🔬Consumptioning: Retail Sales & the Stock Market

Plus: Gold is at a crossroads; Steel is on the chopping block; and much more!

“Time in the market beats timing the market.”

- Ken Fisher

“In business, one has to know when to step back and think.”

- Henry Ford

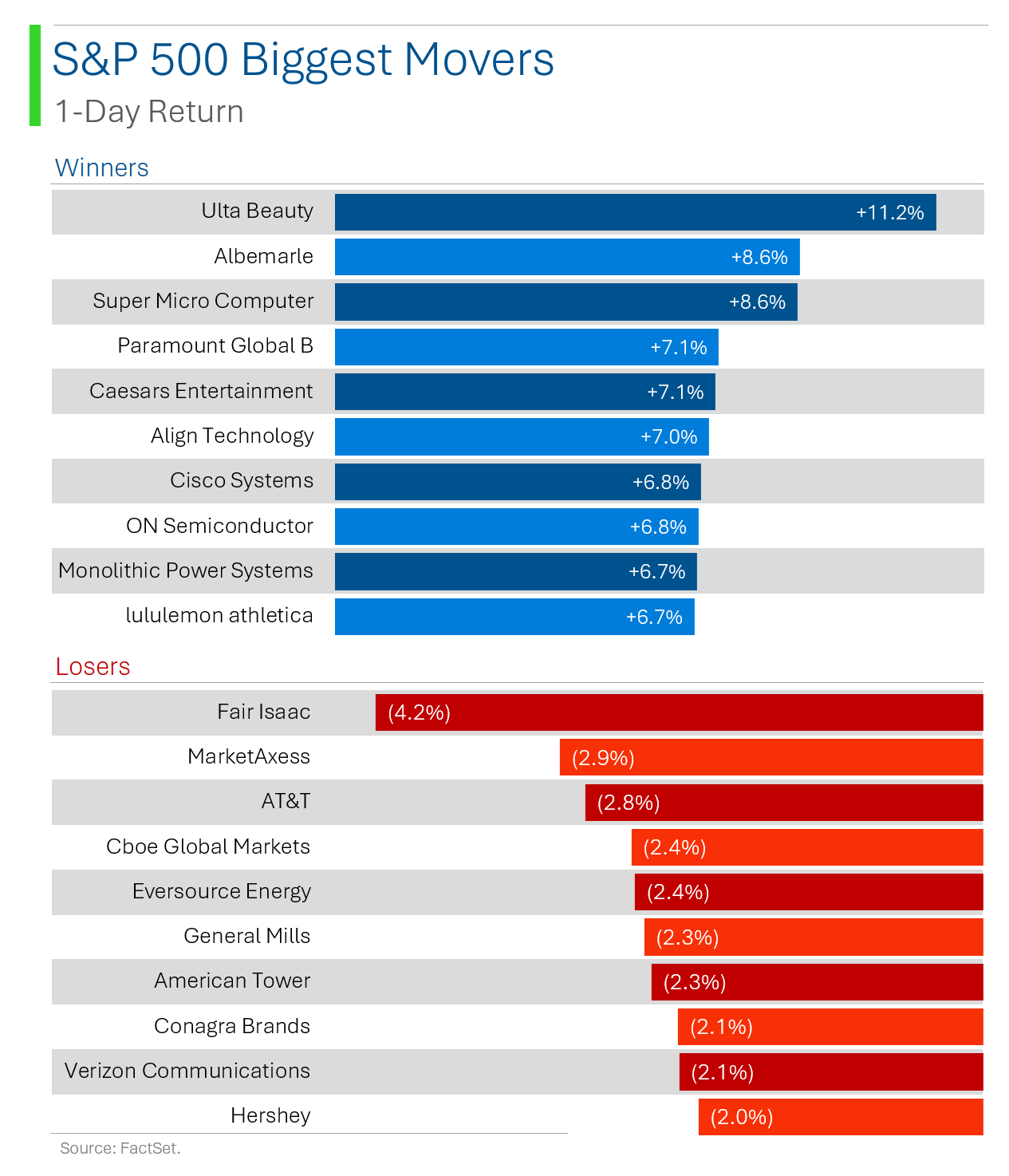

Banger of a day for the big US market with the S&P 500 +1.6% and Nasdaq +2.3% - both have traded higher for the last six sessions.

