🔬Chinese Stocks Stop Sucking After $7 trillion in Losses

I get into the efforts the Chinese Government is taking to shore up its capital markets; have a brief moment of nostalgia over BlackBerry's plight; and check out the Suez and China chip situation.

"In the short run, the market is a voting machine, but in the long run, it is a weighing machine"

- Benjamin Graham

“If you lend someone $20 and never see that person again, it was probably worth it”

- Author Unknown

Half decent day for the big US markets with the S&P 500 +0.23% and Nasdaq +0.07%.

9 of 11 sectors closed in the green, with Materials bouncing back to finish tops (+1.7%), while Tech gave back some of its recent gains (-0.5%).

Way too many earnings releases, with Palantir the hero of the day (+30.8%) after a decent beat but the Street loved the big AI momentum. Spotify popped +4% after a record increase in users.

New York Community Bancorp plunged another 22.2% today, despite regional bank worries starting to ease.

Street Stories

Shanghai Shuffle: Chinese Stocks Rebound After Xi's Market Makeover

Chinese stocks had a field day on Tuesday, with the Shanghai Composite Index strutting up by +3.2%, while the CSI 1000 Index, perhaps feeling left out, skyrocketed by ~7%, marking its grandest day ever. This surge came as a welcome reprieve after Chinese markets had shed nearly $7T in value since their 2021 zenith. The rally kicked off with a promise from Central Huijin Investment, a Chinese sovereign fund with a penchant for state-run banks and other hefty SOEs, to beef up its ETF shopping spree.

Adding to the excitement, regulators hinted at a powwow with President Xi and company to chat about market vibes and the latest "support". Too early to tell if this, plus the short selling ban will be enough to pull Chinese stocks out of their slump after recent policy tweaks have been more of a tease than the market-shaking "bazooka" moves investors are daydreaming of. Just last week, the Shanghai Composite took a more than 6% nosedive, as skepticism over stimulus efforts dampened spirits.

