🔬China's Mega Stimulus

Plus: India wants to be a chip player, Southwest throws kitchen sink; and much more!

“Generally, the greater the stigma or revulsion, the better the bargain.”

- Seth Klarman

“A good rule to remember for life is that when it comes to plastic surgery and sushi, never be attracted by a bargain.”

- Graham Norton

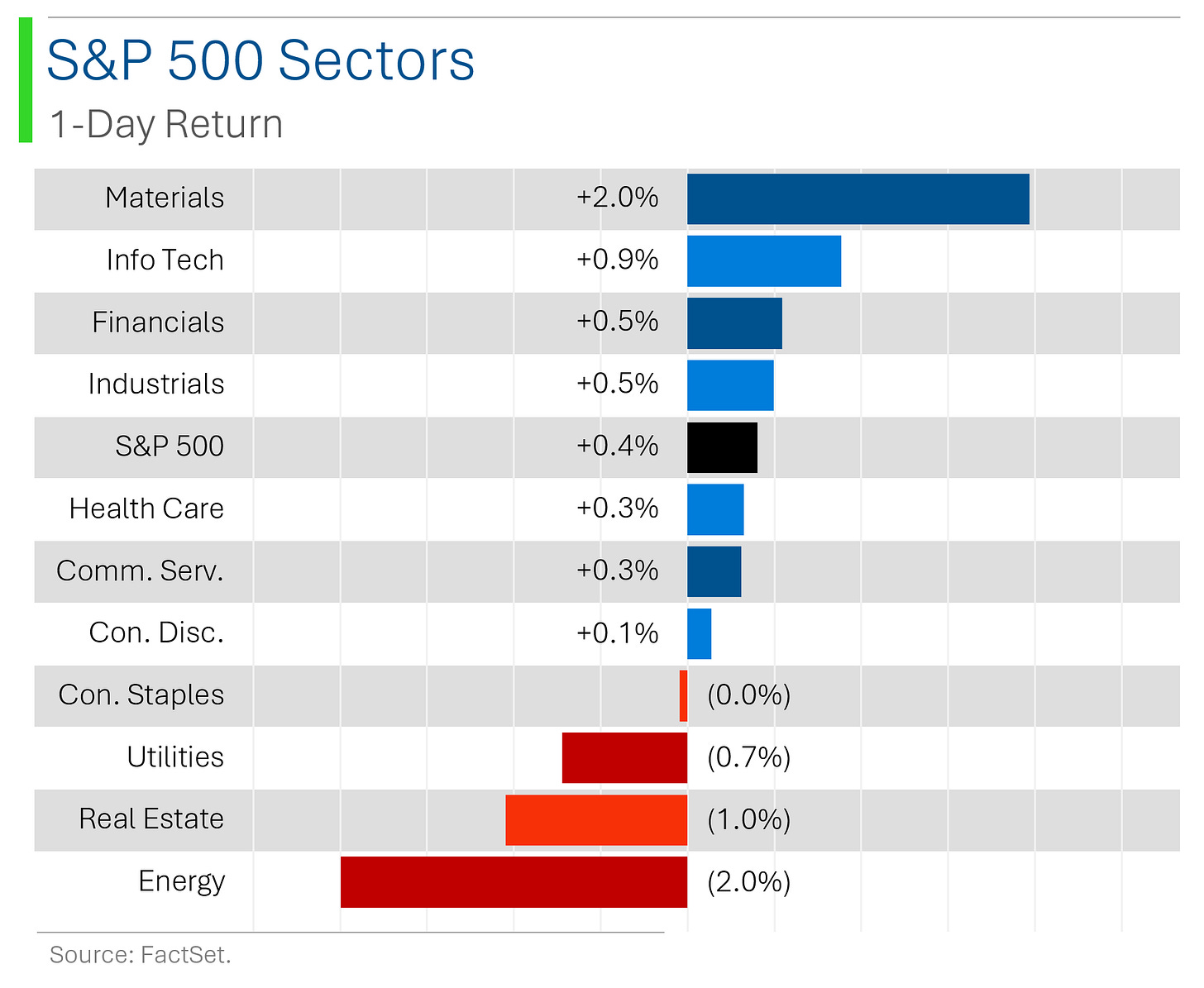

US Equities Rally: Stocks rebounded Thursday, with the S&P 500 hitting another all-time high and the Nasdaq posting its fourth straight gain. Outperformers included semiconductor companies, small caps, airlines, and banks, while energy, managed care, and cybersecurity lagged.

