🔬Cheap Stocks vs. Expensive Stocks

Plus: Why Is September Terrible for the stock market?

"The way of the successful investor is normally to do nothing – not to buy and sell all the time."

- Jim Rogers

"Your margin is my opportunity."

- Jeff Bezos

Friday marked a strong end to the month for the big US markets, with the S&P 500 +1.0% and Nasdaq +1.1%. This was enough for the S&P to squeak into the green for the week (+0.2%), however, the Nasdaq closed the week -0.9%.

All 11 sectors finished higher Friday following a few modest positives on the economic front (see below). For the week, Financials (+2.9%) and Industrials (+1.7%) faired the best, while Tech (-1.5%) had a week to forget.

July Core PCE Inflation came in at +0.2% which matched Wall Street consensus estimates. Personal Income and Personal Spending both came it stronger than expected.

Final Michigan Consumer Sentiment was mostly in line with expectations and one year inflation expectations declined modestly.

Notable companies:

Intel (INTC) [+9.5%]: Reportedly considering strategic options, including splitting design and manufacturing businesses.

MongoDB (MDB) [+18.3%]: Q2 earnings and revenue beat expectations, with strong Q3 guidance and raised FY guidance, highlighting Atlas strength despite a challenging macro environment.

Elastic (ESTC) [-26.5%]: Q1 revenue and EPS beat, but FY revenue guidance cut, with positive GenAI momentum overshadowed by lowered expectations for the second consecutive quarter.

More below in ‘Market Movers’.

Street Stories

Cheap Stocks vs. Expensive Stocks

Two categories of investors have been facing off for decades over their favored style: Value vs. Growth.

Value Investing - as laid out by Benjamin Graham - doesn’t really exist anymore. Most of the cigar butts to be found have been smoked or are rotting, and if you can find a company trading below cash or at a Price to Book of 0.5x, they are probably an accounting fraud or on the brink of bankruptcy.

Growth Investing on the other hand has as many definitions are there are growth investors. From hippie futurists, like Cathie Wood, to momentum traders, and everything in between.

To oversimplify then, there are ‘cheap stocks’ - ones with low Price to Earnings multiples - and ‘expensive stocks - ones with high P/Es.

So which ones do better?

