🔬Chips Are Down: Has the Semiconductor Hype Short-Circuited?

Plus: U.S. employment picture continues to threaten 'soft landing' narrative; and much more!

“If you’re not a risk-taker, you should get the hell out of business.”

- Ray Kroc

"I made my money the old-fashioned way. I was very nice to a wealthy relative right before he died."

- Malcolm Forbes

Terrible Friday for the big US markets with the S&P 500 -1.7% and Nasdaq -2.6%. Poor sentiment mostly driven by week Non-Farm Payrolls (see below) which continued to paint a rapidly weakening picture of the US job market.

Only 1 of 11 sectors closed higher Friday …but that was Real Estate which was +0.007%. Oof.

Notable companies:

United States Steel (X) [+4.3%]: U.S. Steel is still in the spotlight as Cleveland-Cliffs shows interest in buying assets, with analysts saying it's undervalued.

Broadcom (AVGO) [-10.4%]: Broadcom beat Q3 estimates and raised AI revenue forecasts, but weaker non-AI segments and lower-than-expected guidance for Q4 disappointed.

Tesla (TSLA) [-8.4%]: Mostly due to broader sell-off which hit AI-related stocks hardest. (Elon got his wish to be considered an AI-play lol)

Mobileye Global (MBLY) [-8.5%]: Intel may sell part of its stake in Mobileye, which sparked concern after Bloomberg reported the potential move.

More below in ‘Market Movers’.

Street Stories

Chips Are Down: Has the Semiconductor Hype Short-Circuited?

The market’s been pretty weird the last two months: In early June we had a pretty big sell-off; then it immediately rebounded in early August; and more recently we’ve started to see hints of another sell-off.

But while the broader market is only down a few percent from the July all-time high, the average semiconductor company is down around 25%.

Does this mean the party’s over?

It doesn’t seem like it is. At least, not yet.