Economic Data and Market Reaction: Strong economic data, including better-than-expected durable goods orders and lower-than-expected initial jobless claims, supported the soft-landing narrative. Treasuries weakened, but the dollar fell, while oil prices dropped 2.9% on Saudi headlines and copper rose on China stimulus news.

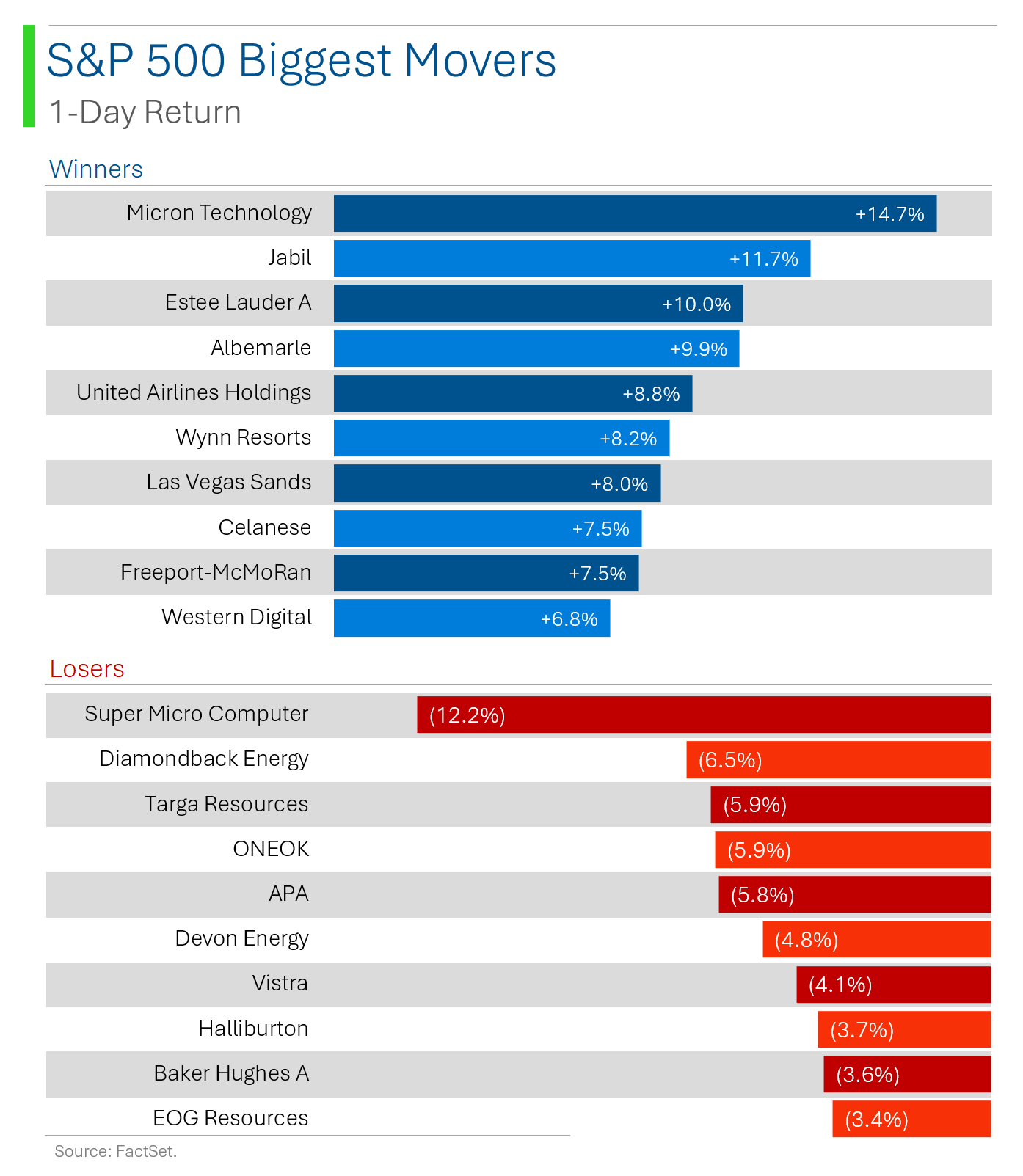

Corporate Updates: Micron Technology surged on strong Q4 results and guidance, citing strong AI-related demand, while Accenture saw solid bookings and raised guidance. Meanwhile, Wells Fargo submitted a review to lift its asset cap, Super Micro Computer faced a DOJ probe, and Southwest Airlines gained on strategy updates and buybacks.

