“A journey of a thousand miles begins with a single step”

- Old Chinese Proverb

Table of Contents:

Hot IPO Market

Following ARM’s successful $54.5bn IPO last week and the listing of Instacart (priced at $9.9bn) yesterday, the market is abuzz with chatter about the US ‘IPO Window’ opening back up after domestic and macro economic concerns halted the action in 2022.

While the IPO market - buoyed by lofty valuations in the US tech sector - appears strong, it hasn’t exactly been closed.

And while the US is generally considered to be in better economic form than the rest of world, the window there hasn’t exactly been closed either - particularly in China. How much of the Chinese IPO market is driven by operational strength and investor appetite, and how much driven by a growing concern to get listed before a weakening economy potentially slams the window shut remains to be seen.

Having said all that, there is no contesting that compared to 2020 and 2021 the current IPO market is a shadow of itself. An important thing to note, however, might be to consider how much of 2020 and 2021 volume was based on companies pushing forward to get a listing (and raise public market capital) while the window was open back then. Looking back its strange to think that amongst all the COVID chaos that the equity markets were so strong, but high valuations and an unclear future were definitely a motivation for companies to make their market debuts.

Opinion: While equity markets appear to currently be receptive to new issuances, companies that might normally be in the backlog might have already IPO’d implying that even with an open IPO window, new issuances might be artificially below where they would have been. Just another thing to blame the pandemic for…

Despite the recent hype about the IPO market, investors might be wise to take caution based on the performance of recent IPOs to date.

Instacart is next to list but the impressive $10bn valuation remains a far cry from its valuation at its last fundraising in 2021 of $39bn.

