🔬Cheap Stocks vs. Expensive Stocks, Netflix Got Bigger, and Much More

"Investing without research is like playing stud poker and never looking at the cards"

- Peter Lynch

“A successful man is one who can lay a firm foundation with the bricks others have thrown at him”

- David Brinkley

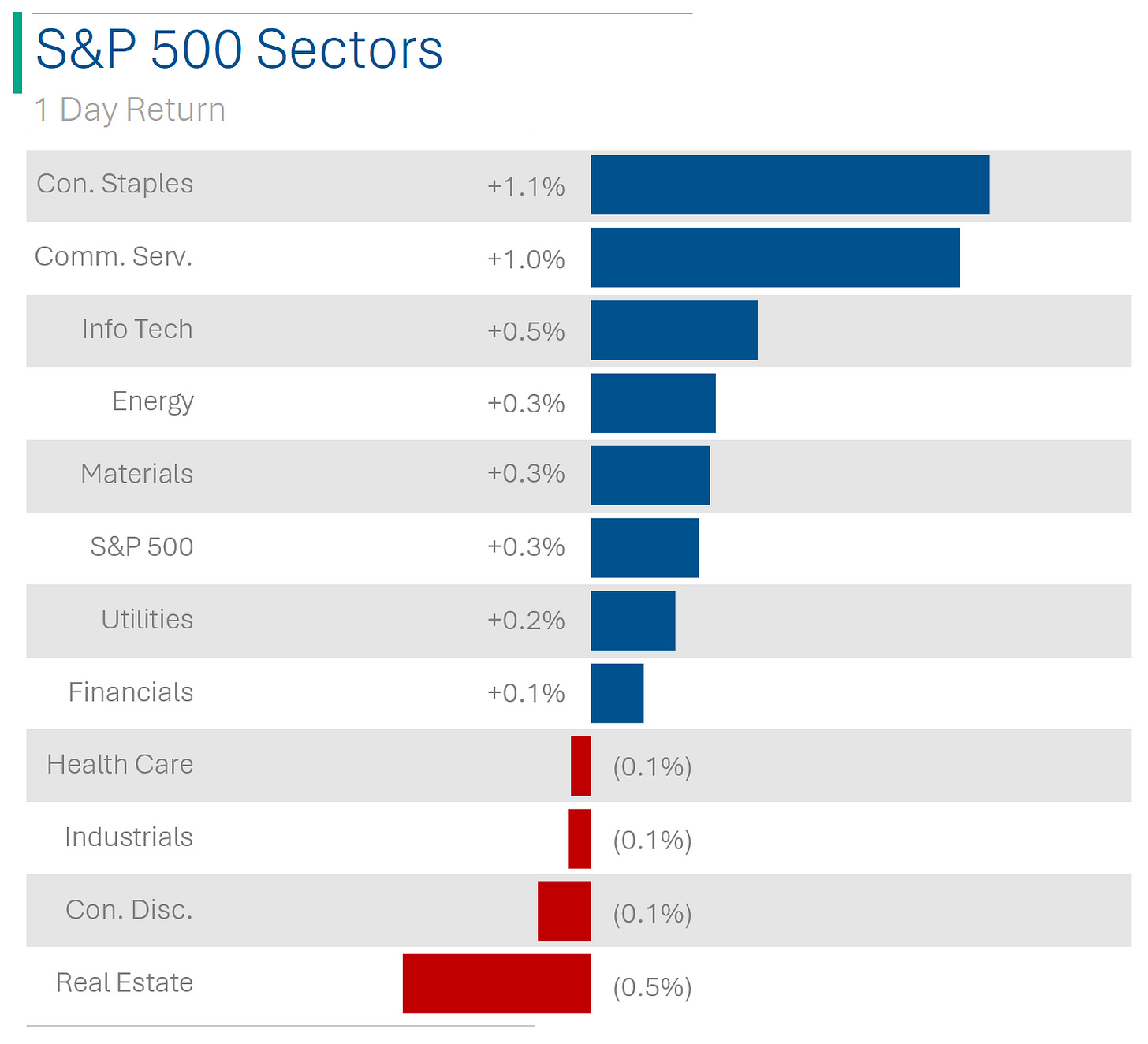

Decent enough day for the big US markets with the S&P 500 and Nasdaq both solidly in the green (+0.29% and +0.43% respectively).