9 of 11 sectors closed higher, led by Consumer Discretionary (+3.4%) and Tech (+2.5%). Real Estate was the worst (0.3%) but didn’t get too banged up.

Retail Sales came in strong and so did jobless claims (see below).

Notable companies:

Ulta Beauty (ULTA) [+11.2%]: Berkshire Hathaway disclosed a stake of 690K shares.

Dell Technologies (DELL) [+7.1%]: Added to JPMorgan's Analyst Focus List; shares have underperformed other AI beneficiaries since earnings, but AI server market is still early.

Walmart (WMT) [+6.6%]: Q2 revenue and EPS beat, raised FY guidance; US comp growth ahead of consensus, share gains led by upper-income households; no further consumer health decline seen.

Nike (NKE) [+5.1%]: Pershing Square disclosed a stake of 3 million shares.

Robinhood Markets (HOOD) [+4.8%]: Upgraded to buy at Deutsche Bank; solid growth in transaction revenue, better cost control, and reduced dependence on cryptocurrency.

Street Stories

Consumptioning

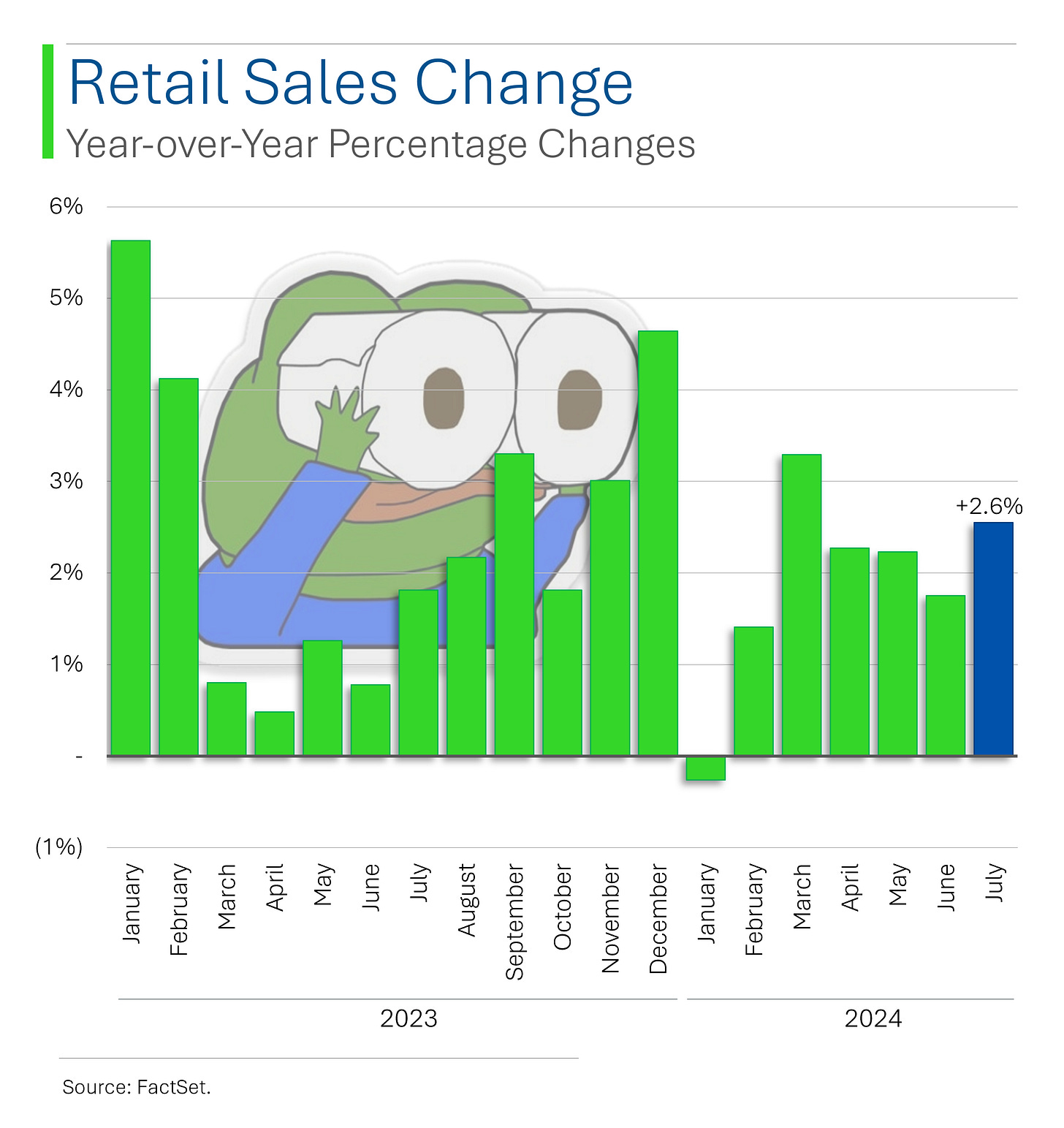

July retail sales surged 1.0% in July, far outpacing the expected 0.3% rise, as consumers continued to spend on cars, electronics, and food.

This surprise boost came even as inflation eased to its lowest level since 2021, signaling that shoppers aren't ready to slow down just yet.

Year-over-year July numbers represented a healthy +2.6% and reversed 3 months of consecutive declines.

The $615 billion monthly print also meant that Retail Sales hit a fresh all-time high. So that’s cool.

