🔬Correction Complete: The Shifting Stock Market Fortunes

"The secret of change is to focus all of your energy not on fighting the old, but on building the new."

- Socrates

"Play by the rules, but be ferocious."

- Phil Knight

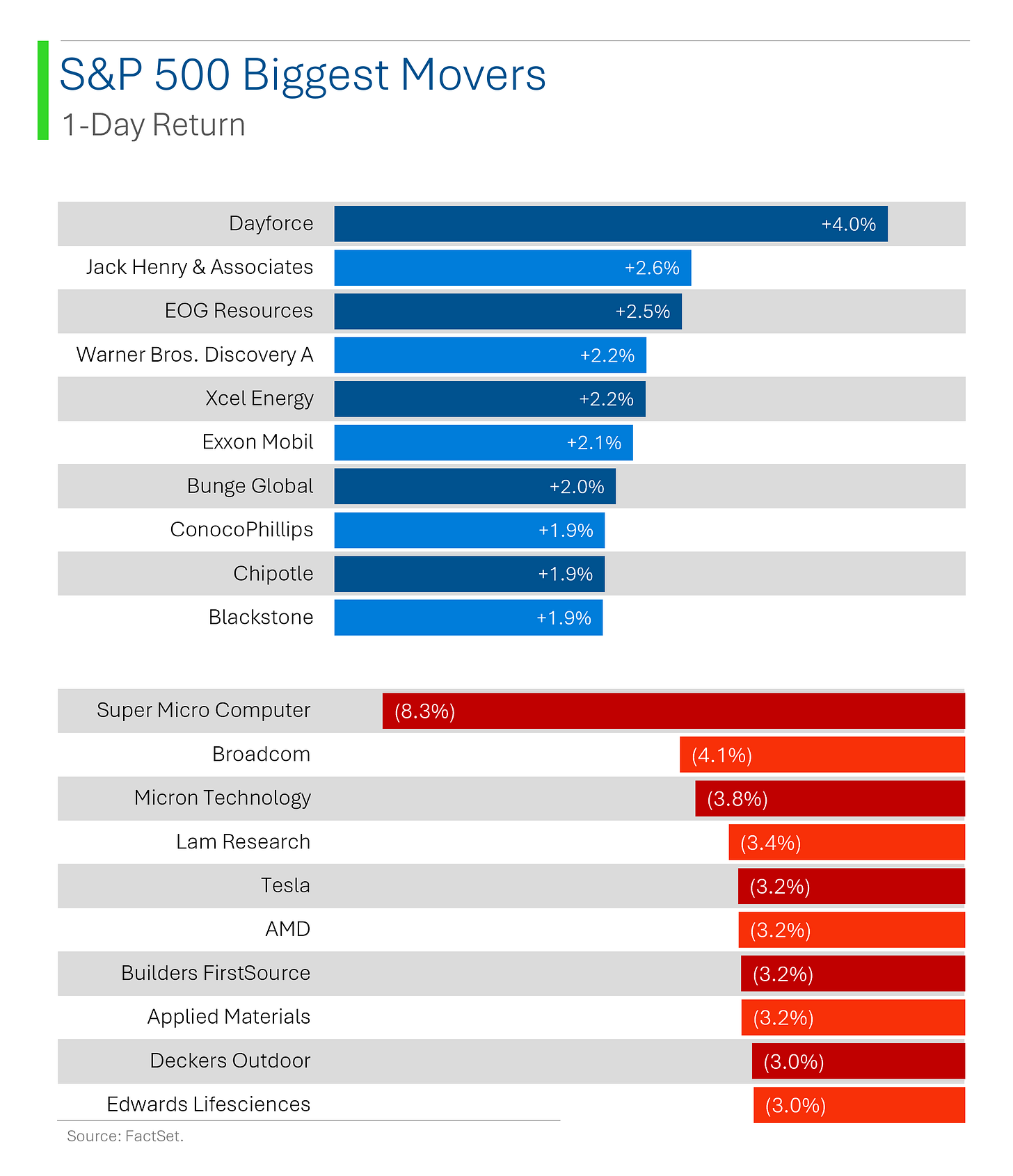

Soft day for the big U.S. markets with the S&P 500 -0.3% and Nasdaq -0.9%, despite decent July Durable Goods Orders (+9.9% MoM). Seems like a bit of de-risking ahead of Nvidia’s important Q2 on Wednesday.