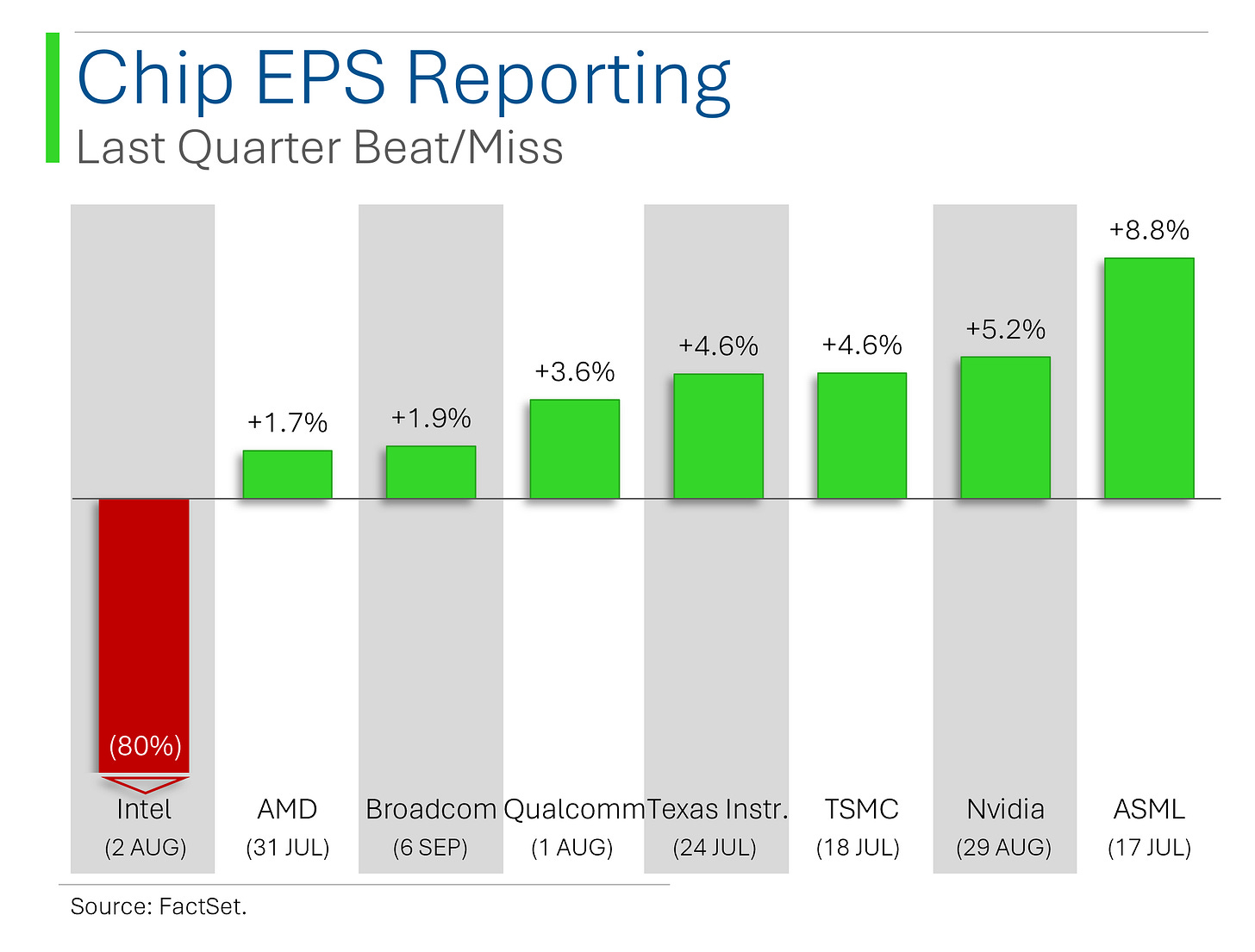

As you can see below, the big names in the chip industry are still out there banging out quality growth quarter after quarter.

The two exceptions below are ASML and Intel: The former because the Dutch equipment maker is prone to lumpy growth and is also taking a bit of a hit from Chinese export restrictions. As for the latter, well, if you’ve been reading StreetSmarts you know what I think of Intel…

It’s even more impressive at the Earnings Per Share level: Excluding Intel and ASML the average company in the peer set saw their last quarter EPS come in at +49.9% above the same quarter last year.

So yeah, still doing ‘alright’…

But while the growth has remained strong, expectations for future growth are a bit muddled.

For example, Nvidia and TSMC have seen Wall Street estimates for this year’s revenue steadily increase over the course of the year (the three big jumps with Nvidia occur on their Q4, Q1 and Q2 reporting dates).

For the rest it’s pretty much been a wash or - in the case of Intel (again) and Texas Instruments - it’s actually been trending materially downward. Yeesh.

And we won’t have to wait too long to see where this is trending as Q3 reporting is just around the corner. In fact, Broadcom reported Friday and Nvidia, with it’s weirdo January fiscal year end, only reported Q2 two Thursdays ago.

Hopefully things hang in there like they did last quarter, where really only Intel stunk it up.

