🔬Charlie Munger Passes Away at 99 and Much More

"It's not always easy to do what's not popular, but that's where you make your money"

- John Neff

"I’m only rich because I know when I’m wrong"

- George Soros

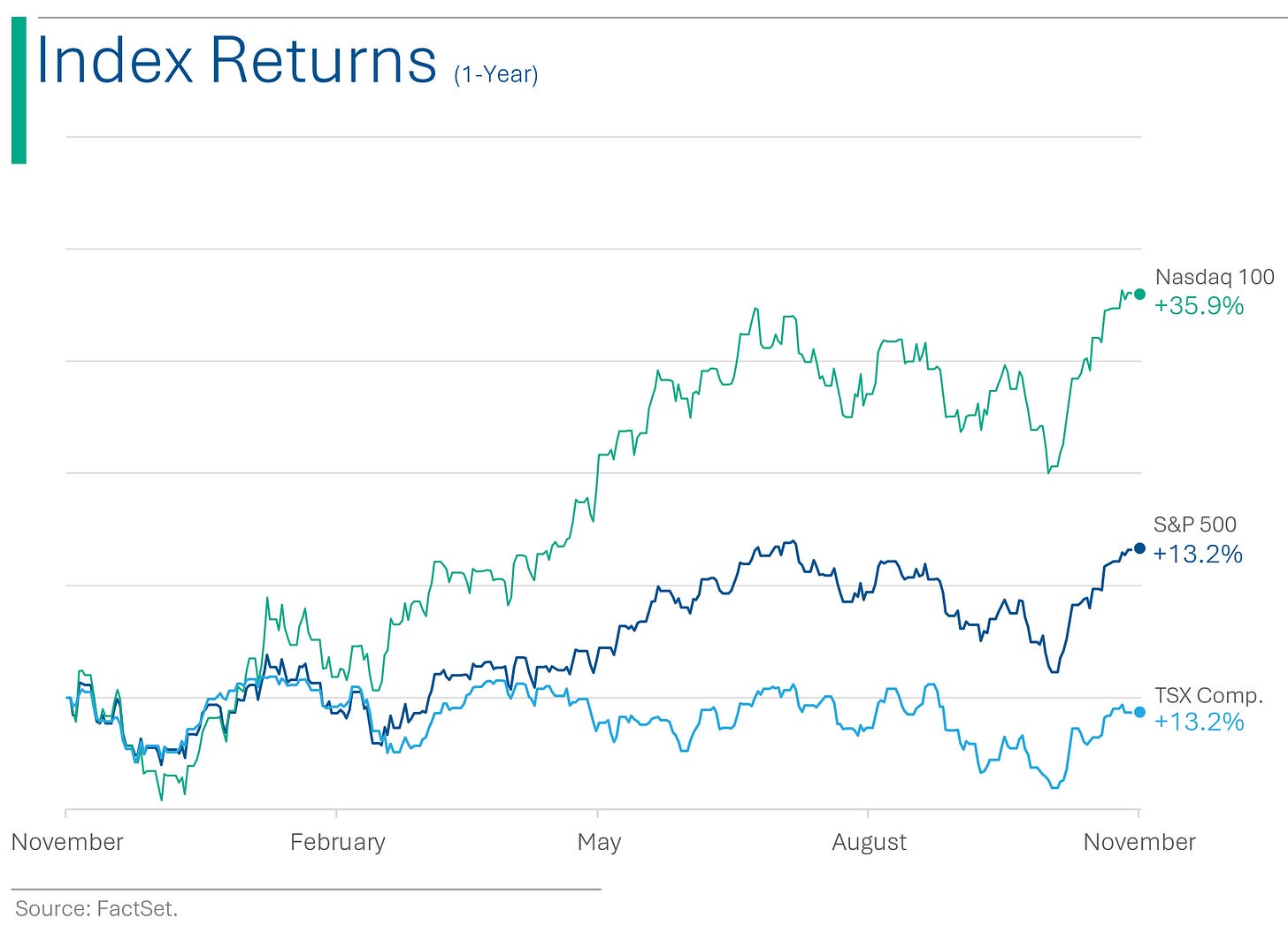

Another day of small price movement in the major indices (S&P 500 +0.10%, Nasdaq +0.29%). Seems like everyone is sitting on their hands after very Bullish November (S&P 500 up 8.6% month-to-date).

8 of 11 sectors closed in the green. Best was Consumer Discretionary (+0.5%). Worst was Health Care (-0.5%).

Tesla had another good day (+4.5%) (more below).

Gold was up another 1.4% and in spitting distance of its all-time high less than 2.5% away. Bitcoin was up 4.4%. Crypto fraud hype be damned!

Dovish Fed-Speak pushed 2024 interest rate expectations down (more below).

Housing Prices up 3.5% YoY, while November Consumer Confidence beat though prior month revised lower.

Street Stories

“FOREVER CHEMICALS” LAWSUIT THROWN OUT - A U.S. appeals court overturned a lower court's ruling that would have allowed nearly 12 million Ohio residents to sue 3M, DuPont, and other manufacturers as a group for alleged contamination from PFAS, often called "forever chemicals." The court found the lawsuit too broad, lacking specific evidence linking these companies directly to PFAS in the plaintiff's body. This decision follows 3M's $10.3 billion settlement in June and a similar $1.19 billion deal by DuPont and Corteva with U.S. water providers over PFAS contamination claims.

IPOs BACK ON THE TABLE? - After some false starts to the long-awaited re-opening of the ‘IPO Window’, Chinese fast-fashion company Shein has filed paperwork for a US listing, having last held a private market valuation of $66 billion. Several other high-profile companies, including Reddit, Lineage Logistics, Rubrik, and Kardashian-backed Skims, are reportedly gearing up for potential IPOs. This uptick in IPO activity, coupled with rising interest in speculative sectors like crypto and profitless tech, reflects a growing optimism in financial markets, buoyed by expectations of Fed rate cuts and improved economic conditions.