5 of 11 sectors closed higher, led by Energy (+1.1%). Tech (-1.1%) and Consumer Discretionary (-0.8%) were the worst.

WTI Crude Oil closed up +3.5% following the latest flare up in the Middle East as well as Libyan production disruption.

Notable companies:

XPeng, Inc. (XPEV) [+7.1%]: The Chinese automaker's stock rose after the CEO purchased more than 2 million shares.

PDD Holdings (PDD) [-28.5%]: The company's Q2 sales missed expectations, but EPS was better; they warned of pressured revenue growth due to competition and external challenges, with plans to invest heavily in the platform.

SolarEdge Technologies (SEDG) [-9.2%]: The stock dropped after the company announced a leadership transition, with CEO Zvi Lando stepping down and CFO Ronen Faier taking over as Interim CEO.

More below in ‘Market Movers’.

Street Stories

Correction Complete: The Shifting Stock Market Fortunes

The stock market went into freefall starting July 10th in what culminated with the S&P losing 10.7% by early August. Some rosy news out of the Fed and signs that inflation was cooling reversed that sell-off, and just as quickly as the market went down, it climbed back to pre-crash levels.

So I guess nothing’s changed?

Actually, no. Hidden behind the opaque market headlines, a massive shift has taken place in the market. Lemme explain…

To start, despite the market tanking, most companies were still in the green. For example, on August 2nd - the low point of the sell-off with the S&P 500 down 10.7% - 58% of companies were still up compared to pre-meltdown levels. Tf?

And now that the market is pretty much back to flat, a whopping 76% of companies are up from before the crash, with 58% up by more than 5%.

What gives? Well, some pretty basic algebra will show you that the biggest companies (think Mag7) stunk, while the vast majority of companies did just fine.

The Mag7 helps clearly illustrate this: The biggest companies were also the companies that had done the best this year - and built up steep valuations along the way. As a result, they were the ones that got hit hardest as the market rotated into less appreciated areas.

TL;DR - the market excluding the mega-caps did just fine.

This rotation was also present in the relative performance of the sectors. Tech, techy Communication Services and Consumer Discretionary were 3 of the top 4 best performing sectors in the year to July 10th.

And they are also the only sectors in the red since July 10th.

