🔬 Chip Reporting is a Mess, Meta is a Beast, Peloton is a Joke, and Much More

I talk about the big semiconductor reporting, Peloton's implosion, Polestar's bailout, ISM's rebound, and sprinkle in some earnings news.

"I made a fortune getting out too soon"

- J.P. Morgan

“The trick is to stop thinking of it as ‘your’ money”

- IRS auditor

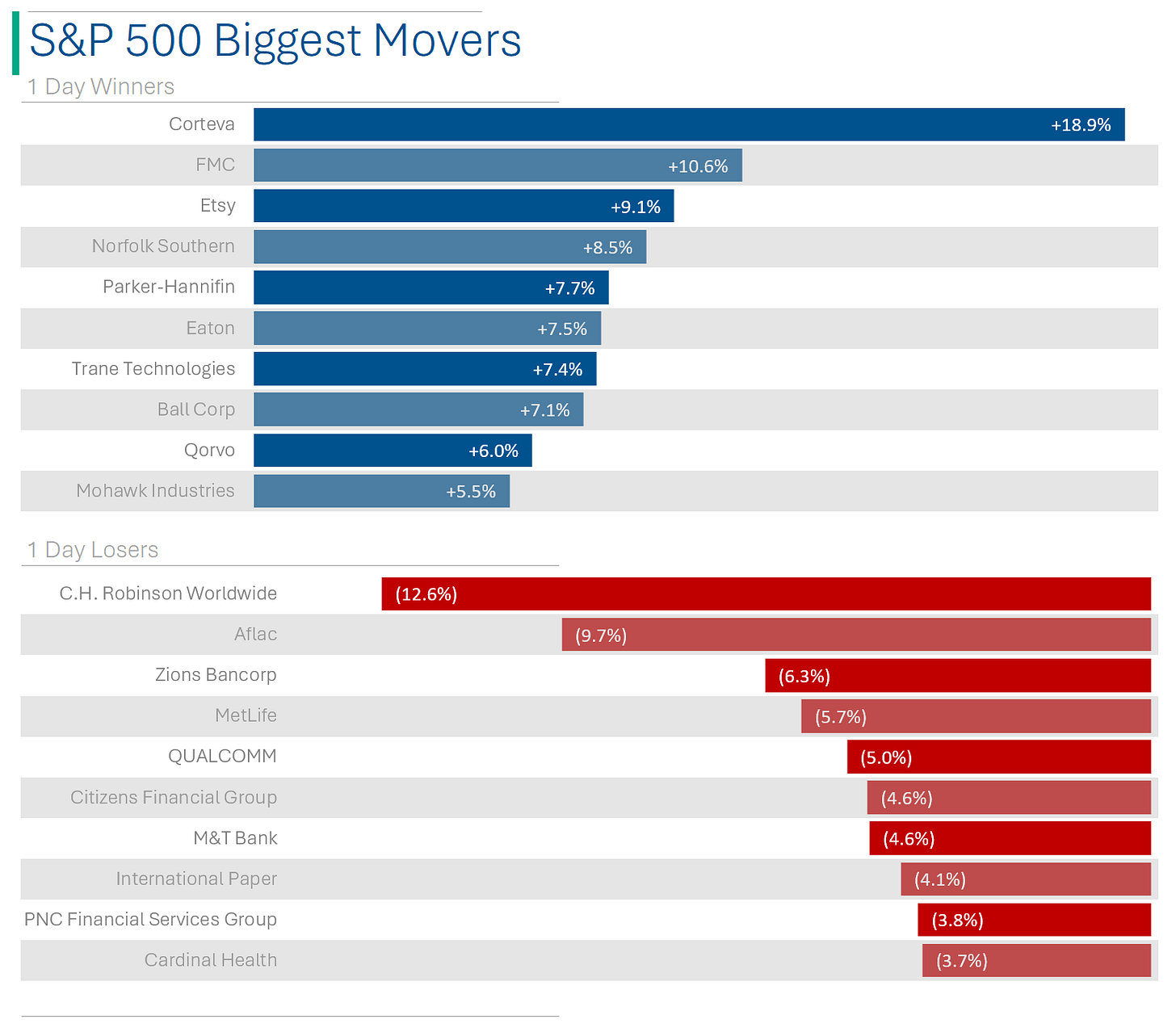

Bounce back for the big US markets after yesterday’s softness, as the S&P 500 was +1.25% and Nasdaq +1.30%.

