🔬Congress Is A Hedge Fund

Plus: Inflation came in light, to much aplomb; the Fed meeting basically didn't happen; and much more!

“Pain + Reflection = Progress”

- Ray Dalio, Principles

“It's all about bucks, kid. The rest is conversation”

- Gordon Gekko

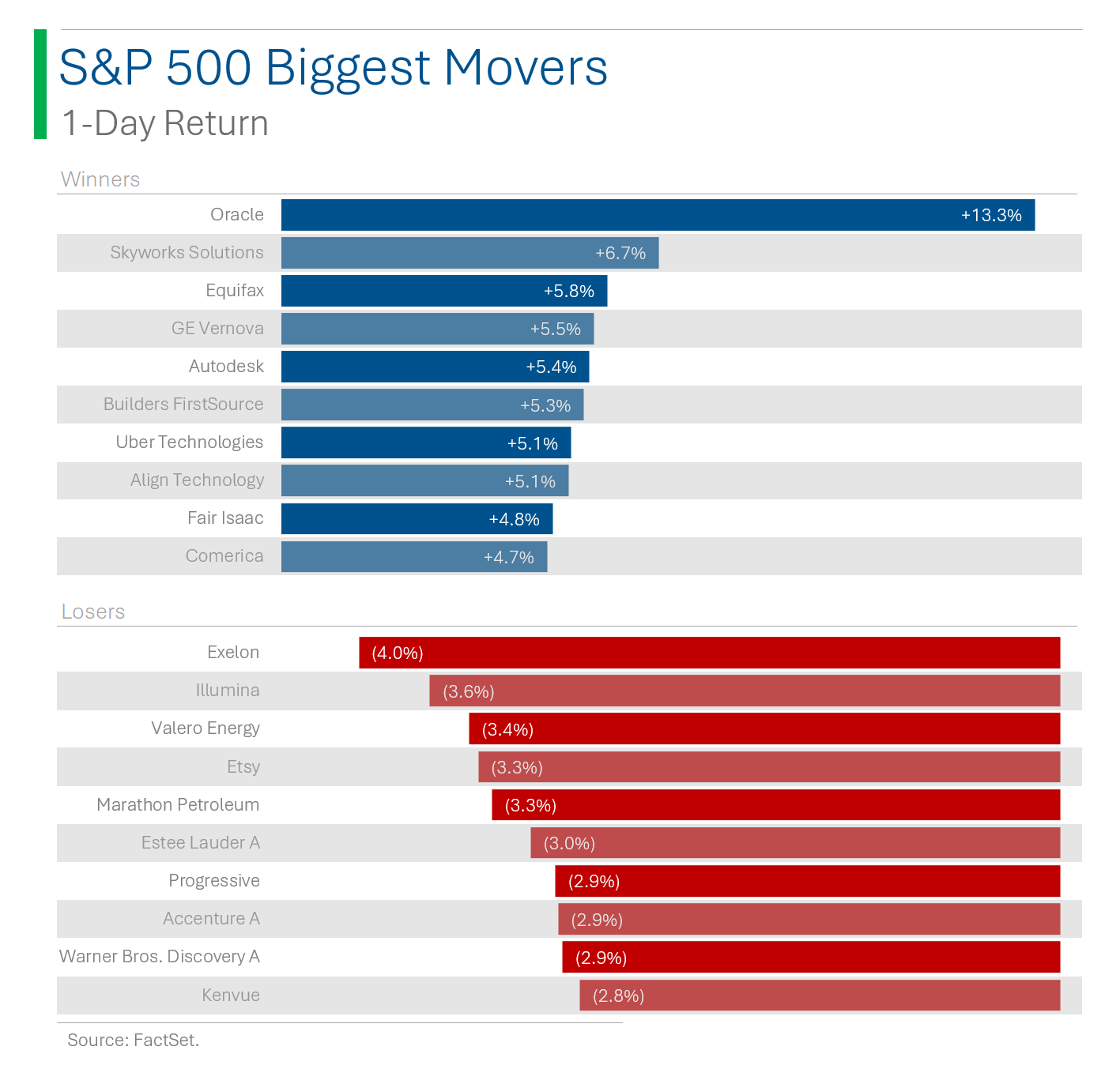

Big day for the big US markets with the S&P 500 +0.9% and Nasdaq +1.5%, as the long awaited inflation print came in (generally) positive.