Notable companies:

Micron Technology (MU) [+14.7%] flagged strong datacenter demand, AI-driven tailwinds, and DRAM pricing as standouts, despite some concerns about PC and smartphone softness.

Super Micro Computer (SMCI) [-12.8%] is reportedly under DOJ investigation for alleged accounting violations, adding to existing SEC charges and Hindenburg Research’s August short report.

Southwest Airlines (LUV) [+5.4%] unveiled its Investor Day strategy with big EBIT targets, a $2.5B buyback, and mixed guidance for 2H.

More below in ‘Market Movers’.

Street Stories

China's Economy: Now with 2 Trillion More Reasons to Care

China’s top brass is pulling out the big guns to revive the economy, promising to boost fiscal spending and stop the real estate market from nosediving, signaling a stronger commitment to hit the country's annual economic goals.

The Politburo vowed to stop the real estate market's decline and limit new-home construction to address oversupply - you know, since building ghost cities wasn’t working out. Reports suggest the government will issue 2 trillion yuan ($284 billion) in special sovereign bonds to boost consumption and help local governments manage debt.

This stimulus effort, combined with recent rate cuts, lifted China's stock market which is desperately in need of some good news. Economists see this as a significant shift from the government's previous piecemeal approach, reflecting heightened urgency to tackle the economic slowdown.

Silicon Samosa: India's Chip Revolution is Heating Up

India aims to boost its electronics sector from $155 billion to $500 billion by 2030, but it can’t go it alone; Taiwan holds 44% of the global semiconductor market, and partnerships like Tata Electronics’ deal with Powerchip Semiconductor are essential to India’s progress.

Furthermore, the U.S. is also stepping in with Micron set to produce India’s first chips by 2025.

Beyond financial incentives, India sees this as a strategically vital area, with national security concerns in the increasingly fractious Indo-Pacific political environment.

*cough* China *cough*

However, India trails China, which controls 28% of the market.

China’s infrastructure and established supply chain give it a clear edge, but India’s low labor costs and expanding infrastructure could help it catch up, but collaboration - particularly with the West - is critical.

Imagine your country’s labor being referred to as ‘low-cost’ in comparison to China. Ooof.

Southwest’s “Revolutionary” Plan: Now with Assigned Seating!

Southwest Airlines just unveiled a three-year “revitalization” plan, which includes fancy new premium seats, red-eye flights, and - wait for it - assigned seating by 2026, like every other airline in existence (finally).

This bold move comes as activist investor Elliott Management, holding a 10% stake, demands leadership changes, blaming CEO Bob Jordan for not turning things around faster - guess he thought he had more legroom to maneuver.

I mean, they do have a point…

CEO Jordan fired back, claiming his plan is "transformational," but Elliott isn't buying it and is pushing for a shareholder vote to bring in a new cast of characters to the board.

Still, the plan was enough to pop Southwest’s shares +5.4% so at least somebody liked it.

Joke Of The Day

Why is Google Chrome like a submarine? They tend to get a little slow if you open too many windows.

Hot Headlines

CNBC / Eric Adams indictment unsealed as New York mayor charged in campaign contribution scheme. The indictment alleges he accepted over $100,000 in illegal donations and luxury travel from Turkish businessmen, stretching back to his time as Brooklyn borough president. Douche.

CNBC / Misinformation running rampant on Facebook has officials concerned about election disruptions. Election officers from multiple states report issues with Meta's diminished focus on political content and reductions in trust and safety teams. In fact, the rise of misleading posts, coupled with Meta's layoffs and deprioritization of news, leaves state and regional officials scrambling to maintain election integrity. If that’s the case, it really leaves me wondering why some of our family friendly financial content gets rejected from their ad-center…

WIRED / Millions of cars may be hacked due to website bug. Security researches have added Kia to the long list of exploitable car companies as they found a vulnerability on their web portal which could potentially be used to hack certain function like starting the engine or unlocking the doors. Imagine ppl that can do that level of nerd stuff out there stealing Kia’s.