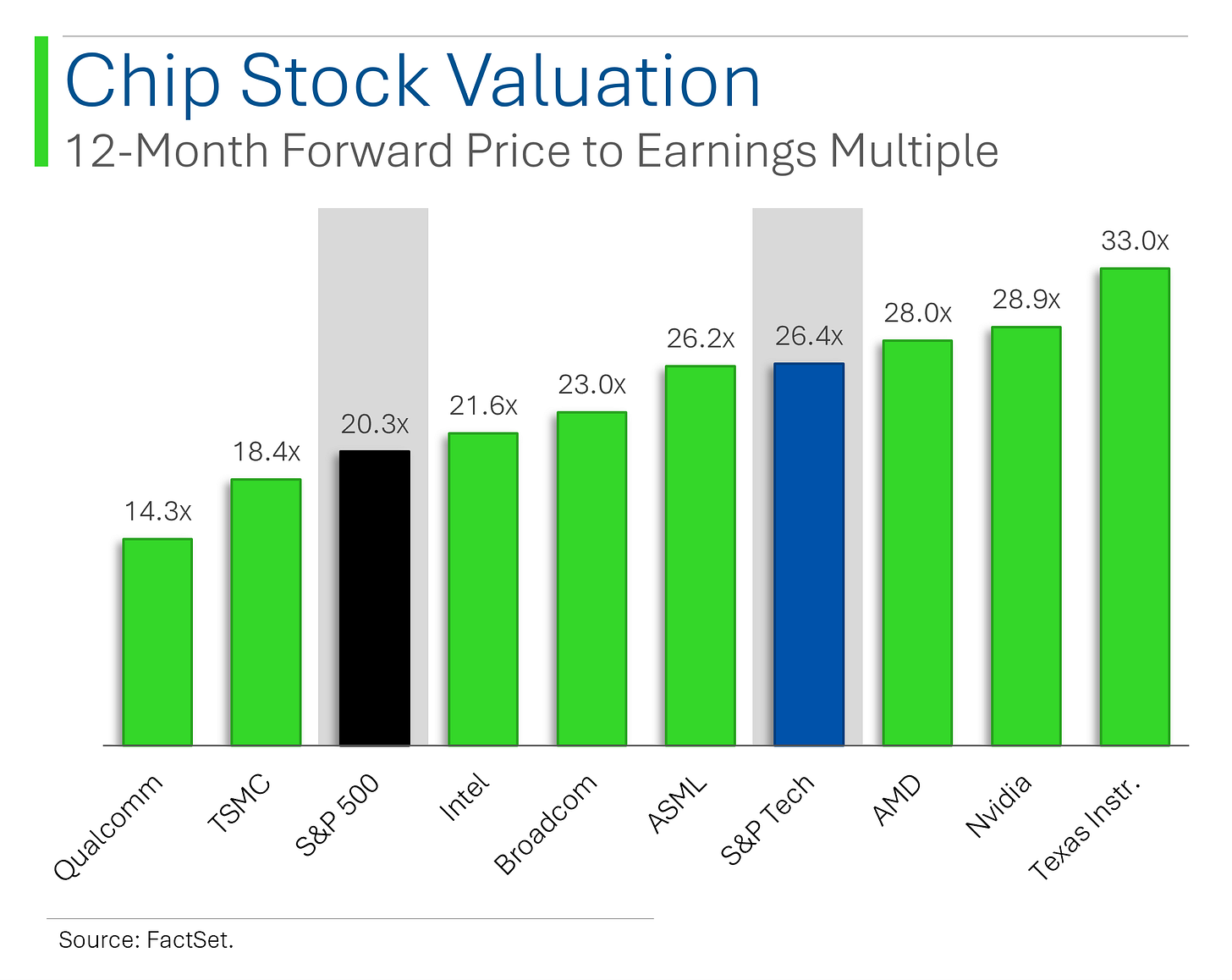

So now that we’ve established that the Chip companies are probably ok, that doesn’t necessarilly mean that they won’t crash further. Most have had pretty big rallies and trade at valuations with lots of air underneath.

As you can see below, Chipland isn’t exactly trading at a discount.