7 of 11 sectors closed higher, led again by Tech (+2.5%) and its cyclical little buddy Industrials (+0.9%). Energy (-1.1%) and Staples (-1.0%) were at the bottom, as ‘risk on’ trades and a cooling Energy rally were the casualties.

May inflation came out and was net positive (more below), while the Fed meeting basically said frig all.

Notable companies:

Oracle (ORCL) [+13.3%]: Fiscal Q4 results light, but key takeaways include 44% y/y increase in RPO to $98B, driven by AI and cloud bookings; signed over 30 AI contracts; positive on double-digit revenue growth guidance for FY25 and expectations for 50%+ OCI growth. #hope

Apple (AAPL) [+2.9%]: Follow-on hype from yesterday’s AI fueled rally, after Chat-GPT deal and ‘Apple Intelligence’ announcement.

Rubrik (RBRK) [-8.9%]: Q1 EPS and Revs beat, and guided FY25 EPS and Revs ahead of estimates; analysts noted strong subscription and cloud ARR growth but cautioned on lower implied net new ARR through Q4 following Q1 beat.

More below in ‘Market Movers’.

Street Stories

Invest With Congress

The best kind of information is inside information. The problem is that that could get you sent to Club Fed for a bit and miss ski season in Gstaad.

Solution? Join Congress.

Washington is too much of a cesspool for your liking? Well, now you have a clear second best option: Congress-tracking ETFs!

Yes, middling ETF player Tuttle Capital just got a heck of a lot cooler by filing to register a new trust to manage their pending ‘Tuttle Capital Congressional Trading ETF’. As part of the Stop Trading on Congressional Knowledge Act of 2012 - acronym STOCK Act (cute…) - Congresspeople have 30 days to report on any financial transactions over $1,000.

This information can be found on just another soulless government website (link), with Tuttle claiming the fund will ‘will obtain and use information derived by others from [Periodic Transaction Reports] filed by U.S. Congresspeople and their family members […] to determine which equity securities of publicly traded companies, and how much of each equity security, to select for the Fund.’ Sweet.

Annoyingly, however, is that people (or ETFs) piling in on trades after Congresspeople will only push their investment returns higher. Not that most of them need the excess return.

For example, Nancy Pelosi and her husband netted an estimated 65% return on their portfolio in 2023 (the S&P 500 was up 24%), and reportedly purchased $2 million in Nvidia call options at the end of last year (you know, right before shares went parabolic).