Federal Reserve Meeting

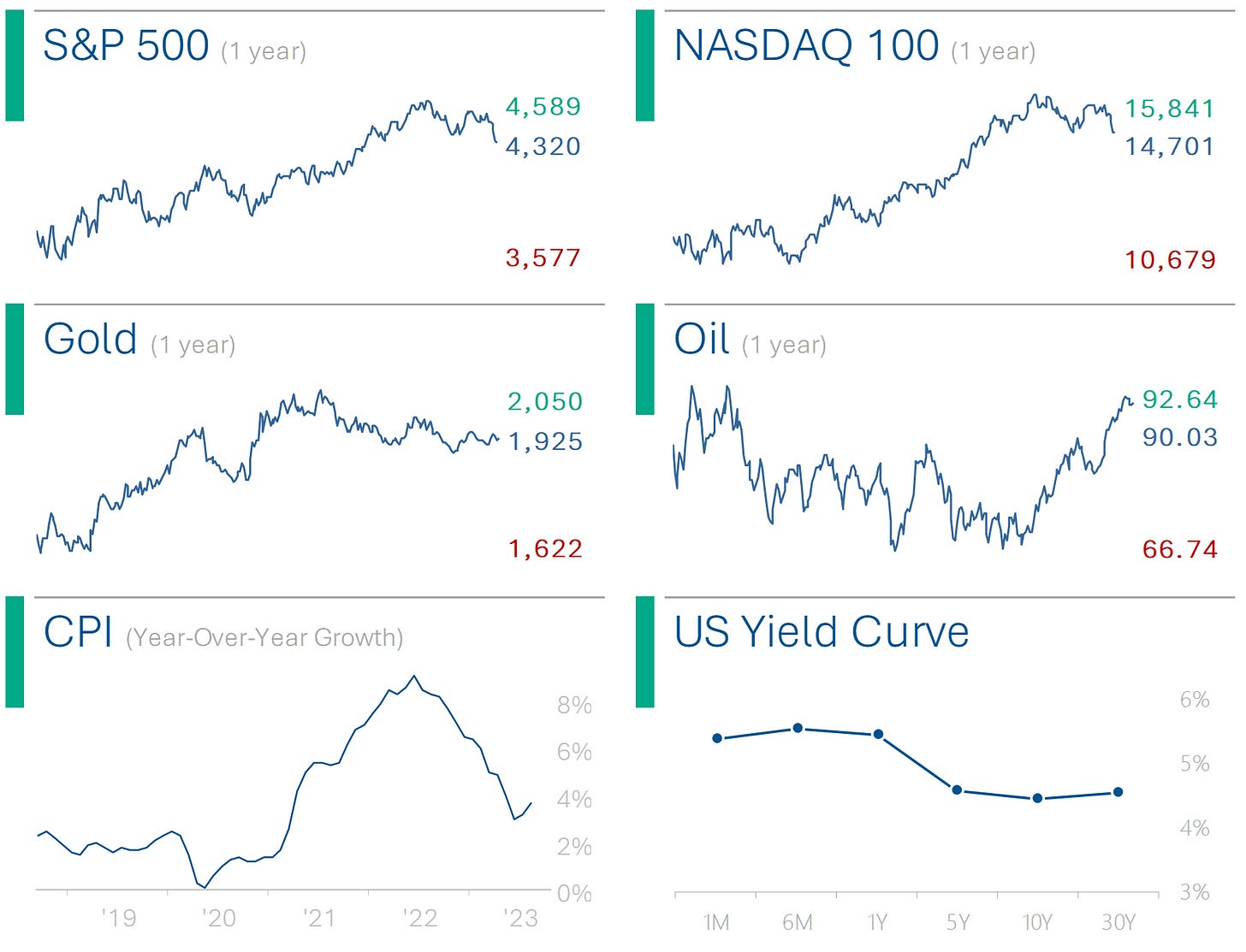

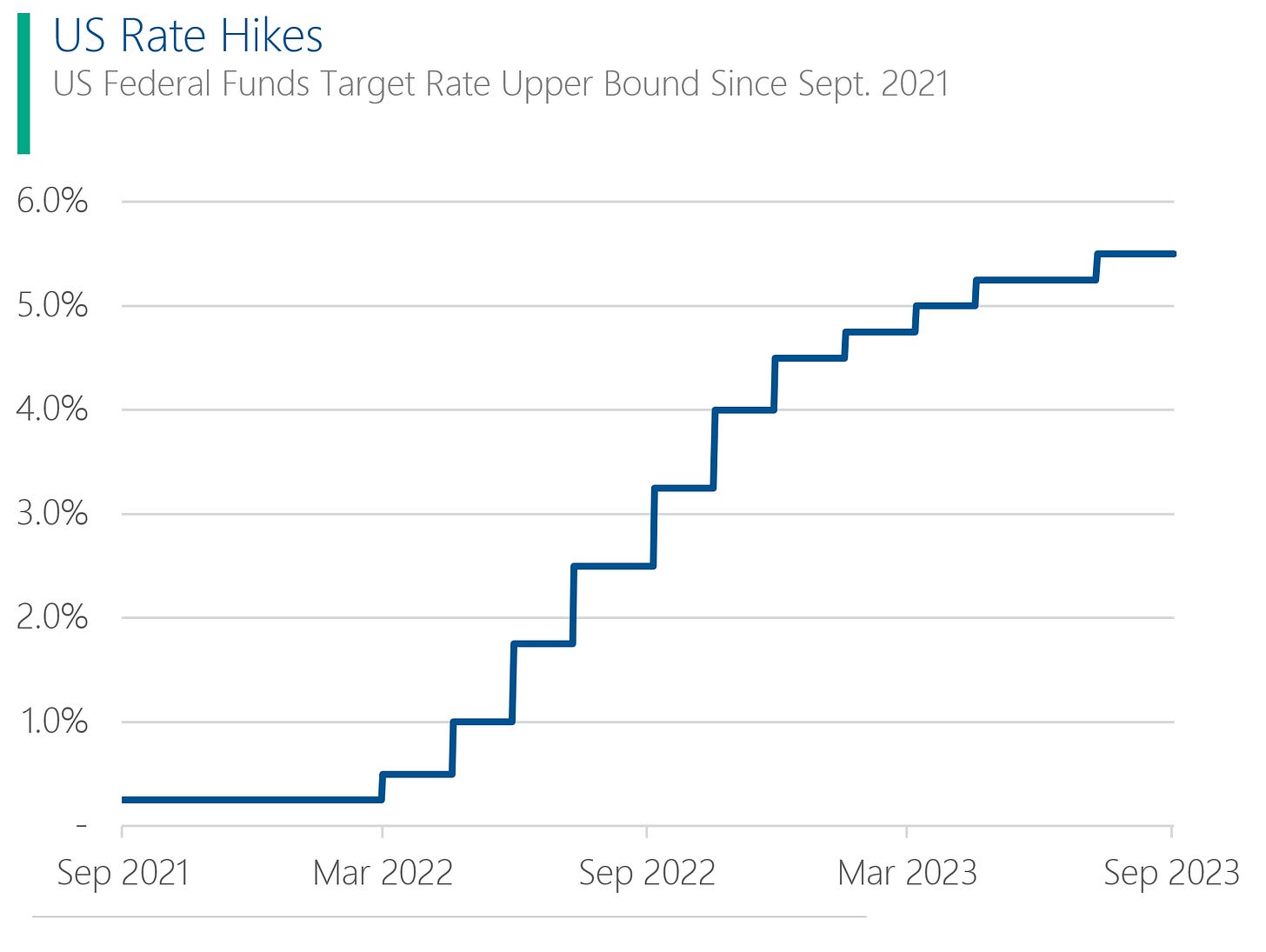

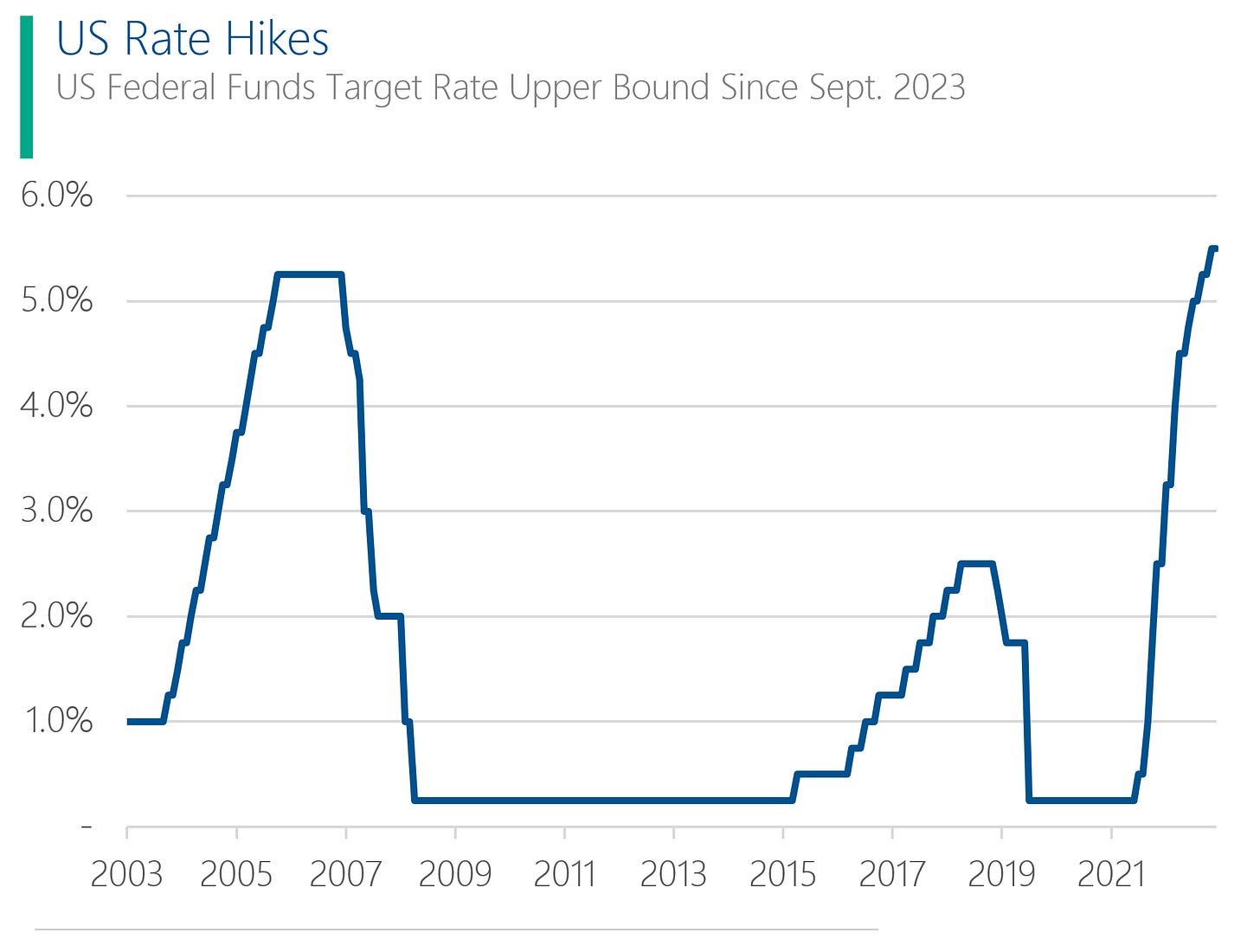

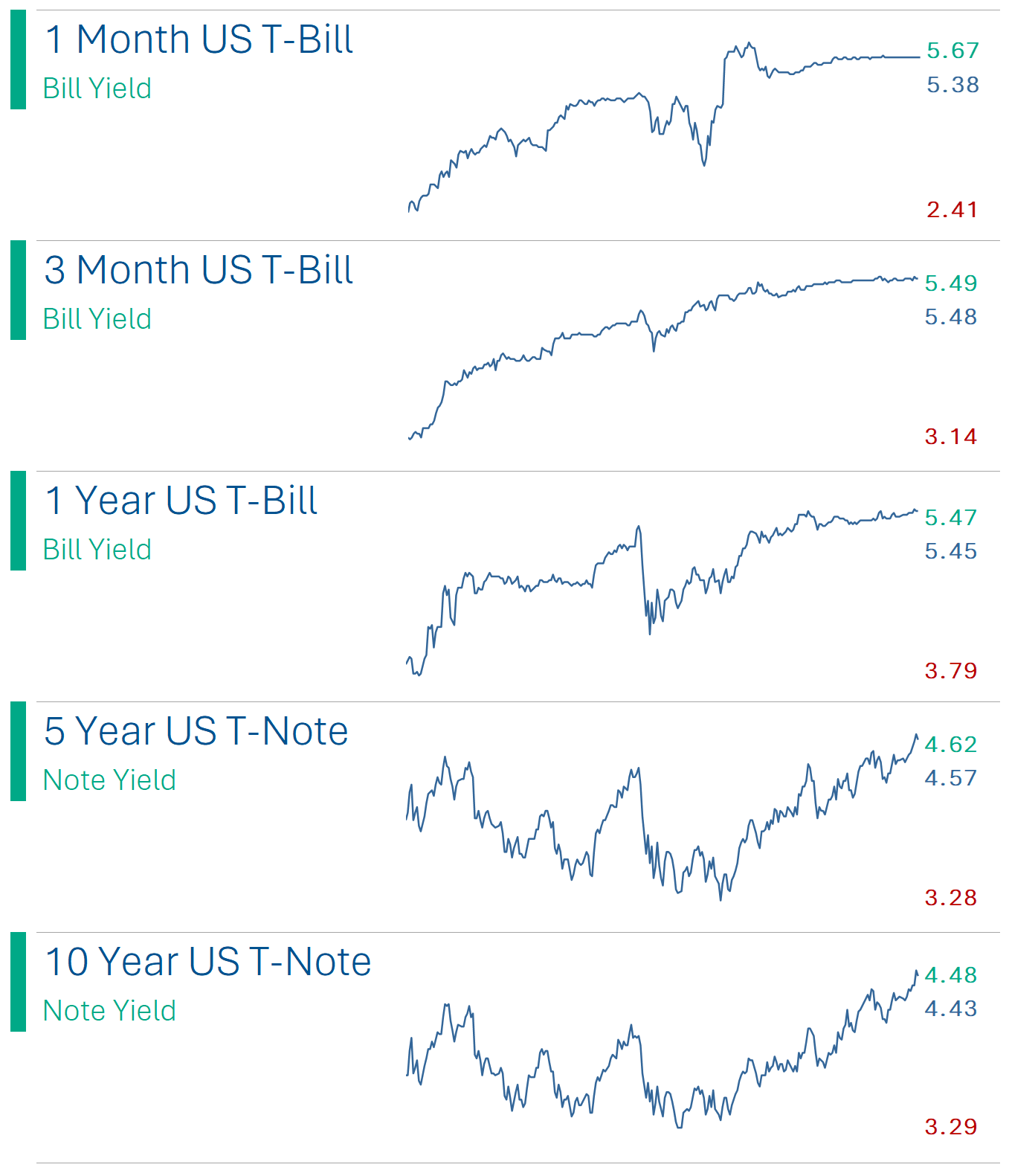

The US Fed is expected to keep its policy rate unchanged at the upcoming meeting at 2PM today. Currently sitting at 5.25-5.5%, March 2022 through May 2023 the Fed raised rates at 10 successive meetings - by anywhere from a quarter to three quarters of a point - as it fought the worst rise of inflation since the early 1980s.

