🔬Covid Companies Pt. II: No One Likes Us Anymore

Plus: Reddit sinks after Wall Street coverage says valuation and growth suck; too much Fed-speak to handle (and none of it's good); and much more.

"In God we trust; all others bring data"

- Michael Bloomberg

“The bigger the smile, the sharper the knife”

- Ferengi Rules of Acquisition (#47), Star Trek

Yucky day for the big US markets (S&P 500 -1.2%; Nasdaq -1.4%) as hawkish Fed-speak and possible Iranian escalation against Israel put the breaks on a positive day in the markets.

All 11 sectors closed lower but Tech (-1.7%) and Healthcare (-1.4%) were worst. Energy (-0.1%) was best as more mid-East headlines keep supporting oil prices, which were up another +1.4% yesterday.

Lamb Weston (-19.4%), one of the world’s biggest processed potato makers, saw it’s shares fried after a weak Q3. Levi Strauss (+12.4%) did the opposite, with beats on Revs and EPS, and increased guidance.

Non-Farm Payrolls is out tomorrow. Street looking for 200k job growth and unemployment rate to drop from 3.9% to 3.8%.

Street Stories

Covid Companies Pt. II: No One Likes Us Anymore

This is a continuation from yesterday’s newsletter in case you haven’t read it.

To refresh your memory, we ended yesterday’s note with graphs showing that Pfizer had made $106 billion in high margin Covid revenue, did $70 billion in M&A, and yet somehow found itself with LOWER EPS four years later. What a total bag of hammers!

But how did Moderna do? Ummm…it’s complicated.