7 of 11 sectors closed up, lead by Consumer Staples (+1.1%). Real Estate proved the weakest, down -0.5%.

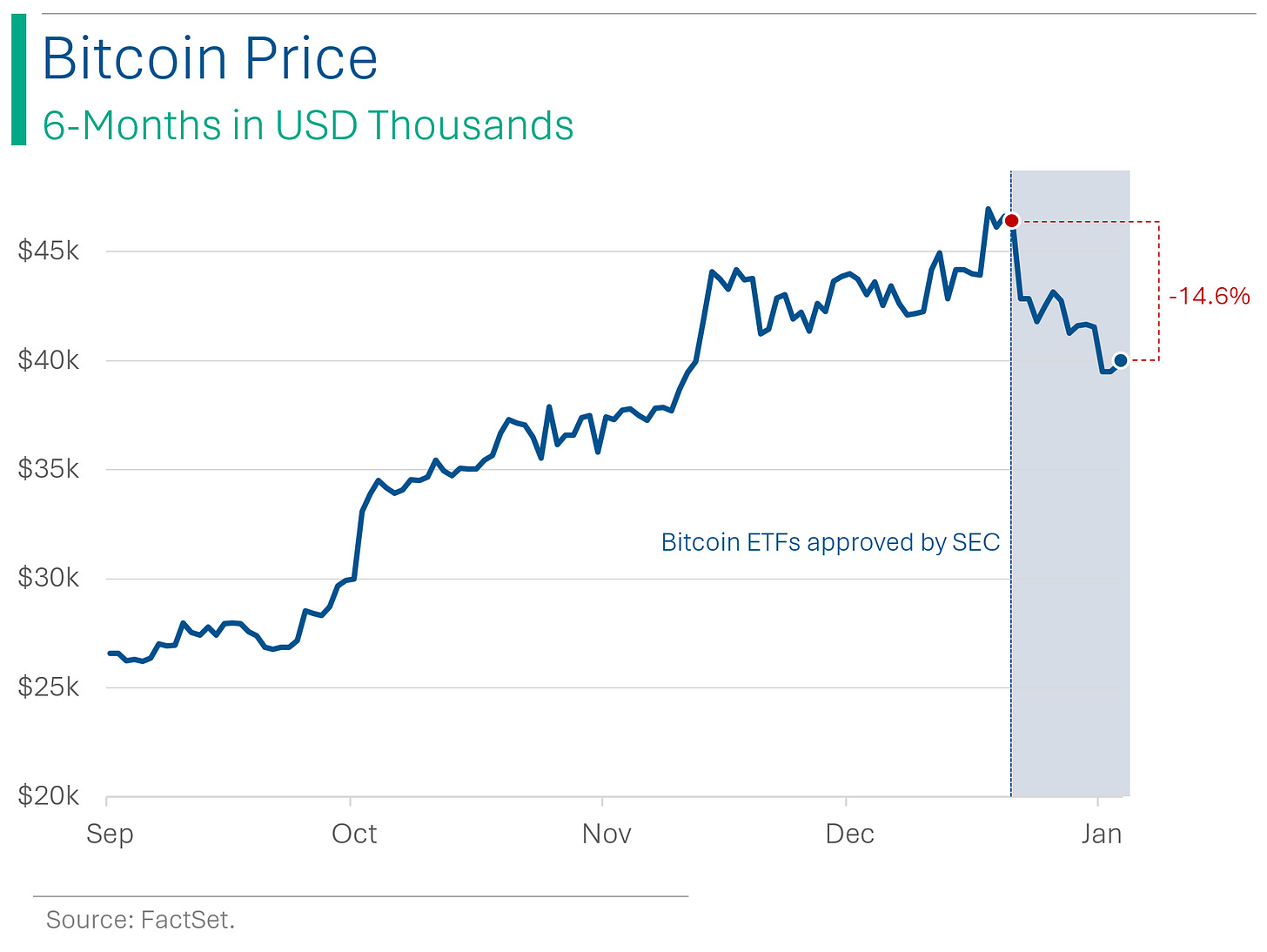

Bitcoin was down -0.5% bringing the total to 14.6% since ETFs got approved (more below).