10 of 11 sectors were in the win column, led by Consumer Discretionary and Consumer Staples (both +2.0%). Energy was the only weak link down -0.1%.

Meta had a blow-out quarter as revenue cracked $40bn for the first time, up 25% on the year. The company declared its first dividend, which will reportedly give Zuckerberg $700m a year in payouts. Stock is up 17% in afterhours trading.

Amazon and Apple also reported after close also and are +6% and -3% respectively.

Initial jobless claims came in at 224k vs. estimates for 214k as layoffs are increasingly coming up in the news as potentially worrisome.

Street Stories

Semis Are Bipolar

After Qualcomm reported after close Wednesday, all but Nvidia (February 21st) and Broadcomm (29th) of the big name chip companies have reported. And, well, it’s a bit of a dog’s dinner. Equipment maker ASML is in the top spot after stating it’s backlog grew significantly and is expecting 2025 to be a banner year once new capacity comes online. TSMC has done well too, citing that the huge inventory backlog (mostly smartphone and PC) has wound down and that they will be returning to growth. Also, talk about their new 3-nanometer chips also added to the AI hype-train.

On the other side of the wafer, Texas Instruments missed big on revenues (which were down 13% from 2022) and posted Q1 revenue guidance that was well below what the street was predicting. Intel fared even worse, slightly weak on Revenue but missing big on its outlook for Q1 (EPS: $0.13 vs. Wall Street at $0.34😕).

The results show that often in stocks, a rising tide doesn’t lift all boats if the boards are leaky. It also helps if you can talk convincingly about AI demand on your call.

Qualcomm Q1 Highlights:

Earnings Per Share: $2.75 ex-items vs Wall Street $2.37 [+16% Beat]

Revenue: $9.92 billion vs the Street at $9.51 billion [+4.3% Beat]

Q2 Guidance:

Earnings Per Share: $2.20-2.40 vs the Street at $2.25 [+2.2% at midpoint]

Revenue: $8.9-9.7 billion vs the Street at $9.28 billion [+0.2% at midpoint]

Pelton (Still) isn’t a Good Business

The pandemic superstar, Peloton, still hasn’t been able to catch its breath and, at this rate, I’m not sure it ever will. The company reported another sad quarter, as a slight beat on Revenue wasn’t nearly enough to compensate for a miss on cash flow proxy EBITDA and chopping their Q1 revenue guidance. I think the market agrees with me as the stock blew up (again), closing down 24.3% and bringing the grand total to a 97.5% decline since its pandemic high in January 2021. Very good chance this is the last time we talk about $PTON. Good grief.

Peloton Q2 ‘Highlights’

Revenue: $743.6 million vs Wall Street estimate of $733.2 million

EBITDA: ($81.7 million) vs the Street at ($78.3 million)

2024 Guidance:

Revenue: $2.675-2.750bn (cut from $2.70-2.80bn) vs. the Street at $2.74bn

Maintains adjusted EBITDA ($75.0)-($25.0M) vs the Street at ($40.3M)

EV Maker Polestar Gets Bailed Out

Geely, the Chinese automaker that owns Volvo, is set to become a new, direct shareholder in Polestar, taking over Volvo's 48% stake in the struggling Swedish EV brand that was spun out of Volvo only two years ago. This move is seen as a bailout for Polestar as Volvo has announced it will no longer fund Polestar’s loss making misadventures. The company has faced challenges in building brand recognition and sales, particularly in China, the world's largest EV market. Shares closed down 15.7% on the news, now 81.7% off its SPAC listing price in 2022.

***For anyone that wants to say ‘they’re still small and not operating at scale’, when Tesla was at that revenue level in 2014 it had 28% gross margins manufacturing in California, back when batteries priced like they were made of solid gold***

Manufacturing Index Shows Upswing

The ISM Manufacturing Index - a monthly indicator of US economic activity based on surveys from 300 leading manufacturing firms - came in at 49.1 vs. Wall Street estimates for a 47.2 print. Basically, the industrial side of the US economy looks brighter than the big brains expected.

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

Research Analyst Motto: The less you say, the less you have to retract.

If you work in a bank you can’t bring home samples.

