🔬Cheap Stocks vs. Expensive Stocks

Plus: ECB/BOE cuts on the horizon; US mortgage rates moderate slightly; and much more

"The way of the successful investor is normally to do nothing – not to buy and sell all the time."

- Jim Rogers

"Your margin is my opportunity."

- Jeff Bezos

Modest day in the green for the big US markets (S&P 500 +0.5%, Nasdaq +0.3%). The Dow is on a six day winning streak.

10 of 11 sectors closed higher. Lame sectors Real Estate (+2.3%) and Utilities (+1.5%) were in the lead, while cool sector Tech (-0.3%) was the sole one in the red.

Initial jobless claims printed at 231K well ahead of consensus for 213K.

Notables:

Airbnb (ABNB) [-6.9%]: Q1 gross bookings and revenue beat, EBITDA surpassed by nearly $100m; Q2 room nights expected stable versus anticipated double-digit growth.

Arm Holdings (ARM) [-2.3%]: Fiscal Q4 results better, driven by strong Licensing. FY25 revenue growth guidance set at 22%, slightly missing Street expectations amid high valuation.

Duolingo (DUOL) [-18%]: Q1 earnings and revenue exceeded forecasts, with paid subscribers and total bookings above consensus but analyst didn’t like drop in daily active users.

Full list below in ‘Market Movers’

Street Stories

Cheap Stocks vs. Expensive Stocks

Two categories of investors have been facing off for decades over their favored style: Value vs. Growth.

Value Investing - as laid out by Benjamin Graham - doesn’t really exist anymore. Most of the cigar butts to be found have been smoked or are rotting. And if you can find a company trading below cash or at a Price to Book of 0.5x, they are probably an accounting fraud or on the brink of bankruptcy.

Growth Investing on the other hand has as many definitions are there are growth investors. From hippie futurists, like Cathie Wood, to momentum traders, and everything in between.

To oversimplify then, there are ‘cheap stocks’ - ones with low Price to Earnings multiples - and ‘expensive stocks - ones with high P/Es.

So which ones do better?

To take a stab at this, I split the S&P 500 as it was five years ago into four buckets based on their forward P/E multiples. The lowest bucket had an average P/E of 8.6x, while the highest bucket had an average P/E of 36.6x.

So which bucket has done better?

Interestingly, the answer isn’t as clear cut as you’d expect: The ‘Lowest’ bucket had a modest return, the ‘Low’ bucket did better, and the ‘Highest’ bucket did best of all.

But ‘High’? That did worst of all. I don’t get it.

I even went back and removed some sectors where P/E isn’t a particularly good metric as that might be distorting the numbers. Even without Materials, Real Estate and Utilities the impact was negligible.

Despite ‘High’ being a bit of an outlier, I think there are some interesting conclusions to be drawn from this:

‘Lowest’ P/E - Definitely a stock pickers game. The cheapest of the cheap had the second best upside for the top quartile of performers, but the worst performance for the bottom quartile. If you are going to mess around with the ‘Lowest’ P/E stocks it’s best to do your homework and maybe not take a passive or ETF approach.

‘Low’ P/E - This seems to be the best place for most part-time retail investors. Best downside support (bottom quartile did the best), top quartile is just behind ‘Lowest’ for 2nd, and the average return was second only to ‘Highest’. Safe and good returns.

‘High’ P/E - Not much to say. The sector composition was quite similar to ‘Low’ but it underperforms it in all facets (top quartile, bottom quartile and average return). Maybe the take-away is that just because the market likes a basket of stocks that it considers ‘quality’ and deserve a premium, might not warrant it if the underlying growth isn’t there.

‘Highest’ P/E - Best overall return and some real flyers, however, the bottom 50% underperforms the bottom 50% from the ‘Low’ basket. High risk but high reward.

The data only covers the last 5 years so I’d be hesitant to declare a winner in the ‘Growth vs. Value’ debate but I will suggest the following:

If you think you can out-stock-pick the market, then ‘Value’ stocks can be quite rewarding.

If you want to shoot the lights out and aren’t scared of a bit of downside risk then ‘Growth’ is for you.

If you don’t want to think too hard but still want a good return with minimal risk then a basket of quality, moderately priced stocks are for you.