US rates are now sitting at their highest level in over 20 years.

While US inflation has been roughly inline with their G7 peers…

… it has comparably higher GDP growth forecast this year.

The concern for policy makers remains, however, how well the economy can endure these rate hikes. Over the last year Wall Street Analyst’s US GDP forecasts have moved around significantly, with estimates for 2023 continually improving over the calendar year, while estimates for a weaker 2024 have only increased.

When Will The Rally Stop?

A lot has been made about the rally in the US market with several notable investors coming out as openly bearish. It’s worth noting that other than the Consumer Discretionary, Information Technology and Communication Services sectors the year-to-date returns have actually been quite muted.

Within those sectors, Consumer Discretionary and Into Tech appear to be trading at a record valuations but Comm. Services – despite the +40% rally this year – doesn’t seen too out of whack with history. Worth noting is that in 2018 a reshuffle of index constituents saw the addition of several ‘techy’ names to Comm. Services like Meta, Netflix, Alphabet, etc. in the so called ‘De-FANGing’ of Tech, so historical valuations aren’t exactly ‘Apples-to-Apples’.

Compared to the rest of the S&P 500, valuations in Info Tech and Consumer Discretionary really stand out. And while you can make an argument that Consumer Discretionary isn’t too outlandish given that the current valuation is still within a standard deviation of its historical mean, it’s important to note that things got pretty weird during COVID which heavily skewed the data upward (for example, if a stock goes down 50% but expected earnings decline 75% the P/E doubles).

Opinion: I’m starting to get a little concerned about valuations in Tech but much more so for Consumer Discretionary. While you don’t have to subscribe to the idea that the US is headed into a deep recession in order to bridge to the idea that valuations in Consumer Discretionary normalize, as most economists and analyst believe that the US economy will cool down in 2024 (see ‘US Rate Hikes’ above) and with that will likely come less spending on non-essentials.