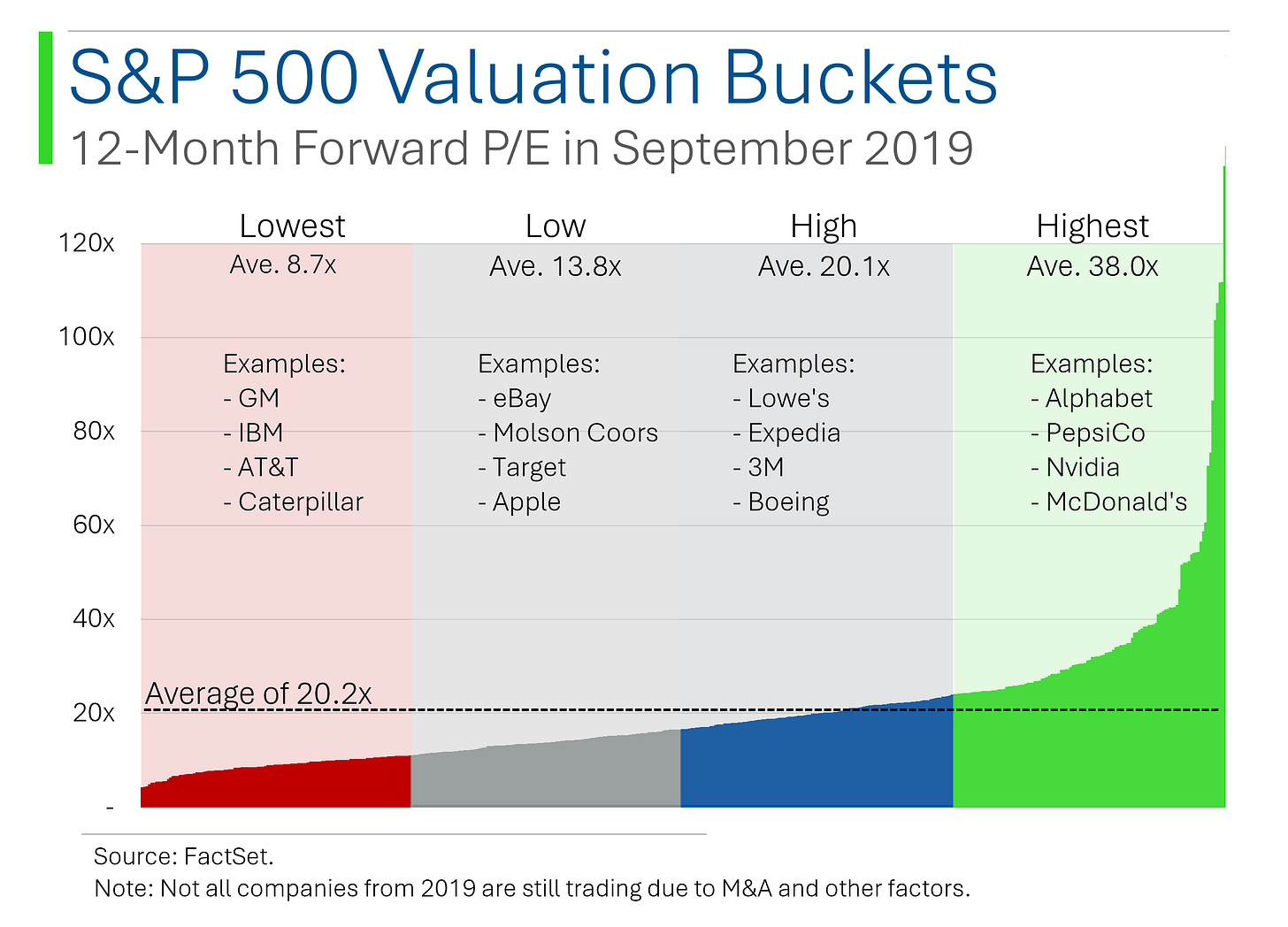

To take a stab at this, I split the S&P 500 as it was five years ago into four buckets based on their forward P/E multiples. The lowest bucket had an average P/E of 8.7x, while the highest bucket had an average P/E of 38.0x.

So which bucket has done better?

