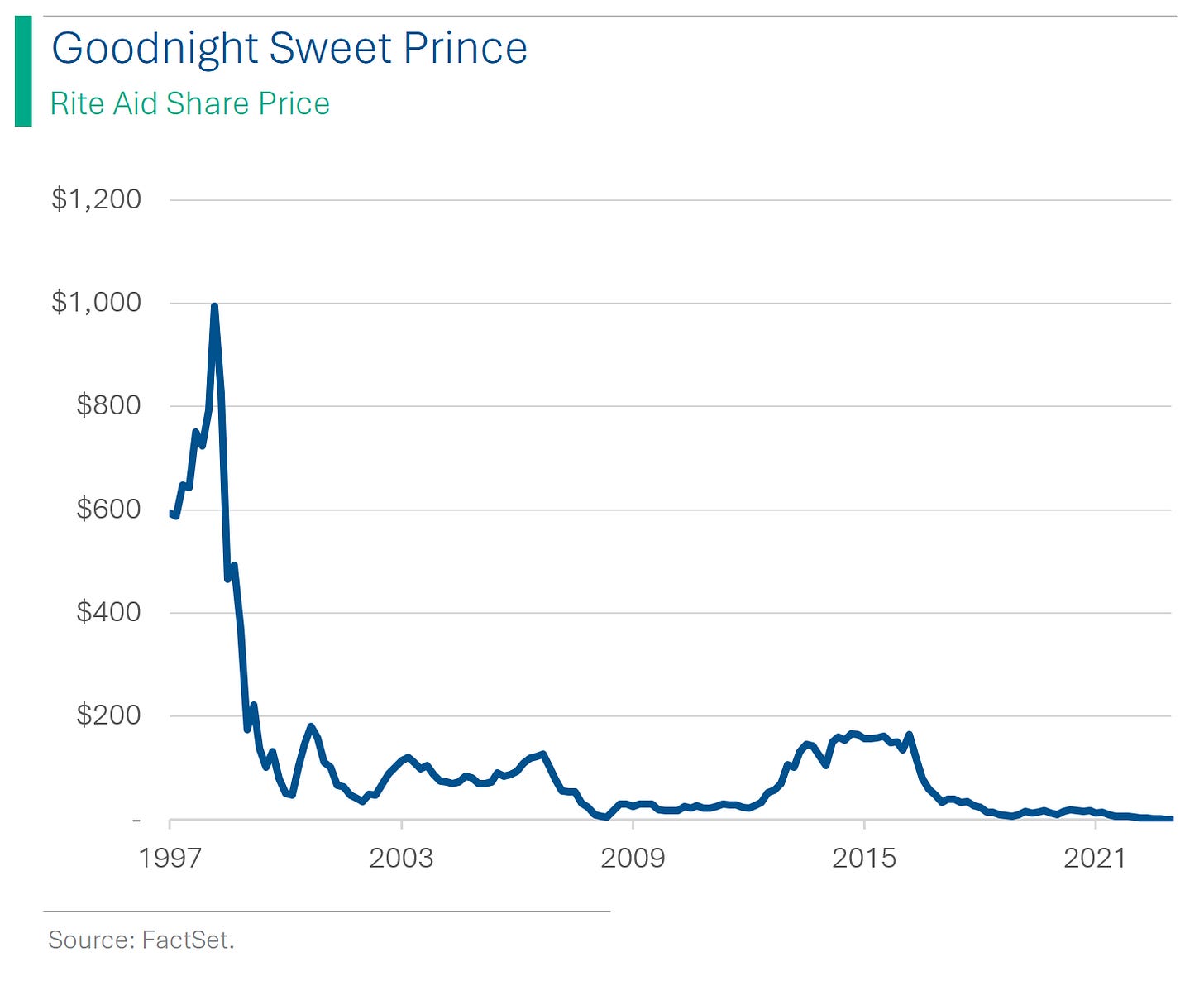

Pills, Bills, and Bankruptcy: Rite Aid’s Slippery Slope to Chapter 11

The American drugstore chain Rite Aid filed for Chapter 11 bankruptcy. The company runs ~2,100 locations across 17 US states, down from the 5,000 it had in 2008. The Wall Street Journal reported that they have closed 200 locations over the past two years, with many more likely to come.

Some deaths are quick, like a henchman in a Bond film, and some take 20 years. Rite Aid is too short of cash to effectively right-size the business. They lack both an internal pharmaceutical benefit manager (like CVS) and a quality consumer business (like Walgreens or Walmart). Let’s not forget that they also got tied up in the opioid prescription scandal, which was the final straw for markets (Walmart, CVS and Walgreens all settled billion-dollar lawsuits last November).

Take-Away: I used to cover Rite Aid in my health care stock-picking days, and the real death happened in 2017, after the year-and-a-half merger process with Walgreens got called off at the 11th hour over anti-trust concerns. This company has been a zombie ever since.

Job Offers in Jeopardy: MBAs’ Unexpected Curriculum

Many companies, including EY, Amazon, and BCG, are delaying or reducing M.B.A. hiring due to economic uncertainties, affecting students at major business schools who are now facing a competitive and uncertain job market.

M.B.A. students are experiencing a "career limbo," with a slowdown in job offers and delayed hiring decisions, prompting universities and career offices to advise exploring alternative career paths and patience.

Some consulting firms still report increased interest and application numbers as M.B.A. students are exploring fewer available options, with a shift towards considering positions at smaller companies and a variety of roles within different industries.

Take-Away: I did my full-time recruiting in Fall of 2008. Not much sympathy here.

If you really want it, though, you might need to re-direct and accept a few years’ delay in your game plan. But when you get there, being in a slimmer cohort can help to play catch-up. Good luck!

Joke Of The Day

Did you hear about the man who wanted to invest in an agricultural company?

He was impressed with their organic growth.

Student: I can’t believe it increased by 1500%.

Professor: I’m sick of hearing about BITCOIN! Nothing can increase by that much and still be a good investment.

Student: I was talking about the price of college tuition since 1980.

Hot Headlines

(Forbes) Lululemon Stock Rallies To 52-Week High After Joining S&P 500 - the company replaces Activision Blizzard after its take-over by Microsoft.

(Reuters) Ford, UAW leaders spar as auto strike costs rise

(Axios) LinkedIn to lay off hundreds of people amid broader restructuring - More tech layoffs! Tech Crunch actually made a neat graphic showing the scope of the culling last week (link)

(Reuters) Trouble China property company Country Garden's entire offshore debt to be in default if Tuesday payment not made

(CNN) Adobe previews new AI editing tools - check out the demo video, it’s witchcraft!

Trivia

When was the Wall Street Journal founded?

1839

1889

1929

1934

The Wall Street Journal has around 3.4 million digital subscribers, how many people still pay for the ole printed broad sheet?

1.1 million

254 thousand

560 thousand

88 thousand

The WSJ was founded by Charles Dow and Edward Jones (of Dow Jones fame). It was bought by Clarence Barron (of Barron’s fame), whose descendants owned it until 2007 when it was bought by who?

News Corp.

Time Warner

Thomson Reuters

Fox Corp.

(answers at bottom)

Market Update

Trivia Answers

1889. Dow and Jones originally made news briefs they’d sell to traders at the stock exchange before eventually creating the WSJ.

560 thousand.

News Corp. Rupert Murdoch (RIP) added The Journal to his media empire fora cool $5 billion.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and give us a ‘Like’ below.