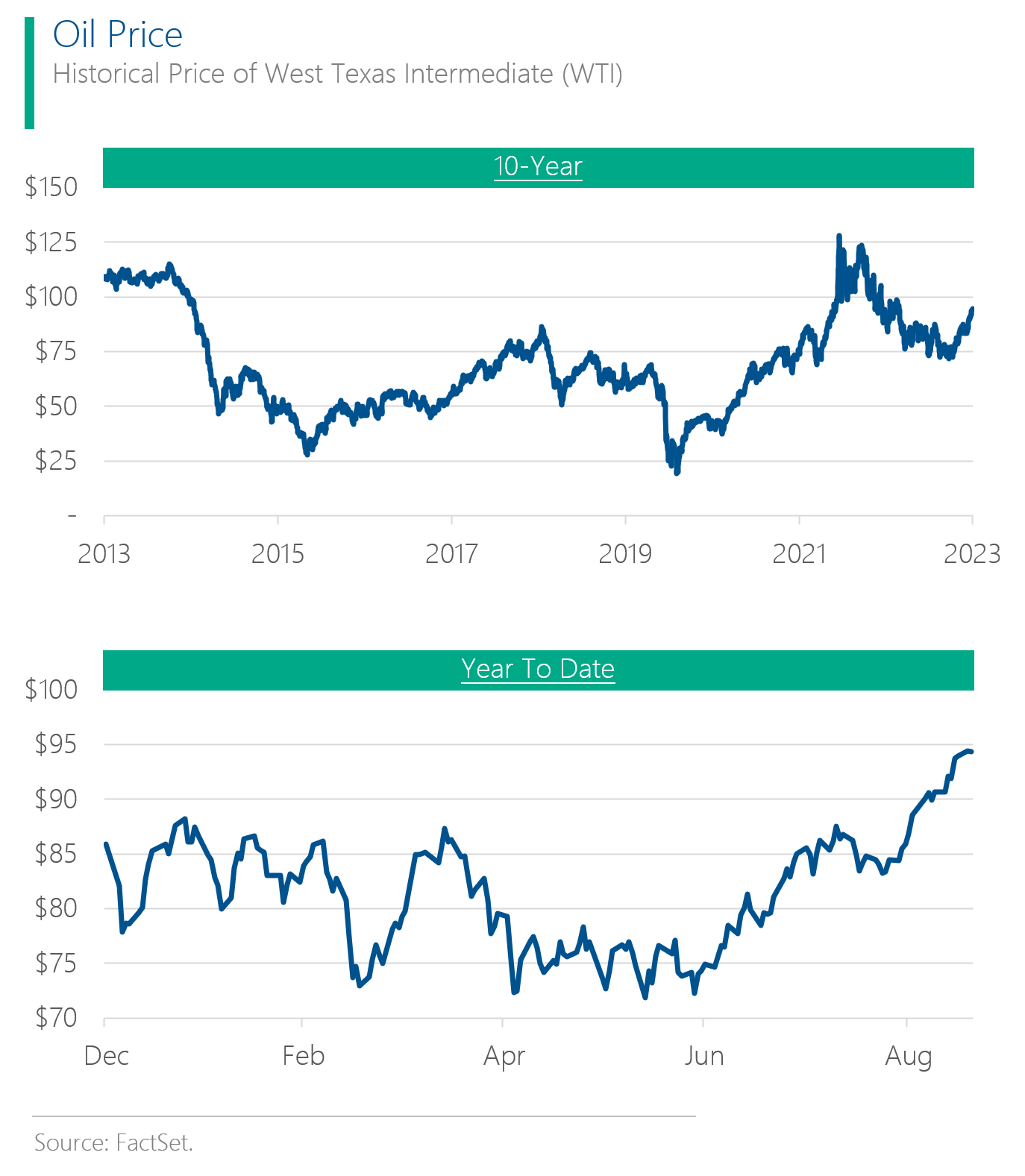

Oil Rally

The price of Oil is starting to find its way back into the news cycle as West Texas Intermediate ($91bbl) and Brent Crude ($94bbl) appear to be closing on the much touted ‘$100 a barrel’ mark where everyone seems to start going crazy. Supply cuts from Russia and the Saudis (Supply Side) and a surprisingly robust global economy (Demand Side), particularly in global travel, have put pressure on prices from both sides.

History has shown the global economy more than capable of withstanding the pressures at these levels before but with growing concern about softening economies and recession fears in 2024, this may not be the straw that broke the camel’s back but it isn’t very helpful.

As central banks continue to hunt down inflation, increasing oil prices – which find their way into everything from mining and manufacturing to shipping and travel – are of little help to future rate hike decisions playing out across the globe.

Speed Round

India and Canada are at odds with each other over the murder of Canadian national Hardeep Singh Nijjar in Vancouver in June. The Canadian government now asserts the killing was a politically motivated assassination by India due to Mr. Nijjar’s vocal advocacy of India creating a separate Sikh controlled state in India’s Punjab region. India has denied the allegations, and both nations have expelled diplomats and negotiations for a new trade deal between the two nations has been halted. Read more: Reuters Article

Labor negotiations between the Big Three US automakers (GM, Ford, Stellantis) are ongoing as the limited UAW strike reaches its sixth day. Workers are currently on strike at GM’s Wentzville Assembly in Missouri, Stellantis’ Jeep assembly complex in Toledo, Ohio, and select departments in Ford’s assembly plant near Detroit. UAW President Shawn Fain now stating that if an agreement can’t be agreed by Friday, the UAW will expand the strike to other facilities. This strike remains unique amongst past labor unrest at the Big 3, as historically strike actions have been limited to one manufacturer at a time. Read more: Barron's Article

Instacart shares increased 12% in their first day of trading on the NASDAQ. Read More: WSJ Article

Elon Musk could be in the hotseat again as a Justice Department probe investigating improper personal benefits he may have received from Tesla. Among the concerns are any perks that Elon might have received that weren’t appropriately disclosed to shareholders. Not really a shocker since his disclosures have often been…odd (remember that whole ‘Considering taking Tesla private at $420’ Tweet that he got fined by the SEC over?). The Justice Department has an ongoing investigation into the use of company resources for the so-called ‘Project 42’ (apparently a weird glass house for Elon), and the SEC was looking into whether Elon mislead consumers and investors with the claims about Tesla’s cars autonomous driving capabilities. Genius often looks like crazy. Read more: WSJ Article

Trivia:

Where's the oldest stock exchange in the world?