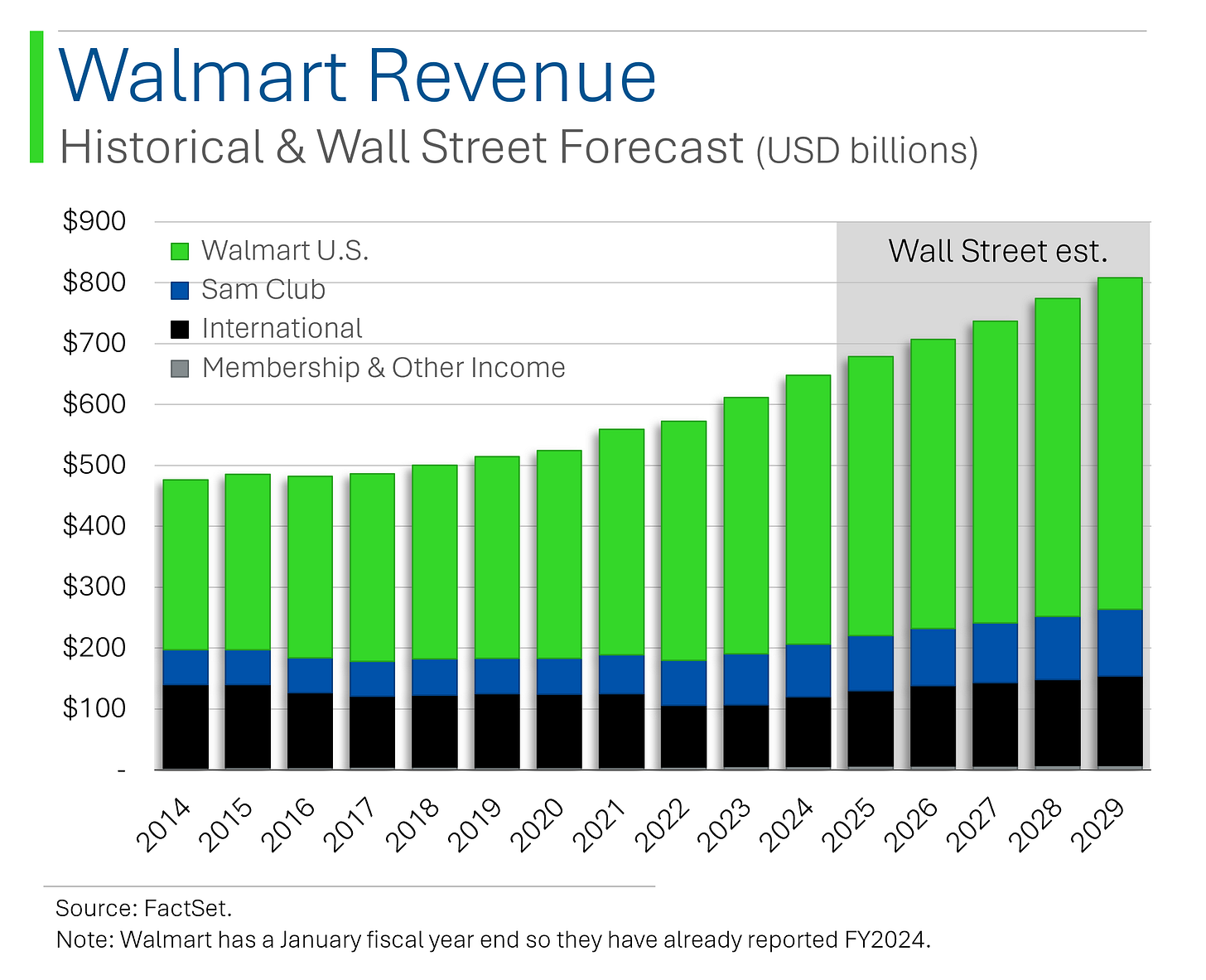

This coincided nicely with Walmart’s Q2 earnings release which saw them beat on revenue and EPS, and upping their full-year guidance. The company appears in great shape but the caveat here is that they are a low-cost retailer and their strength could be indicative of a weakening consumer, forced to move down market.

Walmart essentially said as much on the call, noting that their biggest share gains were led by upper-income households. Not exactly SPAM and shotgun shells but not the healthiest of long-term indicators either.

Steel Crisis?

China’s state-owned Baowu, the world’s largest steelmaker, just sounded the alarm, predicting a steel industry crisis that could make 2008 look mild.

With China’s economy cooling rapidly, steel supply is piling up, and they’re offloading it on foreign markets, sending prices into a tailspin. However, while iron ore and rebar futures are already hitting multi-year lows, production hasn’t really changed all that much around the globe.

Gold, the comeback king.

Gold has been on a 20% tear this year and while that rally has seen a little bit of volatility near its all time highs over the last week, it has remained within $50-100 of setting a new record.

For many, the inflation thesis is still top of mind as the market can’t seem to agree on the level of rate cuts we’ll see throughout the rest of the year. Despite that, gold has grossly outperformed the US Dollar Index through 2024.

Time to see if it can hold its own in the face of normalizing global inflation and rate cutting.

Joke Of The Day

How do you make a small fortune by trading options? Start with a big fortune.