Tech and techy Communication Services started Q4 earnings with Netflix stealing the show (+10.1% in afterhours trading).

Street Stories

The Cheap vs. The Expensive

While I often cite the S&P 500 and use it as my benchmark of choice, it’s important to realize its made up of a lot of companies (500 or so if you’d believe it). Some great. Some dogs. Some dogs with fleas.

So for curiosity’s sake, I thought I’d dig in a bit and see how great are the most expensive companies - on a Price to Earnings basis, that is - and how terrible are the cheapest ones. Do they deserve the hype or the hate?

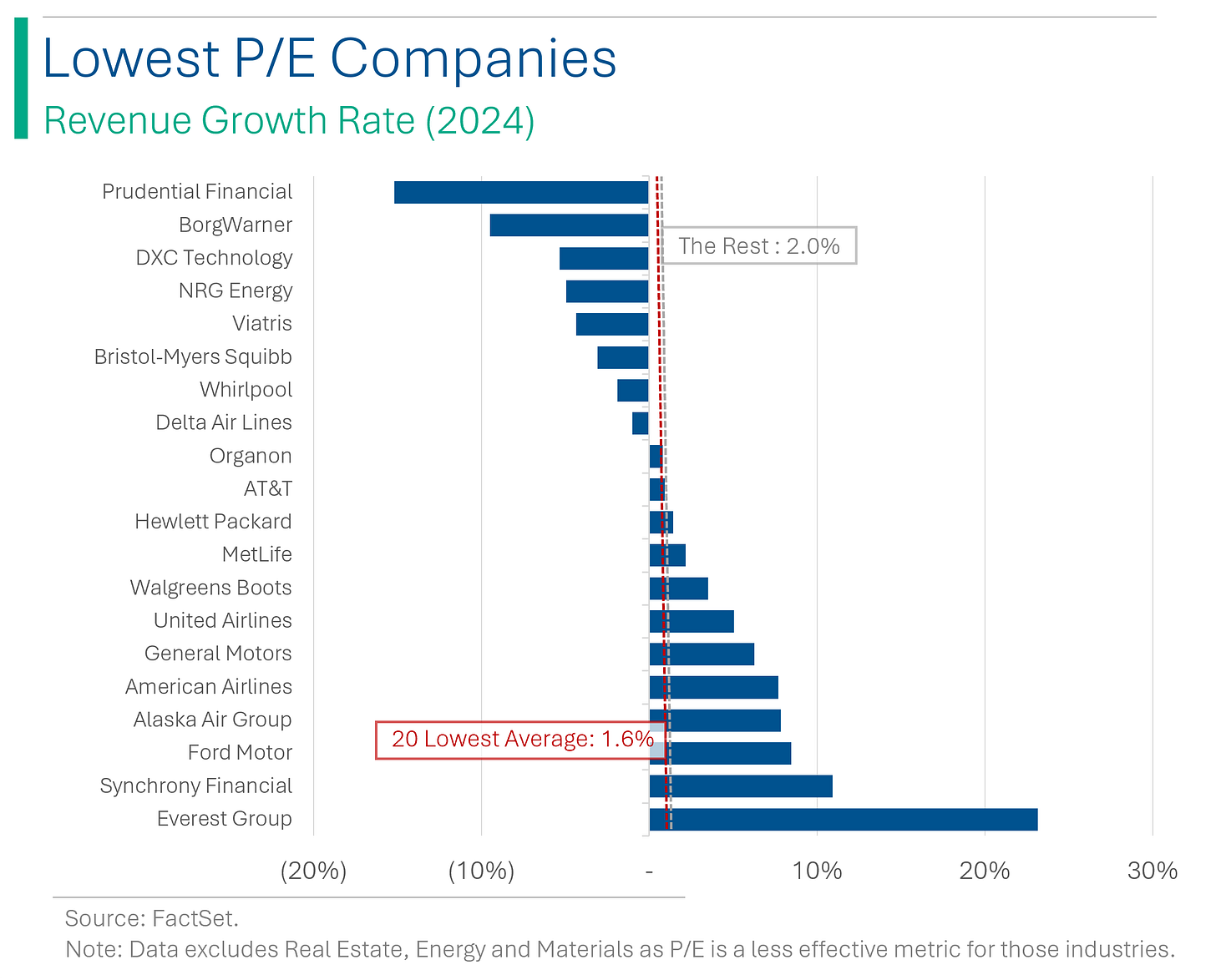

As you can see below, the ‘cheapest’ 20 companies average a forward P/E ratio of around 6.4x - a 69% discount to the S&P average of around 20.6x.

