🔬Chip Happens: The Semiconductor Reporting Wrap-up

Plus: The VIX needs some context; and much more!

"Never interrupt your enemy when he is making a mistake."

- Napoleon Bonaparte

“You don’t hear much about syphilis these days. Very much the MySpace of STDs”

- Tom (Succession)

Decent bounce back after yesterday’s rout, with the S&P 500 and Nasdaq both +1.0%.

All 11 sectors closed higher, led by Real Estate (+2.3%) and Financials (+1.5%). Tech finished +1.1% but not nearly enough to offset Monday’s -3.8%.

Notable companies:

Uber Technologies (UBER) [+10.9%]: Q2 EBITDA, revenue, FCF beat; Mobility and Delivery drove bookings; Q3 EBITDA guidance matches consensus; $400M headwind from strong USD; analysts see profitability path in grocery and retail.

Palantir Technologies (PLTR) [+10.4%]: Q2 EPS and revenue beat; US commercial revenue up 70% Y/Y; Q3 guidance ahead; FY24 guidance raised; US government revenue better than expected.

Fox Corp. (FOXA) [+6.8%]: FQ4 EPS and EBITDA beat, revenue in line; raised dividend; ad revenue better than expected; election cycle expected to boost results.

SunPower (SPWR) [-43.8%]: Declared Chapter 11 bankruptcy; entered a "stalking horse" agreement with Complete Solaria to sell assets for ~$45M cash; expects to complete the transaction by mid-September.

More below in ‘Market Movers’.

Street Stories

Chip Happens: The Semiconductor Reporting Wrap-up

Reporting season is winding down and most of the big chip companies are done releasing their earnings reports, with the notable exceptions of Nvidia and Analog Devices with their wacky January and October fiscal year ends.

Since so much of market sentiment has been tied to the sector, I thought it made sense to do a quick overview of how things are trending.