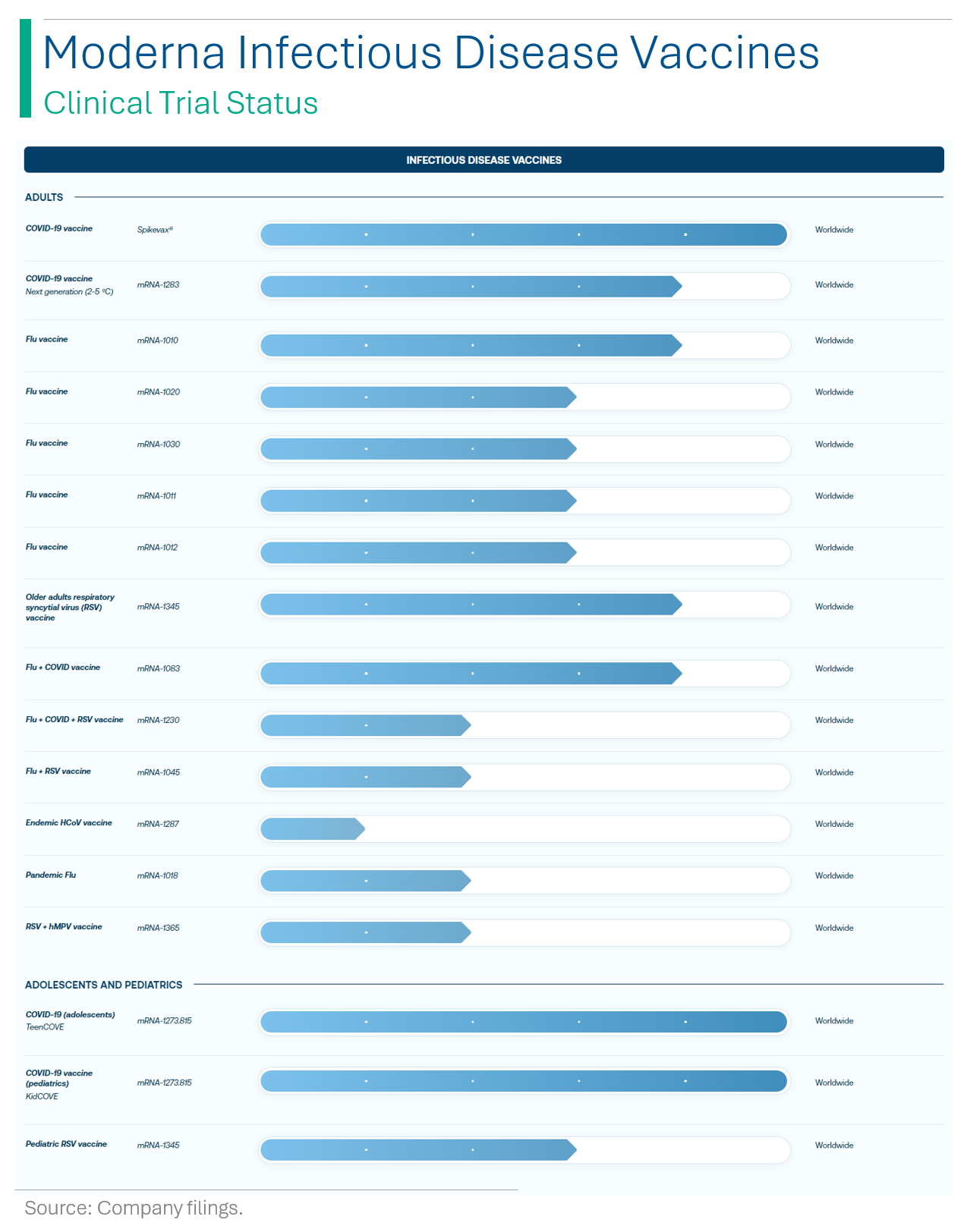

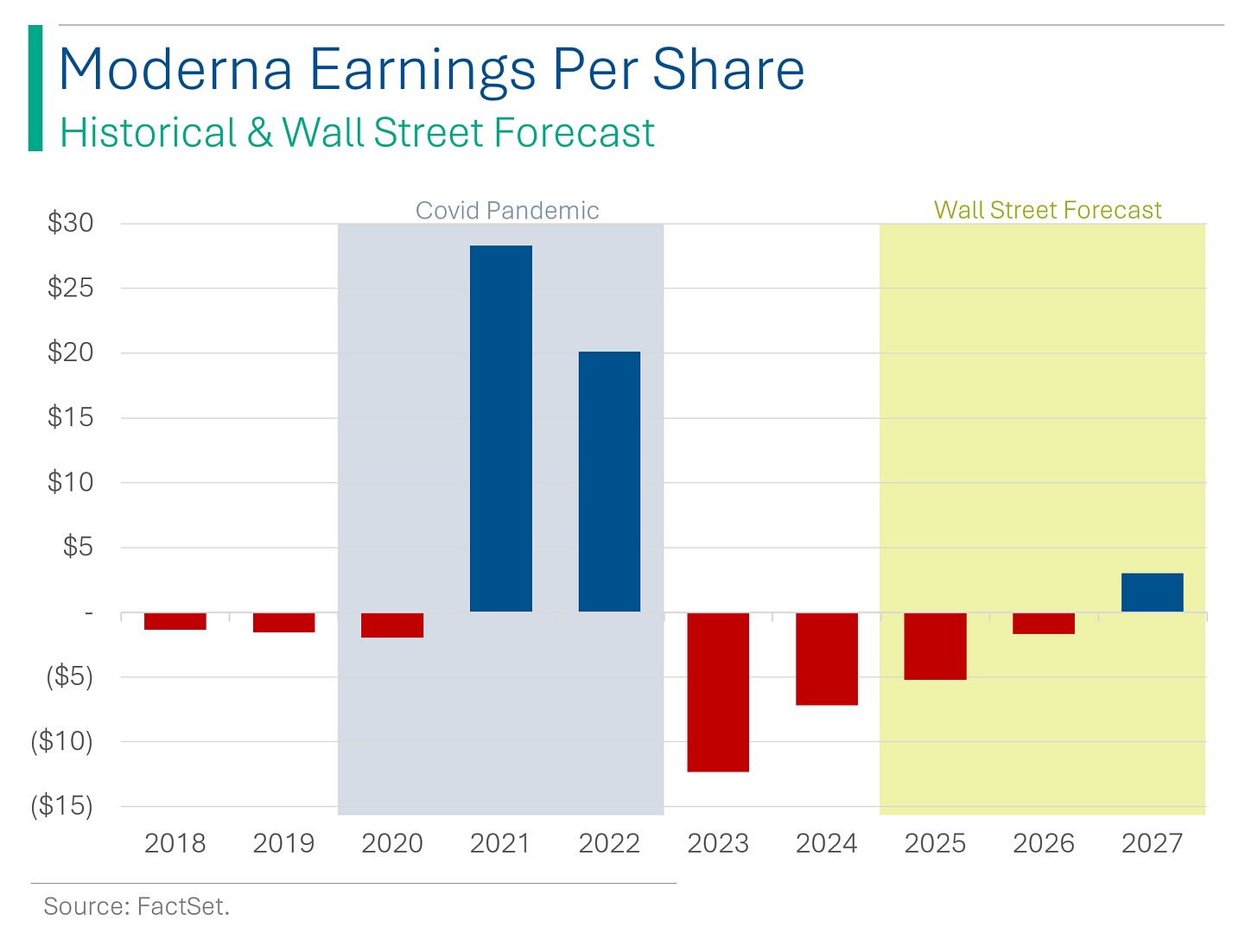

See, other than from its Covid vaccine Spikevax, Moderna hasn’t actually ever made any money (‘Other Revenues’ typically refers to grants or payments for partnership rights). Founded in 2010, IPO’d in 2018, the company currently has 35 clinical trials running but to date has only released Spikevax to the market. Granted it was one hell of a product - bringing in $18 billion in 2021.

Moderna’s Respiratory Syncytial Virus (RSV) vaccine is expected to get FDA approval in May, and there are some interesting bits to their pipeline - like cancer vaccines - but this is nowhere near a sustainably profitable business. The company’s value, which is a lot (current market cap of $39 billion), mostly has to do with the potential future value of its IP, particularly their RNA technology.

As a result, the Street doesn’t have a particularly bullish outlook on the company, only seeing them return to profitability in 2027. Given that when I met the company in 2018, they said they’d have dozens of products on market in a few years, I’d be inclined to take that with a grain of salt.

So that’s where things are at. Combined, both companies have pulled in roughly $150 billion in Covid sales. Moderna does have a nice $10 billion cash pile to tie it over until (fingers crossed) they get some more products on market. Whereas Pfizer is in rougher shape, as patent cliffs have been sucking out the sales of some of their blockbuster drugs, such as breast cancer treatment Ibrance ($4.7B in 2023), and current big sellers, like anticoagulant Eliquis ($6.7B in 2023), have basically plateaued. Ie: Not great.

To conclude, Covid vaccines and treatments added an incredible jolt to profits of Moderna and Pfizer, but now with the pandemic in the rearview mirror, investors have turned their backs on them. $106 billion in Covid sales later, and Pfizer is worth $83 billion less than it was before the pandemic. And while way off their share price peak in 2021, Moderna has held in better but only time will tell how well their RNA technology is able to carve out new markets. Given their bold claims about cancer vaccines, I think we should all be rooting for them again.🤞