Hot Headlines

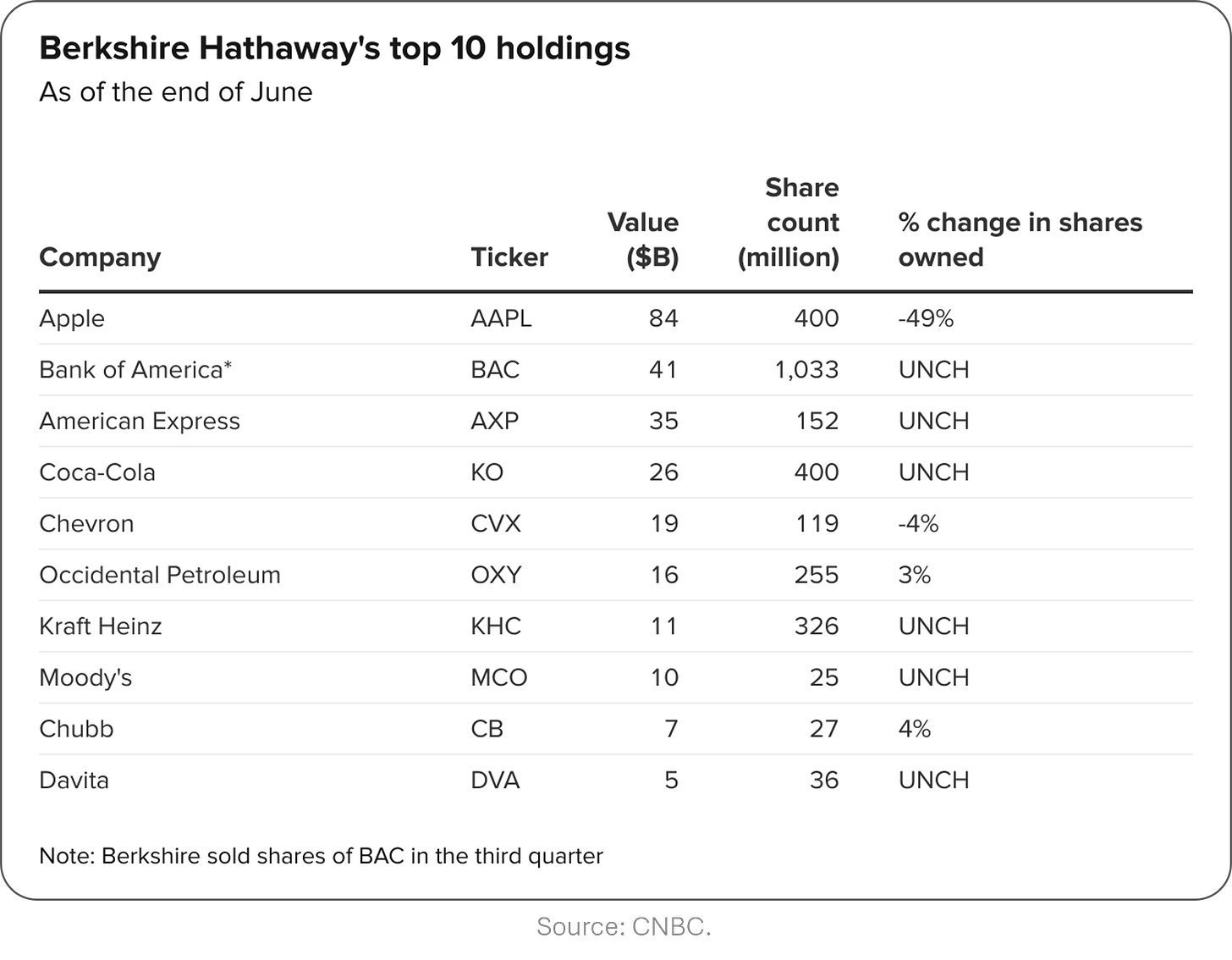

CNBC / Warren Buffett slashed his Apple position by nearly 50%. Warren has been making sweeping changes to his portfolio, such as his investment into Ulta Beauty - take a look at his top 10 holdings below, but generally appears to be raising cash. Not a great sign.

CNBC / NBCUniversal is pinning Peacock’s streaming success on its $2.45 billion per year NBA deal. NBCUniversal signed a $2.45 billion per year deal with the NBA to broadcast games for 11 years, beginning with the 2025-26 season. BofA forecasts deal profitability from the very beginning. This brings the number of subscriptions you need to watch the NBA season to 37.

CNBC / JD Vance accepts VP debate with Tim Walz on Oct. 1, challenges him to accept another. Ohio Senator JD Vance is stepping up to the debate stage on Oct 1st, but he’s not planning on stopping at one round…Sidenote; that’s also the date of Trump’s hush money trial sentencing.