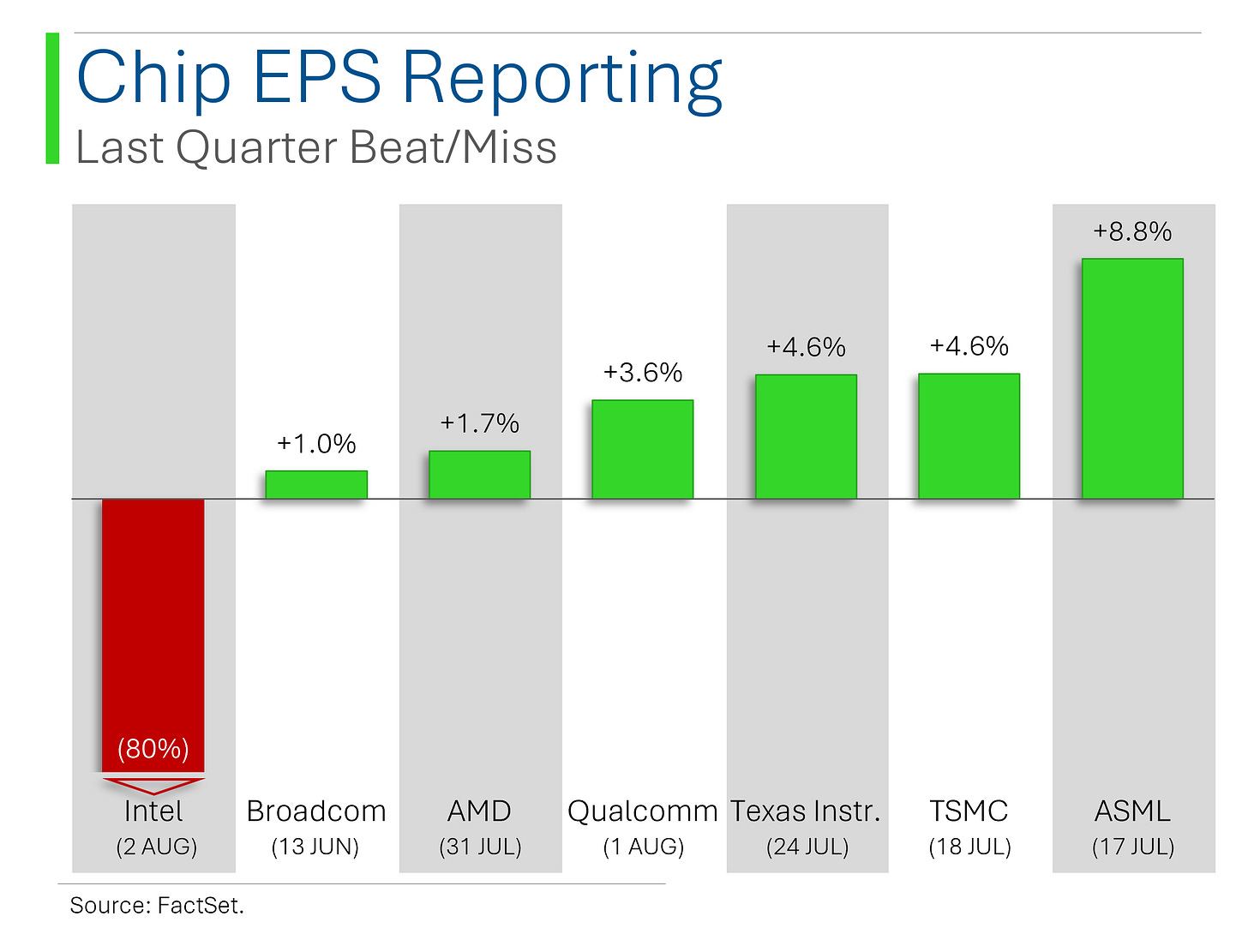

Off the bat, things have been generally positive with most of the big chip players beating Wall Street estimates for their quarter revenue. The exceptions here are the s****y companies legacy players Intel and Texas Instruments which appear to be struggling.

On the earnings front, the picture is much the same. Except that TI - through some novel cost cutting and efficiency actually posted a handy Q2 beat on Earnings Per Share.

This is also where I’d like to transition from calling Intel ‘struggling’ and instead use the word ‘dumpster fire’. Ya, it hasn’t been a pretty coupla years here…

(I did a pretty sweet Intel deep-dive back in May. Check it out!)

Compared to recent quarters, the growth trends appear pretty strong also.

Revenue growth for the quality companies (read as: not Texas Instruments or Intel) averaged +18% for the quarter compared to last year.

The only ‘weak link’ was equipment maker ASML, which I don’t think we need to worry about (sales can be lumpy with big ticket equipment; there was a bit of a demand shock from Chinese sanctions; and they literally have a monopoly).

(My pal Daan Rijnberk did a great write-up on ASML if you want to learn more about the company)

Earnings-wise, things are pretty much the same. The quality companies are still showing positive growth and Intel investors are asking their family doctors if ACE inhibitors are right for them.