I’ve long suspected that some of the folks at the FactSet Helpdesk are from abroad and give themselves - what they believe - are western sounding names (good ole ‘Rob McBob’ and ‘Jessica-Britney Kanye’ were classics) but today’s was the best:

Hot Headlines

CNBC | Disney’s streaming services have begun cracking down on password sharing. My cousin Ray Ray is still pissed about Netflix doing this - but it worked.

Bloomberg | Regional bank worries reemerged after NYCB shares blew up on Wednesday but Citizens Financial Group CEO says the pain is in the past. Says last year’s surge in interest rates and shift in deposits that contributed to the failure of firms including Silicon Valley Bank and Signature Bank have largely been dealt with.

Reuters | US said to back strikes on Iran targets in Iraq, Syria as Gaza truce hopes rise. Did someone order a special delivery of freedom?

SKY News | F1 legend Lewis Hamilton to leave Mercedes after 'amazing 11 years' and move to Ferrari. He also said ‘this car is a friggin brick’.

CNBC | Mark Zuckerberg says Meta will ‘keep things lean,’ going big in AI with a lid on hiring. Hard to trust the guy that changed the name of Facebook on a whim because he thought ‘the metaverse’ was the future.

Trivia

This week’s trivia is on investing 101.

If a stock has a beta of 1.5, it is generally considered:

A) Less volatile than the market

B) More volatile than the market

C) Perfectly correlated with market volatility

D) Not correlated with market movementsIn finance, what is 'leverage'?

A) Vertical integration of operations

B) Increased profitability from reducing costs

C) Using borrowed capital for investment

D) The power of a CEO'Amortization' in finance usually refers to:

A) The increase in asset value over time

B) The division of a loan into smaller, periodic payments

C) The erosion of an assets value due to inflationD) The process of gradually writing off the initial cost of an asset

(answers at bottom)

Market Movers

Winners!

Norfolk Southern (NSC) [+9.1%]: An Ancora Holdings-led group has bought a $1B stake, nominating a majority of directors and seeking CEO Alan Shaw's replacement due to missed operating targets.

Etsy (ETSY) [+9.1%]: Elliott Management's Marc Steinberg is now on the board, signaling strategic influence and potential changes ahead. ACTIVISTS!

Canada Goose (GOOS) [+8.5%]: Despite slightly lower Q3 revenue, better EBIT and in-line EPS were reported. Strong DTC sales and APAC success noted, with improved holiday performance leading to narrowed guidance.

Qorvo (QRVO) [+6.0%]: Continued its streak with another quarter of beating expectations and raising forecasts, driven by iPhone content gains, Android market stabilization, and recovery in non-smartphone segments.

Plug Power (PLUG) [+5.6%]: Marked a milestone with the first customer fill of liquid green hydrogen at its Georgia facility, a week after starting operations there, signaling progress in green energy initiatives.

Losers!

Peloton Interactive (PTON) [-24.3%]: FQ2 EBITDA fell more than expected, but revenue, gross profit, and FCF were above forecasts. FY24 EBITDA is anticipated to be negative, contrary to positive expectations, with analysts concerned about growth and Connected Fitness subscriptions.

Polestar Automotive (PSNY) [-15.7%]: Ceasing to receive funding from VOLCAR.B.SS as it transfers some Polestar shares to Geely (175.HK).

C.H. Robinson Worldwide (CHRW) [-12.6%]: Missed Q4 EPS and revenue targets amid declining demand and a tough pricing climate, indicating potential market bottoming as freight demand weakens and carrier capacity exceeds demand.

Aflac (AFL) [-9.7%]: Q4 adjusted EPS and revenue fell short, with a less promising sales outlook in Japan but a stronger forecast in the U.S. over the coming years, despite lower-than-expected variable investment income.

MetLife (MET) [-5.7%]: Beat Q4 EPS and revenue expectations but offered disappointing guidance for 2024, affected by ongoing investment income challenges and rising corporate costs, leading to a significant net income drop.

Qualcomm (QCOM) [-5.0%]: FQ1 EPS and revenue outperformed expectations, but Q2 forecasts are mixed. Downgraded by Citi due to expected share losses at Samsung, with broader concerns about structural challenges including issues with Huawei and the Chinese market.

Market Update

Trivia Answers

B) A beta of 1.5 is generally considered more volatile than the market.

C) Using borrowed capital for investment is financial leverage.

D) Amortization is the process of gradually writing off the initial cost of an asset.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.