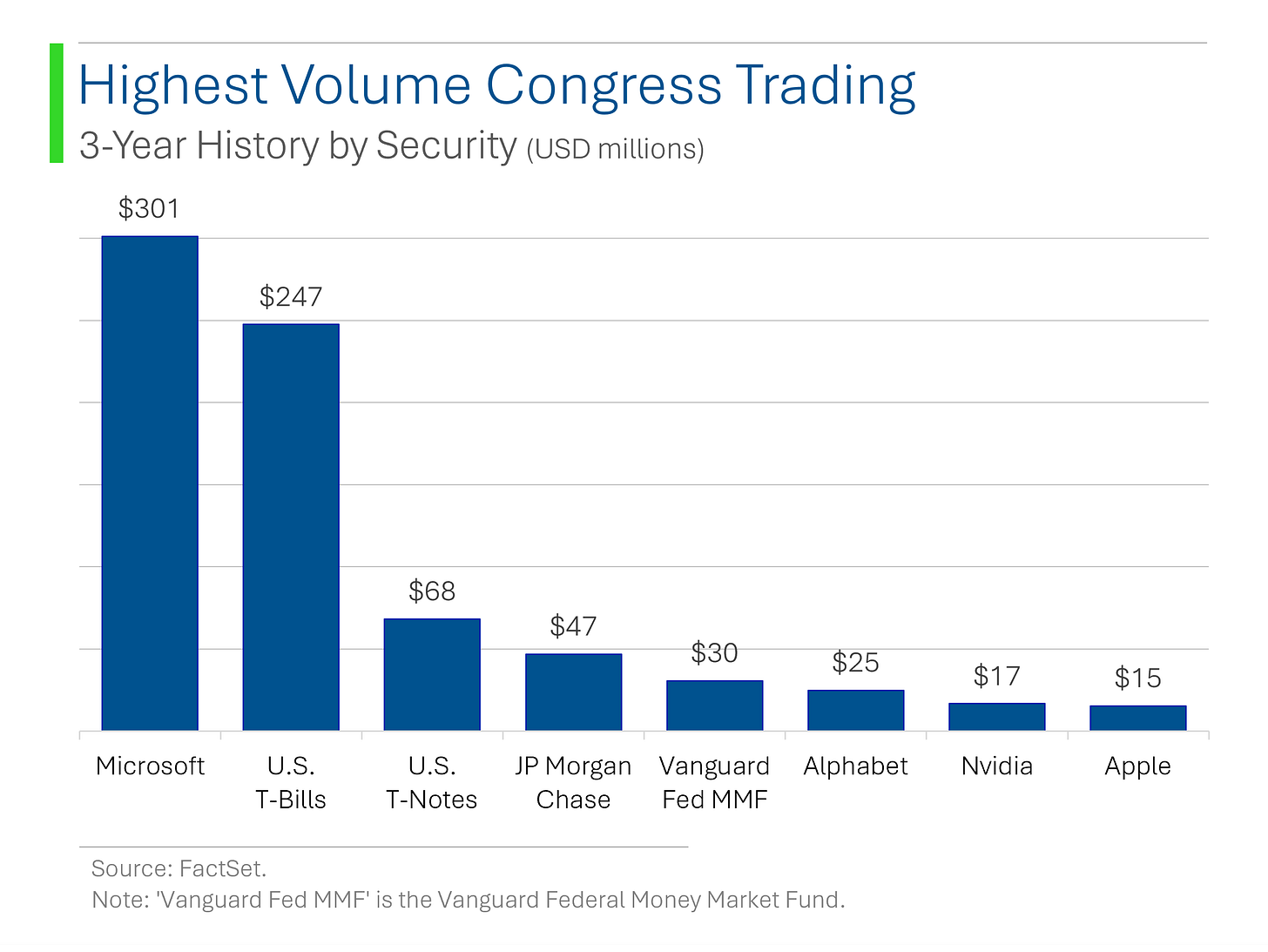

And just if you’re curious, I had a look to figure out the most popular trades by Congress over the last three years. Volume-wise, Microsoft and T-Bills have been the fan favourite.

Meanwhile five of the Mag7 (Apple, Microsoft, Amazon, Alphabet and Nvidia) have been the most popular trades by the number of Congress investing.

Anyway, not to over do it - but I genuinely think the way that elected officials get to manage their money is absurd. When I was at my last job picking stocks for a living, I not only had to clear all my personal trades with our internal compliance department but also with my wife’s (who works at a financial firm) compliance department. Beyond minimum holding periods, if someone out in the Beirut office did a clearing trade 2 weeks ago, I could be blocked from transacting.

It literally cost me tens of thousands of dollars in missed opportunities but it was fair because it ensured that anyone with a hint of market intel - let alone insider knowledge - couldn’t benefit from it.

Hell, most of my friends at large asset management firms or hedge funds - some of the most savvy investors in the world - pretty much just have ETFs in their personal accounts because it isn’t worth the trouble to run through the compliance hoops. If f***** Citadel and Point72 have stricter trading rules than folks sitting on the House Ways and Means Committee then something is truly rotten.