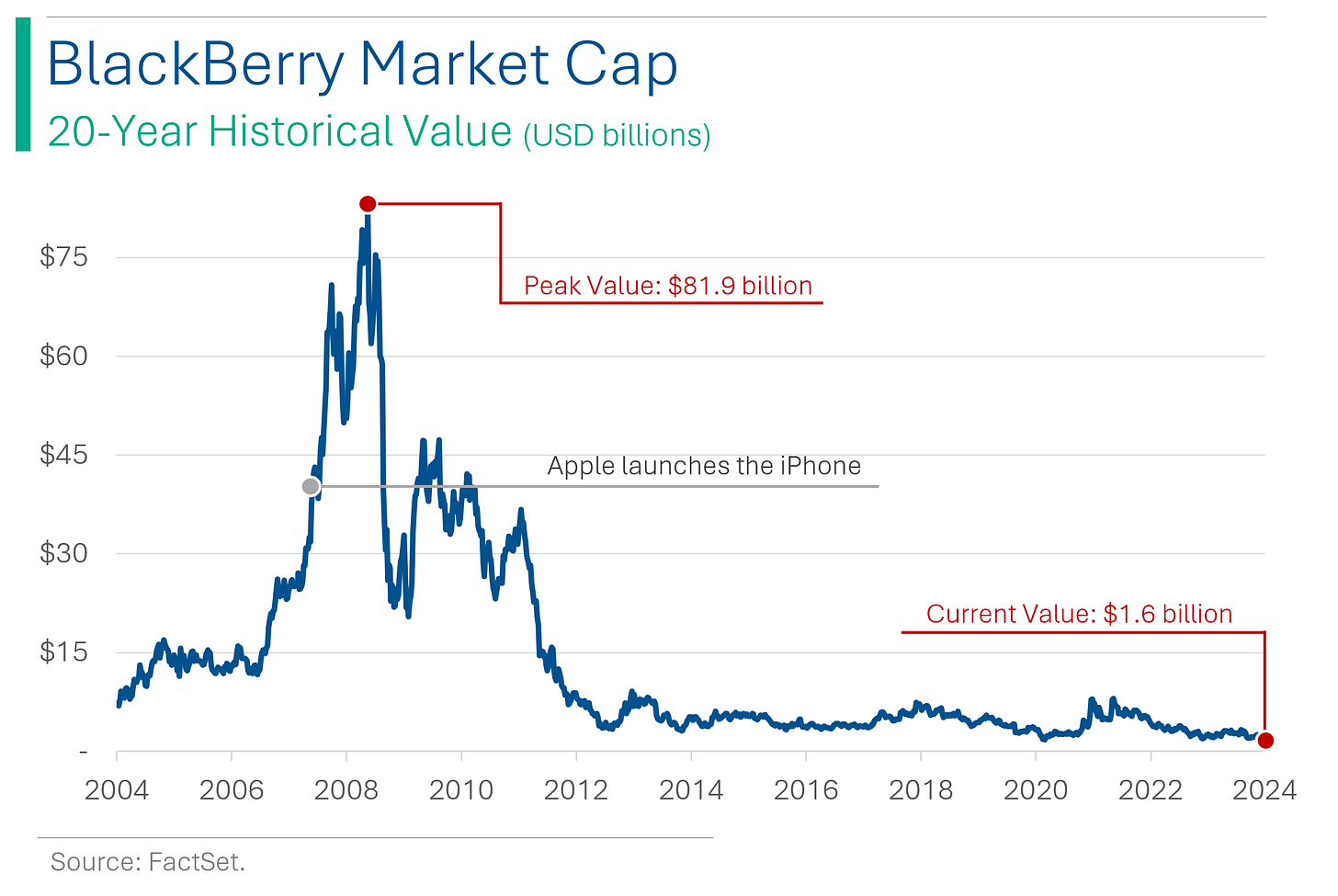

Remember BlackBerry? The Short-Sellers Do

In the ongoing story of ‘why can’t Canada have nice things’ (see: Nortel, Valeant, etc.), BlackBerry hit a fresh all-time low. While no longer a (failed) handset maker, the now (semi-failed) cybersecurity and automotive software company is just scraping by: Q4 report comes out in April with the Street targeting just $25 million of EBITDA on $821 million of Revs.

It sucks is unfortunate to see such a great company collapse. My happiest times while in investment banking were hiding in the washroom playing Brick Breaker. Goodnight sweet prince.

#brickbreakmyheart

Nerd Talk Is Fatuous

Yes, if you’ve been following this newsletter you might have guessed that fatuous was my word of the day. We’re getting smarter together. Anywhoo, lot of talk yesterday about ‘rate stabilization’ as the story of the day after the HUGE back-up in rates (+30bps in the U.S. 10-Year over the previous 2 days). According to the nerds, interest rates pushing higher is a function of hotter January employment (Friday’s strong Non-Farm payrolls) and ISM Services PMI (survey of business conditions for non-manufacturing companies), plus a Fed meeting where J.Pow pushed back hard against a March rate cut.

If you work in Rates or FX this stuff matters, but I wanted to highlight it because, for the rest of us, getting too far into the weeds and letting it impact our investment decisions is silly. Having an economic outlook is important, but too much market noise is counter productive.

Supply Chains Back-up as Suez Traffic Down 40%

Something that surprised yesterday was McDonald’s calling out the Houthi idiot situation as being responsible for part of their earnings miss. Really? With 10% of the world’s shipping moving through the canal, an increasing number of companies, from Whirlpool to Tesla, have cited ongoing or imminent supply chain crunches due to the Houthi attacks on global shipping, with the potential inflationary effects expected to play out over several months.

China's Chip Chess: SMIC's Sneaky Sidestep in the Semiconductor Saga

Following US and international sanctions aimed at curbing China’s next-gen chip ambitions, China's Semiconductor Manufacturing International Corp. (SMIC) is advancing its technological capabilities by preparing to mass-produce 5 nanometer-class processors (close to the top of the line 3-nm ones by TSMC and Samsung). This leap forward is achieved without the extreme ultraviolet (EUV) lithography tools from ASML, which SMIC has been barred from acquiring due to restrictions led by Western powers. Instead, the company is ingeniously leveraging "stockpiled" (aka illicitly acquired or modified) deep ultraviolet (DUV) lithography tools to sustain its ambitious advancements.

The move is in tandem with Huawei’s HiSilicon initiative to maintain competitive edges in AI and smartphone technologies amidst global trade tensions. The move reflects a broader narrative of China's strategic navigation through the intricate web of international sanctions, underscoring its determination to foster technological independence and prowess despite external pressures. And let’s be honest, we knew they weren’t gunna sit back and take it.