Lyon, France

Barcelona, Spain

Hamburg, Germany

Toulouse, France

Antwerp, Belgium

Geneva, Switzerland

Where was the first stock exchange in the United States?

Boston, Mass.

New York, N.Y.

Philadelphia, Pa.

Washington, D.C.

(answers at bottom)

Joke Of The Day:

Why are nudists bad for the stock market?

They are associated with bare markets.

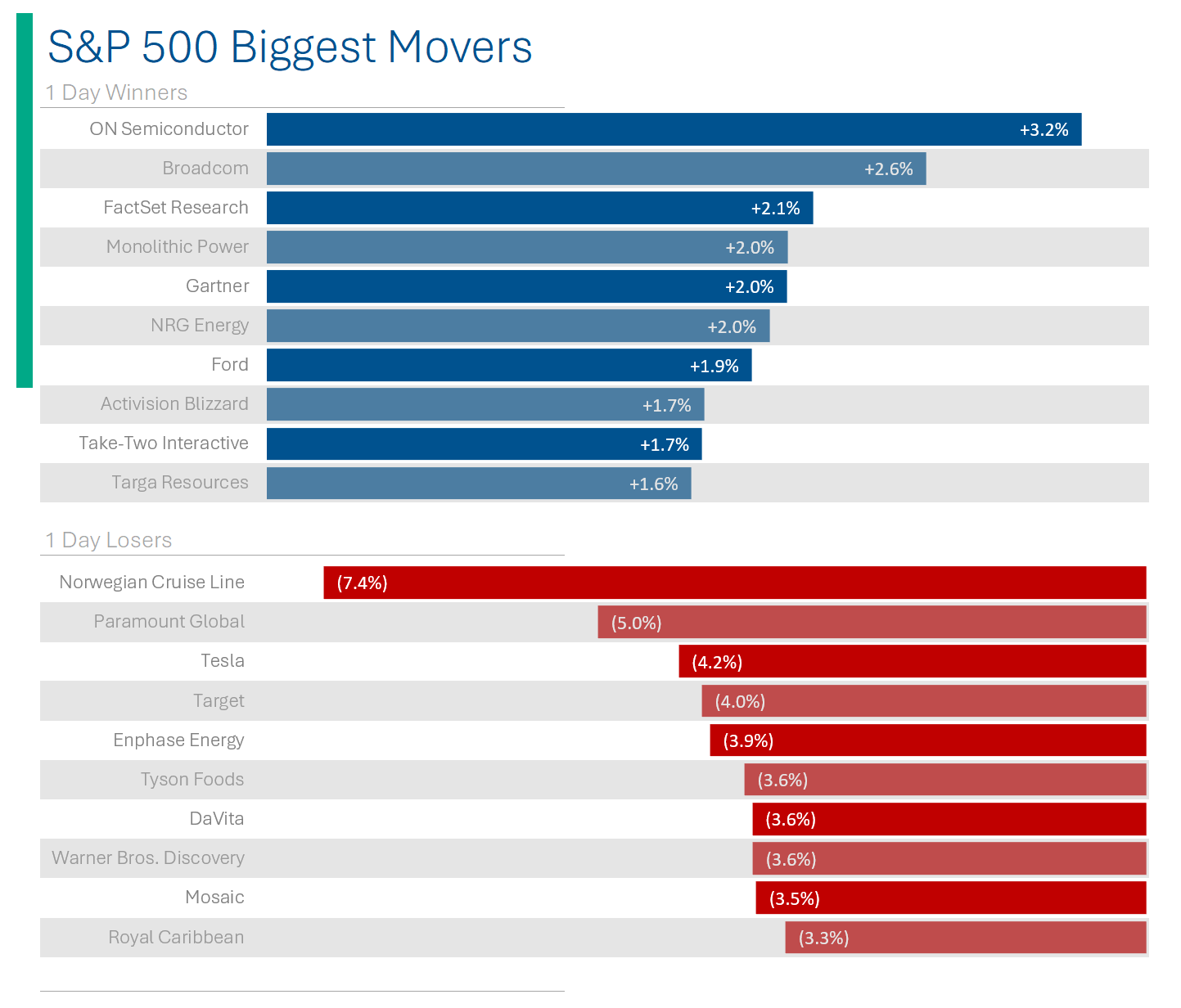

Market Update

Main Indices

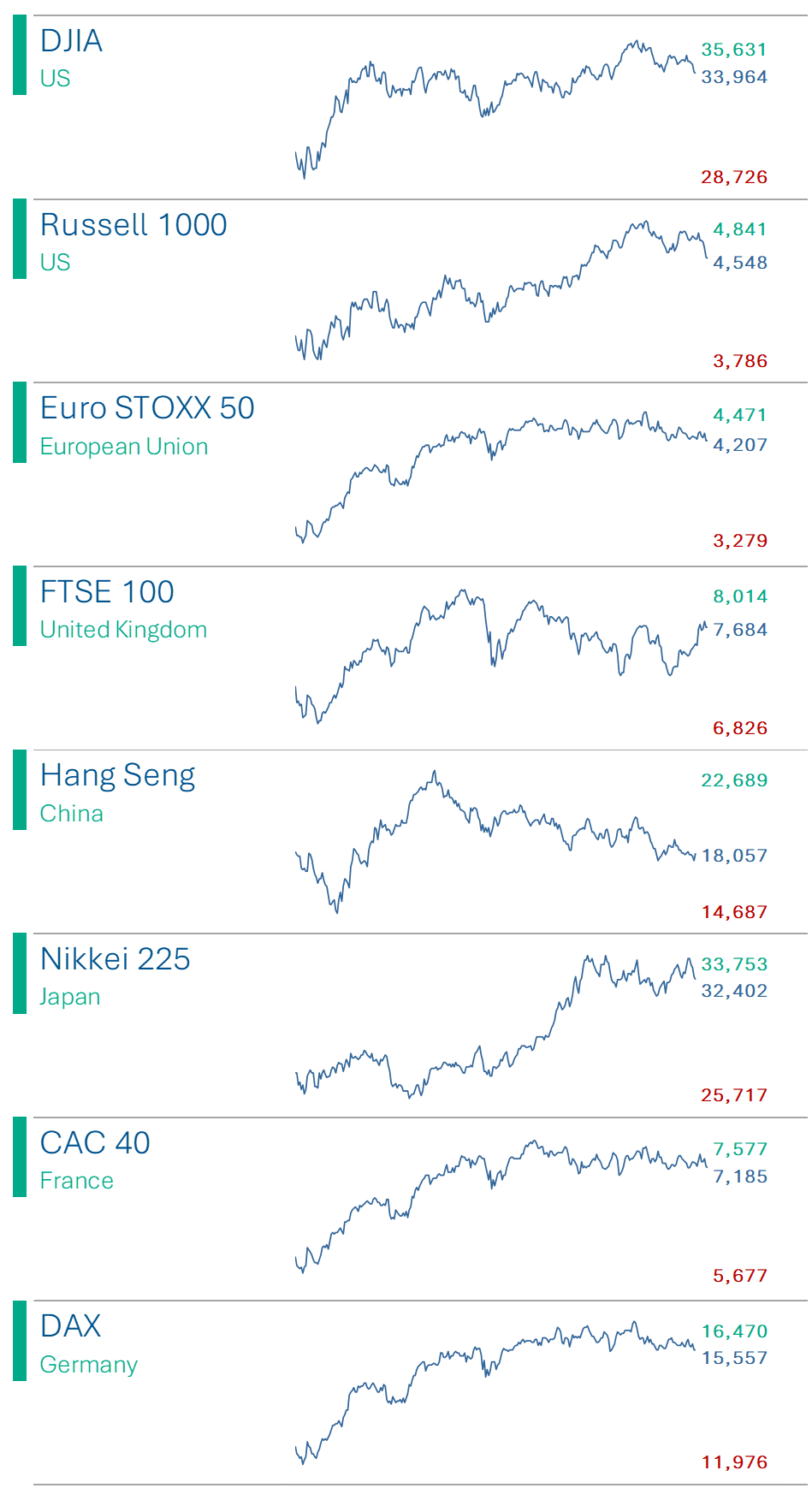

Global Market Indices

Global Commodity Prices

Key Global Exchange Rates

Interest Rates

Trivia Answers:

Where's the oldest stock exchange in the world? The Belgian ‘Antwerp Bourse’ opened its doors in 1460 and kept going until 1997.

Where was the first stock exchange in the United States? New York is where all the action is today, of course, but the Philadelphia Stock Exchange, founded in 1790, predated it by two years