Happy hunting!

UK & EU Rate Cuts Pending

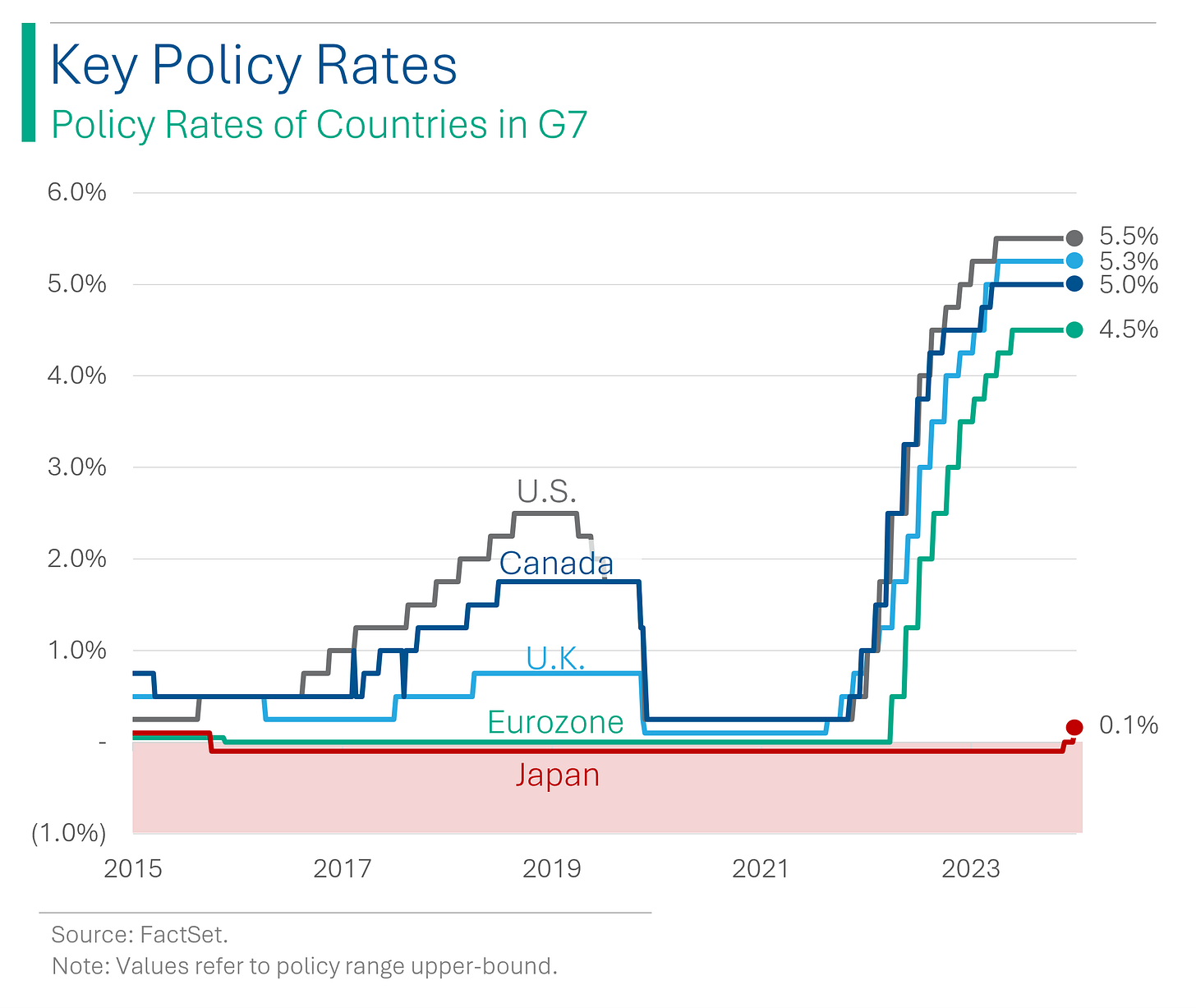

The Bank of England held rates at 5.25% but said they could cut as early as next month, as Governor Andrew Bailey highlighted the need for a less restrictive monetary policy amid improving inflation forecasts.