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

Kid 1: “What kind of work does your Daddy do?”

Kid 2: “My Daddy’s a teacher. What does your Daddy do?”

Kid 1: “He’s a stockbroker.”

Kid 2: “Honest?”

Kid 1: “No, just the regular kind.”

Hot Headlines

Fox Business | Ousted WeWork CEO Adam Neumann trying to buy company back. After four years away, the world’s least likeable human is trying to buy it back given it’s now worth a 1/30th of his severance cheque. Class.

CNBC | Snap Chat plunges 30% on revenue miss and light guidance, as company says Middle East war creates ‘headwind’. I don’t think its the war, bra.

CNBC | ESPN, Fox and Warner Bros. Discovery to launch joint sports streaming platform this year. Disney finally found a solution to its ESPN problem.

Reuters | US SEC adopts Treasury market dealer rule as market overhaul continues. SEC added rules requiring proprietary traders and other firms that routinely deal in government bonds and other securities to register as broker-dealers, subjecting them to stricter oversight. And less fun.

Yahoo | Venezuela bets US won’t renew oil sanctions after it backslides on promised free election deal. Maybe the US is too busy rn, or maybe it’s the wrong time to try and call their bluff. Tbd.

What Ryan’s Reading

I started reading Purity Macro’s newsletter. It’s a nice, concise update on economic and investing news from a former Head of FX at one of the big banks.

Trivia

This week’s trivia is on Investing 101.

An inverted yield curve often signals:

A) A healthy economy

B) A potential recession

C) Rising inflation

D) Decreased lendingThe 'time value of money' implies that:

A) A dollar today is worth more than a dollar in the future

B) Money grows over time due to interest rates/investment returns

C) Time is money

D) Money is timelessWhat is the lowest S&P rating a bond can have before it’s consider non-investment grade AKA a junk bond?

A) D

B) BBB

C) BBB-

D CCC

(answers at bottom)

Market Movers

Winners!

Palantir Technologies (PLTR) [+30.8%]: Q4 EPS met expectations, revenue exceeded; Q1 and FY24 revenue forecasts optimistic. AI platform and FCF growth noted, with expected government sector acceleration.

GE Healthcare Technologies (GEHC) [+11.7%]: Q4 earnings beat with tax aid; FY EPS guidance optimistic. Strength in Imaging noted despite weaker Ultrasound.

Hertz Global (HTZ) [+8.9%]: Q4 EBITDA missed, revenue slightly better than expected. Management cited robust demand across sectors.

DuPont de Nemours (DD) [+7.4%]: Q4 EPS at guidance's high end; revenue and EBITDA matched forecasts. $1B buyback and dividend increase announced; FY24 guidance slightly cautious.

BP (BP) [+6.3%]: Q4 net income above expectations, $1.75B buyback started. Natural gas trading buoyed results; Q1 upstream activity expected to increase.

KKR (KKR) [+5.8%]: Q4 earnings and FRE surpassed estimates, driven by transaction fees. Positive outlook on fees, deployment, and management.

Spotify Technology (SPOT) [+3.9%]: Q4 EPS aligned, revenue slightly under forecasts. MAUs exceeded expectations; improved profitability in music/podcasts noted.

Losers!

Symbotic (SYM) [-23.6%]: FQ1 EPS missed, revenue matched expectations, EBITDA slightly above. Q2 revenue guidance optimistic, but EBITDA forecast disappoints due to margin pressures and slower system implementations.

New York Community Bancorp (NYCB) [-22.2%]: Dividend cut and reserve build reported by Bloomberg after OCC pressure; FT noted CRO Nicholas Munson's early 2024 departure.

Fabrinet (FN) [-18.4%]: Q2 EPS and revenue exceeded forecasts; Q3 guidance ahead but not up to Street's high hopes, with concerns over AI growth moderation.

FMC Corp (FMC) [-11.5%]: Q4 EBITDA missed, Q1 outlook and FY24 guidance lowered due to a 25% volume drop. Market destocking continues, overshadowing last week's optimism from CTVA.

Market Update

Trivia Answers

B) An inverted yield curve often signals a recession.

A) The time value of money implies that a dollar today is worth more than a dollar in the future.

C) BBB- is the lowest tier of investment grade by S&P. It is the equivalent of Baa3 in the Moody’s system.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.