And while clearly this is a mixed bag, the average growth for the next fiscal year is 1.6% which isn’t a far cry from the 2.0% that ‘The Rest’ (the non-Highest/non-Lowest P/E companies) is forecast to make off with.

On the other end of the spectrum, the 20 highest P/E stocks average around 58.2x, or a 183% premium to the index average 20.6x.

What you get for that though is a much stronger growth profile, with the average company expected to see revenue grow by 12.1% this year - a 505% increase over ‘The Rest’. Not too shabby.

To tie it all in; the market isn’t stupid. There are some weird exceptions, such as genomics company Illumina trading at 156x but expecting negative revenue growth this year (it’s been a ‘3 years out’ story for the last decade), but generally the companies growing the fastest seem to trade at the highest multiples, and the opposite for the slowest ones.

Lastly, despite being ‘cheap’, the lowest P/E stocks haven’t exactly shown much life in their shares. In 2023, the lowest P/E stocks had an average return of -0.8%, while the index averaged a +16% year*.

*Note that this is the average return of the companies, and isn’t market cap weighted figure that reflects the return of the S&P 500 (which was +24%). Moreover, this excludes the Energy, Real Estate and Materials companies.

For the high P/E stocks it’s a very different story, with the average return equalling +48.1% - 200% higher than the return for the average S&P 500 companies.

When markets are hot, it pays to be in the growth names.

Bitcoin’s Post-ETF Flop

Since Bitcoin ETFs got the greenlight from the SEC on January 10th, it hasn’t been pretty. I’ve written in the past how ‘catalysts’ are important for stocks, which I presume translates into crypto. After a big event, like say an M&A deal or a biotech drug approval, investors can be left sitting on their hands waiting for the next thing that will move the share price. And for Bitcoin, it’s not exactly like these are the long-term, buy-and-hold type. The next catalyst for Bitcoin is likely the next ‘Halving’ event, when the block rewards for mining Bitcoin will be cut in half. And that’s not until April.

Netflix's New Season: Record Subscribers, Ad Adventures, and a WrestleMania Debut

Financially, Netflix Q4 wasn’t anything to write home about:

Revenue: $8.83bn vs. Wall Street consensus $8.72bn [+1.3% Beat]

Earnings Per Share: $2.11 vs Wall Street consensus $2.22 [-5.0% Miss]