Bloomberg / Citi and Apollo join forces in ginormous $25 billion private credit push. The partnership will target non-investment grade lending, initially focusing on North America. This move marks a shift in strategy as banks like Citigroup look to maintain fee streams without tying up their balance sheets, while private credit managers seek new investment sources. Usury is a sin…especially this late in the credit cycle.

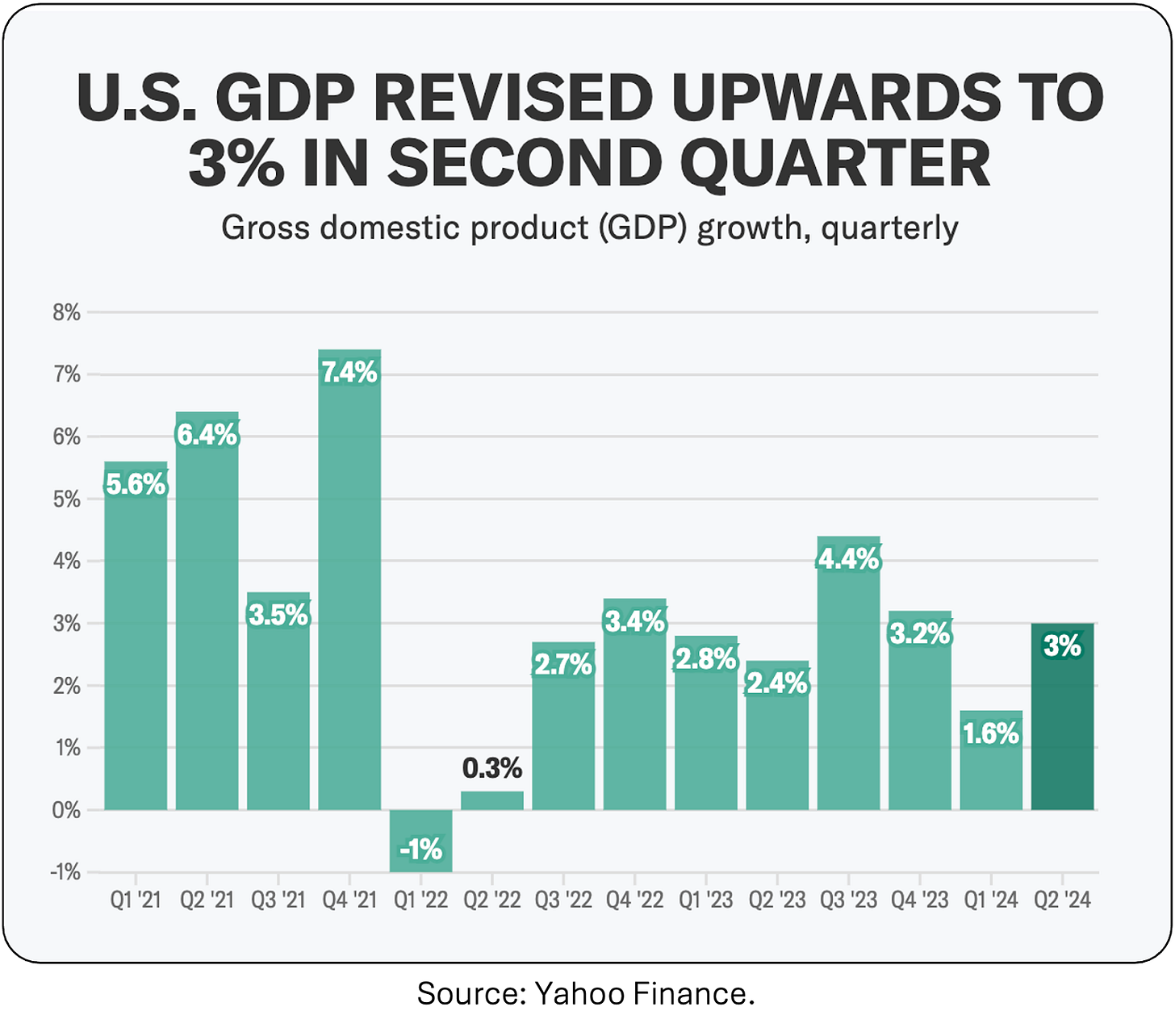

Yahoo Finance / US economy grows GDP at 3% annualized pace in second quarter. The steady economic performance reinforces confidence that the economy will continue expanding at a solid pace, especially with inflation coming down and unemployment claims remaining low at 218k for the week ending Sept. 21.