This stance aligns with the European Central Bank's expected rate cut next month, contrasting with the US Federal Reserve, which may delay easing until later in the year as the US is still experiencing inflation well above their peers.

Rate Relief: Mortgage Rates Take a Modest Dip in the Housing Heat

After five straight weeks of increases, the average rate on a 30-year mortgage decreased to 7.09% from 7.22%, offering slight relief amidst rising housing prices and low inventory.

Mortgage rates are largely influenced by the bond market, which has seen higher yields as expectations for interest rate cuts by the Federal Reserve have evaporated. So yeah, it sucks right now.

Joke Of The Day

Did you hear about the first restaurant to open on the moon? Great food, but no atmosphere.

Hot Headlines

Yahoo Finance / Roughly one in 37 homes are now considered seriously underwater in the US, particularly in the South. Nationally, 2.7% of homes carried loan balances at least 25% more than their market value in the first few months of the year.

Bloomberg / Apple plans to power AI tools with in-house server chips by this Year. The company is placing high-end chips - similar to ones it designed for the Mac - in cloud-computing servers designed to process the most advanced AI tasks coming to Apple devices.

WSJ / Neuralink’s first brain-chip implant in a human appeared flawless but there was a problem. Connective ‘threads’ came loose which limited the amount of data ‘downloaded’ from patient Noland Arbaugh. Interestingly, they updated the algorithms to make collection more efficient. Basically, this guy’s brain got a software patch. Wicked.

Yahoo Finance / SanFran Fed President Mary Daly favors waiting to gain confidence that inflation is dropping, saying ‘it’s going to be a bumpy ride’. Does believe policy is sufficiently restrictive (phew!)

Ritholtz Wealth / TikTok ‘finfluencers’ peddle horrendous financial advice that is causing harm to young investors. Sad but there’s some real gold here (most of it is from the @TikTokInvestors X account).

Trivia

I just reread Michael Lewis’ first book, Liar’s Poker, on Salomon Brother’s in the ‘80s. For more than a decade, Salomon ruled Wall Street and epitomized the gluttony and greed of the 1980s. Here’s some Salomon Brother’s trivia.

Salomon Brothers was a key player in developing which financial market?

A) Derivatives

B) Forex

C) Mortgage-backed securities

D) Private equityWhat two Salomon Managing Directors ended up co-founding the hedgefund Long-Term Capital Management, whose collapse triggered a mini financial crisis?

A) Robert Merton and Jamie Dimon

B) Myron Scholes and John Meriwether

C) Steve Banner and Thomas Michaels

D) Steve Cohen and Robert GoldsteinWhich company acquired Salomon Brothers in 1997?

A) J.P. Morgan

B) Travelers Group

C) Bank of America

D) CitigroupAfter a rogue trading scandal led to the ousting of the firm’s CEO, what famed investor stepped in briefly as Chairman?

A) Warren Buffett

B) Ray Dalio

C) Peter Lynch

D) Carl IcahnThe man who helped build Salomon Brother’s into the Wall Street powerhouse it was in the ‘70s and ‘80s as CEO is pictured below (with a gold bar as a paper weight). Who was he?

A) Lewis Ranieri

B) Michael Milken

C) Michael Lewis

D) John Gutfreund

(answers at bottom)

Market Movers

Winners!

Blue Bird (BLBD) [+24.5%]: Big Q2 fiscal beats in revenue, EBITDA, and EPS; raised FY guidance despite expected 2H margin pressures from inflation and rising costs. Market demand for school buses remains robust.

Warby Parker (WRBY) [+18%]: Q1 earnings, revenue, and margins surpassed expectations; average revenue per customer topped forecasts. Highlighted margin boosts from faster glasses sales and efficiencies in optical labs; raised FY guidance.

Applovin (APP) [+14.4%]: Strong Q1 EBITDA performance and Q2 guidance ahead; Software and Apps segments outperformed. Benefited from AXON 2.0 adoption, improved performance, and increased gaming customer spending.

YETI Holdings (YETI) [+12.8%]: Q1 EPS and revenue outpaced estimates; raised FY24 EPS guidance, reaffirmed revenue growth. Noted double-digit growth in wholesale and direct-to-consumer channels, Drinkware, and Coolers & Equipment; highlighted gross margin improvements.