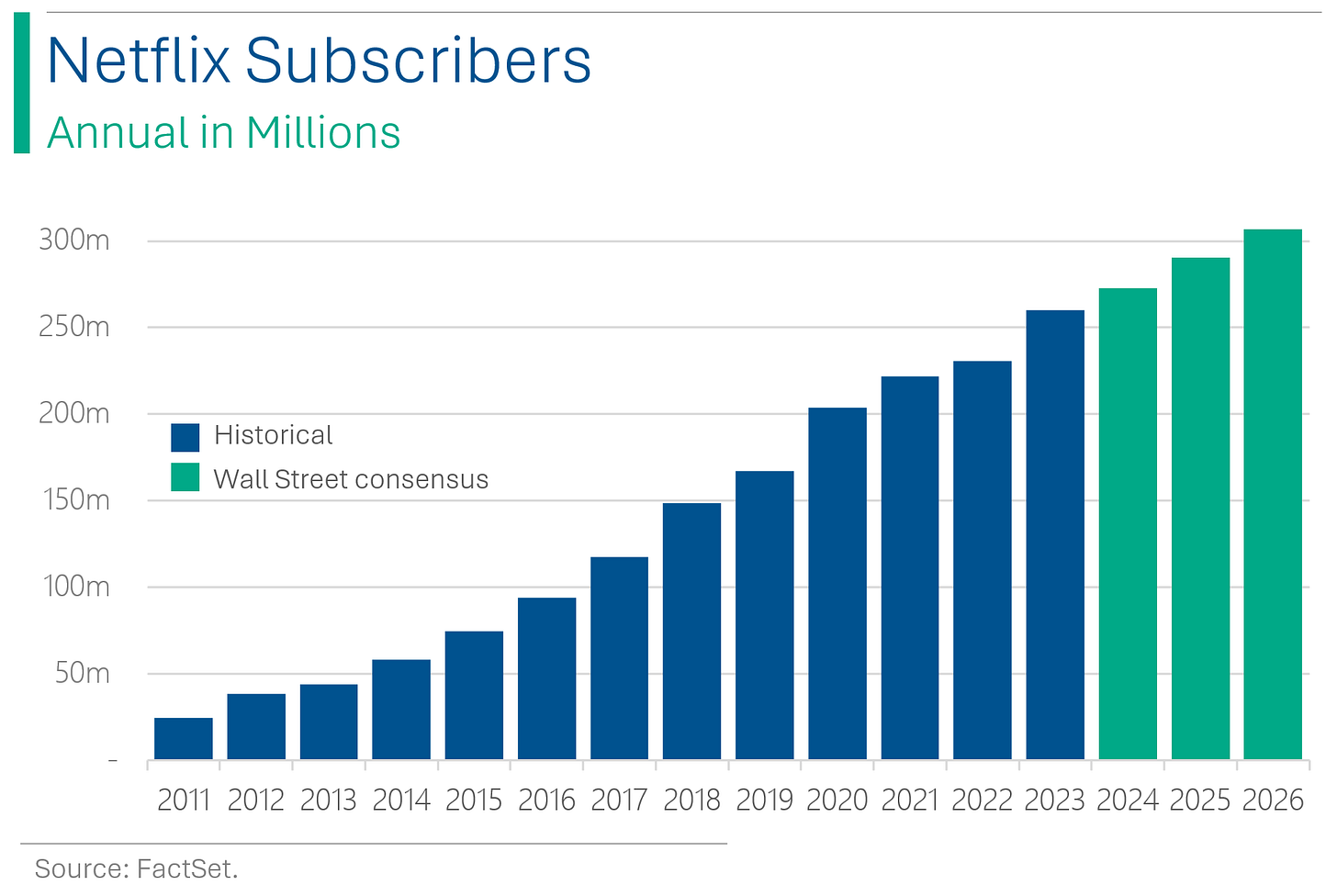

However, what stood out to the Street was the significant subscriber growth, that saw the company adding 13.1 million subscribers and reaching a record 260.8 million paid subscribers, exceeding Wall Street's expectations of 256 million. The company plans to focus on profit rather than subscriber growth, implementing strategies like price hikes and ad-supported tiers.

Netflix is also expanding into live entertainment, including the announcement today that they with plans to stream WWE Raw starting next year (Reuters has the story), and is enhancing its advertising-based plan, which has already reached over 23 million global monthly active users. The stock is up +10.1% in afterhours trading, but is still well off it’s all-time high back in 2021.

White Collar Cuts

I compiled a small list of some of the companies that have announced major layoffs in the last month or so. I’m pretty sure any job that requires a college degree is now being eliminated.

Alphabet announced more layoffs following the 13k it announced last January

Amazon announced new cuts to film/television, Twitch (35%), Audible (5%) and more. This comes after 27k cuts in 2013 (granted a lot of those were fulfillment center jobs)

BlackRock just announced it will cut 3% of its workforce

Citigroup said it would eliminate 26k jobs by 2026

Discord is cutting 17%

Wayfair is cutting 13%

Pixar (Disney) cutting <20%

Xerox is cutting 13%

Duolingo is cutting 10%

NBC News is cutting 1-3%

Treasure Financial cutting 60 to 70%

NuScale to cut 28%

Trigo doing a 15%

Macy’s is cutting 3.5%

Pitch to cut two-thirds of staff

Sharpie & Rubbermaid (Newell) to cut 7%

Flexe to cut 38%

InVision to cut the whole company

Rent The Runway going for 10%

Big cuts at Sports Illustrated which have already got them fighting with the union