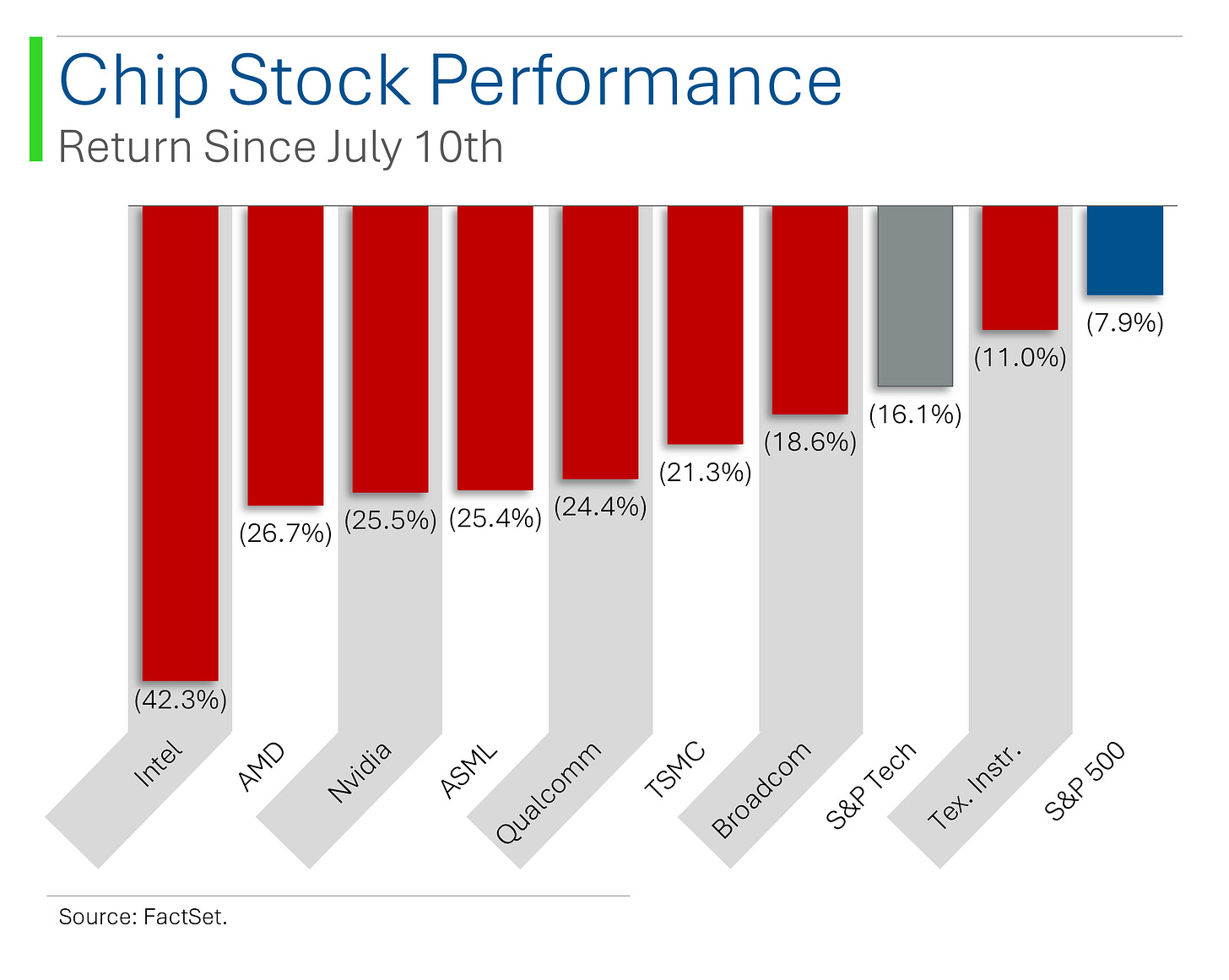

Despite the continued strength, the chip stocks have really been taking it on the chin throughout this recent sell-off, with the average company now down 24%.

This definitely might present some good buying opportunities but it is worth noting that none of these stocks (ok, maybe Qualcomm) are actually what you would call ‘cheap’.

Lastly, the obvious missing piece to all of this is Nvidia, which has been the poster child of the chip/AI bull market.

They won’t report their Q2 until around August 23rd (est.) but while their shares are now down more than 25% from their July peak, Wall Street hasn’t soured on the story as estimates for their upcoming fiscal years continue to be revised upwards.