Interesting links:

CPI Didn’t Ruin Things

Excluding the switch that got flipped that made people stop hating Apple this week, the market has been sitting on its hands in anticipation of May’s Consumer Price Index inflation release.

Thankfully it wasn’t a disaster! (My gentle heart couldn’t bear it)

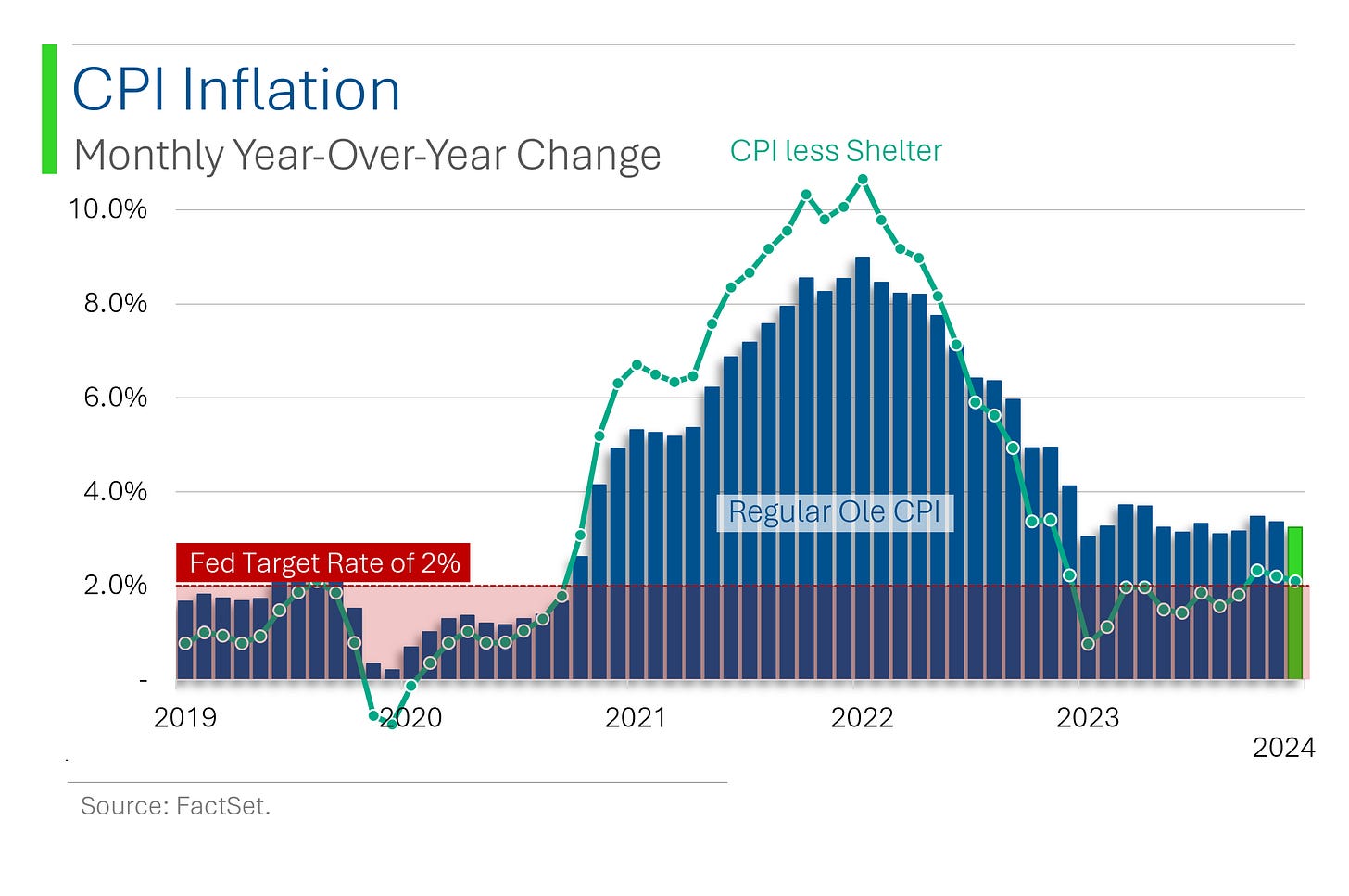

The print came in lower than expected with headline inflation up only +0.2% month-over-month vs. estimates for +0.3%, for it’s lowest rise since August 2021. Annoyingly, Shelter costs (+0.4%) continued to rise for the fourth straight month, but for the most part it was a modest positive.