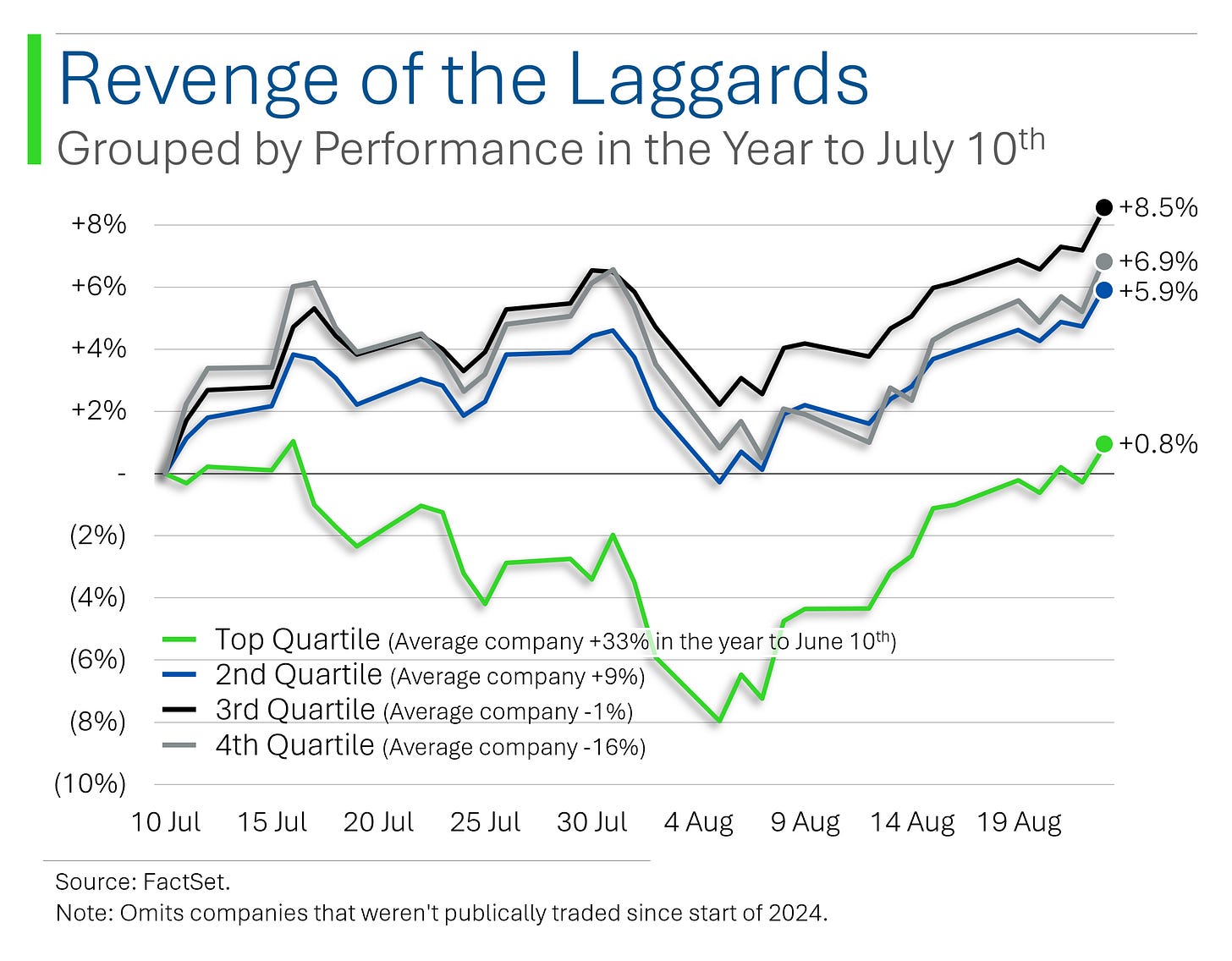

This rotation is also visible when looking at which stocks had performed the best in 2024 up until July 10th. Stocks in the top quartile got hit pretty hard and have only now come back to break-even. While the bottom 75% of stocks are up on average by 7.1% since July 10th.

Basically Mr. Market is playing Robin Hood; taking from the go-go stocks, and giving to the also rans.