Reddit Update

I’m not saying I was right, but….

Reddit has fallen sharply (37%) since the company’s early peak after four days of trading (and the last time I made fun of their valuation). There is limited broker coverage of the company as yet, but none of the research has been particularly rosy. Notably, Morgan Stanley, Goldman Sachs, JP. Morgan and BofA - who ran the IPO for Reddit - have yet to cover the name by their research teams.

Hawkish Fed-Speak

Riddle: What is coming but never arrives?

While I’ve included the correct answer at the bottom by the trivia ones, increasingly it seems like the Fed’s first rate cut could be included here. At the start of the year, with the ‘Peak Fed’ narrative in full-swing, the markets were pricing in up to four rate cuts. Then three. Then two. And now even that seems in question, following a particularly punishing Thursday of Fed members weighing in on inflation. Seriously, who keeps giving these people microphones?

Highlights:

Fed Chair Powell: Reiterated previous commentary; current data hasn't significantly altered the Fed's course.

Chicago's Goolsbee (non-voter): Highlights housing prices as the primary threat to the 2% inflation target, expected faster inflation decline.

Richmond Fed President Barkin (voter): Early 2024 data less encouraging; suggests the Fed can wait before cutting rates.

Philadelphia Fed President Harker (non-voter): Believes inflation remains excessively high.

Cleveland's Mester (voter): Predicts slower disinflation this year but considers a rate cut appropriate later on.

Minneapolis Fed President Kashkari (non-voter): Suggests rate cuts might not occur this year if inflation doesn't improve.

Explainer - Voter/Non-Voter: Beside the above individuals name is listed either ‘Voter’ or ‘Non-Voter’, which is meant to indicate whether that individual is a voting member of the group within the Federal Reserve that determines rate cuts, the Federal Open Markets Committee (aka the ‘FOMC’).