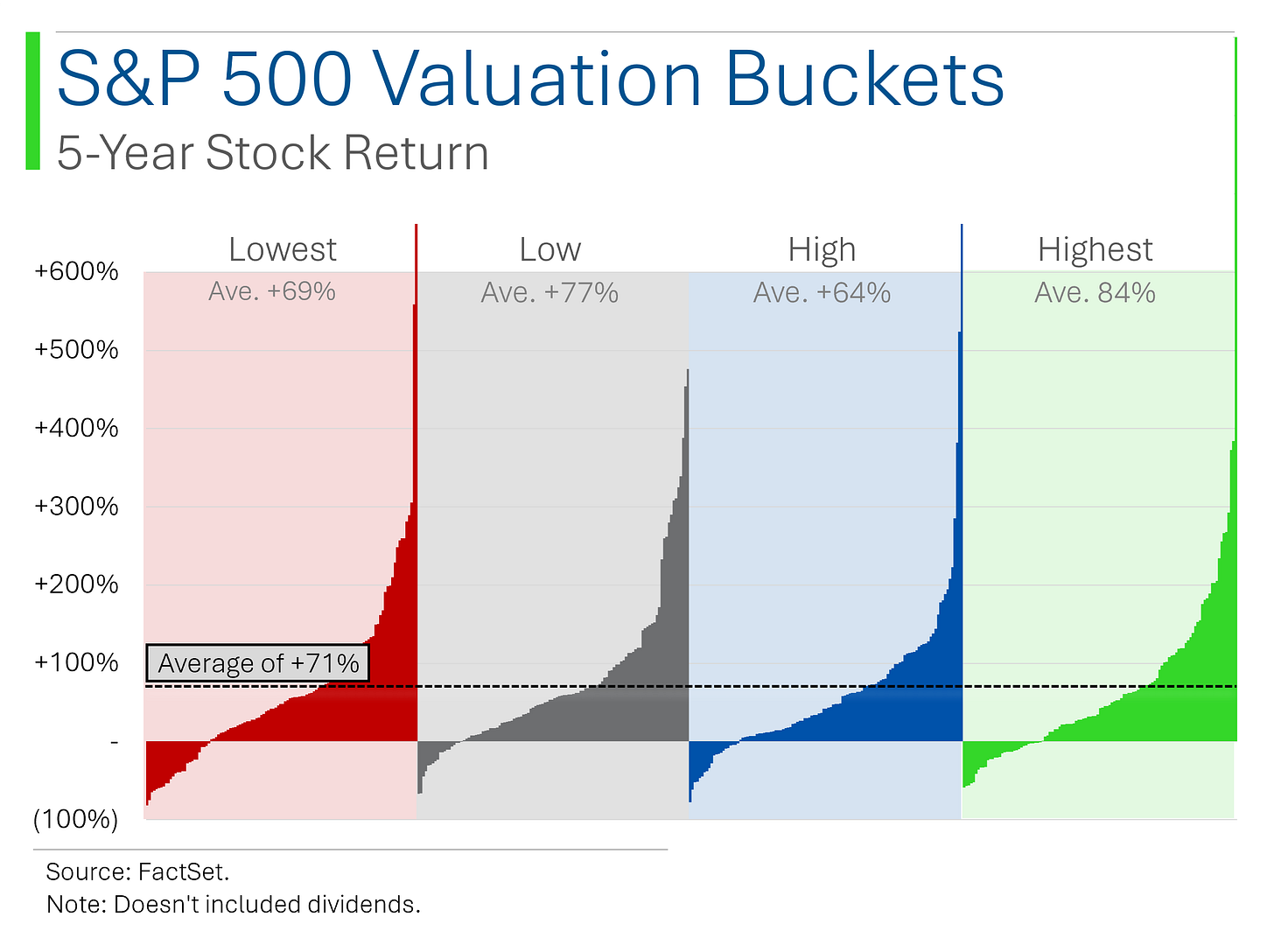

Interestingly, the answer isn’t as clear cut as you’d expect: The ‘Lowest’ bucket had a modest return, the ‘Low’ bucket did better, and the ‘Highest’ bucket did best of all.

But ‘High’? That did worst of all. I don’t get it.

I even went back and removed some sectors where P/E isn’t a particularly good metric as that might be distorting the numbers. Even without Materials, Real Estate and Utilities the impact was negligible.

Despite ‘High’ being a bit of an outlier, I think there are some interesting conclusions to be drawn from this:

‘Lowest’ P/E - Definitely a stock pickers game. The cheapest of the cheap had the second best upside for the top quartile of performers, but the worst performance for the bottom quartile. If you are going to mess around with the ‘Lowest’ P/E stocks it’s best to do your homework and maybe not take a passive or ETF approach.

‘Low’ P/E - This seems to be the best place for most part-time retail investors. Best downside support (bottom quartile did the best), top quartile is just behind ‘Lowest’ for 2nd, and the average return was second only to ‘Highest’. Safe and good returns.

‘High’ P/E - Not much to say. The sector composition was quite similar to ‘Low’ but it underperforms it in all facets (top quartile, bottom quartile and average return). Maybe the take-away is that just because the market likes a basket of stocks that it considers ‘quality’ and deserve a premium, might not warrant it if the underlying growth isn’t there.

‘Highest’ P/E - Best overall return and some real flyers, however, the bottom 50% underperforms the bottom 50% from the ‘Low’ basket. High risk but high reward.

The data only covers the last 5 years so I’d be hesitant to declare a winner in the ‘Growth vs. Value’ debate but I will suggest the following:

If you think you can out-stock-pick the market, then ‘Value’ stocks can be quite rewarding.

If you want to shoot the lights out and aren’t scared of a bit of downside risk then ‘Growth’ is for you.

If you don’t want to think too hard but still want a good return with minimal risk then a basket of quality, moderately priced stocks are for you.

Happy hunting!

Why Is September Terrible?

Investors and traders are some of the most superstitious folks around. My favorite one is the legendary Paul Tudor Jones putting on a pair of special tennis shoes whenever he needs the market to rally.

(This is from the seminal ‘80s time capsule that is the documentary Trader - which Tudor Jones was so ashamed of that he has spent millions buying up all the VHS copies and periodically sues to have it taken down from YouTube)

For my part, however, I’m proud to say that I’m not superstitious… Well, ok, there is this one thing: Don’t buy stocks in September.

September has been a terrible month for the stock market for years now, and the ‘September Effect’ is now common parlance. At this point I don’t think any real technical factors are causing it but rather it’s just a self-fulfilling prophecy at this this point.

Joke Of The Day

Did you hear about the first restaurant to open on the moon? Great food, but no atmosphere.

Hot Headlines

The Guardian / Senior Hamas commander killed by Israeli police in West Bank. Israeli police took out a senior Hamas commander in Jenin while he was still in his car, which, according to the IDF, was practically a mobile armory. Two Hamas gunmen then tried to escape and were killed by an Israeli Airstrike.

Bloomberg / Tokyo inflation tops expectations building case for BOJ hikes. Consumer prices were up 2.4% in August, which might not sound like much, but in the world of central banking, it’s enough to set off some alarm bells. So…is it time for a new-new central bank policy?