Something I harped on back in May was that I think the Fed might be missing the boat when it comes to its inflation objectives, as much of what’s embedded into the aggregate print are things that don’t seem to be too restrained by elevated rates.

For example, if you exclude the impact of housing (mostly an exogenous factor based on lagging supply and demand) and auto insurance (an oligopoly cartel), year-over-year inflation is only +0.6%. Which is probably too low.

Ok, fine. We’ll go with crazy.

Joke Of The Day

My wife accused me of being immature so I told her to get out of my fort.

Classic Golden Arches pattern/buy-signal…

Hot Headlines

Reuters / Caterpillar boosts buyback authorization by $20 bln and raises dividend. Massive buyback for the $161 billion company, which I might add has raised dividends for 30 consecutive years. #Goals

Bloomberg / Amidst the new activist battle with Eliot Management, Southwest urged by second big investor to replace leadership. Artisan Partners, Southwest’s ninth-largest shareholder, urged the board in a letter on Wednesday to “reconstitute itself and upgrade company leadership” in order to fairly assess the path forward for the airline. Management and Board released a statement effectively saying ‘Go f*** yourself’.

Reuters / FedEx to cut up to 2,000 back-office jobs in Europe amid weak freight demand. Company expects the downsizing will help save between $125 million and $175 million a year from fiscal 2027. At least they didn’t say ‘AI’.

CNN Business / Ex-employees sue Elon Musk and SpaceX, claiming illegal firings after they called out alleged gender bias and harassment. Not touching this one with a telephone pole…

Bloomberg / Investors push increased odds of September rate cut following positive May inflation report. The caveat being that these are the same people that had a 97% probability of a March rate cut back in December.

Market Movers

Winners!

Avidity Biosciences (RNA) [+32.6%]: Announced positive data from phase 1/2 trial of AOC 1020 in patients with facioscapulohumeral muscular dystrophy; observed over 50% reduction in DUX4 regulated genes and functional improvement trends. Science nerd for ‘good’.

Casey's General Stores (CASY) [+16.7%]: FQ4 earnings, revenue, and EBITDA margin beat; comps above consensus in all segments; management highlighted strength in pizza, bakery, and beverages; FY25 guidance in line with the Street; increased quarterly dividend.

Rentokil Initial (RTO) [+13.7%]: Nelson Peltz's Trian confirmed a large position in the company and aims to work with management to increase shareholder value. Was wondering who they’d f*** with next after they pulled the chute on Disney last month.

Oracle (ORCL) [+13.3%]: Fiscal Q4 results light, but key takeaways include 44% y/y increase in RPO to $98B, driven by AI and cloud bookings; signed over 30 AI contracts; positive on double-digit revenue growth guidance for FY25 and expectations for 50%+ OCI growth.

Zillow Group (ZG) [+12.8%]: Director Jay Hoag disclosed purchase of 2.34M shares.

Losers!

Rubrik (RBRK) [-8.9%]: Q1 EPS and revenue beat; guided FY25 EPS and revenue ahead of estimates; analysts noted strong subscription and cloud ARR growth but cautioned on lower implied net new ARR through Q4 following Q1 beat.

Market Update

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested. Or enemy. I’m not picky.

I looked into the congress trading stuff, unusual whales uses some pretty wonky methodology that likely overstates performance. Still some questionable things going on.

Dang should have shouted out my podcast! Every weekend I send out a podcast that has a hedge fund trading report, a politician trading report, insider trades, guru trades, and more!