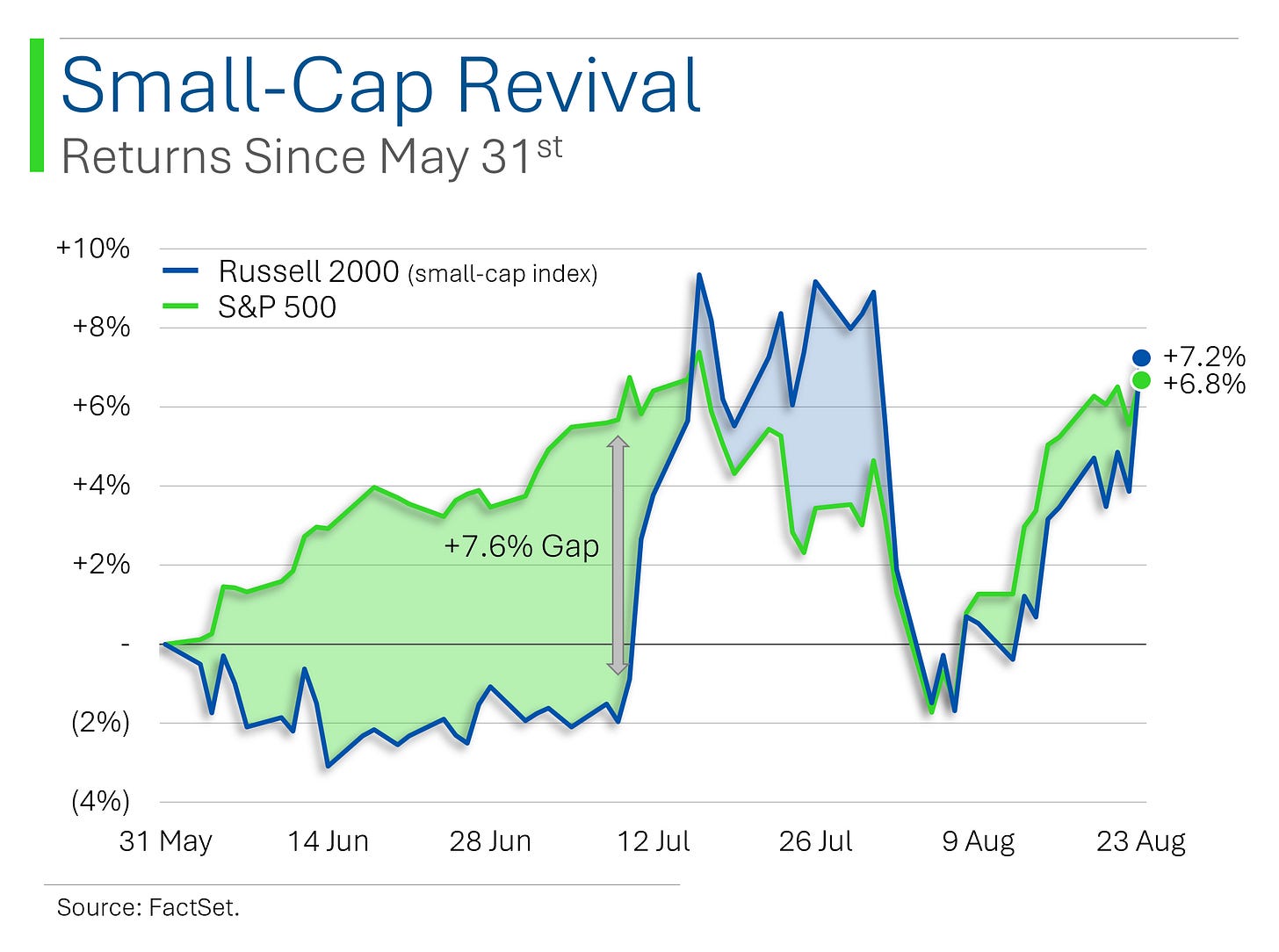

One area that it’s nice to see start to finally work is Small-Cap. From the start of 2021 until the July 10th correction, the Russell 2000 was up only 3.9% while the S&P 500 was up 50.0%. Zero love.

This all turned around on July 10th and now the Russell is actually outpacing the S&P since the start of summer.

Nice to see the underdogs get some attention.

To wrap this up, the market may be back to where it was a few weeks ago but it’s not exactly business as usual. Investors are spreading their nets wider and looking under rocks to find what’s going to work, and the 2024 heroes seem to have lost their luster.

Time will tell if these underdogs have the bite to justify the pivot.

Joke Of The Day

Politicians and diapers have one thing in common: they should both be changed regularly… and for the same reason.

Hot Headlines

CNBC / Apple announces iPhone event for Sept. 9. OooOooo, can’t wait to see how good the camera is!