Reuters / Intel CEO set to pitch board on plans to shed assets and cut costs. Investors haven’t been happy with Intel these days; America’s very own is losing the chip race and their market cap just shrank below $100B. That said, CEO Gelsinger apparently has some radical changes in mind that might even include a spin-off of some core assets. All eyes will be on the firm’s presentation for a turnaround which will occur mid-September.

Reuters / DirecTV subscribers lose access to Disney networks after failure to reach deal. Disney and DirecTV just turned off the lights on over 11 million subscribers, failing to reach a deal for ESPN, ABC, and other networks. This occurred right before the NFL season starts as well as before the remaining presidential debates take place. Almost like they timed it on purpose!

Yahoo Finance / Goldman Sachs says hedge funds continue short bet against banks. In a note on Monday, the firm flagged growing shorts globally across the banking sector as well as insurers over the course of last week. GS also noted that banks were net sold in six of the last seven weeks.

Trivia

Today’s trivia is on the history of banking.

The Rothschild family became prominent in European banking during the 18th and 19th centuries. In which city did Mayer Amschel Rothschild establish the first Rothschild bank?

A) Paris

B) Frankfurt

C) London

D) ViennaWhich banking institution, established in 1694, is one of the oldest central banks and serves as the model for most central banks today?

A) Federal Reserve

B) Bank of France

C) Bank of England

D) Deutsche BankThe first central bank in the United States, established in 1791, was known by what name?

A) The Federal Reserve

B) The Second Bank of the United States

C) The First Bank of the United States

D) The National Bank of AmericaIn which decade did the Glass-Steagall Act, separating commercial and investment banking in the United States, come into effect?

A) 1920s

B) 1930s

C) 1940s

D) 1950s

(answers at bottom)

Market Movers

Winners!

MongoDB (MDB) [+18.3%]: Q2 earnings and revenue beat expectations, with strong Q3 guidance and raised FY guidance, highlighting Atlas strength despite a challenging macro environment.

Intel (INTC) [+9.5%]: Reportedly considering strategic options, including splitting design and manufacturing businesses.

Marvell Technology (MRVL) [+9.2%]: Q2 revenue beat with in-line EPS; positive outlook for Q3 driven by Data Center strength, AI custom silicon ramp, and sequential growth across all segments.

Dell Technologies (DELL) [+4.3%]: Q2 earnings and revenue exceeded expectations with raised FY guidance, driven by strong AI server metrics, despite a slower-than-expected PC recovery.

Abercrombie & Fitch (ANF) [+3.7%]: Upgraded to buy from neutral by Citi after a selloff, citing strong Q2 performance and conservative Hollister guidance for the second half.

NXP Semiconductors (NXPI) [+3.0%]: Board approved an additional $2B authorization for the existing share repurchase program.

CrowdStrike (CRWD) [+2.1%]: Upgraded to buy from hold by HSBC, with the impact of a July outage now resolved and strong guidance for the second half of the year.

Losers!

Elastic (ESTC) [-26.5%]: Q1 revenue and EPS beat, but FY revenue guidance cut due to GTM model changes affecting customer commitments and sales executions, with positive GenAI momentum overshadowed by lowered expectations for the second consecutive quarter.

Alnylam Pharmaceuticals (ALNY) [-8.5%]: Released HELIOS-B Phase 3 study results for vutrisiran, with analysts noting the data was less competitive and definitive than investors had hoped.

Ulta Beauty (ULTA) [-4.0%]: Q2 EPS, comps, margins, and revenue missed, with the first comp decline since 4Q20; FY25 guidance lowered due to cautious consumer spending, operational disruptions, and increased competition.

Talos Energy (TALO) [-3.9%]: President & CEO Tim Duncan steps down, effective 29-Aug-24.

Market Update

Trivia Answers

Mayer Amschel Rothschild established the first Rothschild bank in Frankfurt, Germany.

The Bank of England, established in 1694, is one of the oldest central banks and serves as the model for most central banks today.

The first central bank in the United States, established in 1791, was known as The First Bank of the United States.

The Glass-Steagall Act, separating commercial and investment banking in the United States, came into effect in the 1930s.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Superb charts in here!!

When I owned SBUX I often wondered if I should think of it as a growth stock or a value stock. Most growth stocks don't have a 2.5% dividend yield and how much more can it grow after there is a Starbucks on every street corner. Sadly, SBUX is probably in your "high P/E" category.