So ya, despite the big sell-off, things seem to be solid in chip land. I mean, they can still obviously get a lot worse tho…🙃

Volatility Gone Viral: The VIX Without Context

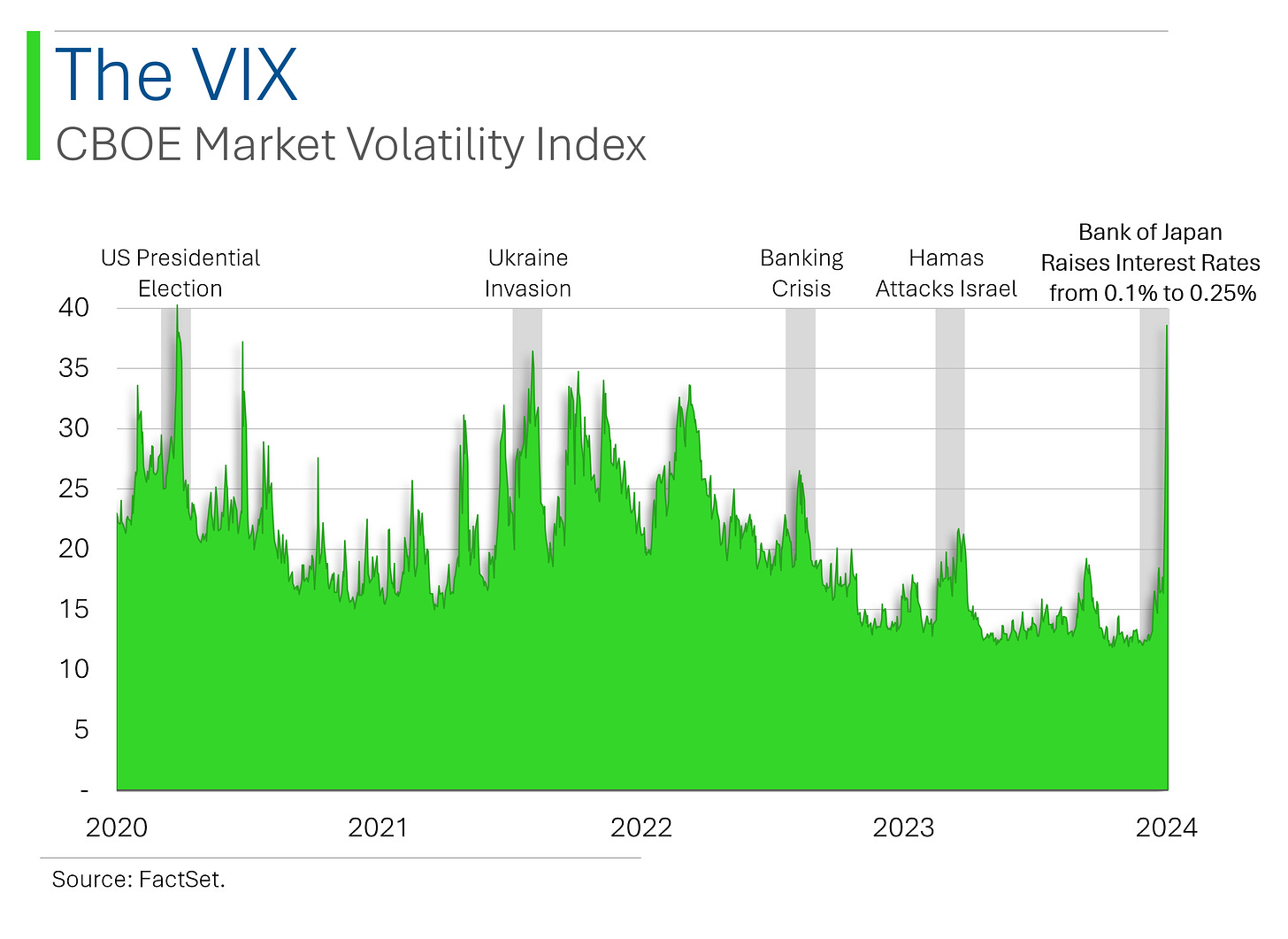

So much has been made about Monday’s Japan induced sell-off triggering a comically large jump in the CBOE’s Market Volatility Index (aka ‘The VIX’) that I thought I’d try to add a bit of context to the situation.