Explainer: I’ve written a decent amount about the weak performance of IPOs this year (see: ‘Birken-flops’, ‘Just how dead is the IPO Market?’) and the basic idea is that you need market sentiment to be strong with high risk tolerance (‘Risk On’). Having your stock trade flat to down after an IPO, isn’t a sign of a failed listing; it actually means the selling shareholders have maximized their value. What is bad, however, is having your stock crater after listing because the normal slew of institutional investors and asset managers that would participate, aren’t in the mood to take on any new potential volatility. While this price defenestration shouldn’t (hopefully) persist forever, investors are fragile creatures and a terrible stock chart rarely looks appetizing to new investors.

Essentially, investors don’t usually make it a habit of catching ‘Falling Knives’ on their way to terminal velocity. And while things have looked good in November, we’re in the type of market where its anyone’s guess how things will look in a few weeks/months when the IPO is ready to launch. Why take the chance and be someone else’s canary in the IPO coal mine?

ANOTHER DISNEY FLOP - Disney's "Wish" evidently didn't have enough magic, gathering a modest $31.8 million over its debut, a far cry from the 'happily ever after' $45-$55 million the company had forecast. This latest box office 'oops' joins the studio's 2023 parade of not-so-blockbuster hits (The Marvels, Ant-Man, Little Mermaid, Elemental, Indiana Jones), amidst whispers that Disney's dip into 'woke' waters might be rocking its audience boat, a situation CEO Bob Iger is now trying to smooth over, presumably without a fairy godmother's help. Hopefully they can put their house (of Mouse) in order. Seems like only yesterday I was writing about The Marvels flop (Edit: That was only Nov-14). (Forbes has more)

U.S. HOUSE PRICES - Despite rising mortgage rates, U.S. home prices continued to increase, with a 3.9% rise in September compared to the previous year, even as mortgage rates approached 8%. In contrast, rents have started to ease, dropping 0.9% in November from October, amidst a surge in new apartment supply and seasonal factors, suggesting a potential cooling in the rental market. (More on this from CNBC)

Explainer: One of the biggest reasons why house prices have been rising despite super high mortgage rates is that the supply of houses on the market is still near record lows.

MORE (GENERALLY DOVISH) FED SPEAK - Speaking in Washington, Fed Governor Waller expressed confidence in current policies to slow the economy and reduce inflation towards the 2% target, cautioning against over-reliance on financial tightening. However, Fed Governor/Fun Police Bowman advocated for further rate hikes, warning of the risk of inflation settling above the 2% target without additional measures. Following these remarks, market expectations for 2024 shifted, with increased odds of rate cuts, as swaps indicated around 90 basis points of rate reductions from the current level by year-end. (Reuters has more)

Joke Of The Day

Today I went to a presentation on how ships are held together. It was riveting.

Hot Headlines

CNBC | Amazon announces Q, an AI chatbot for businesses, to compete with Chat-GPT, Copilot for Microsoft 365 and Duet AI for Google Workspace

CNN | Finland to close entire border with Russia. Basically, Russia is using non-Russian foreign migrants as another effort to sow social discontent in Europe. Who would want to leave Russia?

CNBC | Amazon announces new AI chip, Trainium2, for training artificial intelligence models, and it will also offer access to Nvidia’s next-generation H200 Tensor Core graphics processing units

Bloomberg | Hamas releases 12 hostages despite ceasefire looking shaky after claims of Truce Violations

Bloomberg | Musk’s Cybertruck Is Already a Production Nightmare for Tesla

Trivia

This week’s trivia is on the Roman Empire.

What was the approximate population of Rome at its peak around the 2nd century AD?

a) 500,000

b) 1 million

c) 2 million

d) 5 millionWhat unusual job did the Romans invent that was actually significant to their economy?

a) Professional mourner

b) Wine taster

c) Public scribe

d) Urine collectorWhat was the main reason Romans built such an extensive road network that was the backbone of their economy?

a) Commerce

b) Military deployment

c) Pilgrimage

d) Cultural exchange

( answers at bottom)

Market Movers

Winners!

PDD Holdings (PDD) [+18.1%] Crushed Q3 revenue and EPS increase, with 94% year-over-year growth due to expanded online marketing and transaction services.

Affirm Holdings (AFRM) [+11.5%] Upgraded to hold from underperform at Jefferies, citing stabilizing capital costs, and better credit performance.

Seadrill (SDRL) [+5.6%] Beat Q3 EPS and revenue forecasts, raised FY adjusted EBITDA guidance, secured contracts for West Neptune and West Vela, and authorized an additional 250M share buyback.

Tesla (TSLA) [+4.5%] Announced Cybertruck delivery event and won a minor lawsuit in Sweden but think stock is just whippy atm. Definitely not linked to Cybertruck reliability.

Losers!

ACELYRIN (SLRN) [-32.4%] Disclosed dosing sequencing errors in izokibep drug trial for psoriatic arthritis. Don’t need my decade-long background in Health Care investing to know that’s pretty dumb.

GE HealthCare Technologies (GEHC) [-4.2%] Follow-on fun from yesterday’s downgrade.

Market Update

Trivia Answers

b) The population peaked out at around 1 million.

d) Urine collection (gross) was important because of the ammonia, which was used in the laundering of clothes, and other things such as fertilizer, tanning, and even in the whitening of teeth (extra gross).

b) Military deployment across the republic and later the empire was the initial reason for the road network, but later proved invaluable for the development of trade.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.