CNBC / Canada imposes a 100% tariff on imports of Chinese-made electric vehicles, matching the U.S. This move came as a result of Trudeau’s concerns over predatory Chinese trade practices. Additionally, Trudeau announced a 25% tariff on Chinese steel and aluminum.

Bloomberg / Applied Materials gets DOJ subpoena relating to their application for Federal grants. The chipmaker is was already under scrutiny over their dealings in China, which may be the catalyst for the increased attention.

Bloomberg / Elliott increases Southwest Air stake and pushes for complete overhaul of operations. Elliott Investment Management has increased its stake in Southwest Airlines to 9.7%, intensifying its push for a major overhaul of the carrier's leadership and operations. Elliot’s representative plans to meet with Southwest on September 9th to discuss these changes in person. Southwest continues to support its current leadership, with CEO Bob Jordan defending the airline's strategic direction.

Reuters / Icahn Enterprises hit near 21-year low on share sale worth up to $400m. While the firm claims to be using the proceeds to support potential acquisitions, this is merely the most recent in their undoing since getting exposed by Hindenburg Research on May 2nd of 2023 for rampant stock manipulation. Check out the full report here. This guy’s supposed to be a legend?!

Yahoo Finance / IBM to shut China R&D team, affecting less than 1,000 staff. Apparently geopolitical tensions drove IBM’s decision to shut down this hardware R&D team. Furthermore, the impacted job functions will be relocated primarily to India. Huh, IBM is still in business? There’s a fun fact.

Trivia

Today’s trivia is on commercial space companies!

SpaceX has led the charge in making space more accessible by significantly lowering launch costs. Which of the following achievements is SpaceX best known for in the commercial space industry?

A) Developing the first private spacecraft to dock with the International Space Station

B) Launching the first satellite into orbit

C) Building the largest satellite constellation

D) Being the first company to fly tourists to the MoonBlue Origin, founded by Jeff Bezos, has ambitious goals for space exploration. What is the primary focus of Blue Origin’s New Shepard rocket?

A) Delivering cargo to the Moon

B) Suborbital space tourism

C) Launching satellites into geostationary orbit

D) Transporting astronauts to the ISSBoeing has been a long-time partner of NASA and is heavily involved in human spaceflight. What is the name of Boeing's spacecraft designed to transport astronauts to the International Space Station under NASA's Commercial Crew Program?

A) Orion

B) Dragon

C) Starliner

D) CygnusAmazon is expanding into the commercial space sector with its Project Kuiper. What is the primary goal of Amazon's Project Kuiper?

A) To launch reusable rockets

B) To develop a satellite-based broadband network

C) To offer space tourism services

D) To create a lunar base for human settlement

(answers at bottom)

Market Movers

Winners!

XPeng, Inc. (XPEV) [+7.1%]: The Chinese automaker's stock rose after the CEO purchased more than 2 million shares.

PTC Therapeutics (PTCT) [+2.2%]: UBS upgraded the stock from neutral to buy, citing valuation and potential upside from upcoming NDA filings and product launches.

Losers!

PDD Holdings (PDD) [-28.5%]: The company's Q2 sales missed expectations, but EPS was better; they warned of pressured revenue growth due to competition and external challenges, with plans to invest heavily in the platform.

SolarEdge Technologies (SEDG) [-9.2%]: The stock dropped after the company announced a leadership transition, with CEO Zvi Lando stepping down and CFO Ronen Faier taking over as Interim CEO.

Wayfair (W) [-2.4%]: Argus Research downgraded the stock to hold from buy, citing muted home sales and elevated interest rates in the current environment.

Market Update

Trivia Answers

A) SpaceX is best known for developing the first private spacecraft to dock with the International Space Station.

B) Blue Origin’s New Shepard rocket is primarily focused on suborbital space tourism.

C) Boeing's spacecraft designed to transport astronauts to the ISS is called the Starliner.

B) Amazon's Project Kuiper aims to develop a satellite-based broadband network.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.