My main point is that it was stupid.

There was a lot of tension built into the market: US economic data has been looking pretty f*****; the only stuff crushing it this year (Tech mostly) has been in free fall; and yeah, sure, the unwinding of the Yen Carry Trade is important. That said, sometimes there are just more people in a hurry to sell than there are people in a hurry to buy.

No one wants to catch a falling knife. And frankly, having spent the better part of a decade at a large asset manager, I can say that the non-algo part of the buy-side actually moves pretty slow.

But if you looked at the intraday VIX on Monday, you might have assumed that the sky was falling. Or that the most significant market events this millennium were the Great Financial Crisis (2008), the Covid Pandemic (2020) and the Bank of Japan raising it’s main policy rate from +0.1% to +0.25%.

I love the stock market but goddamn if it doesn’t do some stupid stuff now and then.

Joke Of The Day

Interviewer: What are your thoughts about nepotism in a workplace environment?

Candidate: Well, that’s a really good question, Dad

Hot Headlines

Axios / Elon Musk’s X sues major brands and Ad industry group over antitrust claims. Suit includes CVS Health, Mars, Orsted and Unilever over allegations that their discrimination against X led to a general industry boycott. Yes, this is the third day in a row for new Elon Musk related lawsuits. He’s basically the new Big Tobacco from a billable hours perspective.

CNBC / Disney raises streaming prices for Hulu, Disney+ and ESPN+. As of mid-October, most plans will be rising by $1 to $2 a month. Tough choice whether to cancel my sub with all their great new content lately…

CNBC / Microsoft fires back at Delta after massive outage, says airline declined ‘repeated’ offers for help. They look like such clowns rn.

The Block / BlackRock and Nasdaq make the push for options on spot Ethereum ETF. In a filing posted Tuesday to the U.S. Securities and Exchange Commission's site, BlackRock and Nasdaq proposed a rule change to list and trade options on the iShares Ethereum Trust.

Bloomberg / JPMorgan says Carry Trade unraveling is only half complete. The +11% appreciation of the Yen is driving formerly profitable trades into the red but JPM says it’s only 50-60% unwound.

Trivia

Today’s trivia is on Walmart (cuz I’m sick of talking about Tech, Yen, AI and chips).

When was Walmart founded?

A) 1945

B) 1950

C) 1962

D) 1970

Where was the first Walmart store opened?

A) Dallas, Texas

B) Rogers, Arkansas

C) Wellington, Kentucky

D) Woodstock, West Virginia

What was the original name of Walmart?

A) Walton's 5&10

B) Walton's Market

C) Walton's Discount City

D) Sam's Wholesale Club

How many Walmart stores are there worldwide as of 2023?

A) About 5,000

B) About 8,000

C) About 10,000

D) About 11,000

(answers at bottom)

Market Movers

Winners!

Lumen Technologies (LUMN) [+93.1%]: Announced securing ~$5B in new business driven by AI connectivity demand; discussing another ~$7B in opportunities; upgraded to neutral from sell at Citi.

Kenvue (KVUE) [+14.7%]: Q2 earnings and revenue beat; slight declines in Skin Health/Beauty and Self Care offset by Essential Health growth; reaffirmed FY EPS and revenue guidance; analysts positive on volumes.

Yum China Holdings (YUMC) [+12.0%]: Q2 EPS beat but revenue light; larger comp decline for KFC and Pizza Hut, though margins improved; FY24 guidance unchanged; analysts positive on cost-cutting margins.

Uber Technologies (UBER) [+10.9%]: Q2 EBITDA, revenue, FCF beat; Mobility and Delivery drove bookings; Q3 EBITDA guidance matches consensus; $400M headwind from strong USD; analysts see profitability path in grocery and retail.