Trivia

Today's trivia is all about the business side of the NFL - time to see how well you know the numbers behind the game!

Which NFL team was the first to be valued at over $5 billion by Forbes?

A) Dallas Cowboys

B) New England Patriots

C) New York Giants

D) Los Angeles RamsWhat year did the NFL sign its largest TV deal to date, worth over $110 billion?

A) 2018

B) 2021

C) 2020

D) 2019Which of the following teams was the first to sell a stadium naming rights deal for over $400 million?

A) Las Vegas Raiders

B) San Francisco 49ers

C) Los Angeles Rams

D) Chicago BearsWhich player signed the most lucrative NFL contract extension in history as of 2023, valued at over $500 million?

A) Patrick Mahomes

B) Dak Prescott

C) Joe Burrow

D) Lamar JacksonWhich city hosted the most Super Bowls as of 2023, boosting its local economy through tourism and media exposure?

A) Miami

B) Los Angeles

C) New Orleans

D) Houston

(answers at bottom)

Market Movers

Winners!

Micron Technology (MU) [+14.7%] flagged strong datacenter demand, AI-driven tailwinds, and DRAM pricing as standouts, despite some concerns about PC and smartphone softness.

Jabil (JBL) [+11.7%] reported a Q4 beat, solid FY guidance, and announced a $1B share buyback, with optimism around datacenter, electric vehicles, and semiconductors.

New York Community Bancorp (NYCB) [+7.1%] got an upgrade to overweight from Barclays thanks to solid footing, new management, and raised capital.

Accenture (ACN) [+5.6%] had a solid earnings beat with growth in Consulting and Managed Services, raised guidance, and boosted both dividend and buyback.

Southwest Airlines (LUV) [+5.4%] unveiled its Investor Day strategy with big EBIT targets, a $2.5B buyback, and mixed guidance for 2H.

Wells Fargo (WFC) [+5.2%] submitted a third-party review to the Fed aiming to lift its asset cap, though the cap could extend into 2025.

CarMax (KMX) [+5%] posted decent Q2 earnings with solid retail sales but weaker wholesale sales and financing, though they’re optimistic about H2 trends.

Aramark (ARMK) [+2.9%] could be in play for an acquisition by Sodexo, according to Bloomberg.

Starbucks (SBUX) [+1.9%] got upgraded to outperform, with Bernstein seeing balanced growth under the new CEO.

NRG Energy (NRG) [+1.5%] raised its FY24 guidance, attributing it to a strong integrated platform and top-notch execution.

Losers!

Concentrix (CNXC) [-19%] missed on Q3 earnings, cut FY24 revenue guidance, and flagged lower client volumes and a bigger shift to lower-cost geographies.

Super Micro Computer (SMCI) [-12.8%] is reportedly under DOJ investigation for alleged accounting violations, adding to existing SEC charges and Hindenburg Research’s August short report.

Sonos (SONO) [-4.5%] was downgraded to underweight, with Morgan Stanley citing a consumer backlash from its May app redesign, hurting brand favorability.

Market Update

Trivia Answers

A) Dallas Cowboys – The Cowboys were the first NFL team valued at over $5 billion, solidifying their place as America's most valuable sports franchise.

B) 2021 – In 2021, the NFL signed its biggest broadcast deal, valued at over $110 billion across multiple networks.

C) Los Angeles Rams – SoFi Stadium secured a $625 million naming rights deal, making it the largest in sports history.

A) Patrick Mahomes – Mahomes inked a $503 million extension with the Kansas City Chiefs, making it the biggest contract in sports history at the time.

A) Miami – Miami has hosted the Super Bowl 11 times, more than any other city, driving significant tourism and revenue.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Always a comprehensive read! I asked my husband about the 5 NFL questions as he is more the NFL/sports guy than me :-) He only got the last question wrong, to my amazement!🫢