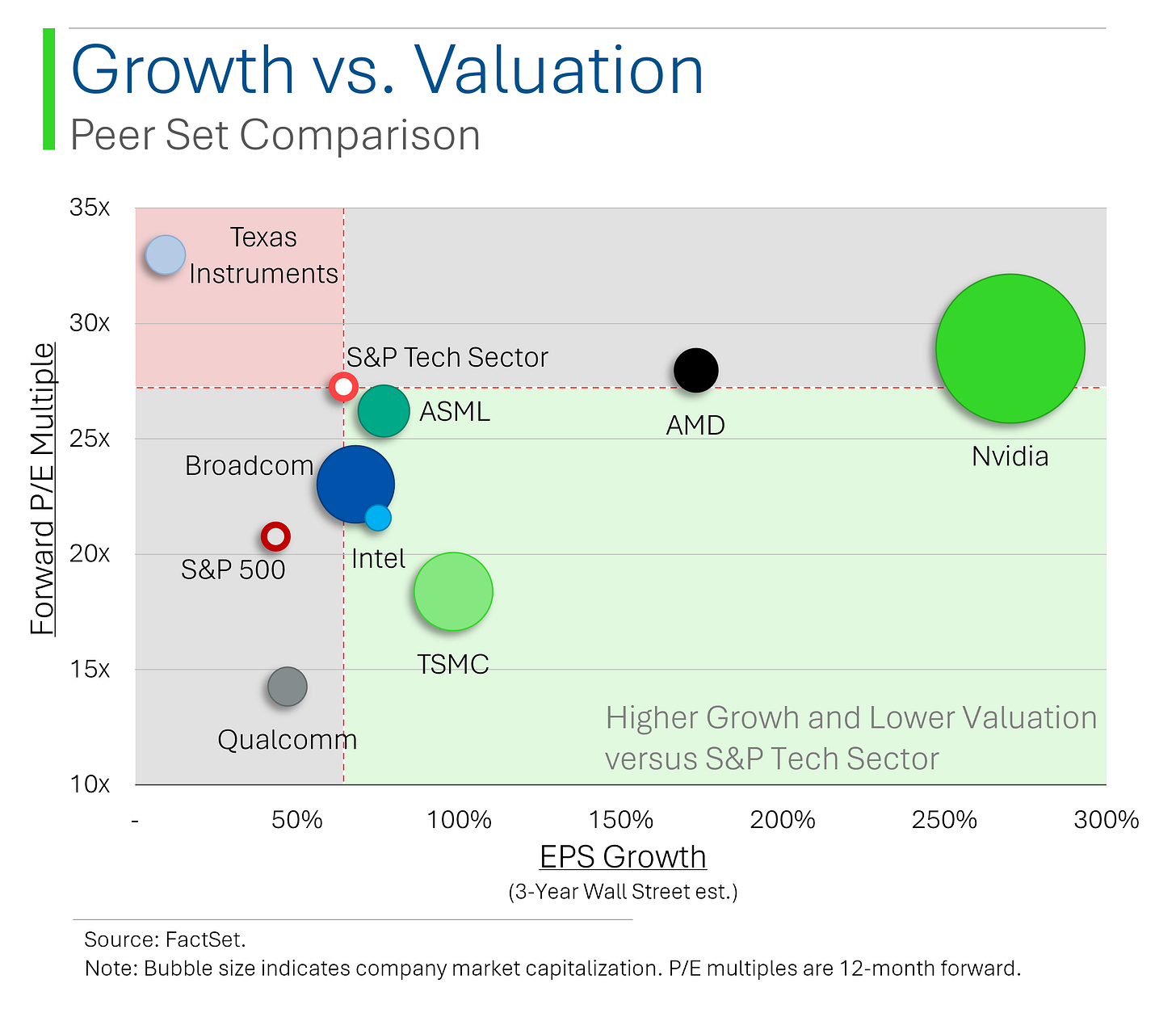

However, expectations for growth should be considered to add some context to these valuations. For example, the main Semiconductor companies - save for Qualcomm and Texas Instruments - are all forecast to have higher growth EPS growth over the next three years than the S&P 500 Tech sector.

And of those names, only AMD and Nvidia trade at a higher forward P/E multiple - and they are expected to have massively higher EPS growth.

That seems much more palatable…

It’ll be interesting to see what happens next but I think we can all be happy that overall market sentiment seems to finally have detached itself from ‘how’s Nvidia this week’. For better or worst…

Non-Farm is Non-Good

Signs that the U.S. labor situation is cooling added another straw to the proverbial camel’s back Friday, as Non-Farm Payrolls came in light again at +142k shiny new jobs; missing the Street’s estimates for +165k jobs. However, that was enough to round the unemployment rate back to 4.2% from 4.3% .

Also worth noting is that the July payrolls figure was revised down to 89k from 114k. Sure, economists aren’t perfect (lol) and material revisions are to be expected but it seems like every month now gets a massive downward revision and, well, it’s getting pretty comical at this point.

Should we be putting so much value in the BLS’ jobs data?

Joke Of The Day

What do you get when you mix Goat DNA and Human DNA?

Kicked out of the petting zoo. 🫠

Hot Headlines

Reuters / Venezuela Opposition Leader Gonzalez Flies to Spain After Arrest Warrant. Opposition leader Edmundo Gonzalez has arrived in Spain and is seeking asylum (Stalin and Hitler did something similar to their political adversaries). If you haven’t been following, Gonzalez had contested President Maduro's claim to victory, and is now facing an arrest warrant.

CNBC / Former President George W. Bush Has No Plans to Endorse in the Election. This marks a notable stance as Bush had endorsed previous Republican nominees like Mitt Romney in 2012 and John McCain in 2008. Funny enough, former Vice President Dick Cheney, even backed Kamala Harris, citing Donald Trump as a threat to the republic. For Cheney to call you a threat to the republic...

Bloomberg / Trump Leads Harris By a Point in NYT-Siena College National Poll. That said, there’s a margin of error of three percentage points, so the race remains a toss-up. Poll takers reportedly 56% favoring Trump on handling the economy and 51% rating current economic conditions as “poor.”