Palantir Technologies (PLTR) [+10.4%]: Q2 EPS and revenue beat; US commercial revenue up 70% Y/Y; Q3 guidance ahead; FY24 guidance raised; US government revenue better than expected.

Biomarin Pharmaceutical (BMRN) [+8.0%]: Q2 results ahead; raised FY guidance; positive on Voxzogo supply constraints relief; aiming for Roctavian profitability by YE25; early September Investor Day expected positive.

Fox Corp. (FOXA) [+6.8%]: FQ4 EPS and EBITDA beat, revenue in line; raised dividend; ad revenue better than expected; election cycle and Super Bowl expected to boost results.

Baxter International (BAX) [+6.6%]: Q2 earnings and revenue beat; strong Healthcare Systems and Pharma demand; Q3 guidance ahead; raised FY guidance; exploring Kidney Care separation.

Planet Fitness (PLNT) [+6.1%]: Q2 EPS, EBITDA, revenue beat, though comps light; reaffirmed FY24 guidance; analysts highlight member growth despite churn.

Zoetis (ZTS) [+6.0%]: Q2 beat and raised FY guidance; strong performance in companion animal franchises.

Molson Coors Beverage (TAP) [+5.4%]: Q2 EPS and revenue beat; FY24 guidance reaffirmed; driven by favorable pricing and shipment timing; strong demand in Europe and Asia.

Caterpillar (CAT) [+3.0%]: Q2 earnings beat but revenue light; lower sales volumes offset by price; declining dealer inventories expected in H2; slight cut to FY guidance but outlook still positive.

Losers!

SunPower (SPWR) [-43.8%]: Declared Chapter 11 bankruptcy; entered a "stalking horse" agreement with Complete Solaria to sell assets for ~$45M cash; expects to complete the transaction by mid-September.

Chegg (CHGG) [-22.2%]: Q2 EBITDA, net income, and revenue beat; subscribers, GM, and EBITDA margin ahead; Q3 EBITDA, revenue guidance below expectations; management sees flat enrollment through 2029 and restructuring targets by 2024.

ZoomInfo Technologies (ZI) [-18.3%]: Q2 results missed due to larger-than-expected write-offs from SMB headwinds; lowered FY guidance and announced CFO transition; multiple downgrades.

Atkore (ATKR) [-14.7%]: FQ3 earnings miss with weak revenue and margins; limited demand increase from construction season; soft pricing across Electrical business; margins affected by ASP declines and higher freight costs; FY24 guidance below expectations.

Teradata (TDC) [-14.1%]: Q2 results and Cloud ARR missed; lowered FY outlook, delayed $1B Cloud ARR target to 2026; flagged longer sales cycles due to budget scrutiny; announced restructuring; downgraded at JMP.

Henry Schein (HSIC) [-8.1%]: Q2 earnings in line but revenue missed; lower PPE sales and slower cyber recovery noted; cut FY EPS and revenue guidance; announced restructuring plan and $500M buyback.

Topbuild (BLD) [-7.1%]: Q2 EPS and revenue missed; lowered FY24 guidance; cited lower volume due to higher interest rates, project delays, and supply constraints affecting residential and commercial markets.

Vulcan Materials (VMC) [-4.4%]: Q2 earnings and revenue light; Aggregates in line, Asphalt and Concrete segments weak; negative weather impacts flagged; cut FY adjusted EBITDA guidance but sees improvement in Aggregates profitability.

Owens Corning (OC) [-4.1%]: Q2 revenue light with Roofing and Insulation below expectations; EBITDA and EPS ahead due to better margins; guided legacy business in line with last year for Q3; NA building markets remain healthy.

Market Update

Trivia Answers

C) Walmart was founded in 1962.

B) The first Walmart opened in Rogers, Arkansas.

C) Walton's Discount City was the original name of Walmart.

D) There are currently about 11,000 Walmart stores.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.