Equinix (EQIX) [+11.5%]: Mixed Q1 results with slight reductions in key 2024 guidance metrics; Audit Committee found no need for financial restatements, overshadowing guidance adjustments.

Bumble (BMBL) [+11.5%]: Q1 earnings and revenue exceeded forecasts; paying user count and total net adds were strong. Q2 guidance slightly below expectations but FY guidance reaffirmed; boosted buyback by $150M.

Klaviyo (KVYO) [+11.3%]: Q1 EPS and revenue beat, with 35% y/y revenue growth. Q2 revenue guidance exceeded expectations, FY24 revenue guidance raised by $10M; margins also exceeded forecasts.

SharkNinja (SN) [+6.4%]: Q1 EPS and revenue outperformed; sales up across all categories. Raised FY24 EPS and revenue growth guidance; noted significant international growth potential.

Cheesecake Factory (CAKE) [+6.2%]: Q1 EPS surpassed expectations with better RLMs. Reiterated 2024 guidance, positive on stable consumer spending environment and market share gains.

Planet Fitness (PLNT) [+5.6%]: Q1 EPS beat with a slight revenue miss; not as negative as expected. Lowered FY24 EPS, revenue growth, and comps guidance; noted shifts to consumer savings, COVID concerns, and marketing challenges.

Trade Desk (TTD) [+3.1%]: Beat Q1 EPS, EBITDA, and revenue estimates; Q2 revenue and EBITDA guidance above forecasts. Analysts focused on CTV agreement gains and growing emphasis on retail media, minimized concerns over cookie depreciation.

Losers!

EPAM Systems (EPAM) [-26.8%]: Q1 earnings surpassed expectations with revenue in line; Q2 guidance fell short of expectations, FY guidance cut. Management cited a challenging demand environment unlikely to improve this year.

Roblox (RBLX) [-22.1%]: Q1 bookings missed, Q2 bookings guidance also below expectations; broad-based decline in engagement noted across regions and platforms. Efforts to address issues showing positive results since mid-April; FY bookings guidance reduced.

Duolingo (DUOL) [-18%]: Q1 earnings and revenue exceeded forecasts, with paid subscribers and total bookings above consensus. Q2 and FY guidance met Street expectations, but analysts concerned about deceleration in daily active users and smaller bookings beat.

EXACT Sciences (EXAS) [-9%]: Q1 revenue outperformed but EPS and margins fell short; increased investments in sales staff noted. FY revenue guidance reaffirmed; analysts view selloff as excessive, optimistic on Cologuard growth.

GoodRx Holdings (GDRX) [-8.9%]: Q1 revenue slightly better, EBITDA exceeded by about 10%; Q2 guidance aligns with expectations, slightly higher FY revenue and EBITDA guidance but not matching Q1 performance. Early analyst reactions positive despite stock decline.

SolarEdge Technologies (SEDG) [-8.5%]: Q1 EPS missed, revenue exceeded expectations; Q2 revenue guidance below consensus due to channel issues and macro headwinds. High demand for single-phase batteries in the U.S. shifted margins due to their lower margins.

Airbnb (ABNB) [-6.9%]: Q1 gross bookings and revenue ahead, EBITDA surpassed by nearly $100M; Q2 room nights expected stable versus anticipated double-digit growth. Margin headwinds from investments noted, but more positive outlook for 2H growth reacceleration.

Papa John's International (PZZA) [-6.8%]: Q1 North America comps declined more than expected; March trends worsened. EPS better due to margin gains; commentary focused on new marketing strategies and development pipeline.

Arm Holdings (ARM) [-2.3%]: Fiscal Q4 results better, driven by strong Licensing; Q1 guidance also better on Licensing, but Royalties guidance fell short due to weak demand in IoT, Industrial, and Networking sectors. FY25 revenue growth guidance set at 22%, slightly missing Street expectations amid high valuation.

Market Update

Trivia Answers

B) Myron Scholes and John Meriwether co-founded LTCM.

C) Mortgage-backed securities

B) Travelers Group bought Salomon in 1997.

A) Yep, for a short-time Warren Buffett oversaw Salomon as Chairman.

D) John Gutfreund was CEO during Salomon’s hayday.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.