Bloomberg / Boeing Reaches Deal With Union After Marathon Weekend Talks. Boeing reportedly offered a 25% wage increase over four years, with an immediate 11% boost and a $3,000 bonus. While workers still need to vote, the stakes are high for Boeing given the deep impact a bottleneck would have on their ability to service the firm’s $45B debt pile.

Yahoo Finance / Google's Second Antitrust Trial Starts Monday. The DOJ, along with 17 state attorneys general, argue that Google created a “moat” around the ad tech industry, using its dominant search engine to edge out competition and control both sides of the digital ad space. Look I get this is important, but who wants to use Bing?

Trivia

Today's Trivia Is On Insider Trading!

Which notorious insider trading case in the 1980s led to the downfall of a major Wall Street player, marking one of the largest securities fraud cases in U.S. history?

A) Enron Scandal

B) Martha Stewart Case

C) Ivan Boesky Scandal

D) Bernie Madoff Ponzi SchemeIn which year did the U.S. Congress pass the Insider Trading Sanctions Act, which allowed for significant financial penalties for illegal insider trading?

A) 1934

B) 1984

C) 1990

D) 2002Which famous hedge fund faced legal trouble and a $1.8 billion fine for insider trading, marking one of the largest settlements in U.S. history (and served as the basis for the TV show ‘Billions’)?

A) Renaissance Technologies

B) SAC Capital

C) Bridgewater Associates

D) Pershing SquareWhich early 20th-century financier, famous for cornering the copper market, was convicted of insider trading and later became a symbol of unethical Wall Street behavior?

A) Jay Gould

B) John D. Rockefeller

C) Charles Ponzi

D) William C. Durant

(answers at bottom)

Market Movers

Winners!

Samsara (IOT) [+13.6%]: Samsara crushed it with strong Q2 earnings, solid guidance, and big growth with large customers.

Guidewire Software (GWRE) [+12.4%]: Guidewire had a strong Q4, with cloud sales booming and FY25 looking promising.

Bowlero (BOWL) [+6.6%]: Bowlero saw solid growth with Q4 results and decent guidance, despite challenges in the entertainment sector.

Smartsheet (SMAR) [+5.9%]: Smartsheet beat Q2 earnings, raised FY25 guidance, and stirred up buyout buzz from Blackstone and Vista.

United States Steel (X) [+4.3%]: U.S. Steel is still in the spotlight as CLF shows interest in buying assets, with analysts saying it's undervalued.

DocuSign (DOCU) [+4.0%]: DocuSign had a solid Q2 with raised guidance and a new IAM platform gaining traction, but analysts were cautious about the size of the beat.

Helen of Troy (HELE) [+3.6%]: Helen of Troy announced a fresh $500M buyback plan after wrapping up their previous one.

Losers!

Braze (BRZE) [-19.4%]: Braze had solid Q2 results and raised FY25 guidance, but the tough macro environment and slow subscription growth raised concerns.

Broadcom (AVGO) [-10.4%]: Broadcom beat Q3 estimates and raised AI revenue forecasts, but weaker non-AI segments and lower-than-expected guidance for Q4 disappointed.

Bloom Energy (BE) [-9.8%]: Bloom Energy got downgraded to hold due to backlog uncertainty and unclear guidance around SK and the expiring ITC.

Mobileye Global (MBLY) [-8.5%]: Intel may sell part of its stake in Mobileye, which sparked concern after Bloomberg reported the potential move.

Super Micro Computer (SMCI) [-6.8%]: Super Micro Computer was downgraded, with uncertainty over regulatory compliance and customer retention weighing on new investor interest.

Market Update

Trivia Answers

C) The Ivan Boesky Scandal rocked Wall Street in the 1980s, leading to massive reforms and regulations on insider trading.

B) The Insider Trading Sanctions Act was passed in 1984, increasing penalties for illegal insider trading.

B) SAC Capital faced a $1.8 billion fine, marking one of the largest insider trading settlements in history.

A) Jay Gould, a notorious financier, was convicted of insider trading and became a symbol of greed on Wall Street.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

A great read, and good arguments for the chip sector -- the "heart" of technology.

Sad to see Intel's market cap is smaller than AMD in your "Growth vs. Valuation". And a question - when you mention the X-axis as EPS growth on that chart, do you mean 100% of the EPS growth of the S&P Tech sector or the 100% is an absolute number? Thanks!