VideoAmp cut 20%

Orca Security to layoff 15%

Unity Software is cutting 25% of its staff

Riot Games cutting 11% of its workforce

Brex (expense management fintech) cut 20%

Ericsson is cutting 9k jobs

Other cuts at TikTok, LA Times, Universal Music

The interesting bit is that despite all of this, the jobless claim numbers have continued to come down. Maybe it’s too early to see the impact but certainly what stands out is that blue collar workers appear to have some solid job security at the moment. Which is good.

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

CEO 1: ‘Tell me, how many people work in your company?’

CEO 2: ‘About half.’

I’ve been told by coworkers that I’m condescending…that means I talk down to people.

Hot Headlines

CNN | Amazon fined €32 by French regulators for ‘excessive intrusion’, including reportedly tracking its warehouse employees to the second. No word on peeing in water/wine bottles.

The Verge | Federal Trade Commision says TurboTax isn’t allowed to say it’s ‘free’ anymore. The vast majority of services and return types don’t fall into the charity bucket.

Bloomberg | China is reportedly considering a $278 billion aid package for its beleaguered stock market which has been getting crushed (I wrote about this yesterday). The package would go into a fund that would buy shares in Chinese companies.

CNBC | Johnson & Johnson to settle talc baby powder investigation, will reportedly pay $700 million. If you haven’t followed this, J&J was found to have knowingly sold baby powder with asbestos in it (above the legally allowable limit, that is).

WSJM | Marijuana sales in Michigan hit $3 billion in 2023, topping alcohol. No word on Dorito sales.

Trivia

This week’s trivia is on technological innovation.

Who was first to develop GPS technology?

A) Apple

B) GoogleC) United States Department of Defense

D) Garmin

Which company was responsible for the first commercially successful jet airliner?

A) Airbus

B) de Havilland

C) Bombardier

D) Embraer

Who invented the first modern, cost-effective way to make steel 1856?

A) Henry Ford

B) Henry Bessemer

C) Alfred Nobel

D) Thomas Edison

(answers at bottom)

Market Movers

Winners!

Plug Power (PLUG) [+31.0%]: Secured a $1.6B loan facility with the Department of Energy.

TKO Group Holdings (TKO) [+15.8%]: The WWE owner formed a partnership with Netflix, making it the new home for WWE Raw from 2025.

Inhibrx, Inc. (INBX) [+8.9%]: To be acquired by Sanofi (SNY) for $30 per share, totaling $2.2B. Spinning out all non INBRX-101 assets to form new company, Inhibrx Biosciences. This just sounds like a tax move or a way to payoff management.

Alibaba Group (BABA) [+7.9%]: Jack Ma reportedly buying Alibaba stock, as per NY Times.

NetEase (NTES) [+7.9%]: China's game industry regulator removed video game draft rules, boosting shares.

Alcoa Corp. (AA) [+6.8%]: Gains amid EU considering sanctions on Russian aluminum products.

United Airlines (UAL) [+5.3%]: Surpassed Q4 earnings and revenue forecasts. Despite 737 MAX 9 issues, FY24 EPS outlook is promising.

Losers!

Logitech International (LOGI) [-11.5%]: Q3 non-GAAP EPS and revenue exceeded forecasts with FY24 guidance raised, despite a 3% year-over-year dip in like-for-like sales. The company anticipates FY25 challenges including a competitive market, tough conditions in China, and losses in the keyboard segment.

3M (MMM) [-11.0%]: Faced a steeper than expected decline in Q4 organic sales and missed segment EBIT due to weaker restructuring benefits. Q1 guidance is below expectations, and FY24 EPS guidance is 4% under market predictions. The company reaffirmed its plan to spin off its Healthcare segment in the first half of 2024.

Market Update

Trivia Answers

A) United States Department of Defense invented GPS back in 1973.

B) The de Havilland Comet was the first commercial jet plane. It first flew in 1949.

B) Henry Bessemer invented the ‘Bessemer Process’ which kicked off the mass production of steel.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.