This group consists of the seven members of the Federal Reserve Board and five members out of the twelve regional Federal Reserve Bank presidents. Of those five, the President of the NY Fed is always a member, but the other presidents rotate across one year terms. So, while it can be helpful to listen to the perspectives of all the Fed Presidents, not all of their opinions carry the same weight. Especially Kashkari, he kinda sucks.

Joke Of The Day

A positive attitude may not solve all your problems, but it will annoy enough people to make it worth the effort.

Hot Headlines

Reuters / Google parent Alphabet weighs offer for online marketing software company HubSpot. $HUBS currently has a market cap of $34B so it would be a megamerger. Largest online ads player buying one of the largest online marketing software companies? I’m sure the FTC won’t notice…

Reuters / Boeing and Airbus exploring framework to divvy up Spirit Aero's operations. Spirit was spun off from Boeing in 2005 and diversified to supply Airbus, which is now its second-biggest customer. The company makes about 70% of Boeing's 737, including the fuselage, and supplies large parts of the 787.

CNBC / Ford to delay all-electric SUV and truck to focus on offering hybrid vehicles across its lineup by 2030. Company plans to offer hybrid options across its entire North American lineup by 2030. Ford was #2 in US EV sales for the last two years behind Tesla.

Bloomberg / Copper jumps to new 14-month high on supply risks and demand hopes. Disruptions at major mines mixed with a rosier outlook for global manufacturing have pushed prices higher.

Axios / Biden admin gives $20B in "green bank" funding to fund clean energy and pollution reduction projects. The plan is designed to fund tens of thousands of projects across the US, and the plan ("Greenhouse Gas Reduction Fund") is the largest non-tax investment in the 2022 climate law.

Trivia

Today’s trivia is on Alibaba.

In what year did my hero Jack Ma found Alibaba?

A) 1994

B) 1999

C) 2000

D) 2003Alibaba’s 2014 IPO raised a record how much and at what valuation?

A) $11 billion at $75 billion valuation

B) $16 billion at $134 billion valuation

C) $21 billion at $163 billion valuation

D) $25 billion at $231 billion valuationWhat was the initial focus of Alibaba?

A) Consumer electronics

B) B2B marketplace

C) Online retail

D) Social networkingWhat is the current market capitalization of Alibaba in USD?

A) $45 billion

B) $183 billion

C) $297 billion

D) $479 billion

(answers at bottom)

Market Movers

Winners!

Levi Strauss (LEVI) [+12.4%]: Beat Q1 EPS and revenue expectations, raised FY24 EPS guidance, and reaffirmed revenue growth outlook. Noted market share gains among young adults and high-income groups, with increased gross margin expectations.

Conagra Brands (CAG) [+5.4%]: Surpassed FQ3 earnings and revenue forecasts. Reported less severe organic growth decline, strong Grocery & Snacks results, and margin benefits from productivity. Reaffirmed FY EPS and net sales guidance, raising OM outlook.

HubSpot (HUBS) [+5.0%]: Google reportedly discussing acquisition of the company.

Losers!

Lamb Weston Holdings (LW) [-19.4%]: Missed fiscal Q3 sales and EPS with a 17% drop in NA volume, outpacing +5% price/mix improvement. Cut FY guidance due to greater-than-expected impact from EPR transition and noted weak near-term restaurant traffic trends.

Paramount Global (PARA) [-8.5%]: CNBC's Faber reported a potential deal with Skydance might include issuing up to $3B in stock. Mentioned PARA may need to raise equity regardless of deal outcome.

Block, Inc. (SQ) [-6.2%]: Downgraded to underweight from neutral by Morgan Stanley, pointing to high market penetration and limited expansion opportunities for Cash App.

Hertz Global (HTZ) [-5.0%]: Downgraded to sell from neutral by Goldman Sachs, pointing to near-term hurdles like pricing, costs, and depreciation per unit pressures.

Market Update

Trivia Answers

B) The company was founded in 1999.

D) The IPO raised $25 billion at a $231 billion valuation.

B) Alibaba started as a B2B marketplace.

B) Alibaba is valued at $183 billion.

Riddle Answer: Tomorrow is always coming but never arrives.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.