Yahoo News / Venezuelan opposition leader rejects Brazil's idea of redoing Venezuela's presidential vote. Follows President Nicolás Maduro’s obviously manipulated election victory on July 28th. Controlled opposition much?

Axios / Trump casts upcoming sentencing date in N.Y. case as election interference. Former President Donald Trump is framing his legal troubles as a political attack, labeling his upcoming sentencing in New York as an attempt to interfere with the election.

Trivia

Today’s trivia is on Walmart!

Walmart was founded by Sam Walton in 1962. It went public on the New York Stock Exchange in what year?

A) 1968

B) 1970

C) 1972

D) 1975What major e-commerce company did Walmart acquire in 2016 to strengthen its online presence?

A) Shopify

B) Zappos

C) Jet.com

D) WayfairWhat was Walmart’s reported revenue for the fiscal year 2023?

A) $572 billion

B) $510 billion

C) $600 billion

D) $680 billion

(answers at bottom)

Market Movers

Winners!

Lumentum Holdings (LITE) [+14.8%]: FQ4 earnings and revenue beat, OM better than consensus; management highlighted a major transceiver award (potentially NVDA); next-Q revenue guide above Street, some analysts believe telecom has bottomed.

Ulta Beauty (ULTA) [+11.2%]: Berkshire Hathaway disclosed a stake of 690K shares.

Dell Technologies (DELL) [+7.1%]: Added to JPMorgan's Analyst Focus List; shares have underperformed other AI beneficiaries since earnings, but AI server market is still early.

Dutch Bros (BROS) [+6.9%]: Upgraded to buy at UBS; concerns over growth slowdown are overblown, catalysts for 2025 comp acceleration exist.

Cisco Systems (CSCO) [+6.8%]: FQ4 earnings, revenue, and margins beat consensus; normalizing customer buying patterns; FY25 guidance aligns with Street; positive demand and infrastructure trends.

Walmart (WMT) [+6.6%]: Q2 revenue and EPS beat, raised FY guidance; US comp growth ahead of consensus, share gains led by upper-income households; no further consumer health decline seen.

Deere & Co. (DE) [+6.3%]: Q3 EPS and revenue beat; Ag & Turf strength and better margins drove profits; reaffirmed FY24 NI target of ~$7B; dealer and company inventory destocking.

Nike (NKE) [+5.1%]: Pershing Square disclosed a stake of 3 million shares.

Robinhood Markets (HOOD) [+4.8%]: Upgraded to buy at Deutsche Bank; solid growth in transaction revenue, better cost control, and reduced dependence on cryptocurrency.

Carrier Global (CARR) [+4.1%]: Selling fire business for $3B to Lone Star Funds; expected closure by end of 2024.

Sirius XM Holdings (SIRI) [+3.8%]: Berkshire Hathaway increased its holding from 36.7M to 132.9M shares.

Tapestry (TPR) [+3.3%]: FQ4 EPS beat, revenue slightly ahead; raised dividend; FY25 EPS midpoint below Street due to Capri acquisition; analysts noted strong inventory controls.

Losers!

Dillard's (DDS) [-10.8%]: Q2 revenue and comps missed, EPS down Y/Y; higher expenses squeezed profitability; total retail sales down 3% Y/Y; inventory unchanged.

Titan Machinery (TITN) [-10.5%]: Negative Q2 preannouncement and slashed FY guidance; retail demand has softened over the last few months; updated guidance reflects subdued demand.

Grab Holdings (GRAB) [-7.1%]: Q2 revenue and net income missed; FY24 guidance reaffirmed, disappointing hopes for an upward revision; now free cash flow positive.

Pilgrim's Pride (PPC) [-3.3%]: Downgraded to neutral at Bank of America; noted the chicken market has benefited from higher prices and lower grain costs, but expects tough comps in Q4.

Market Update

Trivia Answers

C) 1972 was the year Walmart went public on the New York Stock Exchange.

C) Jet.com was the e-commerce company Walmart acquired in 2016.

A) $572 billion was Walmart’s reported revenue for the fiscal year 2023.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.